PakAlumni Worldwide: The Global Social Network

The Global Social Network

Renewable Energy in Pakistan: 15.2% of Households Use Solar

Solar panel installations in Pakistani homes are rising rapidly. Pakistan PSLM/HIES 2018-19 survey results reveal that 15.2% of all households are using solar panels as a source of energy for their homes. Khyber-Pakhtunkhwa province leads the nation with 40% of all households using solar energy. Rural Pakistan is embracing solar power at a faster rate than Urban Pakistan. Adoption of solar in rural areas of KP is at 43%, Sindh 33.9%, Balochistan 20.4% and Punjab 7.9%. Rapid decline in cost of solar panels appears to be driving the adoption of solar in Pakistan's rural areas where grid power is either unavailable or unreliable. Pakistan is starting to join the clean energy revolution with increasing adoption of solar and recent announcement of National Electric Vehicle Policy. Covid19 pandemic may temporarily slow it down but the upward trend will likely continue.

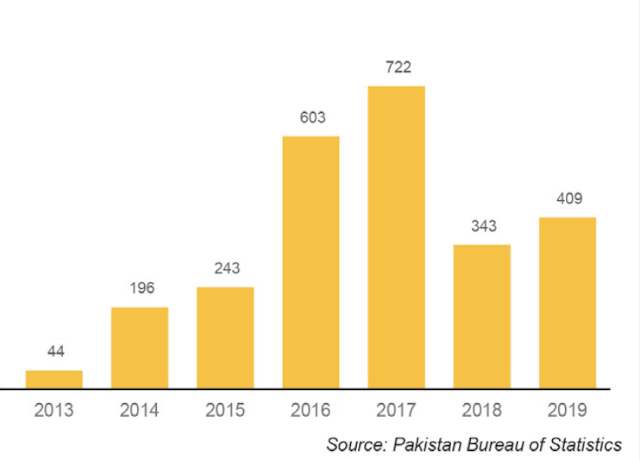

Pakistan Solar Panel Imports in Millions of US Dollars. Source: FBS... |

Solar Panels in Pakistan:

Imports of solar panels have increased at 15.9% annually in US dollar terms and 22.6% in Pakistan rupee terms in the last years. Solar panel imports have jumped from just $1 million in 2004 to a peak of $772 million in the fiscal year ending June 30, 2017, then declined to $343 million in 2018 and then rose again to $409 million in 2019. Covid19 pandemic may temporarily slow it down but the upward trend will likely continue.

Households Using Solar Panels. Source: PSLM/HIES 2018-19 Via Bilal ... |

Solar panel installations in Pakistani homes are rising rapidly. Pakistan PSLM/HIES 2018-19 survey results reveal that 15.2% of all households are using solar panels as source of energy for their homes.

Government survey data shows that 20% of rural households are using solar panels, significantly ahead of just 7.7% urban households in the country. Khyber-Pakhtunkhwa province leads with 40% of households using solar energy, followed by Balochistan 25.7%, Sindh 20.5% and Punjab 6.4%.

Rural Pakistan is leading the nation into wider use of solar power. Adoption of solar in rural areas of KP is at 43%, Sindh 33.9%, Balochistan 20.4% and Punjab 7.9%. Rapid decline in cost of solar panels appears to be driving adoption of the solar energy in Pakistan's rural areas where grid power is either unavailable or unreliable.

Pakistan Electric Vehicle Policy:

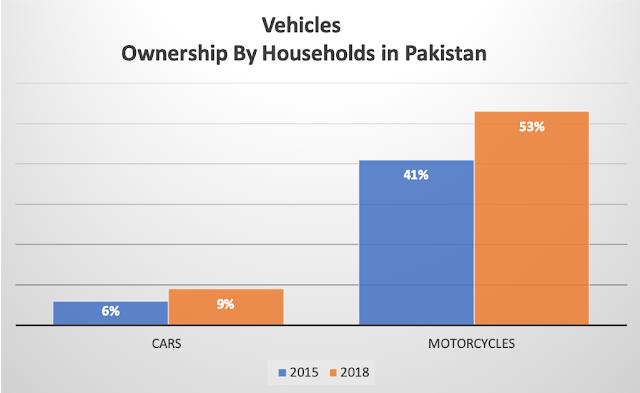

Pakistan has a low level of motorization with just 9% of the households owning a car. Nearly half of all households own a motorcycle. Motorization rates in the country have tripled over the last decade and a half, resulting in nearly 40% of all emissions coming from vehicles. Concerns about climate change and environmental pollution have forced the government to to take a number of actions ranging from adoption of Euro6 emission standards for new vehicles with internal combustion engines (ICE) since 2015 and announcement of a national electric vehicle (EV) policy this year.

