PakAlumni Worldwide: The Global Social Network

The Global Social Network

Production and Sales of Cars and Televisions Rose in Pakistan in 2010-11

Automobile:

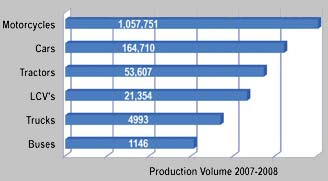

146,271 vehicles were produced in Pakistan in 8 months from July 2010 to February 2011, representing an increase of 9.2% y-o-y on the 133,918 units produced over the same period of FY09/10, according to figures from the Pakistan Automotive Manufacturers Association (PAMA). This consists of 85,924 units for passenger car production, 1,807 units truck production, 308 units bus production, 580 units jeep production, 12,000 units pick-up production and 45,652 units farm tractor production. Sales largely mirror production in Pakistan's auto market: the first eight months of FY10/11 saw a total of 143,785 new vehicles sold in the country, an increase of 7.1% y-o-y. Extrapolating the eight-month data across 12 months, total vehicle production would amount to 219,407 units, while total vehicle sales would register 215,678 units. This compares to the BMI forecast for the full fiscal year of just over 221,500 and just over 224,000 for production and sales respectively. However, these figures for FY10/11 aggregate sales and production are still considerably below the high watermark reached for both variables in FY07/08.

Although FY10/11 and FY09/10 have seen reasonably strong growth in y-o-y terms for both sales and production volumes, the industry is still recovering from a disastrous year in FY08/09, which was hit by a combination of the global economic downturn and severe internal political instability.

Consumer Electronics:

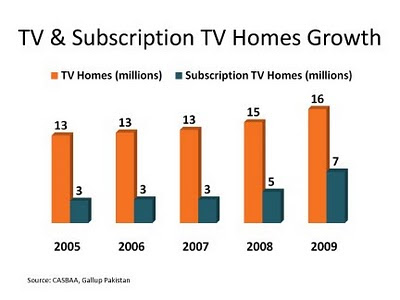

The media revolution of 24X7 news, entertainment and sports centered around rising number of television channels drove tv set sales up by 28.6% in 2010-2011.

Pakistan's consumer electronics market, including personal computers, mobile handsets and audio-video products, is now estimated at about $1.8 billion. BMI forecasts that this market will grow to $3 billion by 2015.

Computers accounted for about 20% of Pakistan's consumer electronics spending in 2010. BMI forecasts Pakistan's domestic market computer hardware sales (including notebooks and accessories) of $312 million in 2011, up from $292 million in 2010. Computer hardware CAGR for the 2011- 2015 period will be about 8%.

Mobile Handsets Pakistan's market handset sales are expected to grow at a CAGR of 16% to 29.5 million units in 2015, as mobile subscriber penetration reaches 70%. Revenues growth will be slower due to lower average selling prices (ASPs) of mobile handsets, with most handsets sold at less than $40. Another issue is the declining growth rate of mobile subscriber penetration, which is now more than 60%. 3G licenses are still expected to be awarded in 2011, but Pakistan's telecoms regulator has yet to confirm this.

Fast Moving Consumer Goods:

Fast moving consumer goods (GMCG) sector, including food, beverage and tobacco, grew by 9.3%, according to Economic Survey of Pakistan 2010-11. Adverting revenue from this sector has continued to drive proliferation of electronic mass media in Pakistan.

Conclusion:

The continuing growth in consumer spending is a testament to Pakistanis' resilience in the midst of multiple and very serious crises of energy shortages, continuing militancy and political violence and instability. The question is how long can this extraordinary resilience last if the corrupt and incompetent Pakistani politicians continue to persist in their mismanagement of the country and its economy.

