PakAlumni Worldwide: The Global Social Network

The Global Social Network

Sri Lanka is a Shining Example For India and Pakistan

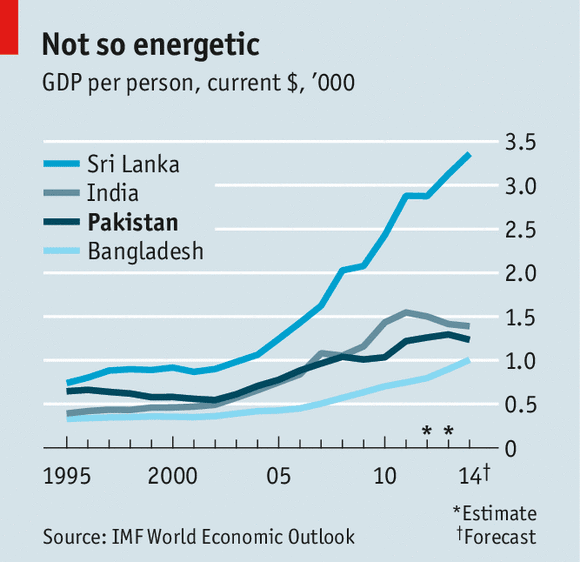

Since the end of the civil war in 2009, Sri Lanka has been booming even as the rest of South Asia region has lagged.

|

| Per Capita GDPs South Asia Region Source: Economist |

Sri Lanka's per capita income has quintupled over the last two decades from about $700 to $3500, significantly outperforming all other South Asian economies. During the same period, Pakistan's per capita GDP has increased from $500 to $1300 while India's is up from $400 to $1400.

In addition to its high per capita GDP for the South Asia region, Sri Lanka has also excelled on Human Development Index (HDI), a key indicator of social development assessed each year by the United Nations Development Program (UNDP).

|

| Human Development Index in South Asia Source: UNDP |

Sri Lanka has the fastest growing economy with the highest social indicators in South Asia region. Its economy grew at 7.2% last year and it is expected to post 8% growth this year. With a literacy rate of 91% and life expectancy of 76 years, the UNDP ranks it among countries with high human development. It has achieved this progress in spite of a 26-year-long violent insurgency by the Tamil Tigers (LTTE) which it successfully ended in 2009.

By contrast, both India and Pakistan continue to lag Sri Lanka in terms of both economic and social indicators. India's economy has slowed in recent years. India's per capita GDP has shrunk in US dollar terms this year, significantly reducing the gap with Pakistan whose GDP has also seen slow growth since 2008. India suffers from low levels of human development with a rank of 136 among 187 countries. Pakistan ranks even lower at 146.

|

| GDP Per Capita in US$ Source: World Bank |

Pakistan's per capita GDP remained essentially flat in 1990s before doubling in years 2000-2008 on Musharraf's watch when Pakistan joined the ranks of middle income countries with per capita income of $1000 or more. Pakistanis have seen a very modest growth in their incomes since 2008.

While India's human development is still low, it has continued to make steady progress in the last two decades. Pakistan's human development progress briefly accelerated in years 2000-2007 on President Musharraf's watch. Pakistan's HDI grew an average rate of 2.7% per year under President Musharraf from 2000 to 2007, and then its pace slowed to 0.7% per year in 2008 to 2012 under elected politicians, according to the 2013 Human Development Report titled “The Rise of the South: Human Progress in a Diverse World”. Going further back to the decade of 1990s when the civilian leadership of the country alternated between PML (N) and PPP, the increase in Pakistan's HDI was 9.3% from 1990 to 2000, less than half of the HDI gain of 18.9% on Musharraf's watch from 2000 to 2007.

There is much Pakistan can learn from Sri Lanka's record on human and economic development as well as fighting violent insurgencies. It is especially important today as its economy and education suffer in the midst of a growing Taliban violence that threatens the very existence of Pakistan.

Related Links:

Haq's Musings

Can Pakistan Learn From Sri Lanka to Defeat TTP?

