PakAlumni Worldwide: The Global Social Network

The Global Social Network

World's Tallest Commercial & Office Tower Planned For Karachi, Pakistan

Bahria Town and Abu Dhabi Group agreed to invest $45 billion in real estate in Pakistan. After signing the investment deal, Malik Riaz and Shaikh al-Nahyan announced that Karachi, not Dubai nor Shanghai, will soon boast having the world's tallest building.

Representing the largest foreign investment to date in Pakistan, there will be $35 billion invested in several large commercial and residential real estate projects in Karachi, and another $10 billion in Lahore and Islamabad. It's expected to create 2.5 million new jobs in the country.

His Highness Sheikh Nahyan bin Mubarak al Nahyan, Chairman of Abu Dhabi Group, was quoted by Express Tribune as saying, “I am

genuinely happy that in this historic project of Pakistan we are working

with the visionary Malik Riaz Hussain, this guarantees that not only

the project will be delivered beyond our expectations but also before

time. We will Inshallah be welcoming first residents in next 3-4 years.”

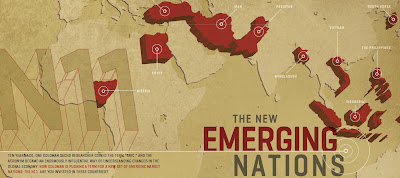

Why is Abu Dhabi Group interested in investing in Pakistan? Why not put all or most of these $45 billion in GCC or other Middle East nations? Answering a reporter's question

about the growth prospects of GCC (oil-rich nations of Gulf Cooperation

Council) at a recent investment conference in Dubai, Golman Sachs' Jim O'Neill said: "Some GCC

countries are well placed to be hubs for the BRIC and N-11-influenced

world. I often think of Dubai as a kind of N-11 center, even the capital

of the N-11 world, given its business adjacency to Egypt, Pakistan,

Iran, Turkey, and, of course, India and Russia."

Pakistan is already experiencing a renewed construction boom with cement sales rising by double digits. Domestic cement consumption surged 10.10% in Pakistan in January 2013, according to All Pakistan Cement Manufacturers Association. On top of 8% increase in Fiscal Year 2011-12, it jumped another 8% for the first seven months of Fiscal Year 2012-13.

There is a lot of privately funded real estate development activity

visible in all major cities of the country. Big real estate developers

like Bahria Town and Habib Construction are developing both commercial

and housing projects in Islamabad, Karachi and Lahore. Other cities like

Faisalabad, Hyderabad, Larkana, Multan, Mirpur, Peshawar and Quetta are

also seeing new housing communities, golf courses, hotels, office

complexes, restaurants, shopping malls, etc.

Cement consumption is an important barometer of national economic activity, according to a research report compiled by a Credit Suisse analyst. Last year, CS analyst Farhan Rizvi said in his report that "higher PSDP (Public

Sector Development Program) spending has led to a resurgence in domestic

cement demand in FY12 (+8%) and with increased PSDP allocation for FY13

(+19%) and General Elections due in 2013, domestic demand is

likely to remain robust over the next six-nine months".

This latest investment will add to it. It will give a big boost to the national economy.

The Abu Dhabi Group is a major investor in Al-Falah Bank and United Bank in Pakistan. It recently announced acquisition of all of SingTel’s shares in Warid

Telecom, a mobile telephone service operator in Pakistan. With the agreement, the group has become the sole owner with

equity holding of 100% in the Pakistani telecom company. Abu Dhabi Group said it plans to improve Warid Telecom’s

operations in Pakistan by introducing new technologies, services and

packages.

Back in 2008, there was a lot of excitement in Pakistan when Dubai developer Emaar announced a massive real estate project valued at $43b to develop two island resorts near Karachi. That investment never materialized. Let's hope this time will be different. Let's hope Abu Dhabi Group and Bahria Town will follow through on their commitments.

Here's a video of Malik Riaz speaking with Dunya News:

Related Links:

Haq's Musings

Renewed Construction Boom Pushes Cement Sales in Pakistan

DCK Green City in Karachi, Pakistan

Pakistan on Goldman Sachs' Growth Map

Investment Analysts Bullish on Pakistan

Precise Estimates of Pakistan's Informal Economy

Comparing Pakistan and Bangladesh in 2012

Pak Consumer Boom Fuels Underground Economy

Rural Consumption Boom in Pakistan

Pakistan's Tax Evasion Fosters Aid Dependence

Poll Finds Pakistanis Happier Than Neighbors

Pakistan's Rural Economy Booming

Pakistan Car Sales Up 61%

Resilient Pakistan Defies Doomsayers

-

Comment by Riaz Haq on February 16, 2013 at 5:10pm

-

Here's a PTI report on world's tallest building in Karachi:

Pakistani construction tycoon Malik Riaz has signed a multi-billion dollar deal with Abu Dhabi group to build the world's tallest building in the country overtaking Dubai's Burj Khalifa.

