PakAlumni Worldwide: The Global Social Network

The Global Social Network

Shale Gas Revolution For Abundant & Cheap Energy in Pakistan

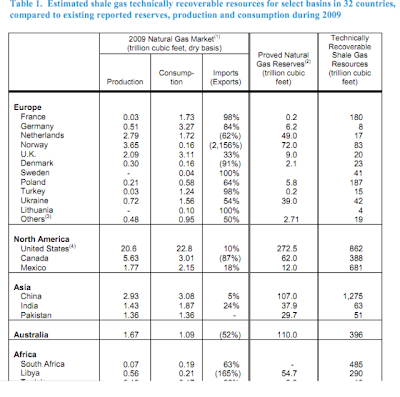

US natural gas prices have fallen below $2 per million BTU (approx 1000 cubic feet), about one-sixth of the price Pakistan has agreed to pay for Iranian gas. With over 50 trillion cubic feet of known shale gas reserves in Sindh alone, Pakistanis can also enjoy the benefits of cheap and abundant source of energy for decades via the shale gas revolution already sweeping America.

Increased production of gas from shale rock in the US has created a huge new supply, pushing down gas prices from $13/BTU (million British thermal units) four years ago to just $2/BTU today, even as the price of oil has more than doubled. By contrast, the Iran pipeline gas formula links the gas price to oil prices. It means that Pakistan will have to pay $12.30/BTU at oil price of $100/barrel, and a whopping $20/BTU for gas if oil returns to its 2008 peak of $150/barrel.

To encourage investment in developing domestic shale gas, Pakistan has approved a new exploration policy with improved incentives as compared with its 2009 policy, a petroleum ministry official said recently. Pakistan Petroleum is now inviting fresh bids to auction licenses to explore and develop several blocks in Dera Ismail Khan (KPK), Badin (Sind), Naushero Firoz (Sind) and Jungshahi (Sind), according to Oil Voice.

In addition to the fact that the Iran gas is extremely expensive, the entire Iran-Pakistan gas pipeline project raises other serious issues as well.

Iran-Pakistan Pipeline Issues:

1. Chinese investors and contractors have pulled out of the project for fear of being hit by US sanctions on their banks and other companies.

2. Russia's Gazrom is reportedly interested but only if it gets the deal at whatever price it decides to charge without any competitive bidding.

3. Pakistani companies and financial institutions are also under threat of US sanctions if they participate in the project.

4. If the pipeline does eventually get built, it will still be several years before gas starts to flow to Pakistan.

5. If Iran is still under US sanctions when the Iranian gas imports finally begin, Pakistan will have difficulty paying for the gas using international banking system. Iran has already been suspended by SWIFT, the Society for Worldwide Interbank Financial Telecommunication, which is the main mechanism used for international bank transactions.

6. The largest chunk of Pakistan's trade deficit is accounted for by energy imports. Iranian gas bill will only worsen this deficit, contributing to yet another balance of payments crisis sending Pakistan back to IMF.

Advantages of Domestic Shale Gas Development:

1. Cheap domestic gas can start flowing from Pakistani shale in a couple of years if Pakistan can make a deal with US (and American pioneers of shale gas like George Mitchel's Devon Energy) to invest and execute on an accelerated schedule in exchange for dropping Iran pipeline.

2. Pakistan will dramatically reduce its dependence on foreign sources and save a lot of foreign exchange spent on hydrocarbon imports.

3. Gas burns a lot cleaner than coal which is also a option given vast amounts of it in Thar desert. World Bank and other International financial institutions are more amenable to financing shale gas development than coal.

4. Abundant and cheap domestic gas supplies can help reduce electricity load-shedding which is caused mainly by under-utilization of installed generating capacity for lack of affordable fuel.

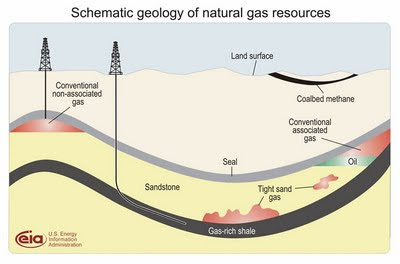

Shale gas revolution began a few years ago when an American named George P. Mitchell defied the skeptics and fought his opponents to extract natural gas from shale rock. The method he and his team used to release the trapped gas, called fracking, has paid off dramatically. In 2000, shale gas represented just 1 percent of American natural gas supplies. Today, it is over 30 percent and rising.

Among the potential downsides of shale gas development is the possibility of groundwater contamination reported in some places in the United States. Such risks can be minimized by following accepted practices to protect the aquifers which are found at levels well above the deep shale rock fractured for extracting natural gas.

Cheap and abundant energy is a pre-requisite for rapid economic growth in any country. Pakistan is no exception. The sooner Pakistanis recognize and resolve this crisis, the better it will be for the south Asian nation.

