PakAlumni Worldwide: The Global Social Network

The Global Social Network

Goldman Sachs' Jim O'Neill Bullish on Pakistan

In his recently published book "The Growth Map", Goldman Sachs' Jim O'Neill of BRIC fame has reiterated Pakistan's long term growth prospects as part of the Next 11 (N-11) group of nations which includes Bangladesh, Egypt, Indonesia, Iran, Mexico, Nigeria, Pakistan, Philippines, Turkey, South Korea, and Vietnam.

Goldman Sachs has recently launched an N-11 equity fund (GSYAX) to enable investors to take advantage of growth in the Next-11 group of nations.

Answering a reporter's question about the growth prospects of GCC (oil-rich nations of Gulf Cooperation Council) at a recent investment conference in Dubai, he said: "Some GCC countries are well placed to be hubs for the BRIC and N-11-influenced world. I often think of Dubai as a kind of N-11 center, even the capital of the N-11 world, given its business adjacency to Egypt, Pakistan, Iran, Turkey, and, of course, India and Russia."

While the primary criterion used by Goldman Sachs for membership of a developing nation in BRIC and N-11 is the size of its population, the firm also considers what it calls Growth Environment Score (GES) of each nation. The 13 variables which make up growth environment score are inflation, fiscal deficit, external debt, investment rate, openness of the economy, penetration of phones, penetration of personal computers, penetration of internet, average years of secondary education, life expectancy, political stability, rule of law and corruption.

Goldman Sachs has given Pakistan a low GES score which puts the country among the bottom third of Next-11 nations. However, this score is rising, and Goldman forecasts that Pakistan will be among the top 20 world economies by 2025.

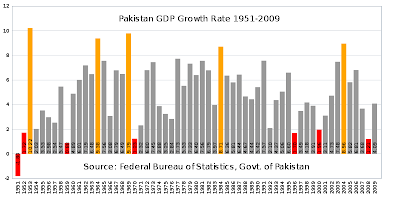

It seems to me that Goldman Sachs' assessment of Pakistan's growth prospects are too heavily influenced by the current crises the country faces. It is too conservative and does not fully reflect its future potential based on the nation's economic history over the last 64 years. For example, Goldman assumes a future growth rate that is less than the average of over 5% a year which Pakistan has seen over the last 64 years.

My view is that Goldman Sachs' forecast should fully reflect the fact that Pakistan's per capita GDP increased by 60% to $3,000 in the last decade. Even if it is assumed that there is no demographic dividend and the country's gdp growth rate will not accelerate, its per-capita income should still rise to nearly $20,000 by 2050, well above the Goldman Sachs' forecast of $15,066.00.

It is unrealistic to assume that Pakistan's economy will not benefit from its very young population. With half of its population below 20 years and 60 per cent below 30 years, Pakistan is well-positioned to reap huge demographic dividend, with its workforce growing at a faster rate than total population. This trend is estimated to accelerate over several decades. The average Pakistanis are now taking education more seriously than ever. Youth literacy is about 70% and growing, and young people are spending more time in schools and colleges to graduate at higher rates than their Indian counterparts in 15+ age group, according to a report on educational achievement by Harvard University researchers Robert Barro and Jong-Wha Lee. Vocational training is also getting increased focus since 2006 under National Vocational Training Commission (NAVTEC) with help from Germany, Japan, South Korea and the Netherlands.

The fact is that equity markets in Pakistan have already produced much higher returns than BRICs' markets have over the last decade.

Pakistan's main stock market ended 2010 with a 28 percent annual gain, driven by foreign buying mainly in the energy sector, despite concerns about the country's macroeconomic indicators after summer floods, according to Reuters. Although it was less than half of the 63% gain recorded in 2009, it is still an impressive rise in KSE-100 index when compared with the performance of Mumbai(+17%) and Shanghai(-14.3%) key indexes. Among other BRICs, Brazil is up just 1% for the year, and the dollar-traded Russian RTS index rose 22% in the year, reaching a 16-month closing high of 1,769.57 on Tuesday, while the ruble-based MICEX is also up 22%.