Private vehicle ownership in Pakistan has risen sharply over the last 4 years. More than 9% of households now own cars, up from 6% in 2015. Motorcycle ownership has jumped from 41% of households in 2015 to 53% now, according to data released by Federal Bureau of Statistics (FBS) recently. There are 32.2 million households in Pakistan, according to 2017 Census.

Pakistan's National EV Policy is a forward looking step needed to deal with climate concerns from growing transport sector emissions with rapidly rising vehicle ownership. It offers tax incentives for buyers and sellers. It also focuses on development of nationwide charging infrastructure to ease adoption of electric vehicles.

Low Carbon Energy Growth:

In recent years, Pakistan government has introduced a number of supportive policies, including feed-in tariffs and a net metering program to incentivize renewables. These have been fairly successful, and renewables capacity in the country surged substantially over 2018 when 1245 MW was added, of which 826MW was contributed by the solar sector, according to Fitch Solutions.

Pakistan’s Alternative Energy Development Board (AEDB) recently signed deals for projects that will see the country expand its wind power capacity by 560 MW. Fitch Solutions forecasts Pakistan's solar capacity to grow by an annual average of 9.4% between 2019-2028, taking total capacity over 3.8GW by the end of our forecast period.

Sindh government has recently signed a deal for 400MW solar park at Manjhand, 20MW rooftop solar systems on public sector buildings in Karachi and Hyderabad, and 200,000 solar home systems for remote areas in 10 districts of the province. The project is estimated to cost USD105million, with the World Bank funding USD100 million.

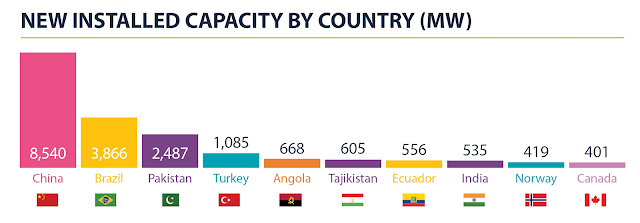

The biggest and most important source of low-carbon energy in Pakistan is its hydroelectric power plants. Pakistan ranked third in the world by adding nearly 2,500 MW of hydropower in 2018, according to Hydropower Status Report 2019. China added the most capacity with the installation of 8,540 megawatts, followed by Brazil (3,866 MW), Pakistan (2,487 MW), Turkey (1,085 MW), Angola (668 MW), Tajikistan (605 MW), Ecuador (556 MW), India (535 MW), Norway (419 MW) and Canada (401 MW).

New Installed Hydroelectric Power Capacity in 2018. Source: Hydrowo... |

Hydropower now makes up about 28% of the total installed capacity of 33,836 MW as of February, 2019. WAPDA reports contributing 25.63 billion units of hydroelectricity to the national grid during the year, “despite the fact that water flows in 2018 remained historically low.” This contribution “greatly helped the country in meeting electricity needs and lowering the electricity tariff for the consumers.”

Chinese BYD in Pakistan:

Multiple media reports suggest that China's BYD is about to enter Pakistan market following the announcement of Pakistan National EV Policy. These reports indicate that Toyota, one of the largest automakers in Pakistan, has signed a deal with BYD to manufacture electric vehicles.

Other reports indicate that Pakistan's Rahmat Group is in talks with BYD to set up an electric vehicle plant at Nooriabad in Sindh province.

Minister for Science and Technology Fawad Chaudhry has claimed that in three years Pakistan will become the first country to manufacture electric buses, which will be driven by an electric motor and obtains energy from on-board batteries.

Summary:

Pakistan is starting to join the clean energy revolution with increasing adoption of solar and recent announcement of National Electric Vehicle Policy. Solar panel installations in Pakistani homes are rising rapidly. Pakistan PSLM/HIES 2018-19 survey results reveal that 15.2% of all households are using solar panels as source of energy for their homes. The country has set targets for renewable energy growth and announced National Electric Vehicle Policy. In recent years, Pakistan government has introduced a number of supportive policies, including feed-in tariffs and a net metering program to incentivize renewables. These have been fairly successful, and renewables capacity in the country surged substantially over 2018 when 1245 MW was added, of which 826MW was contributed by the solar sector, according to Fitch Solutions. High-capacity battery pack costs have dropped nearly 40% since 2015, according to Wood Mackenzie data as reported by Wall Street Journal. Cost reductions are expected to continue to only $8 to $14 per MW-hour by 2020, or about a penny per kW-hour. While production and use of renewable energy are growing, the electric vehicles in Pakistan have yet to find traction. Hopefully, the National EV policy will encourage production and adoption of electric vehicles in the country. Covid19 pandemic may temporarily slow it down but the upward trend will likely continue.

