PakAlumni Worldwide: The Global Social Network

The Global Social Network

Will Pakistan Take Advantage of Historic Low LNG Prices?

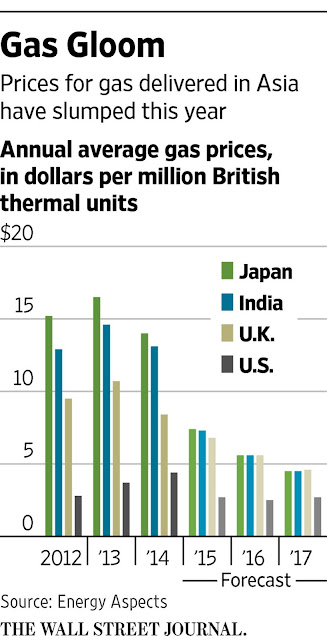

With softening demand from China and 130 million tons per year (mmpta) of additional LNG supply set to reach market over the next five years, gas research firm Wood Mackenzie sees continuing downward pressure on global LNG spot prices.

|

| LNG Price History Source: WSJ |

“The entire industry is worried because it is hard to tell when China’s demand will pick up again,” said an LNG strategist at a Malaysian energy company who attended the Wood Mackenzie conference in Singapore, according to Wall Street Journal. “Rising demand from smaller countries such as Pakistan, Egypt and Bangladesh is not enough to offset the declining demand from north Asia.”

As recently as two years ago, LNG shipped to big North Asian countries like Japan and Korea sold at around $15 to $16 a million British thermal units. This month, the price has already hit $6.65 a million BTUs, down 12% from September, according to research firm Energy Aspects. It expects prices to fall further in Asia next year, to under $6 per million BTUs, as a wave of new gas supply in countries from the U.S. to Angola to Australia comes on line, according to Wall Street Journal.

Petronet LNG Ltd, India’s biggest importer of liquefied natural gas (LNG), is saving so much money buying the commodity from the spot market that it’s willing to risk penalties for breaking long-term contracts with Qatar.

This is a great opportunity for Pakistan to take advantage of historically low LNG prices to alleviate its severe load-shedding of gas and electricity. Recently, Pakistan has launched its first LNG import terminal in Karachi and started receiving shipments from Qatar. Pakistan has also signed a $2 billion deal with Russians to build a north-south pipeline from Gwadar to Lahore. But the country needs to rapidly build up capacity to handle imports and distribution of significant volumes of LNG needed to resolve its acute long-running energy crisis.

Here's a related video discussion:

http://dai.ly/x3ccasi

Pakistan Local Elections; Indian Hindu... by ViewpointFromOverseas

https://vimeo.com/144586144

Pakistan Local Elections; Indian Hindu Extremism; LNG Pricing; Imra... from WBT TV on Vimeo.

https://youtu.be/LZavD-tkReg

Related Links:

Haq's Musings

Pakistan's Twin Energy Crises of Gas and Electricity

Affordable Fuel For Pakistan's Power Generation

Pakistan Shale Oil and Gas Deposits

China-Pakistan Economic Corridor

Blackouts and Bailouts in Energy Rich Pakistan

Pakistanis Suffer Load Shedding While IPPs Profits Surge

-

Comment by Riaz Haq on October 31, 2015 at 9:51am

-

#LNG glut to steal coal market share as gas replaces #coal in power generation. #Pakistan #India #China http://reut.rs/1HdNoIQ via @Reuters

* LNG competition to cast doubt over new coal power capacity

* LNG supply to grow by 35 mln tonnes in 2016-Energy Aspects

By Sarah McFarlane

LONDON, Oct 29 (Reuters) - A wave of liquefied natural gas due to hit energy markets over the next couple of years is expected to displace tens of millions of tonnes coal demand globally, helped by government initiatives to move away from polluting power generation.

Both coal and LNG are oversupplied after higher prices during the past decade triggered investments in new projects and expansion plans. At the same time the gap between their prices has narrowed as LNG has become more competitive, particularly where governments penalise coal via taxes or emissions trading schemes.