Related Links:

Haq's Musings

Resilient Pakistan

Pakistan's Rural Economy Showing Strength

Pakistan's Exports and Remittances Rise to New Highs

Incompetence Worse Than Corruption

Sugar Crisis in Pakistan

Agricultural Growth in India, Pakistan and Bangladesh

Pakistan's Rural Economic Survey

Pakistan's KSE Outperforms BRIC Exchanges in 2010

High Cost of Failure to Aid Flood Victims

Karachi Tops Mumbai in Stock Performance

India and Pakistan Contrasted in 2010

Pakistan's Decade 1999-2009

Musharraf's Economic Legacy

World Bank Report on Rural Poverty in Pakistan

Copper, Gold Deposits Worth $500 Billion at Reko Diq, Pakistan

China's Trade and Investment in South Asia

India's Twin Deficits

Pakistan's Economy 2008-2010

Auto Industry in India, Pakistan and China

Media Revolution in Pakistan

-

Comment by Riaz Haq on September 17, 2011 at 7:59pm

-

Reduction in taxes announced by the government helped car sales sprint 35% in the first two months of financial year 2011-12, according to a report in The Express Tribune:

Sales stood at 29,537 units from July to August 2011 against 21,833 units sold in the preceding year, according to data released by Pakistan Automotive Manufacturers Association on Monday.

The incentive given by the government in terms of removal of 2.5% special excise duty on imported and locally manufactured vehicles coupled with reduction in general sales tax to 16% from 17% were the core reasons for the growth, said Summit Capital analyst Sarfraz Abbasi.

Growth was primarily led by Pak Suzuki Motor Company as its sales rose by 67% to 18,301 units followed by Indus Motor by 6% to 8,829 units.

The biggest leap forward was seen in Suzuki Swift sales that tripled to 1,274 units against 421 units in the same period last year. Liana, under the domain of 1,300cc engine capacity and above, recorded 149% jump in its sales to 127 units in comparison with just 51 units sold in the same period last year.

Meanwhile, tractor sales dropped by a hefty 78% to 1,993 units on the back of higher input taxes and plant shutdowns during the period. Al-Ghazi Tractors’ production operation remained completely shut during August.

Moreover, car sales declined by 31% in August alone amid less working days due to Eid holidays and lower production on account of Ramazan.

Company-wise breakup shows that this time Indus Motor took the front seat to lead sales with an increase of 27% to 4,728 units compared with 3,360 units sold in the same period last year.

New variants launched by the company in 1,600cc segment and CNG vehicles introduced in the already established market acted as a catalyst in this growth.

http://tribune.com.pk/story/250984/car-sales-rise-35-per-cent/

-

Comment by Riaz Haq on October 23, 2011 at 9:15pm

-

Here's a report in The Nation newspaper on Pakistan's auto parts industry:

The auto sector has taken initiative to organize the show for local auto part vendors to look for more export opportunities. Praising the efforts of local vendors in developing the engineering base and enhancing the skill sets of local engineers, they said that it is for the efforts of OEMs that local auto manufacturers have achieved 60 percent localization.

The auto sector is fully committed to localization process and has already developed 60 vendors and has arranged 34 technical assistance agreements for transfer of technology. In this regard, the IMC has invested Rs13 billion in development of internal infrastructure which includes Press Shop, Engine Shop and Paint Shop.

The OEMs have invested over Rs75 billion in local auto industry and it contributes more than 5 percent annually towards the national exchequer. Moreover OEMs and auto parts manufacturers employ around 200,000 people and supports employment of over 1,392,000 persons throughout its supply chain of vendors, suppliers and dealers.

The auto industry experts expressed confidence that the show will attract local and foreign investors and that the local auto industry will get support from government and policy makers which will help open doors for exploring foreign markets.

The local car manufacturers including the Indus Motors Company are the platinum sponsor for Pakistan Auto Parts Show (PAPS 2011) aimed to provide a platform for local engineering firms to introduce their products.

The auto sector in Pakistan is committed to play its role in the development of engineering base of the country. So, sponsoring ‘PAPS 2011’ is a step in this direction, which will showcase the achievements of Pakistan auto industry.

http://nation.com.pk/pakistan-news-newspaper-daily-english-online/B...

