PakAlumni Worldwide: The Global Social Network

The Global Social Network

Will Pakistan Take Advantage of Historic Low LNG Prices?

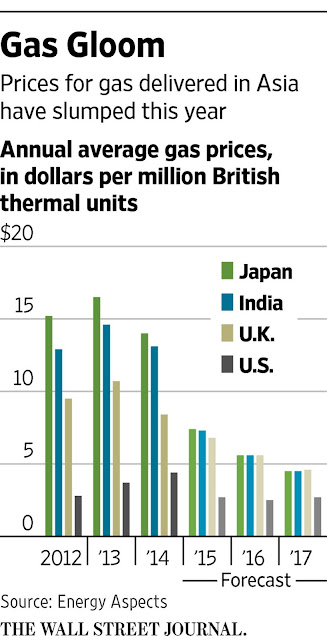

With softening demand from China and 130 million tons per year (mmpta) of additional LNG supply set to reach market over the next five years, gas research firm Wood Mackenzie sees continuing downward pressure on global LNG spot prices.

|

| LNG Price History Source: WSJ |

“The entire industry is worried because it is hard to tell when China’s demand will pick up again,” said an LNG strategist at a Malaysian energy company who attended the Wood Mackenzie conference in Singapore, according to Wall Street Journal. “Rising demand from smaller countries such as Pakistan, Egypt and Bangladesh is not enough to offset the declining demand from north Asia.”

As recently as two years ago, LNG shipped to big North Asian countries like Japan and Korea sold at around $15 to $16 a million British thermal units. This month, the price has already hit $6.65 a million BTUs, down 12% from September, according to research firm Energy Aspects. It expects prices to fall further in Asia next year, to under $6 per million BTUs, as a wave of new gas supply in countries from the U.S. to Angola to Australia comes on line, according to Wall Street Journal.

Petronet LNG Ltd, India’s biggest importer of liquefied natural gas (LNG), is saving so much money buying the commodity from the spot market that it’s willing to risk penalties for breaking long-term contracts with Qatar.

This is a great opportunity for Pakistan to take advantage of historically low LNG prices to alleviate its severe load-shedding of gas and electricity. Recently, Pakistan has launched its first LNG import terminal in Karachi and started receiving shipments from Qatar. Pakistan has also signed a $2 billion deal with Russians to build a north-south pipeline from Gwadar to Lahore. But the country needs to rapidly build up capacity to handle imports and distribution of significant volumes of LNG needed to resolve its acute long-running energy crisis.

Here's a related video discussion:

http://dai.ly/x3ccasi

Pakistan Local Elections; Indian Hindu... by ViewpointFromOverseas

https://vimeo.com/144586144

Pakistan Local Elections; Indian Hindu Extremism; LNG Pricing; Imra... from WBT TV on Vimeo.

https://youtu.be/LZavD-tkReg

Related Links:

Haq's Musings

Pakistan's Twin Energy Crises of Gas and Electricity

Affordable Fuel For Pakistan's Power Generation

Pakistan Shale Oil and Gas Deposits

China-Pakistan Economic Corridor

Blackouts and Bailouts in Energy Rich Pakistan

Pakistanis Suffer Load Shedding While IPPs Profits Surge

-

Comment by Riaz Haq on October 24, 2017 at 9:16pm

-

THE EXPRESS TRIBUNE > BUSINESS

LNG supply: Pakistan seeks further fee cut for North-South pipelinehttps://tribune.com.pk/story/1539653/2-lng-supply-pakistan-seeks-fe...

Pakistan has asked Russia to make a further reduction in the tolling fee for pumping liquefied natural gas (LNG) through a planned $2 billion North-South pipeline that will bring energy for consumers in Punjab.

“Pakistan is seeking to further push down the fee to $0.78 per million British thermal units (mmbtu) in talks with Russia,” a senior government official said while talking to The Express Tribune.

Earlier, Moscow had demanded $1.2 per mmbtu for gas transmission. However, a negotiating committee, set up with approval of the Economic Coordination Committee (ECC), later agreed on 85 cents per unit.

At present, the two sides are finalising terms and conditions of a commercial agreement to pave the way for execution of the project.

“Pakistan and Russia have discussed parallel ways of implementing the project amid fears of sanctions on the Russian companies nominated to execute the project,” the official said. “After the two sides sign the commercial agreement, groundbreaking of the project will take place.”

