PakAlumni Worldwide: The Global Social Network

The Global Social Network

Expensive Fuel Hits Power Sector in India & Pakistan

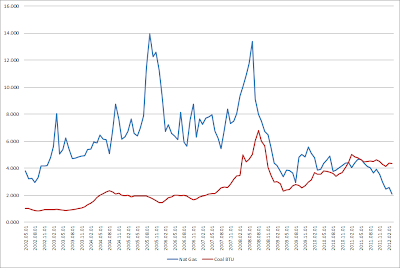

Lack of affordable fuel has forced many power producers in Pakistan to operate at a fraction of their installed capacity since 2008. It has led to widespread load-shedding in the country, seriously hurting its economy. Similar situation now appears to be developing in India as well, although it's not quite as serious as Pakistan's current crisis yet. Current costs of various fuel options vary from $4 per mmBTU for coal to $20 per mmBTU for oil. Recently, the US prices of natural gas have dropped dramatically from $12 per mmBTU a few years ago to less than $2 per mmBTU, about half the price of coal, with the shale gas revolution currently sweeping the United States.

India burns coal to produce 55 percent of its electricity needs. Domestic coal production has increased just 1 percent last year while 11 percent additional power generation capacity has been installed. Some power producers have been importing coal, but that option has become more untenable recently because India’s biggest supplier, Indonesia, has doubled coal prices, according to a report in New York Times.

The gap between demand and supply in India has increased to 10.2 percent last month, from 7.7 percent a year earlier. In some states like Andhra Pradesh and Tamil Nadu, power cuts have become so common that many factories report getting more electricity from diesel generators than they do from the power grid, at much higher cost.

Retail rates for electricity are lower than the cost of producing and delivering it and the difference is made up by Indian state government subsidies running into hundreds of billions of rupees annually.

Unlike India which uses coal, Pakistan relies heavily on natural gas for the bulk of electricity production and other energy needs. Demand for natural gas now exceeds 4.5 billion cubic feet per day or 1.6 trillion cubic feet per year, with a shortfall of nearly 300 million cubic feet per day. According to BMI, gas accounted for 47.5% of Pakistan's primary energy demand (PED) in 2007, followed by oil at 30.7%, hydro-electric energy at 12.9% and coal with a 7.9% share.

The main option Pakistan is pursuing now is Iran-Pakistan pipeline to import gas and reduce the growing gap between supply and demand. However, this option faces serious obstacles with tightening US and international sanctions aimed at isolating Iran because of concerns about Iran's nuclear ambitions. At the same time, Pakistan is also negotiating for LNG imports from Algeria. The wholesale prices of these options are 3 to 4 times more expensive than the the retail rate of $3 to $5 per mmBTU for domestic gas being produced in Pakistan.

In addition to gas imports, Pakistan has other options to meet its energy needs. Some of these are as follows:

1. Developing its shale gas reserves estimated 51 trillion cubic feet near Karachi in southern Sindh province. The US experience has shown that investment in shale gas can increase production quite rapidly and prices brought down from about $12 per mmBTU in 2008 to under $2 per mmBTU recently. Pursuing this option requires US technical expertise and significant foreign investment on an accelerated schedule.

2. Increasing production of gas from nearly 30 trillion cubic feet of remaining conventional gas reserves. This, too, requires significant investment on an accelerated schedule.

3. Converting some of the idle power generation capacity from oil and gas to imported coal to make electricity more available and affordable.

4. Utilizing Pakistan's vast coal reserves in Sindh's Thar desert. The problem here is that the World Bank, Asian Development Bank and other international financial institutions (IFIs) are not lending for coal development because of environmental concerns.And the Chinese who were showing interest in the project have since pulled out.

5. Hydroelectric and other renewables including wind and solar. Several of these projects are funded and underway but it'll take a while to bring them online to make a difference.

In my view, Pakistan should pursue all of the above options with options 1, 2 and 3 as a priority for now. Pakistan's best interest is not in defying Saudis and Americans to buy expensive Iranian gas and end up with crippling sanctions which could be much worse than its current energy crisis. Its best interests will be served by developing its own cheap domestic shale gas on an accelerated schedule with Saudi investment and US tech know-how. If the Americans and the Saudis refuse to help, then Pakistan will have a stronger case to go with the Iran gas option.