"There is a monstrous amount of LNG coming into the market, on pure cost economics you can say coal is cheaper than LNG at any realistic price, but it's going to be used somewhere and if it is coming in the volume that's forecast, it will be displacing coal," a coal trader said.

"New coal generating capacity is less likely to be realised in a world awash with LNG."

One of the biggest factors in how much switching occurs will be what the world's largest coal consumer China does.

Environmental concerns and a desire to help financially distressed domestic coal miners has led to a dramatic fall in Chinese coal imports, with shipments down 30 percent in the first nine months of the year, compared with the same period a year ago.

Smog has emerged as a major problem for the government, which has relied on coal and highly polluting heavy industries to fuel its economic growth, especially in northern regions.

"In China, gas will be cheap, gas will be oversupplied, LNG will be oversupplied for the next 3-5 years and that will give an opportunity for policymakers to work harder to switch from coal to gas, but it will take time," said Torbjörn Törnqvist, chief executive of Swiss-based trade house Gunvor.

"Everyone in Beijing knows what the problem with coal fire stations in China is and they will go for gas."

Beyond China, Europe is also seen as a region where switching is likely to take place.

Trevor Sikorski, an analyst at consultancy Energy Aspects, said around 130 million tonnes of thermal coal was vulnerable to being replaced by gas for power generation on an annual basis in Europe.

Sikorski suggested that given the amount of new LNG projects due to come on line in the coming two years, gas prices could be low enough to encourage this level of switching by 2017.

Energy Aspects forecasts some 35 million tonnes of additional LNG supply hitting the market next year, a 16 percent increase on 2015.

Earlier this month oil and gas industry bosses again urged governments to ditch coal in favour of less polluting natural gas, which emits around half of the CO2 coal does, in power plants and heavy industry.

"LNG will continue to cannibalise the coal market, coal's not going to die, but it's hard to be bullish," said Jeffrey Landsberg, managing director of U.S. based consultancy Commodore Research. (Reporting by Sarah McFarlane, editing by David Evans)

-

Comment by Riaz Haq on November 3, 2015 at 7:51am

-

#Pakistan-#Qatar deal on #LNG purchase to be signed on November 15, 2015 https://shar.es/15sGpo via @sharethis

Qatar and Pakistan will sign historical deal for the provision of Liquefied Natural Gas (LNG) in the mid of November and immediately after that the supply of LNG to Pakistan will be started through ships.

The Jang Group has achieved the bullet points of this agreement. According to the agreement the Economic Coordination Committee of the Federal Cabinet will give approval to this 15-year deal for the purchase of LNG from Qatar at its meeting on Thursday (November 5) which will be presided over by Finance Minister Ishaq Dar. Federal Minister for Petroleum and Natural Resources Shahid Khaqan Abbasi will give briefing to the meeting regarding the LNG agreement. He will tell the meeting that Qatar will supply three million ton LNG to Pakistan through 52 ships annually. The price of the LNG will be attached to the price of Brent crude oil.

Qatar will provide 400 million cubic ft natural gas daily to Pakistan which is equal to the present production of Sui gas field. The natural gas made by LNG will be provided to nine IPPS. These nine IPPs will produce approximately 1800MW power daily through LNG.

Besides these nine IPPs the natural gas produced by this LNG will be provided to Nandipur Power Plant from March 2016 and this will decrease 25% per unit cost of production of power in Nandipur.

The natural gas produced by LNG will also be provided to fertilizer factories including Pak-Arab Fertilizer and Daud Hercules Fertilizer which would help them produce Urea fertilizer and Phosphate Urea.

This gas will also be supplied to CNG stations. Pakistan has been importing LNG from different sources including Australia, Nigeria, New Guinea, Spain and Belgium and also from Qatar since March 26, 2015.

The private sector of fertilizer has purchased three ships so far and one ship of LNG has been purchased by owners of the CNG stations.

According to the agreement Qatar will provide four ships of LNG every month. The LNG will be provided to brass and textile industries that are ready to buy LNG. The wheel of industry will start booming through such move. This will also create job opportunities for skilled, unskilled and unemployed manpower. It is also expected that gas loadshedding will decrease greatly for domestic consumers with provision of LNG to other sectors.

