PakAlumni Worldwide: The Global Social Network

The Global Social Network

Standard Chartered Bank: Pakistan Among Most Upwardly Mobile Emerging Nations

Pakistan is among the most upwardly mobile nations in the world, according to a new Standard Chartered Bank study titled "Climbing the Prosperity Ladder".

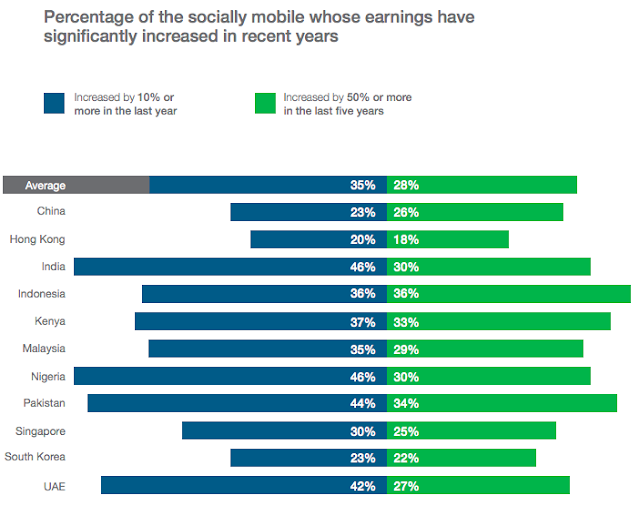

The Standard Chartered study looks into social mobility, financial proficiency and digital savviness among 11,000 emerging affluent consumers in China, Hong Kong, India, Indonesia, Kenya, Malaysia, Nigeria, Pakistan, Singapore, South Korea and the UAE. 34% of Pakistani respondents said their incomes have increased by more than 50% over the last 5 years while 44% said they have seen 10% or more income growth in the last year.

|

| Socially Mobile Income Growth. Source: Standard Chartered Bank |

China, India and Pakistan:

Standard Chartered study talks about the "fast-growing economies of China, India and Pakistan are providing abundant opportunities for scaling the social pyramid". Here's an excerpt of the Standard Chartered report:

The fast-growing economies of China, India and Pakistan are providing abundant opportunities for scaling the social pyramid. Leading the way, in both China and India 67% of the emerging affluent are experiencing positive social mobility, while Pakistan is not far behind with 64%. Of the emerging affluent in these countries, India and Pakistan both have more than one in 10 (11%) that are experiencing supercharged social mobility, versus 7% in China. Strong earnings progression is fueling impressive rates of social mobility in all three countries. Many of the socially mobile have benefitted from a salary increase of 50% or more in the last five years – 34% in Pakistan, followed by 30% in India and 26% in China. This gap could widen, with India and Pakistan more optimistic about their future salaries than their Chinese counterparts. Almost half of the socially mobile in Pakistan (48%) and India (46%) predict another earnings increase of 50% or more in the next five years, whereas less than three in 10 (29%) expect the same in China. While the emerging affluent in China are more cautious about salary growth than their counterparts in fast-growing Pakistan and India, workplace remuneration is just one side of the social mobility equation. Education has been considered crucial to improving social standing in China for a long time, but the generational shift towards university access among the socially mobile is larger than any other market: more than nine in 10 have attended university (91%), compared to 34% of their fathers and 29% of their mothers.

Education Mobility:

Upwardly mobile Pakistanis have seen a significant increase in education levels. 89% of them have college degrees compared to 66% of fathers and 49% of mothers who did.

|

| Socially Mobile Education Levels. Source: Standard Chartered Bank |

Gender Balance:

In terms of gender parity, 51% of socially supercharged in Pakistan are men and 49% are women.

|

| Socially Mobile Gender Differences. Source: Standard Chartered |

Intergenerational Mobility:

Are they better off than their parents? The answer is a resounding Yes for 79% of Pakistanis who feel better off than their parents.

|

| Inter-generational Mobility. Source: Standard Chartered |

Saving For Education:

Upwardly mobile Pakistanis see the value of education for their children. 18% of them say saving for their children's education is a top priority.

|

| Saving For Education. Source: Standard Chartered |

Summary:

Standard Chartered Bank study finds that Pakistan is among the most upwardly mobile nations in terms of income and education. 79% of Pakistanis feel they are better off than their parents. 34% of socially mobile Pakistani respondents say their incomes have increased by more than 50% over the last 5 years while 44% say they have seen 10% or more income growth in the last year. 89% of them have college degrees compared to 66% of fathers and 49% of mothers who did.

Related Links:

-

Comment by Akhtar Hussain on October 30, 2018 at 2:11am

-

Riaz Sahib, Keep spreading the good news. It is a great motivation for us Pakistanis and the World.

Thank you.

