PakAlumni Worldwide: The Global Social Network

The Global Social Network

US Promoting Venture Capital for Pakistani Entrepreneurs

US is providing $80 million to create multiple VC and PE funds in Pakistan. These funds will be run by professional fund managers who will be required to manage and raise additional money from other sources to start multiple funds. US Embassy in Islamabad told Express Tribune that they expect that "there will be substantial interest from local, regional and international investors”.

Polish Model:

The initiative is based on the Polish American Enterprise Fund model which was started with $140 million from US government and has now grown to several billion dollars of investable funds, according to Express Tribune.

US AID's Theodore Heisler said that co-investment was essential in bringing the size of each fund to a level where it can cover operating expenses.

The funds will focus on investing in small and medium entrepreneurial companies which, the US Silicon Valley experience has demonstrated, are major drivers of innovation, economic growth and job creation.

History of VC and PE Funds:

In 2010, the Overseas Private Investment Corporation (OPIC) provided JSPE Private Equity Fund II $50 million with a target capitalization of $150 million.

Venture capital investing is not entirely new in Pakistan, according to Venture Beat. Silicon Valley insiders like Reid Hoffman, Mark Pincus and Joe Kraus, along with Draper Fisher Jurvetson (DFJ) and EPlanet Ventures have already started. In 2003, Hoffman, Pincus and Kraus invested in Monis Rahman, a Pakistani-American who left Intel for entrepreneurship. Rahman had successfully launched and sold a start-up in the Bay Area, eDaycare.com.

There are several investment firms in Pakistan, such as BMA Capital, Indus Basin Holdings and JS Private Equity, that offer examples of professionally managed funds. In addition, there are Social Entrepreneurial Funds like Acumen Fund, Dawood Foundation and Kashf Foundation which are very active in the SME sector in Pakistan.

Opportunity in Pakistan:

Pakistan has the world’s sixth largest population, seventh largest diaspora

and the ninth largest labor force. With rapidly declining fertility and

aging populations in the industrialized world, Pakistan's growing

talent pool is likely to play a much bigger role to satisfy global

demand for workers in the 21st century and contribute to the well-being

of Pakistan as well as other parts of the world.

With half the population below 20 years and 60 per cent below 30 years,

Pakistan is well-positioned to reap what is often described as

"demographic dividend", with its workforce growing at a faster rate than

total population. This trend is estimated to accelerate over several

decades. Contrary to the oft-repeated talk of doom and gloom, average

Pakistanis are now taking education more seriously than ever. Youth

literacy is about 70% and growing, and young people are spending more

time in schools and colleges to graduate at higher rates than their

Indian counterparts in 15+ age group, according to a report on

educational achievement by Harvard University researchers Robert Barro and Jong-Wha Lee. Vocational training is also getting increased focus since 2006 under National Vocational Training Commission (NAVTEC) with help from Germany, Japan, South Korea and the Netherlands.

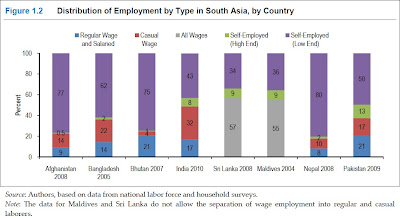

A 2012 World Bank report titled "More and Better Jobs in South Asia"

shows that 63% of Pakistan's workforce is self-employed,

including 13% high-end self-employed. Salaried and daily wage earners

make up only 37% of the workforce. Even if one chooses to consider just the 13% who are high-end self-employed as entrepreneurs, it's still a significant population willing to take risks who can do better with greater availability of venture and private equity money.

A recent Pew Survey of 21 countries

reported that 81% of Pakistanis believe in hard work to achieve

material success. Americans are the second most optimistic with 77%

sharing this belief followed by Tunisians (73%), Brazilians (69%),

Indians (67%) and Mexicans (65%).

Conclusion:

Promoting venture capital and private equity investments in Pakistan is a welcome initiative. It has the potential to unleash funding of new profitable ideas in small and medium size entrepreneurial businesses for significant returns to investors while also helping Pakistan achieve much needed economic stimulus with new jobs to lift more people out of poverty.