-

Comment by Riaz Haq on November 9, 2015 at 11:50am

-

#Pakistan Minister Shahid Khaqan Abbasi finalizes $16 billion #LNG deal with #Qatar for 1.6 billion tons a year. http://af.reuters.com/article/nigeriaNews/idAFL9N0VZ00F20151109 …

DOHA Nov 9 (Reuters) - Pakistan has finalised a $16 billion liquefied natural gas (LNG) deal with supplier Qatar and shipments are expected to begin next month, Pakistani energy minister Shahid Khaqan Abbasi said on Monday.

The amount is 1.5 million tonnes per year, the minister said, adding that the two sides had agreed a price.

The two sides have agreed a price, he said without elaborating.

"We have finalised the deal. The first shipment is expected in December," he said. "We are hopeful for similar deals in the future." - Reuters

-

Comment by Riaz Haq on December 3, 2015 at 12:29pm

-

Purchasing LNG from the government of Qatar at the rate of $8.64/mmBtu on the basis of a long-term agreement was an ill-considered and non-transparent move that our government was, until recently, ready to embark upon. Relenting to public criticism, the government has now called for bids to make the purchase. However, the big question remains.

LNG is a very expensive option for importing energy. As it comes out of the ground it first has to be cooled to minus 180 degrees centigrade to turn it into liquid form. This is a highly expensive operation. Transport of LNG from one place to another requires specialised ships, which charge high rates. For loading and unloading these ships need special terminals where the liquid gas is turned into ordinary gas for industrial and domestic use before it can be pumped into our gas pipelines. These are prohibitively energy consuming and costly processes.

Besides, there are pipeline losses along the way, not to mention transportation losses and costs. Thus a consignment that costs $8.5/mmBtu in Qatar may well cost a consumer, in say Multan, $11.5/mmBtu after taking into account all the transport costs.

We just need to look at the international index for LNG as we can find for Brent oil. There are a number of international price indices for gas. The Henry Hub in the US currently prices gas at $2.13/mmBtu, the TTF index in France and Holland currently price gas at $5.3/mmBtu in pipeline ex-France. All are considerably lower than the $8.64/mmBtu quoted in the press as import price from Qatar.

Instead of importing LNG, the most economical option would be to rely on gas in Pakistan. Currently our proven reserves are approximately 40 tcf of which some has been consumed. We also have approximately 105 tcf of unconventional shale or tight gas, and this is yet to be explored. Our neighbours Iran (1300 tcf) and Turkmenistan (600 tcf) hold the second and fourth largest gas reserves in the world (Qatar with 900 tcf has the third largest), whereas the Turkmenistan-Afghanistan-Pakistan-India (Tapi) pipeline is still at feasibility stage.

Iran has already extended its pipeline to our border and is offering gas at approximately $3.5/mmbtu to potential investors in Iran. If we add transportation costs it would cost approximately $5.5-6/mmBtu in Punjab as opposed to $11.5/mmBtu for Qatar LNG.

How much more expensive would LNG be? If we take 5,000MW as the additional installed power capacity that would run on gas, the demand for gas as fuel would be approximately 180 million mmBtu per annum. As mentioned above, the difference in cost between pipeline gas from Iran or other sources would be $5.5/mmBtu ($6/mmBtu as opposed to $11.5/mmBtu from LNG – at the power plant). Thus this would add approximately $1 billion per annum to the fuel cost or $20 billion for the lifetime of these projects. This money would be far better used for developing much needed social or physical infrastructure or for improving our security.

