PakAlumni Worldwide: The Global Social Network

The Global Social Network

World Bank: Pakistan Reduced Poverty and Grew Economy During COVID19 Pandemic

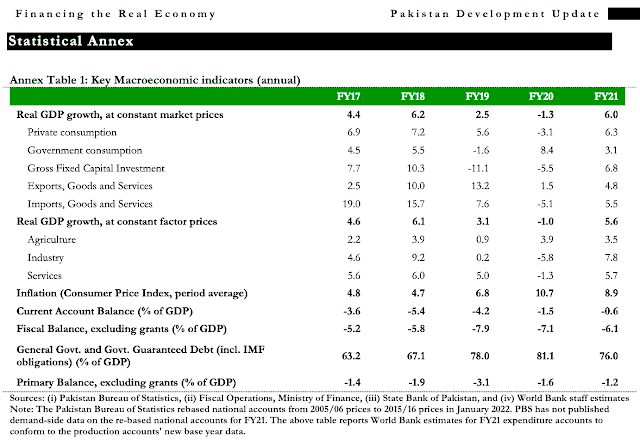

Pakistan poverty headcount, as measured at the lower-middle-income class line of US$3.20 PPP 2011 per day, declined from 37% in FY2020 to 34% in FY2021 in spite of the COVID19 pandemic, according to the World Bank's Pakistan Development Update 2022 released this month. The report said Pakistan's real GDP shrank by 1% in FY20, followed by 5.6% growth in FY21. The report highlights high inflation and low savings rate as key economic issues.

|

| Pakistan's Macroeconomic Indicators. Source: World Bank |

The report credited the PTI government led by former Prime Minister Imran Khan for timely policy measures, particularly the Ehsaas program, for mitigating the adverse socioeconomic impacts of the COVID-19 pandemic. Here's an excerpt of the report titled Pakistan Development Update 2022:

"The State Bank of Pakistan (SBP) lowered the policy rate and announced supportive measures for the financial sector to help businesses and the Government expanded the national cash transfer program (Ehsaas) on an emergency basis. These measures contributed to economic growth rebounding to 5.6 percent in FY21. However, long-standing structural weaknesses of the economy, particularly consumption-led growth, low private investment rates, and weak exports have constrained productivity growth and pose risks to a sustained recovery. Aggregate demand pressures have built up, in part due to previously accommodative fiscal and monetary policies, contributing to double-digit inflation and a sharp rise in the import bill with record-high trade deficits in H1 FY22 (Jul–Dec 2021). These have diminished the real purchasing power of households and weighed on the exchange rate and the country’s limited external buffers."

The report cites high rates of inflation hurting the people, particularly the poor who spend about half of their income on food. Here's an excerpt:

"Headline inflation rose to an average of 9.8 percent y-o-y in H1 FY22 from 8.6 percent in H1 FY21, driven by surging global commodity and energy prices and a weaker exchange rate. Similarly, core inflation has been increasing since September 2021. Accordingly, the State Bank of Pakistan (SBP) has been unwinding its expansionary monetary stance since September 2021, raising the policy rate by a cumulative 525 basis points (bps) and banks’ cash reserve requirement by 100 bps"

|

| Pakistan Savings Rate Comparison. Source: World Bank |

The World Bank report highlights the low level of personal savings and investments as a key impediment to economic growth. Here's an excerpt:

