PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan: A Unique Lab For Mobile Banking Innovation

Spurred by a favorable regulatory and technology environment, Pakistan is witnessing dramatic growth in branchless banking, according to a March 14, 2012 report by the State Bank of Pakistan.

Here are some of the key indicators contained in the State Bank report:

1. Number of branchless banking accounts jumped 40 percent to 929,184 in October-December 2011 (Second quarter of FY2011-12) from the preceding three month period.

2. Total amount of branchless banking deposits surged 169 percent to Rs 503 million in Oct-Dec 2011 from July-September 2011.

3. Number of branchless banking transactions during the second quarter rose 30 percent to 20.6 million while the value of transactions showed a growth of 35 percent to reach Rs. 79,410 million.

4. Branchless banking agents network in Pakistan grew by 16 percent in the second quarter (October- December 2011) of current fiscal year 2011-12 to reach 22,512 agents covering the entire length and breadth of the country.

5. The average size of branchless banking transaction was Rs 3,855 while the average number of daily transactions was 228,855.

6. Bills payment and mobile phone SIM card top-ups remained the dominating activity in the quarter under review with 53 percent share in total number of transactions, followed by fund transfers and deposits with share of 39 percent and 8 percent respectively.

7. While P2P payments remained the most popular mechanism with 74pc share in the total funds transfer, mobile branchless banking is penetrating all areas of payments such as utility bills, Government-to-Person (G2P) and Person-to-Person (P2P) payments while scaling up other services relating to deposits and loans.

A 2011 report by World Bank's Consultative Group to Assist the Poor (CGAP) describes Pakistan's mobile banking as "a unique laboratory for innovation". Here's an excerpt from it:

"Branchless banking regulation was first introduced in Pakistan in April 2008. From the beginning, the State Bank of Pakistan (SBP) has taken a constructive regulatory approach by providing clear guidance and being willing to listen to businesses and adjust regulation where necessary. A variety of business models is emerging that involves a wide range of players, including mobile network operators (MNOs), technology companies, and even a courier business. (Notably, a bank remains ultimately liable to SBP in all the models.) The government is further encouraging innovation by piloting the use of branchless banking to distribute government payments. Taken together, these factors make Pakistan a unique laboratory for innovation."

In a country where only 22% of the population owns bank accounts and more than 62% owns mobile phones, mobile banking is proving to be the fastest way to promote financial inclusion considered by experts to be essential to lift people out of poverty. Benefits include easy access for rural customers to banking services through agents in villages without bank branches, better documentation of the economy, enlarging of the tax-base and efficiency of economic transactions.

Related Links:

Pakistan Ranks High in Microfinance

Media & Telecom Sector Growing in Pakistan

Pakistan's Financial Services Sector

Fighting Poverty Through Microfinance

-

Comment by Riaz Haq on October 10, 2012 at 8:30am

-

Here's Pak Observer report on branchless banking growth in Pakistan:

Karachi—Branchless Banking is helping in reaching out to the low income, unbanked people through more than 30,000 access points throughout the country. Nearly 30 million transactions worth Rs.115 billion have been processed during the fourth quarter of the last fiscal year through branchless banking and the average daily transactions have been reported at 315,178 while the total number of branchless banking accounts has increased to 1.7 million. According to the World Bank’s Consultative Group to Assist the Poor (CGAP), Pakistan is the fastest growing branchless banking market in the world.

Addressing the journalists Deputy Governor, State Bank of Pakistan (SBP),Kazi Abdul Muktadi during his visit to Karachi Press Club today.

Expressing his resolve to provide banking services to all segments of the society, he said that with the concerted efforts of all, we will be able to achieve the desired goal of ‘Banking for All’.

Emphasizing the need for an efficient and thriving banking system, he said that the State Bank is providing regulatory environment to financial institutions to enhance financial inclusion in the country. ‘Providing people with access to finance is a challenging task, not just for the central bank but also for all the stakeholders,’ he observed.

