PakAlumni Worldwide: The Global Social Network

The Global Social Network

Will Pakistan Take Advantage of Historic Low LNG Prices?

With softening demand from China and 130 million tons per year (mmpta) of additional LNG supply set to reach market over the next five years, gas research firm Wood Mackenzie sees continuing downward pressure on global LNG spot prices.

|

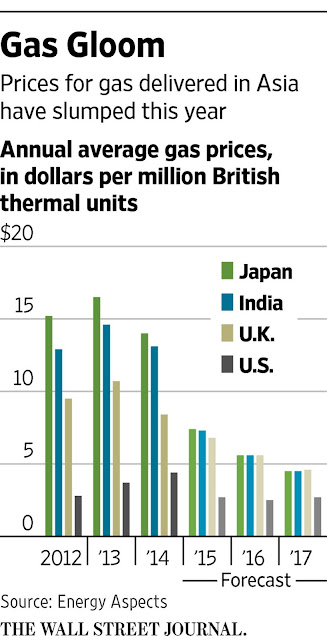

| LNG Price History Source: WSJ |

“The entire industry is worried because it is hard to tell when China’s demand will pick up again,” said an LNG strategist at a Malaysian energy company who attended the Wood Mackenzie conference in Singapore, according to Wall Street Journal. “Rising demand from smaller countries such as Pakistan, Egypt and Bangladesh is not enough to offset the declining demand from north Asia.”

As recently as two years ago, LNG shipped to big North Asian countries like Japan and Korea sold at around $15 to $16 a million British thermal units. This month, the price has already hit $6.65 a million BTUs, down 12% from September, according to research firm Energy Aspects. It expects prices to fall further in Asia next year, to under $6 per million BTUs, as a wave of new gas supply in countries from the U.S. to Angola to Australia comes on line, according to Wall Street Journal.

Petronet LNG Ltd, India’s biggest importer of liquefied natural gas (LNG), is saving so much money buying the commodity from the spot market that it’s willing to risk penalties for breaking long-term contracts with Qatar.

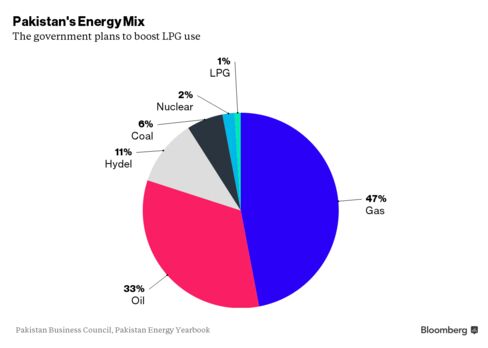

This is a great opportunity for Pakistan to take advantage of historically low LNG prices to alleviate its severe load-shedding of gas and electricity. Recently, Pakistan has launched its first LNG import terminal in Karachi and started receiving shipments from Qatar. Pakistan has also signed a $2 billion deal with Russians to build a north-south pipeline from Gwadar to Lahore. But the country needs to rapidly build up capacity to handle imports and distribution of significant volumes of LNG needed to resolve its acute long-running energy crisis.

Here's a related video discussion:

http://dai.ly/x3ccasi

Pakistan Local Elections; Indian Hindu... by ViewpointFromOverseas

https://vimeo.com/144586144

Pakistan Local Elections; Indian Hindu Extremism; LNG Pricing; Imra... from WBT TV on Vimeo.

https://youtu.be/LZavD-tkReg

Related Links:

Haq's Musings

Pakistan's Twin Energy Crises of Gas and Electricity

Affordable Fuel For Pakistan's Power Generation

Pakistan Shale Oil and Gas Deposits

China-Pakistan Economic Corridor

Blackouts and Bailouts in Energy Rich Pakistan

Pakistanis Suffer Load Shedding While IPPs Profits Surge

-

Comment by Riaz Haq on February 2, 2016 at 10:04pm

-

A 75% Slump in #LNG Gas Aids #Pakistan's Quest to End #Energy Crisis. #loadshedding http://bloom.bg/1Ko4N8S via @business

A 75 percent drop in liquefied natural gas prices since 2014 is just what Pakistan needed. Prime Minister Nawaz Sharif’s government is confident it will help end the nation’s energy crisis by 2018.

