PakAlumni Worldwide: The Global Social Network

The Global Social Network

Soaring Prices of Imported LNG Threaten Pakistan's Economic Recovery

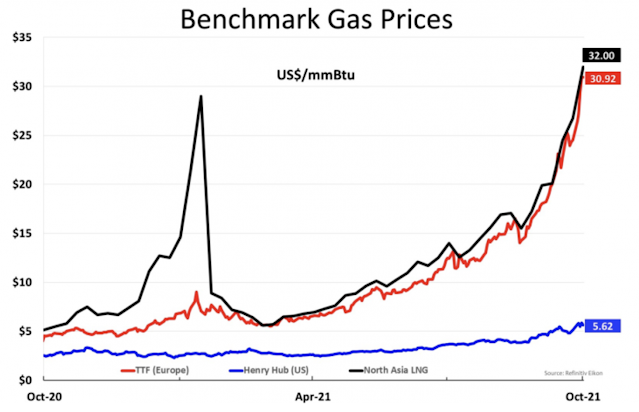

Soaring LNG prices are adversely affecting Pakistan's balance of payments and threatening the nation's post-COVID economic recovery. Pakistan's trade deficit has widened to nearly $12 billion in July-September 2021 quarter, up more than 100% from the same period last year. The nation's heavy reliance on expensive imported energy has been the main cause of prior balance of payments crises that have forced it to seek IMF bailouts more than a dozen times in the last 70 years.

|

| Global LNG Prices. Source: The Peninsula Qatar |

|

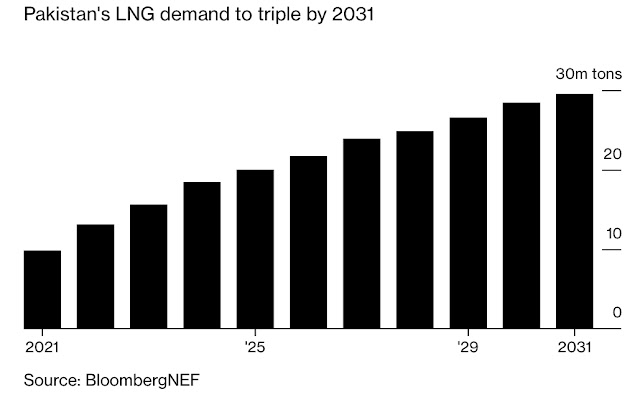

| Pakistan: World's Fastest Growing LNG Market. Source: Bloomberg |

|

| Global Commodity Price Increases |

|

| Pakistan Trade Stats. Source: Topline Securities |

|

| Pakistan Coal Power Plants Under CPEC. Source:China's Global Power ... |

|

| All Pakistani Power Plants Under CPEC. Source: China's Global Power... |

|

| Pakistan's Malik Amin Aslam with CNN's Becky Anderson |

Malik Amin Aslam, Pakistan Prime Minister Imran Khan's special assistant on climate change, said recently in an interview with CNN that his country is seeking to change its energy mix to favor green. He said Pakistan's 60% renewable energy target would to be based on solar, wind and hydro power projects, and 40% would come from hydrocarbon and nuclear which is also low-carbon. “Nuclear power has to be part of the country’s energy mix for future as a zero energy emission source for clean and green future,” he concluded. Here are the key points Aslam made to Becky Anderson of CNN:

1. Pakistan wants to be a part of the solution even though it accounts for less than 1% of global carbon emissions.

|

| 900 MW Zonergy Solar Park in Bhawalpur, Pakistan |

|

| 1,100 MW Karachi Nuclear Power Plant Unit 2 |

|

| Pakistan Among Top 3 Countries For Newly Installed Hydro |

|

| Installed Wind Power in Pakistan. Source: Modor Intelligence |

|

|

|

https://www.youtube.com/embed/Q_s4kQXChuM"; title="YouTube video player" width="560"></iframe>" height="315" src="https://img1.blogblog.com/img/video_object.png" width="560" style="cursor: move; background-color: #b2b2b2;" />

Haq's Musings

South Asia Investor Review

Pakistan's Debt Crisis

Declining Investment Hurting Pakistan's Economic Growth

Rooftop Solar Net Metering Growth in Pakistan

Can Pakistan Avoid Recurring IMF Bailouts?

Pakistan is the 3rd Fastest Growing Trillion Dollar Economy

CPEC Financing: Is China Ripping Off Pakistan?

Pakistan Ramps Up Nuclear Power Generation

Is Pakistan Ready For Clean Energy Revolution?