The project is likely to come up on an island some 3 to 4 kilometres off the coast of Karachi and into the Arabian sea.

Riaz is confident that the project will generate around 2.5 million jobs and promote investment opportunities for different industries.

Riaz signed the USD 45 billion deal yesterday with the Abu Dhabi group which also successfully runs the Al-Falah bank chain in Pakistan.

According to the agreement, USD 45 billion would be invested on different construction projects in Pakistan.

Out of the total amount, about USD 35 billion worth of investments will be made in Sindh while USD 10 billion will be invested in Islamabad and Lahore, media reports said.

"We have selected the site for our mega project which will be spread over 16,000 acres of land and also house 125,000 houses," Riaz said today.

"Besides the world's tallest building the project will include a media city, a sports city, an international complex, a medical and educational complex, restaurants, shopping centres, multiplex halls," Riaz said.

Though Riaz did not name the site where the project would be constructed but sources aware of the developments told PTI that the site for the project would most likely be an island some 3 to 4 kilometres off the coast of Karachi and into the Arabian sea.

"It is most likely going to be the 'Kutta Island' which gets its name because stray dogs which are killed are dumped on it," a source said.

The source said the island was also given to another big construction magnate Emmar properties of the UAE but the project was scrapped.

Riaz said the Emmar project was scrapped and they lost millions of dollars because of the global recession and because there was no direct and strong local presence in the project.

Riaz rose to prominence with his 'Bahria' town residential projects throughout Pakistan and also after the Supreme Court took up the hearing of the case in which the son of Chief Justice Iftikhar Chaudhry was accused of taking money and favours from him allegedly in return of settling cases.

Riaz said the tallest building in Karachi would beat the Burj Khalifa of Dubai.

"This construction project will bring in staggering investment into Pakistan and it will benefit industries and people. My dream is to create a new Pakistan and new Karachi," he said.

http://www.hindustantimes.com/world-news/Pakistan/Pakistan-tycoon-t...

-

Comment by Riaz Haq on February 18, 2013 at 4:26pm

-

Here's an ET report on soaring profits at Nestle Pakistan:

Profits at Nestle Pakistan shot up in 2012 as the company saw its margins increase for the first time in four years, as more and more consumers from Pakistan’s rising middle class are able to afford some of its higher-margin products.

On Monday, the company announced its financial results for the year ending December 31, 2012 – and it was a remarkably positive report: net revenues were up 22% for the year to Rs79 billion, and profits up an even higher 25.6% to Rs5.9 billion compared to the same period in the previous year.

The strong revenue growth for Nestle is particularly remarkable, considering the fact that it is the largest food and consumer goods company in the country, and yet still shows little sign of a slowdown in growth. Indeed, much of that growth appears to be volumetric, showing that consumers have a higher demand for Nestle’s products rather than revenue increases simply being a function of inflation.

But perhaps most encouraging for the company was its increase in gross profit margins, which rose from 25.8% in 2011 to 27.2% in 2012, suggesting that the company is selling more of its higher-margin products. At least some of that higher margin, however, was eroded by higher logistics and distribution costs.

Part of the reason for those higher costs is the installation of more refrigerators as more of its chilled products get sold (mostly yogurt). But another part of it may be that the company is expanding its distribution network into areas where transportation infrastructure is poor and cost of getting products to customers is higher, driving up its overall average.

Nonetheless, Nestle’s size in Pakistan – though miniscule by global standards – appears to insulate it from the kinds of risks that some of its smaller competitors face. Engro Foods, for instance, has somewhat higher distribution costs as a percentage of revenues than Nestle.

Nestle Pakistan’s Swiss parent is the world’s largest food company, with a wide array of products: from those that are commodity-like, to higher-margin products like health foods and chocolates. In Pakistan, however, Nestle has, until recently, been primarily a dairy company. Indeed, until the early 2000s, Nestle’s presence in the country was incorporated as Nestle Milkpak Ltd, named after its signature product. It remains the largest player in the dairy market, collecting milk from an estimated 190,000 farmers spread over 145,000 square kilometres in Punjab and Sindh.

