PakAlumni Worldwide: The Global Social Network

The Global Social Network

Diaspora Remittances to Pakistan Soar 21X Since Year 2000

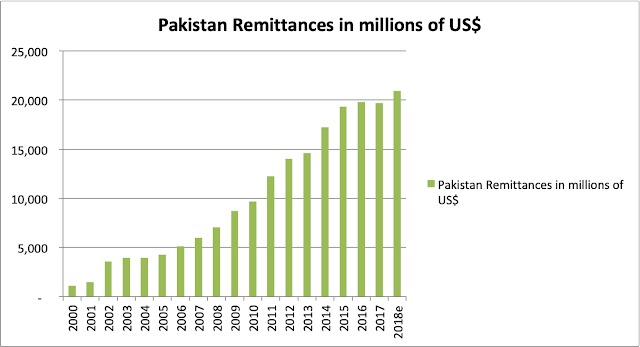

Remittance inflows from Pakistani diaspora have jumped 21-fold from about $1 billion in year 2000 to $21 billion in 2018, according to the World Bank. In terms of GDP, these inflows have soared nearly 7X from about 1% in year 2000 to 6.9% of GDP in 2018.

Meanwhile, Pakistan's exports have declined from 13.5% of GDP in year 2000 to 8.24% of GDP in 2017. At the same time, the country's import bill has increased from 14.69% in year 2000 to 17.55% of GDP in 2017. This growing trade imbalance has forced Pakistan to seek IMF bailouts four times since the year 2000. It is further complicated by external debt service cost of over $6 billion (about 2% of GDP) in 2017. Foreign investment in the country has declined from a peak of $5.59 billion (about 4% of GDP) in 2007 to a mere $2.82 billion (less than 1% of GDP) in 2017. While the current account imbalance situation is bad, it would be far worse if Pakistani diaspora did not come to the rescue.

Diaspora Remittances:

Estimated inflows of $20.9 billion make Pakistan the world's 7th largest recipient of remittances for 2018, according data released by the World Bank in its latest "Migration and Remittances" report of December 2018. In South Asia region, Pakistan is the second largest recipient of remittances of $20.9 billion after top-ranked India's $79.5 billion.

Pakistan Remittances in Millions of US Dollars. Source: World Bank |

Remittances from Pakistani diaspora have grown nearly 21-fold since the year 2000. Pakistanis sent home remittances adding up to 6.9% of the country's GDP in 2018, up from 1% back in year 2000.

Pakistan's Trade:

In 2017, Pakistan exported goods and services worth $22 billion while it imports amounted to $57 billion, a trade deficit of $35 billion for the year. This is a dramatic deterioration from about $2 billion trade deficit (2% of GDP) in year 2000 to $35 billion trade deficit (about 12 % of GDP) in year 2017.

Pakistan Trade Deficit in Billions of US$. Source: World Bank |

Pakistan's exports have declined from 13.5% of GDP in year 2000 to 8.24% of GDP in 2017. At the same time, the country's import bill has increased from 14.69% in year 2000 to 17.55% of GDP in 2017.

Foreign Direct Investment:

Foreign direct investment (FDI) in Pakistan was a mere $2.82 billion (less than 1% of GDP) in 2017, down from a peak of $5.59 billion (4% of GDP) in 2007. The lack of foreign investment has contributed to the country's dwindling reserves and balance of payments difficulties requiring it to seek yet another IMF bailout.

Pakistan's External Debt. Source: State Bank of Pakistan via Dr. Is... |

Pakistan's Debt:

Significant growth in remittances from Pakistani diaspora has clearly helped but the external accounts gap is too big for it. This has forced Pakistan to borrow heavily in recent years. It has raised debt service costs and put pressure on Pakistan's reserves.

Summary:

Remittances from Pakistani diaspora have jumped 21-fold from about $1 billion in year 2000 to $21 billion in 2018, according to the World Bank. In terms of GDP, these inflows have soared nearly 7X from about 1% in year 2000 to 6.9% of GDP in 2018. Meanwhile, Pakistan's exports have declined from 13.5% of GDP in year 2000 to 8.24% of GDP in 2017. Foreign investment in the country has declined from a peak of $5.59 billion (about 4% of GDP) in 2007 to a mere $2.82 billion (less than 1% of GDP) in 2017. At the same time, the country's import bill has increased from 14.69% in year 2000 to 17.55% of GDP in 2017. This growing trade imbalance has forced Pakistan to seek IMF bailouts four times since the year 2000. It is further complicated by external debt service cost of over $6 billion (about 2% of GDP) in 2017. While the current account imbalance situation is bad, it would be far worse if Pakistani diaspora did not come to the rescue.

Related Links:

Can Pakistan Avoid Recurring Balance of Payment Crisis?

Pakistan Economy Hobbled By Underinvestment

Can Indian Economy Survive Without Western Capital Inflows?

