PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Vast Oil Reserves

Pakistan has more shale oil than Canada, according to the US Energy Information Administration (EIA) report released on June 13, 2013.

The US EIA report estimates Pakistan's total shale oil reserves at 227 billion barrels of which 9.1 billion barrels are technically recoverable with today's technology. In addition, the latest report says Pakistan has 586 trillion cubic feet of shale gas of which 105 trillion cubic feet (up from 51 trillion cubic feet reported in 2011) is technically recoverable with current technology.

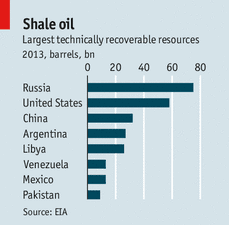

The top ten countries by shale oil reserves include Russia (75 billion barrels), United States (58 billion barrels), China (32 billion barrels), Argentina (27 billion barrels), Libya (26 billion barrels), Venezuela (13 billion barrels), Mexico (13 billion barrels), Pakistan (9.1 billion barrels), Canada (8.8 billion barrels) and Indonesia (7.9 billion barrels).

Pakistan's current annual consumption of oil is only 150 million barrels. Even if it more than triples in the next few years, the 9.1 billion barrels currently technically recoverable would be enough for over 18 years. Similarly, even if Pakistan current gas demand of 1.6 trillion cubic feet triples in the next few years, it can be met with 105 trillion cubic feet of technically recoverable shale gas for more than 20 years. And with newer technologies on the horizon, the level of technically recoverable shale oil and gas resources could increase substantially in the future.

|

| Source: US EIA Report 2013 |

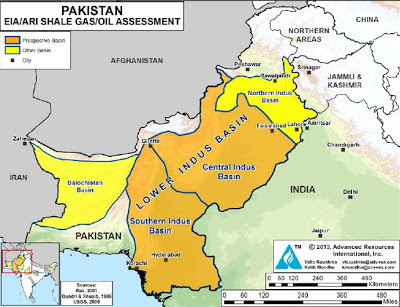

As can be seen in the shale resource map, most of Pakistan's shale oil and gas resources are located in the lower Indus basin region, particularly in Ranikot and Sembar shale formations.

|

| Source: US EIA Report 2013 |

Since the middle of the 18th century, the Industrial Revolution has transformed the world. Energy has become the life-blood of modern economies. Energy-hungry machines are now doing more and more of the work at much higher levels of productivity than humans and animals who did it in pre-industrial era. Every modern, industrial society in history has gone through a 20-year period where there was extremely large investment in the power sector, and availability of ample electricity made the transition from a privilege of an urban elite to something every family would have. If Pakistan wishes to join the industrialized world, it will have to do the same by having a comprehensive energy policy and large investments in the power sector. Failure to do so would condemn Pakistanis to a life of poverty and backwardness.

The availability of large domestic shale oil and gas expands the opportunity to reduce Pakistan's dependence on imports to overcome the current energy crisis and to fuel the industrial economy. But it'll only be possible with high priority given to investments in developing the energy sector of the country.

Related Links:

Haq's Musings

US EIA International Data on Per Capita Energy Consumption

Pakistani Guar in Demand For American Shale Fracking

Affordable Fuel for Pakistan's Electricity

Pakistan Needs Shale Gas Revolution

US Census Bureau's International Stats

Pakistan's Vast Shale Gas Reserves

US AID Overview of Pakistan's Power Sector

US Can Help Pakistan Overcome Energy Crisis

Abundant and Cheap Coal Electricity

US Dept of Energy Report on Shale Gas

Pakistan's Twin Energy Crises

Pakistan's Electricity Crisis

Pakistan's Gas Pipeline and Distribution Network

Pakistan's Energy Statistics

US Department of Energy Data

Electrification Rates By Country

CO2 Emissions, Birth, Death Rates By Country

China Signs Power Plant Deals in Pakistan

Pakistan Pursues Hydroelectric Projects

Pakistan Energy Industry Overview

Energy from Thorium

Comparing US and Pakistani Tax Evasion

Pakistan's Oil and Gas Report 2010

Circular Electricity Debt Problem

International CNG Vehicles Association

Rare Earths at Reko Diq?