Is there an urgent need to sign a long-term sale agreement? Due to faulty design our lone LNG terminal cannot receive (and has not received) any LNG carriers as the approach channel needs to be deepened and widened. This will take almost one year and cost around $100m. Therefore until this is sorted out a long-term purchase agreement cannot be effective. The current ad-hoc arrangement of sending the Floating Storage Regasification Unit (FSRU) to Qatar every two weeks for refilling can easily continue at spot rates as this at best is an interim arrangement.

http://www.thenews.com.pk/Todays-News-9-353221-The-LNG-cost

-

Comment by Riaz Haq on December 19, 2015 at 7:10pm

-

GLOBAL #LNG-February 2015 prices dip to between $6.90-$7.00 per mmBtu as #Pakistan nears 120 cargo award http://af.reuters.com/article/energyOilNews/idAFL8N1473J620151218 …

Asian liquefied natural gas (LNG) prices eased this week as two companies emerged as the front-runners to supply Pakistan with 120 cargoes between 2016 and 2020.

The price of Asian spot cargoes for February delivery was pegged at between $6.90-$7.00 per million British thermal units (mmBtu), down from around $7.10 per mmBtu last week.

Shell and trading house Gunvor are on course to supply Pakistan with 120 cargoes after both companies submitted the lowest offers in two highly sought after tenders.

Jordan's National Electric Power Company (NEPCO) said its floating LNG import terminal was back working at full capacity after adverse weather disrupted operations earlier this month.

NEPCO declared force majeure on the terminal on Dec. 5 due to strong winds requiring it be moved away from the jetty, a spokeswoman for the company said.

Gas supplies to both Jordan and Egypt were disrupted for a few days before the plant initially resumed operation at half capacity, and then finally full capacity, the spokesperson said.

Nigerian exports of LNG are recovering after a disruption in loadings last week led to reduced flows compared with November averages.

LNG exports in November averaged 20 million tonnes/year (mt) while December is averaging just 16 mt/year, according to one industry source. (Reporting by Oleg Vukmanovic in Milan and Sarah McFarlane in London, editing by William Hardy)

-

Comment by Riaz Haq on December 24, 2015 at 7:47pm

-

#Pakistan's gasoline demand set for strong double digit growth, imports to rise - Oil | Platts News Article & Story http://www.platts.com/latest-news/oil/karachi/feature-pakistans-gas... …

According to estimates from the petroleum ministry, gasoline demand is expected to grow by 15% year on year to 5.3 million mt (around 39.5 million barrels) in fiscal 2015-2016 (July-June) led by low prices, non-availability of compressed natural gas and a rise in auto sales.

In 2016-17, demand is expected to rise 11% on the year to 5.9 million mt, government officials estimated.

"To compete effectively in the market and ensure timely product availability, PSO has to import more Mogas in the coming years in view of the expected increase in demand," Sheikh Imranul Haq, managing director of Pakistan State Oil, told Platts Wednesday. PSO is the largest oil marketing and distribution company in Pakistan.

"Currently we are importing on average three cargoes per month, but this can go up to four or five by next year," he said.

Of the 4.6 million mt of gasoline Pakistan consumed in the fiscal year ended June 2015, only 1.5 million mt was produced domestically, with the remaining 3.1 million mt, or 67% imported, according to ministry data.

Though Pakistan is expected to see an increase in domestic gasoline output next year, this will not be enough to compensate for the rise in demand.

The 46,000 b/d Attock Refinery will lift its gasoline production from 30,000 mt/month to 50,000 mt/month by March 2016, while the 50,000 b/d Pakistan Refinery has already doubled gasoline production from 11,000 mt/month to 22,000 mt/month.

"Since refinery production is not expected to increase drastically, PSO will have to rely on imports," Haq said.

KEY FACTORS

Lack of availability of CNG led by stagnant domestic production and delays in LNG imports has been a major factor driving up gasoline demand in the country.

Natural gas production in the country has been at standstill at 4.2 Bcf/day over the past two years, while demand has risen substantially.

The CNG sector needs around 450,000 Mcf/d of gas to meet demand, but owing to lack of gas availability and diversion to residential customers, gas supply to CNG pumps ranges between 380,000 Mcf/day to 400,000 Mcf/day, Ghaiss Abdullah Paracha, chairman of the All Pakistan CNG Association said by telephone from Islamabad.

The retail price of gasoline has fallen to Pakistan Rupees 77 ($0.6)/liter from Rupees 114/liter in November 2014 following the sharp drop in international crude oil prices.

