PakAlumni Worldwide: The Global Social Network

The Global Social Network

Soaring Prices of Imported LNG Threaten Pakistan's Economic Recovery

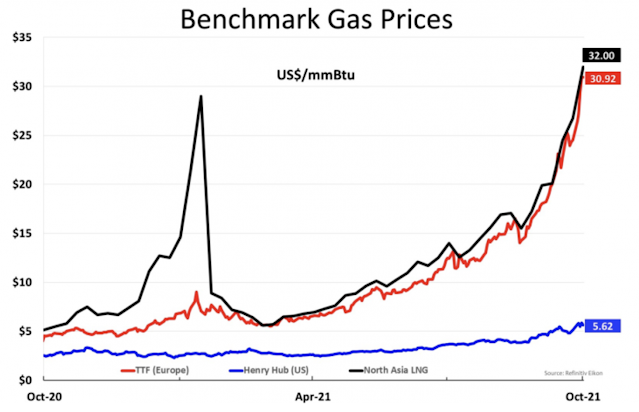

Soaring LNG prices are adversely affecting Pakistan's balance of payments and threatening the nation's post-COVID economic recovery. Pakistan's trade deficit has widened to nearly $12 billion in July-September 2021 quarter, up more than 100% from the same period last year. The nation's heavy reliance on expensive imported energy has been the main cause of prior balance of payments crises that have forced it to seek IMF bailouts more than a dozen times in the last 70 years.

|

| Global LNG Prices. Source: The Peninsula Qatar |

|

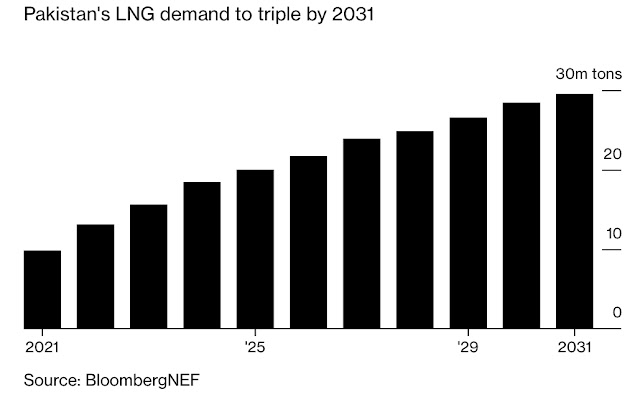

| Pakistan: World's Fastest Growing LNG Market. Source: Bloomberg |

|

| Global Commodity Price Increases |

|

| Pakistan Trade Stats. Source: Topline Securities |

|

| Pakistan Coal Power Plants Under CPEC. Source:China's Global Power ... |

|

| All Pakistani Power Plants Under CPEC. Source: China's Global Power... |

|

| Pakistan's Malik Amin Aslam with CNN's Becky Anderson |

Malik Amin Aslam, Pakistan Prime Minister Imran Khan's special assistant on climate change, said recently in an interview with CNN that his country is seeking to change its energy mix to favor green. He said Pakistan's 60% renewable energy target would to be based on solar, wind and hydro power projects, and 40% would come from hydrocarbon and nuclear which is also low-carbon. “Nuclear power has to be part of the country’s energy mix for future as a zero energy emission source for clean and green future,” he concluded. Here are the key points Aslam made to Becky Anderson of CNN:

1. Pakistan wants to be a part of the solution even though it accounts for less than 1% of global carbon emissions.

|

| 900 MW Zonergy Solar Park in Bhawalpur, Pakistan |

|

| 1,100 MW Karachi Nuclear Power Plant Unit 2 |

|

| Pakistan Among Top 3 Countries For Newly Installed Hydro |

|

| Installed Wind Power in Pakistan. Source: Modor Intelligence |

|

|

|

https://www.youtube.com/embed/Q_s4kQXChuM"; title="YouTube video player" width="560"></iframe>" height="315" src="https://img1.blogblog.com/img/video_object.png" width="560" style="cursor: move; background-color: #b2b2b2;" />

Haq's Musings

South Asia Investor Review

Pakistan's Debt Crisis

Declining Investment Hurting Pakistan's Economic Growth

Rooftop Solar Net Metering Growth in Pakistan

Can Pakistan Avoid Recurring IMF Bailouts?