Pakistan's key share index KSE-100 dropped about 5% in 2011, significantly less than most the emerging markets around the world. Mumbai's Sensex, by contrast, lost about 25% of its value, putting it among the worst performing markets in the world.

Given the historical economic data I have shared in this post, I remain optimistic that Pakistan can and will easily beat Jim O'Neill's current forecast in the coming decades.

Related Links:

Pakistan's 64 Years of Independence

Goldman Sachs & Franlin-Templeton Bullish on Pakistan

Emerging Market Expert Investing in Pakistan

Pakistan's Demographic Dividend

Genomics & Biotech Advances in Pakistan

Pakistan Rolls Out 50Mbps Broadband Service

More Pakistan Students Studying Abroad

-

Comment by Riaz Haq on March 23, 2012 at 9:28am

-

Here's an excerpt on Pakistan from a recent Worth magazine piece posted on Goldman Sachs website:

THE MENTION OF PAKISTAN

PROMPTS MEMORIES OF OSAMA BIN LADEN and worries about current instability more readily than it does investment opportunity. “But a large portion of Pakistan is relatively stable, and it’s a country that’s growing rapidly almost in spite of itself,” says Paul Herber, portfolio manager of the Forward Frontier Strategy Fund.

Pakistan’s local oil and gas companies are a promising investment play. Unlike other N11 nations, where these resource companies are government-owned and give investors little access, “a lot of Pakistan’s oil and gas companies are public,” Herber says. The country is by no means a big global oil producer, but with 170 million people—more than Russia— growth in domestic demand is likely to boost the domestic industry, Herber says.http://www.goldmansachs.com/gsam/pdfs/USTPD/education/092911_WO13_G...

-

Comment by Riaz Haq on March 27, 2012 at 9:58am

-

Here are excerpts of former PM Shaukat Aziz's recent interview with Fortune magazine:

Q. It's been more than six years since Goldman Sachs (GS) recognized Pakistan among the Next Eleven newly industrialized countries -- inflation is up, investment is at a 40-year low, and infrastructure is deteriorating, particularly in the power sector. By just about any measure things are not particularly good, so what is the source of your optimism about the Pakistani economy?

A. The problems of the world economy have obviously leaked to Pakistan. Yes, investment is down, trade also, but in Pakistan's case a lot of this is due to the security situation, the war on terror. We have to pay a huge price in terms of damaging our investor confidence -- both domestic and foreign.

On the other hand, we should bear in mind that more than two-thirds of the population lives in rural areas and agriculture has done well, especially in cotton -- prices and exports are up and the farmer is relatively more comfortable.

The country's human capital is a strong suit, the Pakistani people are very talented, their skills levels are impressive and they are hard-working. There's a huge number of Pakistanis working overseas and we can export a few more million and there won't be an iota of difference because there is a whole pipeline of trained – and untrained - people coming.

Q. You mentioned the need for good management. How would you assess the current management of the economy? I ask that in light of the lapsing of the stabilization plan with the IMF.

A. Being out of the IMF -- obviously this reflects the desire of the government to have more flexibility to pursue its reforms. The IMF program does bring with it certain macroeconomic discipline and that's beneficial, but I also believe in economic sovereignty. You need good governance and good management, but abdicating the economy to the IMF is not the way to succeed. What we need is growth and job creation, like every other country in the world.

Q. The disagreement with the IMF is at least in part related to tax collection, which has been notoriously weak in Pakistan. There is a lot of concern whether Pakistan can muster the political will to make tough reforms, partly because of self-serving elites among the political class that have brought the country to the point of being nearly a failed state.

A. No, I think that's not true. The country is large -- roughly 180 million people -- and it's functioning. It has many challenges -- governance issues, transparency and management issues -- on top of the security issues that have cost us dearly. But the country is functioning. Obviously it could function better, but it's not come to a grinding halt. Life is going on.

http://finance.fortune.cnn.com/2012/01/09/pakistan-shaukat-aziz/

-

Comment by Riaz Haq on April 12, 2012 at 10:11am

-

Here's a News report on rising sales of cars, motorcycles and tractors in Pakistan:

Sales of automobiles in the first nine months (July-March) of the current fiscal year increased 15 percent to 128,576 units, compared to 111,852 units same period last year, according to the data released by the Pakistan Automotive Manufacturers Association (PAMA).

