PakAlumni Worldwide: The Global Social Network

The Global Social Network

Will Pakistan Take Advantage of Historic Low LNG Prices?

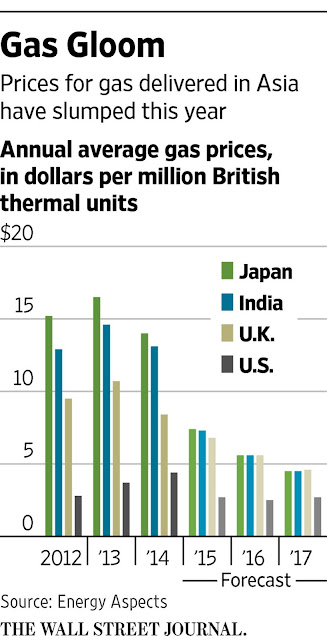

With softening demand from China and 130 million tons per year (mmpta) of additional LNG supply set to reach market over the next five years, gas research firm Wood Mackenzie sees continuing downward pressure on global LNG spot prices.

|

| LNG Price History Source: WSJ |

“The entire industry is worried because it is hard to tell when China’s demand will pick up again,” said an LNG strategist at a Malaysian energy company who attended the Wood Mackenzie conference in Singapore, according to Wall Street Journal. “Rising demand from smaller countries such as Pakistan, Egypt and Bangladesh is not enough to offset the declining demand from north Asia.”

As recently as two years ago, LNG shipped to big North Asian countries like Japan and Korea sold at around $15 to $16 a million British thermal units. This month, the price has already hit $6.65 a million BTUs, down 12% from September, according to research firm Energy Aspects. It expects prices to fall further in Asia next year, to under $6 per million BTUs, as a wave of new gas supply in countries from the U.S. to Angola to Australia comes on line, according to Wall Street Journal.

Petronet LNG Ltd, India’s biggest importer of liquefied natural gas (LNG), is saving so much money buying the commodity from the spot market that it’s willing to risk penalties for breaking long-term contracts with Qatar.

This is a great opportunity for Pakistan to take advantage of historically low LNG prices to alleviate its severe load-shedding of gas and electricity. Recently, Pakistan has launched its first LNG import terminal in Karachi and started receiving shipments from Qatar. Pakistan has also signed a $2 billion deal with Russians to build a north-south pipeline from Gwadar to Lahore. But the country needs to rapidly build up capacity to handle imports and distribution of significant volumes of LNG needed to resolve its acute long-running energy crisis.

Here's a related video discussion:

http://dai.ly/x3ccasi

Pakistan Local Elections; Indian Hindu... by ViewpointFromOverseas

https://vimeo.com/144586144

Pakistan Local Elections; Indian Hindu Extremism; LNG Pricing; Imra... from WBT TV on Vimeo.

https://youtu.be/LZavD-tkReg

Related Links:

Haq's Musings

Pakistan's Twin Energy Crises of Gas and Electricity

Affordable Fuel For Pakistan's Power Generation

Pakistan Shale Oil and Gas Deposits

China-Pakistan Economic Corridor

Blackouts and Bailouts in Energy Rich Pakistan

Pakistanis Suffer Load Shedding While IPPs Profits Surge

-

Comment by Riaz Haq on April 18, 2017 at 8:02pm

-

#Pakistan Minister Ahsan Iqbal claims 3,600 MW #electricity will be added in May 2017 to cut #loadshedding #CPEC

http://pakobserver.net/3600-mw-electricity-added-system-next-month-...

Minister for Planning, Development and Reforms, Ahsan Iqbal on Monday said some 3,600 megawatt (MW) electricity would be added to the national grid by next month, which would help reduce energy shortfall in the country.

Addressing a press conference here, he said total 10,000 MW electricity would be added to the grid by May 2018 bridging total gap in demand and supply.

He said the Pakistan Muslim League-Nawaz (PML-N) government had made record investment in the energy sector. Such investment had not been seen in the sector for the last 15 years and production of only 16,000 megawatt electricity was made possible during 66 years. After completion of projects, uninterrupted power supply would be available, which would start a new of era of development in industry, agriculture and services sectors, he added.

Responding to the criticism that the present government could not manage to overcome the energy crisis despite lapse of four years, the minister said energy projects took three to four years to complete. The projects initiated by the PML-N government were near completion and would soon start commercial operations, he added.

