PakAlumni Worldwide: The Global Social Network

The Global Social Network

World Bank: Pakistan Reduced Poverty and Grew Economy During COVID19 Pandemic

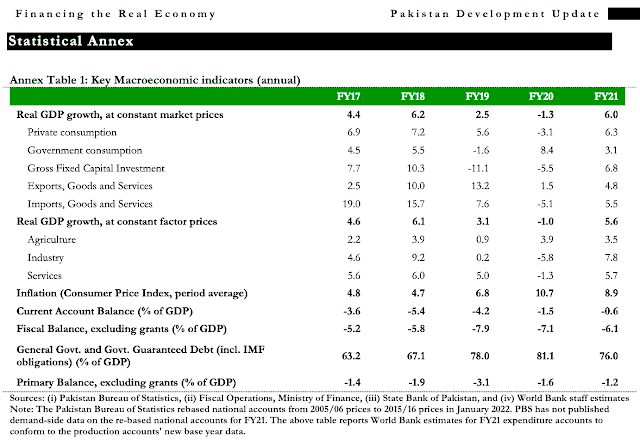

Pakistan poverty headcount, as measured at the lower-middle-income class line of US$3.20 PPP 2011 per day, declined from 37% in FY2020 to 34% in FY2021 in spite of the COVID19 pandemic, according to the World Bank's Pakistan Development Update 2022 released this month. The report said Pakistan's real GDP shrank by 1% in FY20, followed by 5.6% growth in FY21. The report highlights high inflation and low savings rate as key economic issues.

|

| Pakistan's Macroeconomic Indicators. Source: World Bank |

The report credited the PTI government led by former Prime Minister Imran Khan for timely policy measures, particularly the Ehsaas program, for mitigating the adverse socioeconomic impacts of the COVID-19 pandemic. Here's an excerpt of the report titled Pakistan Development Update 2022:

"The State Bank of Pakistan (SBP) lowered the policy rate and announced supportive measures for the financial sector to help businesses and the Government expanded the national cash transfer program (Ehsaas) on an emergency basis. These measures contributed to economic growth rebounding to 5.6 percent in FY21. However, long-standing structural weaknesses of the economy, particularly consumption-led growth, low private investment rates, and weak exports have constrained productivity growth and pose risks to a sustained recovery. Aggregate demand pressures have built up, in part due to previously accommodative fiscal and monetary policies, contributing to double-digit inflation and a sharp rise in the import bill with record-high trade deficits in H1 FY22 (Jul–Dec 2021). These have diminished the real purchasing power of households and weighed on the exchange rate and the country’s limited external buffers."

The report cites high rates of inflation hurting the people, particularly the poor who spend about half of their income on food. Here's an excerpt:

"Headline inflation rose to an average of 9.8 percent y-o-y in H1 FY22 from 8.6 percent in H1 FY21, driven by surging global commodity and energy prices and a weaker exchange rate. Similarly, core inflation has been increasing since September 2021. Accordingly, the State Bank of Pakistan (SBP) has been unwinding its expansionary monetary stance since September 2021, raising the policy rate by a cumulative 525 basis points (bps) and banks’ cash reserve requirement by 100 bps"

|

| Pakistan Savings Rate Comparison. Source: World Bank |

The World Bank report highlights the low level of personal savings and investments as a key impediment to economic growth. Here's an excerpt:

"The savings challenge has only been exacerbated by the low level of financial inclusion in the country, where even those who save are not saving with the financial system, and as such savings are not being fully leveraged to support capital formation. Only 21 percent of the population has access to an account and only 18 percent of the population uses digital payments. There are also large gaps in financial inclusion, with vulnerable segments having limited access at high prices. In terms of access to accounts, 7 percent of adult women have access compared to 35 percent of adult men, and 15 percent of young adults (ages 15–24) have access compared to 25 percent of older adults. It should be highlighted, however, that Pakistan has made notable gains on the financial inclusion agenda in recent years, supported by policy reforms and holistic strategies such as the National Financial Inclusion Strategy. However, despite the progress made, Pakistan underperforms on key metrics of financial inclusion in comparison to its peer comparators. Estimates suggest that less than 50 percent of domestic savings find their way to the financial sector, with the rest used in real estate, being intermediated through informal channels, or are soaked up directly by the government through National Savings. The incentive system is skewed such that savings flow outside of the financial sector. The large quantum of currency in circulation (CiC) in the economy is also indicative of this trend. The CiC/M2 ratio, which averaged 22 percent till June 2015 has increased to over 28 percent as of June 2021. The increase in CiC/M2 ratio translates into excess CiC of PKR1.4 trillion. These are resources that could have been intermediated for productive uses by the financial sector but are currently outside the sector."