State Bank of Pakistan is trying to make the banking services available at the door step of the people, he said and added that promoting access to banking services is the corner stone of SBP’s policy framework. He said the State Bank under its Branch Licencing Policy has made it compulsory for banks to open at least 20% of their new branches in rural and under-served areas.

Abdul Muktadir said the banking industry of Pakistan has tremendous growth potential to deliver lot more than what it is delivering right now. ‘The significance of e-banking and m-commerce cannot be overemphasized because of the fact that both have brought about remarkable changes in the ways people think and do their banking business today,’ he added.

The transformation from traditional to modern ways of banking is taking place at a fast pace. A number of alternate delivery channels for provision of banking services like ATMs, Credit Cards, POS terminals, Internet Banking, Debit Cards already exist in our country to benefit the masses. ‘Currently, 93% of the total bank branches are offering Real-Time Online services,’ he added.

Abdul Muktadir said the SBP would ensure that the high level of banking service standards is maintained for the safety, security and cost effectiveness with adequate levels of protection for consumers’ interests.

The SBP Deputy Governor, who also inaugurated an ATM at Karachi Press Club, pointed out that the availability of ATMs in Pakistan is quite low as there are only 5600 ATMs in the country. At present, there are about one ATM against two bank branches while in developed countries, there are three ATMs against one bank branch. SBP has recently issued policy instructions to all banks which bind them to expand their ATM network in a phased manner so as to achieve a target level of one ATM for each bank branch. ‘Once this target is achieved, we have plans to gradually raise the bar so as to meet the international levels.

-

Comment by Riaz Haq on November 1, 2012 at 10:41am

-

Here's an IBM press release in Sacramento Bee on its contract for mobile banking technology in Pakistan:

KARACHI, Pakistan, Nov. 1, 2012 /PRNewswire/ -- IBM (NYSE: IBM) today announced that Monet, one of Pakistan's leading mobile-commerce providers, has selected a customized IBM cloud-based solution that will enable the company to enhance service efficiency and expand its presence across the country.

Launched in 2012, Monet provides banks, mobile network operators and branchless banking agents in Pakistan with a technology platform that offers end-users a simple interface through which they can access a wide range of financial services on their mobile phones.

Mobile banking and financial services are expected to grow significantly in Pakistan in the coming years. Increased demand for affordable banking, a lack of traditional banking infrastructure and an aggressive branchless banking mandate from the State Bank of Pakistan (SBP) has driven quick uptake of mobile banking in the country.

With a population of 180 million, a mobile phone penetration of more than 70% and a banked ratio of only 22%, Pakistan offers a large potential market for Mobile Financial Services (MFS). According to an SBP recent branchless banking newsletter, the number of mobile banking accounts was at 1.45 million, showing a growth of 37% during the second quarter of 2012, with new level zero account openings registering a jump of 370%. The existing accounts activity level also improved substantially during the quarter as the number of active accounts increased by 66%.1

To capture this opportunity, Monet chose IBM to develop a unique IT environment allowing the company to offer reliable and efficient services to a growing customer base throughout the country.

"Mobile financial services have reached an inflection point where they have moved from niche to mainstream," said Ali Abbas Sikander, CEO, Monet. "We believe mobile can potentially become the strongest channel for the delivery of financial services. IBM's cloud solution will allow us to reach our clients easily, giving us access to a wider base of customers and ultimately extending the reach of financial services in the country."

IBM will develop a specialized solution based on IBM SmartCloud technology, to deploy Monet's mobile banking applications from Fundamo, a leading mobile financial services platform provider and an IBM partner. The private cloud will allow Monet to save on initial investments in IT and help the company offer more efficient services at a reduced cost.

IBM SmartCloud infrastructure is based on IBM servers, storage and software optimized to meet growing mobile demand. In addition, Monet has outsourced the entire networking, security, cryptographic solutions, and disaster recovery to IBM, in order to focus on its core business.

"Mobile and Cloud are a powerful combination to provide sustainable and affordable banking services to millions of people in Pakistan," said Adnan Siddiqui, CGM, IBM Pakistan and Afghanistan. "IBM has global experience in the financial services sector and a thorough understanding of the local market, and our engagement with Monet is expected to benefit banking customers across the country."..