Related Links:

Haq's Musings

Pakistanis Lead the World in Faith in Hard Work

Entrepreneurial Pakistanis

Financial Services Sector in Pakistan

Venture Capital Investing in Pakistan

Minorities are Majority in Silicon Valley

String Food and Beverage Demand Draws Investments to Pak Agribusiness

Strong Earnings Propel Pak Shares to New Highs

Pakistan's Underground Economy

Tax Evasion Fosters Aid Dependence

Poll Finds Pakistanis Happier Than Neighbors

Pakistan's Rural Economy Booming

Pakistan Car Sales Up 61%

Resilient Pakistan Defies Doomsayers

-

Comment by Riaz Haq on October 5, 2012 at 11:05pm

-

Here's a Gulf Daily story on Pakistan's new rules for sukuk:

SYDNEY: Pakistan's regulator has issued new draft rules for the issuance of sukuk, or Islamic bonds, as part of a range of initiatives to boost the Islamic banking sector in the country.

Under the rules, sukuk will have to be structured to comply with standards of the Bahrain-based Accounting and Auditing Organisation for Islamic Finance Institutions(AAOIFI), as well as those set by the local regulator.

The draft rules also include requirements for disclosure of information about the issuers and for the issuers to appoint Islamic scholars who vet the sukuk structures.

There is a consultation period on the draft until October 15.

The number of individual sukuk issues in Pakistan has shrunk in recent years, despite the rapid growth of issuance globally, which is projected by Commerzbank to exceed $100 billion this year.

Last year, the Pakistani sukuk market was led by three sovereign sukuk which raised a combined 163.6bn rupees ($1.72bn), according to securities commission data.

Three corporate sukuk raised a combined 5.4bn rupees. This compares with 21 sukuk in 2007, most of which were corporate, raising a combined 49.3bn rupees. In 2008 there were 18 sukuk which raised 31.9bn rupees.

AAOIFI standards indicate how Islamic financial products should be structured; following the standards could increase the interest of foreign investors in investing in Pakistani sukuk.

Pakistan aims to lift Islamic finance's share of its banking sector through a series of reforms. Last month the central bank said it was developing a five-year plan for Islamic banking.

The country is introducing new rules for takaful (Islamic insurance) designed to increase competition.

http://www.gulf-daily-news.com/NewsDetails.aspx?storyid=339152

-

Comment by Riaz Haq on January 13, 2013 at 8:38pm

-

Here's PakObserver on US support for entrepreneurship in Pakistan:

Friday, January 11, 2013 - Islamabad—US Ambassador Richard Olson affirmed that the United States will continue to support the development of Pakistan’s entrepreneurs, including through the U.S. Ambassador’s Fund, during a visit to the National University of Sciences and Technology’s (NUST) Technology Incubation Center on Thursday.

“We all know that societies thrive when their people have ample opportunity, and this is why the United States supports young entrepreneurs in Pakistan,” said Ambassador Olson during a tour of NUST’s state-of-the-art Technology Incubation Center.

While at NUST, Ambassador Olson announced that the U.S. Ambassador’s Fund, which supports small-scale, high-impact programs for communities throughout Pakistan, will now also focus on support to Pakistan’s entrepreneurs. The U.S. Embassy also recently unveiled an entrepreneurship program called Khushhali Ka Safar (Journey to Prosperity), which provides support to innovative Pakistani entrepreneurs by connecting them with American investors and mentors, particularly from the Pakistani-American diaspora and academic institutions.

Ambassador Olson highlighted NUST’s future Center for Advanced Studies, which will focus on Pakistan’s energy needs, and is being established together by the Governments of Pakistan and the United States. Three Centers will eventually be established across the country. “These Centers, a five-year, $127 million program funded by the U.S. Agency for International Development, will promote the development of Pakistan’s water, energy, and agriculture sectors through applied research, training, university linkages, and contributions towards policy formation. We look forward to promoting entrepreneurship and innovation through the strong links each center will have with the private sector,” said the Ambassador.

