PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Should Seek US & Saudi Help to Develop Domestic Shale Gas Reserves

There are strong rumors that Kingdom of Saudi Arabia has joined the United States to oppose Iran-Pakistan gas pipeline project for which Pakistan is trying to arrange financing in the face of tightening US sanction on Iran.

The Chinese have already pulled out of the project after the US imposed sanctions on banks and other entities dealing with projects and transactions involving Iran. Russia's Gazprom is reportedly interested in financing and constructing the Pakistan section of the pipeline, but only on the condition that the project be awarded to it without any competitive bidding.

The question now is how should Pakistan deal with the situation? Can Pakistan satisfy its growing energy needs without alienating the Saudis and avoiding crippling US sanctions which could be more damaging than its current energy crisis?

To answer these questions, let's first examine the following facts:

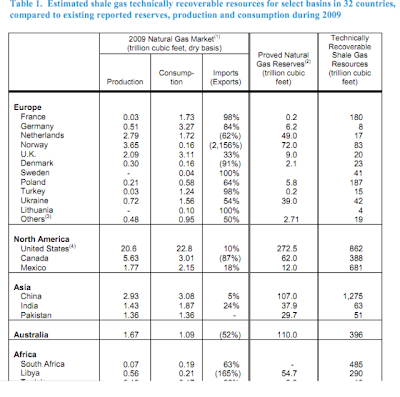

1. Pakistan has at least 50 trillion cubic feet of recoverable domestic shale gas reserves, according to US Energy Information Administration.

2. US oil and gas companies are pioneers and leaders in shale gas development. In fact, these firms have been so successful that there is now a gas glut in the United States and gas prices have plummeted to less than $2 per mmBTU (approx 1000 cubic feet).

3. Iran-Pakistan deal requires Pakistan to pay $11-12 per mmBTU for its gas, six times the current price in the United States. Since the pricing formula for Iranian gas is based on the price of oil, it's almost certain that Pakistan will end up paying more than $12 per mmBTU with rising oil prices in the future.

4. Pakistan needs investment and technical know-how to develop its shale gas reserves to assure cheap and abundant energy supply.

Considering the above-mentioned facts, I think the best option for Pakistan is to go with its own domestic shale gas at a fraction of the price Iran is demanding.

Pakistan's best interest is not in defying Saudis and Americans to buy expensive Iranian gas and end up with crippling sanctions which could be much worse than its current energy crisis. Its best interests will be served by developing its own cheap domestic shale gas on an accelerated schedule with Saudi investment and US tech know-how. If the Americans and the Saudis refuse to help, then Pakistan will have a stronger case to go with the Iran gas option.

Related Links:

Pakistan Needs Shale Gas Revolution

Pakistan's Vast Shale Gas Reserves

US Can Help Pakistan Overcome Energy Crisis

Abundant and Cheap Coal Electricity

US Dept of Energy Report on Shale Gas

Pakistan's Twin Energy Crises

Pakistan's Electricity Crisis

Pakistan's Gas Pipeline and Distribution Network

Pakistan's Energy Statistics

US Department of Energy Data

Electrification Rates By Country

CO2 Emissions, Birth, Death Rates By Country

China Signs Power Plant Deals in Pakistan

Pakistan Pursues Hydroelectric Projects

Pakistan Energy Industry Overview

Comparing US and Pakistani Tax Evasion

Pakistan's Oil and Gas Report 2010

Circular Electricity Debt Problem

International CNG Vehicles Association

Lessons From IPP Experience in Pakistan

Correlation Between Human Development and Energy Consumption

-

Comment by Riaz Haq on April 20, 2012 at 6:34pm

-

Here's a NY Times report on India's fuel shortages hurting electricity generation:

India — India has long struggled to provide enough electricity to light its homes and power its industry around the clock. In recent years, the government and private sector sought to change that by building scores of new power plants.

