PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Government Ad Spend Cuts Trigger Media Business Shakeout

Pakistan's 88 billion rupee media industry is in the midst of a major shakeout after a long period of rapid double-digit growth since the turn of the century. Hundreds of journalists and other staff have lost their jobs. At least one TV channel, Waqt News, has closed while several others are downsizing. While such consolidation was long overdue after nearly two-decade long period of explosive growth, the PTI government's decision to reduce advertising budget, which constitutes nearly a quarter of all ad spending in the country, appears to be the main trigger. Those affected by consolidation are accusing the government of exercising press censorship by cutting its ad spending.

Rapid Growth:

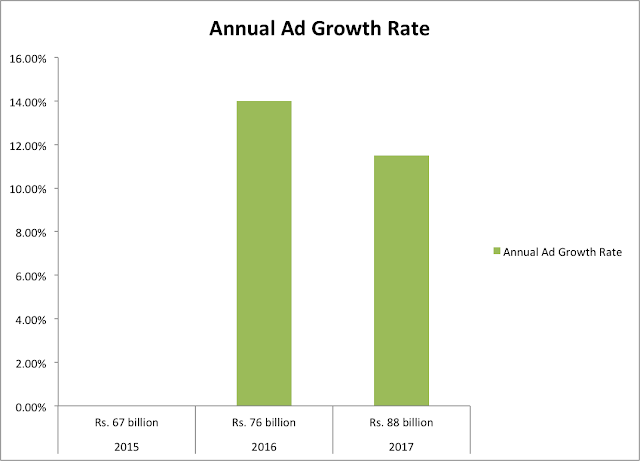

Rising buying power of rapidly expanding middle class in Pakistan drove the nation's media advertising revenue up 14% to a record Rs. 76.2 billion 2016 and another 12% to Rs. 88 billion in 2017, making the country's media market among the world's fastest growing media markets.

Industry Shakeout:

Massive commercial media growth in Pakistan has been most apparent in terms of private TV channels growing from just one in Year 2000 to over 100 today after President Musharraf's deregulation of electronic and other media.

Explosive growth with many new entrants is the fundamental business reason for the recent wave of consolidation and shakeout. Shakeout is a business term used to describe the consolidation of an industry or sector after it has experienced a period of rapid growth in demand followed by oversupply.

At least one TV channel, Waqt News owned by Nawai-Waqt Media Group, has closed while several others are downsizing. “We are trying to compile exact figures of the affected media persons. So far, we can say that around 1,000-1,500 workers have lost their jobs or faced cuts in salaries in the past few weeks,” Muhammad Afzal Butt, president of one the main factions of Pakistan Federal Union of Journalists (PFUJ) told The News Sunday (TNS) this week.

Government Spending:

About a quarter of Rs. 80 billion ad revenue comes from federal and provincial government ads in the media. Some of the TV channels receive as much as 50% of their revenue from the government.

"The government has cut its media spend by more than 70% and companies by almost 50%", according to a leading advertising agency owner who spoke to Dawn.

"The (federal) government used to spend some Rs. 10 billion on advertisements annually, which was increased up to Rs35 billion in the last years of the (Nawaz Sharif's PMLN) government," Fawad Chaudhry, federal minister of information, told The News Sunday (TNS). This tax-payers’ money, says the minister, was used by the previous government to bribe the media for favorable coverage.

Digital Adverstising:

Growing slice of the media ad spend is being claimed by online advertising with accelerating broadband penetration in Pakistan. Most recent data from Pakistan Telecommunications Authority shows that 62 million Pakistanis now subscribe to mobile broadband and this number is increasing by one to two million new subscribers each month.

Digital media spending rose 27% in 2015-16 over prior year, the fastest of all the media platforms. It was followed by 20% increase in radio, 13% in television, 12% in print and 6% in outdoor advertising, according to data published by Aurora media market research.

Summary:

Significant reduction in government spending on advertising has triggered a long-overdue shakeout after almost two decades of rapid media growth in Pakistan. About a quarter of Rs. 80 billion ad revenue comes from federal and provincial government ads in the media. Some of the TV channels receive as much as 50% of their revenue from the government. Hundreds of journalists and other staff have lost their jobs. At least one TV channel, Waqt, has closed while several others are downsizing. Those affected by consolidation are accusing the government of exercising press censorship by cutting its ad spending.

Here's a video discussion on Pakistani media business with Misbah Azam, Sabahat Ashraf and Riaz Haq.