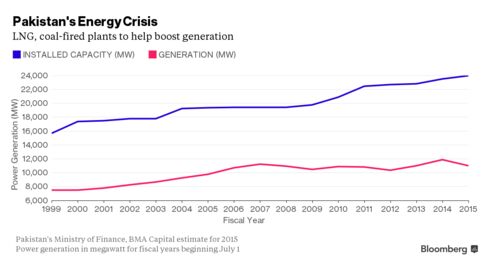

In three years, the South Asian nation plans to import as much as 20 million tons of the super-chilled gas annually, according to Pakistan’s Petroleum Minister Shahid Khaqan Abbasi. That’s enough to feed about 66 percent of Pakistan’s power plants that have a total capacity of 23,840 megawatts. A fuel shortage has rendered half the nation’s generators idle.

“The energy crisis will be solved before the government’s term ends in 2018,” Abbasi said in a phone interview. “When a customer comes to us asking for gas, we can say, yes, we will deliver gas to you on this date. Earlier we said there is no gas, goodbye.”

Sharif’s plan to use LNG and build coal-fired electricity plants will help textile, fertilizer and steel producers boost output and spur growth that the nation’s power regulator estimates is 3 percentage points below potential. Outages lasting 18 hours had led to street protests in Karachi as recently as June, while falling natural gas production at home forced companies such as Tuwairqi Steel Mills Ltd. to idle it’s plant.

Pakistan is going all out for LNG “as it’s become more affordable,” Vahaj Ahmed, an analyst at Exotix Partners LLP in Dubai said by phone. “This gives policy makers room to justify why they are going for it. The difference between imported and natural gas is very small now.”

About 60 million cubic feet per day of LNG imports will be reserved for textile companies that have export orders, according to the finance ministry. The industry accounts for about half of Pakistan’s total exports, which declined 14 percent in the six months to Dec. 31. Fuel pumps, which are often shut for days, will benefit from the imports in the nation that was once the world’s largest compressed natural gas market.

LNG for delivery in Northeast Asia has dropped about 75 percent since 2014, according to World Gas Intelligence data compiled by Bloomberg. Spot price of the supercooled gas is likely to trade between $4 and $5 per million British thermal unit over the next four years, Goldman Sachs Group Inc. analysts including Christian Lelong wrote in a report dated Jan. 31.

Pakistan will become one of the world’s top five buyers of LNG should the government’s plan succeed, according to Abbasi. The nation started importing LNG using a floating facility last year. Two more terminals are scheduled to be completed next year, Mobin Saulat, chief executive officer at Inter State Gas Systems told reporters last month. The nation got its first shipment last year.

The world’s top five LNG importers are Japan, South Korea, China, India and Taiwan, according to International Group of Liquefied Natural Gas Importers. Pakistan also separately agreed on a 15-year contract with Qatar.

LNG will improve diversification of Pakistan’s energy needs but its only one part of the equation, Mervyn Tang, lead analyst for Pakistan at Fitch Ratings Ltd. said in an e-mail. “Progress on multiple fronts could help foster a sustainable stable energy environment, with potential positive knock-on effects for private investment and economic growth,” he said.

-

Comment by Riaz Haq on February 10, 2016 at 8:53am

-

#Qatar Clinches 15-Year Contract to Supply #LNG to #Pakistan. 20 million tons a year for 66% of power http://bloom.bg/1QVqfBB via @business

Qatar Liquefied Gas Co., the world’s biggest producer of liquefied natural gas, signed a 15-year contract to supply Pakistan State Oil Co. with 3.75 million metric tons of fuel annually, the Qatari company said.

The supplier, known as Qatargas, plans to deliver the first cargo in March, the company said Wednesday in an e-mailed statement. Qatargas didn’t disclose the contract’s value. A proposed deal with Qatar for 1.5 million tons of LNG per year was worth $16 billion, Pakistan’s Petroleum Minister Shahid Khaqan Abbasi said during a visit to Doha in November.

Pakistan plans to import as much as 20 million tons of the super-chilled gas annually, enough to feed about 66 percent of Pakistan’s power plants. A fuel shortage has idled half the nation’s generators. A 75 percent drop in LNG prices since 2014 has reduced the cost of the South Asian country’s energy needs.

Qatargas, with annual capacity of 42 million tons, will supply Pakistan State Oil from joint venture plants it operates with ExxonMobil Corp. and Total SA. Pakistan State Oil shares rose 1.7 percent, the most since Feb. 4, to close as the leading gainer by points in Karachi’s benchmark 100 share index.

Talks between Qatargas and Pakistani officials date back to 2012. Pakistan intended to buy 3 million tons of LNG per year, split between long-term and shorter contracts. The country’s state oil company decided to cancel a tender for 60 cargoes of the fuel in January.