South Asia Lags in UN MDG Goals

History of Human Development in Pakistan

Musharraf Accelerated Economic and Human Capital Growth in Pakistan

Politics of Patronage in Pakistan

Will "Last Chance" Talks With TTP Succeed?

-

Comment by Riaz Haq on February 17, 2014 at 10:03pm

-

Here's a report on US Investment Banks cutting staff in India:

New York: Investment banks from UBS AG to Morgan Stanley spent half a decade building their operations in India, betting that a growing economy would trigger a boom in mergers and stock sales. They’ve spent the last three years reversing that expansion.

The number of investment-banking positions in India has dropped by about 30% since 2010—more than double the pace of global industry cutbacks in the same period—according to the Indian unit of recruiter Randstad Holding NV. Some firms, including Bank of America Corp., have made even steeper cuts.

The reductions reflect the falloff in deals and equity offerings involving Indian companies, down about 50% by value from 2010, as the country’s $1.8 trillion economy slows and corporate debt rises. “Some banks have resorted to lowering fees as they chase work, further denting revenues. More job cuts may come as big mergers and stock offerings remain subdued,” people familiar with the matter said.

“It is a bloodbath at investment banks focusing on deals above $100 million,” said Vikram Utamsingh, a Mumbai-based managing director at consulting firm Alvarez and Marsal Inc. “It’s extremely difficult at this point in time to get hired as an investment banker in India. I don’t know how any bank will grow in this market.”

BofA reductions

Bank of America’s local unit, the second-ranked takeover adviser in India last year, has cut almost half of an investment-banking team that numbered 40 in 2010, said a person with knowledge of the matter, who asked not to be identified as the details are confidential. UBS has reduced investment-banking headcount to 10 from 16 during the same period, while Morgan Stanley’s local staff has fallen to about 22 from 35, people familiar with the banks’ operations said.

Spokesmen for the three banks declined to comment.

“Not all foreign firms are retrenching. Moelis and Co., the investment bank founded by Ken Moelis, entered India in 2012 and now has nine bankers there,” said Manisha Girotra, CEO of the New York-based firm’s local unit. Girotra said she plans to add staff in India, calling it a long-term strategic market for Moelis.

“Some foreign banks have responded to India’s challenges by cutting senior positions there in favour of flying in bankers from offices like Hong Kong and Singapore when needed,” according to executives who spoke on condition of anonymity....http://www.livemint.com/Politics/zM6SKqn1KpRRItXMETrMSK/Wall-Street...

-

Comment by Riaz Haq on February 28, 2014 at 9:53am

-

Here's an AFP report on GDP growth in Pakistan's current fiscal year:

KARACHI (AFP) - Pakistan recorded five per cent growth in the first quarter of the current fiscal year, the central bank said on Friday, beating its target and almost doubling the figure for the same period last year.

The State Bank of Pakistan's data for the early months of the financial year began in July 2013, said GDP grew by 5.0 per cent, compared with only 2.9 per cent in the first quarter of the last fiscal year.

Nuclear-armed Pakistan, plagued by a bloody, destabilising Islamist insurgency and chronic power shortages, has struggled to energise its economy in recent years.

Growth has bumped along well below the level experts say is needed to absorb new entrants to the workforce from Pakistan's growing, youthful population.

http://www.straitstimes.com/breaking-news/money/story/pakistans-eco...

-

Comment by Riaz Haq on February 28, 2014 at 10:01am

-

Here's a BBC report on slowing economic growth in India:

India's economic growth rate slowed down in the most recent quarter, according to official figures.

The economy expanded at an annual rate of 4.7% in the three months to December, down from 4.8% in the previous quarter.

The figure was lower than analysts had been expecting.

Asia's third-largest economy has been weighed down by various factors, such as high inflation, a weak currency and a drop in foreign investment.

For the same period in 2012, annual GDP growth was 4.5%.

This is the fifth quarter in a row that India's annual growth rate has been below the 5% mark.