Related Links:

Clean Energy Revolution in Pakistan

Pakistan Electric Vehicle Policy

Recurring Cycles of Drought and Floods in Pakistan

Pakistan's Response to Climate Change

Massive Oil and Gas Discovery in Pakistan: Hype vs Reality

Digital BRI: China and Pakistan Building Fiber, 5G Networks

Growing Water Scarcity in Pakistan

China-Pakistan Economic Corridor

Ownership of Appliances and Vehicles in Pakistan

-

Comment by Riaz Haq on July 21, 2023 at 4:37pm

-

LONGi and Nimir Energy Forge Strategic Partnership to Advance Solar Energy Solutions in Pakistan

https://solarquarter.com/2023/07/20/longi-and-nimir-energy-forge-st...

LONGi and Nimir Energy announced the signing of a Memorandum of Understanding (MOU) aimed at fostering collaboration in the development and deployment of solar energy solutions. This strategic partnership marks a significant milestone in the pursuit of sustainable and clean energy sources to meet Pakistan’s growing energy demand.

Under the terms of the MOU, Nimir Energy and LONGi will work together to explore opportunities and synergies in solar energy projects and capacity-building initiatives. The collaboration will leverage Nimir Energy’s expertise in project development and LONGi’s cutting-edge solar technology to drive the adoption of renewable energy in pan-Pakistan, pushing the government’s intent to promote solar.

Nimir Energy is part of Nimir Group, providing services in renewable energy with a primary focus on solar EPC for industrial, commercial and residential users. Nimir Group has been serving Pakistan and its business community since 1964 with a diversified range of products.

With climate action in full swing, Nimir would like to play a positive role in bringing in the right resources to ensure Pakistan’s transition to clean and sustainable energy. The company’s commitment to sustainable development aligns perfectly with LONGi’s vision to enable the world to transition to a low-carbon future through its industry-leading solar products and solutions.

LONGi, renowned for its high-efficiency solar modules and advanced photovoltaic technology, has emerged as a global leader in the solar industry. By joining forces with Nimir Energy, the company aims to expand its reach and accelerate the development of solar energy projects in key markets around the world.

“We are delighted to enter into this strategic partnership with LONGi, a company that shares our commitment to advancing renewable energy solutions,” said Waqas Ahmed Rana, COO of Nimir Energy. “Through this collaboration, we will combine our strengths and resources to drive innovation and promote the widespread adoption of solar energy, contributing to a more sustainable future.”

“LONGi is excited to join forces with Nimir Energy, a respected player in the renewable energy sector,” stated Ali Majid, Country head, Sales of LONGi. “Together, we can unlock new opportunities and create lasting impact by accelerating the deployment of solar energy projects worldwide. This collaboration exemplifies our dedication to addressing the challenges of climate change through technology innovation and sustainable business practices.”

With 90 terawatt-hours of total energy needed, Pakistan ranks among the top countries with huge potential for solar energy. Rising electricity prices and instability in the grid have added further to the woes of the average Pakistani consumer. LONGi envisions solving this problem by providing a cost-effective and high-quality solution to the public at large. As the biggest panel manufacturer in the world, LONGi plans to cater to all kinds of consumers with a focus on industrial users to provide services unparalleled in the market.

-

Comment by Riaz Haq on August 18, 2023 at 7:41am

-

Kuwait’s EnerTech Holding Explores Renewable Energy Cooperation With Pakistan’s K-Electric

https://solarquarter.com/2023/08/14/kuwaits-enertech-holding-explor...

Kuwait-based energy firm EnerTech Holding is actively exploring collaboration and investment prospects with Pakistan’s K-Electric power supply company.

The objective is to expedite Pakistan’s shift to renewable energy sources, according to a joint statement released by the two entities this week. Pakistan’s energy imports, accounting for 30.7% of total imports, reached $17 billion during the previous fiscal year (2022-23).