-

Comment by Riaz Haq on June 22, 2012 at 11:11pm

-

Here's a report on rising auto & tractor sales in Pakistan:

As per the latest available data of auto sales, recently released by the Pakistan Automotive Manufacturers Association (PAMA), car and LCV sales witnessed a 15.1% YoY growth in 11MFY12. Segment-wise break-up reveals that the economy segment (less than 1,000cc) led the growth with sales increasing by 24.9% YoY during the period under review. This was followed by the 1,000-1,300cc segment, which witnessed sales growth of 19.2% YoY to 26,734 units. The high-end segment (1300cc+) meanwhile remained the sector’s laggard and sales grew by a meager 2.1% YoY to 58,458 units. This lackluster performance can mainly be attributed to the suspension of production at Honda Atlas Car’s (HCAR) plant from Dec-11 to Mar-12, and single-digit sales growth of Corolla. Sales of LCV’s and 4×4’s registered a healthy 27.4% YoY growth in 11MFY12, mainly due to a jump in Bolan (PSMC), Ravi (PSMC) and Hilux (INDU) sales.

Pakistan Suzuki Motor Company Limited (PSMC) witnessed a 31% YoY improvement in sales in 11MFY12 to 100,805 units. PSMC has benefitted from the Punjab Government’s Yellow Cab Scheme, which has resulted in sales of Mehran and Bolan to increase by 39% YoY and 54% YoY respectively. Sales of Swift, Cultus and Alto meanwhile, increased by 67% YoY, 23% YoY and 15% YoY respectively in 11MFY12. Total units sold by the company in May-12, increased by 20% MoM to 10,608 units. On a YoY basis, this figure is 34% higher than May-11’s sales of 7,920 units.

Sales of Indus Motor Company Limited (INDU) decreased by 7% MoM in May-12 to 4,846 units. The primary reason behind this decline is the discontinuation of Coure, with only 63 units being sold during the month. During 11MFY12, the company sold a total of 48,907 units, which is 6% higher on a YoY basis. Hilux has remained at the forefront (with respect to sales growth), and its sales are higher by 56% YoY to 3,625 units in 11MFY12. Sales of Corolla during 11MFY12 increased by 9% YoY to 41,720 units.

Honda Atlas Cars Pakistan Limited (HCAR) reported a 53% MoM increase in total units sold to 1,150 units. The company’s endeavors to clear the backlog of orders of its City model resulted in sales of the model to jump by 533% MoM to 1,050 units. In 11MFY12 however, the company was only able to sell 9,901 units (33% lower YoY) owing suspension of production due to floods affecting its primary parts supplier in Thailand last year.

Al-Ghazi Tractors Limited (AGTL) registered a healthy 20% MoM sales growth to 2,743 units in May-12, helping the segment attain an overall performance improvement of 10% MoM to 6,913 units. On a YoY basis however, the sector recorded 33% lower sales owing to the imposition of GST last year, which resulted in demand for the product drying and production being suspended as a consequence. Millat Tractors Limited meanwhile, reported a 4% MoM improvement in sales to 4,170 units. On a YoY basis, sales of AGTL and MTL declined by 42% and 28% respectively during 11MFY12. This was mainly on account of the suspension of production mentioned above..

http://investorguide360.com/11mfy12-auto-sales-register-15-yoy-grow...

-

Comment by Riaz Haq on July 13, 2012 at 10:46pm

-

Here's an ET report on potential GM investment in Pakistan:

The Adviser to Prime Minister on Industries Muhammad Basharat Raja said that talks were held with delegations of Korean Company and General Motors (GM) to motivate them to invest in Pakistan and he hopes for positive results.

Raja told the National Assembly that the government is considering giving more incentives for investment in car manufacturing in the country. He added that presently one hundred and fifty thousand cars are being manufactured in the country and fifty thousand are being imported annually which are not sufficient to meet requirements.