In addition, the United States recently launched the multi-year Pakistan Private Investment Initiative. Drawing on public-private partnerships, this initiative will spur job growth and economic development by expanding access to capital for Pakistan’s small- to medium-sized companies.Another U.S. program, the Pakistan Firms Project, helps to increase the profitability and incomes of small and medium-sized businesses in vulnerable areas by identifying and removing constraints to private-sector job growth in key areas such as agriculture, livestock, minerals, and tourism.

-

Comment by Riaz Haq on May 7, 2013 at 9:04pm

-

Here's a Dawn report on Startup Grind launch in Karachi:

Originally founded in California, Startup Grind is an international community with a global presence in more than 40 cities and 20 countries.

Its mission is dedicated to celebrate the success stories of founders and innovators of business startups and encourage entrepreneurship.

The monthly interviews and startup mixers provide a great opportunity to entrepreneurs-in-making to network with ambitious people and benefit from the ‘pearls of wisdom’.

The official launch in Pakistan took place on Friday, the 3rd of May at T2F (The Second Floor).

It was hosted by Mr. Fawaad Saleem, the Chapter Director for Startup Grind and chaired Mr. Farzal Ali Dojki as the guest of honour. Mr. Farzal is the CEO of Next Generation Innovations, a consulting company that specializes in customized IT solutions and often partners with startup businesses to support their launch and operations.

The event started off with tea and networking as professionals across different spectrums of the industry engaged in meaningful networking. Before the interview began, Mr. Farzal gathered the prime issues that plagued the audience’s minds regarding startups.

The concerns focused on lack of funding opportunities, successful team-building, and making the choice between entrepreneurship and employment in the early stages of one’s career.

He concluded his talk with three lessons.

Firstly, as a startup you need to work hard and with dedication.

Secondly, it is important to hire carefully and ‘fall in love’ with the people you are hiring.

Thirdly, in order to launch a startup, it is important to work in a startup first. The learning curve of working in a successful small team is extremely high. One gets the opportunity to engage directly with the customers, take decisions, and explore areas of growth.

http://dawn.com/2013/05/06/startup-grind-launches-in-pakistan/

-

Comment by Riaz Haq on June 26, 2013 at 8:32pm

-

Here's a ET report on USAID helping lunch a private equity fund in Pakistan:

The United States and the government of Pakistan hosted the ‘US-Pakistan Business Opportunities Conference’ in Dubai, where USAID in association with the Abraaj Group and JS Private Equity Management (JSPE) announced the creation of the ‘Pakistan Private Investment Initiative’ which will launch two new private equity funds focused solely on Pakistan’s dynamic and fast-growing small- and medium-sized businesses.

USAID Administrator Dr Rajiv Shah announced that USAID will provide a seed investment to capitalise the funds which will be matched by Abraaj Group and JSPE with investments of their own, as well as private funds raised from other limited investors.

“We are seeding individual funds with $24 million each. The Abraaj Group and JSPE will match or exceed our commitment. We fully expect them to exceed that contribution,” said Dr Rajiv Shah. “Pooled funds will initially be $100 million which we expect will grow many fold into hundreds of millions of dollars in investment for small and medium businesses.”

The announcement came at the end of the first day of the conference. “By partnering with Abraaj and JS Private Equity Management, USAID capitalises on these companies’ expertise to make smart investment decisions that will grow the Pakistani economy, create jobs, and generate profits for investors who seize the economic opportunities that Pakistan presents,” Shah said.

Speaking at the conference US Ambassador Richard Olson said, “The United States is one of the largest investors in Pakistan, and the US government supports Pakistani business leaders by offering access to finance, facilitating business deals, and strengthening business education.”

“With 190 million potential customers, Pakistan is a huge emerging market opportunity for US companies,” Ambassador Olson observed.

The conference, sponsored by the US government, was attended by 200 American, Pakistani and Emirati businesses including Gillette, Citibank, General Electric, Procter and Gamble, Abraaj Group, Big Bird Group, Coca-Cola, Conoco Phillips, Engro, Estee Lauder, Goldman Sachs, IBM, Monsanto, Nishat Group, and the Saif Group.http://tribune.com.pk/story/568796/access-to-finance-usaid-launches...