Related Links:

Pakistan's Vast Shale Gas Reserves

US Can Help Pakistan Overcome Energy Crisis

Abundant and Cheap Coal Electricity

US Dept of Energy Report on Shale Gas

Pakistan's Twin Energy Crises

Pakistan's Electricity Crisis

Pakistan's Gas Pipeline and Distribution Network

Pakistan's Energy Statistics

US Department of Energy Data

Electrification Rates By Country

CO2 Emissions, Birth, Death Rates By Country

China Signs Power Plant Deals in Pakistan

Pakistan Pursues Hydroelectric Projects

Pakistan Energy Industry Overview

Comparing US and Pakistani Tax Evasion

Pakistan's Oil and Gas Report 2010

Circular Electricity Debt Problem

International CNG Vehicles Association

Lessons From IPP Experience in Pakistan

Correlation Between Human Development and Energy Consumption

-

Comment by Riaz Haq on April 14, 2012 at 8:10am

-

Here's a Daily Times report on IFI holdings of Pakistani shares:

Foreigners remained aggressive in Pakistan’s oil and gas sector as they continued to own more than 500 million shares ($950 million) in Oil and Gas Development Company (OGDC) and approximately 120 million shares ($250 million) of Pakistan Petroleum Ltd (PPL), which represent 83 percent and 45 percent of free float of OGDC and PPL, respectively. This is primarily due to higher oil prices and decent volumetric growth. Similarly, their shareholding in Pakistan State Oil (PSO) and Pakistan Oilfields (POL) is expected to remain almost the same. Thus out of $2.7 billion worth of stocks that foreigners hold (as of March to December 2011), approximately 50 percent of the foreign shareholding is only concentrated in oil sector, including which OGDC alone contributes 35 percent.

Interestingly, foreigners which own every third Pakistani share of free-float, have been net buyers of $11 million so far in CY2012 primarily due to record inflows in regional markets amid improved risk appetite and better global economic data. Last year due to depressed global markets, foreign participants offloaded their positions in Pakistan liquidating $123 million net in 2011 contrary to net buying of $526 million in 2010. However, thanks to continued interest in Pakistan market, foreigners now hold shares valuing $2.7 billion as of March 30, 2012 (28 percent of free float). Their peak holding was $5.1 billion (27 percent of free float) in April 2008 and lowest was $1 billion (17 percent of free float) in March 2009.

Estimated holdings of foreigners in Pakistan key stocks are OGDC $950 million, MCB $250 million, PPL $250 million, UBL $135 million, Lucky Cement $135 million, FFC $125 million, Unilever $100 million, POL $75 million, Hubco $65 million, NBP $50 million, Engro $35 million, Nestle $35 million, PSO $25 million and DGK Cement $20 million.http://www.dailytimes.com.pk/default.asp?page=2012\04\14\story_14-4-2012_pg5_17

-

Comment by Riaz Haq on June 6, 2012 at 7:52pm

-

Here's the Nation on Pakistan's soaring oil imports:

Pakistan’s oil import bill soared by 43.52 per cent to reach $12.583 billion during the first ten months (July-April) of the outgoing financial year 2011-2012 against $8.768 billion in the same period of last year (2010-211).

According to the latest figures released by Pakistan Bureau of Statistics (PBS) on Monday, the break-up of $12.583 billion oil import revealed that country imported petroleum products worth of $8.355 billion in July-April 2011-2012, up by 69.81 per cent if compared with $ 4.920 billion of July-April 2010-2011. Meanwhile, the import of petroleum crude increased by 9.89 per cent to $ 4.228 billion during the period under review against $3.848 billion of the corresponding period of the last year.

It might be mentioned here that country’s exports had recorded negative growth of over three per cent during the first ten months of the outgoing financial year, as these were recorded at $19.393 billion in the period under review against $20.092 billion of same period last year. On the other hand, country’s imports increased by 14.81 per cent in one year, as these were recorded at $37.042 billion in July-April 2011-2012 against $32.263 billion of July-April 2010-2011. Therefore, the trade deficit remained higher at $17.649 billion in July-April period of 2011-2012 against $12.171 billion of same period last year.

Meanwhile, the break-up of imports further revealed that import of food items recorded a minor decline of 1.73 per cent and reached $4.231 billion in July-April period of the year 2011-12 against the $4.305 billion in July-April period of the year 2010-11.

According to the data, import bill of milk products increased by 3.75 per cent, wheat unmilled decreased by 100 per cent, imports of dry fruits and nuts surged by 2.78 per cent, import of tea increased by 4.76 per cent, import of spices reduced by 5.16 per cent, soyabean oil’s imports went down by 30.79 per cent, palm oil import increased by over 18.26 per cent, sugar import declined by 97.89 per cent, import of pulses went down by 7.06 per cent and import of all other food items increased by 32.51 per cent during the period under review.