-

Comment by Riaz Haq on October 24, 2017 at 9:20pm

-

Gunvor, Gas Natural Fenosa Submit Lowest Bids In #Pakistan #LNG Tender | Rigzone

http://www.rigzone.com/news/wire/gunvor_gas_natural_fenosa_submit_l...

Commodities trader Gunvor and Spain's Gas Natural Fenosa put in the lowest bids in a tender to supply Pakistan with four liquefied natural gas (LNG) cargoes in January, a document posted on Pakistan LNG Ltd's website show.

The state-run importer launched the tender last month, setting out four delivery windows across January for the country's second floating import terminal in Port Qasim, which has faced lengthy operational delays.

The terminal, called the BW Integrity, is currently moored offshore, waiting until a sub-sea and on-shore section of pipeline is built to feed the regasified LNG into the country's gas grid.

The project was initially due to start around May but was since delayed to mid-November. As a result of start-up uncertainty, Pakistan LNG Ltd delayed awarding a tender for four cargoes due to be delivered in December by Trafigura , B.B. Energy and Gunvor.

Some Pakistan-based sources say that the import terminal may not be ready to receive supply until January at the earliest, although other sources are more optimistic.

Six companies took part in the latest tender for January supply, including Gunvor, Vitol, Gas Natural Fenosa, Trafigura and B.B. Energy.

Swiss trader DufEnergy also bid but was disqualified on technical grounds, according to the document.

All bids are expressed as a percentage of Brent.

For the Jan. 11-12 delivery window, Gas Natural Fenosa submitted the most competitive bid at 16.25 percent of Brent.

For Jan. 16-17 and Jan. 21-22, Gunvor was most competitive at 16.4844 percent and 16.8931 percent, respectively.

For Jan. 26-27, Gas Natural Fenosa won with its 16.125 percent bid, according to the document.

Pakistan LNG Ltd is due to officially award the cargoes at a later date.

-

Comment by Riaz Haq on January 25, 2018 at 11:31am

-

Pakistan lowers electricity price by 2.99 rupees per unit

Source: Xinhua| 2018-01-25 22:07:15|Editor: Yurouhttp://www.xinhuanet.com/english/2018-01/25/c_136924891.htm

ISLAMABAD, Jan. 25 (Xinhua) -- Pakistani National Electric Power Regulatory Authority (NEPRA) announced on Thursday to reduce the electricity price by 2.99 rupees (2.7 U.S. cents) per unit under the fuel adjustment for the month of December, 2017.The decision in this regard was taken in a public hearing, which was conducted under Chairman NEPRA Tariq Saddozai in Islamabad. The hearing was conducted upon request of the Central Power Purchasing Agency (CPPA) which requested the NEPRA to cut the power price.

The CPPA informed at the hearing that the generation of electricity during December was recorded at 7.76 billion units, which was produced at 5.11 rupees (4.6 U.S. cents) per unit while its cumulative cost was 40.60 billion rupees (0.37 billion U.S. dollars).

The power distribution companies charged consumers 8.10 rupees (7.3 U.S. cents) per unit during the month under review, it added.

-

Comment by Riaz Haq on January 25, 2018 at 5:15pm

-

This year's downturn in India followed the country's first reverse auction in February, which saw tariffs crashing to INR 3.42/kWh ($0.052/kWh). In comparison, feed-in-tariffs across the states at the time were INR 4-6/kWh ($0.06-$0.09/kWh).

The fallout was swift, with nearly all states discouraging or stopping feed-in-tariff (FIT)-based purchasing. Industry experts saw the low tariff as an anomaly, despite the second wind auction pushing prices down even further to INR 2.64/kWh ($0.04/kWh).

The government is planning additional auctions — for as much as 6GW in the next four months. However, wind-power developers and manufacturers are having to cope with the impacts of the sudden downturn.

Perhaps most notably affected was Siemens Gamesa Renewable Energy (SGRE), which has struggled over the past nine months, blamed, in part, on the market downturn. Prior to the merger between the two major European OEMs, Gamesa was the leading manufacturer in India.

https://www.windpowermonthly.com/article/1453174/the-inr-264-kwh-ta...