General Motors, the world’s largest automaker based on sales has brands like of Cadillac, Chevrolet, GMC, Opel and Vauxhall under its belt. In Pakistan, General Motors markets its products through Nexus Automotive Limited, the exclusive importer and progressive manufacturer of the automaker’s products in the country. Nexus started manufacturing Chevrolet Joy in Pakistan in December 2005 whereas other GM products sourced from the global GM network are also planned for introduction to the local market. Nexus uses idle capacity at the Ghandhara Nissan Limited plant at Port Qasim to assemble Chevrolets, under the GM contract assembly agreement.

The project estimated value is $15 million and GM-Chevrolet has provided full support to ensure that the local components and the car assembled here meet GM quality standards and customer expectations.

Auto sales in fiscal 2012 stood at 157,325 units according to the data released by the Pakistan Automotive Manufacturers Association. In terms of car sales, Pak Suzuki Motor Company is leading with 95,142 units followed by Indus Motor Company and Atlas Honda.

http://tribune.com.pk/story/408082/exploring-avenues-pakistan-seeks...

-

Comment by Riaz Haq on July 16, 2012 at 7:52am

-

Here are excerpts of PakistanToday's interview with Pepsico Asia chief Qasim Khan:

.. In a recently-conducted detailed interview with Pakistan Today (PT), Qasim Khan, a US-educated Pakistani who is PepsiCo’sgeneral manager and president for the North and South Asia Business Unit that, in its scope, ranges from Japan to Mongolia, talked at length about the immense potential as well as challenges the MNCs like his own are presently facing in Pakistan.

-----------

What is the current size

and scope of your business in Pakistan?Qasim Khan: PepsiCo International is intricately linked towards the development of the corporate sector in Pakistan as we were one of the first multinationals to start operations in Pakistan in 1967. Now we are the biggest Food and Beverage Company in terms of the retail turnover in Pakistan having seven beverages franchises across the country. We also brought in Foreign Direct Investment in the shape of a concentrate plant set up in Hattar. Today, Pakistan is the 6th largest market for PI worldwide and we have three brands; Pepsi, Dew and 7-UP which are bigger than our rivals in terms of volume contribution. Pepsi is ingrained as a household brand while our contributions towards the development of sport, specifically cricket and music industry is unparalleled. We have been the pioneers of developing both these industries while strengthening our beverages brands over the past many decades. Since 2006 we also introduced the famous Lay’s potato chips brand in Pakistan by investing in a state-of-the-art plant which employs over a 1000 people. We have made strong investments in the agricultural sector of Punjab by introducing latest technologies for potato growers and are looking to expand potato growing into the country’s northern areas. We also plan to export potatoes to other countries around the world. Our snacks portfolio consists of leading global brands like Lays, Cheetos, Kurkure and Wavy.

--------------

PT: OK, now tell us what made PepsiCo invest in Pakistan?

Qasim Khan: Pakistan’s opportunity is driven from the following facts:

Large Market: It’s the 6th most populace country in the world with approximately 70 percent population under the age of 30.

Trained Workforce: A large trained and productive population represents a big opportunity to Pakistan to benefit from its demographic dividends.

Investment Policies: Pakistan’s policy trends have been consistent with liberalization, de-regulation, privatization and facilitation being the cornerstones of its policy.

Large Agro Base: The strong agriculture base presents a great opportunity for our food business to expand in the future. We realize that Pakistan is the 11th largest wheat producer, 12th largest rice producer and the 5th largest milk producer in the world.

Geo-Strategic Location: It can be a gateway between the energy rich Central Asian states, the financially-liquid Gulf states and technologically-advanced Far Eastern countries. This alone makes Pakistan a market teeming with possibilities.

Incomes on F&B: A significant amount of individual incomes (as high as 40 percent) are spent on food and beverage representing a huge opportunity for the industry.

Financial Markets: The capital markets are being modernized, and reforms have resulted in development of improved infrastructure in the stock exchanges of the country. The Securities and Exchange Commission of Pakistan has improved the regulatory environment of the stock exchanges, corporate bond market and the leasing sector....http://www.pakistantoday.com.pk/2012/07/16/news/profit/grappling-wi...

