PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan to Become World's 6th Largest Cement Producer By 2030

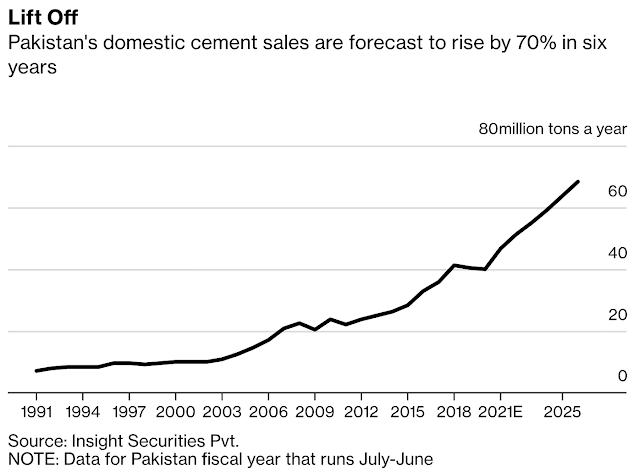

Pakistan's rank as world's leading cement producer will rise from 16th in 2018 to 6th by 2030. It will replace Japan among the world's top 10 cement producing nations in 2030, according to World Cement Association forecast. Cement consumption is an important indicator of development activity and economic growth. Pakistan's domestic cement sales are continuing to grow, up 9.2% in October, 2019 from the same month last year. Total sales (local and export) in 4-month period between July and October 2019 stood at 16.117 million tons, 4.5 per cent higher than 15.419 million tons during the same period last year.

| Source: World Cement Association |

Last year, Pakistan produced 41.14 million tons of cement, according to International Cement Review. The country's cement industry has already built capacity to produce 59.5 million tons in anticipation of future demand for housing and infrastructure. World Cement Association expects Pakistan to produce 85 million tons, 2% of the world's cement production in 2030.

|

| Cement Sales in Pakistan. Source: Bloomberg |

Currently, China produces more than half of all the cement used in the world. India produces 8% and and European Union 3%. The three will continue to be at the top in 2030. However, China's share will drop to 35% while India's share will double to 16%.

|

| Top Cement Producing Countries in 2019 |

Pakistan's domestic cement sales grew 9.2% in October, 2019 from the same month last year. Total sales (local and export) in 4 months period between July and October 2019 stood at 16.117 million tons, 4.5 per cent higher than 15.419 million tons during the same period last year. Cement consumption is an important indicator of the state of economy. It is the most important construction material. It drives construction industry that is among the biggest employers in the world. Cement is used to build homes, factories, schools, hospitals, roads, bridges, ports and all kinds of other infrastructure.

|

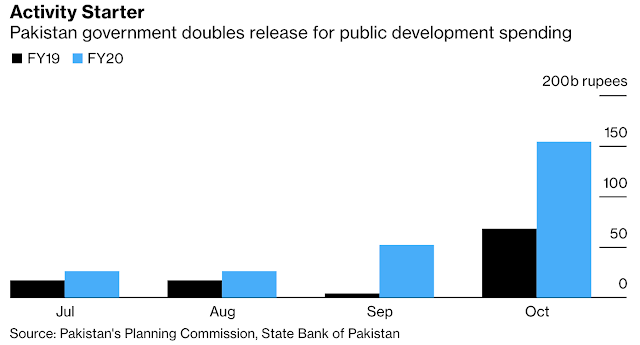

| Recent Spike in Public Sector Development Spending (PSDP) |

Development of infrastructure under China Pakistan Economic Corridor projects is continuing to drive cement demand in the country. In addition, construction of major new housing communities is underway. One example of such a community is Karachi's Bahria Town. It is being built on the outskirts of Pakistan's financial capital is among the world's largest privately developed and managed cities. It is spread over an area of a little over 70 square miles, larger than the 49 square miles area of San Francisco. When completed, Bahria Town will house over a million people, more than the entire population of San Francisco.

-

Comment by Riaz Haq on July 9, 2022 at 9:37pm

-

Pakistan’s cement dispatches drop in 2022 financial year

https://www.globalvillagespace.com/pakistans-cement-exports-fall-by...