According to the data, in the third quarter (Jan.-March) of this year, automobile sales increased 7 percent to 46,632 units from 43,753 units in the correspondent quarter last year. When compared with the second quarter of this year, sales in the third quarter showed an impressive growth of 22 percent.

Pak Suzuki Motor Company (PSMC) continued to depict strong sales showing a growth of 32 percent in the July-March period to 81,360 units compared with 61,693 units in the same period last year. Analysts attribute strong growth to the yellow cab scheme announced by the Punjab government. In March 2012 alone, PSMC sales stood at 11,198 units, up 16 percent from same month last year and 12 percent from February 2012.

On the other hand, Indus Motor Company sales growth remained subdued during the period under review. The company sold a total of 38,858 units compared to 37,259 units in the same period last year, up by 4 percent. In the third quarter, the company sold 14,792 units against 14,851 units in the same period last year.

Samina Kanji, an analyst at BMA Research, a 15 percent year-on-year growth in auto sales is primarily due to the yellow cab scheme of the Punjab government. On the other hand, motorcycles and three wheelers sales increased on month-on-month basis and sales in March stood at 70,671 units as compared to 65,011 an increase of 5,660 units, the data showed. Total sales of farm tractors decline to 6,229 units as compared to previous month sales of 8,906 units. Sales of trucks and buses sales in March stood at 379 units as compared to 304 units in February 2012.

http://www.thenews.com.pk/Todays-News-3-102452-Auto-sales-show-15pc...

-

Comment by Riaz Haq on May 1, 2012 at 10:44am

-

Here are some excepts of a BBC Op Ed on Indian economy titled "Five things wrong with India's economy":

After several official predictions that India would grow by 7-8% in 2011-12, the finance minister finally admitted in his Budget 2012 speech that the growth would be 6.9%.

The actual figure may be lower at 6.5%, thanks to the statistical error in sugar production, which dragged down January's industrial production growth figure from 6.8% to 1.1%.

Although ratings agency Standard and Poor's estimate for 2012-13 is 5% or above, Indian economists feel they won't be surprised if the economy grows by just 4%.

"If things remain the way they are, in terms of policy decisions, investments and sentiments, I would go to the extent that the figure may be 3%," says a senior economist with a leading business association.

--------

Wholesale price inflation, which is under 7%, could increase to 9-10% over the next few months.Food inflation is still high at double-digit levels, and any hike in fuel (petrol and diesel) prices in the near future will spur inflation.

A combination of low growth and high inflation, or near-stagflation, would be India's worst economic nightmare come true.

-------------

In 2011-12, the fiscal deficit zoomed from a projected 4.6% of GDP to 5.9%. Although Budget 2012 predicted it would come down to 5.1% in 2012-13, most economists remain sceptical.Low growth rates, lower-than-estimated government revenues, and higher-than-expected expenditures, especially on welfare schemes for rural employment and the right to food, may force the deficit to go up in 2012-13, as happened in the previous financial year.

Although exports grew by 20% in 2011-12, imports rose at a faster pace, and the trade deficit went up to $185 billion, the highest ever in the country's history.

Since August 2011, foreign exchange reserves have dipped from $322bn to $293bn due to the higher trade deficit and other foreign exchange outflows.

-----------

Coalition compulsions, a united opposition and corruption allegations have forced the government to backtrack on key economic reforms, including foreign direct investment (FDI) in multi-brand organised retail.