China Global Power Database on Power Plants in Pakistan

CPEC Transforming Pakistan

Pakistan's $20 Billion Tourism Industry Boom

Pakistan Among Top 3 Countries For New Hydro Installed Capacity

Riaz Haq's YouTube Channel

PakAlumni Social Network

-

Comment by Riaz Haq on October 12, 2021 at 4:17pm

-

Greener CPEC: Debt-for-environment swaps

https://www.thethirdpole.net/en/regional-cooperation/greener-cpec-a...

In a debt-for-environment swap (DFE), a creditor government reduces a debtor country’s debt in return for commitments by the indebted nation to invest domestically in environmental conservation initiatives. DFEs aim to allow a country burdened with debt to simultaneously address its financial issues while remedying environmental degradation and social inequality.Any proposed DFE schemes should align with Pakistan’s existing sustainability policies to avoid issues of social inequality and inefficient implementation. For example, in April 2021 Pakistan’s government proposed a DFE scheme to propel its existing Ten Billion Tree Tsunami afforestation programme. But implementing a DFE swap in this context could worsen social issues associated with the plan, such as forced displacement and the loss of community herding traditions.

For foreign financial aid to work on the ground, Pakistan needs to address inconsistencies within its existing domestic policies. It should consult local communities, NGOs and local government agencies when designing interventions, and ensure that their implementation is transparent. This would enable Pakistan to effectively address criticisms of ‘greenwashing’ in its economic recovery programme.

Adapting Pakistan’s Special Economic Zones

Special Economic Zones (SEZs) are free-trade areas in a country, where the commercial laws are tailored to attract both foreign and domestic investors, such as allowing certain tax exemptions. SEZs, which represent an integral component of CPEC’s second phase provide a significant opportunity for employment generation and business growth in Pakistan. It was announced in February, for instance, that the jewel in the CPEC crown, Gwadar SEZ (home to Gwadar Port), would become a tax-free zone. Addressing unemployment is a key aspect of the country’s recovery plan, considering that half of Pakistan’s working-age population experienced either income or job losses during the pandemic and GDP contracted by an estimated 1.5% in the 2020 financial year.In China, for instance, SEZs attract around 50% of total foreign investment, something that if replicated would be hugely beneficial to Pakistan’s economy. However, in order for foreign investors not to crowd out smaller businesses from supply chains in SEZs, the Pakistani government should encourage joint ventures between local businesses and foreign investors.

-

Comment by Riaz Haq on October 13, 2021 at 7:16pm

-

#Pakistan faces an existential crisis with fast melting glaciers. It has more glaciers outside of the polar icecaps than anywhere on earth. The glaciers feed one of the oldest and most fertile valleys on the planet. #water #agriculture #food https://aje.io/rnedz9 via @AJEnglish

The UN’s Intergovernmental Panel on Climate Change (IPCC) published its latest report in August 2021, on the heels of one of the hottest and most devastating summers on record: floods in northern Europe and China, wildfires in the US, and heatwaves everywhere.

The report tells us that the consequences of the current global warming crisis are largely irreversible. The most we can do is to prevent all-out ecological collapse.

One of the more sobering findings of the report is that polar and mountain glaciers are likely going to continue to melt, irreversibly, for decades or centuries to come.

Pakistan has more glaciers outside of the polar icecaps than anywhere on earth. The glaciers feed one of the oldest and most fertile valleys on the planet – that of the Indus Basin, split between India and Pakistan. Roughly 75 percent of Pakistan’s 216 million population is settled on the banks of the Indus River. Its five largest urban centres are entirely dependent on the river for industrial and domestic water.

Pakistan has been blessed with regular agricultural cycles that have sustained its economy through successive crises. However, if the IPCC Report is correct – which it almost certainly is – by 2050, the country will be out of water.

Pakistan is not the only low-income country facing the impacts of climate change. It is not alone in looking on helplessly as industrialised nations – China and the US being the foremost – drag their heels on lowering emissions. Pakistan, like the Maldives and many other island nations, will suffer from the consequences of global warming disproportionately. However, unlike many countries that have taken up the issue of global emissions at the UN, Pakistan is not doing even the bare minimum to try and secure its future.

To say that this is the largest security issue the country will face in the next few decades would be putting it mildly. No other country is as dependent on non-polar ice for freshwater as Pakistan. No other country stands to lose as much. Yet, Pakistan’s government seems singularly unaware of the looming crisis. It has not even made much effort to meet its target of producing 60 percent of its electrical power from renewable sources by 2030. At the moment, the country still gets well over 60 percent of its electricity from fossil fuels.