-

Comment by Riaz Haq on January 25, 2018 at 5:16pm

-

CERC Sets ₹3.48/kWh as the National Average Power Purchase Cost for Open Access in India

https://mercomindia.com/cerc-sets-%E2%82%B93-48kwh-national-average...

The Central Electricity Regulatory Commission (CERC) has set the national average power purchase cost (APPC) at ₹3.48 (~$0.0542)/kWh, barring a few states for open access. According to CERC the APPC will apply during the financial year (FY) 2017-18 and until further orders for deviation settlement with respect to open access.

Regional entities selling open access (large power consumers of 1 MW or more purchasing power in the open market) wind or solar power under REC framework and captive power projects that do not have a power purchase agreement will use APPC for settlement.

The new national APPC is ₹0.08 (~$0.0013) higher than the national APPC for FY 2016-17, which was ₹3.40 (~$0.0529)/kWh. The updated APPC will not apply to the states of Tamil Nadu, Tripura, Delhi, Jharkhand, Gujarat, Maharashtra, Assam, Kerala, and Rajasthan.

The total power purchase cost considered when computing the APPC excluded both transmission charges and the cost of generation or procurement from renewable energy sources. The national APPC for FY 2017-18 was determined by computing the average APPC for all states and union territories (UTs) weighted by the volume of the conventional power purchased by the respective state/UT.

In cases where multiple utilities operate in a single state, the state’s average power purchase cost was weighted by the total power for respective utilities to compute APPC for the entire state.

In its order, the CERC stated that since the state electricity regulatory commissions (SERCs) for a few states/UTs have not issued APPC orders or tariff orders in past financial years, the new APPC will not apply to those states.

Meanwhile, the APPC determined in FY 2014-15 will apply in Tamil Nadu and Tripura and the APPC determined in the FY 2015-16 tariff order will apply in Delhi and Jharkhand. The CERC added that the APPC applicable for Rajasthan distribution companies will be ₹3.4266 (~$0.0534)/kWh, in step with a new tariff order issued by the Rajasthan Electricity Regulatory Commission (RERC).

In the states of Gujarat, Maharashtra, Assam, and Kerala, the tariff order for FY 2016-17 will be applied as the APPC.

The CERC invited comments from stakeholders on the national APPC determination but received none.

-

Comment by Riaz Haq on January 27, 2018 at 10:47am

-

THE EXPRESS TRIBUNE > BUSINESS Higher prices force Pakistan to scrap LNG spot purchase deals

Higher prices force Pakistan to scrap LNG spot purchase deals

By Zafar Bhutta Published: January 12, 2018

https://tribune.com.pk/story/1606333/2-higher-prices-force-pakistan...

ISLAMABAD: The government has decided to ink direct liquefied natural gas (LNG) supply deals with more energy-rich countries in the hope of securing cheaper contracts compared to spot purchases from energy companies.

The decision came after Pakistan received higher bids for spot purchases, which led to cancellation of a couple of contracts.

At present, Pakistan has a 15-year government-to-government LNG import agreement with Qatar, which has been shipping gas since March 2015. Now, the government has got engaged in talks with other countries as well including Russia and Malaysia to clinch state-to-state supply deals.

“State-owned Pakistan LNG Limited has been forced to scrap deals for two LNG ships due to higher quoted rates. Bids were invited for four cargoes and in response foreign companies made offers in the range of 13.2% to 16% of Brent crude oil price,” said a senior government official while talking to The Express Tribune.

Qatar is supplying LNG to Pakistan at 13.37% of Brent price and global commodity trading firm Gunvor is also bringing cargoes at the same rate. Apart from these, Pakistan LNG Limited sought bids for short- and long-term purchases and secured contracts at the best rate of 11.64% of Brent crude price. Short-term deal was signed with Gunvor whereas the long-term contract was won by Italian energy giant Eni.

The two companies will supply 200 million cubic feet of gas per day (mmcfd), meaning Pakistan LNG Limited needs to secure contracts for an additional 400 mmcfd, which will be supplied to three LNG-based power projects of 3,600-megawatt production capacity in Punjab.

Already, the second LNG terminal has started commercial operations in late November 2017 at Port Qasim in order to dedicate 600 mmcfd of LNG for the three power plants.

According to the government official, Pakistan LNG Limited planned to make spot purchases for the additional 400 mmcfd through six ships – two ships by Eni and Gunvor and the remaining four through spot purchases.