--------------

In 2011-12, the domestic private sector was wary of huge investment commitments; many firms delayed or postponed plans to invest in expansion or building new factories.An April 2012 overview of the Reserve Bank of India (RBI) stated that "consultations with industry and banks suggest that new project investment continue to be sluggish"

-----------

-

Comment by Riaz Haq on May 2, 2012 at 5:57pm

-

Here are excepts of an interview of Elliot Theorist Mark Galasiewski who's bullish on Pakistan:

To answer your question, there are various ways to make long-term investment decisions. For example, Warren Buffett has shown that picking individual stocks can provide good returns over time. But it's a very labor-intensive and time-consuming process, to research companies thoroughly enough to have the kind of conviction that he does. And his “buy and hold” strategy means that he suffers significant drawdowns in his portfolio at times -- like during the 2007-2009 crash.

Elliott wave analysis gives you the opportunity to make long-term bets with a similar conviction -- but with a fraction of the elbow grease. Instead of pouring over hundreds of quarterly reports and legal documents, you look for Elliott wave patterns in the charts of market indexes. Those patterns reflect investors' collective bias, bullish or bearish. (I won't go into details of why this is so; our Club EWI has tons of free reports explaining the mechanics of the Elliott Wave Principle.)

So, knowing what part of the Elliott wave pattern your market is in, you know how the pattern should progress from there, ideally. And that gives you a probabilistic forecast for the trend. It doesn't work 100% of the time (what does), but our subscribers remember more than one successful forecast we've made using Elliott waves.

For example, on March 23, 2009 -- at the time when almost no one felt bullish -- we issued a special report to our subscribers forecasting a multi-year bull market in Indian stocks. Two weeks later, we identified three more markets in the region -- Pakistan, Sri Lanka, and Indonesia -- that we believed were also likely to enjoy an "Indian Ocean Renaissance."

India, Pakistan, Sri Lanka, Indonesia have all since generated some of the best returns among global stock markets. Without knowledge of the Elliott Wave Principle, it would have been difficult to forecast the boom -- especially given the dismal news events at the time. Do you remember the headlines in early 2009?

The world was engulfed by the global financial crisis, and most people believed the worst was still ahead. The currencies of India, Pakistan, Sri Lanka, and Indonesia had collapsed. Pakistan and India were on the brink of conflict over the Mumbai terrorist attacks of late 2008. A civil war was still raging in Sri Lanka. Who would turn bullish on stock under those "fundamental" conditions? We did, and only because Elliott wave patterns in the price charts of those four markets told us to "buy."

And by the way, the terrible conditions in India, Pakistan and Sri Lanka mostly reversed along with the market rally over the next year.

---------

The Wave Principle is how the market works. Financial markets are non-rational and counter-intuitive. Investing according to conventional assumptions eventually leads to financial ruin, since the market too often does the opposite of what most people expect.Even thinking contrarily is insufficient, because sometimes it’s necessary to run with the herd. But Elliott wave analysis helps you to determine which psychological stance is most appropriate at any given time. Often, the news at the time would be suggesting you do the opposite.

http://www.elliottwave.com/freeupdates/archives/printer/2012/04/26/...

-

Comment by Riaz Haq on September 9, 2012 at 8:20pm

-

Here's a DNA Op Ed o India story unraveling:

These days, I tell my kids to go, and not look back. My eldest is at university in the US and my son is preparing for admissions. Make your lives in America, I tell them. For the first time in a quarter century I’m pessimistic about India. In fact, 20 summers ago I visited the US and found its mood so negative and in such contrast to newly-liberalised India’s optimism that it seemed the two countries were on different trajectories; and I believed the choice to live in India was the right one.

In 2004 the US National Intelligence Council projected the 2020 world scenario in a report called “Mapping the Global Future”. It mostly dwelled on how the rise of China and India would affect the US and the rest of the planet. It was optimistic about India’s prospects in the long term — though by 2050 our per capita GDP was projected to be only 20% of the USA’s, even though our total GDP might be second in the world; and demography and political development gave India more hope than China — but it still listed three economic growth prospects for India: good, bad and ugly. Here, bad meant middling along, always verging on greatness but never quite there; and ugly meant slipping back into a 1970s-type morass.

Midway between the year of the report and the year of its projections, it is not a stretch to say that India would be lucky to achieve the bad scenario outlined by the USA’s NIC. The irony is that Prime Minister Manmohan Singh, who, under the direction of the late PV Narasimha Rao, liberalised the economy and gladdened the middle-class’s heart, is the same man responsible for the despondency that has now set in. For it is now a commonplace to hear that there no longer is an “India story”.

