PakAlumni Worldwide: The Global Social Network

The Global Social Network

Surging Food Prices Push Pakistan Overall Inflation Rate to 10.9% in May 2021

Food prices in Pakistan rose 14.8% in May while the average inflation rate for July-May period of the current fiscal year came in at 8.83%, according to Pakistan Bureau of Statistics. Meanwhile, global food prices have surged by 40% in May, the highest rate in a decade, according to the United Nations Food and Agriculture Organization. Poor harvest due to bad weather and COVID19 pandemic-related disruptions in production and distribution are being blamed.

|

| Global Food Prices Soaring. Source: FAO via Financial Times |

In Pakistan, chicken prices shot up by 60%, followed by 55% increase in prices of eggs, 31% rise in prices of mustard oil and wheat prices were up by 30% year over a year, according to the PBS. Globally, prices of cereals (including wheat) jumped 37%, vegetable oil 124%, meat 10% and sugar 57%.

|

| Food Items Seeing Double Digit Price Surges. Source: Bloomberg |

Higher imports of food items at high prices and increased shipping costs have added to Pakistan's food inflation woes. Among the factors contributing to elevated food prices are drought in South America and record purchases by China. Cooking oils have soared too on demand for biofuel.

“We have very little room for any production shock. We have very little room for any unexpected surge in demand in any country,” Abdolreza Abbassian, senior economist at the UN’s Food and Agriculture Organization, warned in a phone interview with Bloomberg. “Any of those things could push prices up further than they are now, and then we could start getting worried.”

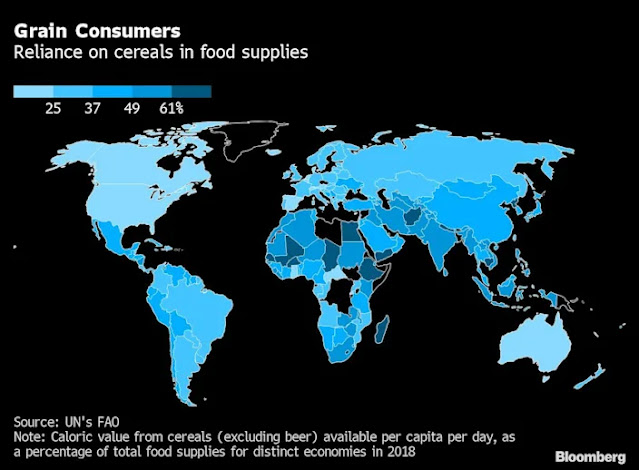

Developing countries such as Pakistan where an average consumer spends 40% or more on food will be particularly hit by surging food prices. A jump of 37% in cereals is of special concern because people in poor nations get more than 50% of their daily caloric intake from cereals. Early reports indicate that Pakistan is seeing a record production of wheat with an increase of two million tons to 27.3 million tons from 25.3 million tons last year.

|

| Caloric Intake From Cereals. Source: Bloomberg |

In West Africa, the prices of staples are up 40% over a five-year average. Countries such as Nigeria, are experiencing food inflation of 23%, the highest level in 15 years, according to the UN World Food Programme. The WFP also warned of vulnerable countries faced with soaring prices, including Lebanon, where food inflation soared to 400% last year on the back of a currency crisis, the pandemic and the after-effects of the Beirut port explosion. Food price inflation in Lebanon is still more than 200%. Countries such as Syria and Sudan are also struggling with food inflation of more than 200 per cent, the WFP said. The impact will be worsening poverty and hunger and slower recovery from the pandemic, according to the Financial Times.