Related Links:

Haq's Musings

Pakistan Needs Shale Gas Revolution

US Census Bureau's International Stats

Pakistan's Vast Shale Gas Reserves

US AID Overview of Pakistan's Power Sector

US Can Help Pakistan Overcome Energy Crisis

Abundant and Cheap Coal Electricity

US Dept of Energy Report on Shale Gas

Pakistan's Twin Energy Crises

Pakistan's Electricity Crisis

Pakistan's Gas Pipeline and Distribution Network

Pakistan's Energy Statistics

US Department of Energy Data

Electrification Rates By Country

CO2 Emissions, Birth, Death Rates By Country

China Signs Power Plant Deals in Pakistan

Pakistan Pursues Hydroelectric Projects

Pakistan Energy Industry Overview

Water Scarcity in Pakistan

Energy from Thorium

Comparing US and Pakistani Tax Evasion

Zardari Corruption Probe

Pakistan's Oil and Gas Report 2010

Circular Electricity Debt Problem

International CNG Vehicles Association

Rare Earths at Reko Diq?

Lessons From IPP Experience in Pakistan

Correlation Between Human Development and Energy Consumption

BMI Energy Forecast Pakistan

-

Comment by Riaz Haq on April 21, 2012 at 8:34pm

-

World Bank agrees to assist with financing for Dassu Dam, to be built in Kohistan area on River Indus with 1500MW power generation capacity, reports Daily Times:

WASHINGTON: The World Bank (WB) has allocated an unprecedented amount of $1.8 billion for Pakistan’s development projects, mainly in energy sector, in the current year, Finance Minister Dr Abdul Hafeez Shaikh said after holding a meeting with World Bank Vice President Isabel Guerrero on Friday.

Pakistan’s ambassador to the United States Sherry Rehman also attended the meeting during the IMF-WB annual spring gathering of economic leaders from across the world.

The WB has also agreed to assist with financing for a multi-year Dassu Dam, to be built in Kohistan area on River Indus with a 1500MW power generation capacity. The WB Board has already approved power generation enhancement project.

“This is a big sign of confidence in Pakistan’s ability to accomplish development for its people that the World Bank is allocating an unprecedented amount in one year,” Shaikh said.

The amount follows last year’s $1.2 billion assistance, and will be spent on completion of development projects in energy and water sectors as well as infrastructure, social and reform programmes.

The WB vice president was appreciative of Pakistan’s economic performance in these difficult times of global economic and regional challenges, the finance minister said.

Shaikh acknowledged the bank’s sustained cooperation with Pakistan, calling the financial institution a reliable development partner of the country.

The World Bank leader expressed satisfaction with the measures Islamabad has taken to enhance its revenue generation (which has increased by 25 percent over the last nine months), the continuing strong performance of the external sector, both exports and remittances and a healthy 4 percent GDP growth expected this year....

http://www.dailytimes.com.pk/default.asp?page=2012\04\21\story_21-4-2012_pg7_2

-

Comment by Riaz Haq on April 25, 2012 at 4:31pm

-

Russia has reportedly backed out of funding IP pipeline, reports Express Tribune:

KARACHI: The government is working on an alternative plan to finance the $1.5 billion Iran-Pakistan (IP) gas pipeline as hopes for funding from Russia fade in the face of mounting pressure from the US to stop the project, says a senior government official.

Earlier, a Chinese bank backed out of financing the vital gas supply project which may ease most of the energy shortage in the country.

“In the alternative plan, the government is studying a joint investment formula, according to which the engineering, procurement and construction (EPC) contractors will be invited to provide some funds for the pipeline,” the official said.

In talks held between Pakistani and Russian officials in the first week of April in Moscow, Pakistan asked Russia to either extend a loan or provide finished products and other material relating to the pipeline. Russia agreed to respond to the proposal in two weeks, but no response has been received so far.

After the return of the delegation from Moscow, the government officials had, however, announced that Russia had agreed in principle to give financial and technical assistance for the pipeline.

“A reminder has been sent to Russia in this regard and it is to reply by April 30,” the official said. Petroleum Secretary Ijaz Chaudhry also confirmed that Russia had not yet responded to the proposal.

Pakistan approached Russia after a Chinese bank hinted at its inability to push ahead with financing the project amid increasing US pressure. Russia offered to finance the entire pipeline during a four-day visit of Foreign Minister Hina Rabbani Khar to Moscow in February.