According to the dispatch split, northern-based mills shipped 39.44Mt of cement domestically during the FY21–22, which is 2.8% less than the 40.58Mt shipped during the FY20–21. From FY21–22 to FY21–22, the north’s exports decreased by 64.5% to 910,685t, compared to 2.56Mt exported in the prior fiscal year.

Domestic shipments by southern-based mills in FY21–22 totaled 8.19 Mt, up 8.7% from 7.53 Mt of cement in the prior fiscal year. However, exports from the southern zone had a significant reduction of about 35.6%, falling from 6.74Mt in the fiscal year to 4.34Mt in FY21-22.

-

Comment by Riaz Haq on September 3, 2024 at 8:56am

-

Pakistan: Domestic cement sales declined by 4.6% to 38.2Mt in FY2024 from 40Mt in FY2023, reflecting a slowdown in construction activities. Despite this, exports were up by 56% to 7.1Mt, contributing to a slight overall rise in cement dispatches of 1.6% to 45.3Mt in 2024, according to Dawn newspaper.

https://www.globalcement.com/news/item/17555-cement-sales-fall-in-p....

----------

Pakistan: Cement Sector Profitability To Improve – OpEd

July 22, 2024 0 Comments

By Shabbir H. Kazmi

https://www.eurasiareview.com/22072024-pakistan-cement-sector-profi...

According to Topline Securities, its cement universe is expected to post profit of PKR12.5 billion for 4QFY24 as against a profit of PKR11.1 billion for 3QFY24, up by 13%QoQ, due to higher average retention prices.

This will take FY24 profits to PKR51.1 billion, up 84%YoY due to increase in GP margins to 29%.

While on YoY basis, Topline cement universe posted loss of PKR2.8 billion in 4QFY23 due to higher effective tax rate related to super tax liability. Excluding for tax implications, Profit Before Tax (PBT) in 4QFY24 is expected to increase by 45% YoY due to higher revenues and other income.

Net sales are anticipated to grow by 10%YoY to PKR91.3 billion in 4QFY24 despite 7%YoY decline in local cement sales, thanks to 11%YoY increase in average local cement prices.

Decline in cement dispatches in 4QFY24 was due to: 1) lower working days amid Eid holidays, 2) high cost of construction, and 3) lower demand due to economic slowdown.

Capacity utilization of the cement sector clocked in at 52% in 4QFY24, as compared to 55% in 4QFY23

Gross margin of the sector are anticipated to improve by 1%YoY to 27% in 4QFY24 due to higher retention prices.

During the 4QFY24, cement players in the South region mostly relied on Richards Bay coal, while those in the North region used a combination of Afghan and local coal. Richards Bay coal prices averaged at US$108 per ton in 4QFY24 as compared to US$109 per ton in 4QFY23 and US$97 per ton in 3QFY24, down 1% YoY and up 11% QoQ.

Average retention price for 4QFY24 is estimated at PKR914/bag, up 11% YoY and 2%QoQ.

Other income of the sector is estimated to rise to PKR5.6 billion in 4QFY24, up by 44%YoY.

LUCK is expected to contribute 60% in sector’s other income.

The brokerage house has an Overweight stance on Pakistan Cement sector with Luck Cement (LUCK), Maple Leaf Cement (MLCF) and Fauji Cement Company (FCCL).

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

American Prof John Mearsheimer on International Geopolitics in South Asia

Professor John Mearsheimer, a renowned international relations expert known for his theory of "offensive realism", has recently spoken to India's CNN-News18 about the impact of US-China competition on geopolitics in South Asia. Sharing his thoughts in interviews on India-Pakistan conflict after the Pahalgam attack, he said: "There is really no military solution to this (Kashmir)…

ContinuePosted by Riaz Haq on May 24, 2025 at 5:30pm

Has Pakistan Destroyed India's S-400 Air Defense System at Adampur?

Pakistan claims its air force (PAF) has destroyed India's high-value Russian-made S-400 air defense system (ADS) located at the Indian Air Force (IAF) Adampur air base. India has rejected this claim and posted pictures of Prime Minister Narendra Modi posing in front of its S-400 rocket launchers in Adampur. Meanwhile, there are reports that an Indian S-400 operator, named Rambabu Kumar Singh, was killed at about the time Pakistan claims to have hit it. Pakistan is believed to have targeted…

ContinuePosted by Riaz Haq on May 21, 2025 at 4:00pm — 2 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network