Pakistan is already facing mounting environmental challenges. Heatwaves are killing scores of people and impacting crop cycles and yields on a regular basis. This year, both its largest city Karachi and its capital city Islamabad experienced devastating floods. Furthermore, the 806-kilometre (500-mile) Karakoram Highway, which is a critical part of Pakistan’s economic corridor with China, was shut down multiple times, for multiple days, due to landslides. These devastating landslides were a direct result of large-scale deforestation in the area north of Kohistan and south of Jaglot. Further north towards Shimshal and east towards the Skardu Valley, timber mafias are rapidly stripping old-growth forests, all but guaranteeing future environmental catastrophes.

---------------------

Today, Pakistan is facing an existential crisis. The effects of climate change are not threatening a single sector or region of the country, but the lives and livelihoods of its entire population. As this year’s IPCC report underlined, we are, sadly, already too late to reverse the damage caused by the rampant consumption of fossil fuels. The choice we are facing now – in Pakistan and around the world – is to continue on a path to certain destruction, or start fighting for our collective survival.

-

Comment by Riaz Haq on October 15, 2021 at 9:12am

-

Topline Securities

@toplinesec

Advance Release of Foreign Trade Statistics:

Textile exports continue to grow, up 25% YoY. Rising petroleum imports remain a concern as they are up 87% YoY

https://twitter.com/toplinesec/status/1449041324846506000?s=20

-

Comment by Riaz Haq on October 15, 2021 at 10:04am

-

#Remittances of $8 billion from #Pakistani diaspora in July-Sept 2022 quarter will pay for two-thirds of the $12 billion #trade deficit. #Pakistan government still needs to borrow over $4 billion to pay for the rest. https://www.dawn.com/news/1650949

Overseas Pakistanis sent the highest-ever $8 billion remittances during the first quarter of the current fiscal year, registering a growth of 12.5 per cent over the same period last year.

The State Bank of Pakistan (SBP) on Friday reported that with inflows of $2.7bn in September, workers’ remittances continued their strong momentum and remaining above $2bn since June 2020.

“This is the 7th consecutive month when inflows recorded around $2.7bn on average,” said the SBP. In terms of growth, remittances increased by 17pc in September compared to the same month last year, while comparing with August inflows it was 0.5pc higher.

The surging imports in 1QFY22 widened the trade deficit putting immense pressure on the rupee-dollar exchange rate which ultimately reflected in higher current account deficit. The situation for the economic managers is not comfortable except the higher remittance supported the economy beyond imagination.

The country had received record remittances of $29.4bn in FY21 which helped it curtail the current account deficit.

“The proactive policy measures by the government and SBP to incentivise the use of formal channels, curtailed crossborder travel in the face of Covid19, altruistic transfers to Pakistan amid the pandemic, and orderly foreign exchange market conditions have positively contributed towards the sustained improvement in remittance inflows since last year,” the central bank said in statement.

However, the deterioration of exchange rate has created serious problems for the external trade activities. Recently, the SBP has taken several measures to curtail outflow of dollars and reduce the import bill, but the exchange rate is still against the rupee which has lost about 11.5pc during the last five months.

The highest remittances were received from Saudi Arabia but they were 2.6pc less than the same period of last year. During July-September 2021-22 the remittances from Saudi Arabia were $2.025bn against $2.080bn last year. The contribution of Saudi Arabia in the total remittances during the first quarter of FY22 was almost 25pc. In September, Pakistan received $691m from the kingdom against $694m in the same month of last year.

The remittance from the United Arab Emirates was second highest as it witnessed a growth of 8.7pc while it amounted to $1.545bn during the first quarter of FY22.

The inflows from UK and USA noted a growth of 13.2pc and 32pc amounting to $1.115bn and $836m respectively. The growth in the first quarter of FY21 was 71.5pc for UK and 63pc for USA.

For the first time, the inflows from EU countries surpassed the total inflows from other GCC countries. The inflows from EU countries rose $889m compared to $880.7 from the GCC countries. The remittances from EU countries increased by 47.8pc compared to the same period of last fiscal year.

-

Comment by Riaz Haq on October 20, 2021 at 6:34pm

-

From Twitter:

Syed Arif Rehman

@arif1981r

Excellent communication by Finance Ministry. Even during these tough times, it is always great to see government communicating transparently with stakeholders. Well done.