Moscow linked the proposal with the award of contract to its energy giant, Gazprom, without bidding. However, to give its consent the government will have to waive Public Procurement Regulatory Authority (PPRA) rules, designed to ensure transparency in government dealings.

“Funds will be generated through infrastructure gas development cess and EPC contractor will also be asked to extend some financing,” the official said, adding the government would make it part of the tender for EPC contract....

tribune.com.pk/story/369493/ip-pipeline-govt-considers-alternative-as-russia-caves-in-to-pressure-business/

-

Comment by Riaz Haq on May 11, 2012 at 10:18pm

-

Here's a News story on LPG production in Pakistan: Pakistan has become self-sufficient in meeting local demand of the liquefied petroleum gas (LPG) and the dividend of exploiting this locally-produced fuel has started benefiting the end-consumers in the shape of drastic reduction in its prices, making it a viable auto fuel, as well, industry sources said on Friday.

As domestic production of LPG is up by 25 percent since the start of the year 2012, its price has also seen continuous decline lately.

The present demand of 1,200 tons per day is being met through locally-produced LPG, the sources said.

“After three years, we have once again become self-sufficient in meeting our local demand of LPG through domestic sources,” an industry official said.

It is expected that the local component of LPG will grow further by end of this year to 1,475 tons per day. After a gap of five years, LPG has now become cheap fuel if it is compared with petrol, the source added.

Besides initiative taken by the government to explore local LPG reserves, glut in market and illegal import of cheap commodity through Iran have been described as the main factors for this price cut. Nevertheless, various categories of consumers will indeed welcome this price decline amid prevalent severe energy crisis.

The latest LPG price cut was announced by the state-owned Oil and Gas Development Company Limited (OGDCL) as it reduced its base stock price of LPG for the third time this month to Rs58,000 per ton exclusive of duties and taxes.

The latest price reduction of Rs7,000 per ton came in the wake of piles of unsold stocks and a mounting domestic production, which is up by 25 percent since the start of the year.

“LPG demand typically begins to slacken with the onset of summer. However, this year the demand has also been affected by an over supply of product both locally and from cheap and under-invoiced Iranian imports,” said Belal Jabbar, the spokesman for the LPG Association of Pakistan.

The current producer price is $225, or Rs20,000 per ton below the Saudi Aramco contract price with which LPG prices have remained indexed.

The drastic reduction in price is effectively a de-linkage from the international price benchmark and augurs well for the LPG industry, as the product has become cheaper than petrol, diesel and even CNG.

“In the light of the increasing domestic production, which has made imports altogether redundant, we urge the honourable federal minister Dr Asim Hussain to immediately notify de-linking of LPG producer prices from Saudi Aramco CP as this will keep the product affordable for the common man,” said Belal.

The revised price of LPG companies for their distributors will be Rs970 for domestic and Rs3,732 for commercial cylinders. Similarly distributor price for the consumers will be Rs1,125 for domestic and Rs4,320 for commercial cylinders.

Retail prices in various parts of the country are expected to be as follows; Sindh and Balochistan Rs90 per kilogram, Punjab Rs95 per kilogram, Khyber-Pakhtunkhwa Rs100 per kilogram, AJK Rs105 per kilogram and Northern Areas Rs115 per kilogram.

http://www.thenews.com.pk/Todays-News-3-107727-Pakistan-becomes-sel...

-

Comment by Riaz Haq on May 23, 2012 at 10:44pm

-

Here's a Nation story on China approving $450 billion loan for Neelum-Jhelum dam project:

