PakAlumni Worldwide: The Global Social Network

The Global Social Network

Soaring Prices of Imported LNG Threaten Pakistan's Economic Recovery

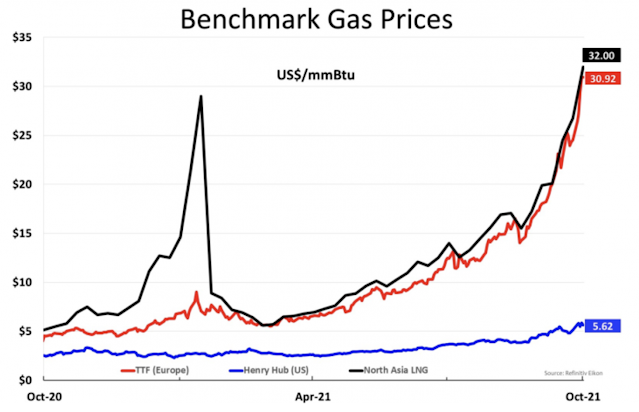

Soaring LNG prices are adversely affecting Pakistan's balance of payments and threatening the nation's post-COVID economic recovery. Pakistan's trade deficit has widened to nearly $12 billion in July-September 2021 quarter, up more than 100% from the same period last year. The nation's heavy reliance on expensive imported energy has been the main cause of prior balance of payments crises that have forced it to seek IMF bailouts more than a dozen times in the last 70 years.

|

| Global LNG Prices. Source: The Peninsula Qatar |

|

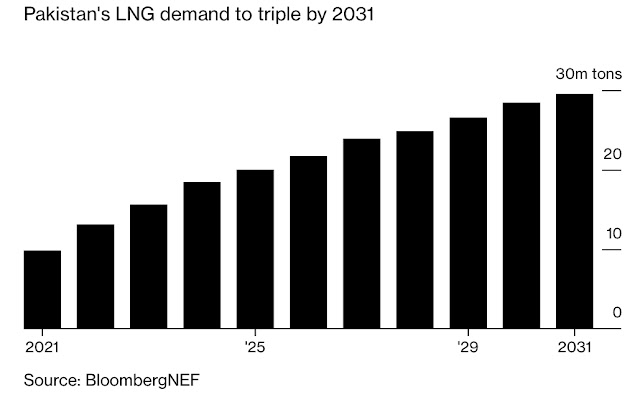

| Pakistan: World's Fastest Growing LNG Market. Source: Bloomberg |

|

| Global Commodity Price Increases |

|

| Pakistan Trade Stats. Source: Topline Securities |

|

| Pakistan Coal Power Plants Under CPEC. Source:China's Global Power ... |

|

| All Pakistani Power Plants Under CPEC. Source: China's Global Power... |

|

| Pakistan's Malik Amin Aslam with CNN's Becky Anderson |

Malik Amin Aslam, Pakistan Prime Minister Imran Khan's special assistant on climate change, said recently in an interview with CNN that his country is seeking to change its energy mix to favor green. He said Pakistan's 60% renewable energy target would to be based on solar, wind and hydro power projects, and 40% would come from hydrocarbon and nuclear which is also low-carbon. “Nuclear power has to be part of the country’s energy mix for future as a zero energy emission source for clean and green future,” he concluded. Here are the key points Aslam made to Becky Anderson of CNN:

1. Pakistan wants to be a part of the solution even though it accounts for less than 1% of global carbon emissions.

|

| 900 MW Zonergy Solar Park in Bhawalpur, Pakistan |

|

| 1,100 MW Karachi Nuclear Power Plant Unit 2 |

|

| Pakistan Among Top 3 Countries For Newly Installed Hydro |

|

| Installed Wind Power in Pakistan. Source: Modor Intelligence |

|

|

|

https://www.youtube.com/embed/Q_s4kQXChuM"; title="YouTube video player" width="560"></iframe>" height="315" src="https://img1.blogblog.com/img/video_object.png" width="560" style="cursor: move; background-color: #b2b2b2;" />

Haq's Musings

South Asia Investor Review

Pakistan's Debt Crisis

Declining Investment Hurting Pakistan's Economic Growth

Rooftop Solar Net Metering Growth in Pakistan

Can Pakistan Avoid Recurring IMF Bailouts?

Pakistan is the 3rd Fastest Growing Trillion Dollar Economy

CPEC Financing: Is China Ripping Off Pakistan?

Pakistan Ramps Up Nuclear Power Generation

Is Pakistan Ready For Clean Energy Revolution?

China Global Power Database on Power Plants in Pakistan

CPEC Transforming Pakistan

Pakistan's $20 Billion Tourism Industry Boom

Pakistan Among Top 3 Countries For New Hydro Installed Capacity

Riaz Haq's YouTube Channel

PakAlumni Social Network

-

Comment by Riaz Haq on September 18, 2022 at 4:40pm

-

Strong #US #Dollar Spells Trouble for World #Economy. Its rise being felt in #fuel and #food shortages in #SriLanka, in #Europe’s record #inflation, in #Japan’s exploding #trade deficit, #Pakistan's #IMF bailout and #Bangladesh seeking IMF help https://www.wsj.com/articles/dollars-rise-spells-trouble-for-global... via @WSJ

For the U.S., a stronger dollar means cheaper imports, a tailwind for efforts to contain inflation, and record relative purchasing power for Americans. But the rest of the world is straining under the dollar’s rise.

“I think it’s early days yet,” said Raghuram Rajan, a finance professor at the University of Chicago’s Booth School of Business. When he served as governor of the Reserve Bank of India last decade, he complained loudly about how Fed policy and a strong dollar hit the rest of the world. “We’re going to be in a high-rates regime for some time. The fragilities will build up.”