|

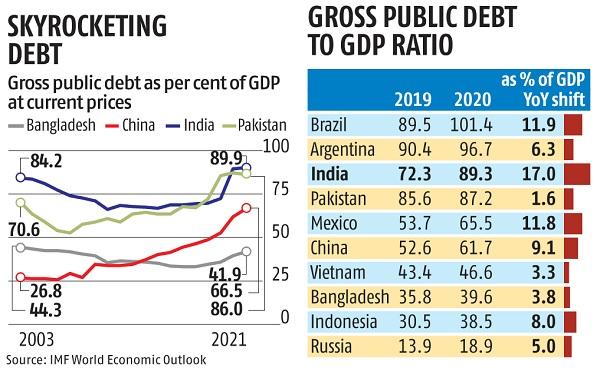

| Debt-to-GDP Increase During Pandemic. Source: Business Standard |

Pakistan is among world's top 10 food producing countries. After a wheat and sugarcane shortfall last year, there are reports of record production of wheat and corn in Pakistan this year. Higher domestic production will hopefully help contain food price inflation in coming months,

Related Links:

Haq's Musings

South Asia Investor Review

Pakistan Among World's Largest Food Producers

Construction Industry in Pakistan

Pakistan's Pharma Industry Among World's Fastest Growing

Pakistan to Become World's 6th Largest Cement Producer by 2030

Is Pakistan's Response to COVID19 Flawed?

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid1...

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Coronavirus Antibodies Testing in Pakistan

Can Pakistan Effectively Respond to Coronavirus Outbreak?

How Grim is Pakistan's Social Sector Progress?

Pakistan Fares Marginally Better Than India On Disease Burdens

Trump Picks Muslim-American to Lead Vaccine Effort

Democracy vs Dictatorship in Pakistan

Pakistan Child Health Indicators

Pakistan's Balance of Payments Crisis

Panama Leaks in Pakistan

Conspiracy Theories About Pakistan Elections"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on June 5, 2021 at 9:20am

-

#Pakistan’s Public #Debt To GDP Remained Unchanged During the #COVID19 #pandemic while #india’s debt-to-GDP ratio increased from 74% to 90%. Most emerging countries saw debt-to-gdp increase by 10% during the #coronavirus pandemic. via @forbes. #economy https://www.forbes.com/sites/naeemaslam/2021/06/04/pakistans-public...

Even giants like the United States and India have had difficulty dealing with the coronavirus pandemic. Donald Trump, Dwayne Johnson, and Ellen DeGeneres have all been infected by this virus. In this situation, Pakistan has succeeded in reviving its economy, which is expected to grow by nearly 4% in 2021, exceeding initial projections.

The State Bank of Pakistan (SBP) initially predicted a 3% growth in GDP, while the International Monetary Fund (IMF) and World Bank predicted 1.5% and 1.3% increases, respectively. The country's per capita income will rise 14.6% from $1,405 in 2020 to $1,610 in 2021.

The services sector, which is forecasted to grow by 4.43% in 2020-2021, is responsible for the majority of the growth. This is certainly remarkable for a country like Pakistan which is becoming successful in expanding its services sector. The agricultural sector's predicted growth is 2.77%, while that of the industrial sector is 3.57%.

The bleak situation in India, which has reported an incredible number of 28,441,986 cases and 338,013 deaths, has alarmed both government authorities and medical specialists in Pakistan. Due to the increase in awareness caused by social media in Pakistan, Pakistani citizens have begun to wear masks, which they did not previously.

Last year, the country saw a surge in cases during the Eid-festival, but the government was quick to move this time, imposing partial lockdowns, closing non-essential enterprises, and prohibiting domestic tourism, which helped the country avoid a spike in cases. However, the restrictions imposed have jeopardized the labor class's livelihoods.

MORE FOR YOU

Stock Market: Growth Stocks On Discount

Big Tech Is About To See A Massive Outflow - Where Will This Money Go?

Three Stocks To Buy Now

Vaccination Plan

The government hopes to have vaccinated 70% of the population by the end of 2021. 5.3 million citizens have been vaccinated so far. With the help of CanSino Bio, a Chinese company, Pakistan has developed its own "PakVac" vaccine, bolstering the country's vaccination program.

Stock Market Sentiment

Last week Pakistan reported the highest traded volumes on the Pakistan Stock Exchange at 1.56 billion shares and 2.21 billion shares respectively on May 26 and May 27. Investors are optimistic because of the populist budget proposal and improved growth forecasts.