To curtail its dependency on imported fossil fuels and conserve foreign currency, Pakistan aims to raise the proportion of clean energy in its energy mix to 60% by 2030, a considerable increase from the current 4% attributed to renewable sources.

Abdallah Al-Mutairi, the CEO of EnerTech Holding, expressed enthusiasm about K-Electric’s ambitions in line with Pakistan’s renewable energy vision. He stressed the potential of collaboration between EnerTech’s expertise and K-Electric’s legacy in driving substantial progress towards these goals.

K-Electric envisions catering to around five million customers with an electricity demand of 5,000 megawatts (MW) by 2030. The company aims to meet up to 30% of this demand through renewable energy, reducing reliance on imported fuels for electricity generation and benefiting the national economy.

Moonis Alvi, the head of K-Electric, highlighted the opportunity to work closely with global entities like EnerTech, possessing an established international presence and investment portfolio. This collaboration can facilitate the adoption of best practices, thus enhancing energy delivery to customers while promoting a greener and more sustainable future.

EnerTech Holding, a subsidiary of the National Technology Enterprises Company (NTEC) and an extension of the Kuwait Investment Authority, spans across 65 countries. Its collaboration with K-Electric aligns with both entities’ dedication to advancing sustainable energy solutions.

-

Comment by Riaz Haq on August 28, 2023 at 10:18pm

-

Haier revolutionizes cooling solutions with launch of Pakistan's first Solar Hybrid Air Conditioner

https://en.dailypakistan.com.pk/28-Aug-2023/haier-revolutionizes-co...

Haier is proud to unveil an unprecedented leap in the realm of cooling solutions with the introduction of Pakistan's very first solar hybrid air conditioner. This groundbreaking innovation marks a monumental shift towards sustainable and energy-efficient living, setting new standards in the industry. The launch of the solar hybrid air conditioner underscores Haier's dedication to shaping a brighter future for generations to come.

The Haier solar hybrid air conditioner is a groundbreaking marvel that operates entirely on solar power during daylight hours, eliminating the need for any intermediary devices such as inverters, batteries, UPS, or converters. By seamlessly integrating four 540W solar panels and establishing a direct connection to the outdoor unit, the AC functions autonomously, setting an industry precedent. This marks a historic milestone in Pakistan, where an air conditioner operates directly on solar power without any supplementary support.

For the very first time, consumers can embrace cooling technology that not only cools their spaces but also ensures zero electricity bills during daylight hours. Never before in Pakistan has an air conditioner operated directly on solar power without any intermediate support. This innovative approach significantly minimizes the concerns related to electricity costs and additional equipment expenses. As daylight graces the solar panels, the AC operates exclusively on solar energy, providing cooling comfort without the burden of utility bills. The system seamlessly switches to the grid only in case of cloudy weather, mimicking the hybrid concept found in modern-day hybrid cars. Additionally, the same holds true for nighttime operations.

-

Comment by Riaz Haq on June 24, 2024 at 10:07am

-

Illuminating Pakistan: Leading solar provider commit to dig deep PV market--China Economic Net

http://en.ce.cn/Insight/202405/31/t20240531_39022443.shtml

LAHORE, May. 31 (Gwadar Pro)– “Today, LONGi’s footprint in Pakistan is around 5GW. I believe we are well positioned to seize such an opportunity to further our efforts towards a green future for Pakistan.”

In recent months, clean energy has experienced a new period of rapid growth, with global renewable energy capacity increasing by 50 percent in 2023 compared to the previous year. Pakistan is committed to becoming an important renewable energy development hub in South Asia and the entire Asian region, and is vigorously promoting green transformation at the national level.

As report goes, the Sindh government lately announced to provide solar systems to 200,000 households across the province, including 50,000 homes in Karachi. “A total of 6,656 solar systems will be distributed in each district of the province,” the Director of Sindh Solar Energy has confirmed. Ali Majid, Pakistan General Manager of leading solar solutions provider LONGi, believes that it is undoubtedly good news for Pakistan’s photovoltaic industry, specifically, for Chinese PV companies that have been deeply involved in the local market.

The systems will include solar panels, charge controllers, and batteries. Currently, Sindh generates 400 megawatts of electricity from solar energy. This project is expected to significantly increase solar power generation in the province.

“Nestled in a region blessed with ample sunlight, Pakistan boasts approximately 2.9 million MW of solar power potential,” Ali told in an interview with Gwadar Pro. “And while the initial cost of solar technology has been a deterrent, the decreasing global cost is making it more economically viable for Pakistan.”