Pakistan is the 3rd Fastest Growing Trillion Dollar Economy

CPEC Financing: Is China Ripping Off Pakistan?

Pakistan Ramps Up Nuclear Power Generation

Is Pakistan Ready For Clean Energy Revolution?

China Global Power Database on Power Plants in Pakistan

CPEC Transforming Pakistan

Pakistan's $20 Billion Tourism Industry Boom

Pakistan Among Top 3 Countries For New Hydro Installed Capacity

Riaz Haq's YouTube Channel

PakAlumni Social Network

-

Comment by Riaz Haq on October 30, 2021 at 11:19am

-

Energy Consumption in Residential Sector of Pakistan

Sadia Gul

University of California, Davis

Rafia Akbar

Muhammad Bilal Sajid

Ghulam Ishaq Khan Institute of Engineering Sciences and Technology

https://www.researchgate.net/publication/342734707_Energy_Consumpti...Energy consuming buildings account for 30-40% of the overall energy consumption in the world and are responsible for more than one third of greenhouse gases emissions. In Pakistan Residential building sector has around 47% share in total energy consumption. Study is conducted to identify the energy consumption pattern and the areas of energy wastage in residential sector of Islamabad. From the analysis of its annual energy usage it can be clearly seen that electricity consumption dominates in term of cost but natural gas has major share in annual energy consumption. Recommendations are provided which include required energy retrofit measures for improving building performance and financial assistance from Government officials. Through these energy efficiency measure significant reduction in carbon footprint can be achieved.

-

Comment by Riaz Haq on October 30, 2021 at 6:54pm

-

According to the World Bank, Pakistan is one of the top five vulnerable countries, despite having no significant contribution to climate change. Another report mentions: “In 2019, CO2 emissions for Pakistan was 223.6 million tons. Between 1970 and 2019, CO2 emissions of Pakistan grew substantially from 17.7 to 223.6 million tons rising at an increasing annual rate that reached a maximum of 15.38 percent in 1987 and then decreased to 1.33 percent in 2019.”

https://dailytimes.com.pk/831596/cop26-what-would-pakistan-look-for/

The drastic decrease in carbon emissions is, surely, the result of steps taken by Pakistan under its Climate Action – the Sustainable Development Goal (SDG) 13. The flagship project, Ten Billion Tree Tsunami (TBTT), is not just a tree plantation movement, but a comprehensive initiative for ecosystem conservation and management. More than a billion new plantations, revised plans for forest management and development across the countries with the engagement of provinces and administrative entities, and capacity of institutions have already been noticed and appreciated by the national and international environment and climate watchdogs.

The Sustainable Development Report 2020, written by a group of authors led by Prof. Jeffrey Sachs, President of the Sustainable Development Solutions Network (SDSN), and published by Cambridge University Press, has declared Pakistan accomplished all targets of the SD-13 ten years ahead of the actual date – 2030. The UNDP SDGs report has also shown Pakistan’s remarkable progress on SDG-13 Climate Action.

COP26 is an opportunity for Pakistan to vigorously showcase its achievements so far as well as its vulnerabilities. Pakistan has been facing the worst impact in the forms of short-span heavy rains, flash floods, unprecedented land-sliding incidents, glacial melting, air pollution and fast diminishing water resources, climate prone crop diseases and low productivity and many others. Overburdened by debt, incapacity and capital shortfall have further increased Pakistan’s vulnerability. Keeping in view the performance on climate action, Pakistan should be slated among the global top priorities for funding, human resource development and institutional strengthening to protect masses living at the edge and their livelihood resources.