@MuzzammilAslam3

https://twitter.com/arif1981r/status/1450890461514805250?s=20

-------------------------

Key Points:

Current Account Deficit in Q1 FY 2021-22 is $3.4 billion'

Imports include nearly $1 billion of COVID vaccines

High prices of energy imports

Exports up 12.5% in Q1

Improved outlook for food imports due better wheat & sugarcane harvest as well higher cotton output-----------

-

Comment by Riaz Haq on October 21, 2021 at 7:57am

-

#Coal will power much of #India for the next few decades, according to leaked documents seen by BBC News. India is among countries lobbying the #UN against completely moving away from #fossil fuels, the documents show. #COP26Glasgow #carbon #ClimateCrisis https://www.bbc.com/news/world-asia-india-58991207

Countries will be asked to commit to slashing greenhouse gas emissions at the COP26 climate summit in November.

India is the world's third-largest carbon emitter, after China and the US.

India aims for renewables and nuclear energy to account for 40% of its installed electricity capacity by 2030 - a goal it could achieve ahead of time, according to the Climate Action Tracker (CAT).

But it remains the world's second-largest consumer of coal, which still powers more than 70% of its grid. But coal will be difficult to give up, India has told the team of scientists compiling the UN report ahead of the summit in Glasgow.

The reports - which bring together evidence on how best to slow down global warming - are by the Intergovernmental Panel on Climate Change (IPCC), the UN body studying climate change.

"In spite of substantial growth in renewable energy sector in India, coal is likely to remain the mainstay of energy production in the next few decades for sustainable economic growth of the country," said a senior scientist from India's Central Institute of Mining and Fuel Research, according to the leaked documents.

CAT estimates that by 2030, India's emissions intensity will fall to 50% below 2005 levels, going past its avowed target, 35%. But India has yet to explain how it will reach net zero emissions - nor has it said by when it plans to do so.

China, the world's biggest carbon emitter and coal consumer, has pledged to go carbon neutral by 2060. And demand for coal in the country has also flattened, possibly leaving the future of the fossil fuel in the hands of Indian policy makers.

-

Comment by Riaz Haq on October 21, 2021 at 5:11pm

-

#FossilFuel Drilling Plans Undermine #Climate Pledges. As #China and #US are expecting to cut back on #coal extraction in the decades ahead, that would be offset by plans for new mining in places like #Australia , #India & #Russia. #COP26Glasgow #Carbon https://www.nytimes.com/2021/10/20/climate/fossil-fuel-drilling-ple...

Countries are planning to produce more than twice as much oil, gas and coal through 2030 as would be needed if governments want to limit global warming to Paris Agreement goals.

The report looked at future mining and drilling plans in 15 major fossil fuel producing countries, including the United States, Saudi Arabia, Russia, Canada, China, India and Norway. Taken together, those countries are currently planning to produce more than twice as much oil, gas and coal through 2030 as would be needed if governments want to limit warming to 1.5 degrees Celsius (2.7 degrees Fahrenheit) above preindustrial levels.

Scientists and world leaders increasingly say that holding global warming to 1.5 degrees Celsius is crucial if humanity wants to avoid the most catastrophic consequences of climate change, such as ever-deadlier heat waves, large scale flooding and widespread extinctions. The world has already heated up roughly 1.1 degrees since the Industrial Revolution.

----------

Making the task even tougher, the world is currently experiencing a severe energy crunch, with Europe, Asia and Latin America all facing shortages of natural gas this fall to supplant their renewable power operations. The International Energy Agency recently warned that nations need to significantly increase their investment in clean energy to overcome these problems, but the disruptions could also bolster calls for more fossil fuel production. China’s government, for example, recently ordered coal companies to increase their mining output to manage an electricity shortage that has led to rolling blackouts nationwide.

To address these challenges, the new report calls for closer international coordination “to ensure that declines in fossil fuel production are distributed as equitably as possible, while minimizing the risks of disruption.”

-

Comment by Riaz Haq on October 22, 2021 at 1:31pm

-

#US intelligence report identifies #India, #Pakistan & #Afghanistan among 11 countries most at risk due to climate change. #Himalayas Glaciers are melting. Pakistan relies on downstream #water from heavily glacier-fed rivers. #ClimateCrisis #food #COP26 https://timesofindia.indiatimes.com/world/us/first-ever-us-intel-re...

-

Comment by Riaz Haq on October 27, 2021 at 7:20am

-

SBP eases terms for renewable energy financing

https://www.dawn.com/news/1651531

The State Bank of Pakistan (SBP) has allowed all Renewable Energy Investment Entities (RE-IEs) to avail financing on easy conditions to remove growing electricity shortage in the country.

The SBP on Monday said that to promote investment in RE solutions by companies, the central bank has eased the conditions for renewable energy solution providers under its Refinance Scheme for Renewable Energy.