Consequently, the company invited bids, but the offers were made at higher rates compared to those for the existing deals.

Vitol submitted bids at 15.9147% of Brent price for March 8-9 delivery and 13.8301% for delivery on March 22-23. Trafigura offered its bid at 15.0591% of Brent price for March 27-28 delivery and BB Energy came up with the lowest bid at 13.2701%.

Earlier, these companies technically qualified for the supply of four cargoes in February 2018 at higher rates.

BB Energy submitted its bid for February 6-7 delivery at 15.731% of Brent price and Gunvor offered to bring cargo on February 16-17 at 16.0857%.

For February 21-22 delivery, Trafigura submitted its bid at 15.8488% whereas for February 26-27 delivery, the company quoted 14.9887% of Brent price.

Earlier, these companies technically qualified for the supply of four cargoes in February 2018 at higher rates.

BB Energy submitted its bid for February 6-7 delivery at 15.731% of Brent price and Gunvor offered to bring cargo on February 16-17 at 16.0857%.

For February 21-22 delivery, Trafigura submitted its bid at 15.8488% whereas for February 26-27 delivery, the company quoted 14.9887% of Brent price.

-

Comment by Riaz Haq on September 10, 2018 at 7:49am

-

#Pakistan played bug #gas firms to save $600 million. After 2 years of negotiations #Qatar refused to lower price for #LNG. Pakistan then sought public bids for 120 cargoes in open markets bringing bids from big suppliers like Shell & BP https://www.bloomberg.com/news/articles/2018-09-09/playing-gas-gian... via @markets

Pakistan said it saved more than $600 million over the first 10 years of a natural gas supply deal by pitting some of the world’s biggest sellers against each other.

A report from the state’s oil marketing company presented two weeks ago to a senate committee, and reviewed by Bloomberg News, details how the 2016 deal came together with Qatar, the world’s largest supplier of liquefied natural gas. It also sheds a rare light on such high-stakes energy deals, which are almost exclusively settled behind closed doors and stay hidden from public scrutiny.

The maneuvering by Pakistan came after two years of negotiations hit an impasse as Qatar refused to lower its offer price for LNG. So Pakistan sought leverage on the open market in late 2015, publicly seeking 120 cargoes in two large tenders, which brought in bids from suppliers including Royal Dutch Shell Plc and BP Plc.

While negotiations with Qatargas Operating Co. were under way, the tender was “issued to fetch maximum number of bidders and best price option,” the presentation said. “The strategy helped bring down prices with Qatargas and saved $610 million."

Pakistan then informed Qatar about the lowest bid, from Switzerland-based Gunvor Group Ltd., which the Middle East supplier agreed to match. Pakistan still purchased some LNG from Gunvor, awarding it the first tender. But the volumes it sought from the second tender ended up in the final Qatar deal, bulking it up by 25 percent.

The head of a senate committee now scrutinizing the deal, Mohsin Aziz, confirmed the details of the presentation in an interview last week. Pakistan State Oil Co. and Qatargas officials didn’t respond to requests for comment. Gunvor and BP declined to comment. Shell said it looks forward to future LNG options in Pakistan, without directly commenting on the tender.

The deal with Qatar, which was eventually settled for 3.75 million metric tons annually over 15 years, marked Pakistan’s emergence as an LNG buyer. The country turned to imports after its own declining production forced some factories to shut and caused blackouts. Imports have grown rapidly since early 2016, with Pakistan the seventh-largest LNG buyer globally in August, according to Bloomberg vessel-tracking data.

-

Comment by Riaz Haq on January 30, 2019 at 5:31pm

-

#LNG imports in #MiddleEast plummeting. 37% slump in 2018 & prolonged negative outlook is in contrast to region’s 2-year LNG #gas demand surge. Oil prices barely enough to balance the budget of #Gulf monarchies of #SaudiArabia, #UAE, https://www.bloomberg.com/news/articles/2019-01-30/the-middle-east-... via @markets

The Middle East was a bright spot for global liquefied natural gas demand in 2015. Now imports have plummeted so much that it could take a decade to recover.

Last year’s 37 percent slump and the prolonged negative outlook is in contrast to the region’s two-year LNG demand surge that outpaced global growth, according to BloombergNEF and ship-broker Poten & Partners Inc. data. The Middle East is now expected to make up less than 4 percent of global imports for at least eight years.