The government has approved Pakistan’s Nationally Determined Contribution (NDC) for the UN Climate Conference COP26 where it has aimed for an ambitious 50 per cent reduction on top of the present 1.3 per cent carbon emissions by 2030 subject to the provision of $100 bn climate finance. Special Assistant to Prime Minister Malik Amin Aslam has mentioned that national funding, professional capacity and institutional strengthening will simultaneously take place while mobilising global resources to attain the goal.

-

Comment by Riaz Haq on October 30, 2021 at 6:57pm

-

‘Pakistan to present diverse agenda at COP-26’

https://www.thenews.com.pk/print/904317-pakistan-to-present-diverse...

Pakistan is all set to have a diverse representation at the 26th Conference of the Parties (COP-26) in Glasgow where the key negotiations would open up with a debate on developing countries’ plight of bearing the brunt of environmental degradation caused by the developed countries, said Dr. Abid Qaiyum Suleri, Executive Director, Sustainable Development Policy Institute (SDPI).

Dr. Suleri was addressing a pre-COP-26 briefing held here by SDPI.

Dr. Suleri said that this year, the conference is going to have an extraordinary representation of civil society, parliamentarians, think tanks, and the private sector from across the globe.

He went on to say that the developed countries during the moot would focus on emerging economies like China, India, Brazil, and South Africa to reduce their carbon emissions and provide a financing work plan for chipping in global climate change mitigation efforts.

Dr. Shafqat Munir from SDPI, while moderating the briefing highlighted the key features of the SDPI’s study on Green Recovery during COVID-19 in power and energy sectors.

Dr. Hina Aslam and Dr. Sajid Amin, authors of the study, underpinned the outcomes and recommendations of their research that suggested an ambitious opportunity to convincingly reduce emissions and debt burden through investments in renewable energy projects.

Earlier, SDPI held a discussion on ‘Green Financing and Economic Recovery of Pakistan’ in the backdrop of climate goals for COP-26.

Speaking on the occasion, Secretary Power Division, Ministry of Energy, Ali Raza Bhutta, asserted that the energy mix of Pakistan is very healthy as around 29% of electricity is coming through hydropower. Likewise, the contribution of solar, wind, and biogas is projected to increase significantly in the future.

Shah Jahan Mirza, Managing Director, Private Power, and Infrastructure Board (PPIB) informed the participants that the Government of Pakistan has shown a strong commitment towards increasing the share of renewable energy through HRE Policy 2019 which targets to increase the renewable energy share in power generation to 20% by 2025 and 30% by 2030.

Dr. Sardar Moazzam, Managing Director, National Energy Efficiency and Conservation Authority (NEECA) explained the role of energy efficiency and conservation in green recovery and said that it has been missing from the landscape of energy planning.

Faisal Sharif, Director, Project Appraisals, Private Power & Infrastructure Board, suggested that the green stimulus can accelerate the transition towards green and clean energy, simultaneously spurring green economic recovery and growth by creating millions of jobs and putting emissions into structural decline.

M Ali Kemal, Chief, SDGs, Planning Commission of Pakistan, emphasised the debt swaps and green financing mechanisms support green recovery from Covid-19.

Kashmala Kakakhel, the climate finance specialist, was of the view that there is a need to further address all the relevant SDGs of the country such as poverty as green recovery is not only about Net-Zero.

Hartmut Behrend, Coordinator, Pakistan-German Climate and Energy Initiative, Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ), Dr Sajid Amin Javed from SDP and Dr Fareeha Armughan also shared their views with the participants, especially about green financing and climate finance mechanism.

-

Comment by Riaz Haq on November 5, 2021 at 5:27pm

-

With Climate Pledges, Some Wall Street Titans Warn of Rising Prices

Leaders of some of the world’s biggest financial firms say that the rush to transition to clean energy could have unintended consequences for the global economy.

https://www.nytimes.com/2021/11/04/business/cop26-wall-street-pledg...