Read more here: http://www.sacbee.com/2012/11/01/4953392/leading-pakistan-mobile-ba...

-

Comment by Riaz Haq on November 20, 2012 at 10:40am

-

Here's an ET story on expansion of branchless mobile banking in Pakistan:

KARACHI: In another strong sign that branchless banking is gaining momentum in Pakistan, Zong and Askari Bank – the latest entrant to join this bandwagon – have partnered to launch a complete branchless banking solution.

The State Bank of Pakistan (SBP), according to sources in Zong, issued branchless banking licence to Zong and Askari Bank last Friday after auditing their pilot project, launched in May this year.

This is the second branchless banking license issued by the SBP this month – the central bank had awarded a mobile financial services licence to Mobilink’s sister concern Waseela Bank.

The product, according to Zong officials, will soon be launched commercially. The branchless banking portfolio includes services like mobile account, money transfers, utility bill payment among others, Zong said in a press statement. Additionally, Zong is going to offer services like salary disbursement, it added.

This will be first of its kind collaboration where a telecom operator and a commercial bank will provide branchless banking services under a relationship where none of the parties has any shares or controlling interest in each other, – the revenue will be shared between the partners.

“Branchless banking is only the beginning of a new banking revolution in the country, we are launching our new branchless banking services to foster financial inclusion of the unbanked population in Pakistan,” Usman Ishaq, executive director (commercial) at Zong said while responding to an email by The Express Tribune.

The project, according to Ishaq, is targeted for the unbanked population of the country, who have no means of availing banking or financial services.

It merits mentioning that only 22% of the country’s population owns a bank account; by contrast, more than 60% Pakistanis have access to mobile phones – the unbanked segment of Pakistan, therefore, provides an opportunity for expansion of branchless banking.

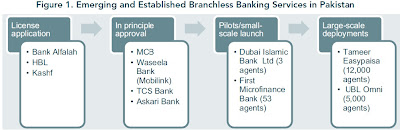

Branchless banking regulation was introduced in Pakistan in April 2008; the central bank has, since then, taken a constructive regulatory approach to encourage investment in this sector – the SBP had issued four branchless banking licences between 2008 and 2011 and the branchless banking just clicked in the country.

Telenor Pakistan, through its subsidiary, Tameer Microfinance Bank launched easypaisa in October 2009 – they processed 23 million transactions amounting to Rs43 billion ($500 million) till the end of July, 2011.

In April 2010, United Bank (UBL) entered sector by launching UBL Omni. It got numerous contracts to disburse payments for public sector organisations and government schemes such as the Benazir Income Support Programme, flood relief programme and the United Nations World Food Programmme.

First MicroFinance Bank and Dubai Islamic Bank Pakistan were among the pilot or small-scale launches – the former had partnered with Post Office in 2008 for loan disbursements.

The fast growing branchless banking sector of the country even got attention from international researchers.

In an October 2011 report – Branchless Banking in Pakistan: A Laboratory for Innovation – Consultative Group to Assist the Poorest (CGAP) mentioned Pakistan as one of the fastest growing markets for branchless banking in the world.

In its report, the CGAP had mentioned Waseela Bank, Askari Bank, Bank Alfalah and MCB Bank as anticipated players to enter the market during next 12 months. While the first two have already got licences, the others are yet to announce their entry in this growing market segment, if they still intend to that is.

http://tribune.com.pk/story/468247/as-mobile-banking-grows-zong-ask...

-

Comment by Riaz Haq on February 12, 2013 at 8:36am

-

Here's PR Newswire on digital money in Pakistan:

Pakistan’s financial services industry is currently on the turn, as digital money is spreading on the back of the fast-paced mobile phone penetration. Working side by side with a range of public and private organisations, the State Bank of Pakistan is involved in creating favourable conditions to promote efficient financial inclusion through a branchless banking model, as well as to enhance payment systems for broader use.