Chinese EXIM Bank, after a long delay, has now approved $450 million loan to finance 969MW Neelum Jhelum hydropower project, which would add about 5.15 billion units of cheap electricity to the national grid every year by 2016.Well-placed official sources informed TheNation that Chinese EXIM Bank after a long delay has now approved $450 million loan to finance the Neelum Jhelum hydropower project located near Muzaffarabad adding that the Economic Affair Division (EAD) has also gotten an approval from the Chinese bank in this regard. They told that the Neelum-Jhelum hydropower project needed $700 million foreign funding to complete the project by 2016. The major financiers of the project include the Kuwait Fund, the Export Import Bank of China, the government of the UAE and the Saudi Fund for Development. Sources further told that project had originally been budgeted to cost Rs130 billion, but costs had witnessed skyrocketed rise by 154per cent to Rs330 billion. In the revised plan submitted by the water and power ministry, the main reason for the spike in costs was attributed to a change in design, but a detailed examination of the figures has shown that primary cause for the increase was delay in completion. Sources further told that more than 30per cent of the work on the project had been completed. The project would earn about Rs45 billion in revenues annually and would therefore be able to recover its cost of construction within seven years.It is also learnt that as the Chinese EXIM bank found hesitant to release the worthy amount since 2009 resultantly the delay for unknown reasons had caused the cost of the project to rise to Rs330 billion ($3.7 billion). It was also feared that the pace of construction might slowdown providing an edge to India, which had been building Kishanganga project on the same Neelum River on its side of Kashmir because if Pakistan failed to complete its project before India, then it might lose the water rights to the upper riparian country. Further, according to Indus Water Treaty (IWT), the country that first completes its project on Neelum tributary will have the priority rights on the water of Neelum River. Furthermore, the Neelum Jhelum Hydropower Project Company (NJHPC), a wholly owned subsidiary of the Water and Power Development Authority was set up to manage this very project.It is to be noted here that the top man of China had committed this loan during the visit of President Asif Ali Zardari to Beijing in 2009 but the Chinese Exim bank did not entrain Pakistan although three years have elapsed since the commitment of China to Pakistan resultantly the country was in contact with Islamic Development Bank, Saudi Development Bank, Abu Dhabi Fund, Kuwait Fund for the required finding. Even IDB had committed $200 million, Saudi Fund $337 million, Abu Dhabi Fund $100 million and Kuwait Fund $30 million and the government was pursing the said donors to expedite the disbursement of their credit line for the timely completion of the project.Waqar Masood Secretary Economic Affairs Division while confirming the information pertaining the receiving of approval worth of $450 million loan to help finance the 969-megawatt Neelum Jhelum hydropower project. He also informed that documentation process in this regard would take one month while disbursement of such a hefty amount is likely within one-month....

http://www.nation.com.pk/pakistan-news-newspaper-daily-english-onli...

-

Comment by Riaz Haq on June 24, 2012 at 9:36am

-

Here's an FT piece on the negative impact of power sector in Pakistan:

...Munir, born and educated in Lahore, makes his case in the latest issue of the Economic & Political Weekly of India, to be published on Saturday.

“The 1994 privatisation of the energy sector offered investors generous returns and created pricey overcapacity,” he told beyondbrics. “This created an expensive legacy which is the real problem of today’s energy crisis.”

Unless that problem is dealt with, he sees no light at the end of the energy tunnel.

He says Pakistan’s government, helped by the World Bank, “sweetened” its energy privatisation with attractive conditions, fearing it wouldn’t be able to attract investors otherwise. It guaranteed a 12 to 15 per cent annual return (indexed in dollars, not rupees), gave tax breaks and paid interest on private funding – more expensive for the government than providing the funding itself. ”The deal was too good to be true for investors,” Munir says.

The government gave those guarantees during an economic boom it assumed would continue. That turned out not to be the case.

Munir says the model turned out to be badly constructed in terms of creating value for the government and people of Pakistan. Even in an environment of economic growth and efficient energy generation, it would have been hard for the government to finance the plan. But since both have been absent, it became nearly impossible to pay for privatised energy.

What else went wrong?

Most private investors chose to build oil-powered plants because of their low construction costs and short lead times. This backfired as the oil price has trebled since the 1990s. Variable costs, and therefore prices to consumers, are at unsustainable levels. “No wonder many consumers can’t afford to pay their bills,” Munir says.

To make things worse, the government neglected to step on the brakes when its generous conditions attracked too many investors. Assuming economic growth would continue, it allowed too much capacity to be built and guaranteed the same return on that extra capacity, whether it was used or not.

But as growth stalled, the government could no longer meet its commitments. So operators have begun shutting down power plants, killing the lights across Pakistan – which is now enduring daily power outages in spite of having excess generating capacity of almost 35 per cent.

Munir says the government should develop new power plants using cheaper fuels, and that this shouldn’t be a problem in a country with an abundance of coal, waterways and sun.

But Pakistan must first escape its vicious payment cycle. The Economist magazine reports that Pakistan’s so-called circular debt to energy producers stands at $880m. It is only getting worse because of rising interest costs and dollar-rupee appreciation.

“We need to get out of the the current deals,” says Munir. But at what cost, and does this imply default? “Your guess is as good as mine,” the academic admits.