-

Comment by Riaz Haq on May 19, 2022 at 8:41pm

-

Arif Habib Limited

@ArifHabibLtd

Current Account Balance Apr’22CAB: $-623mn (+132% YoY, -39% MoM)

Remittances: $3.1bn (+12% YoY, +11% MoM)

Total imports: $7.0bn (+25% YoY, -3% MoM)

Total exports: $3.8bn (+35% YoY, +1% MoM)https://twitter.com/ArifHabibLtd/status/1527489074482782210?s=20&am...

-

Comment by Riaz Haq on May 21, 2022 at 11:20am

-

Arif Habib Limited

@ArifHabibLtd

Monthly Technology exports witnessed at USD 249mn during Apr’22, up by 29% YoY while down by 4% MoM.

During 10MFY22, technology recorded exports worth $ 2.2bn marking a 29% YoY jump.

https://twitter.com/ArifHabibLtd/status/1527496887137353736?s=20&am...

-------------

According to the State Bank of Pakistan data, in April 2022, ICT export remittances grew to $249 million up by 29 percent, compared to $193 million reported in April 2021.

However, ICT export remittances declined by 4 percent on a month-on-month basis in April 2022 when compared to $260 million in March 2022.

Prime Minister Shehbaz Sharif has said that Pakistan offers huge opportunities for investments in the technology sector and the government intends to increase IT exports from $1.5 billion to $15 billion in the coming years.

For achieving this target, the premier said that foreign tech companies would be facilitated in all respects with regard to investment, expansion, and close collaboration.

The Ministry of Information Technology presented recommendations in the last cabinet to enhance software exports. The cabinet told the ministry to present recommendations before the Economic Coordination Committee and later again before the cabinet.

Speaking at the meeting, PM Sharif said Pakistan had a huge potential for investment and exports in the IT sector which needed to be exploited.

Federal Minister for IT and Telecommunication Syed Aminul Haq has directed the PSEB to take every possible step to achieve the target of IT export remittances. He said that under the prime minister’s vision of “Digital Pakistan”, it is vital to take forward all the matters related to information technology and connect the youth especially students to the digital world.

-

Comment by Riaz Haq on May 21, 2022 at 11:20am

-

Remittances to Reach $630 billion in 2022 with Record Flows into Ukraine

https://www.worldbank.org/en/news/press-release/2022/05/11/remittan...

https://www.knomad.org/publication/migration-and-development-brief-36

Remittances to South Asia grew 6.9 percent to $157 billion in 2021. Though large numbers of South Asian migrants returned to home countries as the pandemic broke out in early 2020, the availability of vaccines and opening of Gulf Cooperation Council economies enabled a gradual return to host countries in 2021, supporting larger remittance flows. Better economic performance in the United States was also a major contributor to the growth in 2021. Remittance flows to India and Pakistan grew by 8 percent and 20 percent, respectively. In 2022, growth in remittance inflows is expected to slow to 4.4 percent. Remittances are the dominant source of foreign exchange for the region, with receipts more than three times the level of FDI in 2021. South Asia has the lowest average remittance cost of any world region at 4.3 percent, though this is still higher than the SDG target of 3 percent.

-

Comment by Riaz Haq on May 21, 2022 at 5:12pm

-

GDP growth estimated at 5.97pc for FY 2021-22

By Ghulam Abbas

https://profit.pakistantoday.com.pk/2022/05/18/gdp-growth-estimated...

Pakistan has estimated the Gross Domestic Product (GDP) growth in the range of approximately 6 percent for the current fiscal year with the major contributions of industrial and services sectors.

Unlike the IMF projection of a 4 percent GDP growth rate for Pakistan, the Pakistan Muslim League Nawaz led government has estimated a 5.97 percent provisional GDP growth rate for the year 2021-22.

The 105th meeting of the National Accounts Committee to review the final, revised and provisional estimates of GDP for the years 2019-20, 2020-21 and 2021-22 respectively was held on Wednesday under the chair of Secretary, MoPD&SI.

The provisional GDP growth rate for the year 2021-22 is estimated at 5.97% as broad-based growth was witnessed in all sectors of the economy.