"The savings challenge has only been exacerbated by the low level of financial inclusion in the country, where even those who save are not saving with the financial system, and as such savings are not being fully leveraged to support capital formation. Only 21 percent of the population has access to an account and only 18 percent of the population uses digital payments. There are also large gaps in financial inclusion, with vulnerable segments having limited access at high prices. In terms of access to accounts, 7 percent of adult women have access compared to 35 percent of adult men, and 15 percent of young adults (ages 15–24) have access compared to 25 percent of older adults. It should be highlighted, however, that Pakistan has made notable gains on the financial inclusion agenda in recent years, supported by policy reforms and holistic strategies such as the National Financial Inclusion Strategy. However, despite the progress made, Pakistan underperforms on key metrics of financial inclusion in comparison to its peer comparators. Estimates suggest that less than 50 percent of domestic savings find their way to the financial sector, with the rest used in real estate, being intermediated through informal channels, or are soaked up directly by the government through National Savings. The incentive system is skewed such that savings flow outside of the financial sector. The large quantum of currency in circulation (CiC) in the economy is also indicative of this trend. The CiC/M2 ratio, which averaged 22 percent till June 2015 has increased to over 28 percent as of June 2021. The increase in CiC/M2 ratio translates into excess CiC of PKR1.4 trillion. These are resources that could have been intermediated for productive uses by the financial sector but are currently outside the sector."

-

Comment by Riaz Haq on April 23, 2022 at 8:46pm

-

Arif Habib Limited

@ArifHabibLtd

Monthly Technology exports reached at all-time during Mar’22, up by 24% YoY and 29% MoM to $ 259mn.

During 9MFY22, technology recorded exports worth $ 1.9bn marking a 29% YoY jump.

https://twitter.com/ArifHabibLtd/status/1517809966501236737?s=20&am...

----------

Arif Habib Limited

@ArifHabibLtd

Highest ever total exports in the month of Mar'22, up by 18% YoY | 9% MoM to USD 3.74bn.

https://twitter.com/ArifHabibLtd/status/1517797547171094528?s=20&am...

----------

ICT exports surge to near $2 billion in 9M FY22

https://en.dailypakistan.com.pk/23-Apr-2022/ict-exports-surge-to-ne...

-

Comment by Riaz Haq on April 24, 2022 at 11:02am

-

Pakistan and the International Monetary Fund (IMF) have agreed, in principle, to extend the stalled bailout programme by up to one year and increase the loan size to $8 billion, giving markets the much-needed stability and a breathing space to the new government, the media reported.

https://www.business-standard.com/article/international/breakthroug...

The understanding has been reached between Pakistan Finance Minister Miftah Ismail and IMF Deputy Managing Director Antoinette Sayeh in Washington, sources told The Express Tribune on Sunday.

Subject to the final modalities, the IMF has agreed that the programme will be extended by another nine months to one year as against the original end-period of September 2022, the sources added.

The size of the loan would be increased from the existing $6 billion to $8 billion -- a net addition of $2 billion, a senior government functionary requesting anonymity said.

The previous PTI-led government and the IMF had signed a 39-month Extended Fund Facility (July 2019 to September 2022) with a total value of $6 billion. However, the previous government failed to fulfil its commitments and the programme remained stalled for most of the time as $3 billion remained undisbursed.

Before taking Pakistan's case to the IMF Board for approval, Islamabad would have to agree on the budget strategy for the next fiscal year 2022-23, the sources said.

Also, the government of Prime Minister Shehbaz Sharif would have to demonstrate that it would undo some wrong steps taken by the former regime against the commitments that it gave to the IMF Board in January this year.

Pakistan is passing through a phase of political and economic uncertainty and the decision to stay in the IMF programme for longer than original period would bring clarity in economic policies and soothe the rattling markets, Express Tribune reported.

-

Comment by Riaz Haq on April 26, 2022 at 6:52pm

-

Modest progress on SDGs

Khaleeq Kiani

https://www.dawn.com/news/1686708

Pakistan’s first Sustainable Development Goals (SDGs) Status Report (2021) is out and the country’s overall progress on SDGs is modest.

“Overall, Pakistan’s SDGs (composite) index score has increased from 53.11 in 2015 to 63.49 in 2020 i.e. 19.5 per cent up from the baseline of 2015,” according to Dr Shabnam Sarfraz, member of Social Sector and Devolution of the Ministry of Planning, Development and Special Initiatives.

In summary, the status report finds a considerable decline in extreme poverty, improvement in access to energy, increased industrial activities, reduction in maternal mortality, improvement in undernourishment, food insecurity, wash and housing, and climate action.