Over the past few years, the company has expanded its product portfolio in Pakistan to include fruit juices, breakfast cereals, instant noodles and confectionaries. But it is still a small proportion of its global portfolio.

Nestle’s ability to rapidly grow its revenues and profits despite being the biggest player in Pakistan appears to be indicative of the tremendous room for growth in the Pakistani market. Consumer spending is expanding as the country’s middle class grows on the back of rapid urbanisation, and increasing household incomes as more and more young people enter the workforce.

Even the advent of a strong local rival in the form of Engro Foods does not appear to have dented Nestle’s growth prospects. In earlier conversations with The Express Tribune, officials at both Nestle and Engro Foods are keen to downplay any talk of a rivalry between the two companies, insisting that there is plenty of room for both to grow. Considering the blowout growth at both firms, there appears to be considerable merit to their argument.

The global giant is currently on track to invest upwards of CHF320 million ($347 million) in expanding its production capacity within Pakistan as part of a three-year plan.

http://tribune.com.pk/story/509211/corporate-results-profits-soar-a...

-

Comment by Riaz Haq on February 18, 2013 at 10:06pm

-

Here's Khaleej Times on incentives in Pak foreign investment policy:

Pakistan has offered major financial and tax-free business incentives and infrastructure facilities to foreign investors as a big Saudi steel mills goes on stream.

These incentives were offered at the highest level by Prime Minister Raja Pervez Ashraf. The prime minister’s came on the occasion of the inauguration of production at the just-built state-of-the-art Tuwairqi Steel Mills Limited (TSML), built by Al Tuwairqi Group of Industries of Saudi Arabia, and South Korea’s Pohang Iron and Steel Company (Posco). Al Tuwairqi Group has invested $350 million and Posco $16 million in the project. This first phase of TSML has been completed at a cost of $366 million. It will produce 1.28 millions tonnes of steel annually. It is the first steel mill in Pakistan built by the private sector.

The inauguration ceremony was highlighted by the prime minister’s unveiling of the pro-FDI incentives plan. Prime Minister Ashraf invited foreign and local investors to come up with industrial projects to be located at Pakistan’s Export Processing Zones (EPZs).

Pakistani EPZs have all modern infrastructure. “I urge foreign investors from across the globe to invest in Pakistan. I assure you full government support, facilities, a business-friendly environment and policies. At our EPZs we provide you with a huge number of incentives and exemptions,” he said.

The key features of Pakistan’s investment policy include, equal treatment to Pakistani and foreign investors, 100 per cent share holding in projects and businesses, an unlimited repatriation of the dividends, annual and accumulated profits. Highlighting these incentives, and still many more, the prime minister asked foreign investors, particularly those from Islamic countries, “to benefit from Pakistan’s EPZs.”

--------

“We at Al Tuwairqi, feel honoured in introducing the world’s most advanced DRI technology, based on the Midres process, owned by Kobe Steel of Japan, in Pakistan,” he said.TSML is also embarking upon several new projects, subsequent to commercial operation of DRI project. It plans to work on the upstream and downstream production processes, involving billet/thin slabs production, and iron ore exploration in Pakistan, its beneficiation and pelletisation.

“As our social corporate responsibility, we are also focused on the clean power generation in Pakistan,” Dr Hussain said. “We see Pakistan as a land of immense opportunities. We are very clear in our perception that Pakistan, as a country has to grow, and we are determined to play an instrumental role towards its development. In the survival of Pakistan is the survival of the entire Muslim Ummah,” he said.

Posco chairman and CEO Joon-Yang Chung, said: “The TSML will significantly contribute towards Pakistan’s economy.”

“Today, Pakistan’s economic development and structural adjustment calls for a higher quality steel products to be manufactured in this country. At TSML, we will develop high-performance products, featuring high strength, corrosion resistance, sustainability and light- weight, and improve the technological competence related to such products. To add to its success, Posco is determined in building a successful partnership with Al Tuwairqi to benefit from its presence in Pakistan and is fully focused to make TSML a world class steel making unit through possible expansion of initially set DRI plant using forward and backward integration,” added Chung.