-------------

The U.S. dollar is experiencing a once-in-a-generation rally, a surge that threatens to exacerbate a slowdown in growth and amplify inflation headaches for global central banks.

The dollar’s role as the primary currency used in global trade and finance means its fluctuations have widespread impacts. The currency’s strength is being felt in the fuel and food shortages in Sri Lanka, in Europe’s record inflation and in Japan’s exploding trade deficit.

This week, investors are closely watching the outcome of the Federal Reserve’s policy meeting for clues about the dollar’s trajectory. The U.S. central bank is expected Wednesday to raise interest rates by at least 0.75 percentage point as it fights inflation—likely fueling further gains in the greenback.

In a worrying sign, attempts from policy makers in China, Japan and Europe to defend their currencies are largely failing in the face of the dollar’s unrelenting rise.

Last week, the dollar steamrolled through a key level against the Chinese yuan, with one dollar buying more than 7 yuan for the first time since 2020. Japanese officials, who had previously stood aside as the yen lost one-fifth of its value this year, began to fret publicly that markets were going too far.

The ICE U.S. Dollar Index, which measures the currency against a basket of its biggest trading partners, has risen more than 14% in 2022, on track for its best year since the index’s launch in 1985. The euro, Japanese yen and British pound have fallen to multidecade lows against the greenback. Emerging-market currencies have been battered: The Egyptian pound has fallen 18%, the Hungarian forint is down 20% and the South African rand has lost 9.4%.

The dollar’s rise this year is being fueled by the Fed’s aggressive interest-rate increases, which have encouraged global investors to pull money out of other markets to invest in higher-yielding U.S. assets. Recent economic data suggest that U.S. inflation remains stubbornly high, strengthening the case for more Fed rate increases and an even stronger dollar.

Dismal economic prospects for the rest of the world are also boosting the greenback. Europe is on the front lines of an economic war with Russia. China is facing its biggest slowdown in years as a multidecade property boom unravels.

-

Comment by Riaz Haq on September 18, 2022 at 4:41pm

-

Strong #US #Dollar Spells Trouble for World #Economy. Its rise being felt in #fuel and #food shortages in #SriLanka, in #Europe’s record #inflation, in #Japan’s exploding #trade deficit, #Pakistan's #IMF bailout and #Bangladesh seeking IMF help https://www.wsj.com/articles/dollars-rise-spells-trouble-for-global... via @WSJ

For the U.S., a stronger dollar means cheaper imports, a tailwind for efforts to contain inflation, and record relative purchasing power for Americans. But the rest of the world is straining under the dollar’s rise.

“I think it’s early days yet,” said Raghuram Rajan, a finance professor at the University of Chicago’s Booth School of Business. When he served as governor of the Reserve Bank of India last decade, he complained loudly about how Fed policy and a strong dollar hit the rest of the world. “We’re going to be in a high-rates regime for some time. The fragilities will build up.”

-------------

-------

On Thursday, the World Bank warned that the global economy was heading toward recession and “a string of financial crises in emerging market and developing economies that would do them lasting harm.”

The stark message adds to concerns that financial pressures are widening for emerging markets outside of well-known weak links such as Sri Lanka and Pakistan that have already sought help from the International Monetary Fund. Serbia became the latest to open talks with the IMF last week.

“Many countries have not been through a cycle of much higher interest rates since the 1990s. There’s a lot of debt out there augmented by the borrowing in the pandemic,” said Mr. Rajan. Stress in emerging markets will widen, he added. “It’s not going to be contained.”

A stronger dollar makes the debts that emerging-market governments and companies have taken out in U.S. dollars more expensive to pay back. Emerging-market governments have $83 billion in U.S. dollar debt coming due by the end of next year, according to data from the Institute of International Finance that covers 32 countries.

-

Comment by Riaz Haq on November 3, 2022 at 11:07am

-

Comment by Riaz Haq on June 10, 2023 at 8:21am

-

Pakistan plans to push coal-fired power to 10 GW, shift away from gas

https://www.gastopowerjournal.com/markets/item/13377-pakistan-plans...

Soaring fuel prices have made Pakistan move away from importing LNG and use domestic lignite to generate electricity instead. “LNG is no longer part of the long-term plan,” Pakistan’s energy minister Khurram Dastgir Khan told Reuters, revealing targets to increase coal-fired capacity to 10 GW, up from currently 2.31 GW, and build no more gas-fired power plants.

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Has Pakistan Destroyed India's S-400 Air Defense System at Adampur?

Pakistan claims its air force (PAF) has destroyed India's high-value Russian-made S-400 air defense system (ADS) located at the Indian Air Force (IAF) Adampur air base. India has rejected this claim and posted pictures of Prime Minister Narendra Modi posing in front of its S-400 rocket launchers in Adampur. Meanwhile, there are reports that an Indian S-400 operator, named Rambabu Kumar Singh, was killed at about the time Pakistan claims to have hit it. Pakistan is believed to have targeted…

ContinuePakistan Downs India's French Rafale Fighter Jets in History's Largest Aerial Battle

Pakistan Air Force (PAF) pilots flying Chinese-made J10C fighter jets shot down at least two Indian Air Force's French-made Rafale jets in history's largest ever aerial battle involving over 100 combat aircraft on both sides, according to multiple media reports. India had 72 warplanes on the attack and Pakistan responded with 42 of its own, according to Pakistani military. The Indian government has not yet acknowledged its losses but senior French and US intelligence officials have …

ContinuePosted by Riaz Haq on May 9, 2025 at 11:00am — 32 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network