Lessons From IPP Experience in Pakistan

Correlation Between Human Development and Energy Consumption

-

Comment by Riaz Haq on August 3, 2013 at 7:05am

-

Here's a Saudi Gazette story on US oil reserves:

NEW YORK — US proved oil reserves grew by a record amount in 2011, according to a government report Thursday, in the latest indicator of the North American energy boom.

The US added 3.8 billion barrels of crude in 2011, a 15 percent increase, according to the US Energy Information Administration. The amount represents a record volumetric increase in oil reserves for the second year in a row, EIA said.

Proved oil reserves stood at 29.0 billion barrels in 2011 (vs 257 billion barrels in Saudi Arabia), the highest volume since 1985.

"Horizontal drilling and hydraulic fracturing in shale and other tight rock formations continued to increase oil and natural gas reserves," said EIA Administrator Adam Sieminski.

"Higher oil prices helped drive record increases in crude oil reserves, while natural gas reserves grew strongly despite slightly lower natural gas prices in 2011."

The data came as US petroleum producers continue to push oil output to levels not seen since the early 1990s.

Energy companies have also boosted natural gas output in recent years due to the shale boom. While natural gas output varies monthly somewhat due to incremental investment decisions, US natural gas production has been at record levels in recent years.

The US added 31.2 trillion cubic feet (0.9 trillion cubic meters) of natural gas reserves in 2011, an increase of 9.8 percent, the EIA said. The 2011 natural gas volumetric increase was the second largest in US history after the 2010 rise.

http://www.saudigazette.com.sa/index.cfm?method=home.regcon&con...

-

Comment by Riaz Haq on August 30, 2013 at 10:36pm

-

A news story in Pakistan's Express Tribune claims that US EIA estimates of Pakistan shale oil and gas reserves are "exaggerated".

http://tribune.com.pk/story/597544/hold-your-barrels-eia-report-exa...

I find such claims by journalists and the people they quote totally ridiculous.

Their opinion is not based on any knowledge about shale geology and methods of assessment of oil and gas reserves.

Americans know more about shale oil and gas based on actual experience of the ongoing shale revolution in America.

Opinions of US EIA experts are much more reliable in this regard.

-

Comment by Riaz Haq on October 12, 2013 at 11:27pm

-

Here's a China Daily report on what China can learn from US shale energy development:

WASHINGTON -- The surging shale energy output in recent years has been centering in North America, but it can also happen in other places like China, a US energy expert said Friday.

Shale gas will come to play a more important role in China's energy mix in the long term, said IHS Cambridge Energy Research Associates Chairman Daniel Yergin at a seminar on energy boom in North America.

"China has great potential for shale gas but it will take perhaps five to 10 years to develop, due to the lack of infrastructure and logistic capabilities," Yergin told Xinhua.

He added that Chinese energy companies among others are learning the necessary technologies from their American counterparts to unlock the unconventional energy including shale oil and gas.

The energy industry was concerned a decade ago that US energy output had hit the ceiling and started to go down, but now the United States is about to overtake Russia in terms of oil and gas production, said Yergin.

The United States produced the equivalent of 22 million barrels a day of oil, natural gas and related fuels in July, according to figures from the Energy Department.

The shale energy bonanza reduced US imports of natural gas and crude oil by 32 percent and 15 percent respectively in the past five years.

However, the environmental implications of shale gas extraction, a process that includes hydraulic fracturing, remain uncertain.

Hydraulic fracturing involves pumping water, sand and chemicals deep underground into horizontal gas wells at high pressure to crack open hydrocarbon-rich shale and extract natural gas.

Accelerated shale gas drilling and hydrofracking in recent years has fueled concerns about contamination in nearby drinking water supplies.http://usa.chinadaily.com.cn/business/2013-10/12/content_17027019.htm

-

Comment by Riaz Haq on November 20, 2013 at 11:27pm

-

Here's a News story on US agreeing to help Pakistan with shale gas development:

ISLAMABAD: In a major development the US has agreed to extend the technical help for the exploration of shale gas reserves in Pakistan and to this effect a US company is all set to initiate a study for an exact assessment of oil and gas reserves – particularly the shale gas – available in Pakistan, an official told The News.