-----

Pakistan - Renewable Energy

https://www.trade.gov/country-commercial-guides/pakistan-renewable-...

According to National Electric Power Regulatory Authority’s (NEPRA) 2022 yearly report, Pakistan’s total installed power generation capacity is 43,775 MW, of which 59% of energy comes from thermal (fossil fuels), 25% from hydro, 7% from renewable (wind, solar and biomass), and 9% from nuclear.

Wind data, provided by Pakistan's Meteorological Department, measures Pakistan's coastal belt at 60km (Gharo-Keti Bandar) and 180km long, with an exploitable potential of 50,000MW of electricity generation through wind turbines. Currently, 36 private wind projects are operating, producing approximately 1845MW.

Small hydropower projects are mainly located in remote areas of Pakistan particularly the North of the country. Recently, the GoP has identified new generation requirements by capacity, fuel technology, and utilizing indigenous resources for power generation by announcing the Indicative Generation Capacity Expansion Plan (IGCEP). This plan aims to add 13,000 MW of hydropower capacity to the current 9000 MW capacity by 2030.

According to the Private Power & Infrastructure Board (PPIB) of the Ministry of Energy, seven solar projects of 530 MW are operational and supplying electricity to the national grid.

With the rising costs of electricity in Pakistan and an unreliable grid supply, more industries and commercial organizations are turning to captive solar solutions. There has been a strong surge in domestic installation of rooftop photovoltaic panels in larger cities. For projects under 1 MW, net metering regulations came into effect in September 2015. The current state of the energy sector is promising for growth in solar power in the future. given rising fossil fuel prices.

-

Comment by Riaz Haq on July 9, 2024 at 8:24am

-

Pakistan's rooftop solar boom shines spotlight on power crisis - Nikkei Asia

https://asia.nikkei.com/Spotlight/Asia-Insight/Pakistan-s-rooftop-s...

ISLAMABAD -- Srinagar Highway offers a sun-drenched, 25-kilometer straight shot from Islamabad's international airport to the center of Pakistan's capital. It also affords a clear view of how increasing numbers of citizens are reacting to frequent power cuts and bloated electricity bills: Rooftops on buildings lining the route are covered in solar panels.

Atesham ud Din is among the homeowners who made the switch, investing $9,000 in a solar panel system two years ago to take advantage of one of Pakistan's most plentiful natural resources. "Now we never face the problem of power cuts, and our power bill is almost nil," the 34-year-old development professional told Nikkei Asia.

Amid rising power prices, consumption of electricity from the national grid skidded 10% in fiscal 2023 from the previous year. That is exacerbating problems in the crisis-ridden electricity sector, which is straining under $8.3 billion of debt, much of it owed to Chinese energy producers.

And the cash-strapped government is facing further pressure to increase electricity prices in budget-balancing moves on which its hopes of securing a loan deal with the International Monetary Fund rest.

The strain on the national grid is apparent. During the last week of June alone, there were 12 hours of "load shedding," or power cuts, in many areas of Lahore due to transmission flaws, reducing people's ability to use electric fans or air-conditioning systems just as temperatures in the city of more than 11 million people reached 46 degrees Celsius.

It's not immediately clear exactly how many people are switching to solar panels as an alternative source of electricity. Some households have opted for simple set-ups to fuel their own needs, residents says, while others, like ud Din, have invested significant sums into bigger solar panel systems, with a view to selling excess power generated to the national grid.

Saif ur Rehman, 48, a Lahore importer of medical equipment, has installed a system of 14 solar panels at his office.

"Now I can get peace of mind and focus on my business with uninterrupted access to electricity all day long and don't have to worry about load shedding," Rehman told Nikkei Asia.

Shahzad Qureshi, a vendor of solar panels in Lahore, said he has witnessed an exponential increase in sales of inexpensive panels, mostly imported from China.

"There is an increase of more than 50% in sales of solar panels this summer," he said. Panels cost $90 apiece on average, and vary in size and capacity.

The roots of the crisis in the power sector can be traced back to 1994, when Pakistan offered lucrative deals to foreign investors to establish power plants as the country with a rapidly growing population -- 130 million at the time, 241 million by 2023 -- chased economic growth.

Called independent power producers (IPPs), these operators secured a guaranteed return on investment indexed to the U.S. dollar, plus payment for fixed capacity charges -- covering their debt servicing and other fixed costs -- regardless of whether the power plants are operational.