He said since the PML-N government came into power, the economic indicators were on the upward trajectory. “Economic growth has gone up to over 5 per cent in 2016 from 3.7 per cent in 2013, inflation rate has come down and industrial growth rate is improving,” he added.

He said the government was focusing on manufacturing high cost commodities instead of low cost ones, therefore, during last three years the export of former had increased.

To a question, he said though the public debt had increased, yet the debt to GDP (gross domestic product) ratio decreased to 60.5 per cent in December 2016 against 62.4 per cent in December 2015.

The minister said the opponents of China Pakistan Economic Corridor (CPEC) were trying to mislead the people that the project would increase the public debt and damage the local industry. In fact, it would help strengthen the country’s industrial sector, he added.

“Huge number of employment opportunities will be created for the local people as Chinese industries are being shifted to Pakistan,”, he said, adding that the Pakistani industry would also become more competitive.

He said due to the CPEC, Pakistan’s economy was now shifting from low cost agriculture industry to high value industrialization. Major development projects, which had been pending for decades, were now at the completion stage, he added.

He said the government had completed the long awaited N-85 connecting Quetta with Gwadar. It would construct over 1,000 kilometer roads across the Balochistan province, he added.

It was the current government that made the long awaited Diamir Bhasha Dam project a reality as its ground breaking was going to be held in a few months, he added.

Ahsan Iqbal rebutted an allegation levelled by scientist Dr Samar Mubarak against the government of fixing tariff rate of Rs 24 per unit of electricity produced from Thar Coal. The traiff was fixed at only Rs 8.5 per unit, he added.—APP

-

Comment by Riaz Haq on April 30, 2017 at 8:20am

-

Glimmer of light in #Pakistan’s blackout crisis. #loadshedding #CPEC https://www.ft.com/content/12643508-2b0b-11e7-9ec8-168383da43b7 … via @FT

The households and small businesses that crowd the narrow lanes of Gazdarabad, Karachi, are used to blackouts. Until recently, residents here, as in many parts of Pakistan’s biggest city, suffered between eight and 10 hours a day without electricity.

It has taken years for engineers from K-Electric, the local power company, to unpick the tangle of loose wires and illegal connections that were symptomatic of a city deprived of regular electricity for the past decade.

“We would have up to 10 hours of load-shedding,” says Tariq Gulsher, a local resident, referring to the area’s power cuts during the latest of Pakistan’s energy crises. “Although we could pay people for access to a back-up generator, it was expensive and fluctuations in the power often meant our equipment broke.”

Gazdarabad’s residents now have reliable, 24-hour power — but they are the lucky ones. Pakistan is facing an unprecedented power crunch, which has left households and businesses either in the dark or relying on back-up generators for large portions of the day.

It poses a risk to economic growth as Pakistan becomes a more attractive place for foreign consumer businesses, which are enticed by its young and growing population and cautiously optimistic about improving security.

Ehsan Malik, chief executive of the Pakistan Business Council, says the energy shortfall “is business’s biggest difficulty right now”.

Electricity in Pakistan is both insufficient and expensive. Peak demand surpasses maximum generating capacity by 6 gigawatts — equivalent to about 12 medium-sized coal power plants.

Pakistan plans to remedy this by building coal-fired power stations funded by more than $35bn in Chinese loans — part of the $50bn-plus China-Pakistan Economic Corridor scheme to improve Pakistan’s infrastructure. Several large power stations are under construction and the government says at least one will come online every month until next March, producing eight gigawatts of new capacity.

These schemes are intended eventually to take advantage of the 175bn tonnes of coal reserves discovered at Thar, about 400km east of Karachi. The amount of fuel there puts Pakistan in the top 10 countries in coal reserves.

Pakistan has some of the highest power prices in the region, at $0.13 per unit of electricity, compared with $0.12 in India, $0.11 in China and $0.09 in Bangladesh. Furnace oil is burnt to produce 40 per cent of the supply, with hydroelectric dams accounting for 30 per cent and gas 25 per cent. Virtually none of the energy comes from coal, which is far cheaper,

“We are sitting on some of the largest coal reserves in the world but the government in the 1990s was completely focused on furnace oil,” says Syed Murad Ali Shah, chief minister of Sindh province. A concern is the financial risk. The falling cost of solar energy could render coal power plants useless, and energy suppliers complain the electricity tariffs set by authorities are too low for them to make a profit or attract new investment.