The study is to take nine months to be completed, reveals one of the senior officials – who were part of the high level delegation that recently visited the US and held dialogues on energy in Washington and Houston between November 12 and 16.

The delegation – headed by the Minister for Petroleum and Natural Resources Shahid Khaqan Abbasi – comprised of secretaries and heads of public sector entities.

Later, the petroleum ministry signed an agreement with the US consultant Advanced Engineering Associates International, Inc (AEAI) that would embark on the strategic study to assess the actual reserves of shale gas in Pakistan and then with the help of the US experts four methods would be formulated to exploit the shale gas reserves.

The Director General Petroleum Concession Saeed Ullah Shah said the study will be completed in nine months. To a question, he said that the USAID would finance the study.

The EIA (Energy Information Administration) — US federal authority on energy statistics and analysis – in June last said that Pakistan was estimated to have fresh recoverable shale gas reserves of 105 trillion cubic feet (TCF) and more than nine billion barrels of oil.

The official said Pakistan has conventional gas reserves of just 23 TCF and conventional oil reserves of 286 million barrel per day. “We have set the date to AEAI for the exact identification and authentication of shale gas reserves,” he said.

“Shale gas had seen tremendous developments in the United States and a couple of other countries were trying to use the latest energy source. Pakistan was also encouraging exploration and production companies to venture into the field,” said the official. Secretary petroleum and natural resources Abid Saeed said that US officials showed willingness to help Pakistan in coping with energy crisis and extend the technical expertise and training to Pakistan’s officials in shale gas exploitation. USAID has already helped Pakistan in formulating the shale gas policy.

http://www.thenews.com.pk/Todays-News-3-215321-US-to-provide-techni...

-

Comment by Riaz Haq on December 4, 2013 at 10:23pm

-

Here's a Dawn report on UNESCAP Statistical Year Book 2013:

ISLAMABAD, Dec 3: About 1.3 billion people in the world are living without electricity; two-thirds of them being in 10 countries and four of them, including Pakistan, in the Asia Pacific region, says a report of the United Nations.

According to the Statistical Yearbook for Asia and the Pacific-2013 released by a UN commission on Tuesday, an estimated 60 per cent of capacity-addition efforts in future will be focused on mini-grids and off-grid connections in which renewable energy sources will play a vital role.

In the generation of electricity from renewable sources, the Asian and Pacific region led the world in 2010. But this amounted to only 15.8 per cent of the region’s total electricity, which is below the world average of 19.4 per cent.

With less than 400 kilowatt-hours per capita, the annual household electricity consumption in the region is the second lowest among the world’s regions, after Africa where it is 200kwh.

About 2.6bn people in the world and 1.8bn in the region use solid fuels for cooking. The WHO estimates that more than 1.45 million people die prematurely each year from indoor air pollution caused by burning solid fuels with insufficient ventilation.

Women’s economic empowerment

The report says that despite its economic growth, the region lags behind in economic empowerment of women. It calls for targeted policy measures to facilitate women’s economic empowerment.

Women still bear the burden of unremunerated productive work, shouldering the major share of household management and care-giving responsibilities.

The report says that in Pakistan women spend 5.5 hours a day on housework and 1.2 hours on childcare whereas men spend 2.5 hours on housework and 0.9 hours on childcare.

It also says that women are overrepresented in sectors and positions that are vulnerable, poorly paid and less secure. For instance, 42 per cent of working women/girls belonged to agriculture sector in 2012 compared with 36.0 per cent of male workers.

http://www.dawn.com/news/1060369/pakistan-among-10-countries-facing...

-

Comment by Riaz Haq on February 20, 2014 at 8:25am

-

Here's a Marketwatch report on oil and gas find in Pakistan:

CALGARY, ALBERTA, Feb 18, 2014 (Marketwired via COMTEX) -- Jura Energy Corporation ("Jura") CA:JEC +18.37% today announced a gas and condensate discovery at the Ayesha-1 exploration well in the Badin IV South block.