Pakistan-China-Russia Vs India-Japan-US

Chinese Yuan to Replace US $ as Reserve Currency?

Remittances From Overseas Pakistanis

-

Comment by Riaz Haq on August 8, 2022 at 4:38pm

-

Remittances Are a Lifeline for Developing Countries With Economic Instability

https://thefintechtimes.com/remittances-are-a-lifeline-for-developi...

Remittances sent worldwide have increased 64.3 per cent in the past decade, rising from $420.1billion 10 years’ ago to $653.4billion in the last year, shows research by ACE Money Transfer, the online remittance provider.

---

Global economic growth is expected to slump from 6.1 per cent last year to 3.2 per cent this year — significantly lower than the 4.1 per cent anticipated in January. This is due to rising interest rates and spiralling inflation. This slowdown in growth is expected to hit low-income countries harder.

---

Remittances also play a key role in urban areas, helping drive investment into real estate and infrastructure in developing countries.

Rashid Ashraf, CEO of ACE Money Transfer, says, “Remittances have a massive impact on people’s lives across the world. When times are tough and economies are struggling, this is when remittances are particularly important.

“Around three-quarters of remittances sent globally are used to cover essential things, like putting food on the family’s table and covering medical expenses, school fees or housing expenses. In addition, in times of crises, migrant workers tend to send more money home to cover loss of crops or family emergencies.”

Countries facing significant economic stress at present include Sri Lanka, Pakistan, Nigeria and Nepal. Remittances play a key role in supporting the economies of all mentioned countries.

Remittances key to helping Sri Lanka and Nepal’s struggling economies

Sri Lanka in particular has struggled following the pandemic, with its economy having collapsed. The country has been short of cash to pay for vital food and fuel imports and has defaulted on its debt.

Remittances are a key pillar of Sri Lanka’s economy, reaching $7.1billion in the past year, up from $6.7billion the previous year. Remittances in Sri Lanka support economic growth, reduce the burden on social security payments and help alleviate poverty. Increases in remittances could significantly aid Sri Lanka’s economic recovery.

-----

How remittances can help moderate inflation in Pakistan and Nigeria

Pakistan and Nigeria are two other countries facing economic difficulties where remittances can play a key role in their recoveries. Both countries have been struggling with the effects of surging inflation this year.

Pakistan’s currency has devalued 28 per cent compared to the US dollar so far this year, fuelling surges in the prices of vital imported goods such as fuel, cooking oil and grains.

This has made remittances to Pakistan, which have risen 26 per cent to a record $33billion in the past year, even more important. Remittances are a key source of foreign currency for Pakistan and play a significant role in supporting its currency. This is in turn can help control inflation and the price of essential goods and services in the country.

---

The role of remittances in strengthening resilient economies like the Philippines

Remittances can also play an important role in countries where the economy has remained resilient. This includes the Philippines’ economy, which has continued to show rapid expansion this year despite global headwinds.

An important stabilising factor in its economy has been remittances, which have reached a record high of $34.9billion in the past year. Remittances in the Philippines are important in supporting domestic consumer spending, which has driven the country’s economic growth.

Remittances are a crucial source of foreign capital for many developing countries. Unlike other flows of private capital, remittances have remained resilient throughout the pandemic. As economics across the world continue to recover, remittances continue to play a vital role in helping countries build resilience and drive economic growth.

-

Comment by Riaz Haq on February 2, 2025 at 10:18am

-

Remittances (to Pakistan) expected to surpass $35bn in FY25: analysts

https://www.thenews.com.pk/print/1278605-remittances-expected-to-su...

KARACHI: Pakistan’s remittances are projected to exceed the central bank’s forecast of $35 billion for the fiscal year 2025, thanks to the country’s efforts to curb illegal foreign exchange trade, increasing citizens working abroad, and economic stability bolstered by the International Monetary Fund (IMF) bailout, according to analysts.

In a recent report, an analyst at Topline Securities estimates that remittances will reach $37 billion this fiscal year. He expects the country’s current account balance to breakeven, resulting in a surplus of 0.5 per cent of its gross domestic product (GDP) -- equivalent to approximately $0-2 billion -- primarily driven by higher-than-expected remittance inflows.

During the July-December period of FY25, remittances increased to $17.8 billion, representing a 33 per cent rise compared to the same period last year. The State Bank of Pakistan (SBP) projects total remittance inflows of $35 billion for this fiscal year, up from $30.3 billion in FY24.

Remittances play a vital role in supporting the country’s external account and foreign exchange reserves. Currently, the SBP’s forex reserves amount to $11.37 billion, sufficient to cover over two months’ worth of imports.

According to the SBP’s monetary policy statement, while the import bill has exceeded export earnings, remittance inflows have more than compensated for the widening trade deficit. Given these trends, particularly the strong remittance growth, the outlook for the current account balance has significantly improved. It is now expected to remain within a surplus or deficit of 0.5 per cent of GDP in FY25.