New comprehensive viewport “Digital Money in Pakistan 2013” drawn up by Shift Thought provides an in-depth analysis of Pakistan’s digital money market, within the context of the larger Asia-Pacific region and worldwide trends.

The viewport provides an in-depth overview of how digital money services are developing in the country, focusing on what is driving digital money, the kinds of business models and the adoption and maturity of the market. It also goes into the detail of the needs of various market segments, discusses the whole package of services expected by the sector, delves into the regulatory environment, gives a refined understanding of the local payments system and introduces key categories of the players and partnerships that are forming around the delivery of digital money services. The viewport is supplemented with extensive profiles of multiple industry players as well as of the services launched in the Pakistani digital money market.

----------

Pakistan is currently undergoing a transformation in financial services, with the spread of Digital Money aided by the rapid penetration of mobile phones.The Reserve Bank of Pakistan is working with several public and private organisations to promote financial inclusion through a branchless banking model by creating an enabling environment for the development os services in the country.At ShiftThought we work with organisations around the world to shift the thinking from a focus on Mobile Money to planning for the wider set of initiatives we term as Digital Money. Through this Country Series of viewports we share with you findings from our on-going in-depth analysis of the state of play of Digital Money Initiatives in each country, within the context of the larger region and world-wide trends.

Digital Money services are no longer confined to a single industry, and this breaks down traditional models of competitive analysis. Our approach is designed to helps players to understand the strategies and business models coming from industries other than their own, across a range of products and services and from different parts of the world, to distil best practices for building successful brands that provide innovative access to financial services.

http://www.businesswire.com/news/home/20130211005467/en/Pakistan-Di...

-

Comment by Riaz Haq on February 13, 2013 at 8:52am

-

Here's ET on increasing e-banking in Pakistan:

The overall value and volume of e-banking transactions throughout the country increased during the second quarter (October to December 2012) to Rs 7.6 trillion (18.02 per cent)and Rs 79.45 (11.31 per cent) million respectively, the State Bank of Pakistan reported on Wednesday.

State Bank of Pakistan’s Payment Systems report for the second quarter of FY13 released today revealed that the branches of 484 banks in Pakistan were added to the Real-Time Online Branches (RTOB) network during the second quarter of the current fiscal year (FY13) and now 94 percent branches are offering online banking services.

Calculating the overall internet banking services across the country, overall 9,896 branches of banks out of 10,523 are offering the service. During the second quarter, the overall value and volume of internet banking transactions had seen an increase in of 18.82 percent and 14.29 percent in the overall value and volume of internet banking from the first quarter of 2012, respectively.

The Payment Systems infrastructure in the country had also seen an increase because of the installation of 245 new Automated Teller Machines at banks around the country. Today, the number of ATMs across Pakistan has reached a total of 6,232. The report further said that ATM transactions had a major share of 61.12 percent in terms of transaction volume with an average value of Rs9,779 per transaction.

The overall e-banking transactions in value terms was 6.27 percent during the second quarter, increasing the value and volume of ATM transactions by 10.33 percent and 10.68 percent respectively in the second quarter as compared to the first quarter of the current fiscal year.

The report also said that over 20.72 million banking cards were issued in the country by the end of December, 2012, witnessing an increase of 5.33 percent in the second quarter compared to the preceding quarter.

Point of Sale (POS) terminals showed a growth of 6.25 per cent and 5.06 per cent in value and volume respectively as compared to the first quarter of the current fiscal year, with value and volume of transactions standing at Rs22.1 billion and Rs4.5 million, respectively, in the second quarter.

The report also pointed out an increase of large-value payments through Real Time Gross Settlement (RTGS) with 9.46 percent in value and 10.35 percent in volume as compared to the first quarter. The recorded value and volume was Rs42.13 trillion and Rs12.16 billion respectively in the second quarter.