Energy regulators have slashed the tariffs of a range of suppliers in the last year, causing three of them to slide from profits into losses. Since virtually all the electricity distribution companies are state owned, it is up to the government to fill the holes its policies have created.

-

Comment by Riaz Haq on May 16, 2017 at 9:57pm

-

THE EXPRESS TRIBUNE > BUSINESS

Pakistan set to overcome energy crisis in six months: Abbasi

https://tribune.com.pk/story/1411718/pakistan-set-overcome-energy-c...

Pakistan is poised to overcome the chronic energy crisis in the next six months as it doubles the import of liquid natural gas (LNG) and removes the deficit in power production, said Federal Minister for Petroleum and Natural Resources Shahid Khaqan Abbasi on Tuesday.

“The second LNG import terminal would become operational in two months,” Abbasi said at the rebranding of a Pakistan State Oil’s (PSO) outlet in Karachi.

The new import terminal, Pakistan LNG Terminal Limited at Port Qasim by Pakistan GasPort consortium, would add 600 million cubic feet per day (mmcfd).

Engro’s Elengy Terminal Pakistan Limited at Port Qasim has already been importing 600mmcfd in the country from Qatargas.

The minister said import of LNG would continue to increase to meet rising domestic demand going forward.

“The domestic demand has shot up to 7bcfd (billion cubic feet per day) against local production at 4bcfd,” he said.

“Local production has remained stagnant at 4bcfd for the last 15 years.”

He said that the country would do away with the deficit gas production by importing 3bcfd by December 2018.

A Turkish company, Global Energy Infrastructure Limited, is constructing another LNG import terminal with a capacity of 750mmcfd at Port Qasim. As per plans, the terminal would be ready to import gas sometime in July-December 2018, it was learnt.

-

Comment by Riaz Haq on July 10, 2017 at 8:04am

-

#Pakistan Sees Bigger #LNG Profile; Imports to Surge From 4.5 Million Tons in 2016 to 30 Million Tons by 2022

https://www.nytimes.com/reuters/2017/07/10/business/10reuters-pakis...

Pakistan says it could become one of the world's top-five buyers of liquefied natural gas (LNG), with Petroleum Minister Shahid Abbasi predicting imports could jump more than fivefold as private companies build new LNG terminals.

Outlining Pakistan's ambitious plans - which, if fully implemented, could shake up the global LNG market - Abbasi told Reuters that imports could top 30 million tonnes by 2022, up from just 4.5 million tonnes currently.

Cheaper than fuel oil and cleaner burning than coal, LNG suits emerging economies seeking to bridge electricity shortfalls and support growth on tight budgets.

(For a graphic on LNG market share by region click http://reut.rs/2uGUu9X)

"Within five years, I don't see any reason why we should not be beyond 30 million tonnes (in annual LNG imports). We will be one of the top five markets in the world," Abbasi said.

That kind of jump would represent one of the fastest growth stories in the energy industry, comparable to what China has done in many commodities - but there are doubts whether Pakistan can achieve its ambitions, given the complexity and cost of expansion projects.

"It's always possible, but seems very difficult as they will need much more (regasification) capacity and downstream pipeline capacity," said Trevor Sikorski at Energy Aspects, a London-based industry market researcher. "There are infrastructural issues and financial issues."

"Still, it is one of the key LNG growth markets, and its demand will help tighten up the market that has threatened to lurch into over supply."

Abbasi said no one took Pakistan seriously after a decade of botched attempts to bring LNG to the country, but this has changed with the construction of new LNG terminals and gas plants. He said foreign suppliers are now arriving in Pakistan - where energy shortages have prompted Prime Minister Nawaz Sharif to promise he'll end the country's frequent blackouts.

"Before, we used to go out to talk to LNG suppliers. Now they're coming to us," Abbasi said.

"(LNG) is really what has saved the whole energy system. It has been a huge success in Pakistan and it will continue," he said after Sharif on Friday inaugurated a new Chinese-built LNG power plant that uses General Electric turbines.