Economic Growth

According to SBP’s Governor, Reza Baqir, the unexpected growth in GDP is due to accommodative monetary and fiscal policy. SBP quickly reduced its policy rate by 625 basis points to 7% and released a stimulus amounting to 5% of GDP. In addition, the governor said that the government was able to control the coronavirus situation reporting 12 new cases per million, compared to 62 new cases per million reported globally.

-

Comment by Riaz Haq on June 5, 2021 at 9:33am

-

India’s public debt to gross domestic product (GDP) is likely to increase to a record high of 89.3 per cent in 2020, breaking the previous high of 84.2 per cent in 2003. The ratio was 72.3 per cent in 2019 and 68.8 per cent five years ago in 2015, according to the data from the International Monetary Fund World Economic Outlook (WEO).

This makes India the most indebted major economy after Brazil and Argentina among the emerging markets. In South Asia, India now becomes the most indebted country after Bhutan and Sri Lanka and worse off than Bangladesh, Pakistan, and Nepal.

https://www.business-standard.com/article/economy-policy/india-s-pu...

-

Comment by Riaz Haq on June 10, 2021 at 9:39am

-

KEY POINTS of Pakistan Economic Survey 2020-21

COVID rendered 20 million people jobless, says Tarin.

However, working population is back to 53m out of the total 55m labour force when the pandemic began, he says.

Economy grew more than the government's, IMF's and World Bank's expectations.

Agriculture growth measured at 2.77% despite large-scale losses in cotton crop.

Exports increased, but remittances grew by a significant 29%, providing a boost to forex reserves.

FBR collected an unprecedented Rs4.2 trillion in 11 months of the outgoing year.

Pakistan's stock market is currently the best-performing in Asia, fourth-best in the world, he says.

The poor will be number one priority for us in tomorrow's budget, says Tarin about government's economic priorities.

IT industry growing by 40-50%, we want them to grow by 100%, he says.

Power is a "black hole" sector; we overbuilt and are now making crippling capacity payments, says finance minister as he speaks on power reforms.

FBR harassment has to end; audits will be conducted by third parties, says Tarin.

https://www.geo.tv/latest/354427-budget-2021-22-finance-minister-sh...

-----------

As Pakistan unveiled the Economic Survey 2020-21, the government announced it beat many earlier projections as the economy was able to stage a V-shaped recovery. Here are the salient features of the survey, according to AHL Research.

Pakistan's GDP provisionally grew 3.9% during FY21. Growth for FY20 was revised down to -0.47% from -0.38% earlier.

For FY21, GDP at current market prices stood at Rs47.7 trillion.

Services sector saw a growth of 4.43%, mainly on the back of wholesale and retail trade segment (8.37%), and finance and insurance sector (7.84%).

Agriculture sector registered a growth of 2.77%.

Wheat witnessed a growth of 8.1%, rice 13.6%, while maize recorded a growth of 7.38%.

Sugarcane recorded the second-highest ever production at 22%. On the other hand, cotton witnessed a negative growth of 22.8% resulting in 15.6% decline in cotton ginning.

At the end of March 2021, Pakistan’s total public debt stood at Rs38 trillion. The domestic debt amounted to Rs25.6 trillion (up 13.8% YoY) while foreign public debt was Rs12.5 trillion.

Average National Consumer Price Index (CPI) stood at 8.83%.

Remittances increased by 29% YoY, amounting to $26.7 billion, as per 11MFY21 SBP data.

Pakistan’s Foreign Direct Investment (FDI) hit $1.55 billion during 10MFY21, a decline of 32% YoY.

Pakistan saw a current account surplus of $773 million in 10MFY21 against a deficit of $4,657 million recorded in the same period last year. During 10MFY21 total imports recorded a growth of 8% YoY to $48,625 million. Exports clocked in at $25,889 million, posting a jump of 6% YoY.

Country recorded a trade deficit of $22,736 million compared to a deficit of $20,599 million in 10MFY21, seeing an increase of 11%.

Per capita income for FY21 stood at Rs246,414 (+14.6% YoY). In dollar terms, it was $1,543 (+13.4% YoY).

https://www.brecorder.com/news/40099198/key-highlights-of-economic-...