-

Comment by Riaz Haq on November 6, 2018 at 9:55am

-

#Indian #Muslims left out of #India's growth story, World Bank study shows. Mobility levels for #African-#Americans in the #US are better than those for Muslims in India but #mobility among lower caste SCs, STs is comparable to that of African-Americans. https://www.livemint.com/Politics/E32q8vPxpaiYIpqcql8OYM/Muslims-le...

“Higher caste groups have experienced constant and high upward mobility over time, a result that contradicts a popular notion that it is increasingly difficult for higher caste Hindus to get ahead,” Asher and his co-authors point out. The extent to which inter-group differences in mobility are driven by location varies substantially by group. Among STs, the district of residence explains 59% of the upward mobility gap with upper castes, the study shows. Place matters considerably less for SCs (14% of the upward mobility gap) and Muslims (9% of the upward mobility gap).

-

Comment by Riaz Haq on November 6, 2018 at 1:49pm

-

According to a Gilani Research Foundation Survey carried out by Gallup Pakistan, 42% Pakistanis believe that their household’s financial situation will improve in the coming year.

http://gallup.com.pk/42-pakistanis-believe-that-their-households-fi...

A nationally representative sample of men and women from across the four provinces was asked, “Do you think your household’s financial situation will improve, worsen or remain the same in the coming year?” In response to this question, 42% said that they believe that their household’s financial situation will improve, 36% said that it will remain the same, and 22% said that it will worse.

This question is used as a proxy across the world for gauging consumer’s confidence in the economy currently, and a predictor for the future. Gallup Pakistan is currently in process of setting up a Consumer Confidence Index.

-

Comment by Riaz Haq on November 7, 2022 at 10:56am

-

Miftah Ismail

@MiftahIsmail

I gave a talk at Habib University a few days ago. This one clip has touched a nerve with a lot of people. Let know what you think. (Hopefully for a little bit you can come out of your partisan posture and judge the argument on its merits).

https://twitter.com/MiftahIsmail/status/1589659579822243841?s=20&am...

Former finance minister Miftah Ismail said on Monday Pakistan is “intolerant as hell” and “belligerently uneducated” as the elite capture of resources has left no space for reforms.

https://www.dawn.com/news/1715551

Speaking at Habib University, the businessman-turned-politician wore the hat of an economics professor to talk to students in the uneasy presence of the educational institute’s rich benefactors who have “invented their own economies” in an otherwise poor country.

He referred to the families of the Dawoods and Habibs — some of their members sat in the front row — as evidence of poor upward social mobility in Pakistan. They’re the richest Pakistanis of today just like their fathers were the richest Pakistanis of yesteryear, he said. “What shot at success does the son of an ordinary Pakistani have against my son?” he asked, rhetorically.

Mr Ismail’s address mostly consisted of views and anecdotes that he’s already told many times over — word for word, in some cases — since his latest five-month stint at the top of the finance ministry. He reiterated the I-saved-Pakistan-from-default message while calling the idea of the finance ministry controlling the exchange rate “nuts”.

His hour-long talk was salted with the seasoning of doom and gloom. Pakistan will likely be a country for the top one per cent even in 2047, he said. “Which problem have we ever solved?” he said while referring to the decades-old issues of low literacy, terrorism and the circular debt that still plague the nation of 220 million.

Responding to a question about the likelihood of the country receiving climate reparations — dollars that the world’s biggest polluters are supposed to give to developing nations for suffering the consequences of climate change — Mr Ismail said their likelihood was minimal.

Quoting from two meetings he had with a group of ambassadors from European nations, Mr Ismail said the country shouldn’t be expecting any climate reparations whatsoever. “Pakistan isn’t a well-liked country, to put it diplomatically,” he said.

He made a strong case for privatising the twin gas distribution companies, which were losing one-fifth of their supplies under the head of unaccounted-for gas (UFG). “The issue of UFG will be solved within one year if you privatise the two companies,” he said while implying that their directors lack the so-called skin in the game to bring about any real change in the state-owned enterprises.

Mr Ismail gave assurances that the central bank was going to penalise eight commercial banks that were caught manipulating the exchange rate to make billions in profit while he sat at the helm of the finance ministry.

Replying to a question, the former finance minister acknowledged the outsized role of the military in politics. “It isn’t a good thing. The influence of the military must come down over the years,” he said.

-

Comment by Riaz Haq on November 12, 2022 at 10:27am

-

Study reveals social mobility booming in Pakistan

https://profit.pakistantoday.com.pk/2018/10/29/study-reveals-social...

The Standard Chartered Bank (SCB-Pak) has conducted a study on ‘Emerging Affluent Consumers’ in eleven countries including Pakistan, in which it found that nearly two-thirds or 64 per cent of emerging affluent consumers in Pakistan are experiencing upward social mobility while 11 per cent are enjoying ‘supercharged’ social mobility.