Consequently, Pakistan pays a hefty amount to IPPs every year. In fiscal 2023, the government paid them $4.7 billion just for capacity payments. That figure is expected to cross $9 billion in fiscal 2024 due to a combination of factors, the most important being the reduction in demand for electricity.

Payment of capacity charges increases the electricity production costs for the government, which translates into increased power bills for consumers, a bane for large sections of society in a developing economy like Pakistan.

-

Comment by Riaz Haq on July 9, 2024 at 8:25am

-

Pakistan's rooftop solar boom shines spotlight on power crisis - Nikkei Asia

https://asia.nikkei.com/Spotlight/Asia-Insight/Pakistan-s-rooftop-s...

The government initially sought to incentivize the solar panel business. In 2017, it started a system for "net metering," in which people can sell excess electricity produced by their solar panels back to the national grid.

In March 2023, a Gallup Pakistan survey found 88% of respondents expressing satisfaction with the overall performance of the solar panels installed at their homes.

Still, solar power has plenty of room to grow, since it contributes a negligible portion of Pakistan's power mix. As of June 2023, the installed capacity of solar power in Pakistan stood at 630 megawatts, just 1.4% of the overall installed power capacity.

And as per the National Electric Power Regulatory Authority's State of Industry Report 2023, there were merely 56,000 net-metering connections, representing just 0.15% of the nation's electricity consumers.

But the appeal of solar is evident in distant rural regions that have limited connections to the national grid.

For example, the remote village of Kardigap, in Balochistan province, nearly 1,000 kilometers southwest of Islamabad, gets electricity from the national grid for merely three hours per day. Solar panels are becoming more common on the rooftops of houses in the village of 5,000 people, according to one resident who has gone a stage further and installed a full solar energy system sufficient to cater to his household's needs around the clock.

Vaqar Ahmed, joint executive director at the Sustainable Development Policy Institute (SDPI), an Islamabad-based think tank, agrees that solar energy offers an ideal solution for rural areas. "Solar has been a sort of blessing for rural areas of Pakistan, with more stable provision of energy, and these regions do not have high power demand," Ahmed said in an interview.

But even as the solar panel business has boomed, in March the government indicated it wanted to end the net-metering policy as it seeks to meet the IMF's criteria for state spending commitments.

Experts believe that the government is not sending a strong signal to potential investors in solar energy.

"Solar energy has faced policy whiplash in the last few years," said Aadil Nakhoda, an assistant professor of economics at the Institute of Business Administration in Karachi. "Frequent remarks by policymakers to reduce net-metering rates and then end the [practice] entirely has caused distress among domestic consumers."

Experts think the government fears that the continued spread of rooftop solar panels will increasingly lead to a loss of customers paying for electricity from the national grid.

A government official familiar with the developments told Nikkei on condition of anonymity, citing the sensitivity of the matter, that the government fears losing substantial investments in the electricity grid and generation systems: "If solar energy replaces [part of] the electric grid, then it will be a major economic blow that the government can't handle under current economic distress."

The Ministry of Energy did not respond to questions on the matter.

In the meantime, power industry watchers say solar offers one route for Pakistan to exit its energy woes.

"Pakistan has been ranked at No. 26 on the Renewable Energy Country Attractiveness Index by Ernst & Young," Aftab Alam, an expert on climate change and social development, told Nikkei Asia. "It would be an inexcusable failure if the government does not convert such blessings into socioeconomic development."

The SDPI's Ahmed said Pakistan could follow China's lead when it comes to solar power. "In China, there is no shortage of electricity but they are still building solar parks to keep future power needs in mind."

-

Comment by Riaz Haq on July 9, 2024 at 8:26am

-

Pakistan's rooftop solar boom shines spotlight on power crisis - Nikkei Asia

https://asia.nikkei.com/Spotlight/Asia-Insight/Pakistan-s-rooftop-s...

As things stand, existing users of solar panels are counting on the government to facilitate the spread of solar energy.

Rehman, the businessman from Lahore, said the government should encourage the local manufacturing of solar panels, which would help to maintain foreign exchange reserves.

Khuram Idrees, a resident of Rawalpindi who has a solar system at his home, recommended that the government provide interest-free loans to consumers to install solar systems. "All around the globe, green energy is supported by governments by incentivizing people to adopt such technologies," Idrees told Nikkei.