Related Links:

Advertising Revenue in Pakistan

The Other 99% of Pakistan Story

-

Comment by Riaz Haq on December 5, 2018 at 6:43pm

-

DIGITAL SPENDS IN PAKISTAN WILL GROW BY 47% IN 2018 – MAGNA STUDY

According to Magna, Pakistan’s advertising market is expected to grow by 13.7% in 2018, reaching $916 million. Magna’s intelligence team found that 73% of media spends are concentrated on television, with spending growing by 14% in 2018.

The report found that the 2017 ICC Champions Trophy and Pakistan’s surprise win over India contributed towards strong ratings, as did the Pakistan Super League initiated by Habib Bank Limited and Spark/Blitz of Publicis Groupe.

“The 2018 Elections are expected to create inventory shortage and generate double-digit inflation,” said the report. “In 2019 the Cricket World Cup will be a massive driver, yet again. Digital media is under-developed with just 3% of total media revenues, but growing quickly (+47% in 2018). Social Media is the fastest growing internet category (+70% in 2018), with already 16% of the population being active of which 14% through mobile devices.”

http://www.madvertising.pk/magna-apac-advertising-will-grow-7/

-

Comment by Riaz Haq on December 5, 2018 at 6:47pm

-

The dawn of advertising in Pakistan (1947-2017)

https://www.dawn.com/news/1398497

Pakistan’s first digital companies were born from small departments, developing websites within larger software development companies. From thereon, until as late as 2006, two years after the entry of Facebook and a year after YouTube came into existence, it never occurred to anyone how user-unfriendly these websites were.

They were fully functional, but they lacked aesthetics and did not even attempt to make the user experience easy. The flaw was that technology people are very good with coding but useless at design and communication.

In 2008, the multinational companies began to wake up to the opportunity and did the smart thing – they asked their advertising agencies to develop their websites or at the least, design them so that the software houses could build a better user experience.

Oddly, most agency owners failed to spot the opportunity this presented. However, along the way, something happened independently that forced the advertising agencies to look at digital as a viable source of revenue.

Between 2000 and 2010, agency revenues had started to shrink. Revenues from print jobs had gone as clients preferred to work directly with the printing presses. Then came the media buying houses and the agencies lost their commission revenue on media. Finally, as more and more film directors started to work directly with clients, TVC production also went, resulting in the closure of in-agency AV departments.

Desperate, the agency owners looked for anything that seemed like an opportunity and the fact that the software houses were so bad creatively, was a good way to generate some revenue.

Of course, in typical Pakistani agency tradition, they did it in the most unprofessional way. Interns, fresh out of college, were hired to handle their clients’ digital requirements. By 2010, blue-chip companies began to take an interest in social media.

Although the first digital agencies had started popping up in early 2000s, it was not until 10 years later that they began receiving serious business propositions. Along the way, clients experienced many frustrating moments, not least because if the software houses lacked creativity, the agencies lacked technological know-how in equal measure.

It has been a long journey. However, today, the frustration has shifted from the client end to the digital agency end, which, to their credit, eventually managed to evolve at a breathtaking speed. It was the clients that were lagging behind.

Even as late as 2015, 26 years after the birth of the World Wide Web, most clients still thought a digital presence meant only having lots of ‘likes’ on Facebook posts; quite astonishing, considering that the version of the software I am using to write this article will be outdated in less than six months. So imagine the frustration digital agencies experience when their clients are still living in 2006.

So, while during the late nineties and early 2000s, agencies spent much of their time trying to catch up with their clients’ digital requirements, today, the clients are the ones who need to catch up with global trends. And they must do so quickly. There was a time when each country could conceivably choose to adopt technology at their own pace; today, this is no longer practical, simply because the speed in the evolution of technology does not permit this any longer.

What is required is the rapid synchronisation in the digital capabilities of the digital agencies and of their clients in Pakistan.

-

Comment by Riaz Haq on December 8, 2018 at 7:42pm

-

Dwindling advertisement revenues for print and electronic media in Pakistan have brought several news organisations on the verge of closure or staff layoffs in hundreds. According to the chief executive of a leading advertisement firm in Islamabad, the private sector—including banks, textile industry and telecom firms—has slashed their advertisement budget by 50 per cent during the past few years.

https://www.newslaundry.com/2018/11/22/pakistan-media-spend-ownersh...