-

Comment by Riaz Haq on February 18, 2016 at 8:50pm

-

#Russia to Spend Billions on #Gas Pipeline in #Pakistan. #Putin http://learningenglish.voanews.com/content/russia-to-spend-billions... …

Russian President Vladimir Putin is expected to visit Pakistan in the next few months to begin a gas pipeline project.

Pakistan’s Prime Minister Nawaz Sharif asked Putin to visit.

Mobin Saulat heads Inter State Gas Systems, the Pakistani company that would build the pipeline. He says Putin may visit Pakistan before June.

He says Russia is interested in the project because 200 million people live in Pakistan, and investing in the country could help Russia gain influence in other South Asian nations.

When Pakistani officials and energy experts visited Moscow recently, they met with the heads of three large Russian energy companies for the first time in more than 20 years. He says that shows Russia’s interest in Pakistani energy issues.

Saulat says he believes the pipeline is the first of many investments Russia will make in Pakistan.

Experts say both countries may have strategic and political reasons to work together on the gas pipeline project.

Pakistan has tried to form new partnerships to reduce its dependence on the United States and China.

Russia will spend about two to $2.5 billion dollars on the project. That is almost 85 percent of the cost.

The 1,100-kilometer-long pipeline will be able to transport 34 million cubic meters of gas per day throughout Pakistan from Karachi to Lahore. The first part of the project is expected to be finished in two years. The last two parts are set to be completed in 2019.

-

Comment by Riaz Haq on February 19, 2016 at 11:03am

-

#Qatar puts #Iran-#Pakistan #gas deal under question. Qatar's #LNG cheaper for Pakistan than Iran gas http://en.trend.az/business/energy/2496947.html …

As Pakistan blames the sanctions imposed on Iran for delaying gas intake from this country, however a Pakistani official claims there is another reason.

Pakistani Parliamentary Secretary for Petroleum and Natural Resources Shahzadi Umerzadi Tiwana said that Qatar's LNG price is lower than the price of Iran's natural gas. that of Iran.

In particular, she mentioned the recent $16-billion deal with Qatar, saying that Qatari LNG is low priced as compared to gas that Iran would be supplying to Pakistan.

According to Pakistani sources, LNG arriving in any particular month will fetch 13.37% of the preceding three-month average price of a Brent barrel (considering the present Brent price as a proxy, that would equate to $167.5 per 1000 cubic meters).

Comparing the figure with the revenues of Tehran gas deals with Turkey and Iraq, it indicates that Iranian gas wouldn't compete with Qatari LNG on Pakistani market.

In 2014 Iran was exporting gas to Turkey at above $420 per 1000 cubic meters, but the figure plunged to $225 currently due to low oil price. Iran previously said that the price of gas for Iraq would be similar to Turkey.

The price in Qatar-Pakistan's new LNG deal is very low. For instance, Tiwana said that the average price of LNG cargos imported so far by Pakistan State Oil (PSO) is $7.8224/MMBTU (million british thermal units). Converting BTU to cubic meters, then Pakistan imports 1000 cubic meters of gas at $291.

Pakistan said on February 10 that it had signed a 15-year agreement to import up to 3.75 million tons per year of LNG, or more than 14 million cubic meters per day (mcm/d) of natural gas from Qatar.

Iran also has a contract with Islamabad to export 22 mcm/d of gas to this country, while Pakistan should have started gas intake in January 2015, but yet to start construction of pipeline on its territory.

Tiwana didn't touch upon any plan regarding the Iran-Pakistan pipeline, but said that an agreement for laying gas pipeline for bringing LNG from Karachi to Lahore had already been signed between Pakistan and Russia with worth $2 billion, projected to be completed by December 2017. The project doesn't have anything to do with Iranian gas.

On the other hand, China is planning to start the construction of another pipeline from LNG terminals in Gwadar port to power plants in Navvabshah city (Pakistan).

This rout can help the realization of Iran-Pakistan gas deal, because Gwadar port has less than 100 km distance from Iranian borders, but the low Qatari LNG price may discourage Islamabad from such a move.

-

Comment by Riaz Haq on February 19, 2016 at 11:14am

-

International arbitration court rules #Iran should cut #gas price to #Turkey up to 15.8 pct. #Pakistan #Qatar #LNG http://af.reuters.com/article/energyOilNews/idAFL8N15H3CL …

Turkish Energy Minister Berat Albayrak confirmed on Tuesday that the International Chamber of Commerce (ICC) has ruled in favour of Turkey in a dispute with Iran on the gas price, ordering a cut of between 13.3 percent to 15.8 percent.