"The surge in oil consumption hinged around the global crude price. However, the trend and international developments like OPEC maintaining the crude oil supplies indicate that low domestic price would stay for long," said Nauman Ahmad Khan, head of research at Karachi-based brokerage house Foundation Securities, adding that rising vehicle sales would also help consumption over coming years.

During the fiscal year ended June 30, 2015, car sales recorded growth of 31% year on year to 179,953 units. And in the four months to October 2015, sales shot up 67% year on year, said Muhammad Tahir Saeed, senior research analyst at Karachi based brokerage house Topline Securities.

LNG AN OPTION

Some industry officials, however, said that the growth in petroleum products demand might not be as much as estimated by the government as CNG pump owners have successfully lobbied the government to import LNG independently, instead of depending on the state run companies Pakistan State Oil and Sui Northern Gas.

Pakistan's overall oil products demand in 2014-15 period was 22 million mt, up from 21.44 million mt the previous year. In the year ending June 30, 2016, consumption is expected to rise to 22.8 million mt, while in the year ending June 2017 it would rise to 23.5 million mt, government officials estimated.

-

Comment by Riaz Haq on January 13, 2016 at 8:46am

-

#Pakistan ready with last part of #LNG pipeline link to #Iran http://www.thenational.ae/business/energy/pakistan-ready-with-last-... … via @TheNationalUAE

Pakistan is ready to complete the short final pipeline spur that would enable it to import natural gas from Iran once sanctions are lifted, according to the head of one of Pakistan’s state energy companies.

“In the very near future we expect delegations from the two countries to meet,” said Zahid Muzzafar, the chairman of Oil and Gas Development Company, which is government-controlled, but has publicly traded shares on the Karachi and London exchanges.

“Once we get the right signals from the international community and our own government’s decision we are all set to build that pipeline,” Mr Muzzafar said, referring to the expected lifting of international sanctions related to Iran’s nuclear programme that have restricted its oil and gas exports since 2011. Final clearance is expected this month.

The pipeline spur would run from Pakistan’s port city of Gwadar, where it has nearly completed its first liquefied natural gas (LNG) intake plant, to Iran’s border 80 kilometres away. Pakistan has a rapidly growing need for natural gas and is also building a pipeline from Gwadar to the middle of the country as part of a network of pipelines that will include supply via Turkmenistan–Afghanistan–Pakistan–India Pipeline, or Tapi.

Pakistan has long-term aims to be an energy transit country uch as Turkey, which connects central Asian oil and gas supplies to Europe and the rest of the world via pipelines that include the one that terminates at the Mediterranean port of Ceyhan. Pakistan’s strategy would link supplies in central Asia, including Turkmenistan, as well as Iran – which rivals Russia as the world’s largest holder of gas reserves, to the huge markets in China and India, as well as serving its own growing demand.

Mr Muzzafar said additional supplies from Iran can be linked into the system that is being developed currently, which includes a US$2.5 billion project to complete the LNG terminal at Gwadar and pipeline it 700km to Pakistan’s mid-country, terminating at Nawabasah.

First LNG cargo was bought on the spot market from Qatar. Pakistan has tendered for 60 cargoes over five years. Mr Muzzafar said, and the first successful bidders were Gunvor, a Russian-owned trading house, and Royal Dutch Shell.

The China-Pakistan Economic Corridor, a $46bn multi-pronged mega project, plans to link Gwadar, Khuzdar and other western Pakistan areas via roads, rail and pipelines to Dera Ghazi Khan, Dera Ismail Khan and Peshawar in the east, and onto the western Chinese city of Kashgar, 3,000km away

-

Comment by Riaz Haq on January 14, 2016 at 9:41pm

-

Shell to lose $1billion #LNG contract as #Qatar offers #Pakistan lower price

http://tribune.com.pk/story/1027664/short-term-lng-supply-shell-to-... …

Energy giant Royal Dutch Shell is going to lose a five-year liquefied natural gas (LNG) supply contract worth over $1 billion as a Qatari company has agreed to provide the commodity at a lower price to Pakistan.