-

Comment by Riaz Haq on August 2, 2013 at 4:45pm

-

Here's an Express Tribune report on a new private equity fund in Pakistan:

Private equity is poised to take off in Pakistan, with contrarian investors betting that the country is endowed with far greater potential than news reports chronicling Taliban bombings, the war in neighbouring Afghanistan or an evolving democracy’s frequent bouts of political drama might imply.

While Pakistan is undoubtedly a high risk play, investor sentiment has improved following a smooth transition at general elections in May and pledges by the new government of Prime Minister Nawaz Sharif to tackle a stubborn power crisis that has stifled manufacturing.

“I feel like being a kid in a candy store,” said Shaharyar Ahmed, 32, who started his career as an equity researcher at Goldman Sachs in New York, but who returned to his native Pakistan last year. “So many companies, amazing returns, growing in leaps and bounds – it’s a buyers’ market.”Ahmed and his collaborator Isfandiyar Shaheen, 30, are at the vanguard. As co-managers of Cyan Capital, a $50 million private equity fund set up by the Dawood Hercules Group, one of Pakistan’s biggest conglomerates, they must prove that they can find finance-starved companies ready for rapid expansion.

But the risk-hungry duo have now forsaken budding careers in the United States financial industry in the belief that somewhere in Pakistan’s ranks of unglamorous, overlooked family businesses lie hidden the seeds of future corporate giants.

“There’s a new wave of interest in private equity,” said Chairman of JS Private Equity Ali Jehangir Siddiqui while talking to Reuters. “There are certainly some funds that are stepping up to the plate, we hope that there will be more.”

Wild west

The new funds all aim to introduce the private equity model that is now familiar in rich and poor countries alike: groups of investors buy stakes in privately owned companies in return for a say in how they are run.

The theory is that an injection of capital and management savvy will turbo-charge the best of Pakistan’s family-run enterprises, creating jobs for a restive, youthful population and lucrative returns for the funds when they sell their stakes.

“It doesn’t take a rocket scientist to figure out how much you can do in this country, it’s absolutely green,” said Cyan’s Shaheen, a Pakistani who began his career in US investment banking but now lives in Karachi. “It’s like the Wild West.”

Cyan’s confidence in Pakistan’s prospects stems in part from the sheer size of the market in a country of 180 million people, where many conservatively run companies have shied away from scaling up their businesses into nationwide operations.

Companies listed on the Karachi Stock Exchange have grown their profits by at least 13-15% annually since 2009, according to one market analyst. With 49% returns in 2012, the market was among the world’s top performers....http://tribune.com.pk/story/585766/new-private-equity-fund-exposes-...

-

Comment by Riaz Haq on February 22, 2015 at 10:11am

-

Pakistan’s 2nd Annual Start-Up Cup competition launched

To promote and assist the local entrepreneurships across the country, the 2015 Pakistan Start-Up Cup, an intensive, nationwide business competition launched here on Saturday.

The Start-Up Cup is locally driven business model competition open to any idea. This innovative community-based approach is designed to increase the quality and quality of entrepreneurs in the community.

The US Embassy in Islamabad and the Islamabad Indus Entrepreneurs (TiE) Chapter, in collaboration with the US Pakistan Women’s Council, launched the 2015 Pakistan Start-Up Cup, an intensive, nationwide business competition. Entrepreneurs selected to participate in Start-Up Cup will receive coaching through multi-day “Build-a-Business” workshops and regular mentoring to help turn their ideas into a commercial reality. Prize money of $10,000, $7,500, and $5,000 will be awarded to the winner and two runners-ups with the best Start Up concept.

At the opening ceremony, Deputy Chief of Mission of the US Embassy in Islamabad Thomas E Williams, said, “Programs like Start Up Cup foster greater inclusiveness in Pakistan’s economy, particularly for women. The entrepreneurial solutions that arise from competitions such as Start-Up Cup foster inclusiveness, grow economies, promote stability, expand the international supply chain, and spread the exchange of ideas.”