Apart from oil and food imports, the country imported machinery worth of $ 4.567 billion, transport group imports stood at $ 1.670 billion, textile group $1.980 billion, agricultural and other chemicals $ 5.979 billion, metal group $ 2.297 billion, miscellaneous group imports recorded $ 772 million and all other items imports were recorded at $ 2.962 billion during July-April period of 2011-12 against July-April period of 2010-11.

http://www.nation.com.pk/pakistan-news-newspaper-daily-english-onli...

-

Comment by Riaz Haq on December 29, 2012 at 10:22am

-

Here's BR on PPL introducing new petroleum exploration technology in Pakistan:

A PPL statement here on Saturday said that developed by NXT Energy Solutions (NXT), a geophysical service company based in Canada, SFD (Stress Field Detection) is a proprietary cutting edge, eco-friendly airborne reconnaissance method to identify potential hydrocarbon traps and reservoirs in a time- and cost-effective manner, especially in unexplored on- and off-shore frontier regions with limited access and infrastructure.

It said that the SFD is expected to be particularly useful in the current energy scenario, warranting fast track identification of, and production from, relatively deeper, more complex reserves of hydrocarbons to bridge the supply-demand gap.

Welcoming the guests, PPL's Managing Director and Chief Executive Officer, Asim Murtaza Khan, underscored the increasing importance of deploying latest exploration technology to meet production and reserves replacement targets to address the current deficit and ensure future energy security. SFD technology has been successfully applied by leading oil and gas companies in North America, Colombia and other countries. PPL is proud to be the first company to apply the technology in Pakistan', he said.

http://www.brecorder.com/top-news/108-pakistan-top-news/98349-ppl-i...

-

Comment by Riaz Haq on February 24, 2013 at 7:25am

-

Here's a BR report on unconventional oil ad gas policy in Pakistan:

Advisor to Prime Minister on Petroleumand Natural Resources Dr. Asim said that Pakistan offers great potential in the oil and gas sector and the government is doing its part by introducing new policies to meet the rising energy demand .

He was presiding over a seminar organized by the Petroleum Institute of Pakistan (PIP), a representative body of the oil and gas industry, on the topic "Shale Gas Potential in Pakistan" on Saturday.

The purpose of holding this seminar was to create awareness aboutpotential and challenges of shale gas in Pakistan and establish PIP'sprofessional standing in view of assisting the government on dealing with the energy crises in the country.

The forum consisted of 150 distinguished guests from the oil and gas fraternity including government officials, media personnel and students from Karachi's top universities/colleges.

Dr. Asim Hussain said he has been advocating the need to balancecountry's energy mix, which currently is heavily dependent on natural gas.

He stated that the US Energy Information Administration have estimated 51 TCF Shale Gas Reserves in Pakistan, while as estimated reserves for Low BTU Gas are 2 TCF and that of tight gas are 40 TCF.

He added that Shale Gas exploration is high technical and costly, therefore, in order to encourage its exploration, pilot projects are planned.

The Ministry of Petroleum and Natural Resources will facilitate E&P Companies wishing to explore shale gas, by granting special concessions through transparent process and based on merit.

Chairman PIP Asim Murtaza Khan stressed on PIP's role as an effective energy sector advisory body, supporting government and industry in Pakistan todevelop a progressive and sustainable roadmap to meet present and futurechallenges.

He said that PIP is planning to hold series of seminars in nearfuture. The big ticket items that will be discussed and which need theimmediate attention will be the "LPG Outlook in Pakistan", "Fast-trackingimports of LNG", "Refining Vision 2020", "Energy conservation" and"Restructuring of the Pakistan's gas sector".

http://www.brecorder.com/pakistan/business-a-economy/107602-pakista...

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Barrick Gold CEO "Super-Excited" About Reko Diq Copper-Gold Mine Development in Pakistan

Barrick Gold CEO Mark Bristow says he’s “super excited” about the company’s Reko Diq copper-gold development in Pakistan. Speaking about the Pakistani mining project at a conference in the US State of Colorado, the South Africa-born Bristow said “This is like the early days in Chile, the Escondida discoveries and so on”, according to Mining.com, a leading industry publication. "It has enormous…

ContinuePosted by Riaz Haq on November 19, 2024 at 9:00am

What Can Pakistan Do to Cut Toxic Smog in Lahore?

Citizens of Lahore have been choking from dangerous levels of toxic smog for weeks now. Schools have been closed and outdoor activities, including travel and transport, severely curtailed to reduce the burden on the healthcare system. Although toxic levels of smog have been happening at this time of the year for more than a decade, this year appears to be particularly bad with hundreds of people hospitalized to treat breathing problems. Millions of Lahoris have seen their city's air quality…

ContinuePosted by Riaz Haq on November 14, 2024 at 10:30am — 1 Comment

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network