-

Comment by Riaz Haq on June 10, 2021 at 9:56pm

-

#Pakistan #gdp up 3.94% in fiscal year 2020-21 v-shaped #economic recovery after #COVID19 #lockdowns. High remittances from overseas #Pakistanis produce rare current account surplus. Sector-wise: #Manufacturing up 9%, #Services up 4.4%. #Agriculture 2.8% https://www.dawn.com/news/1628602

Finance Minister Shaukat Tarin unveiled the Pakistan Economic Survey 2020-21 at a press conference in Islamabad on Thursday, revealing that the industrial and services sectors had helped the economy rebound and post GDP growth of 3.94 per cent in the first 9 months of the fiscal year (July to March), significantly higher than the target of 2.1pc.

After last year’s contraction of 0.47pc, the economy witnessed a V-shaped recovery, according to the survey document, which was supported by the industrial and services sectors surpassing the government's expectations.

Tarin, during his presser, particularly highlighted growth in large-scale manufacturing (LSM) which he said expanded 9pc.

The Pakistan Economic Survey is an annual report on the performance of the economy, focusing in particular on major macroeconomic indicators.

Sector-wise growth

Tarin started out by underscoring the impact of Covid-19 in causing the economy to contract last year. But, he said, the decisions of this government under Prime Minister Imran Khan helped the economy stabilise which resulted in improving performance on the growth front.

"The government itself had set [GDP] growth target at 2.1pc and the IMF had predicted and even lower number. But the decisions by this government such as incentivising manufacturing, textiles, construction, and interventions in agriculture have helped the economy recover."

According to the survey, Pakistan has recorded a provisional growth rate of 3.94pc in the fiscal year 2020-21. This came "on the basis of a rebound in almost all sectors".

The agriculture sector grew around 2.8pc against a target of 2.8pc. The industrial sector registered a growth of 3.6pc against a target of 0.1pc, while services grew 4.4pc against a target of 2.6pc.

Last year, when overall GDP growth contracted by 0.47pc, industries and services sectors had posted negative growth of 2.6pc and 0.59pc, respectively.

In the industrial sector, Tarin said, large-scale manufacturing (LSM) showed growth of 9pc, playing an important role in helping overall growth.

The minister said agricultural growth met its target despite the "cotton crop getting ruined" because yields of other crops compensated for that.

'Focus now on growth'

Tarin said he had told the prime minister it was time to focus on sustainable growth "until we go to 5-8pc GDP growth".

"We will do interventions and take care of the poor. The poor man has been crushed in this stabilisation phase because the dreams we have shown them have been of a trickledown economy. And this can only happen when growth is sustainable and continuous for 20-30 years," he said.

Tarin, however, emphasised that this growth should not be based on borrowing.

"Countries which had sustainable growth, they grew continuously for 20-30 years. What have we done? Every time we grow by borrowing money, which is credit-based growth."

Inflation

The headline inflation measured by the Consumer Price Index (CPI) was recorded at 8.6pc during July-April FY2021 against 11.2pc during the same period last year. The government had targeted inflation of 6.5pc for FY21.

The survey document says this was achieved "due to the government measures for maintaining price stability."

"Inflation in perishable food items increased 0.1pc against an exorbitant increase of 34.7pc during the same period last year," according to the PES.

The finance minister said the government wanted to control inflation "but prices are still high and affecting the common man".

"So the way to solve this is by increasing production and that is why we have focused on agriculture in this budget," Tarin said.

-

Comment by Riaz Haq on June 11, 2021 at 8:10am

-

#Pakistan Proposes #Budget to Boost #Economic Growth to 4.8% in 2021-22. Total spending: 8.4 trillion PKR vs 7.1 trillion PKR this year. Development budget: Rs. 900 billion, up from Rs. 650 billion. Revenue up 25% to 7.9 trillion rupees($51 billion). #GDP https://www.bloomberg.com/news/articles/2021-06-11/pakistan-propose...

Pakistan plans to spend its way out of the pandemic-induced slump, with a new budget that seeks to put more money in the hands of people and boost economic activity.