The executive also said the provincial governments of Punjab, Sindh—the main contributors of advertisement revenues for print and electronic media—and the central government in Islamabad have slashed their advertisement budget by 70 per cent, leaving the media industry in a bad financial situation.

A compilation of advertising spend collected from multiple sources, Dawn reported, estimates that the market size has grown from Rs 66.9 billion in the financial year 2015 to Rs 87.7 billion in 2017. However, the growth share of electronic and print media shows a decline.

This is also evident from the inability of media organisations to pay salary to their staffers and layoffs of hundreds of journalists in Pakistan. Afzal Butt, president of the Pakistan Federal Union of journalists, said that over the past eight months, nearly 500 journalists lost their jobs due to the bad financial situation.

Last month, Waqt Television, a leading news channels owned by the financially-strong Nawa-e-Waqt group of newspapers, decided to shut down its operations suddenly. No prior notice was given to its employees. It closed down all bureaux in different parts of the country and asked its employees to leave the premises of the TV station immediately.

For both electronic and print media in Pakistan, government advertisements act as the backbone of their finances. “The government, both provincial and central government in Islamabad buy airtime in leading television channels during prime time hours (sic) this subsidises their financial operations,” said a senior government executive. Similarly, governments subsidise operations of leading newspapers by providing them with advertisement revenues.

In August 2018, the Pakistan senate was informed that the government provided advertisements worth Rs 15.74 billion to print and electronic media from 2013 to 2017. In the initial year of its growth, electronic media in Pakistan was greatly dependent on advertisement revenues from big telecom firms for their financial strength. The situation is not the same anymore.

“During the last few years, major telecom companies have slashed their advertisement budgets … They (telecom companies) started with a big budget in 2000 and proved to be a lifeline for the newspaper industry,” says Fasih-ur-Rehman, political editor of a local newspaper. “Economic crunch led to slashing of their advertisement budget,” he added.

An analysis in Dawn states: “The newspaper industry has its own demons to overcome. Watching resignedly as companies took a substantial portion of their media spend from print to digital platforms to reach out to their target markets, the good-old trusted newspaper is faced with a mortal threat as incomes fall drastically.” It adds, “Thus starved of resources, newspapers and magazines have shed pages and created redundancies of their own. Some are finding it hard to pay salaries to their retained employees, contributing to the unrest and the increasingly vocal protest among journalists and other workers in the industry”.

On October 9, the Pakistan Federal Union of Journalists staged a protest in front of Parliament house. The entire leadership of the National Press Club was in attendance at the protest demonstration in front of the Parliament building.

-

Comment by Riaz Haq on December 3, 2022 at 11:40am

-

Video Streaming (SVoD) - Pakistan

Pakistan

https://www.statista.com/outlook/dmo/digital-media/video-on-demand/...

HIGHLIGHTS

Revenue in the Video Streaming (SVoD) segment is projected to reach US$161.10m in 2022.

Revenue is expected to show an annual growth rate (CAGR 2022-2027) of 22.93%, resulting in a projected market volume of US$452.20m by 2027.

In global comparison, most revenue will be generated in the United States (US$34,100.00m in 2022).

The average revenue per user (ARPU) in the Video Streaming (SVoD) segment is projected to amount to US$9.61 in 2022.

In the Video Streaming (SVoD) segment, the number of users is expected to amount to 25.4m users by 2027.

User penetration will be 7.3% in 2022 and is expected to hit 10.1% by 2027.

The usage share of Netflix amounts to an estimated 50% of the Videostreaming (SVoD) segment and the selected region in 2020.

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Trump's Tariffs on India: Can China or Russia Make Up For Lost Exports to US?

The United States is the biggest export market for India. Among its top 5 trading partners, the US is also the only country with which India runs a trade surplus. This surplus is now at risk with the 50% tariff recently imposed by President Donald Trump on imports from India. Can Prime Minister Narendra make up for it by cozying up to China and Russia? Recent trade data shows he…

ContinuePosted by Riaz Haq on September 8, 2025 at 7:00pm

US-India Ties: Does Trump Have a Grand Strategy?

Since the dawn of the 21st century, the US strategy has been to woo India and to build it up as a counterweight to rising China in the Indo-Pacific region. Most beltway analysts agree with this policy. However, the current Trump administration has taken significant actions, such as the imposition of 50% tariffs on India's exports to the US, that appear to defy this conventional wisdom widely shared in the West. Does President Trump have a grand strategy guiding these actions? George…

ContinuePosted by Riaz Haq on August 31, 2025 at 6:30pm — 18 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network