Still, he felt it was time to make his point. “I’m not defending people who don’t pay bills and I’m not promoting government subsidies to keep prices low,” Munir says. “But why isn’t anyone talking about the policy that led to this situation to begin with?”

http://blogs.ft.com/beyond-brics/2012/06/22/pakistans-real-power-pr...

http://www.epw.in/system/files/pdf/2012_47/25/Pakistans_Power_Polit...

-

Comment by Riaz Haq on June 28, 2012 at 7:05am

-

Here's an Asia Times story on power outages or loadshedding in India:

Power outages in India, now enduring the peak demand of hot summer months, are running to as long as eight to 10 hours in northern cities, including the capital, and while large parts of the country continue to be off grid rural areas with access to electricity can be without power for over 20 hours at a stretch.

The Uttar Pradesh government this week ordered that electricity be cut off at malls and shopping centers in the evenings, before apparently backtracking in the face of angry traders who put up defiant protests, clashing with police.

Billions of dollars have been invested by power producers to create new capacity over the past few years, but numerous factors linked to populist politics, over-zealous implementation of

environment norms, transmission losses, pilferage, free power to agriculture and bureaucratic tardiness have resulted in under utilization of existing capacity. In short, India can produce more power if it wants to, but is unable to.

One bottleneck is coal, the majority of which is mined by state-owned Coal India Ltd (CIL). The bulk of Indian power is produced at coal-fired thermal plants, but CIL has not been able to increase output to meet the country's needs.

The environment ministry has declared many of the company's mines to be in "no go" zones, while the bulk of CIL's coal supply comes from areas in eastern India where Maoist rebels are active.

It also has to rely on another government institution, the slip-shod Indian Railways, to move the coal. Coupled with in-built delays and indecision within the government, CIL's output growth has been near stagnant over the past three years, with the result that more than one-third of India's coal-based thermal power plants are running on critically low levels of fuel stocks this season.Estimates suggest that if CIL continues to falter in supplying coal, India's target for adding new power capacity for the 2012-17 period will need to be slashed to 45,000 megawatts from the proposed 76,000 MW. New Delhi has already scaled down its capacity addition target for the next five years by 25,000 MW to 75,000MW from conventional sources.

The coal ministry, meanwhile, has projected that India's annual coal demand could rise over 40% by March 2017 to nearly 1 billion tonnes while domestic coal output may increase by less than 30%, leaving a gap of around 300 million tonnes that will have to be met by imports.

India's power woes do not stop there. Electricity generators such as NTPC, Tata Power and Adani have the option of buying coal from the likes of Indonesia, Africa and Australia, but overseas prices are too steep compared with the artificially depressed domestic prices set by the government.----------

As India does not produce enough of its own oil, the bulk of the diesel is imported, draining foreign exchange, creating balance of payments problems and weakening the rupee - which drives up the cost of imported products such as oil and coal.The government continues to subsidize diesel to protect among others the transport sector - which adds to the ever-rising fiscal deficit, which again helps to fuel inflation. It is no surprise that rating companies such as Standard & Poor's have cautioned that India's investment climate could be pegged at "junk'' levels.

Meanwhile, in the sweltering streets and fields of India, the poor die of heatstroke, a savage reminder that the structural infirmities built into power generation ostensibly to protect the poor are actually harming the impoverished the most. While India pushes to increase its use of renewable and nuclear power, it is the thermal power energy chain that needs some serious attention and reform.

-

Comment by Riaz Haq on July 7, 2012 at 10:19pm

-

Here's a News report on CNG growth in Pakistan:

Pakistan has become the third country in the list of countries with the most natural gas vehicles, as over 26 percent of the vehicles on the roads consume natural gas, suggests the data of Natural Gas Vehicles (NGV) Europe.

The NGV Global suggests that Pakistan has observed the fastest growth in natural gas vehicles since the year 2000 as the number of gas vehicles has surged to around 3.5 million from less than 100,000 vehicles back in the year 2000. While Pakistan is the country with the highest number of CNG refilling stations in the world.

Former CEO of OGDCL, Zahid Khan said that independent seminars and analysts consider CNG to be a burden on the system.An official at the Ministry of Petroleum said that from 2005-06 to 2010-11, CNG consumption increased at the rate of 24 percent, the highest increase witnessed in any sector.