Over the course of the seven-month programe, aspiring Pakistani entrepreneurs will learn to design viable business models, develop customers, and launch their start-up business concepts in the marketplace.

This year’s programme will build on the success of last year’s Start-Up Cup, which saw over 400 entrepreneurs compete for one of the top three prizes. Last year’s winning team went on to defeat 170 other entrepreneurs to win the first-ever World Start-Up Cup competition in Yerevan, Armenia.

The 2015 Start-Up Cup in Pakistan will introduce new partnerships with entrepreneurship centres across Pakistan, including the world’s first Women’s Entrepreneurial Centre of resources, education, access, and training for Economic Empowerment (WECREATE) in Islamabad sponsored by the US Department of State in collaboration with the US Pakistan Women’s Council; the Lahore University for Management Science (LUMS) Centre for Entrepreneurship; and Karachi-based technology incubator “The Nest I/O.”

The partnerships between Start-Up Cup and these centres will ensure that newly established businesses receive sustained support and mentoring, essential tools for long-term success. Numerous US Embassy programmes assist Pakistan’s entrepreneurs by increasing their access to financial resources, supporting opportunities for entrepreneurship education, and nurturing an entrepreneurial culture.

There are four base stations for this program, Islamabad, Lahore, Peshawar and Karachi with overall prize money of Rs22.5 million.

During the opening ceremony esteemed businessman and Islamabad TiE Board member Imtiaz Rastgar said, “StartUp Cup has only came to Pakistan two years ago and already tremendous feats have been achieved as new voices and ingenious minds have been brought to the fore. One can only imagine how much advantage this competition will bring as the years progress”.

http://www.dailytimes.com.pk/islamabad/22-Feb-2015/pakistan-s-2nd-annual-start-up-cup-competition-launched

-

Comment by Riaz Haq on March 21, 2015 at 1:00pm

-

Small is beautiful - unless you are a business that wants to grow. In which case, small is not so appealing. In Pakistan, where 90 percent of businesses are small or medium, challenges to scaling-up businesses have kept the private sector from realizing their full potential and contributing as much as they could to the economy. To help address a major constraint to the growth of small and medium enterprises (SMEs) in Pakistan, the U.S. Agency for International Development (USAID) is partnering with local banks to boost lending to SMEs. The new $60 million "U.S.-Pakistan Partnership for Access to Credit" was launched at last week's U.S.-Pakistan Business Opportunities Conference, as part of a larger bilateral government effort to boost trade and investment in Pakistan.

Finance is an important enabler of economic growth anywhere in the world. For Pakistan, which needs annual economic growth of at least 7 percent just to keep up with the number of youth expected to enter the labor market each year, this financing is important not only for the economy but for stability. Yet the private sector credit to gross domestic product (GDP) and financial depth ratios in Pakistan trail behind leading emerging economies.

In the SME segment, the volume of lending and types of financing tailored to SME needs have been very limited. A World Bank study found that only 16 percent of total credit in Pakistan went to SMEs. Moreover, about 70 percent of SME borrowing was used for working capital while only about 12 percent went toward long-term investment. Another survey shows only 11 percent of micro, small, and medium enterprises (MSMEs) in Pakistan report having access to finance, below the 15 percent international average and well below percentages reported in higher performing middle-income countries like Brazil and Turkey (30 and 48 percent respectively).

Despite these limitations, SMEs make an out-sized contribution to Pakistan's economy. The same World Bank study found that SMEs in Pakistan employ nearly 70 percent of workers in the manufacturing, services, and trade sectors and generate an estimated 35 percent of manufacturing's value addition. They also contribute over 30 percent of GDP and more than 25 percent of export earnings. Thus, alleviating a key constraint to their growth could lead to substantial increases in the number of jobs for Pakistan's large number of youth and greater income generation.

The new Partnership reflects a shared commitment to promote broad-based economic growth in Pakistan. Private sector investment was identified as an essential ingredient for growth in the Government of Pakistan's Vision 2025 strategy. The Partnership is part of a larger umbrella of U.S. support to SMEs in Pakistan to help them grow and expand into new markets. It will provide partner banks- Bank Alfalah, JS Bank, Khushhali Bank and First Microfinance Bank- with a loan portfolio guarantee through USAID's Development Credit Authority (DCA). The guarantee will lower the risk to the banks for lending in sectors they would otherwise perceive as being too risky. It will also encourage partner banks to extend longer-term loans and introduce credit products that address the needs of SMEs.