GLASGOW — Big business finally seems to be taking the climate crisis seriously. After years spent lurking on the sidelines, the chief executives of the world’s largest banks, companies and investment firms this week took a spot at the center of the debate at COP26.

Banks, asset managers and insurers in recent days pledged to use trillions of dollars to achieve net-zero emissions targets as pension funds and other big investors move to divest trillions more from the fossil fuel industry.

Yet some leaders of the world’s biggest financial firms — including some who were part of pledges made at the climate summit in Glasgow — are warning that the rush to rapidly transition away from a carbon-intensive energy system could unleash unintended consequences that would jeopardize the world’s economic recovery in the near term.

While some of their concerns are so far largely speculative, they suggest that less investment in fossil fuel production could send energy prices soaring, and that divestment could make it harder to monitor dirty energy production.

Speaking at a conference in Saudi Arabia last week, Stephen A. Schwarzman, chief executive of the private equity firm Blackstone, said the growing number of institutional investors pledging to divest their holdings from fossil fuel companies was making it harder for oil and gas producers to finance production.

“If you try and raise money to drill holes, it’s almost impossible to get that money,” Mr. Schwarzman said, adding that an energy shortage could lead to “real unrest” around the world. It is a sentiment that has been echoed by other executives in recent weeks, as U.S. oil prices hit $85 a barrel, a seven-year high.

Jamie Dimon, the chief executive of JPMorgan Chase, said in an interview that the world should be transitioning to a decarbonized economy “right now.” But he cautioned that while less money was being invested in fossil fuels, therefore tightening the supply, it was important for banks to keep funding conventional energy production.

-

Comment by Riaz Haq on November 13, 2021 at 9:50am

-

#America Isn’t Ready for the #ElectricVehicle Revolution. #China controls Lithium-ion battery supply chain. #Russia's #Putin predicts #oil will reach $100 a barrel next year. #energy #FossilFuels #EnergyTransition #RenewableEnergy https://www.nytimes.com/2021/11/10/opinion/electric-vehicle-climate... by Steve LeVine

China’s buildup continues to this day. Just a few weeks ago, Contemporary Amperex Technology, China’s largest battery manufacturer, said it would invest up to $4.96 billion on a plant to recycle used E.V. batteries. That was on top of the company’s $297 million acquisition of Canada’s Millennial Lithium Corporation, which was announced in September.

Can the United States hope to ever catch up? In recent months, General Motors, Stellantis and Toyota have each announced plans to build massive battery factories in North America. Ford said it and its South Korean partner will build three U.S. battery plants by 2025 with enough capacity to equip one million E.V.s a year. But no one seems to know exactly how the battery supply chain will come together and where they will obtain each of the necessary precursors, like cobalt and manganese.

--------------

Vladimir Putin, the president of Russia, last month added his voice to a bullish chorus predicting $100-a-barrel oil — double the price at the start of the year. He may have been showing restraint: Some traders are betting on an unprecedented $200 a barrel by the end of 2022. The return of a frenzied oil market is conjuring up unwelcome memories of a global petroleum goliath with the power to influence Western geostrategy and roil societies everywhere.

Yet this is the old story. We now stand at the precipice of the age of batteries and electric vehicles, technologies likely to steamroll fossil-fuel companies and petro states. From a few thousand fully electric cars sold around the world in the late aughts, consumers are on track to buy four million of them this year.

So far, the United States appears to be little more than a spectator to this revolution. While its battery makers and automakers are poised to produce cutting-edge batteries and popular electric vehicles, they will rely almost entirely on a supply chain controlled by China. Over the past decade, China has built up most of the world’s capacity to process the metals that make lithium-ion batteries — the heart of the electric vehicle revolution — work. It is this capacity that puts China in the catbird seat in the race for the future while America falls farther and farther behind.