The Ayesha-1 well was completed in the 'B' Sands of the Lower Goru Formation of Cretaceous age. During a short test on 32/64 inch choke, the well flowed gas with a heating value of approximately 1,000 Btu/Scf at a rate of 11.34 MMcf/d and a wellhead flowing pressure of 1,998 psi. The condensate to gas ratio was in the range of 10-12 bbl/MMcf with minimal water cut production. Detailed testing of Ayesha-1 will continue over the next few days.

Anticipated future production from the Ayesha-1 discovery is expected to be entitled to a gas price of US$6 per MMBtu under Pakistan s Petroleum (Exploration & Production) Policy, 2012.

Shahid Hameed, CEO of Jura, commented on the Ayesha-1 test results saying: "We are delighted with the successful test results. Given Ayesha-1's proximity to existing processing and pipeline infrastructure, this commercial discovery could be brought into production on a fast-track basis. Our Badar and Guddu fields are already in production and first gas production is anticipated from Zarghun South in the first half of 2014."

The drilling rig has now been released from Ayesha-1 and mobilized for the drilling of another exploration well, Haleema-1, in the Badin IV South block. The drilling of Haleema-1 is expected to commence in the first week of March 2014.

Jura holds a 27.5% working interest in the Badin IV South block, which is operated by Petroleum Exploration (Pvt) Limited.

http://www.marketwatch.com/story/jura-announces-gas-and-condensate-...

-

Comment by Riaz Haq on August 21, 2014 at 10:33pm

-

Pakistan has sent samples of shale gas to the United States to determine the prospects of reserves of this untapped energy source following encouraging estimates given by the US Energy Information Administration (EIA), officials say.

According to the EIA assessment, Pakistan holds massive shale gas reserves estimated at 51 trillion cubic feet (tcf), close to the conventional gas reserves of 58 tcf.At present, the government is conducting a study with the technical assistance of US Agency for International Development to prove the presence of huge shale gas deposits in the country.

Sources disclose that USAID has provided $1.8 million in technical assistance for undertaking the study. “Some samples have been sent to the US and research work will be completed in one year,” an official said, adding they were also looking for adopting US technology.

Washington is also imparting technical training to Pakistani officials and employees and engineers of public sector oil and gas companies.

The Ministry of Petroleum and Natural Resources has sent a summary to the Economic Coordination Committee (ECC) of the cabinet, seeking the go-ahead for initiating a pilot project to search and consume the shale gas potential. The move is aimed at gradually bridging the yawning gap between demand and supply of energy.

Shale gas is natural gas that is found trapped within shale formations. It has low permeability compared to conventional reserves, that’s why it does not come out easily and a specific amount of investment and pricing are required to encourage its exploitation.

At present, Pakistan is not producing shale gas and needs to undertake significant initial work to tap this energy resource.

The US, after the discovery of massive shale gas deposits there in recent years, has become a gas-exporting country. In future, reports say, it will experience a boom in shale oil production as well and will become the largest oil producer.

Officials point out that Pakistan will offer $12 per million British thermal units (mmbtu) to gas exploration and production companies under the pilot programme, a price that is close to the cost of gas to be imported from Iran under the Iran-Pakistan pipeline project.

“A policy framework has been prepared and its approval will be sought from the ECC in its upcoming meeting,” an official of the petroleum ministry told The Express Tribune.

According to the official, exploration companies have already found some traces of shale gas during the search for conventional gas as 10% to 12% of shale gas appears on upper faces of conventional gas.

Experts suggest that Pakistan has consumed around 40% of conventional gas reserves and shale gas is the most viable option to meet growing energy needs.

A study conducted by a group of exploration and production companies says the production of shale gas will be economical at about 80% of the price of Brent crude, but this will have to be brought down to 70%.

Apart from shale gas, the government is also planning to drill 400 wells in the next four years in an effort to enhance the country’s oil and gas production.