The report also revealed that major portion for the increased number of overall Pakistan Real Time Interbank Settlement Mechanism (PRISM) transactions increased 14.06 percent during the same period, which was contributed by Interbank Funds Transfers (IBFT). Similarly, the value of overall PRISM transactions increased by 14.96 percent due to securities settlement.

http://tribune.com.pk/story/506723/e-banking-transactions-cross-rs7...

-

Comment by Riaz Haq on March 13, 2013 at 10:43am

-

Here's a Finextra report on mobile money in Pakistan:

A shared mobile money network, built on Visa's Fundamo technology, that can be tapped by banks and telcos is preparing to launch in Pakistan.

Monet - which was set up by the massive Abu Dhabi Group last year - has now secured approval from the State Bank of Pakistan to build its network, which is being offered to local firms planning to launch mobile money services.Built on Fundamo technology, Monet says its offering will provide a managed service platform, agent management services and bill aggregation services to new financial institutions and network operators interested in entering branchless banking services.

The first clients are Pakistan's sixth largest financial institution, Bank Alfalah, and Warid Telecom, who have teamed up to launch a new brand on the platform.

Monet says that its network will make it cheaper, easier and quicker for firms to tap into Pakistan's huge unbanked market. According to the Pakistan Access to Finance Survey, only 12% of the population has access to formal financial services, yet mobile penetration stands at nearly 70%, says the Pakistan Telecommunications Authority.

A recent study by the Boston Consulting Group estimates that 35% of the country's adult population will be using mobile financial services by 2020.

Ali Abbas Sikander, CEO, Monet, says: "We are building an open and collaborative eco-system which benefits all the stakeholders of the financial services ecosystem in Pakistan. Collaborative mobile financial services, as opposed to bank-led or telco-led deployment, is the paradigm shift which will assist in creating a bigger and less costly enabling environment for the issuers, acquirers and service providers."

Aletha Ling, COO, Fundamo, adds: "The platform allows service providers to think big, start small and scale fast. The result will be an ecosystem that that will support the long term and sustained growth of the Pakistani mobile financial services market."

http://www.finextra.com/News/FullStory.aspx?newsitemid=24626

-

Comment by Riaz Haq on July 8, 2014 at 8:15pm

-

A soft revolution of mobile money in Pakistan: A pathway to financial inclusion

Over the past decade, there has been a rapid expansion of mobile money (m-money) networks in developing countries. These are largely intended to help financial services reach unbanked populations. This innovation has been taken up by cellular mobile companies in Pakistan, in partnership with domestic financial institutions, and thus creating some innovative business models for the use of m-money. While these innovations are a positive step forward for greater financial inclusion in Pakistan, a national strategy is essential to facilitate targeted and coordinated efforts between regulators and the private sector.

The challenge of high financial exclusion

Despite comprehensive financial sector reforms in Pakistan, progress on financial inclusion has been slow. In 2011, only 10% of Pakistan’s adult population had accounts at formal financial institutions (Figure 1). In comparison, 68.5% of the adult population in Sri Lanka had bank accounts, whereas this figure is 39.6% in Bangladesh and 35.2% in India.

Pakistan’s m-money infrastructure has expanded rapidly since the launch of the first domestic initiative in October 2009. This expansion has been promoted by a liberal financial and telecommunications regulatory framework, and active private sector participation. Four out of five cellular mobile companies currently operating in Pakistan have launched m-money systems in partnership with financial institutions. The m-money market volume has reached 153 million annual transactions worth US$ 6.2 billion.

There are two ways through which m-money services are provided in Pakistan. More than 95% of m-money transactions are carried out through mobile banking (m-banking) agents, and the rest are processed directly through customers’ mobile-wallet (m-wallet) accounts, using mobile phones. M-banking agents (retail points) provide the basic infrastructure for Pakistan’s m-money services, whereas customers’ m-wallet accounts currently have a limited role in the m-money services market.

In Pakistan, m-money services can improve access to financial services for the unbanked population, which is something which traditional banking channels have not managed to do. The network of 93,864 m-banking agents against only 10,250 commercial bank branches in the country provides a perspective as to the reach m-money has on the un-banked and poor.