Following the financial crash of 2008, the United States and China, along with Japan, South Korea and other countries, began an undeclared race to create and reap the dividends of the E.V. industry, including associated businesses such as battery production. This led the United States and China to inject stout public funding into battery and E.V. start-ups and established companies, in hopes of kick-starting an economic recovery.

In the United States, initially buoyant public and political support for President Barack Obama’s strategy eroded within just a couple of years, following accusations of squandered public funds in a government-backed loan to Solyndra, a California solar panel company that fell victim to cheap Chinese imports.

In China, by contrast, state-backed companies have secured a reliable supply of the raw metals and elements behind E.V. batteries. In the last three and a half years alone, Chinese companies have been the biggest international buyers of additional lithium assets amid soaring prices for the metal.

By 2018, Chinese companies also owned half of the largest cobalt mines in the Democratic Republic of Congo, the source of most of the world’s supply of the metal. Government funding for China’s electric vehicle sector during the past decade amounted to more than $100 billion, according to a study by the Center for Strategic and International Studies.

-

Comment by Riaz Haq on November 13, 2021 at 9:22pm

-

The Pakistan LPG market is expected to grow gradually in the coming years. The country is facing natural gas shortages to meet its energy needs, and, encouragingly, LPG is being promoted as a bridge fuel, especially for energy-starved populations in remote and hilly areas. However, the pace of demand growth will be determined mostly by whether government policies will move LPG toward pricing parity with natural gas and restructure the priority order in the natural gas allocation policy.

https://ihsmarkit.com/research-analysis/Pakistan-LPGs-ongoing-battl...

Natural gas market overview

Natural gas is a major contributor to Pakistan’s primary energy mix, providing almost 50% of the total energy needs (see Figure 1). It is used extensively across a number of sectors—power, residential and commercial, industry, fertilizer, and transport (compressed natural gas [CNG]).

Domestic natural gas production comes primarily from mature nonassociated gas fields in the province of Sindh (see Figure 2). The country’s major gas fields include Sui, Uch, Qadirpur, Sawan, Zamzama, Badin, Bhit, Kandhkot, Mari, and Manzalai. Pakistan’s gas production has been largely flat since 2008, with production peaking at 4.23 Bcf/d in 2012, and eased to 4.01 Bcf/d in 2016 (see Figure 3).

Natural gas reserves have also fallen, from 0.85 Tcm (30.0 Tcf) to 0.50 Tcm (17.6 Tcf), declining by an average of 5% per year since 2005 (see Figure 3). Based on the current rate of production (4 Bcf/d), reserves are expected to last less than 20 years. New investments and exploration have been challenged by regulatory hurdles, insufficient gas prices, and security risks, particularly in the province of Balochistan.

Gas demand in Pakistan is spread across multiple sectors, but high regional imbalances exist. The Punjab region accounts for the most consumption but has the lowest share of production (see Figure 2). The power sector was the largest consumer at 33% of total demand, followed by the residential (21%), industrial (19%), and fertilizer (19%) sectors in fiscal year 2016 (see Figure 4).

The country has a well-developed gas transmission and distribution pipeline network. The network of more than 11,000 km of transmission lines and over 139,000 km of distribution lines belongs solely to two companies: Sui Northern Gas Pipelines Limited (SNGPL) and Sui Southern Gas Company Limited (SSGC). Owing to the country’s large transmission and distribution gas grid, natural gas will remain a major part of the energy mix (see Figure 1).

Gas demand is Pakistan is highly supply constrained, with an unmet demand potential of 1.5–2.0 Bcf/d (see Figure 5). To supplement the gas shortages in various sectors of the economy, Pakistan has plans to ramp up LNG imports. The country’s first LNG import terminal developed by a JV between Engro Corporation and Royal Vopak of the Netherlands came online in March 2015.