Speaking to reporters in Chile, where he is accompanying President Tayyip Erdogan on an official visit, Albayrak said the final price cut would be decided between the two parties based on the ICC's decision.

"Once this ruling takes effect, we will see a discount in (domestic) gas prices this year," he said in comments broadcast on Turkish state television TRT.

-

Comment by Riaz Haq on May 27, 2016 at 4:50pm

-

#Pakistan Energy Crisis Prompts #Engro to Boost #Energy Business With 2nd #LNG-fueled #Power Plant http://bloom.bg/25p6WLd via @business

Engro Corp., owner of Pakistan’s second-biggest fertilizer maker by value, plans to expand its power generation business and build a second liquefied natural gas terminal, betting a revival in economic growth will boost demand for electricity.

The Karachi-based company is looking at the possibility of constructing a 400 to 600 million cubic feet a day LNG terminal, through a partnership, for private sector companies, Chief Executive Officer Khalid Siraj Subhani, 62, said in an interview. It also plans to build a 450 megawatt LNG-fueled power plant for as much as $700 million, he said. Engro is also looking to invest overseas in energy and fertilizer after the firm sells stakes in existing businesses, he said.

“The idea is to keep expanding, there is a strong desire,” Subhani said in Karachi, Pakistan’s commercial capital. “There are so many elements we are working on, how they will materialize it depends, but the shift will happen toward energy.”

Engro is seeking to turn an energy crisis in South Asia’s second-largest economy into an opportunity as the government of Prime Minister Nawaz Sharif pushes to end shortages within two years. The nation is adding power plants with the help of Chinese investment and started importing gas last year with Engro building the nation’s first LNG terminal. Outages lasting 18 hours had led to street protests in Karachi as recently as June, while falling natural gas production at home forced companies to idle it’s plant.

-------

Engro is also considering investing in a fertilizer plant via a joint venture in North America or Africa, Subhani said. The target region will be identified by the year-end and the company wants to replicate a 72 megawatt power plant that it has already constructed and operate in Nigeria, with another facility planned in Africa’s largest economy and other possible projects in neighboring countries including Benin, he said.

“International projects will be less capital intensive, and rely more on our skills and expertise,” Subhani said. He would like to see its international businesses contribute about 20 percent of total revenue within 9 years.

Engro’s plan to expand abroad could be funded by selling stakes in its food, fertilizer and chemical businesses and the company may be able to raise $693 million at current prices, Danish Ali Kazmi, a senior research analyst at Alfalah Securities Ltd. in Karachi, said on May 23.

The company has also sought approval from the government to export as much as 1 million tons of fertilizer, with India being the most logical market after slowdown at home, according to Subhani.

Dutch dairy company Royal FrieslandCampina NV is conducting due diligence to buy 51 percent stake in Engro Foods Ltd. and ATS Synthetic Pvt. in Engro Polymer and Chemicals Ltd. It is also looking to sell up to 24 percent stake in Engro Fertilizers Ltd.

Engro’s shares rose 1.3 percent to 340.50 rupees, poised for their highest close since Aug. 11, at 10:48 a.m. in Karachi. This year Engro’s shares have risen 22 percent, outperforming the 12 percent gain of Pakistan’s benchmark index, the best performer in Asia after stake sale announcements. That’s despite the company’s 2015 annual 4.7 percent rise in revenue, the slowest rate in seven years.

“Fertilizer business is becoming increasingly more challenging,” said Muhammad Asim, chief investment officer at MCB-Arif Habib Savings & Investments Ltd. that manages 66 billion rupees in stocks and bonds. “Power will provide it that stability and potential to build up further.”

-

Comment by Riaz Haq on August 22, 2016 at 11:03pm

-

#Pakistan prepares its second #LNG import terminal http://reut.rs/2bL9MlS via @Reuters

http://www.reuters.com/article/pakistan-lng-idUSL3N1B41ST

Pakistan is taking another step towards becoming a key buyer of liquefied natural gas (LNG), signing a deal to purchase a Floating Storage and Regasification Unit (FSRU) for its second import terminal.

Singapore's BW Group said in a statement on Monday that it would deliver the FSRU to Pakistan GasPort Limited (PGPL) in the fourth quarter, as well as providing the terminal at Port Qasim, Karachi with LNG regasification services in a 15-year agreement.