With the aim of helping address the challenges of energy shortages and climate change, the central bank revised its Financing Scheme for Renewable Energy in July 2019. Since the inception of the scheme, 717 projects having potential of adding 1,082MW of energy supply through renewable sources have been financed. As of June 30, 2021, total outstanding financing under the scheme is Rs53 billion.

RE, often referred to as clean energy, comes from natural sources — sunlight, water and wind — or processes that are constantly replenished.

Since 2019, projects promising 1,082MW of energy supply have been financed

“Now, all RE-IEs interested in installing renewable energy projects and solutions are allowed to avail refinance under Category-III of the scheme,” said the SBP.

An RE-IE is a business entity (including vendors and suppliers) whose business is to establish renewable energy projects for onward leasing, renting out or selling on deferred payment basis or selling of electricity generated from these projects to end users.

The SBP also launched a Sharia-complaint version of the scheme in August 2019. The scheme now comprises of three categories. Under Category-I, financing is allowed for setting up of RE power projects with capacity ranging from 1-50 MW for own use or selling of electricity to the national grid or a combination of both.

Under Category-II, financing is allowed to domestic, agriculture, commercial and industrial borrowers for installation of renewable energy based projects of up-to 1 MW to generate electricity for own use or selling to the grid or distribution company under net metering.

Under Category-III, financing is allowed to vendors, suppliers and energy sale companies for installation of wind and solar systems of up to 5 MW.

While there is substantial take up under Category-I and II, solution suppliers under Category-III faced problems, said the SBP.

Accordingly, in light of the feedback received from stakeholders including RE solution suppliers, Alternate Energy Development Board (AEDB) and banks, the requirement of AEDB certification has been relaxed for RE-IEs who do not undertake installations on their own but hire services of installers or vendors for installation of RE projects.

“However, vendors, suppliers, engineering procurement and construction (EPC) contractors of these RE-IEs will still be required to be certified under the AEDB certification regulations,” said the SBP.

The SBP expects that this revision in Category-III will further facilitate production of clean energy in the country.

-

Comment by Riaz Haq on October 28, 2021 at 10:34am

-

#Qatar to Invest in #Pakistan’s Next #LNG Import Terminal

in a bid to support one of the fastest growing buyers of the super-chilled fuel. Energas’ terminal will be Pak’s largest with a capacity to import 1 billion cubic feet of #gas a year.- Bloomberg

https://www.bloomberg.com/news/articles/2021-10-28/qatar-is-said-to...

https://twitter.com/haqsmusings/status/1453776150824558596?s=20

Qatar, the world’s top supplier of liquefied natural gas, will invest in Pakistan’s next import terminal in a bid to support one of the fastest growing buyers of the super-chilled fuel.

Qasim Terminal Holding Co., a subsidiary of Qatar Energy, has applied for clearance with Pakistan’s government to take a stake in Energas Terminal Pvt., according to people familiar with the matter. Qatar Energy and Energas did not respond to requests for comments while Pakistan’s competition commission declined to comment.

The deal comes as Qatar plans to dramatically increase production over the next decade, which will require the Middle Eastern nation to find more buyers for its fuel. Qatar is already Pakistan’s largest gas supplier with its latest long-term deal slated to start this year.

Energas’ terminal will be the nation’s largest with a capacity to import 1 billion cubic feet of gas a year. Pakistan currently operates two LNG terminals, while Energas and Japan’s Mitsubishi Corp. are vying to build the nation’s first twoprivate projects.

Pakistan is going to dominate LNG growth in emerging Asia along with Bangladesh and Thailand over the next five years. The three nations will almost double LNG imports over 2021-25, according to BloombergNEF.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Prosthetics Startup Aiding Gaza's Child Amputees

While the Israeli weapons supplied by the "civilized" West are destroying the lives and limbs of thousands of Gaza's innocent children, a Pakistani startup is trying to provide them with free custom-made prostheses, according to media reports. The Karachi-based startup Bioniks was founded in 2016 and has sold prosthetics that use AI and 3D scanning for custom designs. …

ContinuePosted by Riaz Haq on July 8, 2025 at 9:30pm

Indian Military Begins to Accept Its Losses in "Operation Sindoor" Against Pakistan

The Indian military leadership is finally beginning to slowly accept its losses in its unprovoked attack on Pakistan that it called "Operation Sindoor". It began with the May 31 Bloomberg interview of the Indian Chief of Defense Staff General Anil Chauhan in Singapore where he admitted losing Indian fighter aircraft to Pakistan in an aerial battle on May 7, 2025. General Chauhan further revealed that the Indian Air Force was grounded for two days after this loss. …

ContinuePosted by Riaz Haq on July 5, 2025 at 10:30am — 6 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network