Though in the past one year new gas deposits had been found, total production of the country stood at almost the same level at four billion cubic feet per day because of depletion of reserves in old fields.

According to officials, the country has added 500 million cubic feet of gas per day (mmcfd) from new finds, but a quantity more than that has been depleted. Therefore, the impact of additional 500 mmcfd is not reflected in overall production.

However, oil output has risen to near 100,000 barrels per day compared to 74,000 barrels per day earlier.http://tribune.com.pk/story/751990/samples-sent-us-to-assess-potent...

-

Comment by Riaz Haq on August 27, 2014 at 10:25pm

-

Here's a Texas news story about Pakistan seeking help of a Pakistani-American oilman in Midland, Tx to develop Pakistani shale oil and gas:

Among those drawn to the Permian Basin is Jalil Abbas Jilani, Pakistan’s ambassador to the United States, who made a brief trip to Midland Wednesday.

“Pakistan has huge oil and gas reserves and we’re looking at this area for investors interested in joint ventures,” explained the ambassador, speaking by phone as he headed to the airport to fly to Houston. He was accompanied by Afzaal Mahmood, general consul for Pakistan stationed in Houston.

Jilani said he was impressed “by the things happening in Midland” and that he was warmly received at the luncheon attended by local oil men, including Don Evans as well as Midland Mayor Jerry Morales and Jose Cuevas, owner of JumBurrito. He said he hopes local businesses will consider participating in what he described as significant opportunities in Pakistan.

It’s estimated Pakistan holds total conventional and unconventional reserves of about 160 trillion cubic feet equivalent.

Anwar, a native of Pakistan, explained that the ambassador was making an “exculpatory” visit to Midland to gauge interest in helping Pakistan develop its unconventional hydrocarbons.

“They have an acute shortage of natural gas. They used to have conventional gas reserves, but with population growth and economic expansion,” they’re experiencing a shortfall, Anwar said.

The U.S. Energy Information Administration cited a Pakistani government report that the country had a natural gas shortfall of 912 billion cubic feet in 2013, though its dry natural gas production has grown by over 80 percent over the last decade to 1,462 Bcf in 2012.

http://www.mrt.com/business/oil/article_79b35ca8-2e55-11e4-81d8-001...