Article continues after this advertisement

The growth of agricultural, industrial and services sectors is 4.40%, 7.19% and 6.19% respectively. Similarly, the growth of important crops during this year is 7.24%.

The growth in production of important crops namely Cotton, Rice, Sugarcane and Maize are estimated at 17.9%, 10.7%, 9.4% and 19.0% respectively.

The cotton crop increased from 7.1 million bales reported last year to 8.3 million bales; Rice production increased from 8.4 million tons to 9.3 million tons; Sugarcane production increased from 81.0 million tons to 88.7 million tons; Maize production increased from 8.4 million tons to 10.6 million tons respectively, whole Wheat production decreased from 27.5 million tons to 26.4 million tons. Other crops showed growth of 5.44% mainly because of an increase in the production of pulses, vegetables, fodder, oilseeds and fruits. The livestock sector is showing a growth of 3.26%. The growth of forestry is 3.13% and fishing is at 0.35%.

The overall industrial sector shows an increase of 7.19%. The mining and quarrying sector has decreased by 4.47% due to a decline in the production of other minerals as well as a decline in exploration costs. The Large Scale Manufacturing industry is driven primarily by QIM data (from July 2021 to March 2022) which shows an increase of 10.4%. Major contributors to this growth are Food (11.67%), Tobacco (16.7%), Textile (3.19%), Wearing Apparel (33.95%), Wood Products (157.5%), Chemicals (7.79%), Iron & Steel Products (16.55%), Automobiles (54.10%), Furniture (301.83%) and other manufacturing (37.83%). The electricity, gas and water industry shows a growth of 7.86% mainly due to an increase in subsidies in 2021-22. The value-added in the construction industry, mainly driven by construction-related expenditures by industries, has registered a modest growth of 3.14% mainly due to an increase in general government spending.

The services sector shows a growth of 6.19%. The wholesale and Retail Trade industry grew by 10.04%. It is dependent on the output of agriculture, manufacturing and imports. The growth in trade value-added relating to agriculture, manufacturing and imports stands at 3.99%, 9.82% and 19.93% respectively. Transportation & Storage industry has increased by 5.42% due to an increase in gross value addition of railways (41.85%), air transport (26.56%), road transport (4.99%) and storage. Accommodation and food services activities have increased by 4.07%. Similarly, Information and communication increased by 11.9% due to improvements in telecommunication, computer programming, consultancy and related activities.

-

Comment by Riaz Haq on May 21, 2022 at 5:13pm

-

GDP growth estimated at 5.97pc for FY 2021-22

By Ghulam Abbas

https://profit.pakistantoday.com.pk/2022/05/18/gdp-growth-estimated...

The finance and insurance industry shows an overall increase of 4.93% mainly due to an increase in deposits and loans. Real estate activities grew by 3.7% while public administration and social security (general government) activities posted negative growth of 1.23% due to high deflators. Education has witnessed a growth of 8.65% due to public sector expenditure. Human health and social work activities also increased by 2.25% due to general government expenditures. The provisional growth in other private services is 3.76%.

Overall, the GDP of the country at current market prices has reached Rs.66.949 trillion in 2021-22 which has resulted in an increase in per capita income from Rs.268,223 in 2020-21 to Rs.314,353 in 2021-22 besides the volume of the economy in dollars in 2021-22 stands at $383 billion.

According to details, the meeting also updated the provisional GDP estimates for the year 2020-21 and revised GDP estimates for the year 2019-20 presented in the 104th meeting of the NAC held in January 2022 on the basis of the latest available data.

The final growth rate of GDP for the year 2019-20 has been estimated at -0.94% which was -1.0% in the revised estimates. The revised growth rate of GDP for the year 2020-21 is 5.74% which was provisionally estimated at 5.57%.

The crop sub-sector has improved from 5.92% to 5.96%. The other crops have improved from provisional growth of 8.08% to 8.27% in revised estimates. The growth of the industrial sector in the revised estimates is 7.81% which was 7.79% in the provisional estimates while the growth of the services sector has improved from 5.7% to 6.0%.

Controversy about Chief Economist’s resignation:

Earlier on Wednesday, it emerged that Chief Economist Planning commission Dr Ahmad Zubair resigned from the position owing to exerting pressure from the high ups of planning and finance ministries on GDP numbers.

Sources on the condition of anonymity said that the Minister for planning and the minister of State for finance Ayesha Ghous Pasha have asked the relevant people in the planning commission to sit with the principal economic advisor Finance ministry on growth numbers with contending that GDP growth would be around 4% in the current fiscal year.