With all stakeholders so determined, and so upbeat, output of high-grade products, and larger investment inflows look all set to benefit Pakistan.

http://www.khaleejtimes.com/kt-article-display-1.asp?xfile=data/int...§ion=internationbusiness

-

Comment by Riaz Haq on February 18, 2013 at 10:52pm

-

Here's ET on Karachi's booming stock market:

KARACHI: Even as most of the city remained shut on Monday owing to a strike call, the Karachi Stock Exchange’s (KSE) benchmark 100-share index gained 0.38% or 68.39 points to end at 17,865.61 points.

The rally was helped by positive news flows from multiple sources, prominent among which were expectations that the cement sector would record a surge in earnings due to stronger domestic sales, higher prices and lower input costs. Also featured was news that the Oil and Gas Development Company (OGDC) had signed direct agreements with fertiliser manufacturers for the supply of gas, and increased expectation that telecom companies will record higher revenues following Pakistan Telecommunication Company’s stellar profits on the back of higher international call termination rates.

Trade volumes remained flat at 292 million shares compared with Friday’s tally of 293 million shares. The value of shares traded during the day was Rs7.18 billion.

“Led by Engro and DG Khan Cement (DGKC), the Karachi bourse achieved a new high,” observed Samar Iqbal, equity dealer at Topline Securities. Both Engro and DGKC’s stocks closed at their upper price limits by the end of the day.

“The said agreement [between Engro and OGDC] will allow Engro to receive gas directly from gas fields, reviving financial prospects for its fertiliser business,” reported Sibtain Mustafa from Elixir Securities. “DGKC continued its positive momentum from last closing as news reports of a $45 billion deal between the Abu Dhabi Group and real estate tycoon Malik Riaz brought in fresh interest.”

Shares of 360 companies were traded on Monday. At the end of the day, 147 stocks closed higher, 161 declined while 52 remained unchanged. Pakistan Telecommunication Company was the volume leader with 29.23 million shares, gaining Rs0.82 to finish at Rs22.77. It was followed by Pace (Pakistan) with 26.60 million shares, gaining Rs0.39 to close at Rs4.32 and NIB Bank with 19.83 million shares, gaining Rs0.15 to close at Rs2.88.

“The majority of volumes were focused on third-tier stocks [...] as retail participation continues to rise. Furthermore, news of Ministry of Petroleum agreeing to increase POL margins by Rs0.25 per litre for motor spirit and Rs0.10 per litre for high-sulphur diesel brought interest in listed oil marketing companies near market end,” Mustafa added.

Foreign institutional investors were net buyers of Rs88.51 million worth of shares, according to data maintained by the National Clearing Company of Pakistan Limited.

http://tribune.com.pk/story/509210/market-watch-bourse-continues-cl...

-

Comment by Riaz Haq on February 19, 2013 at 9:57pm

-

Here's a Nation newspaper story on Korean companies exploring investment in Pakistan:

Representatives of about twenty (20) Korean investment companies are scheduled to visit Pakistan from Feb 27 to March 2 to explore investment.

During the visit, the representatives of these companies are scheduled to hold meetings with the concerned quarters of the projects, sources of BOI said. According to details, the companies include Samsung Constructions and Trading Corporation that will hold meetings for investment in LNG offshore receiving terminal project, CNG bus project through PPP mode and power projects.

The company has also been requested to invest Karachi-Hyderabad expressway and Karachi-Port Qasim elevated expressway, the sources added.

Lotte Group would explore projects in petrochemical sector while Wisdom will be seeking investment opportunities in agriculture sector by utilizing the strengths of both the countries as Pakistan has rich agriculture and dairy resources while Korea has advanced food processing technology.

Similarly, Six-Group Company would be looking projects in LNG and steel market and is also expected to take part in the tender floated by Sui Southern Gas Company.

Korean Railroad would seek investment potential in supplying unused locomotives to Pakistan in addition to providing simulators and training for locomotives’ drivers through KOICA grant.

ECO-One would look investment opportunities in auto rickshaw market, while Korea Water Resource Corporation (K-Water) is interested in hydro power sector and consortium with Daewoo E&C in hydropower project and Lower Palos Valley project.

Dooson Corporation can be a potential investor for Special Economic Zones in Pakistan while GS E&C is interested in desalination, hydro power sector and highway projects. CK Solar will look for opportunities in solar energy sector as the company has been doing a pilot project of about 65kw in PM house and has signed 300 MW solar plant agreement in Balochistan.

Dongin Medical Centre is planning to establish a hospital and resort in any major city of Pakistan while Deokjae Construction (Pvt) Ltd is interested in road and high ways projects as it has participated in Hyderabad Mirpurkhas Dual Carriage Road Project.