But that campaign is now running into difficulties because the country cannot get enough fuel — principally coal — to run the plants. Clumsy policies, poor management and environmental concerns have hampered the country’s efforts to dig up fuel fast enough to keep up with its growing need for power.

A complex system of subsidies and price controls has limited investment, particularly in resources like coal and natural gas. It has also created anomalies, like retail electricity prices that are lower than the cost of producing power, which lead to big losses at state-owned utilities. An unsettled debate about how much of its forests India should turn over to mining has also limited coal production.

The power sector’s problems have substantially contributed to a second year of slowing economic growth in India, to an estimated 7 percent this year, from nearly 10 percent in 2010. Businesses report that more frequent blackouts have forced them to lower production and spend significantly more on diesel fuel to run backup generators.

The slowdown is palpable at Sowmya Industries, a small company that makes metal shutters that hold wet concrete in place while it solidifies into columns and beams, a crucial tool for the construction industry.

The company, located outside this city on the southeast coast of India, is struggling with several issues, including a 20 percent increase in the price of raw materials and falling orders.

But Sowmya’s manager, R. Narasimha Murthy, said the lack of reliable power was an even bigger problem. His company loses three hours of power every evening. And all day on Wednesdays and Saturdays — euphemistically called “power holidays” — it receives only enough electricity to turn on the lights but not enough to use its large metal-cutting machines.

-------------

A major problem is the anemic production of coal, which provides 55 percent of India’s electricity. Coal production increased just 1 percent last year while power plant capacity jumped 11 percent. Some electricity producers have been importing coal, but that option has become more untenable recently because India’s biggest supplier, Indonesia, has doubled coal prices.

------------

For many businesses, the power shortage has become debilitating.In the southern state of Tamil Nadu, Srihari Balakrishnan, a textile factory owner, said he goes through 6,300 gallons of diesel fuel on an average day to keep his operation running, spending $3,000 more than he would if power were available around the clock.

“We are not able to use 20 to 30 percent of our capacity,” he said. “We can’t use grid power for two full days of the week. When we have power, we have a six-hour cut,” he added, using an Indian term for blackouts.

----------

Other companies are also stuck. Reliance Power, controlled by the investor Anil Ambani, says it has stopped construction on a large electricity plant nearby because it can no longer afford to buy coal from Indonesia as planned.http://www.nytimes.com/2012/04/20/business/global/india-struggles-t...

-

Comment by Riaz Haq on April 23, 2012 at 4:37pm

-

Here's Economic Times report on $10 per mmBTU TAPI gas price for India:

Natural gas from Turkmenistan would be delivered to India at an estimated price of about $10 per unit, including $3 as transportation charges and transit fee, in the proposed 1,680-km pipeline via Afghanistan and Pakistan, three persons with direct knowledge of the matter said.

Gas would be purchased at about $7 per unit at Turkmenistan but its cost would rise as it transits across two countries before reaching the Punjab border. It would be cheaper than some long-term LNG contracts, government and industry officials said. Gas-starved India pays a spot price of about $16 a unit for liquefied natural gas. Petronet LNG has recently contracted LNG import from Australia's Gorgon project at $15.8 per unit while Gail's 20-year contract with US' Sabine Pass works out to be around $10 per unit.

http://articles.economictimes.indiatimes.com/2012-03-29/news/312548...

-

Comment by Riaz Haq on May 2, 2012 at 4:44pm

-

Here are excerpts of a Khaleej Times report on Pakistan courting investments at Dubai conference:

...“Keeping in view global food security concerns, the province vast agriculture expanse has capacity to become region’s food basket,” he said.

Shah said agro-related investment projects are ready for investment and introduction to value-addition through use of technology, efficient irrigation system and modern implements can help attain true potential of province agriculture. The Sindh Board of Investment, the primary investment promotion agency of the province, invited Gulf investors and UAE companies in particular to avail the benefits of conducive-investment policies.