GETTING CONNECTED

Pakistan built its first LNG terminal in 2015 and, after some delays, a second terminal is due to come online in October, doubling annual import capacity to about 9 million tonnes.

A consortium of Exxon Mobil, Total, Mitsubishi, Qatar Petroleum and Norway's Hoegh is expected to decide by September whether to build a third LNG terminal for about $700 million, Abbasi said.

Pakistan has dropped plans to finance up to two more terminals, as private companies have said they would finance these themselves and use Pakistan's existing gas network to sell directly to consumers.

"That's been the real success and that's where the growth will come from," Abbasi said, adding that about 10 million homes are linked to gas connections in Pakistan - a nation of around 200 million.

"In the last four years, we would have added two million additional connections. We are really ramping that up."

If Pakistan achieves its ambitious development goals, it could significantly erode market oversupply, which has helped pull down Asian LNG spot prices by more than 70 percent since 2014 to around $5 per million British thermal units (mmBtu).

-

Comment by Riaz Haq on July 21, 2017 at 11:12am

-

Woodside sees Qatar LNG expansion hurting U.S. LNG growth

https://www.reuters.com/article/us-woodside-lng-idUSKBN1A50KT

MELBOURNE (Reuters) - A plan by top global liquefied natural gas (LNG) exporter Qatar to ramp up output will stall the expected growth of U.S. LNG exports, the head of Australia's Woodside Petroleum, operator of the country's biggest LNG plant, said.

Qatar surprised rivals this month when it lifted a self-imposed ban on development of the North Field, the world's biggest natural gas field, saying it would boost LNG output by 30 percent to 100 million tonnes a year in five to seven years.

That put it on course to it wrest back the title of the world's top LNG exporter from Australia, which is set to overtake Qatar in the next two years.

Woodside, operator of the North West Shelf project, said Qatar's plan showed the emirate shares its outlook for solid demand growth for LNG and gives importers like China, India, Pakistan and Bangladesh the supply certainty they need to lock in gas expansion plans.

"The Qataris will not take up all of the available market," Woodside Chief Executive Peter Coleman told Reuters in an interview on Thursday.

Qatar's expansion plan will compete directly with Woodside, which is looking to develop the Browse and Scarborough fields off Western Australia within the next decade - its so-called Horizon 2 projects - by processing gas through the North West Shelf plant or other existing facilities.

"On the challenge side, low cost will get into market, and that's what we're doing with our Horizon 2 projects. We're trying to make sure they're low cost, and they're well positioned, because we're targeting the Asian market," Coleman said.

Projects that will find it harder to compete will be those that need billions of dollars in new infrastructure and coal seam gas-to-LNG projects that need continuous capital spending to drill new wells, he said.

The International Energy Agency last week forecast the United States would become the world's second largest LNG exporter by the end of 2022, but Coleman said the Qatari expansion would stymie that growth.

"It'll keep a lid on U.S. expansions, because U.S. expansions are transportation-challenged," he said.

U.S. LNG flows largely into the Atlantic market, where it competes against pipeline gas from Russia and Norway.

-

Comment by Riaz Haq on July 29, 2017 at 7:51am

-

GE sets gas turbine record in #Balloki #Punjab #Pakistan. #LNG - #Power Engineering International

http://www.powerengineeringint.com/articles/2017/07/ge-sets-gas-tur...

GE sets gas turbine record in Pakistan

07/28/2017

By Tildy Bayar

Features Editor

GE has beat its global record for first fire of an H-class gas turbine in Pakistan.

Along with Chinese EPC partner Harbin Electric International Company, GE said it completed the first test in 66 days from delivery on-site.

It added that grid synchronization of the gas turbine was achieved in 74 days, another record.

Two 9HA.01 gas turbines and one steam turbine were supplied to the 1.2 GW LNG-fuelled combined-cycle Balloki power plant in Punjab, currently under development by Pakistan’s government through the National Power Parks Management Company Limited (NPPMCL).

The plant is scheduled for commissioning later this year. It will feature a primary re-gasified LNG fuel system, a secondary diesel fuel system, water cooled condensers and a cooling tower.

The first turbine is now producing up to 380 MW, GE said.

In a statement, the firm emphasized the “strong collaboration” with NPPMCL and Harbin Electric in driving the project.