-

Comment by Riaz Haq on July 16, 2012 at 8:53am

-

Here's a Bloomberg story on Pakistan seeking US investments:

The American Business Council, that includes the Pakistan units of Coca-Cola Co. and Cisco Systems Inc., plans to invite 10 U.S. companies a year to invest in the South Asian nation and take advantage of rising consumer demand.

“Branded product penetration in Pakistan is so low that the potential for growth is immense,” Saad Amanullah Khan, president of the council, said in an interview in Karachi today. Up to 80 percent of American companies operating in Pakistan, especially technology and consumer goods companies, had a “good year” in 2011.

Pakistan needs to increase overseas investment to help meet an economic growth target of 4.3 percent in the year that began July 1. Foreign direct investment declined 50 percent to $813 million in the year ended June 30, according to the central bank.

The council plans to double its membership of U.S. companies from 63 in the next five years and increase the total investment to $1 billion from $663 million, said Khan, 51, who is also chief executive officer of Gillette Pakistan Ltd.

Pakistan agreed this month to end a seven-month ban on North Atlantic Treaty Organization trucks crossing its territory on the way to Afghanistan, easing tensions with the U.S., its biggest trading partner. The routes were reopened after U.S. Secretary of State Hillary Clinton apologized for the killing of 24 Pakistani soldiers in a November border strike by American helicopters.

Pakistan’s credit rating was lowered deeper into junk status by Moody’s Investors Service on July 13, which cited dwindling currency reserves and political instability. The $200 billion economy faces the fastest inflation in Asia, lingering power blackouts, an insurgency on the Afghan border and reduced aid flows.

http://www.businessweek.com/news/2012-07-16/american-business-counc...

-

Comment by Riaz Haq on August 8, 2012 at 11:12pm

-

Pakistan auto sales rose 23% in FY 2011-12, reports The Nation:

The Pakistan car industry grew by 23% to 178,753 units YoY in FY12 where PSMC contributed 60% followed by INDUS contributing 29% to the total industry sales. The increase can be attributed primarily to 1) good agricultural income 2) deferred sales due to reduction in Sales Tax and 3) Yellow cab scheme.

In Jun12,car sales stood at 19,140 units, depicting an exceptional increase of 158% from 7,419 units sold in Jun11 mainly because of the low base effect as the government was expected to reduce Sales Tax by 1% in Jun11.

PSMC had a phenomenal FY12 as it witnessed a 40% YoY jump in its sales figures contributing more than 50% to the industry’s total sales pie. This growth in units from 79943k to 112157k units was mainly triggered by Punjab Government Yellow cab scheme where PSMC was the prime beneficiary.

INDU also saw its sales units go up to 54477 units from 50015k (9% up in FY12) on the back of good agricultural growth and subsequently good rural income.

Segment wise YoY analysis makes Corolla(+58%), Cultus(+ 20%) and Mehran(+ 46%) the star performers in 1300cc, 1000cc and 800cc respectively. We believe Corolla on the back of agricultural income and Cultus and Mehran as substitutes to Alto and Cuore will continue to capture the customer interest.

Auto sales in June-2012 clocked in at 19.2k units, which is an increase of 15%MoM. This improvement in sales is most likely due to anticipated price hikes by the manufacturers owing to conversion to Euro II compliance and steep depreciation of Rupee. On a YoY watch, auto sales soared by 155%.

However, this growth is misleading as sales last year in June abnormally declined owing to expectation of price cuts. As a result, auto sales reached 179k units (up 22%YoY) in FY12 vs. our expectation of 175k units. In expectation of stiff competition from imports, we expect growth to slowdown to 6% in FY13. We presently have a ‘Market-Weight’ stance on the sector, with Indus Motor (INDU) as our preferred play.

FY12 culminated with a growth of 22%YoY, with sales touching 179k units. The improvement in demand was largely led by the subsidized Yellow Cab scheme offered by the Punjab government. We expect the growth to slow down to 6% in FY13 (sales likely to reach 190k units) owing to a lower amount allocated to the cab scheme this year and stiff competition from imports.