“We are offering investment opportunities in agriculture farming, livestock, grain-storage project as well as in infrastructure development projects,” Muhammed Zubair Motiwala, chairman of the Sindh Board of Investment, told Khaleej Times.

Elaborating, he said the government of Sindh is looking to offer land for establishment of Halal Meat Park in Sukkur and Thatta near Karachi. He said the Rs500 million project will pay back the cost in three to five years and offers a 20-22 per cent IRR to investors.

Motiwala said the provincial government has strived to facilitate and create investor-friendly environment to attract more investment especially in Thar Coalfield, which is declared as a special economic zone. Investors can avail 30-year tax holiday, zero per cent customs duties on import of coal mining equipment and machinery. “We are offering up to 22 per cent IRR to investors on the their investment in Sindh along with other benefits which include repatriation of 100 per cent capital, profits, royalty and zero import duties on capital goods, plant and machinery and equipment not manufactured locally,” he said.

He said that the province has also an estimated hydropower potential of 153 megawatts based on various sites identified along the Sindh canal network.

He said the UAE has showed interest in Thar coal mining and power plant projects. “Al Manhal has shown interest in developing block 2 of the Thar Coalfield. We may discuss the project this weekend and if talks go positively, the UAE firm may invest up to $6 billion in the Thar coal project,” he said.

Motiwala said Thar coal reserves have an estimated potential of generating 100,000 megawatts of electricity for a period of 300 years. “It provides an opportunity for large-scale mining and power-generation over a longer period of time,” he said.

He said Pakistan has been facing an acute shortage of electricity and direly need investments in power-generation projects. According to a delegate, about 700 main industries in Punjab and Sindh are directly affected by electricity shortages in the country.

“About 400 industries in Punjab and 300 factories in Sindh have shut down their operations due to load-shedding and shortage of electricity,” he said.

Motiwala further said Sindh government also offers investment opportunities in renewable energy like solar street light initiative and wind power projects worth around $5.3 billion.

“International investors are in queue to invest in wind power projects because the province has potential to generate 50,000 megawatts electricity through wind turbines across its coastal belt,” he said.

To a question about potential investors in wind energy, he said Hydro China, China Three and NBT/Malakoff, among others, showed interest in 26 projects in the province with installed capacity of 1,800 megawatts.

“We also have offered some renewable energy projects to Masdar. We will discuss some investment opportunities with Masdar officials in Abu Dhabi and expect positive results,” he said....”

http://www.khaleejtimes.com/biz/inside.asp?xfile=/data/uaebusiness/...§ion=uaebusiness

-

Comment by Riaz Haq on May 15, 2012 at 6:10pm

-

Here's Daily Times on need for fiscal reform in Pakistan: Pakistan’s economy requires immediate reforms to overcome the challenges because any more delay in initiating much-needed sector-specific reforms would further aggravate the situation.

USAID Economist Thomas Morris at the Lahore Chamber of Commerce and Industry (LCCI) on Tuesday indicated the country’s fiscal position was fast deteriorating as numbers suggest the gap was widening with every passing day.

He highlighted a major chunk of taxpayers money was being eaten away in defense expenditures, subsidies and interest payments.

After spending huge sums of money on non-development expenditure, the government had left with no money to spend on hard pressing energy shortage and social development.

He pointed out in 2008-09 Pakistan was paying around Rs 99,000 million on account of subsidies, but this figure jumped up to Rs 284,827 million in 2010-11.

There was dire need to correct the energy mix of the country as any change in petroleum products prices adversely affect the government’s budgetary estimates.

He pointed out in 2008-09, the government allocated Rs 77,000 million for electricity subsidies, but it had to spend Rs 99,000 millions when oil prices in the international market were below $80.

On the other hand, in 2010-11 budget, the government earmarked Rs 32,000 million for electricity subsidy, but it had to spend Rs 284,827 million as oil prices had crossed $100 per barrel barrier.