There are only five importers -- Egypt, Kuwait, Jordan, the United Arab Emirates and Israel -- of LNG in the Middle East. Bahrain is expected to join the group this year.

Why are LNG imports falling?

Gas finds in Egypt and the U.A.E. reduced the need for the liquefied fuel, and Jordan increased cheaper pipeline imports. “Domestic gas resources have been the main reason for LNG imports being subdued,” said Fauziah Marzuki, a senior associate at BNEF. Locally produced “gas will always be preferred over imports, within certain cost parameters of course.”

Which countries are leading the decline?

Egypt, the region’s biggest LNG importer in 2016 and 2017, will halt purchases this year and may resume exports thanks to surging domestic supplies from the giant Zohr field. Jordan will rely more on pipeline imports from Egypt, trimming its need for LNG. Bahrain, the only country that will add import capabilities in 2019, isn’t expected to reach meaningful volumes until 2022, according to BNEF forecasts.

Fizzling Gas

Liquefied natural gas imports in the Middle East had a record drop in 2018

What does this mean for Qatari exports?

Qatar, the world’s biggest LNG exporter, has boosted its position in the Middle East’s shrinking market since 2016. The exit of Egypt from the scene will likely erode that status. Almost half of Egypt’s imports came from Qatar last year. Still, the region isn’t a major market for Qatar and growth in Asia will more than offset declines in the Middle East.

How will this impact global markets?

Imports of LNG in the Middle East are dwarfed by Asia. Supply of the fuel -- driven by the U.S., Qatar and Australia -- is expected to rise almost 18 percent by 2030, and demand will grow more than double that rate. Even Kuwait, the region’s biggest importer, barely registers in global terms. Its imports are even less than the smaller markets in Asia such as Thailand, Bangladesh and Pakistan.

LNG Minnow

Middle Eastern countries to comprise just 3 percent of global demand in 2019

-

Comment by Riaz Haq on December 20, 2019 at 10:58am

-

#China Bids Lowest #LNG Price to #Pakistan Amid Massive #Gas Glut In #Asia. PetroChina International Singapore Quotes 8.594% of Brent oil contract for a delivery on February 16-17, 2020. #energy | OilPrice.com https://oilprice.com/Energy/Gas-Prices/China-Dumps-LNG-Amid-Massive... #oilprice

PetroChina, one of the largest buyers of liquefied natural gas (LNG) in the key LNG demand growth market, has offered the lowest bid in an LNG tender in Pakistan, in a sign that the Asian market continues to be oversupplied even after the winter heating season began.

According to the documents from the latest Pakistan LNG tender, PetroChina International Singapore offered the lowest bid at a price slope—that is a percentage of the Brent oil contract—of 8.594 percent, for a delivery window on February 16-17. PetroChina beat commodity traders Gunvor and Trafigura and the trading arm of SOCAR to the lowest bid in the Pakistani tender.

It’s not certain if Pakistan will award this tender, because it sometimes chooses not to buy. But the fact that China is offering LNG so cheaply points to the persistent LNG glut on the Asian markets.

According to Bloomberg, this was at least the second time in which PetroChina has offered the lowest bid in an LNG tender in Pakistan.

This year, Asian spot LNG prices are at their lowest ever for this time of the season.

Last week was the first week since October in which spot LNG prices in Asia increased week on week. Asian LNG spot prices for delivery in January rose to US $5.65 per million British thermal units (MMBtu) last week, up by 15 cents from the previous week, trading sources told Reuters.

Still, prices were at their lowest for this time of the year, because of ample LNG supply and tepid demand growth with milder weather earlier in the heating season.

While the lower LNG prices create some demand in India, for example, overall demand in Asia this winter is certainly not growing at the record-breaking pace of the past three years. The reason—supply is more than enough, as new volumes continue to come out of the U.S., Australia, and to an extent, Russia.

Last month, a Singaporean buyer of a U.S. cargo of LNG canceled the loading, as both Asia and Europe are facing an LNG glut. Some other customers of U.S. LNG cargoes are also reportedly considering paying for those cargoes but not loading them, traders have told Reuters.