There are many areas identified by the report that need urgent collective attention such as education, children out of school, the proportion of youth not in education, employment and training, provision of decent work environment, implementation of climatic adaptation etc.

Since 2015, the Government of Pakistan has not published a consolidated report that presents the country’s progress on SDGs indicators viz-a-viz their baseline values. The report captures the existing data availability gap and compares the baseline 2014-2015 with values of the most recent available data on 133 SDG indicators.

The report says that Pakistan’s progress on SDG-1 — poverty reduction has been steady. Poverty has been on the decline between the period 2014-15 and 2018-19 with 9.3 million people lifted out of poverty away from the national poverty line. Similarly, Pakistan witnessed a significant decline in the proportion of the population affected by disasters.

In a drive towards zero hunger as espoused by SDG-2, undernourishment declined by 4.2pc from 20.2pc to 16pc from 2015 to 2019. Also, a moderate achievement was made through the reduction of stunting by 7pc and wasting by 4pc during 2013-18 among children under five years of age.

Improvements are seen in health outcomes for mothers by reducing anaemia among pregnant women by 16.5pc in seven years during 2011-18. There was a one per cent decrease in the agricultural area under productive and sustainable agriculture, from 39pc to 38pc, over four years during 2015-2019.

On good health and well-being under SDG-3, Pakistan has shown reasonable progress by improving most of the basic health indicators. The number of mothers dying during pregnancy and live births reduced by 32.6pc during 2007-2019. Births attended by skilled health personnel increased by 10pc in five years during 2013-18. National vaccination coverage improved by 11.5pc in five years between 2013 and 2018.

Concerning education achievements (SDG-4), the country’s progress has been dismal. The primary completion rate has stagnated at 67pc in five years during 2015-20. Similarly, the gender gap (SDG-5) of 9pc between the primary completion rate of males and females has also persisted in this period. The lower secondary completion rate has marginally increased from 50pc to 59pc during 2015-20. The national literacy rate stagnated at 60pc in five years during 2015-20, which is alarming and worrying.

More girls were enrolled in schools improving the gender parity in net enrolment at primary, middle and Matric levels during 2015-19. Large deficiencies and disparities persist in the provision of basic services to schools across the country.

Access to clean water and sanitation has also shown improvements at the national and provincial levels over time under SDG-6. Improved source of drinking water is available to 94pc of the country’s population. Access to drinking water in Balochistan has increased by 17pc in 5 years during 2015-20. The population having access to unshared toilets and handwashing facilities is 68pc and 54pc respectively, as per Pakistan Social and Living Standards Measurement Survey (PSLM) 2019-20.

-

Comment by Riaz Haq on April 26, 2022 at 6:53pm

-

Modest progress on SDGs

Khaleeq Kiani

https://www.dawn.com/news/1686708

Pakistan’s first Sustainable Development Goals (SDGs) Status Report (2021) is out and the country’s overall progress on SDGs is modest.

On SDG-7, Pakistan’s commitment to the environment is shown by an increase in the share of renewable energy by more than four times between 2015 to 2019. The reliance on clean fuel (cooking) increased to 47pc in the period during 2018-19, from 41.3pc in 2014-15 at the national level. An increase of 3pc was recorded in 2019- 20 with 96pc of the population having access to electricity as compared to 93pc in 2014-15.

On SDG-8 ensuring decent work and economic growth, the economy experienced a slowdown with an annual growth rate of real GDP per capita declining to -3.36pc in the fiscal year 2019-20 from 2.04pc in 2014-15. Similarly, almost one-third of the total youth (30pc) in the age group (15-24 years) was not obtaining education, employment or training at the national level over the four year period of 2015-19 (SDGs indicator 8.6.1). Within the country, the highest instance of this category of youth was in Khyber Pakhtunkhwa, 38pc. The children aged 10-14 years engaged in work slightly reduced by over 2pc to 6.47pc from 8.64pc during 2015-19, at the national level.