When the official of the planning commission stated that they had made a presentation to the previous minister for planning that as per the statistics of production data of various sectors indicates that GDP growth would be around 5.5 to 6 percent upon this minister of state for finance said that there was a shortfall in the projected projection of wheat crop. The official replied that even with this shortfall of 0.1 million metric tons, the production of sugarcane, rice and cotton as well as tomatoes was considerably higher.

Officials further stated that it would not be possible to show less growth on the basis of data available to all the stakeholders therefore such an effort would affect the compromise of PBS data.

Later on, a letter issued by Ahmad Zubair stated that there is news trending on social and electronic media that I resigned from the position of Chief Economist, planning Commission on account of manipulation attempts concerning FY22 GDP growth estimates. I would like to state that PBS has the mandate to estimate National accounts and that the M/PD&SI has no role in matters related to estimating GDP growth.

-

Comment by Riaz Haq on May 21, 2022 at 5:55pm

-

Islamabad [Pakistan], May 15 (ANI): Pakistan’s oil and eatable import bill surged by 58.98 per cent to USD 24.77 billion in the months of July and April even the country battles a fast declining economy, owing to an increase in international prices and a massive depreciation of the rupee.

https://theprint.in/world/pakistan-oil-eatable-import-bill-spiked-t...

When compared to last year’s import bill of USD 44.73 billion, the country’s overall import bill spiked by 46.51 per cent to USD 65.53 in ten months ending October 2022, reported the Dawn newspaper. The share of these products also faced an increase of 37.79 per cent. The sharp ascent in these two sectors has resulted in trade deficits in Pakistan, adding pressure on the government’s external side.

Further, data released by the Pakistan Bureau of Statistics revealed that the import bill on oil has increased by over 95.84 per cent to USD 17.03 billion in 10MFY22. Further, the import of petroleum products increased by 121.15 per cent in value and 24.17 per cent in quantity, crude oil imports witnessed a hike of 75.34pc in value and 1.36pc in quantity while there was a sharp rise of 39.86 per cent in the value of liquefied petroleum gas imports.

Reportedly, in order to close the gap in food production, the food import bill had a surge of over 12.30 per cent to USD 7.74 billion in 10MFY22, reported the Dawn newspaper. The import bill in Pakistan is likely to spike further in the following months as the Pakistan government has decided to import about 4 million tonnes of wheat and 0.6 million tonnes of sugar to build strategic reserves, reported the Dawn newspaper.

Meanwhile, there was also a steady increase in edible oil imports in terms of both value and quantity. The value of the palm oil import bill was also hiked by 44.64 per cent to USD 3.09 billion in ten months ending October 2022, up from USD 2.14 billion in 10MFY21. This in turn resulted in a domestic price surge in vegetable ghee and cooking oil.

Notably, the import of soybean oil ascended by 101.96 per cent in value and 9.30 per cent in quantity this year while wheat imports had a decline of 19.12 per cent to 2.206 million tonnes from 3.61 million tonnes in the previous year, reported the Dawn newspaper. Pakistan witnessed a zero wheat import in the month of April.

Also, in comparison to 280,377 tonnes of sugar imports in Pakistan last year, this year there was a hike of about 49.52 per cent to 311,851 tonnes of sugar import. There was also a rapid surge in the import bill of tea, spices, and pulses as well.

Meanwhile, according to a report released by the Global Report on Food Crises, Pakistan’s Balochistan, Khyber Pakhtunkhwa and Sindh provinces are suffering from acute food shortages. A hike in food and fuel prices, drought conditions, livestock diseases, and unemployment issues have contributed to the rise in national food rates.

Further, ahead of the delay in the revival of the International Monetary Fund (IMF) programme and falling foreign currency reserves, the Pakistani rupee hit an all-time low against the US Dollar, crippling the country’s economy further. (ANI)

-

Comment by Riaz Haq on May 21, 2022 at 6:56pm

-

Our total consumption of wheat and atta is about 125kg per capita per year. Our per person per day calorie intake has risen from about 2,078 in 1949-50 to 2,400 in 2001-02 and 2,580 in 2020-21

By Riaz Riazuddin former deputy governor of the State Bank of Pakistan.

https://www.dawn.com/news/1659441/consumption-habits-inflation

As households move to upper-income brackets, the share of spending on food consumption falls. This is known as Engel’s law. Empirical proof of this relationship is visible in the falling share of food from about 48pc in 2001-02 for the average household. This is an obvious indication that the real incomes of households have risen steadily since then, and inflation has not eaten up the entire rise in nominal incomes. Inflation seldom outpaces the rise in nominal incomes.