With more access to finance, small and medium businesses are poised to make even larger contributions to the Pakistan economy than they do now. The new U.S.-Pakistan Partnership for Access to Credit will make it possible for dynamic SMEs to be more than small and beautiful. After all, beauty is in the eye of the beholder and for businesses eyeing scale-up, there are few things more attractive than being able to grow.

http://www.huffingtonpost.com/borany-penh/eyeing-business-growth-in...

-

Comment by Riaz Haq on March 18, 2016 at 7:08pm

-

A perennial outsider, Naqvi was born in Pakistan and built his career in the Middle East, no easy feat in a region where Arab prejudice against Pakistanis is common. The fourth child of a plastics manufacturer in Karachi, Naqvi graduated from the London School of Economics. After four years at Arthur Andersen and a short stint at a Saudi conglomerate, he used $50,000 in savings to start an investment advisory firm, Cupola, in Dubai in 1994. In his first deal he raised $8 million for a duty-free-kiosk business and received an $800,000 advisory fee. Five years later, in 1999, he pulled off a complex deal that involved purchasing another business-services company, Inchcape Middle East, for $102 million, with $4.1 million in equity. Naqvi then sold off pieces of the company for a total of $173 million. With the proceeds of that transaction he founded Abraaj in Dubai in 2002.

------------

In summer 2012 Abraaj acquired London-based Aureos Capital, which gave it a global network of offices. Now the combined company does deals in the range of $20 million to $100 million. It has majority stakes in nearly half its portfolio companies, such as the Colombia-based D1 supermarket chain, which grew from 18 stores in 2010 to more than 280 today; Ghana-based ice cream maker Fan Milk International, a coinvestment with Paris’ Danone; and Pakistan’s Karachi Electric Supply, into which Abraaj invested $360 million in 2008.

-----------

Arif Naqvi, chief executive of Dubai’s Abraaj Group, hates the way Westerners speak about his part of the world. His private equity firm, he says, does not operate in emerging markets or, worse, frontier markets.

“We have taken the risk out of investing in what the West mistakenly calls ‘emerging markets,’ ” he says in elegant, Pakistani-accented English from a Madison Avenue outpost. “ They’re growth markets,” he insists.

While his remarks contain a healthy dose of marketing, Naqvi has a point. His $9 billion private equity firm–currently the largest investor in emerging markets outside of Brazil, Russia, India and China–has a track record many developed-world money managers would kill for. Despite operating in places where the rule of law often comes into question, limited partners report an impressive 17% annual return since inception in 2002.

Naqvi, 55, considers the notion of risky emerging markets a myth–part of what he calls “universally practiced hypocrisies.” He reminds a visitor that in 2008 the biggest risk on the planet came not from the developing world but from the financial capital of the modern era, New York City. Why, he asks pointedly, “have you not attached a risk premium to doing business with Wall Street banks?”

In a clubby world of global dealmakers, Blackstone, KKR and Carlyle get most of the headlines, but Abraaj is the undisputed private equity king of investing in the seemingly dangerous markets of Asia, Africa and Latin America. There is no shortage of big investors wanting to get into its newest funds. So far in 2015 the firm has sucked in $1.4 billion in fresh capital, giving Abraaj the largest pool of institutional money now pointed at sub-Saharan Africa in the world.

The firm currently has 300 limited partners, including the Gates and Skoll foundations, the World Bank’s International Finance Corporation (IFC) and the European Investment Bank.

“I view them as having more depth and breadth [in emerging markets] than the bigger players,” says Jin-Yong Cai, CEO of the IFC, which has invested $200 million in Abraaj funds and $70 million directly with Abraaj in deals, including an electric company in Karachi and a home loans company in Ghana.

http://www.forbes.com/sites/elizabethmacbride/2015/11/04/the-story-...