-----------

Frankly, nothing is going to move in this country (except for prices, upwards) for the next few years. Not many of us expect that 2014 will bring us a purposeful and politically sound government; in fact, most of us expect a short-lived regional coalition. If political strategists are looking towards 2016 as a time when a proper agenda can be implemented, then governance between now and then will continue to be characterised by limbo.And if we have this kind of drift for the next four years, during which time the demands of ordinary citizens increase — political action on land, water, power, education, health, the economy, etc — then do you blame some of us for losing hope and telling our children to jump ship? By the time India becomes a big power, if ever, my children will be grandparents. They might as well go out and enjoy life right now.

http://www.dnaindia.com/analysis/column_india-sinking_1738624

-

Comment by Riaz Haq on January 24, 2014 at 10:54pm

-

Here's an AOL piece on Pakistan's economy in 2050:

Recently, Jim O'Neill, one of the most renowned British economist predicted that Pakistan could become world's 18th largest economy by 2050 and its per capita income will cross the 20,500 dollars mark with its GDP around US$ 3.33 trillion in 2050. This means that Pakistan's economy will grow 15 times more than what it stands today within the next 35 years.

Jim became famous for analyzing and coining the world's most powerful economies in a single term, 'BRIC' meaning Brazil, Russia, India and China in 2001. He recently developed another term, 'MINT', meaning Mexico, Indonesia, Nigeria and Turkey and has projected them to be coming up as strong economies in the coming decades.

Currently, Pakistan is ranked the 44th largest economy of the world with GDP of US$ 225.14 billion. If Jim O'Neill's predictions turn out to be true, Pakistan's economically sound conditions can be fruitful for the country's development. Not just this but it can also lead to amicable living conditions for its people and can lead to smooth social atmosphere there.

Other than the 2050 predictions, we should not forget about the serious economic challenges being faced by Pakistan currently. International Monetary Fund signed a financial assistance of USD 6.7 billion to save the country from falling into the periphery of an economic collapse back in September 2013. The energy sector is a cause of severe poverty and growing labour force. Pakistan has failed to develop a variegated economy. Pakistan will need to boost up its confidence in order to attract FDIs, said IMF.

Terrorism is another reason behind the slower economy of Pakistan. It has damaged the image and the economy of Pakistan on numerous levels. Normal business and tasks require more time and extra security due to the challenge of terrorism. Terrorism leads Pakistan to have an extra expenditure on humanitarian aid, law and order and various other fiscal, economic, cultural and social charges.

Pakistan's economic circumstances have different root causes and solutions to those causes are demanding but a lot has changed over the years. Since 2007, the domestic consumer demand has been rising. Many multinational corporations have brilliantly performed in Pakistan. The Pakistani markets have proven to hold better potential than the African markets. It has also been said that if the job crisis in Pakistan is resolved, its economy will outdo the economies of many other countries.

"It would be a great achievement for Pakistan if Jim's predictions turn out to be true. Pakistan will then be entering into the positive spheres of world economics. This will be beneficial for the country," said Sukriti, a student of English Honors who holds high interests in economical issues of the world.

"If Pakistan is able to achieve the mark of GDP US$ 3.33 trillion, then nothing like it. It will be a great achievement not just for Pakistan but also for the neighboring countries. The economical ties will bolster and not just Pakistan but all the surrounding countries will flourish with it," said Arushi, a student of Jesus and Mary College.

Pakistan's growing economy will be a big challenge for the other economies of the world.

http://www.coolage.in/2014/01/24/pakistan-can-have-18th-largest-eco...