Some progress was made on the SDG-9: industry, innovation and infrastructure targets. With the availability of new data from PSLM the baseline value is established with 88pc of the rural population living within two kilometres of an all-season road. The proportion of small-scale industries in total industry value added increased to 10.50pc in 2019-20 from 8.40pc in 2014-15, despite the overall negative effects of Covid-19 in 2019-20. The proportion of the mobile phone-owning population increased by 1pc in two years, from 45pc to 46pc between 2018-20.

A slight dent was made by the reduction of income inequality by 2pc in 2016-2019 for SDG-10. A small decline of 7pc in the proportion of the urban population living in slums, informal settlements or inadequate housing also occurred during 2014-2018 from 45pc to 38pc for SDG-11. Pakistan remains committed to addressing the problem of hazardous waste and to compliance with the Basel Convention as required under SDG-12 concerning sustainable consumption and production. Regarding SDG-13 on climate action, greenhouse gas emissions were 375.03 million tonnes in 2016, a 2.5pc increase from 2015.

Relating to the SDG-14: Life below Water, Pakistan has maintained the proportion of fish stocks at 30pc within biologically sustainable levels for the five years between 2015-20. Despite the growing population and rapid urbanisation pressures, Pakistan’s forest area as a proportion of total land remained unchanged at around 5pc in five years between 2015-2020 which is one of the targets of SDG-15: Life on Land.

On SDG-16: Peace, Justice and Strong Institutions; in terms of counting the uncounted, birth registration of children under 5 years showed an improvement by 8.2pc in five years between 2013-18. Under SDG-17 developing partnerships for achieving SDGs showed significant improvement in its journey towards digital transformation as the fixed internet broadband subscriptions per 100 inhabitants increased by 20pc in three years during 2017-20.

-

Comment by Riaz Haq on April 27, 2022 at 6:33pm

-

#India NITI Aayog’s first “SDG India - Index & Dashboard 2019-20” report showed that of 28 states/UTs it mapped, #poverty went up in 22, #hunger in 24 and #income #inequality in 25 of those states/UTs. #unemployment #economy #COVID19 #BJP #Modi #Hindutva https://www.fortuneindia.com/opinion/how-many-are-poor-in-india/107883

First, the IMF’s estimation.

The IMF used (i) the HCES of 2011-12 (the fiscal year 2011 for the IMF) as the base and estimated consumption distribution for all the years until 2020-21 (IMF’s 2020) “via the use of estimates based on average per capita nominal PFCE growth” and (ii) also took into consideration “the average rupee food subsidy transfer to each individual” for the years of 2004-05 to 2020-21.

The second factor – taking the money value of subsidised and free ration for 2020-21 – was considered because it said without this any exercise of poverty estimation “solely on the basis of reported consumption expenditures will lead to an overestimation of poverty levels”.

Several questions arise out of this methodology. The first is its extensive use of HCES of 2011-12 while being dismissive of the HCES of 2017-18 (which showed poverty growing). The second is, PFCE maps the consumption expenditure of all Indians, rich or poor, except government consumption (GFCE), and doesn’t tell which segment (income level) of society spends how much – making it impossible to know the status of households, which can be considered for poverty estimation.

The third is about the IMF’s assumption that the subsidised and free ration (which started during the pandemic under the PMGKY) reached two-thirds of the population and that the free ration will continue forever (eliminating extreme poverty). The IMF report cheers the Aadhaar-linked ration cards. None of these assumptions can be taken at face value.

The CAG report tabled in Parliament earlier this month highlighted several flaws in the Aadhaar’s functioning, including 73% of faulty biometrics that people paid to correct, duplications and verification failures. Besides, one year after the mass exodus began in 2020, migrant workers had not received subsidised ration, forcing the Supreme Court to lambast the central government (for its failure to operationalise the App being developed for the purpose and work-in-progress “one-nation-one-ration card” system) and direct state governments to ensure ration to migrants.