Coming back to eating habits, our main food spending is on milk. Of the total spending on food, about 25pc was spent on milk (fresh, packed and dry) in 2018-19, up from nearly 17pc in 2001-01. This is a good sign as milk is the most nourishing of all food items. This behaviour (largest spending on milk) holds worldwide. The direct consumption of milk by our households was about seven kilograms per month, or 84kg per year. Total milk consumption per capita is much higher because we also eat ice cream, halwa, jalebi, gulab jamun and whatnot bought from the market. The milk used in them is consumed indirectly. Our total per person per year consumption of milk was 168kg in 2018-19. This has risen from about 150kg in 2000-01. It was 107kg in 1949-50 showing considerable improvement since then.

Since milk is the single largest contributor in expenditure, its contribution to inflation should be very high. Thanks to milk price behaviour, it is seldom in the news as opposed to sugar and wheat, whose price trend, besides hurting the poor is also exploited for gaining political mileage. According to PBS, milk prices have risen from Rs82.50 per litre in October 2018 to Rs104.32 in October 2021. This is a three-year rise of 26.4pc, or per annum rise of 8.1pc. Another blessing related to milk is that the year-to-year variation in its prices is much lower than that of other food items. The three-year rise in CPI is about 30pc, or an average of 9.7pc per year till last month. Clearly, milk prices have contributed to containing inflation to a single digit during this period.

Next to milk is wheat and atta which constitute about 11.2pc of the monthly food expenditure — less than half of milk. Wheat and atta are our staple food and their direct consumption by the average household is 7kg per capita (84kg per capita per year). As we also eat naan from the tandoors, bread from bakeries etc, our indirect consumption of wheat and atta is 41kg per capita. Our total consumption of wheat and atta is about 125kg per capita per year. Our per person per day calorie intake has risen from about 2,078 in 1949-50 to 2,400 in 2001-02 and 2,580 in 2020-21. The per capita per day protein intake in grams increased from 63 to 67 to about 75 during these years. Does this indicate better health? To answer this, let us look at how we devour ghee and sugar. Also remember that each person requires a minimum of 2,100 calories and 60g of protein per day.

Undoubtedly, ghee, cooking oil and sugar have a special place in our culture. We are familiar with Urdu idioms mentioning ghee and shakkar. Two relate to our eating habits. We greet good news by saying ‘Aap kay munh may ghee shakkar’, which literally means that may your mouth be filled with ghee and sugar. We envy the fortune of others by saying ‘Panchon oonglian ghee mei’ (all five fingers immersed in ghee, or having the best of both worlds). These sayings reflect not only our eating trends, but also the inflation burden of the rising prices of these three items — ghee, cooking oil and sugar. Recall any wedding dinner. Ghee is floating in our plates.

-

Comment by Riaz Haq on May 22, 2022 at 7:05am

-

#Pakistan Manufactured 9.72m #MobilePhones Locally in First 4 months of 2022. 53 % of mobile devices are #smartphones and 47 % are 2G. Pakistan imported mobile phones worth $1.810 billion in first 10 months of FY22 compared to $1.684 billion in FY21 https://www.phoneworld.com.pk/locally-manufactured-phones-2022/

In the month of April, the units manufactured/assembled 2.56 million mobile phones against 0.25 million imports. In 2021, Pakistan has manufactured/assembled 24.66 million mobile phones locally as compared to 13.05 million in 2020.

The country also witnesses a decline in the imports of mobile phones. In 2021, the country imported 10.26 million mobile phones compared to 24.51 million in 2020.

Among the 9.72 million mobile phones, 5.69 million are 2G and 4.03 million are smartphones. According to PTA data, 53 % of mobile devices are smartphones and 47 % are 2G on the Pakistan network.

Although the industry has seen significant growth in mobile phone production, still we are lagging behind in some terms. For instance, Pakistan imported mobile phones worth $1.810 billion during the first ten months (July-April) of 2021-22 compared to $1.684 billion during the same period of last year, registering a growth of 7.43 per cent.

According to the Pakistan Bureau of Statistics (PBS), the overall telecom import increased by 14.05 per cent from (July-April) 2021 to 22.