He said the GDP growth would remain 3 percent contrary to government’s claim of four percent.

He said during the global recession Pakistan’s economy remained positive which shows its strength. Therefore, he said the government should focus on curtailing expenditure by cutting non-development expenses.

He said Pakistan should further strengthen its economic relations with the United States by signing new trade agreements.

Agriculture sector in Pakistan is constrained by insufficient investment over many years as its share in the GDP in 1960 was 46.2 percent and in 2010 it was only 20.8 percent.

LCCI President Irfan Qaiser Sheikh said the Chamber was ready to collaborate with USAID in carrying out projects in energy sector for the sake of economy and in the best interest of Pakistan and its nationals.

About the condition applied by US Congress Committee to link economic and military aid to NATO supply resumption, he said it was not justified considering the present situation of Pakistan which has already suffered losses of well over $65 billion due to its frontline role in war against terror. He said the role of USAID in various sectors ranging from energy, education, health, humanitarian assistance and etc needs to be expanded to more areas and with wider scope.

http://www.dailytimes.com.pk/default.asp?page=2012\05\16\story_16-5-2012_pg5_7

-

Comment by Riaz Haq on June 29, 2012 at 4:52pm

-

Here's Indian Bhadrakumar on Russian ties with Pakistan as published in ATOL:

The building blocks of the historic visit by Russian President Vladimir Putin to Pakistan in September have begun arriving in Islamabad. It is a poignant moment in the region's history and politics. This will be the first time a Russian president visits Pakistan since its birth in 1947.

--------------Besides, in immediate terms, mutual understanding with Pakistan is becoming an imperative need for Russia in the post-2014 scenario in Afghanistan, where the Western powers would have withdrawn the bulk of their troops but are nonetheless establishing an open-ended, sizeable military presence of tens of thousands of combat troops.

Russia and Pakistan are joined in their opposition to the long-term occupation of Afghanistan by the West; Russia hopes to influence Pakistani policies with regard to Afghanistan's future and, in turn, cooperation with Pakistan enhances the overall Russian resilience to play an effective role in the stabilization of Afghanistan and in providing security to Central Asia; and, equally, a strong relationship with Pakistan - in the field of energy security, in particular - can provide yet another underpinning for Russia's strategic ties with other key regional powers, especially China, India, Iran and Saudi Arabia.

Last but not the least, Pakistan is a valuable interlocutor for Russia with regard to the activities and movements of the militants operating in North Caucasus.

-------

A stunning thing is that the proposals brought by the Russian experts in the past week to Islamabad essentially pick up the threads of Putin's 2006 proposal. According to the details available so far, Moscow has made the following proposals to Islamabad:

Russia can offer financial and technical assistance for Pakistan's multi-billion dollar gas and power import projects that are in the pipeline.

Specifically, Russia is interested in participating in the two big gas pipeline projects on the anvil, namely, the TAPI (Turkmenistan-Afghanistan-Pakistan-India) and the IP [Iran-Pakistan].

Russia prefers that the cooperation is negotiated at the governmental level through direct negotiations rather than through bidding.

Russia is also keen on participation in the Central Asia and South Asia (CASA) project, which was originally floated in 2006, to bring to Pakistan via transmission lines across eastern Afghanistan 1,000-1,300 megawatts of surplus energy during the summer months from Tajikistan and Kyrgyzstan. (The project has the backing of the World Bank and the Islamic Development Bank.)

Russia will be willing to cooperate in the exploration of oil, gas and minerals in Pakistan.Unsurprisingly, Islamabad has eagerly responded to the Russian proposals. The following understanding seems to have been reached at the talks, which concluded in Islamabad on Wednesday:

Pakistan welcomes the Russian proposals;

Specifically, Pakistan is agreeable to negotiate the contracts with the state-owned Russian energy companies on a government-to-government basis and will be willing to amend its public procurement rules accordingly;

Steps will be taken to conclude a memorandum of understanding to move ahead with the identified projects during Putin's visit;

As regards the IP, Pakistan has already floated the tenders for awarding contracts for the pipeline procurement and construction work for the US$1.5 billion project. Russia's Gazprom may also participate. Pakistan proposes to give weight to bids that have a financial package attached. (China and Iran have also shown interest in the project.)