And what happens when the free ration is discontinued after September 2022? The decline in extreme poverty would return, wouldn’t it? So, does the IMF believe this amounts to poverty elimination?

On the other hand, the WB report seeks to marry the NSSO’s 2011-12 HCES to private sector data, the CMIE’s Consumer Pyramid Household Survey (CPHS), to inform its poverty estimation.

This is when the WB report admits that (i) the CMIE’s CPHS data is not comparable with the NSSO’s and that (ii) it “reweighed CPHS to construct NSSO-compatible measures of poverty and inequality for the years 2015 to 2019”. It said the CPHS data needed to be transformed into “a nationally representative dataset”.

As for the CPHS data, an elaborate debate about its ability to capture poverty took place last year. Several economists, including Jean Dreze, pointed out “a troubling pattern of poverty underestimation in CPHS, vis-à-vis other national surveys”. Several others accused the CPHS of a pronounced bias in favour of the “well-off”, which the CMIE admitted and promised to look into.

Another question arises from the use of the CPHS.

If a private firm like the CMIE can carry out household surveys every month or every quarter (for example, its employment-unemployment data is monthly) why can’t the government with decades of institutional knowledge and experience and huge human and financial resources?

-

Comment by Riaz Haq on April 28, 2022 at 4:09pm

-

India slips 3 spots on 17 SDG adopted as 2030 agenda, says report

India's overall Sustainable Development Goals (SDG) score was 66 out of 100

https://www.business-standard.com/article/current-affairs/india-sli...

India has slipped three spots from last year's 117 to rank 120 on the 17 Sustainable Development Goals adopted as a part of the 2030 agenda by 192 United Nations member states in 2015, a new report said.

With the latest rankings, India is now behind all south Asian nations except Pakistan, which stands at 129. The south Asian countries ahead of India are Bhutan ranked 75, Sri Lanka 87, Nepal 96 and Bangladesh 109.

India's overall Sustainable Development Goals (SDG) score was 66 out of 100.

According to the Centre for Science and Environment's State of India's Environment Report, 2022, released by Union Environment Minister Bhupender Yadav on Tuesday, India's rank dropped primarily because of major challenges in 11 SDGs including zero hunger, good health and wellbeing, gender equality and sustainable cities and communities

India also performed poorly in dealing with quality education and life on land aspects, the report stated.

The previous year, India had suffered on the fronts of ending hunger and achieving food security, achieving gender equality and building resilient infrastructure, promoting inclusive and sustainable industrialisation and fostering innovation.

On the state-wise preparedness, the report said Jharkhand and Bihar are the least prepared to meet the SDGs by the target year 2030.

Kerala ranked first, followed by Tamil Nadu and Himachal Pradesh in the second position. The third position was shared by Goa, Karnataka, Andhra Pradesh and Uttarakhand.

Among the Union Territories, Chandigarh was ranked first, followed by Delhi, Lakshadweep and Puducherry in the second place and the Andaman and Nicobar Islands on the third, the report said.

The 2030 Agenda for Sustainable Development, was adopted by all United Nations Member States in 2015, which provides a shared blueprint for peace and prosperity for people and the planet.

There are 17 Sustainable Development Goals which are an urgent call for action by all countries in a global partnership.

Some of these goals are no poverty, zero hunger, good health and wellbeing, quality education, gender equality, clean water and sanitation, affordable and clean energy, decent work and economic growth, industry, innovation and infrastructure.

It also includes, reduced inequalities, sustainable cities and communities, responsible consumption and production, climate action, life below water, life on land, peace, justice and strong institutions and lastly strengthening global partnerships for the goals.