The Emerging Affluent Study 2018 – climbing the prosperity ladder – examines the views of 11,000 emerging affluent consumers- individuals who are earning enough to save and invest – from 11 markets across Asia, Africa and the Middle East.

Commenting on the study, SCB Retail Banking Head Syed Mujtaba Abbas said, “Ambitious consumers are on an upward social trajectory; they are surpassing their parents’ success in education, careers and home ownership. As their ambitions and aspirations grow, they are demanding convenient financial services and digital technology to broaden their access to money management and advance their financial wellbeing. It is an exciting journey where they are not only improving their own lives, but they are also fuelling growth in some of the world’s most exciting markets.”

According to the study, the average figure for social mobility among the emerging affluent consumers across the markets is 59 per cent, and of these 7 per cent are experiencing supercharged social mobility.

Pakistan’s socially mobile consumers, as identified by the study, have had impressive earnings growth, with almost half (44 per cent) enjoying a salary increase of 10 per cent or more in the past year, and more than a third (34 per cent) seeing their earning jump by 50 per cent or more in the past five years.

In Pakistan, the socially mobile people are also better educated and achieving higher levels of employment and homeownership than their parents. As many as 89 per cent went to universities, compared to 66 per cent of their fathers and less than half (49 per cent) of their mothers, while 83 per cent are in a management position or running their own businesses compared to 65 per cent of their fathers and 28 per cent of their mothers. Similarly, as many as 88 per cent of the socially mobile people own their own home, compared to 81 per cent of their parents at the same age.

Levels of optimism among the emerging affluent in Pakistan are even higher than reality, with 79 per cent believing they are in a better financial position than their parents compared to the 64 per cent in the study that are actually socially mobile.

More than two-thirds (70 per cent) of the emerging affluent in Pakistan say their familiarity with digital tools have been vital to their personal success, while 73 per cent say online banking makes them feel that they have more control over their money and investments, and 67 per cent say digital money management has helped them get closer to achieving their financial goals.

Pakistan’s emerging affluent is comfortable going online for financial advice, with the majority (60 per cent) saying they would invest in financial products online if an on-demand adviser was available. Risk is not a problem for the emerging affluent if strong rewards are possible 58 per cent would accept a high level of risk for a high level of return when investing their money in online financial products.

-

Comment by Riaz Haq on November 12, 2022 at 10:29am

-

Study reveals social mobility booming in Pakistan

https://profit.pakistantoday.com.pk/2018/10/29/study-reveals-social...

The Standard Chartered Bank (SCB-Pak) has conducted a study on ‘Emerging Affluent Consumers’ in eleven countries including Pakistan, in which it found that nearly two-thirds or 64 per cent of emerging affluent consumers in Pakistan are experiencing upward social mobility while 11 per cent are enjoying ‘supercharged’ social mobility.

The Emerging Affluent Study 2018 – climbing the prosperity ladder – examines the views of 11,000 emerging affluent consumers- individuals who are earning enough to save and invest – from 11 markets across Asia, Africa and the Middle East.

Commenting on the study, SCB Retail Banking Head Syed Mujtaba Abbas said, “Ambitious consumers are on an upward social trajectory; they are surpassing their parents’ success in education, careers and home ownership. As their ambitions and aspirations grow, they are demanding convenient financial services and digital technology to broaden their access to money management and advance their financial wellbeing. It is an exciting journey where they are not only improving their own lives, but they are also fuelling growth in some of the world’s most exciting markets.”

According to the study, the average figure for social mobility among the emerging affluent consumers across the markets is 59 per cent, and of these 7 per cent are experiencing supercharged social mobility.

Pakistan’s socially mobile consumers, as identified by the study, have had impressive earnings growth, with almost half (44 per cent) enjoying a salary increase of 10 per cent or more in the past year, and more than a third (34 per cent) seeing their earning jump by 50 per cent or more in the past five years.

In Pakistan, the socially mobile people are also better educated and achieving higher levels of employment and homeownership than their parents. As many as 89 per cent went to universities, compared to 66 per cent of their fathers and less than half (49 per cent) of their mothers, while 83 per cent are in a management position or running their own businesses compared to 65 per cent of their fathers and 28 per cent of their mothers. Similarly, as many as 88 per cent of the socially mobile people own their own home, compared to 81 per cent of their parents at the same age.

Levels of optimism among the emerging affluent in Pakistan are even higher than reality, with 79 per cent believing they are in a better financial position than their parents compared to the 64 per cent in the study that are actually socially mobile.

More than two-thirds (70 per cent) of the emerging affluent in Pakistan say their familiarity with digital tools have been vital to their personal success, while 73 per cent say online banking makes them feel that they have more control over their money and investments, and 67 per cent say digital money management has helped them get closer to achieving their financial goals.