-

Comment by Riaz Haq on October 21, 2014 at 9:46pm

-

Edward L. Morse in Foreign Affairs Magazine on declining cost of finding and extracting shale oil and gas fueling the shale revolution:Despite its doubters and haters, the shale revolution in oil and gas production is here to stay. In the second half of this decade, moreover, it is likely to spread globally more quickly than most think. And all of that is, on balance, a good thing for the world.The recent surge of U.S. oil and natural gas production has been nothing short of astonishing. For the past three years, the United States has been the world’s fastest-growing hydrocarbon producer, and the trend is not likely to stop anytime soon. U.S. natural gas production has risen by 25 percent since 2010, and the only reason it has temporarily stalled is that investments are required to facilitate further growth. Having already outstripped Russia as the world’s largest gas producer, by the end of the decade, the United States will become one of the world’s largest gas exporters, fundamentally changing pricing and trade patterns in global energy markets. U.S. oil production, meanwhile, has grown by 60 percent since 2008, climbing by three million barrels a day to more than eight million barrels a day. Within a couple of years, it will exceed its old record level of almost ten million barrels a day as the United States overtakes Russia and Saudi Arabia and becomes the world’s largest oil producer. And U.S. production of natural gas liquids, such as propane and butane, has already grown by one million barrels per day and should grow by another million soon.What is unfolding in reaction is nothing less than a paradigm shift in thinking about hydrocarbons. A decade ago, there was a near-global consensus that U.S. (and, for that matter, non-OPEC) production was in inexorable decline. Today, most serious analysts are confident that it will continue to grow. The growth is occurring, to boot, at a time when U.S. oil consumption is falling. (Forget peak oil production; given a combination of efficiency gains, environmental concerns, and substitution by natural gas, what is foreseeable is peak oil demand.) And to cap things off, the costs of finding and producing oil and gas in shale and tight rock formations are steadily going down and will drop even more in the years to come.The evidence from what has been happening is now overwhelming. Efficiency gains in the shale sector have been large and accelerating and are now hovering at around 25 percent per year, meaning that increases in capital expenditures are triggering even more potential production growth. It is clear that vast amounts of hydrocarbons have migrated from their original source rock and become trapped in shale and tight rock, and the extent of these rock formations, like the extent of the original source rock, is enormous -- containing resources far in excess of total global conventional proven oil reserves, which are 1.5 trillion barrels. And there are already signs that the technology involved in extracting these resources is transferable outside the United States, so that its international spread is inevitable.In short, it now looks as though the first few decades of the twenty-first century will see an extension of the trend that has persisted for the past few millennia: the availability of plentiful energy at ever-lower cost and with ever-greater efficiency, enabling major advances in global economic growth.WHY THE PAST IS PROLOGUEThe shale revolution has been very much a “made in America” phenomenon. In no other country can landowners also own mineral rights. In only a few other countries (such as Australia, Canada, and the United Kingdom) is there a tradition of an energy sector featuring many independent entrepreneurial companies, as opposed to a few major companies or national champions. And in still fewer countries are there capital markets able and willing to support financially risky exploration and production.This powerful combination of indigenous factors will continue to drive U.S. efforts. A further 30 percent increase in U.S. natural gas production is plausible before 2020, and from then on, it should be possible to maintain a constant or even higher level of production for decades to come. As for oil, given the research and development now under way, it is likely that U.S. production could rise to 12 million barrels per day or more in a few years and be sustained there for a long time. (And that figure does not include additional potential output from deep-water drilling, which is also seeing a renaissance in investment.)Two factors, meanwhile, should bring prices down for a long time to come. The first is declining production costs, a consequence of efficiency gains from the application of new and growing technologies. And the second is the spread of shale gas and tight oil production globally. Together, these suggest a sustainable price of around $5.50 per thousand cubic feet for natural gas in the United States and a trading range of $70–$90 per barrel for oil globally by the end of this decade.These trends will provide a significant boost to the U.S. economy. Households could save close to $30 billion annually in electricity costs by 2020, compared to the U.S. Energy Information Administration’s current forecast. Gasoline costs could fall from an average of five percent to three percent of real disposable personal income. The price of gasoline could drop by 30 percent, increasing annual disposable income by $750, on average, per driving household. The oil and gas boom could add about 2.8 percent in cumulative GDP growth by 2020 and bolster employment by some three million jobs.Beyond the United States, the spread of shale gas and tight oil exploitation should have geopolitically profound implications. There is no longer any doubt about the sheer abundance of this new accessible resource base, and that recognition is leading many governments to accelerate the delineation and development of commercially available resources. Countries’ motivations are diverse and clear. For Saudi Arabia, which is already developing its first power plant using indigenous shale gas, the exploitation of its shale resources can free up more oil for exports, increasing revenues for the country as a whole. For Russia, with an estimated 75 billion barrels of recoverable tight oil (50 percent more than the United States), production growth spells more government revenue. And for a host of other countries, the motivations range from reducing dependence on imports to increasing export earnings to enabling domestic economic development.RISKY BUSINESS?Skeptics point to three problems that could lead the fruits of the revolution to be left to wither on the vine: environmental regulation, declining rates of production, and drilling economics. But none is likely to be catastrophic.Hydraulic fracturing, or “fracking” -- the process of injecting sand, water, and chemicals into shale rocks to crack them open and