Back by the Srinagar Highway, solar adopter ud Din remained concerned by the government's uncertain policy, saying its changing approach on net metering has confused the existing users.

"If the government scraps the net-metering policy, then we will be left high and dry, our investment will be wasted, which is a terrifying prospect," he said.

-

Comment by Riaz Haq on July 9, 2024 at 6:38pm

-

The rise of Pakistan’s C&I solar business – pv magazine International

“In 2022, 2.8 GW of solar panels were imported into Pakistan. In 2023, about 5 GW, despite the import controls, and this year the prediction is for up to 12 GW,” he stated. One of the main hurdles to address in Pakistan's C&I segment is access to financing.

https://www.pv-magazine.com/2024/05/28/the-rise-of-pakistans-ci-sol...

C&I power consumers are increasingly deploying solar arrays in Pakistan due to high energy prices and tariffs.

“The average industrial consumers currently pay a tariff of $0.12/kWh,” Omar Malik, the CEO of Pakistani solar developer Shams Power, told pv magazine. “But this is only half the story, as they also have to pay another $0.10 in taxes on every kilowatt-hour they purchase from the grid. The government relies on five to six sectors for the bulk of its indirect tax collection, with electricity being one of the largest ones.”

High-self consumption rates mean lower electricity costs and lower taxes. Under the nation’s current regulations, the sale of excess power to the grid under net metering is only allowed for generators up to 1 MW in size.

The government also only exempts import duties on solar panels. “The exemption on solar inverters has been recently removed,” Malik said. “But this has not had consequences on the market development.”

Pakistan’s National Electric Power Regulatory Authority (NEPRA) issued 1,596 net-metering licenses across the country with a cumulative capacity of 221.05 MW in the 2022-23 fiscal year, according to official statistics from the Associated Press of Pakistan.

Malik said the market is also growing in terms of panel imports.

“In 2022, 2.8 GW of solar panels were imported into Pakistan. In 2023, about 5 GW, despite the import controls, and this year the prediction is for up to 12 GW,” he stated.

Financing concerns

One of the main hurdles to address in Pakistan’s C&I segment is access to financing.

“Banks and lenders in Pakistan keep considering solar assets as very fast depreciating assets,” Malik explained, noting that the volatility of the Pakistani rupee is still an issue compared to India, where access to financing is easier. “The Indian currency is stable enough for international investors.”

Despite these challenges, Shams Power was able to raise $20 million debt from local banks backed by a guarantee from an international credit enhancer, GuarantCo.

“In order to achieve this, we have to bring the bank in at the project finance stage,” Malik explained. “Or we can even do this after a year or two of operation, when we have some defined cash flows and we can show how these assets are performing and get the portfolio refinanced.”

Many Pakistani companies that export denim and textiles to the US and European markets face pressure from their buyers to support their supply chains with clean energy.

“In effect, there is some pressure to move toward renewables, but it is not coming from the government,” said Malik.

Storage segment

The C&I segment does not yet offer a big business case for battery storage.

“Batteries are still not economically viable when it comes to grid parity owing to high duties and taxes on import of batteries and storage technologies,” Irteza Ubaid, chief operating officer for Shams Power, told pv magazine. “With the current electricity price scheme in place, you can only generate profits when there is a power outage. Or when peak rates hit, you can start using batteries. However, the levelized cost of storage of C&I tier-1 batteries today, however, is still close to $0.35/kWh. We are still not able to give an economic benefit to clients to set up storage because they can buy grid power at less than $0.30, they're really not interested – unless they have a continuous production process and cannot afford any interruptions.”

-

Comment by Riaz Haq on August 9, 2024 at 6:33pm

-

Pakistan Sees Solar Boom as Chinese Imports Surge, BNEF Says – BNN Bloomberg

https://www.bloomberg.com/news/articles/2024-08-09/pakistan-sees-so...

(Bloomberg) -- Pakistan’s market for solar power is booming, propelled by a surge in imports from China, according to BloombergNEF.The country imported some 13 gigawatts of solar modules in the first six months of the year, making it the third-largest destination for Chinese exporters, according to a report by BNEF analyst Jenny Chase. Pakistan’s installed capacity to generate power is just 50 gigawatts. China is the world’s biggest producer of solar equipment.Solar is gaining traction in the South Asian nation following hikes in power prices over the past few years, with the latest increase in July triggering widespread protests. Higher rates have seen grid electricity consumption drop to the lowest in four years as many people switch to independent solar. “Pakistan’s market has the potential to continue to be very large,” said Chase. “If solar is solving the market’s power problems, there is no reason to expect a crash any time soon.”BNEF expects that the country will add between 10 gigawatts and 15 gigawatts of solar this year, mostly on homes and factories, making Pakistan the sixth-largest market in the world. Given the surge in imports, that figure could end up being far higher — or growth could stall if the grid situation improves, prices fall, or the market of middle-class people who can afford solar panels on their roofs saturates, according to the report.