Sambo Engineering Company and Korea Engineering Consultants Corporation is also interested in road and hydro power projects.

http://www.nation.com.pk/pakistan-news-newspaper-daily-english-onli...

-

Comment by Riaz Haq on February 19, 2013 at 10:50pm

-

Here's Bloomberg on OGDC earnings report:

Oil & Gas Development Co., Pakistan’s biggest energy explorer, posted a 20 percent surge in second-quarter profit after production increased.

Net income climbed to 23.6 billion rupees ($240 million), or 5.48 rupees a share, in the three months ended Dec. 31 from 19.7 billion rupees, or 4.57 rupees, a year earlier, the Islamabad-based company said in a filing today. Sales rose 29 percent to 56.8 billion rupees.

“A backlog in development, which is now coming online, as well as fast-track development of recent finds is helping to improve the company’s production profile,” said Naveed Vakil, director research at AKD Securities Ltd. in Karachi. “The company is also benefiting from the decline in the Pakistani rupee that fell nine percent in the quarter” compared with a year earlier, he said.

Oil and Gas Development benefited from an eight percent increase in crude production to almost 39,000 barrels a day. Gas output also rose as much as 12 percent to 1,150 million cubic feet a day, Vakil said.

Shares for Oil and Gas Development fell 1.3 percent, the most in almost three weeks, to 205 rupees at 10:21 a.m. in Karachi. They’ve gained 7.5 percent this year, compared with a 5.3 percent increase in the benchmark KSE 100 Index. The company plans to pay an interim cash dividend of two rupees a share.

http://www.businessweek.com/news/2013-02-20/pakistan-oil-and-gas-de...

-

Comment by Riaz Haq on February 22, 2013 at 7:18pm

-

It appears that Malik Riaz has overstated the real estate deal with Sheikh Nahyan of Abu Dhabi. Here's a clarification published in BR:

It has been erroneously reported by certain media outlets in Pakistan and elsewhere that an investment of $45 Billion is being considered by the Abu Dhabi Group in a major real estate development project in Karachi. The level of Investment referenced has not been discussed or agreed.

"It is possible that the amount referenced may be based upon Bahria Town's own estimates and projections, as the Sponsor and Developer of the project. It is perhaps indicative of the overall market value of the entire development once it is completed in the fifteen to twenty year forecasted timeframe. However, this cannot be verified.

"In order to clarify matters, it should be stated for the record that a non-binding Memorandum of Understanding was entered into by Dhabi Contracting Establishment, a business unit based in Abu Dhabi, which is wholly owned by Sheikh Nahayan Mabarak Al Nahayan, and not by the Abu Dhabi Group. The Memorandum of Understanding was simply an indication of interest by Dhabi Contracting to cooperate with Bahria Town Pakistan (Pvt) Ltd to provide technical support and assistance to the project - as, when and if appropriate commercial terms and conditions were agreed.

"It must be stated clearly and unequivocally that neither Sheikh Nahayan, the Abu Dhabi Group, Dhabi Contracting nor any other related party have undertaken or assumed any financial obligation or commitment to invest in this project and that there is no agreement to do so. However, it should be noted that Sheikh Nahayan continues to value his long-standing relationship with Pakistan and remains committed to his existing investments and to future business opportunities that may arise. It is unfortunate that a discussion on possible technical matters between two construction companies has been misconstrued. "It is also unfortunate that discussions between the parties could not reach any conclusion and the Memorandum of Understanding has been cancelled. "This clarification should adequately correct the record for all interested parties," the clarification concludes.-PR

http://www.brecorder.com/market-data/stocks-a-bonds/0/1156592/

-

Comment by Riaz Haq on February 22, 2013 at 11:41pm

-

Here's a report on EIU ranking Karachi and Mumbai tied for the cheapest cities in the world:

New York? London? Moscow? All these cities have one thing in common: They're insanely expensive. But none of them ranks as the most expensive in the world.

No, that designation is reserved for a city all-too-familiar with the apex of the annual Worldwide Cost of Living Survey, published by the Economist Intelligence Unit. In fact, this year's No. 1 has held down the title of world's most expensive city nearly every year since 1992. Aside from current title holder, only Zurich, Paris and Oslo have worn the championship belt in the last two decades.

SCROLL DOWN TO SEE THE TOP 10.