Gunvor and Royal Dutch Shell had won supply contracts in response to the two tenders floated by Pakistan State Oil (PSO) a few weeks ago for bringing 120 LNG cargoes over a period of five years.

ECC likely to give green light to multibillion dollar LNG deal

Gunvor offered to bring 60 cargoes at 13.37% of Brent crude price whereas Shell quoted 13.8% of Brent crude price for another 60 cargoes.

During negotiations after the opening of bids, Qatargas agreed to match the price offered by Gunvor, which was the lowest, prompting the government to consider scrapping the contract with Shell and award it to the Qatari company.

This was disclosed in a meeting of the Economic Coordination Committee (ECC) on Wednesday this week, which approved a long-term LNG supply agreement worth $15 billion.

The ECC was told that the government would save a substantial amount by transferring the contract won by Shell to Qatar at a lower price. However, Gunvor’s contract will remain intact.

Long-term LNG supply deal still awaited

In the tenders, nine trading firms including commodities giant Vitol, Glencore, Trafigura, Marubeni and US-based Excelerate Energy had submitted bids but all were rejected.

Owing to the plunge in crude oil prices, Shell is focusing on LNG business in the world market. During the previous Pakistan Peoples Party government too, Shell had tried to strike an LNG deal with Pakistan, but failed due to a controversy over the Mashal LNG project, which landed in the Supreme Court.

Pakistan produces 4 billion cubic feet of natural gas per day (bcfd) against demand for over 6 bcfd. The government considers LNG as a fast-track source to bridge the growing energy shortfall.

The lower price offer on the part of Qatar came after Petroleum and Natural Resources Minister Shahid Khaqan Abbasi visited Doha on January 6 and sought a reduction in the LNG rate. Qatar agreed to match the price offered by Gunvor for the short-term supply contract spread over five years.

Pakistan inks LNG deal worth $16b with Qatar

Earlier, Pakistan and Qatar had finalised a long-term supply deal at 13.9% of Brent crude price. The two sides are going to sign a commercial agreement as the ECC has given the go-ahead. Reports suggested that India had struck an LNG deal with Qatar at the lowest price, but Petroleum Minister Abbasi insisted the Indian price was 20% higher compared to the rate agreed between Islamabad and Doha.

Under the proposed arrangement, the long-term LNG supply contract will be for 15 years, but it will be renegotiated after 10 years. The two sides can end the contract if they fail to develop consensus over the price.

Every three months past price of LNG would be taken to calculate the price with Qatar.

As part of the agreement, PSO will receive 1.5 million tons of LNG from Qatargas in the first year and the annual volume will be enhanced to 3 million tons from the second year.

-

Comment by Riaz Haq on January 14, 2016 at 9:42pm

-

Global demand for #LNG drops on weak demand in Asia, increased production and record low prices #Pakistan

http://on.wsj.com/1RCOHKZ via @WSJ

Asia represents more than 70% of world-wide demand for LNG, but Wood Mackenzie said demand from the region’s largest buyers dropped in 2015, including a first-ever decline in shipments to China, which dropped more than 1%, after years of double-digit growth. South Korean imports of LNG fell 11% on the year and shipments to Japan, the world’s single largest market, declined 4%, the report said.

That was offset by growing demand from newer importers such as Egypt, Jordan and Pakistan, the report said.

Lower prices for LNG will likely spur increased demand from other markets, including those with under-utilized LNG import capacity, such as the Britain and continental Europe, Mr. Giles said. “New LNG [production] will compete with existing gas pipelines in the European market from suppliers like Norway and Russia,” he said.

Longer-term, lower LNG prices will prompt emerging markets outside of traditional buyers in Asia to build infrastructure needed to import LNG. It can take as little as six months to install a ship-based offshore regasification facility, Mr. Giles said.