The federal government proposes to raise salaries of government employees by 10% in the year beginning July 1, Finance Minister Shaukat Tarin said in his budget speech in Islamabad on Friday. Taxes on some equity as well as banking transactions will be pared or abolished, he said.

The giveaways notwithstanding, Tarin targets to narrow the budget gap to 6.3% of gross domestic product from 7.1% of GDP this year, less than 1 to 1.5 percentage points the minister estimated last month.

He aims to achieve that by ramping up revenue collection by 25% to 7.9 trillion rupees ($51 billion) in the next fiscal year. Of that, 5.8 trillion rupees would be mopped up from taxes, compared with 4.7 trillion rupees this year, he said.

The budget is an opportunity for Tarin to strengthen Pakistan’s fragile economy, which is currently under a $6 billion bailout program from the International Monetary Fund. A drop in coronavirus cases is allowing the nation to reopen slowly, paving the way for demand to kick in.

The South Asian nation forecast a GDP growth of 4.8% for the next fiscal year, compared with an estimated 3.9% this year. The nation, which recorded a rare GDP contraction last year, targets to achieve a growth of 7% in the next two years, Tarin said.

“It is a spending-led confidence building budget exercise,” said Mohammed Sohail, chief executive officer of Topline Securities Pakistan. “The biggest challenge will be to deal with IMF and rising commodity prices.”

Total spending for next fiscal year pegged at 8.4 trillion rupees vs 7.1 trillion rupees last year

As much as 900 billion rupees will be earmarked for development spending by the federal government , compared with 650 billion rupees this year

Proposes to reduce capital gains tax on stocks to 12.5% from 15%

To abolish withholding tax on equity trading as well as banking transactions

Proposes to reduce sales tax on locally-made cars of 850cc power

To reduce tax on completely knocked-down units of imported electric vehicles

Expects to raise 560 billion rupees through global bonds including Eurobond and Sukuk

Proposes to provide loans on concession to farmers and small businesses

-

Comment by Riaz Haq on June 11, 2021 at 8:16pm

-

#Pakistan earmarks PKR 3.06 tr ($20 billion) for #debt servicing (including interest payments) in the next fiscal year 2021-22, up from Rs 2.94 tr ($18.9 billion) this year. Fed govt allocated Rs 1.6 tr ($10.26 billion) for #foreign debt payments in FY22. https://www.dawn.com/news/1628877

The government has allocated Rs3.060 trillion for debt servicing (including interest payments) in the next fiscal year 2021-22.

During the current fiscal year, Rs2.94tr had been earmarked for the same.

The federal government allocated a sum of Rs1.6tr for foreign loans repayment, short-term loans and other advances in FY22. Rs1.49tr has been allocated for debt servicing in the current fiscal year, however, revised estimates placed it at Rs1.06tr.

Foreign Loans repayment for FY22 will be Rs1.42tr against Rs841 million for the current fiscal year. For short-term foreign credits, Rs74.4bn has been allocated for the next fiscal year. This year, revised estimates for short-term foreign credits are at Rs121.9bn.

According to the Pakistan Economic Survey of 2020-21, total public debt was recorded at Rs38,006bn at end March 2021, registering an increase of Rs1,607bn during first nine months of current fiscal year (9MFY21) which was much less when compared with the increase of Rs2,499bn witnessed during the same period last year.

The increase in total public debt during 9MFY21 was even lower than the federal government borrowing of Rs2,065bn for financing the fiscal deficit. The differential is primarily attributable to appreciation of the Pak rupee against the US dollar by around nine per cent which led to a decrease in the value of external public debt when converted into the local currency.

Debt from multilateral and bilateral sources cumulatively constituted over 80pc of external public debt portfolio at end March 2021. A set of reforms initiated by the government to improve the economy has brought strong support from multilateral development partners during the last two years. This is expected to strengthen confidence and catalyse additional support from development partners’ public debt in the coming years which will also help in reducing the pressure on domestic sources.

Pakistan is availing the G-20 Debt Service Suspension Initiative (DSSI) for a period of 20-months (May 2020-December 2021) which will help defer the debt servicing impact to the tune of around US$3.7bn during this period.