-

Comment by Riaz Haq on August 21, 2021 at 11:06am

-

How #Pakistani fund manager Arif Naqvi ‘robbed’ $100 million from Bill Gates. He distracted the West with massive #philanthropic grants, giving millions of dollars to major #universities, including Johns Hopkins University in the #UnitedStates. https://nypost.com/2021/08/21/how-bill-gates-was-robbed-of-100-mill... via @nypost

In April 2010, he was invited by President Barack Obama, along with 250 other Muslim business leaders, to a Presidential Summit on Entrepreneurship. There, Naqvi gave a speech about the importance of impact investing and how a billion children would need training and jobs in the coming decades.

“It can only happen,” Naqvi told the gathering, “through entrepreneurship.”

Two months later, the US government invested $150 million in Abraaj.

Naqvi did put his money where his mouth was — to a point.

After taking control of his local electric company, Karachi Electric, in 2008, Naqvi made the electricity more reliable and the company profitable. But he also reduced the workforce by 6,000 employees, leading to riots.

Meanwhile, he distracted the West with massive charitable grants.

“Arif gave millions of dollars to universities around the world, including Johns Hopkins University in the United States, and the London School of Economics, which named a professorship after Abraaj,” the authors write. “Following in the footsteps of billionaire philanthropists like Bill and Melinda Gates, Arif started a $100 million charitable organization called the Aman Foundation to improve health care and education in Pakistan.”

But Naqvi also enjoyed the high life, flying around on “a private Gulfstream jet with a personalized tail number — M-ABRJ — and sailed on yachts to meet new investors who could help increase his fortune.”

By 2007, Naqvi had moved into “a palatial new mansion in Dubai’s luxurious, gated Emirates Hills district . . . known as the Beverly Hills of Dubai.”

He was a regular at Davos and similar conferences, where he became friendly with the likes of Gates, who was the guest of honor at a dinner at Naqvi’s home in 2012.

“Bill and Arif had much to discuss,” the authors write. “They agreed that their charitable foundations would work together on a family planning program in Pakistan. Arif seemed to be precisely who Bill was looking for. He was wealthy and concerned for the poor.”

Naqvi was granted a $100 million investment from the Gates Foundation to supposedly invest in hospitals and clinics in emerging markets. This investment, in the new Abraaj Growth Markets Health Fund, helped Naqvi attract $900 million more from other investors.

“This is a significant co-investment partnership,” Gates said about the deal. “It is also an example of the kind of smart partnerships that hold huge promise for the future.”

In reality, Naqvi had already started misusing the money with a “secretive treasury department” that not even most of his employees knew about, the authors write.

“Abraaj was really made up of a tangled web of more than three hundred companies based mostly in tax havens around the world.”

Required by regulators to keep millions of dollars in a bank account for emergencies, the account was usually close to empty, the authors write.

“Just before the end of each quarter, when Abraaj Capital had to report to the regulator, Arif and his colleagues moved money into the account to make it seem like it contained the required amount. A few days [later], they emptied the account again.”

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Indian Military Begins to Accept Its Losses in "Operation Sindoor" Against Pakistan

The Indian military leadership is finally beginning to slowly accept its losses in its unprovoked attack on Pakistan that it called "Operation Sindoor". It began with the May 31 Bloomberg interview of the Indian Chief of Defense Staff General Anil Chauhan in Singapore where he admitted losing Indian fighter aircraft to Pakistan in an aerial battle on May 7, 2025. General Chauhan further revealed that the Indian Air Force was grounded for two days after this loss. …

ContinuePosted by Riaz Haq on July 5, 2025 at 10:43am

Trump Administration Seeks Pakistan's Help For Promoting “Durable Peace Between Israel and Iran”

US Secretary of State Marco Rubio called Pakistan Prime Minister Shehbaz Sharif to discuss promoting “a durable peace between Israel and Iran,” the State Department said in a statement, according to Reuters. Both leaders "agreed to continue working together to strengthen Pakistan-US relations, particularly to increase trade", said a statement released by the Pakistan government.…

ContinuePosted by Riaz Haq on June 27, 2025 at 8:30pm — 4 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network