release the hydrocarbons trapped inside -- poses potential environmental risks, such as the draining or polluting of underground aquifers, the spurring of seismic activity, and the spilling of waste products during their aboveground transport. All these risks can be mitigated, and they are in fact being addressed in the industry’s evolving set of best practices. But that message needs to be delivered more clearly, and best practices need to be implemented across the board, in order to head off local bans or restrictive regulation that would slow the revolution’s spread or minimize its impact.As for declining rates of production, fracking creates a surge in production at the beginning of a well’s operation and a rapid drop later on, and critics argue that this means that the revolution’s purported gains will be illusory. But there are two good reasons to think that high production will continue for decades rather than years. First, the accumulation of fracked wells with a long tail of production is building up a durable base of flows that will continue over time, and second, the economics of drilling work in favor of drilling at a high and sustained rate of production.Finally, some criticize the economics of fracking, but these concerns have been exaggerated. It is true that through 2013, the upstream sector of the U.S. oil and gas industry has been massively cash-flow negative. In 2012, for example, the industry spent about $60 billion more than it earned, and some analysts believe that such trends will continue. But the costs were driven by the need to acquire land for exploration and to pursue unproductive drilling in order to hold the acreage. Now that the land-grab days are almost over, the industry’s cash flow should be increasingly positive.It is also true that traditional finding and development costs indicate that natural gas prices need to be above $4 per thousand cubic feet and oil prices above $70 per barrel for the economics of drilling to work -- which suggests that abundant production might drive prices down below what is profitable. But as demand grows for natural gas -- for industry, residential and commercial space heating, the export market, power generation, and transportation -- prices should rise to a level that can sustain increased drilling: the $5–$6 range, which is about where prices were this past winter. Efficiency gains stemming from new technology, meanwhile, are driving down break-even drilling costs. In the oil sector, most drilling now brings an adequate return on investment at prices below $50 per barrel, and within a few years, that level could be under $40 per barrel.THINK GLOBALLYSince shale resources are found around the globe, many countries are trying to duplicate the United States’ success in the sector, and it is likely that some, and perhaps many, will succeed. U.S. recoverable shale resources constitute only about 15 percent of the global total, and so if the true extent and duration of even the U.S. windfall are not yet measurable, the same applies even more so for the rest of the world. Many countries are already taking early steps to develop their shale resources, and in several, the results look promising. It is highly likely that Australia, China, Mexico, Russia, Saudi Arabia, and the United Kingdom will see meaningful production before the end of this decade. As a result, global trade in energy will be dramatically disrupted.A few years ago, hydrocarbon exports from the United States were negligible. But by the start of 2013, oil, natural gas, and petrochemicals had become the single largest category of U.S. exports, surpassing agricultural products, transportation equipment, and capital goods. The shift in the U.S. trade balance for petroleum products has been stunning. In 2008, the United States was a net importer of petroleum products, taking in about two million barrels per day; by the end of 2013, it was a net exporter, with an outflow of more than two million barrels per day. By the end of 2014, the United States should overtake Russia as the largest exporter of diesel, jet fuel, and other energy products, and by 2015, it should overtake Saudi Arabia as the largest exporter of petrochemical feedstocks. The U.S. trade balance for oil, which in 2011 was −$354 billion, should flip to +$5 billion by 2020.By then, the United States will be a net exporter of natural gas, on a scale potentially rivaling both Qatar and Russia, and the consequences will be enormous. The U.S. gas trade balance should shift from −$8 billion in 2013 to +$14 billion by 2020. U.S. pipeline exports to Mexico and eastern Canada are likely to grow by 400 percent, to eight billion cubic feet per day, by 2018, and perhaps to ten billion by 2020. U.S. exports of liquefied natural gas (LNG) look likely to reach nine billion cubic feet per day by 2020.Sheer volume is important, but not as much as two other factors: the pricing basis and the amount of natural gas that can be sold in a spot market. Most LNG trade links the price of natural gas to the price of oil. But the shale gas revolution has delinked these two prices in the United States, where the traditional 7:1 ratio between oil and gas prices has exploded to more than 20:1. That makes LNG exports from the United States competitive with LNG exports from Qatar or Russia, eroding the oil link in LNG pricing. What’s more, traditional LNG contracts are tied to specific destinations and prohibit trading. U.S. LNG (and likely also new LNG from Australia and Canada) will not come with anticompetitive trade restrictions, and so a spot market should emerge quickly. And U.S. LNG exports to Europe should erode the Russian state oil company Gazprom’s pricing hold on the continent, just as they should bring down prices of natural gas around the world.In the geopolitics of energy, there are always winners and losers. OPEC will be among the latter, as the United States moves from having had a net hydrocarbon trade deficit of some nine million barrels per day in 2007, to having one of under six million barrels today, to enjoying a net positive position by 2020. Lost market share and lower prices could pose a devastating challenge to oil producers dependent on exports for government revenue. Growing populations and declining per capita incomes are already playing a central role in triggering domestic upheaval in Iraq, Libya, Nigeria, and Venezuela, and in that regard, the years ahead do not look promising for those countries.At the same time, the U.S. economy might actually start approaching energy independence. And the shale revolution should also lead to the prevalence of market forces in international energy pricing, putting an end to OPEC’s 40-year dominance, during which producers were able to band together to raise prices well above production costs, with negative consequences for the world economy. When it comes to oil and natural gas, we now know that though much is taken, much abides -- and the shale revolution is only just getting started.