-

Comment by Riaz Haq on February 28, 2014 at 9:40am

-

Here's an interesting Op Ed by a NZ doctoral candidate Christopher Barber in the Diplomat on Pakistan-China economic corridor:

Historian Daniel Headrick made the crucial connection between means and ends in the projection of global influence. For instance, Headrick argued that the Suez Canal, which opened in 1869, acted a tool of empire for the great powers of the nineteenth century. The building of a canal through the Sinai Peninsula not only made trade and empire in Asia faster by avoiding the Cape of Good Hope, but more economical too. This was particularly the case for the world’s superpower, Great Britain. For Britain, the Suez was an important strategic consideration in its imperial outlook, making the transport of goods, officials and soldiers to Bombay and other key colonial hubs easier and affordable....

-----With the development of the corridor, Central Asia, traditionally an economically closed region owing to its geography and lack of infrastructure, will have greater access to the sea and to the global trade network. For Afghanistan and Tajikistan, both of which have signed transit agreements with Pakistan, it will provide a more economical means of transporting goods, making their export products more competitive globally. For China, meanwhile, the corridor will provide it with direct access to the Indian Ocean, enabling China to project itself strategically into the mineral and oil rich regions of Western Asia and Africa (and beyond). And for Pakistan, the project provides the country not only a third deep-sea port but also a better connected gateway into China’s backyard, giving Pakistan the potential to make good on its free trade agreement with the dragon economy.

----

Nevertheless, the corridor will play a crucial role in advancing Pakistan’s economic power. Exporting, transiting, and transporting goods into and out of Central Asia and carrying them away on the current of the world’s sea lanes, the Pakistan-China corridor will be a vital factor in Pakistan’s economic future. The corridor is best thought of as a comprehensive infrastructure package encompassing a wide range of spinoffs, including gas and oil pipelines, railways, an expressway from Karachi to Lahore, fiber-optic cabling, metro bus and underground services for key Pakistani cities....---

In reality, agriculture, chemicals, textiles, and various other manufactured items are the stuff of Pakistan’s true productivity—items that are tradable on the global market and capable of boosting national income. Pakistan has always been well placed to export given its access to the Indian Ocean and proximity to key markets in the West and East, to say nothing of its international reach through the Pakistani diaspora and the fact that it has the third largest English-speaking population in the world. Despite government absenteeism—that reoccurring failure within the political sphere to respond to the Taliban and to the reactionaries that routinely thwart Pakistan’s potential—as well as rampant inflation and a serious lack of currency reserves, Pakistan’s private sector has proven resilient, capable of going in for global trade with the right encouragement. The cue is now for the Pakistani government and the business community to formulate a more global economic policy.

As it stands, the failure to fully capitalize on the free trade agreement between China and Pakistan demonstrates the need for a major policy effort to make the most of the corridor. For one, the Pakistani government needs to place greater emphasis on trade relations in its overall foreign policy as well as foster the exporting aspirations of small and midsize companies. Expansive economic policy, continued liberal reform, and, above all, an improved security situation are the formula needed to make full use of the tools of globalization which Pakistan will soon have at its disposal.

-

Comment by Riaz Haq on September 24, 2015 at 5:05pm

-

Washington Post: #Hindi, #Bengali, #Urdu languages to dominate business world by 2050. #India #Pakistan #Bangladesh http://wpo.st/9e4c0

Hindi, Bengali, Urdu and Indonesian will dominate much of the business world by 2050, followed by Spanish, Portuguese, Arabic and Russian. If you want to get the most money out of your language course, studying one of the languages listed above is probably a safe bet.

The Chinese dialects combined already have more native speakers than any other language, followed by Hindi and Urdu, which have the same linguistic origins in northern India. English comes next with 527 million native speakers. Arabic is spoken by nearly 100 million more native speakers than Spanish, which has 389 million speakers.

Of course, demographic developments are hard to predict. Moreover, the British Council only included today's growth markets, which says little about the growth potential of other nations that are still fairly small today. Also, Arabic and Chinese, for instance, have many dialects and local versions, which could make it harder for foreigners to communicate.

Despite all that, the chart above gives a broad look into which linguistic direction the business world is developing: away from Europe and North America, and more toward Asia and the Middle East.

You want to speak to as many people as possible? How about Chinese, Spanish or French?