There are other complications in accurately assessing the market and its prospects, said Chase. Those include wide discrepancies between official data on installations and imports, as well as claims last year that solar imports were used in money laundering schemes.

-

Comment by Riaz Haq on August 12, 2024 at 8:25pm

-

China adopted classic cutthroat pricing to shift a record 120,427 megawatts (MW) of solar module capacity exports in the first half of 2024, with Pakistan being Asia's largest single market, accounting for 10,450 MW.

Key to the strong export flow was a steep cut in module prices, which averaged 13.7 cents per megawatt over the first half of 2024, compared to an average of 18 cents/MW for the whole of 2023.

https://mettisglobal.news/pakistan-emerges-as-largest-asian-buyer-i...

The Netherlands remained the top country market for China's modules, taking in 23,421 MW of capacity during the opening half of the year.

Brazil was China's second largest market during the first half of the year, snapping up 10,511 MW of capacity.

Pakistan was the world's third and Asia's largest single market, accounting for 10,450 MW.

Meanwhile, India snapped up 8,324 MW.

------

Key Markets

Europe was the top destination for China's solar modules, accounting for 43% of the total, or 52,158 MW.

That total was down 20% from the same period in 2023, as high interest rates, economic growth concerns and trade tensions with China stifled solar installation demand across the continent.

Nonetheless, Europe's purchase total was the second highest tally for a half-year period behind the first half of 2023.

The Netherlands remained the top country market for China's modules, taking in 23,421 MW of capacity during the opening half of the year.

While that total was 25% less than during the opening half of 2023, The Netherlands' purchases were still more than twice the size of any other nation during the first half of the year.

Spain, Germany and Italy were also notable buyers in Europe, but all also showed steep year-on year contractions in purchase volumes, Ember data shows.

Brazil was China's second largest market during the first half of the year, snapping up 10,511 MW of capacity.

That total was up 10% from the same period in 2023, and contrasts with a slight contraction in imports by the Latin American region as a whole during the first half of the year.

Growth Areas

Asia was the second largest regional destination for China's solar parts, accounting for a record 32,109 MW of capacity, or around 27% of the total.

That total was 86% more than during the first half of 2023, and was driven mainly by strong growth in South Asia. Meanwhile, India snapped up 8,324 MW.

Both markets recorded more than 200% jumps in solar imports from the same period in 2023, and represent key growth markets for China in the future.

The Middle East was another key destination for China so far this year, with exports to the region topping 13,000 MW for the first half of the year to account for a record 11% share of China's total solar panel and parts exports.

That compares to 6,228 MW during the first half of 2023, and was driven in large part by strong purchases by Saudi Arabia (7,649 MW), United Arab Emirates (1,892 MW) and Oman (1,396 MW).

Elsewhere, North America remained a tiny market for Chinese panels and parts due to the ongoing trade spat between China and the United States, while Africa's purchases shrank by around 9% from the first half of 2023, and accounted for only 4.3% of China's total sales

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Trump's Tariffs on India: Can China or Russia Make Up For Lost Exports to US?

The United States is the biggest export market for India. Among its top 5 trading partners, the US is also the only country with which India runs a trade surplus. This surplus is now at risk with the 50% tariff recently imposed by President Donald Trump on imports from India. Can Prime Minister Narendra make up for it by cozying up to China and Russia? Recent trade data shows he…

ContinuePosted by Riaz Haq on September 8, 2025 at 7:00pm

US-India Ties: Does Trump Have a Grand Strategy?

Since the dawn of the 21st century, the US strategy has been to woo India and to build it up as a counterweight to rising China in the Indo-Pacific region. Most beltway analysts agree with this policy. However, the current Trump administration has taken significant actions, such as the imposition of 50% tariffs on India's exports to the US, that appear to defy this conventional wisdom widely shared in the West. Does President Trump have a grand strategy guiding these actions? George…

ContinuePosted by Riaz Haq on August 31, 2025 at 6:30pm — 11 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network