-

Comment by Riaz Haq on February 1, 2016 at 10:18pm

-

#LNG price could be de-linked from #oil prices for contracts. LNG producers resist fearing further price collapse

http://www.economist.com/news/finance-and-economics/21689644-it-wil... …

Analysts believe that, as a result, the pricing mechanism for natural gas is on the verge of change, and that a real global market will start to emerge, adding Asian trading hubs to those in America and Europe. This should spur the spread of natural gas, the cleanest fossil fuel and one that should be in the vanguard of the battle against global warming. But producers, who fear any change will lead to a drop in prices, are set to resist. They say long-term oil-linked contracts are still needed to offset the risk of their huge investments in LNG. (Gazprom, a Russian producer, has made the same argument in Europe about pipelines.)

Long-term and cyclical shifts explain why the gap between the two fossil fuels has widened. The LNG trade has grown massively in the past decade (see map). Adrian Lunt of the Singapore Exchange says LNG now rivals iron ore as the world’s second-biggest traded commodity, after oil. In the past 40 years natural gas’s share of the energy mix has grown from 16% to more than 21%. Oil’s has shrunk. Gas generates 22% of the world’s electricity; oil only 4%. It might make more sense to tie the price of natural gas to coal, against which it competes as a power source.

Moreover, during the current decade, the outlook for gas prices has become even more bearish than for oil. Sanford C. Bernstein, a research firm, reckons global LNG supply will increase by about a third over the next three years, pushing overcapacity to about 10%. (There is far less spare capacity in the oil market.) At least $130 billion of this investment in supply is in Australia, which within a few years will overtake Qatar as the world’s largest LNG producer. America will also add to the surplus. Its first, much-delayed LNG exports are due to be shipped from the Gulf Coast in weeks.

Investment in the liquefaction trains, tankers, regasification terminals and other paraphernalia needed to ship natural gas was boosted by a surge in demand from Asia. Japan and South Korea scrambled for LNG after Japan’s Fukushima disaster in 2011 forced them to shut down nuclear reactors. China saw LNG as a way to diversify its energy sources and curb pollution from coal. Last year, however, those countries, which account for more than half of global LNG consumption, unexpectedly slammed on the brakes.

The subsequent supply glut means that the spot price of gas in Asia has plunged. Those buyers who took out long-term oil-indexed contracts when crude was much higher are suffering. Mel Ydreos of the International Gas Union, an industry body, says that Chinese firms saddled with such contracts are urging suppliers to renegotiate them. He notes that a Qatari company recently agreed to renegotiate a long-term contract with an Indian buyer, cutting the price by half.

The drop in Asian prices has brought the cost of natural gas traded in different parts of the world closer to each other. America is an outlier. Thanks to the vast supplies unleashed by the shale revolution, its Henry Hub benchmark is by far the world’s cheapest, at just over $2 per million British thermal units (MBTU). But add liquefaction and transport costs, and American LNG prices rise above $4 per MBTU. In Europe and Asia they are a dollar or two higher. A few years ago the range would have been much wider, from $5 at Henry Hub to $19 in Asia. More homogenous prices are an important step towards a globalised market, says Trevor Sikorski of Energy Aspects, a consultancy.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Trump Administration Seeks Pakistan's Help For Promoting “Durable Peace Between Israel and Iran”

US Secretary of State Marco Rubio called Pakistan Prime Minister Shehbaz Sharif to discuss promoting “a durable peace between Israel and Iran,” the State Department said in a statement, according to Reuters. Both leaders "agreed to continue working together to strengthen Pakistan-US relations, particularly to increase trade", said a statement released by the Pakistan government.…

ContinuePosted by Riaz Haq on June 27, 2025 at 8:30pm — 3 Comments

Clean Energy Revolution: Soaring Solar Energy Battery Storage in Pakistan

Pakistan imported an estimated 1.25 gigawatt-hours (GWh) of lithium-ion battery packs in 2024 and another 400 megawatt-hours (MWh) in the first two months of 2025, according to a research report by the Institute of Energy Economics and Financial Analysis (IEEFA). The report projects these imports to reach 8.75 gigawatt-hours (GWh) by 2030. Using …

ContinuePosted by Riaz Haq on June 14, 2025 at 10:30am — 3 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network