Meanwhile, Pakistan will hand over to Russia by mid-July a draft agreement for financial and technical assistance from the latter for the IP project.

Russia has agreed to finance the rehabilitation of the Guddu and Muzaffargarh power plants. ...

-

Comment by Riaz Haq on December 9, 2012 at 10:22am

-

Here's a PakistanToday report on US help for Pak energy sector:

The US Special Envoy and Coordinator for International Energy Affairs Ambassador Carlos Pascual was in Islamabad on Friday as head of the US delegation at the fourth US-Pakistan Energy Working Group meeting.

Secretary of Water and Power Nargis Sethi and Secretary of Petroleum and Natural Resources Dr Waqar Masood Khan co-chaired the annual Energy Working Group meeting.

The meeting is part of an ongoing bilateral dialogue to help address Pakistan’s energy sector challenges, including power generation, fuel, gas, and reform priorities.

At the conclusion of the meeting, the three officials announced that the United States government will fund an international consultancy to assist Pakistan in acquiring liquefied natural gas (LNG).

Secretary of Water and Power Sethi highlighted the need for an improved and sustained governance structure as a key element for a sustainable power sector and the steps taken so far.

Special Envoy Pascual welcomed the Pakistani government’s commitment to the reform process, improving governance, improving the financial viability and efficiency of the power sector and energy sector in general, and attracting private sector investment in energy production and distribution. The Secretary of Water and Power expressed her appreciation for U.S. assistance under the power distribution improvement project and the energy efficiency programmes.

Special Envoy Pascual also welcomed Pakistan’s adoption of the 2012 Petroleum Exploration & Production Policy, noting that it that has the potential to spur investment in exploration throughout Pakistan. Secretary Khan pointed out the imminent Pakistani oil and gas delegation meetings in Houston and London to promote the auction of licenses for 60 blocks (or exploration zones). “Today, the United States government and the Government of Pakistan launched a new initiative to help Pakistan acquire liquefied natural gas more efficiently,” said Ambassador Pascual at the the working group, “This initiative shows the United States and Pakistan working together on concrete actions to relieve Pakistan’s chronic shortage of electricity. It will accelerate the liquefied natural gas procurement process and offer a cheaper alternative to Pakistan’s current fuel oil imports.” The LNG consultancy, which will commence work before the end of the year, will assist the Government of Pakistan in the terms and assessment of liquefied natural gas supply and delivery from international suppliers.

The effort will speed the procurement process, saving the government the expense of fuel oil imports that are currently used to generate much of the nation’s electricity. The consultancy will also provide market analysis and technical assistance to the government’s implementer of LNG imports. Beyond today’s agreement, the United States and Pakistan together are carrying out large-scale energy projects, that will add 900 megawatts of capacity to the power grid by the end of next year — enough to supply electricity to an estimated 2 million households.

These projects include renovating the power plant at the Tarbela Dam; modernizing the generators at the Mangla Dam; upgrading the Guddu, Jamshoro and Muzafaragarh power plants; and building the Satpara and Gomal Zam dams. US technical assistance is also supporting crucial policy and management reforms underway in the Ministry of Water and Power. These reforms are focused both on reducing the power grid’s technical losses and on increasing collections.http://www.pakistantoday.com.pk/2012/12/08/news/profit/pakistan-and...

-

Comment by Riaz Haq on May 22, 2013 at 10:58pm

-

Here's a Dawn story on Saudi help for incoming Prime Minister Nawaz Sharif to overcome energy crisis in Pakistan:

ISLAMABAD, May 22: With an ‘amiable’ government in place, Saudi Arabia is expected to extend a bailout package of about $15 billion to Pakistan’s highly indebted energy sector by supplying crude and furnace oil on deferred payment to enable it to resolve the chronic circular debt issue.