The South Asian country has been earmarked as an up-and-coming demand outlet for the oversupplied LNG market. Along with Egypt and Jordan, Pakistan was a newcomer to the LNG import market in 2015, helping drive up demand and absorb growing world supplies from a wave of new projects.

The new import terminal will be able to receive 600 million cubic feet of natural gas per day and is expected to be commissioned for operations by mid-2017.

The terminal will reduce Pakistan's gas deficit by 30 percent and ensure fuel for 3,600 megawatts of new power generation plants being constructed in the country, said PGPL chairman Iqbal Ahmed.

Pakistan started up the 3.5 million tonnes per year Engro Elengy LNG terminal, the country's first LNG import facility, in Port Qasim last March. Pakistan shipped in a total of 1.02 million tonnes of LNG in 2015, and has imported 1.78 millions tonnes in the first seven months of this year.

"We are seeing weaknesses more in the North Asian market, and (South) Korea ... and a lot of the strong (demand) growth in where you might expect," said Neil Beveridge, a Hong Kong-based analyst at AB Bernstein, referring to emerging economies such as Pakistan.

Qatar, which signed two term supply contracts with Pakistan this year, is the country's largest LNG supplier.

-

Comment by Riaz Haq on August 31, 2016 at 8:36am

-

Floating liquefied natural gas terminals are key to #Pakistan’s #energy plan. #LNG http://on.wsj.com/2cqS8rj via @WSJ

Pakistan is taking on its acute energy shortage by dramatically ramping up imports of liquefied natural gas, while undertaking the longer-term goal of upgrading its energy infrastructure with new pipelines, refineries and storage facilities.

Key to Pakistan’s plan are floating terminals that will convert imported LNG into gas.

Costing less than half of building a traditional on-land terminal and faster to get up and running, the vessels anchor at ports, often on a long-term basis, and pipe gas into land-based pipeline networks, helping cash-strapped countries meet urgent energy needs. The floating import terminals have opened up new markets for LNG producers, who are under pressure from falling prices that have halved in the past two years due to a wave of new supply.

The country kick-started LNG imports in 2015, with Pakistani petrochemical and energy company Engro Corp. Ltd. leasing a floating import terminal, stationed in Karachi’s Port Qasim from where gas is piped into Pakistan’s local distribution system. A second terminal is planned for mid-2017 by a consortium led by Pakistan GasPort Ltd. Up to five such terminals are needed, said Sheikh Imran ul Haque, chief executive of the country’s biggest energy importer, Pakistan State Oil.

“Pakistan has not seen as much restructuring in its energy sector as what’s happening today in decades. And if we’re successful, there’s a potential investment of around $15 billion in refineries, pipelines, and the other projects coming in,” Mr. Haque said.

Mr. Haque said that Pakistan will be in the market within the next four months to buy around 4 million tons per year of LNG to supply its second import terminal. The LNG will most likely be purchased in a series of tenders at between 0.75-and-1.5 million tons apiece, Mr. Haque added.

Pakistan officials see LNG imports as providing fast relief.

The country of nearly 200 million people has long suffered from a lack of investment in its energy sector, causing hours of rolling supply cuts to homes and businesses daily. The U.S. Agency for International Development estimates that power shortages curb Pakistan’s economic growth by around 2% a year.

-

Comment by Riaz Haq on November 3, 2016 at 10:17pm

-

Next #LNG importing giant #Pakistan readies for buying spree of 600 billion cubic feet per day | ET EnergyWorld

http://energy.economictimes.indiatimes.com/news/oil-and-gas/next-ln...

Pakistan LNG Ltd has launched a mid- and a long-term tender to purchase a combined 240 shipments of liquefied natural gas (LNG), the company said on its website, as the country emerges to become a major gas importer.

Pakistan, which can only meet around two-thirds of its gas demand, is expected to issue further tenders seeking twice as much supply to fill out remaining capacity at its new import terminal at Port Qasim, in the commercial capital Karachi, according to one Pakistani energy expert.

The mid-term tender covers a period of five years and calls for 60 shipments, while the long-term tender is for 15 years and 180 cargoes, according to information presented in the tender documents released on the company's website on Tuesday.

Suppliers must submit bids by Dec. 20.

Pakistan has ploughed billions of dollars into LNG infrastructure, including the construction of a second LNG import terminal and pipelines linking Karachi with Lahore in the Punjab region, the nation's industrial heartland.