The government remained within the benchmarks and thresholds defined in the Medium-Term Debt Management Strategy (MTDS) at the end of December 2020.

The Economic Survey claims that Pakistan has witnessed one of the smallest increases in its public debt during the Covid-19 pandemic. Global public debt to GDP ratio increased by 13 percentage points – from 84pc in 2019 to 97pc in 2020 – whereas Pakistan’s Debt-to-GDP ratio witnessed a minimal increase of 1.7 percentage points and stood at 87.6pc at end June 2020 compared with 85.9pc at end June 2019.

Interest servicing was recorded at Rs2,104bn during 9MFY21 against the annual budgeted estimate of Rs2,946bn. Domestic interest payments were recorded at Rs1,934bn and constituted around 92pc of total interest servicing during 9MFY21 which is mainly attributable to higher volume of domestic debt in total public debt portfolio.

On a full year basis (2020-21), interest servicing is expected to remain below the budgeted estimates primarily due to extension of DSSI from January to June 2021, appreciation of Pak rupee against the US dollar and lower interest servicing on account of National Savings Schemes due to withdrawals against discontinued prize bonds.

-

Comment by Riaz Haq on June 12, 2021 at 6:04pm

-

#Pakistan pins hopes on #export-oriented industries, #agriculture and #housing sector for sustainable growth. Keen to promote exports and take their volume from 8% at present to 20% of Gross Domestic Product (#GDP) in coming years. #economy #Budget2021 https://www.khaleejtimes.com/business/pakistan-pins-hopes-on-agricu...

Addressing a joint post-budget press conference in Islamabad on Saturday, federal minister for finance Shaukat Tarin said the government has presented a growth-oriented budget that also includes relief measures to businessmen, investors, exporters, farmers and common man.

Federal Minister for Industries Khusro Bukhtiar, advisor to the Prime Minister on commerce Razak Dawood, special assistant to the Prime Minister on poverty alleviation and social protection Dr Sania and Federal Board of Revenue chairman Asim Ahmed were also present at the press conference and clarified various aspects of the budget.

Exports share in GDP

Tarin said the government is keen to promote exports and take their volume from eight per cent at present to 20 per cent of the Gross Domestic Product (GDP) in coming years. ”We have suggested various steps to promote exports that would help reduce pressure on the foreign exchange reserves, besides developing the local industrial sector,” he said.

The minister said the special economic zones being set up under the China-Pakistan Economic Corridor would also help in local industrial development and create job opportunities for the skilled and semi-skilled work force.

Agri sector development

Tarin said the government has proposed special initiatives for the development of agriculture sector and prosperity of farming community in the country.

“We accords special attention to small land holders up to 12.5 acres and will extend up to Rs450,000 interest-free loans to enhance agriculture production and alleviate poverty. We have also mobilised banking sector to extend credit facilities to growers at affordable rates,” he said.

“Every farming household would be provided Rs250,000 interest free loan for purchasing agriculture inputs. Another Rs200,000 will be provided to purchase tractor and other machinery to bring innovation and technological advancement in local agriculture sector,” he added.

The finance minister said development of marketing services, cold storage facilities and building strategic reserves of food commodities would also help curb the menace of hoardings, artificial shortage of food commodities and practice of extra profiteering.

Growth-oriented budget

Tarin, who presented PTI’s fourth budget on Friday, said the main focus of the growth-oriented budget is to empower the country’s poor segment so that they would not have to wait for trickle-down effect of economic progress.

“The government is directly targeting the poorest of the poor and facilitating them with different initiatives to upgrade their living standards. It would utilise the ‘bottom-up-approach’ for improving the living conditions of around six million low-income households,” the minister said.

Under the initiative, Tarin said every urban household would be provided Rs500,000 interest-free business loan. Likewise, every farming household would be given interest free loan of Rs150,000 for every crop, interest fee farming loan of Rs250,000 and interest free loan of Rs200,000 for buying tractor and agricultural implements.

“Low-interest loans of up to Rs2 million would be provided to help the people buy houses, besides Sehat Card to every household to facilitate them in time of need,” Tarin said.