The announcement of a new long term auto policy (termed as AIDP-2) will be pivotal for the sector going forward.

Significantly lower duties on CBU imports in the policy can substantially hurt the local manufacturers. We retain our outlook on the sector at ‘Market-Weight’, with INDU as our preferred play. The stock trades at an FY13 PE of 5.8x, and offers a dividend yield of 7.4%http://www.nation.com.pk/pakistan-news-newspaper-daily-english-onli...

-

Comment by Riaz Haq on August 9, 2012 at 7:04pm

-

Here's an ET report n Toyota's rising sales and profits in Pakistan:

Global automobile giant Toyota’s affiliate in Pakistan announced that the 2012 financial year was its most profitable ever in the country, earning Rs4.3 billion in net income, a 57% increase over the previous year.

Indus Motor Company – a company that is 37.5% owned by Japan’s Toyota – announced its annual results on Thursday. The company’s revenues rose by nearly 25% to reach Rs75 billion, largely on the back of increased car sales, though higher prices were also a factor. The company sold over 55,000 cars during the financial year that ended on June 30, 2012, its highest ever for a single year. Both revenues and profits were the highest in the company’s history in Pakistan.

Investors in Indus Motors are likely to be pleased by the management’s decision to announce a Rs24 per share dividend, bringing the total annual payout to Rs32 per share. Given the company’s earnings per share of Rs54.74, that comes to a payout ratio of 58.5%.

Indus Motors assembles the Toyota Corolla, easily the most popular sedan in the Pakistani market, made even more attractive by the company’s wide network of dealerships and after-sales service points, which help the car retain a high resale value. As incomes in Pakistan’s urban middle class have recovered after the 2008 financial crisis, sales of the sedan have bounced back to pre-crisis levels.

Nonetheless, analysts point to several dangers to the company’s business. “Demand for new cars in Pakistan will decline, going forward,” said Atif Zafar, a research analyst at JS Global Capital, an investment bank. “Local car manufacturers are expected to remain under pressure from competition with imported used cars.”

Nonetheless, sales figures for new cars have been improving, reaching a four-year high of over 157,000 units in 2012, an almost 23% increase over the previous year. Indus Motors share of that is almost 35%.

Officials at Indus Motors concurred with JS Global’s assessment that new car demand had slowed in recent weeks, largely due to an expectation among car buyers that the government will relax rules on the import of used cars. Low demand is forcing local manufacturers to cut back on production, they said. Indus suspended its production for four days in July and plans six off-days in August to offset the problem of slow demand.

The largest carmaker of country, Pak Suzuki Motors, is also expected to see a hit in its sales this year. This year, the Punjab government has allocated fewer funds for the Punjab taxi scheme so one can expect that Pak Suzuki may get less orders compared to last year’s order of 20,000 units, Zafar said.

While car importers vow to double car imports this year, local carmakers are continuously pressuring the government to reduce the age-limit of used car imports from the current five years to three years. Pakistan imported 55,000 cars in fiscal year 2012, a massive increase over the 18,000 cars in previous fiscal year.

http://tribune.com.pk/story/419836/profits-at-toyotas-pakistan-affi...

-

Comment by Riaz Haq on October 23, 2012 at 10:48pm

-

Here's 2012 BMI research report on consumer electronics market in Pakistan:

BMI expects the Pakistan consumer electronics market will grow by around 9% in 2012, with strongdemand for smartphones, flat screen TV sets, and tablets providing growth, despite an expectedslowdown in private consumption. The Pakistani consumer electronics market has considerable potential,but this is constrained by a large grey market, poor IP protection, an unstable economic and securitysituation, and weak distribution channels. Reforming high national and provincial taxes and tariffs onproducts ranging from computers to prepaid mobile cards would boost the market. The long-term marketdrivers include a rising population and growing affordability and demand for consumer electronics goodsis also influenced by trends from Middle Eastern markets.