The current high rate of dependence on agents to complete mobile transactions is typical in the initial adoption of m-banking. Moving forward, the importance of m-wallet accounts cannot be neglected. Many financial services including savings, insurance and micro-credit can be delivered through m-wallet accounts, which provide a store of value. As of June 2013, there were only 2.6 million m-wallet accounts, which is not large enough to reduce the high level of financial exclusion in Pakistan. Three new players that started operations in 2013 are relying solely on agent-based m-money services, while neglecting the potential of m-wallet accounts.

https://aric.adb.org/blog/57/a-soft-revolution-of-mobile-money-in-p...

-

Comment by Riaz Haq on June 15, 2015 at 1:43pm

-

Financial Inclusion Challenge Finalist: Telenor #Pakistan Mobile Banking #EasyPaisa

http://on.wsj.com/1MTSnCw

Telenor Pakistan is one of the country’s first mobile banking programs making financial services available to millions of Pakistanis. Photo: Telenor Pakistan

-

Comment by Riaz Haq on November 9, 2015 at 9:48pm

-

NBP, KARANDAAZ #Pakistan to work to improve financial inclusion. Focus on G2P and P2G #mobilemoney transactions http://pakobserver.net/detailnews.asp?id=278596 …

National Bank of Pakistan (NBP) and Karandaaz Pakistan signed a Memorandum of Understanding (MoU) for jointly working on multiple strategies to create the much-required Digital Financial Ecosystem, through a suite of financial transactions to facilitate the citizens of Pakistan with a focus on Government to Person (G2P) and Person to Government (P2G) transactions. The two institutions agreed to collaboratively develop a comprehensive digital financial services strategy for NBP; develop and deploy the required technology as well as roll out a mobile financial system that will add multiple channels of transactions.

The signing took place at the Karandaaz Pakistan’s office in Islamabad and was attended by senior management from both organizations including Mudassir H. Khan – SEVP/Group Chief CRBG NBP, Azfar Jamal – EVP/Head of Remote Banking & ADC and Mr. Imdad Aslam Interim CEO of Karandaaz Pakistan. Speaking at the occasion, Mudassir H. Khan, stated, “By leveraging on the expertise of Banking and Telcos, NBP aims to achieve its long term goal of financial inclusion in Pakistan and also bridge the service-divide between rural and urban. Development of a Financial Eco-system in partnership with Telecom service providers will be catalyst to extend the financial outreach and convenience to every citizen of Pakistan. NBP is working to enable every possible channel by aggregating all the P2G and G2P transactions.

We are excited to have Karandaaz Pakistan joining us in this initiative, whereby Karandaaz, which is a Bill & Malinda Gates Foundation & DFID sponsored entity, will provide their rich experience and expertise to NBP in building the much required financial ecosystem in Pakistan”. Speaking at the event, Imdad Aslam, Interim CEO of the company, stated, “The potential of G2P payments to accelerate financial inclusion in the short to medium term is tremendous and cannot be over emphasized. On the one hand, governments can determine the way they disburse payments to their beneficiaries and drive them towards digital payment streams, which in turn can enable the creation of financial products that address the barriers to financial inclusion.

On the other hand, social benefit payments, intended for the marginalized and vulnerable, inevitably reach some of the most financially excluded populations. Digitization of such payments, therefore, presents great opportunity to increase recipients’ access to financial services and provide them with a financial transaction history.” Concluding the event on a high note, Imdad Aslam said, “The cost of digitization is overshadowed by the benefits to individuals, financial institutions and the government over time, and we expect to see the same in this case.”

-

Comment by Riaz Haq on November 29, 2015 at 7:49am

-

#Pakistan is upbeat on #Islamic branchless banking- http://www.khaleejtimes.com/business/banking-finance/pakistan-is-up... …

Upbeat on shariah-compliant modes, Pakistan has just launched Islamic branchless banking claiming it to be "the first" - globally.

At the same time, State Bank of Pakistan (SBP), the central bank, just unveiled vast opportunities for foreign and domestic investors to come into the fold of all types of conventional and Islamic banking to invest and earn big dividends.