A senior government official said the Saudis had been taking reasonable interest in helping out the incoming PML-N government led by Nawaz Sharif.

They had extended a similar special package to Pakistan soon after it went nuclear in 1998 and faced international economic sanctions.

Between 1998 and 2002, Pakistan received $3.5 billion (Rs190 billion at the exchange rate at that time) worth of oil from Saudi Arabia on deferred payment, a major part of which was converted into grant.

According to the official, as soon as the PML-N emerged as the majority party after the May 11 elections, the Saudi ambassador in Islamabad sought a briefing on the country’s oil requirements from the foreign ministry before calling on prime minister-designate Nawaz Sharif in Raiwind, Lahore.

He was immediately provided a position paper, the official said.

Pakistan expects about 100,000 barrels of crude oil and about 15,000 tons of furnace oil per day from Saudi Arabia on deferred payment for three years. The amount involved works out at about $12-15bn.

The facility can be utilised to reduce loadshedding in the short term and provide an opportunity in the medium term to restructure the power sector by minimising subsidies, eliminating circular debt, ensuring recovery from the public sector and reducing system losses to bring it to a self-sustainable level.

“During the package period, the PML-N government can resolve the electricity crisis and develop hydropower projects through a combination of public and private investments and bagasse-based power production by the sugar industry,” he said.

He said the arrangement for oil supplies on deferred payments could be further discussed during Mr Sharif’s first visit to Saudi Arabia soon after assuming the office of prime minister early next month.

Pakistan’s total crude oil import is about 400,000 barrels per day and 30,000 tons of furnace oil. Its total oil import bill stands at about $15bn per annum.

The official said a request for 100,000 barrels of oil and 15,000 tons per day of furnace oil had already been passed on through the Pakistan-Saudi Arabia Joint Ministerial Commission.

A meeting of the commission could be convened soon after the new government assumed charge, an official said.

The Saudi rulers had not taken any interest in the issue earlier ostensibly because of the chill in their relationship with the PPP government.

Large political delegations taken to Saudi Arabia by the PPP government were cold-shouldered, an official said, adding that warming up of diplomatic relations with Iran and the UAE and cancellation of hunting facilities for Saudi royals had also annoyed the kingdom.

The official said the breathing space provided by the likely Saudi package could also be used for renegotiating gas price with Iran for the Iran-Pakistan gas pipeline to bring it down to a sustainable level.

Under the gas sales and purchase price agreement, any party may seek revision of the rates in view of the cost of alternative import options one year ahead of the first gas flows scheduled to take place in December 2014.

The official ruled out any possibility that the Saudi oil package could be used to persuade Pakistan to stay away from the Iranian gas import. He said the project had reached an advanced stage and involved international agreements and, therefore, backtracking was no option, but the development could give leverage to Pakistan to secure lower gas prices.

http://beta.dawn.com/news/1013070/15-billion-saudi-bailout-likely/

-

Comment by Riaz Haq on June 12, 2013 at 4:24pm

-

Here's a McClatchy report on Sharif allocating no money to Iran-Pakistan gas pipeline:

Pakistan’s newly elected government Wednesday unveiled its first budget, which gave the go-ahead for buying two new nuclear power plants from China but made no allocation for a long-proposed natural gas pipeline from Iran that had sparked complaints from the United States.

In not budgeting for the Iranian pipeline, agreed to by his predecessor in February, Prime Minister Nawaz Sharif tactfully sidestepped a potential diplomatic clash with the United States, which had warned that the pipeline, if it were ever built, could lead to sanctions on Pakistan. The deal also was criticized as a trap for the new administration by Sharif’s brother and de facto deputy, Shahbaz Sharif, the chief minister of Punjab province.