The previous record was set at Pakistan’s 1230 MW Haveli Bahadur Shah plant, where the duration from gas turbine delivery to first fire test was 74 days according to GE.

Pakistan is the first country in the MENA-Turkey-South Asia region to install 9HA turbines.

Rashid Mahmood Langrial, CEO of NPPMCL, said, “We are committed to delivering on the government’s vision to strengthen power generation in Pakistan and to meet the growing needs for power for residential and commercial use.

“With the first fire and synchronization of the first gas turbine, Balloki is on schedule to enter operation and will support the people and national economic growth of Pakistan.

“The record completion of first fire is a strong demonstration of the extraordinary teamwork that is going into the project to ensure its timely commissioning.”

Pakistan is actively working on boosting its energy security. Earlier this month, the nation signed an agreement with France’s Agency for Development (AFD) for $192m in loans to bolster its energy sector against growing demand.

Planned work includes modernizing the 1 GW Mangla hydropower plant and improving transmission efficiency.

-

Comment by Riaz Haq on August 6, 2017 at 8:22am

-

Pakistan, India imported 25m tons of LNG last year

http://www.hellenicshippingnews.com/pakistan-india-imported-25m-ton...

South Asia, long a backwater for energy markets, is emerging as a hotspot for liquefied natural gas (LNG) with Pakistan and Bangladesh set to join India as major consumers, helping to ease global oversupply that has dogged the market for years.

Pakistan started importing LNG in 2015 after developing its first terminal within schedule and budget. A second is about to become operational and a third is expected to be completed next year.

With Bangladesh set to join the club of importers next year, the region could import 80-100 million tonnes a year by mid-2020s, analysts said, making it the world’s second biggest import region, ahead of Europe.

“By 2025, depending on our national demand, we will import anywhere from 2,000 to 2,500 mmcfd of gas,” Hamid said. Those imports would add to plans from India and Pakistan to buy 50 million and 30 million tonnes of LNG per year, respectively, by mid-2020s.

“LNG imports in South Asia are expected to rise four-fold from 22 million tonnes per year in 2016 to over 80 million tonnes per year by 2030,” said Mangesh Patankar, head of Asia-Pacific business development at energy consultancy Galway Group.

Should all plans in the region go ahead and Sri Lanka also starts imports, this figure could rise to 100 million tonnes, industry project data shows. That would push South Asia’s demand ahead of Europe as the world’s second biggest LNG import region by 2020, though it would still lag North Asia’s 150 million tonnes of annual imports.

The boom in demand will help ease oversupply in LNG markets, which have resulted in a more than 70% price fall from their 2014 peaks to $5.75 per million British thermal units.

Source: Reuters

-

Comment by Riaz Haq on August 18, 2017 at 8:24am

-

LNG keeps Pakistan’s economy moving, price lower than other fuels

http://www.brecorder.com/2017/08/17/365294/lng-keeps-pakistans-econ...

Around eight months back, Pakistan signed a 15-year agreement with Qatar for import of 3.75 MTPA (millions ton per annum) to meet its growing energy needs as all the existing natural gas reserves appeared insufficient to bridge the ever-increasing gap between demand and supply of the commodity.

The deal started doing wonders when the imported gas fed industries, CNG stations, gas-fired power generation plants and fertilizer sector, giving an impetus to economic activities in the country.

"The country had no option other than to import gas whether it is the LNG or through Iran-Pakistan and Turkmenistan-Afghanistan-India gas pipeline projects as the country's existing reserves are depleting and there is no major find since long," officials of Ministry of Energy's Petroleum Division told APP.

They expressed confidence that the LNG import would prove to be a game-changer for Pakistan because it was considered an essential part of the energy mix needs of emerging economies.

The world is turning towards the LNG and emerging economies such as China, Korea, Japan, India, Thailand, Indonesia, European Union, and Brazil ensure that teh LNG remains part of their energy mix requirements.

The Japan is importing 80 million ton of LNG every year (MTPA) and India 15 MTPA due to the commodity's low price and efficiency as compared to other fuels.

The Pakistan's gas supply-demand gap has reached four billion cubic feet per day (BCFD) as total unconstrained gas demand of the country is eight BCFD against total supply of four BCFD. Needless to say in winter the demand rapidly increases.