Saad Hanif, head of research at Ismail Iqbal Securities, anticipates that remittances will rise to between $34.8 billion and $35.5 billion in FY25. He noted that the increase in remittances can be attributed to several factors, including the growing number of people travelling abroad for work, the ease of using Roshan Digital Accounts (RDA), improved policy stability under the IMF programme, and a crackdown on illegal transfer channels such as ‘hundi’ and ‘hawala’. In the last two years, over 1.5 million Pakistanis have gone abroad for work, which has boosted remittance inflows. The ease and speed of banking services, particularly with the growth of RDAs and fintech, are encouraging the use of legal channels for remittances.

Tresmark, a financial terminal, stated in a note that surging remittances could be transformative for Pakistan’s economic viability, but certain misconceptions need to be addressed.

One common myth is that everyone in Pakistan is emigrating. However, data shows that emigration patterns from Pakistan align with trends observed in the region, including India and Bangladesh.

Another misconception is that Pakistan is experiencing greater remittance growth than other countries. The report clarifies that, over the past five years, remittance performance in Pakistan has been comparable to that of India and Bangladesh, although the trajectories have differed slightly.

-

Comment by Riaz Haq on April 14, 2025 at 5:38pm

-

Pakistan's remittances reach all-time high of $4.1b in March 2025 | The Express Tribune

https://tribune.com.pk/story/2539793/pakistans-remittances-reach-al...

Pakistan received a record $4.1 billion in remittances in March 2025, the highest monthly inflow on record, State Bank of Pakistan (SBP) Governor Jameel Ahmad said on Monday.

Addressing an event at the Pakistan Stock Exchange (PSX), Ahmad confirmed that the surge in inflows provided crucial support to the economy, foreign exchange reserves, and liquidity for importers.

This marks the first time that remittances have crossed the $4-billion threshold in a single month. The inflow represents a 37% increase year-on-year compared to $2.95 billion in March 2024. Month-on-month, remittances rose by nearly 30%, up from $3.12 billion in February 2025.

Between July 2024 and March 2025, Pakistan received $28 billion in workers’ remittances, reflecting a 33.2% increase from the $21.04 billion recorded in the same period of the previous fiscal year.

SBP governor projected that foreign exchange reserves would exceed $14 billion by June. He added that while foreign debt obligations for FY25 stand at $26 billion, the government expects $16 billion to be rolled over or refinanced, reducing net repayment pressure to around $10 billion.

The SBP governer further noted early signs of economic recovery, but said overall GDP growth for FY25 was now expected to be around 3%, down from earlier projections of over 4.2%, largely due to a weaker-than-expected agricultural season.

In January, Ahmad had said that Pakistan’s macroeconomic targets were on track, with debt levels and the balance of payments under control.

The central bank attributed the increase to enhanced formal banking channels, seasonal factors such as Ramadan-related giving, and exchange rate stability which encouraged legal transfers.

Remittances continue to play a critical role in supporting Pakistan’s external account, stabilising foreign reserves, and supplementing household incomes.

Remittances from other Gulf and European countries also contributed to the surge, though in smaller volumes.

The record inflow offers some short-term relief for Pakistan’s economy, which continues to face external financing pressures and inflationary challenges. Higher remittances are expected to support foreign exchange reserves, strengthen the rupee, and ease the trade and current account deficits.

The inflows are used by households to cover living expenses, healthcare, education, and housing, while also playing a critical role in mitigating external financing gaps.

The SBP also reported improved performance of digital and formal banking channels, noting that increased awareness campaigns and crackdowns on hawala/hundi networks have also redirected inflows through official routes.

-----------------------

Arif Habib Limited

@ArifHabibLtd

Remittances surged to an all-time high of USD 28.0 bn in 9MFY25, setting a new record for the nine-month period.

https://x.com/ArifHabibLtd/status/1911674210008641892

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Modi's Hindutva: Has BJP's Politics Hurt India's International Image?

The Indian cricket team's crass behavior after defeating the Pakistani team at the Asia Cup 2025 group encounter has raised eyebrows among sports fans around the world. Not only did Suryakumar Yadav, the Indian team captain, refuse to do the customary handshake before and after the match in Dubai but he also made controversial statements linking the match with the recent India-Pakistan conflict. “A few things in life are above sportsman’s spirit ......We stand with all the victims of the …

ContinuePosted by Riaz Haq on September 15, 2025 at 7:00pm — 1 Comment

Trump's Tariffs on India: Can China or Russia Make Up For Lost Exports to US?

The United States is the biggest export market for India. Among its top 5 trading partners, the US is also the only country with which India runs a trade surplus. This surplus is now at risk with the 50% tariff recently imposed by President Donald Trump on imports from India. Can Prime Minister Narendra make up for it by cozying up to China and Russia? Recent trade data shows he…

ContinuePosted by Riaz Haq on September 8, 2025 at 7:00pm

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network