The first to take up the Branchless Islamic Banking (BIB) are Kuwait-based Meezan Bank and Ufone, a subsidiary of Pakistan Telecommunications Corporation (PTCL), partly owned by etisalat. The new ventures will carry the brand name of "Meezan-Upaisa," and it is the only Shariah-based branchless banking service.

The other cellphone-based branchless conventional banking in the country are Mobicash Waseela Bank operated by Mobilink, EasyPaisa-Tameer launched in cooperation with Norway-based Telenor, Ypaisa-U bank of Ufone and Timepey-Askari Bank.

While launching the new BIB customer service across Pakistan, SBP governor Ashraf Mahmood Wathra said this is the first product of its kind, not only in Pakistan, but in the whole world. "We have granted the permission to launch this unique service in order to facilitate 95 per cent of Pakistanis who will like to deal only with Islamic banking services, and have remained away from the current conventional banking services, because of their Islamic faith," Wathra said.

SBP, which recently conducted a survey 'Knowledge, attitude and practices of Islamic banking in Pakistan', said there is an overwhelming, and evenly distributed, demand in the urban and rural areas of the country for Islamic banking. The demand for Islamic banking is as high as 95 per cent among the households at the retail level. "Demand stands at 73 per cent among the businessmen," according to the SBP survey, which is based on 9,000 households nationwide and includes banked and non-banked customers, and 1,000 corporates. Meezan Bank and Ufone took a full year to develop the BIB model, which has now been launched.

Win-win situation

"With this new collaboration, we aim to capitalise on the strength of both the parties - Meezan Bank's strength in Islamic banking and Upaisa's geographic footprint in facilitating customers, making it a win-win situation for all. This is because Upaisa is at the forefront in providing branchless banking services, and its collaboration at various levels and Meezan Bank holding over 50 per cent of the Islamic banking share in Pakistan," Ufone President Abdul Aziz said.

Asher Yaqub Khan, chief commercial officer of Ufone, said Islamic branchless banking will accelerate the goal of financial inclusion of the economy to a great extent.

President and chief executive of Meezan Bank Irfan Siddiqui said his bank has played a vital role in expanding access to Islamic financial services in Pakistan. "This initiative is poised to accelerate financial inclusion by adding convenience and greater reliability, deepening the role of Ufone through enhancing the value it provides to its customers and that of Meezan Bank in expanding the reach of Islamic financial services to every citizen in the country."

The two partners - Meezan Bank and Ufone - hope that their partnership will expand Islamic system footprint to its maximum potential customers and facilitate them to avail branchless banking services with utmost ease and convenience under the Islamic system. This will be the fist milestone in the ambit of Islamic branchless banking.

"Our partnership will provide the service at 10,000 points of service across 500 cities, districts and villages. BIB will not only promote micro-financing but also finance for agriculture and small businessmen. It will also encourage savings by the general public, based on profit and loss model."

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

India-Pakistan Cricket Match: The Biggest Single Event in the World of Sports

Why did Pakistan's decision to boycott the India-Pakistan match in solidarity with Bangladesh in this year's T20 World Cup send shockwaves around the world? And why did it trigger the International Cricket Council's and other cricket boards' urgent efforts to persuade Pakistan to return to the match? The reason has a lot to do with its massive financial impact, estimated to be as much as …

ContinuePosted by Riaz Haq on February 11, 2026 at 4:00pm — 2 Comments

Can Pakistan's JF-17 Become Developing World's Most Widely Deployed Fighter Jet?

Worldwide demand for the JF-17 fighter jet, jointly developed by Pakistan Aeronautical Complex (PAC) and China’s Chengdu Aircraft Industry Group (CAIG), is surging. It is attracting buyers in Africa, Asia and the Middle East. At just $40 million a piece, it is a combat-proven flying machine with no western political strings attached. It has enormous potential as the lowest-cost 4.5…

ContinuePosted by Riaz Haq on February 4, 2026 at 8:00pm — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network