They said the LNG was the cheapest alternative fuel and the only instant available remedy to meet the country's energy needs when the existing natural gas reserves were diminishing.

"The LNG is available to consumers at cheaper rate than the LPG. The RLNG price for consumers will be lower than the prices of other alternate fuels. The price of the LNG for consumers is Rs850 per MMBTU as compared to home delivered price of the LPG at Rs2,000 per MMBTU and domestically produced natural gas is priced up to Rs700 per MMBTU," the official disclosed.

----------------------

In 2015, the country got its first LNG terminal, which was built in the record period of 11 months and is injecting 600 MMCFD of RLNG in the national system to meet the existing energy shortfall.

Normally, a terminal takes around three to four years to complete and become operational, but it is the hallmark of the present government to set up the country's first LNG terminal in just 11 months.

The second terminal is scheduled to start functioning shortly at the Port Qasim.

Now, the world's major players are showing interest to invest in the LNG sector of Pakistan by setting up their own terminals and developing supply networks to supply gas to consumers through third party access.

Pakistan is building deeper relations with many countries through oil and gas deals on a government-to-government basis after the successful model of oil imports from Kuwait, and in this context, the LNG import deals with various countries, including China, Turkey, Russia, Malaysia, Indonesia and Oman are being negotiated.

-

Comment by Riaz Haq on August 27, 2017 at 9:36pm

-

#Pakistan PM Abbasi inaugurates 2nd #LNG Terminal at Port Qasim – Daily Pakistan

https://en.dailypakistan.com.pk/pakistan/pm-abbasi-inaugurates-lng-...

Addressing the event, Abbasi said the LNG Terminal-2 was established in a record 330 days. “If you don’t add more gas into the system, you cannot fight the energy crisis,” he insisted, adding that other methods to produce energy are either too expensive or too slow.

Talking about the challenges faced during the project, the prime minister said that many people had questioned it when it started but “Port Qasim came through” and the terminal started functioning in less than 14 months “which is exemplary.”

The premier further said that previous governments had made several attempts to introduce LNG as a source of energy in the country, “but only the PML-N government had succeeded in doing so.”

He said load-shedding will become history by end of November this year.

During the meeting with a delegation of businessmen a day earlier, the premier had said China-Pakistan Economic Corridor (CPEC) projects were the lifeline of economic development in Pakistan, hence the business community should take full advantage of the CPEC projects.

He arrived in Karachi on Saturday on a two-day visit.

Earlier in August, an official at the Ministry of Petroleum and Natural Resources said that imports by the LNG Terminal-1 on Port Qasim fulfill 25 per cent of the national gas shortage. The first terminal had received 102 shipments of LNG, the prime minister said.

-

Comment by Riaz Haq on September 28, 2017 at 10:16am

-

Pakistan to lock another 3 mil mt of LNG in term contracts by year-end

Singapore (Platts)--28 Sep 2017 232 am EDT/632 GMT

https://www.platts.com/latest-news/natural-gas/singapore/interview-...

Pakistan is currently in negotiations to secure an additional three million mt of LNG in long-term contracts by the end of the year to supply its new LNG floating terminal due to arrive by December, according to M. Adnan Gilani, chief operating officer with Pakistan LNG Ltd.

The negotiations are taking place with over half a dozen potential suppliers on a bilateral government-to-government basis, Gilani said at an interview with S&P Global Platts Thursday on the sidelines of the 9th CWC LNG Asia Pacific Summit, held in Singapore September 19-22.

"We hope to have two to three government-to-government agreements signed by the end of this year," Gilani said. "In the interim, we will secure around four spot cargoes a month [the equivalent of 3 million mt/year] until our contracts start."The new supply agreements will increase Pakistan's total LNG contractual commitment to more than 11 million mt/year, as the country aims to resolve a decade-long energy crisis, driven by mounting gas consumption and faltering domestic production.

The new contractual volumes will be delivered to Pakistan's second floating, storage and regasification unit -- with a capacity of 4.5 million mt/year -- due to arrive at Port Qasim by the end of the year.

Currently, imports are being delivered to the Exquisite, an FSRU with a similar capacity, with another two due start up in the second half of 2018, all in Port Qasim.

OIL INDEXATION

As with PLL's previous supply agreements, the new deals will also be priced against international crude oil benchmarks, Gilani said.