-

Comment by Riaz Haq on May 28, 2022 at 8:14am

-

Kaushik Basu

@kaushikcbasu

One picture that sums up India’s biggest problem: youth unemployment. Sadly this is getting little policy attention. It can do lasting damage to the economy. We must shift focus from politics to correcting this.https://twitter.com/kaushikcbasu/status/1530375519186915329?s=20&am...

--------

Youth (ages15-24) #unemployment in #India is 24.9%, the highest in #SouthAsia region. #Bangladesh 14.8%, #Pakistan 9.2%. Source: International Labor Organization & World Bank https://data.worldbank.org/indicator/SL.UEM.1524.ZS?locations=PK-IN-BD

https://twitter.com/haqsmusings/status/1530565654616477696?s=20&...

-

Comment by Riaz Haq on May 30, 2022 at 10:47am

-

Fiscal deficit recorded at 3.8pc in 3 quarters

https://profit.pakistantoday.com.pk/2022/05/30/fiscal-deficit-recor...

The country’s fiscal deficit was recorded at 3.8 per cent of the Gross Domestic Product (GDP) during the first three quarters of the current fiscal year compared to the 3 percent deficit recorded during the corresponding period of last year.

The deficit during July-March (2021-22) stood at Rs2,565.6 billion compared to the deficit of Rs1,652.0 billion during July-March (2020-21), says Monthly Economic Update and Outlook, May 2022 released by finance ministry.

The increase in deficit has been observed on account of the higher expenditures due to the rise in subsidies and grants. It is expected that the expenditure side would come under further pressure in the remaining months of the current fiscal year.

Similarly, the primary balance posted a deficit of Rs447.2 billion against the surplus of

Rs451.8 billion during the period under review.

Meanwhile, on the revenue side, tax collection has been currently showing a remarkable performance by posting a growth of 29 percent during the first ten months of the current fiscal year.

The first ten months’ data shows that the revenue collection has surpassed the target by Rs237 billion. This is despite tax relief measures which have impacted revenue collection by approximately Rs73 billion just in the month of April 2022. Total revenues grew by 17.7 percent in July-March (FY-2022) against the growth of 6.5 percent recorded in the same period of last year.

Higher growth in revenues has been achieved on the back of the significant rise in tax collection, the outlooks says adding, total tax collection (federal & provincial) increased by 28.1 percent whereas non-tax collection declined by 14.3 percent during the period under review.

FBR has taken various policy and administrative measures which paid off in terms of improved tax collection during the current fiscal year. It is expected that with the current growth momentum, FBR would be able to achieve its target during FY 2022. Total expenditure witnessed a sharp rise of 27.0 percent during Jul-Marc FY2022 against a 4.2 percent rise in the same period of last year.

Higher growth in total expenditure during the period has been observed on account of 21.2 percent growth in current spending and 54.6 percent increase in development expenditures.

The government is taking all possible measure to counter the downside risks associated with the economy, which currently has been facing challenges to sustain growth it had achieved during the fiscal year 2021-22, says Monthly Economic Update and Outlook,

May 2022 released here.

“Although the economy of Pakistan has achieved GDP growth of 5.97 percent in FY2022, but the fiscal situation and external sector performance are making it difficult to sustain and impacting the growth outlook in coming year,” noted the report.

It says, the International commodity prices were on rising trend and expected to increase further, adding the pass-through of the increase in global commodity prices was somewhat contained due to government measures. Even then it is expected that Consumer Price Index (CPI) inflation will remain in double digit in May 2022.

Comment

- ‹ Previous

- 1

- 2

- 3

- 4

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Trump Administration Seeks Pakistan's Help For Promoting “Durable Peace Between Israel and Iran”

US Secretary of State Marco Rubio called Pakistan Prime Minister Shehbaz Sharif to discuss promoting “a durable peace between Israel and Iran,” the State Department said in a statement, according to Reuters. Both leaders "agreed to continue working together to strengthen Pakistan-US relations, particularly to increase trade", said a statement released by the Pakistan government.…

ContinuePosted by Riaz Haq on June 27, 2025 at 8:30pm — 4 Comments

Clean Energy Revolution: Soaring Solar Energy Battery Storage in Pakistan

Pakistan imported an estimated 1.25 gigawatt-hours (GWh) of lithium-ion battery packs in 2024 and another 400 megawatt-hours (MWh) in the first two months of 2025, according to a research report by the Institute of Energy Economics and Financial Analysis (IEEFA). The report projects these imports to reach 8.75 gigawatt-hours (GWh) by 2030. Using …

ContinuePosted by Riaz Haq on June 14, 2025 at 10:30am — 3 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network