-

Comment by Riaz Haq on April 28, 2022 at 4:27pm

-

SDG Rankings Report 2021:

https://dashboards.sdgindex.org/rankings

Central African Republic 38.27 165

Nigeria 48.93 160

Haiti 51.35 150

Uganda 53.15 140

Rwanda 57.58 130

Pakistan score 57.72 rank 129

India 60.07 120

Bangladesh 63.45 109

Nepal 66.52 96

Sri Lanka 68.10 87

Bhutan 69.98 75

China 62.07 57

Russia 73.75 46

US 76.01 32

UK 79.97 17

Finland 85.90 1

-

Comment by Riaz Haq on May 2, 2022 at 8:52pm

-

Kuwait seeks to invest $750m in Pakistan projects

Kuwait Investment Authority’s Enertech Holding Co. and Pakistan Kuwait Investment Company have applied for a digital bank license and proposed a hydrogen plant and two smart cities

https://gulfbusiness.com/kuwait-seeks-to-invest-750m-in-pakistan-pr...Kuwait-backed units are planning several projects in Pakistan valued at $750m, marking one of the largest proposed investments in the South Asian country in recent years.

Kuwait Investment Authority’s Enertech Holding Co. and Pakistan Kuwait Investment Company have applied for a digital bank license and proposed a hydrogen plant and two smart cities, said Mohammad Al Fares, chairman at Pakistan Kuwait Investment Co. The two are already working on a $200m water pipeline.

The proposed investments are a boon for Pakistan, which has seen muted foreign investment for more than a decade because of energy outages, terrorism and political instability.

Recent turmoil has led to a regime change while the nation’s foreign exchange reserves have dropped to less than two months of imports.

Newly elected Prime Minister Shehbaz Sharif visited Saudi Arabia, which has provided loan support in the past.

Pakistan is also negotiating with the International Monetary Fund to release $3bn this year. Although loans have been the main stop-gap for financial support, the nation has long sought to increase foreign investment to reduce its reliance on borrowing.

Enertech and Pakistan Kuwait Investment Company have formed an alliance to explore opportunities in Pakistan, said Al Fares.

The latter was established in 1979 by the governments of Pakistan and Kuwait, and holds multiple investments including a 30 per cent stake in Meezan Bank Ltd., Pakistan’s fastest growing bank by deposits.

-

Comment by Riaz Haq on May 2, 2022 at 8:57pm

-

During his latest visit to Saudi Arabia, Pakistani Prime Minister Shehbaz Sharif managed to secure around $8 billion, Indian local media reported.

https://www.albawaba.com/business/how-gcc-lending-pakistan-lifeline...

The Saudi package includes doubling of the oil financing facility, additional money either through deposits or Sukuks and rolling over of the existing $4.2 billion facilities, The News newspaper reported. The report also mentioned that "technical details are being worked out and it will take a couple of weeks to get all documents ready," citing top official sources privy to the development.

It's worth noting that the Kingdom provided $3 billion deposits to the State Bank of Pakistan in December 2021, and also provided the nation with $100 million to procure oil after the Saudi oil facility was operationalized in March 2022.

Under the PTI-led regime headed by ex-Prime Minister Imran Khan, The oil-rich Gulf nation provided a package of $4.2 billion, including $3 billion deposits and a $1.2 billion oil facility for one year and linked it with the IMF programme.

Pakistan and UAE

After his visit to Saudi Arabia, PM Shehbaz Sharif visited the UAE on Saturday. With his interview with Khaleej Times he emphasized on the fact that Pakistan and UAE will increase its cooperation on regional and international issues to bring stability and prosperity in the region.The Prime Minister met His Highness Sheikh Mohamed bin Zayed Al Nahyan, where they both discussed the ways to strengthen the relations between the two countries.

In April 2021, the UAE has extended the term of $2 billion interest-free loan to Pakistan made in January 2019, in an attempt to help the country's economy.

-

Comment by Riaz Haq on May 6, 2022 at 12:41pm

-

Pakistan’s economy is on the brink

Failure to carry out meaningful reform will exacerbate existing political turmoil

YOUSUF NAZAR

https://www.ft.com/content/23f50890-c184-4ee8-bb53-794db2673171

Pakistan’s foreign exchange reserves have fallen sharply in the past two months. The new government hopes to stop the bleeding with an enhanced IMF package and more short-term loans from China and Saudi Arabia. Supplies of electricity to households and industry have been cut as the cash-strapped country can no longer afford to buy coal or natural gas from overseas to fuel its power plants.