PLL aims to change the electricity feedstock landscape by replacing fuel oil with regasified LNG, so LNG priced at a low slope to crude would guarantee the competitiveness of LNG over crude.

"Because of the fuel-oil substitution effect, the risk of oil prices moving in one direction or another is less of a concern; as long as it is oil linked, it is always better for us compared to fuel oil," Gilani said.

The excess use of fuel oil in power generation as a result of Pakistan's decade-long gas shortage has cost the government an extra $1 billion-$2 billion/year.

The country's consumption of diesel and fuel oil, a more expensive alternative to gas in power generation, peaked at 387,140 b/d in fiscal year 2014-15 (July-June), according to data from Pakistan's Oil Companies Advisory Council, before falling 1% in fiscal 2015-20, following the startup of the country's first LNG import terminal in March 2015.

SPOT, SHORT TERM

In the longer term, Pakistan aims to allocate a quarter of its LNG purchases to the spot and short-term markets, Gilani said.

"Initially, our goal is to solve our energy crisis. We have long-term downstream commitments, so we do not mind going to mid-to-long term initially," he said.

"Over the course of time, we will be able to cater to our variable non-cyclical demand... and allocate about a quarter of our portfolio to spot and short term.

PLL is currently purchasing four cargoes per month on a short-term basis as it awaits the start of new term volumes.

In the company's most recent tender, issued Tuesday, PLL sought four cargoes for delivery in January, with an award due to be announced November 3. PLL's previous tender, for four December cargoes, received 15 bids from a total of six sellers: Vitol, Engie, Gas Natural Fenosa, Gunvor, Trafigura and BB Energy. The lowest offer, at 13.98% of ICE Brent, was submitted by BB Energy. An award is yet to be announced.

DEMAND GROWTH

Pakistan's LNG imports are projected to jump over the next five years, with PLL estimating unconstrained demand at 30 million mt/year, or 4 Bcf/day of gas equivalent, by 2022, which is half of the country's total gas demand projection of 8 Bcf/d for that year, according to government estimates.

With domestic production faltering and pipeline import projects still uncertain, the country's dependency on LNG imports to tackle its decade-long gas and energy crisis is unlikely to fade away, especially since global oversupply and low LNG prices are resulting in better supply terms for customers.

"We just need to create the transmission infrastructure to take the gas [from the LNG terminals] to the demand centers in the north," where 70% of the population and three-quarters of the industrial base are located, Gilani previously told Platts.

Pakistan's current consumption of gas, which accounts for half of its energy mix, swings between 6.2 Bcf/d in the summer season and 6.8 Bcf/d in winter. Average minimum temperatures in Punjab province, where more than half of Pakistan's population lives, stay below 5 degrees Celsius for most of the winter period, causing heating demand to rise.

Gas consumption is expected to continue growing at an annual rate of 5%, according to data from Pakistan's Ministry of Petroleum and Natural Resources, driven by a growing economy, rising demand from the power and industry sectors, and expansion of the country's gas supply and distribution network.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Has Pakistan Destroyed India's S-400 Air Defense System at Adampur?

Pakistan claims its air force (PAF) has destroyed India's high-value Russian-made S-400 air defense system (ADS) located at the Indian Air Force (IAF) Adampur air base. India has rejected this claim and posted pictures of Prime Minister Narendra Modi posing in front of its S-400 rocket launchers in Adampur. Meanwhile, there are reports that an Indian S-400 operator, named Rambabu Kumar Singh, was killed at about the time Pakistan claims to have hit it. Pakistan is believed to have targeted…

ContinuePosted by Riaz Haq on May 21, 2025 at 4:00pm — 2 Comments

Pakistan Downs India's French Rafale Fighter Jets in History's Largest Aerial Battle

Pakistan Air Force (PAF) pilots flying Chinese-made J10C fighter jets shot down at least two Indian Air Force's French-made Rafale jets in history's largest ever aerial battle involving over 100 combat aircraft on both sides, according to multiple media reports. India had 72 warplanes on the attack and Pakistan responded with 42 of its own, according to Pakistani military. The Indian government has not yet acknowledged its losses but senior French and US intelligence officials have …

ContinuePosted by Riaz Haq on May 9, 2025 at 11:00am — 32 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network