The government awarded three tenders to Eni and Gunvor in 2016, two of which are tied to the second FSRU targeted to start up in 2017. Pakistan has plans for development of transnational gas pipelines— the TAPI and IPI pipelines—but both projects face geopolitical and technical challenges.

IHS Markit anticipates Pakistan’s LPG production from gas processing to remain stagnant owing to sluggish E&P activities and domestic gas shortages. Furthermore, LPG production from refineries is expected to increase modestly over the forecast period, as no significant Greenfield and brownfield capacity expansions are envisaged

-

Comment by Riaz Haq on February 19, 2022 at 7:23am

-

Pakistan is seeking to buy liquefied natural gas (LNG) cargoes from the spot market after two long-term suppliers failed to fulfil commitments to deliver shipments in March, Bloomberg reported on Friday while citing “people with knowledge of the matter”.

https://www.dawn.com/news/1675863/pakistan-to-tap-spot-cargoes-afte...

Pakistan LNG Ltd has issued a tender for two cargoes to be delivered next month, the international news agency said.

Two suppliers, Eni SpA and Gunvor Group Ltd, recently informed Islamabad about their inability to deliver cargoes scheduled for March, Pakistan LNG Ltd told Bloomberg.

A global energy crunch has resulted in LNG spot prices surging to levels that are too high for cash-strapped nations like Pakistan. The South Asian nation purchased its most expensive LNG cargo ever in November after a similar cancellation, and has avoided additional purchases since then.

Pakistan is “carefully” analysing its gas shortage, and will purchase cargoes depending on the prices they receive, Pakistan LNG Ltd told the news agency. It’s looking for the cargoes to be delivered between March 2 and March 3 and from March 10 to March 11, it said. The offers are due on Feb 22.

Eni’s LNG deliveries to Pakistan were disrupted after its supplier defaulted on obligations for an unspecified reason, the Italian company told Bloomberg in an emailed statement. “Eni is evaluating all contractual remedies, including legal actions,” the company said by email.

Gunvor declined to comment, the Bloomberg report said.

-

Comment by Riaz Haq on June 14, 2022 at 10:15am

-

Stephen Stapczynski

@SStapczynski

Europe's campaign to quit Russian fuel plunges Pakistan into darkness ����

EU's energy policy is designed to punish Moscow for the war in Ukraine. But it's also wreaking havoc thousands of miles away as Pakistan grapples with a gas shortage

https://twitter.com/SStapczynski/status/1536533469807132672?s=20&am...

----------------

Europe's campaign to quit Russian fuel is designed to punish Moscow for its invasion of Ukraine. It's also wreaking havoc thousands of miles away from the conflict, plunging Pakistan into darkness, undermining one regime and threatening the stability of the country's new leadership.

A decade ago, the world's fifth-most populous country took specific steps to insulate itself from the kinds of violent price spikes that are roiling the market today. It made a massive investment in liquified natural gas and signed long-term contracts with suppliers in Italy and Qatar. Now some of those suppliers have defaulted, though they continue to sell into the more lucrative European market, leaving Pakistan in exactly the position it tried so hard to avoid.

In order to avoid blackouts during the Eid holiday last month, the government paid nearly $100 million to procure a single LNG shipment from the spot market, a record for the cash-strapped nation. In the fiscal year ending July, the country's costs for LNG could top $5 billion, twice what they were a year ago. Even so, the government can't cushion the blow for its citizens: The International Monetary Fund is in talks to bail out the nation with a key condition that it cuts fuel and electricity subsidies.

Now parts of Pakistan are experiencing planned blackouts of more than 12 hours, limiting the effectiveness of air conditioning to offer relief during the ongoing heatwave. The previous prime minister continues to draw large crowds to rallies and protests, amplifying citizens' anger about inflation that's rising at 13.8%. Prime-time talk show hosts regularly discuss how Pakistan will get the fuel it needs, and how much it will have to pay.

Last week, the government announced a new raft of energy-saving measures. Civil servants were released from regular Saturday shifts, and the budget for security personnel was slashed 50%.