“With gas production facing a decline, this growth is at the expense of other value-added sectors like fertilizers, the general industry and the power sector,” he said.With growing car ownership and CNG prices being kept at 55 percent of petrol prices, the CNG monster is fast eating into the legitimate gas share of other sectors. Commenting on the investments made by the CNG sector, the official said that many CNG stations were initial investments based on a government incentive.

However the initial cost to set up a CNG station is approximately Rs55 million including Rs.31 million of the land cost and on average, the payback period is three years. Based on current CNG prices, most of the CNG stations have already made significant profits. The industry people say that when deciding on gas allocation, the government should consider the opportunity cost of the allocation of the gas to different sectors.

Fertilizer, textile and other manufacturers are value added industries producing goods locally with capital and equipment, which is already present in the country and this reduces the import of goods and increases the exports of locally manufactured items.

CNG, on the other hand, involves the substitution of one fuel by another.“Keeping energy prices in the form of CNG artificially low, encourages energy inefficiency. But energy spent using petrol for example, is likely to be less as the efficiency of use will be higher. Hence total expenditure on transport will not increase proportionately if CNG is withdrawn,” industry sources said. “The government should consider the fact that petrol is a perfect substitute for CNG, but there is no substitute available for fertilizer plants that use gas as a raw material,” he added. The ministry official said that the CNG sector was stating inaccurately that the government was imposing Rs141 cess tax per mmbtu on CNG.

In reality, in the first official communication on Cess dated Dec 15, 2011, the Cess for CNG was announced to be Rs 141/mmbtu for Region-1 (KPK, Baluchistan, Potohar Region) and Rs 79/mmbtu for Region-2 (Sindh, Punjab excluding Potohar Region). Later on it was reduced to Rs 84.6/mmbtu for Region-1 and Rs 47.4/mmbtu for Region 2 after the CNG associations went into negotiations with the government of Pakistan. Whereas, the fertilizer industry pays Rs 300/mmbtu.

http://www.thenews.com.pk/Todays-News-3-119151-Pakistan-third-large...

-

Comment by Riaz Haq on July 15, 2012 at 9:25am

-

Here's an ET story on Pakistan's high-price LNG deal:

The Pakistan Economy Watch (PEW) on Friday said the government is planning to buy Liquefied Natural Gas (LNG) on inflated rates under the garb of resolving energy crisis.

All rules and regulations have been relaxed for the import of 500 million cubic feet of LNG per day under a long-term contract with Qatar, said Abdullah Tariq, SVP of PEW in a statement.

Current price of LNG is hovering around $12.5 per million British thermal units (MMbtu). A 15-year agreement should bring down the cost to $7/MMbtu. However, the government is planning to buy the same for around $15/MMbtu which will cost slightly over $18/MMbtu when transportation cost is included. Pakistan will have to pay some $5 million daily for 15 years while politicians will get some Rs400 billion in kickbacks if the deal to import LNG from Qatar on hefty rates is finalised, Tariq warned.

Secretary Petroleum Muhammad Ejaz Chaudhry has been fired for resisting the deal while efforts are under way to tame Ogra, which has also opposed the deal, he claimed.

http://tribune.com.pk/story/408182/whistleblower-pew-smells-scam-in...

-

Comment by Riaz Haq on July 27, 2012 at 8:26am

-

Here's PakTribune report on Pakistan-Qatar LNG deal:

US energy giant ConocoPhillips is mediating between Pakistan and Qatar to enable them to strike a multi-billion-dollar liquefied natural gas (LNG) deal, in an apparent attempt to drive Islamabad away from the Iran-Pakistan (IP) gas pipeline project due to tensions between the West and Tehran.

An official of the Ministry of Petroleum and Natural Resources told Our Sources that the Qatari government had designated ConocoPhillips to clinch an LNG supply deal with Pakistan.

Earlier, Qatar had asked Shell to finalise the LNG contract with Pakistan, which could not be reached due to controversy over the Mashal LNG import project.

According to sources, high-ups of the petroleum ministry went to Dubai and London this month to hold negotiations with representatives of the US energy company on the terms of LNG contract.

"Former US Secretary of State Richard Armitage is a member of the board of ConocoPhillips and playing a role to help Pakistan and Qatar reach an agreement," a senior government official said. This may force the government to shelve the IP pipeline project, he said.

Headquartered in Houston (Texas), ConocoPhillips has operations in about 30 countries and has a 30% share in oil and gas reserves being explored under the Qatargas-III project in the North Field near the Iranian border from where LNG will be supplied to Pakistan.