The current crop of tenders are a small part of Pakistan's projected demand as the country works to bring two more import terminals online within the next couple of years, making it a potent force in global gas markets.

The country first began buying LNG last year and has already contracted supplies from trading firm Gunvor and Qatargas, the world's biggest LNG producer.

Cheap gas is tempting out new importers from the Middle East to Africa and Asia, helping stave off a deeper price rout hurting producers' bottom lines.

Cheaper than fuel oil and cleaner-burning than coal, LNG suits emerging economies racing to bridge electricity shortfalls and support growth on tight budgets.

The Port Qasim LNG terminal, which is due to go online in mid-2017, has a capacity of 600,000 million cubic feet per day.

"This tender is for 200 million cubic feet. That means another 400 million will need to be tendered out soon," said the industry source.

A Pakistan LNG official in September said the country was working on commercial as well as government-to-government LNG deals.

-

Comment by Riaz Haq on March 19, 2017 at 8:20am

-

#India should revive #Iran-#Pakistan-India gas pipeline: #Indian Parliamentary Panel http://www.financialexpress.com/india-news/india-should-revive-iran... … via @FinancialXpress

India should consider reviving the long-delayed Iran-Pakistan-India (IPI) gas pipeline following easing of sanctions on Tehran, a Parliamentary panel has said. India had almost abandoned the IPI pipeline in 2008 following the US sanctions against Iran over its suspected nuclear programme and has instead pursued a rival line from Turkmenistan, passing through Afghanistan and Pakistan (TAPI pipeline).

“The government should examine the idea of reviving the (IPI) project as international conditions have become favourable following lifting of sanctions against Iran,” the Standing Committee on Petroleum and Natural Gas said in a report submitted to Parliament on Friday.

The Oil Ministry in its comments to the committee stated that IPI pipeline was envisaged to transport natural gas from South Pars gas field of Iran to Pakistan and India with a carrying capacity of 60 million standard cubic meters per day, to be equally split between India and Pakistan. “The total length of the pipeline up to Indian border (near Barmer) was about 2,135 km (1,100 kms within Iran and the rest within the territory of Pakistan),” the ministry said. “As per past estimates, investments required for this pipeline were in excess of $7 billion.”

There has been “little or no progress” in the IPI project since 2008 for a number of reasons, the Committee said in its report without elaborating.

India is pursuing transnational pipelines to meet rising energy needs. The country is reliant on imports to meet about half of its natural gas needs. The panel said a consortium for Turkmenistan-Afghanistan -Pakistan-India (TAPI) pipeline — TAPI Pipeline Company Ltd (TPCL) — was incorporated in Isle of Man, and shareholders’ agreement signed in December 2015.

Turkmenistan will own 85 per cent of TPCL while India, Pakistan and Afghanistan will each have 5 per cent stake. “The construction of pipeline has commenced in December 2015 and is likely to be completed in about 7 years,” it said.

It recommended that TAPI project be monitored closely in collaboration with other participating countries in order to ensure that the project is completed in time.

“The Committee feels that trans-national pipelines are important elements of national energy security and they need to be pursued vigorously,” the report added.

On April 7 last year the Investment Agreement (IA) of TPCL was signed in Ashgabat. “It relates to initial equity infusion by the shareholders. TPCL subsequently opened its office in Dubai, UAE and has been holding its board meetings,” the ministry said in its submission to the panel.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

IDEAS 2024: Pakistan Defense Industry's New Drones, Missiles and Loitering Munitions

The recently concluded IDEAS 2024, Pakistan's Biennial International Arms Expo in Karachi, featured the latest products offered by Pakistan's defense industry. These new products reflect new capabilities required by the Pakistani military for modern war-fighting to deter external enemies. The event hosted 550 exhibitors, including 340 international defense companies, as well as 350 civilian and military officials from 55 countries.

Pakistani defense manufacturers…

ContinuePosted by Riaz Haq on December 1, 2024 at 5:30pm — 2 Comments

Barrick Gold CEO "Super-Excited" About Reko Diq Copper-Gold Mine Development in Pakistan

Barrick Gold CEO Mark Bristow says he’s “super excited” about the company’s Reko Diq copper-gold development in Pakistan. Speaking about the Pakistani mining project at a conference in the US State of Colorado, the South Africa-born Bristow said “This is like the early days in Chile, the Escondida discoveries and so on”, according to Mining.com, a leading industry publication. "It has enormous…

ContinuePosted by Riaz Haq on November 19, 2024 at 9:00am

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network