-

Comment by Riaz Haq on June 13, 2021 at 7:05am

-

JP Morgan – a global leader in financial services – has issued a report about the investment climate in Pakistan. Titled ‘Pakistan: Reassessing the Investment Thesis’, the report highlighted that there have been positive developments in Pakistan in recent months.

https://propakistani.pk/2021/06/10/jp-morgans-report-confirms-pti-g...

------------

دنیا کے بڑے سرمایہ کاری کے مالیاتی ادارے JP Morgan نے اپنی رپورٹ جاری کردی۔اپنےسرمایہ کاروں کا کہا گیا کہ پاکستان میں سرمایہ کاری کریں یہاں معاشی حالات بہتر ہورہے ہیں۔جے پی مورگن نے 2021 میں پاکستان کی جی ڈی پی کی شرح 4.7 کی پیشگوئی کی ہے۔آئندہ سال معاشی حجم 329ارب ڈالرہوگا

https://twitter.com/FarrukhHabibISF/status/1402912172267737089?s=20

-

Comment by Riaz Haq on June 13, 2021 at 10:26am

-

Pakistan's top 100 Companies earnings rise to all time high

Source: BloombergThey are almost double if compare them with the previous year.

Isn't it Amazing? Esp. In covid!https://twitter.com/Pakistanomy/status/1404079764793610240?s=20

-

Comment by Riaz Haq on June 17, 2021 at 7:41am

-

Pakistan offers #corn (maize) on world market at $282 a ton, $20 cheaper than #India's price. World grain prices have jumped 35% since the beginning of this year. #Pakistan #maize production is 8.465 million tons, up 7.4%from 7.883 million tons last year https://www.thenews.com.pk/print/850277-pakistan-offers-corn-cheape...

Pakistan has emerged as a strong competitor to India in the global corn (maize) market, offering its produce at over $20 a tonne cheaper than India in the global market, especially South-East Asia, an Indian media outlet reported.

“Pakistan is offering corn at $282 (PKR44,200) a tonne, cost and freight, Ho Chi Minh in Vietnam. This is lower than the price quoted by any Indian trader,” said a New Delhi-based trading source, speaking on condition of anonymity. The source said Pakistan traders were making the offer as the neighbouring country looks to export at least one million tonnes of corn this year.

Currently, corn futures are quoted at $6.59 a bushel on Chicago Board of Trade. China’s huge appetite, strong US sales and Brazil shipping woes have all lifted corn prices this year. The cereal has gained over 35 per cent since the beginning of this year.

“We are offering corn to South-East Asia at $305 (PKR47,700) a tonne. But demand has slowed due to quite a few reasons,” said M Madan Prakash, Agri Commodities’ Exporters Association President. Compared with India and Pakistan, Brazil is offering corn at $295 (PKR646,22) and US at $306 (PKR47,900) a tonne free-on-board (FOB) with prices increasing by 63 per cent and 90 per cent, respectively, from a year ago.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

IMF Questions Modi's GDP Data: Is India's Economy Half the Size of the Official Claim?

The Indian government reported faster-than-expected GDP growth of 8.2% for the September quarter. It came as a surprise to many economists who were expecting a slowdown based on the recent high-frequency indicators such as consumer goods sales and durable goods production, as well as two-wheeler sales. At the same time, The International Monetary Fund expressed doubts about the Indian government's GDP data. …

ContinuePosted by Riaz Haq on November 30, 2025 at 11:30am — 1 Comment

Retail Investor Growth Driving Pakistan's Bull Market

Pakistan's benchmark index KSE-100 has soared nearly 40% so far in 2025, becoming Asia's best performing market, thanks largely to phenomenal growth of retail investors. About 36,000 new trading accounts in the South Asian country were opened in the September quarter, compared to 23,600 new registrations just three months ago, according to Topline Securities, a brokerage house in Pakistan. Broad and deep participation in capital markets is essential for economic growth and wealth…

ContinuePosted by Riaz Haq on November 24, 2025 at 2:05pm — 2 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network