German linguistic expert Ulrich Ammon, who conducted a 15-year-long study, recently released a summary of his research. In his book, Ammon analyzes the languages with the most native speakers and the most language learners around the world. Especially for the latter aspect, there is little original data available, which is why Ammon does not provide predictions of exact numbers of speakers per language.

Here's his top three of the languages you should learn if you want to use the language as often as possible, everywhere in the world. If you do not have time, however, don't worry too much: English will continue to top all rankings in the near future, according to Ammon.

1. Chinese. "Although Chinese has three times more native speakers than English, it's still not as evenly spread over the world," Ammon said. "Moreover, Chinese is only rarely used in sciences and difficult to read and write."

2. Spanish. Spanish makes up for a lack of native speakers — compared with China — by being particularly popular as a second language, taught in schools around the world, Ammon said.

3. French. "French has lost grounds in some regions and especially in Europe in the last decades," Ammon explained. "French, however, could gain influence again if west Africa where it is frequently spoken were to become more politically stable and economically attractive."

-

Comment by Riaz Haq on December 7, 2022 at 8:21am

-

Here’s Goldman Sachs' Take on World Economy Through 2075

Goldman Sachs analysts said slower population growth will present “a number of economic challenges,” such as how nations will pay for rising health costs of their aging populations.

https://www.law.com/dailybusinessreview/2022/12/06/heres-goldman-sa...

Goldman Sachs Group Inc. economists have taken a stab at predicting the path of the world economy through 2075.

Two decades since they famously outlined long-term growth projections for the so-called BRIC economies, the economists, now led by Jan Hatzius, expanded their projections to encompass 104 countries over the next half-century.

The results:

Global growth will average just under 3% a year over the next decade, down from 3.6% in the decade before the financial crisis, and will be on a gradually declining path afterwards, reflecting a slowing of labor force growth.

Emerging markets will continue to converge with industrial nations as China, the U.S., India, Indonesia and Germany top the league table of largest economies when measured in dollars. Nigeria, Pakistan and Egypt could also be among the biggest.

The U.S. is unlikely to repeat its relative strong performance of the last decade, and the dollar’s exceptional robustness will also unwind over the next 10 years.

While income inequality between countries has fallen, it will continue to rise within them.

Economists Kevin Daly and Tadas Gedminas saw protectionism and climate change as risks that are “particularly important” both for growth and the convergence of incomes.

------------

Pakistan projected to be among largest economies in the world by 2075: Goldman Sachs

https://www.dawn.com/news/1725141

A research paper published by Goldman Sachs on Tuesday projected Pakistan to be the sixth largest economy in the world by 2075 given “appropriate policies and institutions” are in place.

Authored by economists Kevin Daly and Tadas Gedminas and titled ‘The Path to 2075’, the paper projected that the five largest economies by 2075 will be China, India, the US, Indonesia and Nigeria.

Goldman Sachs has been projecting long-term growth of countries for almost two decades now, initially starting out with BRICs economies, but for the past 10 years they have expanded those projections to cover 70 emerging and developed economies.

Their latest paper covers 104 countries with projections going as far as 2075.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Silicon Valley Pakistani-Americans Among Top Donors to Mamdani Campaign

Omer Hasan and Mohammad Javed are the top donors to Zohran Mamdani’s mayoral campaign in New York City, according to media reports. Both are former executives of Silicon Valley technology firm AppLovin. Born and raised in Silicon Valley, Omer is the son of a Pakistani-American couple who are long-time residents of Silicon Valley, California. …

ContinuePosted by Riaz Haq on September 19, 2025 at 9:00am

Modi's Hindutva: Has BJP's Politics Hurt India's International Image?

The Indian cricket team's crass behavior after defeating the Pakistani team at the Asia Cup 2025 group encounter has raised eyebrows among sports fans around the world. Not only did Suryakumar Yadav, the Indian team captain, refuse to do the customary handshake before and after the match in Dubai but he also made controversial statements linking the match with the recent India-Pakistan conflict. “A few things in life are above sportsman’s spirit ......We stand with all the victims of the …

ContinuePosted by Riaz Haq on September 15, 2025 at 7:00pm — 1 Comment

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network