"I am acutely aware of the hardships people are facing," Prime Minister Shehbaz Sharif said in a tweet in April ahead of the Eid holiday. He ordered his government to resume purchasing expensive overseas natural gas shipments that same week. And earlier this month he warned that they don't have enough money to continue buying gas from overseas.

The supply crunch will go beyond blackouts. The government has redirected existing natural gas supplies to power plants, short-changing fertilizer makers that depend on the fuel as a feedstock. That move could threaten the next harvest, leading to even higher food costs next year. Cellphone towers are using backup generators to sustain service through the blackouts, but they too are running out of fuel.

There's little reprieve on the horizon. The cost of LNG has surged by more than 1,000% in the last two years, first on post-pandemic demand, then on the Russia invasion of Ukraine. Russia is Europe's biggest supplier of natural gas, and the threat of supply disruptions sent spot rates to a record in March.

https://www.ndtv.com/world-news/pakistans-12-hour-blackouts-linked-...

-

Comment by Riaz Haq on June 14, 2022 at 10:16am

-

Meanwhile, Europe has been demanding more and more LNG. So far this year, Europe's LNG imports are up 50% from the same period last year and aren't showing any sign of slowing down. Policymakers in the European Union drafted a plan to significantly increase LNG deliveries as an alternative to Russian gas as they break ties with President Vladimir Putin's regime over the war in Ukraine. Countries like Germany and the Netherlands are fast-tracking the construction of floating import terminals, with the first ones slated to start within the next six months.

https://www.ndtv.com/world-news/pakistans-12-hour-blackouts-linked-...

"Europe is sucking LNG" from the world, said Steve Hill, executive vice president at Shell Plc, the world's top trader of the fuel. "But that means less LNG will go to developing markets."

Not long ago, Pakistan represented the future for the LNG industry. By the mid-2010s, demand for the fuel, gas cooled to 162 degrees Celsius so it can be shipped around the world via tanker, had plateaued in developed markets. But technological advancements had brought down the costs and construction times for import terminals, and new gas fields cut the prices of the fuel itself.

At the new, lower prices, poorer countries could finally consider the fuel. Suppliers set their sights on these new markets, and when Pakistan issued a tender for long-term LNG supplies, more than a dozen companies bid for its business.

In 2017, Pakistan selected Italy's Eni SpA and trading house Gunvor Group Ltd to supply the country with LNG into the next decade. At the time, the terms were considered good, and the prices were lower than a similar contract signed with Qatar the previous year.

Now, though, the two suppliers have canceled more than a dozen shipments scheduled for delivery from October 2021 through June 2022, coinciding with the surge in European gas prices.

Such defaults are almost unheard of in the LNG industry, said Bruce Robertson, an analyst at the Institute for Energy Economics and Financial Analysis. Traders and industry insiders interviewed by Bloomberg couldn't remember the last time so many cargoes were scrapped without being directly related to a major outage at an export facility.

Eni and Gunvor have said they had to cancel because they're facing their own shortages and don't have the LNG to send to Pakistan. Typically when exporters face those kinds of challenges, they replace the deliveries by buying a shipment on the spot market, but Eni and Gunvor haven't done that.

Gunvor declined to comment for this story. Eni's supplier didn't meet their obligation, and was therefore forced to default on shipments to Pakistan, the Italian company said in an emailed statement, also noting that it did not take advantage or benefit from the cancellations and applied all contractual provisions to manage such disruptions.

Suppliers are usually loathe to cancel. It damages the business relationship, and it's often very, very expensive. Developed markets typically demand "failure to deliver" penalties of up to 100%. According to Valery Chow, an analyst at Wood Mackenzie Ltd., "it's very rare for LNG suppliers to renege on long-term contracts beyond force majeure events."