The $35.5 billion budget, which was presented to Parliament by the new minister for finance, Ishaq Dar, suggested that the new government would follow through on Sharif’s plan to resolve the country’s power shortages that Dar said had cut the country’s economic growth by 2 percent in the outgoing fiscal year, which ends June 30.

Dar’s budget would switch Pakistan’s power generation plants from expensive imported fuel oil and gas to much cheaper coal sourced partly from undeveloped reserves in Pakistan’s southern Sindh province. The rest probably would come from huge mines in India, Pakistan’s traditional foe, with which it has fought two wars since both gained independence from Britain in 1947.

The South Asian neighbors opened talks Tuesday about the planned import of Indian electricity via cross-border cables near the eastern Pakistani city of Lahore.

The budget also sets aside about $430 million for new nuclear power plants from China, a project that the United States and India have both objected to at meetings of the Nuclear Supplier Group, one of the international groups that attempts to prevent nuclear proliferation. But Pakistan insists that the plants are unconnected to the country’s nuclear weapons program and are regularly inspected by the International Atomic Energy Agency. Pakistan possesses between 80 and 120 nuclear weapons, according to estimates by Western analysts.

A Cabinet minister, speaking to McClatchy on condition of anonymity because he was not authorized to discuss the project with a reporter, said the Iranian gas pipeline hadn’t been altogether dropped, largely because that would invoke a penalty payment to Iran. Instead, he said, Pakistan’s new government would procrastinate by trying to haggle lower prices from Tehran, based on the comparison with coal.

Analysts also said Sharif could forgo the Iranian pipeline because of the prime minister’s good relations with Saudi Arabia. Sharif spent six years in exile in the Persian Gulf kingdom as part of a deal for his release from jail in Pakistan negotiated by the Saudi royal family, after he was overthrown in a military coup staged by Gen. Pervez Musharraf in October 1999....

Read more here: http://www.mcclatchydc.com/2013/06/12/193732/no-money-in-pakistan-b...

-

Comment by Riaz Haq on February 20, 2014 at 10:12am

-

Here's a Financial Times report on Qatar-Pakistan LNG deal:

Electricity-starved Pakistan is close to signing a deal with Qatar worth as much as $2.5bn a year for the supply of liquefied natural gas (LNG) from the Gulf emirate to fuel Pakistan’s power grid, according to senior officials in Islamabad.

“This will be the last winter of discontent,” said Shahid Khaqan Abbassi, Pakistan’s petroleum minister, in a reference to the long power cuts that have for years angered Pakistani industrialists and householders. He promised a “major improvement” in gas supplies next year after particular severe shortages this winter.Mr Abbassi is close to signing an agreement for the import of LNG from early 2015. Although the government has yet to name a supplier formally, Mr Abbassi and other officials from his ministry said that Qatar was the expected seller.

“If we can provide gas to those of our power generation plants that run on gas, [electricity cuts] will go down by half,” said Mr Abbassi. Demand for natural gas in Pakistan, a country of 180m people, is estimated at 8bn cubic feet per day, double the amount produced locally from gas fields in the south of the country.

Pakistan has also negotiated an agreement to buy gas to be piped from neighbouring Iran, but implementation of the project has been has been hampered by lack of financing and by US opposition.

Mr Abbassi expects Pakistan to buy some 3.5m tonnes of LNG a year from Qatar, meeting only part of the country’s shortfall.

Before the winter, Mr Abbassi alarmed his cabinet colleagues when he told them that for the first time in Pakistan’s history gas supply this year would not be sufficient to meet the needs of domestic consumers – even if supplies to commercial and industrial buyers were suspended.

Nawaz Sharif, prime minister, ordered Mr Abbassi to “take emergency steps” to tackle the situation, according to a senior official working with Mr Sharif. “Failure to provide gas will only enlarge the political risk [to the government],” the official said.