Manufacturing was hardest hit - falling by 1.9% compared with the previous year. The industry is considered one of the country's biggest job creators.

However, hotels, transport utilities and agriculture all showed substantial growth.

"We continue to expect India's economic recovery to remain slow and uneven. Local conditions remain challenging, which is critical as the economy is driven primarily by domestic demand," said Capital Economics economist Miguel Chanco.

Two years ago, India's growth rate stood at about 8%. Economists say the country needs to grow by that much in order to generate enough jobs for the 13 million people entering the workforce each year.

The BBC's Yogita Limaye in Mumbai says the numbers are not good news for the ruling Congress Party, which faces elections in May.

"These figures show that the slowdown really cemented itself in 2013. All four quarters showed growth below 5%," she said.

"One silver lining [for the government] is inflation. Prices had risen steeply in the beginning of the year but over the past two months they have come down."

More than half of the country's 1.2 billion people are under 25. Chand Pandey is one of them. He lost his job at a car parts firm recently and is struggling to find another one.

"Whichever company I go to, they say there's a slowdown and there's less production," he said.

"So they're not hiring any workers right now. It's been two or three months that I've been looking for a job, but I get the same answer everywhere."

-

Comment by Riaz Haq on July 29, 2015 at 9:25pm

-

Times of India Op Ed by Morgan Stanley's Head of Emerging Markets Ruchir Sharma on "The Quiet Rise of South Asia":

Together, India, Bangladesh, Sri Lanka and Pakistan are now growing at an average annual pace of close to 6%, compared to 2% for the emerging world outside China.

Due to their lower per capita income, it should hardly be surprising that South Asian economies are growing faster than other emerging markets. But that spread of nearly four percentage points is the largest in the region’s post-independence history. While hopes for a revival in India exploded when Prime Minister Narendra Modi took power in 2014, promising major economic reform, its smaller neighbours remained under the radar. Now, however, Bangladesh, Sri Lanka and Pakistan are leading the quiet rise of South Asia.

Since the global financial crisis, a number of emerging markets have been ramping up debt and government spending. But the smaller South Asian economies have largely avoided these excesses, so they still have room to boost growth. While falling prices for oil and other raw materials are hurting most emerging regions, they are a boon to the nations of South Asia, all of which are commodity importers.

The impact of low commodity prices is helping to keep inflation low even as growth accelerates, while countries like Brazil, Russia and South Africa face stagflation. Many emerging economies have been hurt by rising wages and have seen their share of global exports decline, but not Pakistan and Bangladesh. Their wages are still competitive, and they are increasing their share of global exports, even as growth in global trade is stagnating for the first time since the 1980s.

They are benefitting along with Sri Lanka as manufacturers look for cheaper wages outside of China, with wages in the manufacturing sector having increased by 370% in the world’s second largest economy over the past decade. Bangladesh is now the second leading exporter, after China, of ready-made clothes to the US and Germany.

And as China and Japan compete with India for influence in the Indian Ocean, they are pouring billions into new ports in Bangladesh, Pakistan and Sri Lanka. The upshot of these positive trends is that South Asia could sustain a growth rate of over 5% for the next few years, which would make it one of the fastest-growing regions in the emerging world.

The competition between Japan and China is a huge boost: after Beijing recently announced plans to build a $46 billion “economic corridor” connecting Pakistan to China, Japan beat out China for rights to build Bangladesh’s first deep-water port, at Matarbari. The inflow of foreign direct investment is helping to keep South Asia in what can be identified as the investment sweet spot: strong economies tend to invest between 25 and 35% of GDP. Sri Lanka and Bangladesh are now right in the sweet spot, at or near 30% of GDP.

Investment also tends to have the greatest impact on jobs and growth when it is going into manufacturing. Both Sri Lanka and Bangladesh have strong manufacturing sectors, representing 18% of GDP. Pakistan is much weaker, with investment at 14% and manufacturing at 12% of GDP. But Pakistan’s manufacturing sector is now growing, due to both increasing electric output and the fact that – like Bangladesh – its young population and labour force is expected to continue expanding for at least the next five years.