Pakistan's contracts called for a more modest 30% penalty for cancellation, most likely in exchange for lower prices overall. At this point, prices in the European spot market are high enough to more than offset those penalties. An LNG shipment for May delivery to Pakistan via a long-term contract would cost $12 per million British thermal units, according to Bloomberg calculations. For comparison, a May delivery spot cargoes to Europe were being traded at over $30. Eni and Gunvor have continued to meet their commitments to clients there.

-

Comment by Riaz Haq on June 14, 2022 at 10:17am

-

So now Pakistan is back to the drawing board, in a worse negotiating position than before. Prime Minister Imran Khan was ousted in April after a fallout with Pakistan's army over a range of issues, including his management of energy supplies and the larger economy.

https://www.ndtv.com/world-news/pakistans-12-hour-blackouts-linked-...

The new prime minister, Shehbaz Sharif, has ordered the state-owned importer to procure the fuel at any cost to halt the crippling blackouts. It's also trying to negotiate new long-term LNG purchase agreements, though the terms will certainly be worse than they were six years ago. The government "will go for the most favorable deal," the Ministry of Energy said in a statement to Bloomberg News.

The expense is creating its own knock-on effects. The country is now "at high risk of default," the Institute for Energy Economics and Financial Analysis said in a note published last month. Moody's Investors Service downgraded its outlook on Pakistan to negative from stable, citing financial concerns that includes a delay in an IMF bailout.

Pakistan's reliance on LNG and its suppliers' willingness to default has worsened the energy crisis in the country. And Pakistan isn't alone. Emerging nations around the world are struggling to meet the needs of their citizens within the constraints of their budgets.

It's also driven them to buy energy from Russia, dampening the effects of Europe's efforts to cut them off.

In the face of financial crisis and massive oil shortages, Sri Lanka has turned to Russia to procure fuel. Pakistan is also exploring long-term contracts with Russian LNG suppliers. India has already boosted purchases from Russia, a trend that may accelerate. In response to the blistering summer heat, the government has ordered power plants to buy fuel from overseas.

Pakistan's woes also bode poorly for other cash-strapped importers, including Bangladesh and Myanmar. The state-owned utility in Bangladesh recently procured the nation's most expensive LNG shipments from the spot market to keep the grids running and industries stocked, while Myanmar has halted imports for the last year due to the run-up in prices.

Europe's massive shift may prompt other countries, like India and Ghana, to rethink long-held plans to increase dependence on the super-chilled fuel. Governments would instead double down on dirtier-burning coal or oil, frustrating efforts to reach ambitious pollution-reduction targets this decade.

In a recent note, Fereidun Fesharaki, chairman of industry consultant FGE, sharply criticized European energy policies for creating "higher prices, economic scarcity and economic misery" around the world. "It is ok for Europe to decide what they want within their borders," he wrote. "But it is unfair and unreasonable to export the mess abroad, especially to the developing world."

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Barrick Gold CEO "Super-Excited" About Reko Diq Copper-Gold Mine Development in Pakistan

Barrick Gold CEO Mark Bristow says he’s “super excited” about the company’s Reko Diq copper-gold development in Pakistan. Speaking about the Pakistani mining project at a conference in the US State of Colorado, the South Africa-born Bristow said “This is like the early days in Chile, the Escondida discoveries and so on”, according to Mining.com, a leading industry publication. "It has enormous…

ContinuePosted by Riaz Haq on November 19, 2024 at 9:00am

What Can Pakistan Do to Cut Toxic Smog in Lahore?

Citizens of Lahore have been choking from dangerous levels of toxic smog for weeks now. Schools have been closed and outdoor activities, including travel and transport, severely curtailed to reduce the burden on the healthcare system. Although toxic levels of smog have been happening at this time of the year for more than a decade, this year appears to be particularly bad with hundreds of people hospitalized to treat breathing problems. Millions of Lahoris have seen their city's air quality…

ContinuePosted by Riaz Haq on November 14, 2024 at 10:30am — 2 Comments

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network