Newly elected prime minister Shehbaz Sharif was in Saudi Arabia last week to seek more financial assistance from the oil-rich kingdom, in addition to the existing bilateral credit of $4.2bn. Pakistan owes China $4.3bn in short-term loans in addition to the expensive loans to finance the power plants built under the China-Pakistan Economic Corridor programme.

Pakistan’s finance minister Miftah Ismail met the IMF in Washington last month and requested an increase in the size and duration of its current $6bn fund programme, initiated in 2019.

International commercial debt markets are practically shut for Pakistan. Its five-year sovereign bonds are trading near 13 per cent, which is among the highest in the emerging markets.

Pakistan’s official liquid foreign exchange reserves (excluding gold reserves of about $4bn) have dropped to just $6.6bn, or by $6bn, since the end of February. The level of reserves provides cover for just one month of imports.

According to Ismail, the fiscal deficit could hit Rs5.6tn ($30bn), or about 8.8 per cent of gross domestic product, versus a target of about Rs4tn, by the end of June. Pakistan’s volatile political situation makes it difficult for the new government to take any tough steps.

The federal budget deficit in the first nine months of the current fiscal year jumped to a staggering Rs3.2tn, 53 per cent higher than compared with the same period of the previous year. A significant reason for this was Khan’s populist measures, including his decision to not pass the impact of rising oil prices to the consumer. It is costing about $1.1bn a quarter to subsidise petroleum products. However, this is not the only reason for the parlous state of the public finances.

Pakistan’s rent-seeking political economy, dominated by the military establishment and special interests, provides Rs1.3tn in tax subsidies to the big businesses and the industries, according to Pakistan’s Federal Bureau of Revenue, its tax collection authority.

However, Pakistan collects very little in taxes from the urban property market, which has been booming for some time, for example. Large houses or plots of land can cost anywhere between $500,000 and $2mn, but the owners pay little tax. According to Shahrukh Wani, an economist at Oxford university, all of Punjab, home to a population of more than 100mn, collects less in urban property taxes than the city of Chennai in India, with a population of about 10mn people.

-------

It is time for Pakistan’s rich to start paying their proper share of taxes. The IMF should not allow itself to be seen as bailing out the wealthy, which it seems to be doing by ignoring Pakistan’s repeated slippages in meeting the programme targets.

The rich should also pay higher taxes on property and pay more for electricity and luxury cars than the low income or middle-class citizens who are already reeling from double-digit inflation (currently 13.4 per cent), which is the third-highest among major global economies. Steve Hanke, a professor of applied economics at Johns Hopkins University, has calculated Pakistan’s realised inflation rate to be a whopping 30 per cent per year, more than double the official rate.

Further delay in carrying out meaningful economic reforms could lead to more economic hardship and social unrest.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Indian Military Begins to Accept Its Losses in "Operation Sindoor" Against Pakistan

The Indian military leadership is finally beginning to slowly accept its losses in its unprovoked attack on Pakistan that it called "Operation Sindoor". It began with the May 31 Bloomberg interview of the Indian Chief of Defense Staff General Anil Chauhan in Singapore where he admitted losing Indian fighter aircraft to Pakistan in an aerial battle on May 7, 2025. General Chauhan further revealed that the Indian Air Force was grounded for two days after this loss. …

ContinueTrump Administration Seeks Pakistan's Help For Promoting “Durable Peace Between Israel and Iran”

US Secretary of State Marco Rubio called Pakistan Prime Minister Shehbaz Sharif to discuss promoting “a durable peace between Israel and Iran,” the State Department said in a statement, according to Reuters. Both leaders "agreed to continue working together to strengthen Pakistan-US relations, particularly to increase trade", said a statement released by the Pakistan government.…

ContinuePosted by Riaz Haq on June 27, 2025 at 8:30pm — 5 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network