Last year's No. 1, Zurich, ascended to the throne of most expensive city in the world thanks to currency fluctuations. But as the EIU explains, efforts to weaken the Swiss franc helped Zurich and Geneva experience the sharpest drops in the rankings, with Zurich tumbling from No. 1 to No. 7, and Geneva falling from No. 3 to No. 10.

CNN points out that strong local currencies powered Sydney and Melbourne toward the top of the list, each rising four places from their 2012 spots.

"Ten years ago there were no Australian cities in the top 50," the index's editor, Jon Copestake, told the Guardian. "But economic growth has supported inflation, and the strength of the Australian dollar against other currencies besides the U.S. dollar has driven up costs. Visitors will certainly feel the difference and people living there will have noticed prices have crept up."

In a region of sharp contrasts, Asia and Australia account for 11 of the 20 most expensive cities, but also six of the 10 cheapest. Karachi, Pakistan and Mumbai, India tie for the cheapest cities measured.

Other surprises: no U.S. city ranks in the top 20, and Caracas, Venezuela, ranks as the most expensive in the Americas -- but Venezuela can thank inflation and a fixed exchange rate of the bolívar to the U.S. dollar for Caracas' artificially high ranking.

What determines the most expensive city in the world? The EIU explains that its bi-annual list takes into account "400 individual prices across 160 products and services," including "food, drink, clothing, household supplies and personal care items, home rents, transport, utility bills, private schools, domestic help and recreational costs." All cities are compared to New York as a base, with the Big Apple's index set at 100.

http://www.huffingtonpost.com/2013/02/05/worlds-most-expensive-city...

-

Comment by Riaz Haq on March 11, 2013 at 8:30am

-

Here's a Nation newspaper report on US developer Thomas Kramer (Florida South Beach fame) signing an MOU with Malik Riaz (Bahria Town) to develop islands off Karachi:

Bahria Town and a US investment group signed an memorandum of understanding (MoU) for $15 to 20 billion investment on Monday.

Former Chairman of Bahria Town Malik Riaz and US investment group Thomas Kramer inked the MoU on behalf of their respective companies for the Bodha Island City project.

Under the project Bahria Town in collaboration with the foreign companies associated with prominent US investor Thomas Kramer would construct the world’s tallest building and a number of other projects some 3.5-kilometres off the Karachi shore.

Malik Riaz speaking on the occasion said that if he is given a chance he would make Pakistan into Dubai and Europe, He said that the project would help provide employment to the unemployed and this in turn would help eliminate terrorism. He said that we would continue to invest in Pakistan despite all odds and we are in talks with foreign investors.

Malik Riaz said that he promises the nation that in next few years he would bring foreign investment worth more than Rs 50 billion and no one can stop that. He said that until children are given quality education Pakistan cannot excel.

A spokesman for the Bahria Town said the project called Bodha Island City would be developed within a period of five to 10 years. He said the project would comprise, Net City, Education City, Health City, Port City and other infrastructure projects.

He said the worlds’ most modern shopping mall would also be built on the Island City, which would deal with international brands.

According to reports, the Island City would be linked with Karachi through a six-lane bridge.

http://www.nation.com.pk/pakistan-news-newspaper-daily-english-onli...

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Has Pakistan Destroyed India's S-400 Air Defense System at Adampur?

Pakistan claims its air force (PAF) has destroyed India's high-value Russian-made S-400 air defense system (ADS) located at the Indian Air Force (IAF) Adampur air base. India has rejected this claim and posted pictures of Prime Minister Narendra Modi posing in front of its S-400 rocket launchers in Adampur. Meanwhile, there are reports that an Indian S-400 operator, named Rambabu Kumar Singh, was killed at about the time Pakistan claims to have hit it. Pakistan is believed to have targeted…

ContinuePosted by Riaz Haq on May 21, 2025 at 4:00pm — 2 Comments

Pakistan Downs India's French Rafale Fighter Jets in History's Largest Aerial Battle

Pakistan Air Force (PAF) pilots flying Chinese-made J10C fighter jets shot down at least two Indian Air Force's French-made Rafale jets in history's largest ever aerial battle involving over 100 combat aircraft on both sides, according to multiple media reports. India had 72 warplanes on the attack and Pakistan responded with 42 of its own, according to Pakistani military. The Indian government has not yet acknowledged its losses but senior French and US intelligence officials have …

ContinuePosted by Riaz Haq on May 9, 2025 at 11:00am — 32 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network