By Tsvetana Paraskova for Oilprice.com

-

Comment by Riaz Haq on February 26, 2021 at 6:51pm

-

#Pakistan considers canceling #LNG contracts with ENI & Gunvor. Both contracts are priced at 11.62% of Brent -- or about $7.42 per million Btu, more than double the current spot price. https://www.worldoil.com/news/2020/2/26/pakistan-lng-considers-canc...

SINGAPORE (Bloomberg) --Pakistan’s main buyer of liquefied natural gas is considering canceling two long-term contracts as a slump in spot prices and abundant production create opportunities for cheaper supply, according to people familiar with the situation.

State-owned Pakistan LNG Ltd. is weighing the possibility of exercising termination clauses in contracts it signed with Eni SpA and Gunvor Group Ltd. in 2017, according to the people, who asked not to be identified because the matter is private. No final decision has been made and the company is seeking input from the Ministry of Energy, said the people. Canceling both deals may cost the Pakistani firm nearly $300 million in penalties, according to Bloomberg calculations.

Pakistan LNG directed questions to the energy ministry, which didn’t respond to requests for comment. Gunvor declined to comment, while Eni didn’t respond to requests for comment.

A glut of new LNG supply and sputtering demand growth have sent spot prices to record lows, straining more expensive long-term supply deals based on oil prices. The global oversupply may persist over the next few years, analysts including Morgan Stanley forecast, stoking speculation that buyers will be pressuring sellers for revisions to term contracts.

Pakistan isn’t alone in seeking better deals. Japan’s Osaka Gas entered into arbitration last year with the marketing unit of Exxon Mobil Corp.’s PNG LNG project after a dispute during a price review. Indian gas importers have started discussions with Qatar on moving away from linking LNG prices to oil and are seeking cheaper rates. In 2015, Petronet LNG reworked the pricing formula in its 25-year contract with Qatar’s RasGas that resulted in lower prices.

Pakistan LNG is still open to sourcing supplies through new or revised contracts if the pricing terms are more favorable, according to one of the people. The South Asian nation is seen as one of the biggest growth markets for the fuel, with BloombergNEF forecasting imports could grow 80% from last year’s level to 2023.

Under the terms of the contracts, which are posted on Pakistan LNG’s website, the company must give a 90-day termination notice and pay damages equal to the value of six cargoes, which is based on average Brent prices for the three months preceding the month the notice is served. That would be about $142.5 million for the Gunvor deal and $148.8 million for Eni, according to Bloomberg calculations based on front-month Brent futures traded on ICE Futures Europe.

The two deals are linked to oil at a rate that prices cargoes more than double what’s currently available through the spot market. The Gunvor contract, which runs for five years to June 2022, is priced at 11.62% of Brent -- or about $7.42 per million Btu according to Bloomberg calculations using the average of November to January.

The Eni contract, which runs for 15 years to 2032, is priced at 11.6247% for the first two years, 11.95% for the following two years, then 12.14% for the remaining 11 years, according to one of the people. Both deals are for one cargo per month.

The Japan/Korea Marker, the spot Asian LNG benchmark published by S&P Global Platts, has dropped more than 50% in the past year and reached a record low this month of $2.71 per million British thermal units. Front-month futures traded at $2.90 per per million Btu on Tuesday in New York. A spot cargo to neighboring India was purchased recently for as low as $2.40 per million Btu.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

American Prof John Mearsheimer on International Geopolitics in South Asia

Professor John Mearsheimer, a renowned international relations expert known for his theory of "offensive realism", has recently spoken to India's CNN-News18 about the impact of US-China competition on geopolitics in South Asia. Sharing his thoughts in interviews on India-Pakistan conflict after the Pahalgam attack, he said: "There is really no military solution to this (Kashmir)…

ContinuePosted by Riaz Haq on May 24, 2025 at 5:30pm

Has Pakistan Destroyed India's S-400 Air Defense System at Adampur?

Pakistan claims its air force (PAF) has destroyed India's high-value Russian-made S-400 air defense system (ADS) located at the Indian Air Force (IAF) Adampur air base. India has rejected this claim and posted pictures of Prime Minister Narendra Modi posing in front of its S-400 rocket launchers in Adampur. Meanwhile, there are reports that an Indian S-400 operator, named Rambabu Kumar Singh, was killed at about the time Pakistan claims to have hit it. Pakistan is believed to have targeted…

ContinuePosted by Riaz Haq on May 21, 2025 at 4:00pm — 2 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network