Under the IP pipeline project, Pakistan will get gas from Iran's South Pars field, the world's largest gas field situated along the Iranian border with Qatar in the Persian Gulf. The Qatari side of the field is called the North Field.

According to reports, delay and low production by Iran may shift some gas reserves to the Qatari side and lead to loss of yield due to low field pressure.

Pakistan and Qatar have already signed a memorandum of understanding, under which Islamabad will import 500 million cubic feet per day (mmcfd) of LNG to generate 2,500 megawatts of electricity.

According to the term sheet, Qatar had demanded a price of $18 per million British thermal units (mmbtu) for LNG supply. In response, Pakistan quoted a price of $10 per mmbtu.

"Pakistan and ConocoPhillips are discussing terms of the agreement and price is also part of the discussion," the government official said.

US embassy officials in Pakistan have also been lobbying and holding meetings with stakeholders of the power and energy sector to try to convince them that the Iran gas project will not be viable for Pakistan.

The US diplomats stress that Pakistan should shelve the IP project, terming it 'bad' and call for inking an LNG deal with Qatar to meet the country's pressing energy needs.

"Pakistan should shelve the IP gas pipeline project and move ahead with LNG deals," a US diplomat said on condition of anonymity.

The petroleum ministry is also receiving technical help from USAID consultants for LNG import.

http://paktribune.com/business/news/LNG-supply-US-energy-giant-help...

-

Comment by Riaz Haq on July 31, 2012 at 7:11pm

-

Here's NY Times on massive power outages in India:

It had all the makings of a disaster movie: More than half a billion people without power. Trains motionless on the tracks. Miners trapped underground. Subway lines paralyzed. Traffic snarled in much of the national capital.

On Tuesday, India suffered the largest electrical blackout in history, affecting an area encompassing about 670 million people, or roughly 10 percent of the world’s population. Three of the country’s interconnected northern power grids collapsed for several hours, as blackouts extended almost 2,000 miles, from India’s eastern border with Myanmar to its western border with Pakistan.

For a country considered a rising economic power, Blackout Tuesday — which came only a day after another major power failure — was an embarrassing reminder of the intractable problems still plaguing India: inadequate infrastructure, a crippling power shortage and, many critics say, a yawning absence of governmental action and leadership.

----------

India’s power sector has long been considered a potentially crippling hindrance to the country’s economic prospects. Part of the problem is access; more than 300 million people in India still have no electricity.But India’s power generation capacity also has not kept pace with growth; in March, for example, demand outpaced supply by 10.2 percent, according to government statistics.

In recent years, India’s government has set ambitious goals for expanding power generation capacity, and while new plants have come online, many more have faced delays, whether because of bureaucratic entanglements, environmental concerns or other problems. India depends on coal for more than half of its power generation, but production has barely increased, meaning that some power plants are idled for lack of coal.

----------

Ramachandra Guha, an Indian historian, said that the blackout was only the latest evidence of government dysfunction in India. On Monday, he noted, 32 people died in a train fire in the state of Tamil Nadu — a reminder that the nation’s railway system, like the electrical system, is underfinanced and in dire need of upgrading.“India needs to stop strutting on the world stage like it’s a great power,” Mr. Guha said, “and focus on its deep problems within.”

http://www.nytimes.com/2012/08/01/world/asia/power-outages-hit-600-...

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Canada Gets Tough on Foreign Students Amid Mounting Tensions With India

The Canadian government has recently taken a series of steps to cut the number of international students studying in Canada. This is believed to be related to the extremely hostile Indian government response to Canadian allegations that the Indian officials ordered assassinations of Sikh activists in Canada. There are now new reports that Ottawa has asked Indian students to resubmit their documents for review. Earlier, Canada made a decision to end the fast-track visa process, known as…

ContinuePosted by Riaz Haq on December 14, 2024 at 10:00am

Russian Hackers Steal Indian Military Secrets From Pakistani Cyber Spies

Hackers linked to Russian intelligence have stolen Indian military data from cyber spies believed to be working on behalf of the Pakistani state, according to an assessment by Microsoft researchers. All those involved are part of what are known as "advanced persistent threat" (APT) organizations in their respective countries. TechTarget defines "Advanced Persistent Threat (APT)…

ContinuePosted by Riaz Haq on December 8, 2024 at 8:00am

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network