Pakistan’s emerging affluent is comfortable going online for financial advice, with the majority (60 per cent) saying they would invest in financial products online if an on-demand adviser was available. Risk is not a problem for the emerging affluent if strong rewards are possible 58 per cent would accept a high level of risk for a high level of return when investing their money in online financial products.

-

Comment by Riaz Haq on November 13, 2022 at 4:43pm

-

INTERGENERATIONAL ECONOMIC MOBILITY: THE CASE OF NORTH-

WESTERN PAKISTAN

Ansa Javed Khan1, Sajjad Ahmad Jan2, Jawad Rahim Afridi3*, Arshia Hashmi4, Muhammad Azeem Ahmed5 1Assistant Director, P&D, Bacha Khan University, Charsadda, Pakistan; 2Assistant Professor, Department of Economics, University of Peshawar, Peshawar, Pakistan; 3*Lecturer, Department of Economics, Sarhad University of Science & IT, Peshawar, Pakistan; 4Assistant Professor, The University of Faisalabad, Department of Management Studies, Faisalabad, Pakistan; 5Associate Professor, Barani Institute of Sciences, Pakistan.

Email: 1*director_pnd@bkuc.edu.pk, 2sajjadahmadjan@uop.edu.pk, 3*jrafridi67@gmail.com, 4arshia.hashim@tuf.edu.pk, 5azeem@baraniinstitute.edu.pk

Article History: Received on 19th June 2021, Revised on 26th June 2021, Published on 29th June 2021

https://www.sciencegate.app/document/10.18510/hssr.2021.93141

Access to Education and Intergenerational Economic Mobility

The following table 1 shows the change in educational status which has taken place between the parents and children’s generations for the overall sample as well as for the sub-groups (Majority and Minority Tribes). The absolute numbers (outside parentheses) and the percentage (within parentheses) in different cells of the table show the people who are illiterate or at different levels of education. The table on one hand shows the intergenerational mobility of people up and down the education ladder and on the other hand reveals the wide and persistent educational gap between the majority and minority tribes. The table shows that 26 % of the respondents in the kids’ generation do not have any education versus 46 % in the parents’ generation. The results affirm the government’s claims and the common perception that, on average, more people have become literate through time and therefore the people in the children’s generation are more likely to be educated than their parent's generation. Further, the college and university graduates in the children’s generation outnumber the school graduates while school graduates outnumber the higher two educational categories in the parents’ generation as most of the students in past used to drop out at both primary or high school levels and couldn’t manage to get into a college or university for higher studies.

The aggregate results for the whole sample are actually driven by the majority tribes as it shows identical trends from the parents’ generation to the children’s generation in all educational. The majority tribe has succeeded in decreasing the number of illiterates from 33% in the parents’ generation to 11% in the children’s generation. College and university graduates (total of 60%) outnumber the school graduates and the illiterate (total of 40%) in the children’s generation as compared to the parents’ generation in the majority tribe where the former is 26% and the latter is 73%. This indicates a visible upward movement of the educational ladder by the members of the majority tribe. The situation of education and literacy in the minority tribe is deplorable if the comparison is either made on basis of children’s and parents’ generations or if the educational attainment levels of the minority and majority tribes are compared. The illiterates outnumber all the other educational categories as in sharp contrast to the educational attainment levels of the majority tribe. The data further reveals that no or only a negligible improvement in the educational status of the people belonging to the minority tribe has taken place between the children’s and parents’ generations. This affirms our presumption that in the North-Western parts of Pakistan, the tribal affiliation of a person determines his or her access to education. The ease of access to education then further transforms into economic mobility or immobility of the people.

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

American Prof John Mearsheimer on International Geopolitics in South Asia

Professor John Mearsheimer, a renowned international relations expert known for his theory of "offensive realism", has recently spoken to India's CNN-News18 about the impact of US-China competition on geopolitics in South Asia. Sharing his thoughts in interviews on India-Pakistan conflict after the Pahalgam attack, he said: "There is really no military solution to this (Kashmir)…

ContinuePosted by Riaz Haq on May 24, 2025 at 5:30pm

Has Pakistan Destroyed India's S-400 Air Defense System at Adampur?

Pakistan claims its air force (PAF) has destroyed India's high-value Russian-made S-400 air defense system (ADS) located at the Indian Air Force (IAF) Adampur air base. India has rejected this claim and posted pictures of Prime Minister Narendra Modi posing in front of its S-400 rocket launchers in Adampur. Meanwhile, there are reports that an Indian S-400 operator, named Rambabu Kumar Singh, was killed at about the time Pakistan claims to have hit it. Pakistan is believed to have targeted…

ContinuePosted by Riaz Haq on May 21, 2025 at 4:00pm — 2 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network