Growing energy shortages in recent years have prompted street demonstrations that only add to political instability in Pakistan.

Some critics have questioned Pakistan’s ability to keep up with the payments for future LNG supplies given the country’s weak finances, although the gas would partly replace oil used for power generation. “That may spare foreign exchange and allow the authorities to pay for at least part of the gas imports,” said Sakib Sherani, a former finance ministry adviser

The discussions with Qatar have deepened uncertainty over an earlier plan by Pakistan to build a pipeline to the Iranian border to import gas from Iran’s South Pars gas field. Mr Abbassi refused to comment on that project, and said only that “Pakistan will need more gas even after the LNG project. We are looking at all possible avenues.”http://www.ft.com/intl/cms/s/0/82b74180-8c79-11e3-9b1d-00144feab7de...

-

Comment by Riaz Haq on January 17, 2018 at 7:09pm

-

Saudi Arabia, Pakistan to boost ties in different fields

By M. Ishtiaq | Published — Wednesday 17 January 2018

http://www.arabnews.com/node/1227871/saudi-arabia

ISLAMABAD: Pakistan and Saudi Arabia have agreed to enhance bilateral cooperation in a number of different fields.

The two sides signed and exchanged documents of protocol at the end of the two-day long 11th Saudi-Pakistan Joint Ministerial Commission (JMC) meeting in Islamabad on Wednesday.

In the closing session, Pakistan’s Minister of Commerce Pervaiz Malik invited Saudi Arabia to invest in renewable energy projects, and in the agriculture, oil exploration and livestock sectors.

“The launching of Vision 2030 in the Kingdom will surely usher in the creation of hundreds of thousands of new jobs in the construction and services sectors … I would like my Saudi brothers to increase the quota of jobs for Pakistani workers in those sectors,” said Malik.

He also suggested the Saudi government could establish a “Saudi-specific training sector” in Pakistan to teach the particular skills needed for the Saudi job market.

The head of Saudi Arabia’s delegation, Majid Al-Qassabi, minister for commerce and investment, said the Kingdom was keen to enhance strategic relations with “our brotherly country Pakistan.”

The Saudi minister admitted that the current volume of trade between the two countries is only “moderate.”

“We need to enhance communication, we need to identify opportunities,” he said. “We need to promote investment opportunities, from both ends. We need to clear all the obstructions, all the challenges, that (inhibit) the ease of doing business.”

The 34-member Saudi delegation included participants from 20 different government entities, the chamber of commerce, and the private sector.

“We are really keen to identify opportunities, we really need to work to establish a long strategic relationship,” Al-Qassabi said.

The minister also announced that Riyadh will host the Saudi-Pakistan Business Forum in the second half of this year. “Hopefully that will be the launching pad for new business and investment relations between the two countries,” he said.

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

IDEAS 2024: Pakistan Defense Industry's New Drones, Missiles and Loitering Munitions

The recently concluded IDEAS 2024, Pakistan's Biennial International Arms Expo in Karachi, featured the latest products offered by Pakistan's defense industry. These new products reflect new capabilities required by the Pakistani military for modern war-fighting to deter external enemies. The event hosted 550 exhibitors, including 340 international defense companies, as well as 350 civilian and military officials from 55 countries.

Pakistani defense manufacturers…

ContinuePosted by Riaz Haq on December 1, 2024 at 5:30pm

Barrick Gold CEO "Super-Excited" About Reko Diq Copper-Gold Mine Development in Pakistan

Barrick Gold CEO Mark Bristow says he’s “super excited” about the company’s Reko Diq copper-gold development in Pakistan. Speaking about the Pakistani mining project at a conference in the US State of Colorado, the South Africa-born Bristow said “This is like the early days in Chile, the Escondida discoveries and so on”, according to Mining.com, a leading industry publication. "It has enormous…

ContinuePosted by Riaz Haq on November 19, 2024 at 9:00am

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network