Headline Expenditure Projections Computer sales: US$309mn in 2011 to US$331mn in 2012, +7% inUS dollar terms. Forecast in US dollar terms upwardly revised, despite a high level of illegal imports.AV sales: US$645mn in 2011 to US$710mn in 2012, +10% in US dollar terms. Forecast in US dollarterms upwardly revised, with the main driver being demand for flat-screen TV sets.

Handset sales: US$750mn in 2011 to US$816mn in 2012, +12% in US dollar terms. Forecast in USdollar terms upwardly revised, but despite the popularity of smartphones, most handsets are sold at lessthan US$50.

Risk/Reward Rating: Pakistan’s score was 28 out of 100.0, with low CE market and Country Structureratings dragging down high Potential Returns. Pakistan took thirteenth place in our latest RRR table, buthas potential to rise over time due to the size of the market.

Key Trends & Developments

The TV sets segment is forecast to grow at a CAGR of about 12% as consumers replace blackand white, and analogue sets with colour and LCD models. About 49% of TV sets sold each yearare still black and white. If the government is unable to crack down on smuggled goods, growthcould be slower than this.

PC vendors must contend with a significant segment of demand being met by imports of usedcomputers from countries such as China. The government has denied reports it plans ban importsof used computers, which is a measure strongly opposed by local retailers. The price differentialbetween an imported second-hand computer and a new one is considerable, according to localimporters.

In 2012, established brands will hope to regain some market share as a result of thegovernment’s recent ban on imported handsets without IMEI numbers. Low-cost Chinesephones are understood to account for around 30% of the local handset market. According toretailer reports, although the ban hit sales of low-cost Chinese handsets, Chinese reacted quicklyto the new circumstances. Meanwhile, established vendors are targeting the low-price tier withproducts offering dual-SIM support and other features that have proved popular for the low-costbrands.

http://www.marketresearch.com/Business-Monitor-International-v304/P...

-

Comment by Riaz Haq on November 3, 2012 at 5:32pm

-

Here's a Daily Times story on Honda launch of a new motorcycle:

KARACHI: Pakistan will be amongst top 5 countries producing and exporting high quality motorcycles in next few years, T Oyama senior Managing Director Honda Motor Company Japan said at the launch of new model ‘Pridor’.

With the hard work of associates, Atlas Honda today stands at the turning point from where the sales and production will touch the ever highest in the history of the country, he said.

It is encouraging after investing $35 million this year, Atlas Honda has increased its motorcycle production capacity to 750,000 vehicles annually keeping in mind the growing local demand, one of the largest motorcycle markets in the world and export potential to regional countries, he said. The leading motorcycle manufacturer is currently conducting a study for an expansion to 1 million units’ production capacity, which is estimated to cost around an additional $50 million. He said the seed of relationship sown by Atlas Group Pakistan’s Yusuf Shirazi and Suichiro of Honda Japan is today the oldest joint venture of Honda Motor Company anywhere in the world i.e Atlas Honda Ltd.

By launching yet another state of the art model Pridor, surpassing all available technologies in the country, Atlas Honda has also proven its commitment to Pakistan’s market, he said.

http://www.dailytimes.com.pk/default.asp?page=2012\11\04\story_4-11-2012_pg5_8

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani International Students Flocking to European Universities

Recent data shows that there are nearly 10,000 Pakistani students attending colleges and universities in Germany. This figure is second only to the United Kingdom which issued over 35,000 student visas to Pakistanis in 2024. The second most popular destination for Pakistani students is Australia which is hosting nearly 24,000 students from Pakistan as of 2023, according to the ICEF…

ContinuePosted by Riaz Haq on July 15, 2025 at 9:00am

Pakistani Prosthetics Startup Aiding Gaza's Child Amputees

While the Israeli weapons supplied by the "civilized" West are destroying the lives and limbs of thousands of Gaza's innocent children, a Pakistani startup is trying to provide them with free custom-made prostheses, according to media reports. The Karachi-based startup Bioniks was founded in 2016 and has sold prosthetics that use AI and 3D scanning for custom designs. …

ContinuePosted by Riaz Haq on July 8, 2025 at 9:30pm

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network