At a time when much of the workforce is entering retirement age in larger emerging nations including China, Korea, Taiwan and Russia, the positive demographic trends in South Asia are potentially a big competitive advantage. With exports and investment strong, Bangladesh is running a current account surplus, Sri Lanka is reducing a deficit now equal to 3% of GDP, and Pakistan has cut its current account deficit from 8% of GDP in 2008 to just 1%.

http://blogs.timesofindia.indiatimes.com/toi-edit-page/bucking-stag...

-

Comment by Riaz Haq on March 23, 2022 at 7:07pm

-

#China mulls package to ease #SriLanka's #economic #crisis. China's ambassador to Sri Lanka says it is considering a request for $2.5 billion in assistance to help the island nation through its worst #debt & #forex crisis in memory- ABC News - https://abcn.ws/3ulunFw via @ABC

COLOMBO, Sri Lanka -- China’s ambassador to Sri Lanka said Monday it is considering a request for $2.5 billion in assistance to help the island nation through a debt and foreign currency crisis.

Qi Zhenhong told reporters that Beijing is studying the Sri Lankan government’s appeal for a $1 billion loan and $1.5 billion credit line.

Sri Lanka needs to make nearly $7 billion in payments on foreign loans this year, but Qi was non-committal about a request to restructure China’s loans to Sri Lanka.

“Our ultimate goal is to solve the problem, but there may be different ways to do so,” he said.

Sri Lanka’s foreign reserves are dwindling at a time when it faces huge debt obligations. The country’s struggle to pay for imports has caused shortages of medicine, fuel, milk powder, cooking gas and other essentials, with people waiting in long queues to get fuel.

Residents are enduring daily power cuts due to a shortage of fuel to operate the generating plants and dry weather has sapped hydropower capacity.

The Central Bank allowed the local currency to free float earlier this month, causing a sharp increase in prices.

Sri Lanka’s economy depends heavily on tourism and trade and the pandemic has been disastrous, with the government estimating a loss of $14 billion over the last two years. The economy is estimated to have contracted by 1.5 % in July- September 2021, according to the central bank.

Sri Lanka's foreign reserves are shrinking partly because of construction projects built with Chinese loans that are not making money. China loaned the country money to build a seaport and airport in the southern Hambantota district and a wide network of roads.

Central Bank figures show that current Chinese loans to Sri Lanka total around $3.38 billion, not including loans to state-owned businesses, which are accounted for separately and thought to be substantial.

Qi said that since the outbreak of COVID-19 in 2020, China has provided $2.8b in financial help to Sri Lanka.

“Our aim is to help Sri Lanka to overcome the current difficulties,” he said.

Last week, neighboring India extended a $1 billion credit line to Sri Lanka to be used for importing food, medicines and other essentials from India.

The two Asian giants are vying for influence in the Indian Ocean and consider Sri Lanka strategically important.

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

US-Israeli Military Use of AI: Iran Targets Data Centers

As the war enters 12th day, both the Israeli and the US militaries are using AI to accelerate decision-making, analyzing vast amounts of intelligence data for generating targets, and optimizing logistics, shifting toward AI-enabled command structures to maintain battlefield superiority. Almost all major US AI data center operators have signed contracts to provide AI tools and services to both the Pentagon and the IDF. This arrangement has not gone unnoticed by the Iranians who are…

ContinuePosted by Riaz Haq on March 11, 2026 at 10:25am

Trump Leads America into an Unpopular War in the Middle East!

President Donald Trump joined Israel in yet another war of choice in the Middle East last week. Polls conducted in the United States immediately after the start of the Iran war show that the majority of Americans do not support it. A YouGov snap poll fielded Saturday — the day of the strikes — found 34% of Americans approve of the U.S. attacks on Iran, with 44%…

ContinuePosted by Riaz Haq on March 3, 2026 at 10:00am — 5 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network