-

Comment by Riaz Haq on October 22, 2014 at 10:11pm

-

As oil prices have fallen, the cost of production from US shale has emerged as a critical question for investors.

In a downturn, higher-cost supply is most at risk, and the need for horizontal wells and hydraulic fracturing – “fracking” – in shale reserves means they are more expensive to develop than many oilfields in the Middle East.

If oil prices fall further, however, US production costs are likely to fall too, providing a safety valve to reduce the pressure on producers.

There is no single answer to the break-even price for shale developments: it varies from area to area and well to well.

Even with US crude prices of about $100 a barrel earlier in the year, the small and midsized exploration and production companies that led the US shale revolution were running large cash deficits.

If oil remains at its present level of roughly $82 per barrel, it will put back the point at which they will be able to cover their capital spending from their cash flows.

However, their costs have already fallen sharply, and could fall further. The median North American shale development needs a US crude price of $57 a barrel to break even today, compared with $70 a barrel in the summer of last year, according to IHS, the research company.

EOG Resources, one of the most successful of the shale oil producers, cut its cost per well in the Leonard shale on the border of Texas and New Mexico from $6.9m in 2011 to $5m this year, while raising average production from each well.

Melissa Stark, a managing director at Accenture, the consultancy, says the industry still has a lot of room for improvement.

With more than 18,000 horizontal wells set to be drilled in the US this year, she argues that improving the “manufacturing model” of repeated similar projects could deliver large savings.

Accenture believes the average cost of a US shale well could be cut by up to 40 per cent by better management of factors such as planning, logistics, and relationships with suppliers.

David Vaucher of IHS says that if prices remain at around today’s levels, rates charged to oil producers for fracking and other services are likely to remain about where they are.

However, he adds, the indications recently have been that productivity per well is still improving. Production from new wells per working drilling rig has been rising in the Bakken of North Dakota and the Eagle Ford and Permian Basin of Texas, the three main shale regions, according to the US government’s Energy Information Administration.

The effort companies are putting into each well is rising. ConocoPhillips and others have been using much more proppant – the sand or similar material used in fracking to hold open cracks in the rock so the oil can flow out – to increase production.

Companies are also fracking wells in more stages: up from an average of 18 sections per horizontal well in 2012 to an expected 23 per well next year, according to Pac West, another consultancy.

Even so, costs per barrel are probably still falling.

Downward pressure on costs will heighten if the oil price continues to fall. Drilling rigs and other equipment such as pumps for fracking tend not to be tied up on long-term contracts, meaning that producers can adjust their spending quickly in response to oil price movements.

In a deepening slump, the service companies providing services such as drilling and hydraulic fracturing are likely to come off worst, according to Steve Wood of Moody’s, the rating agency.

“Exploration and production companies have a product that people will still want to buy,” he says.

“But service companies are dependent on the E & P’s capital spending, which can be cut back.”

Service companies would be hit both by lower activity, and by the greater leverage that their customers will have to bargain their charges down.

Halliburton, the world’s second-largest oil services company by market capitalisation, told analysts on a call this week that activity in the US continued to “surge higher”.

Dave Lesar, chief executive, said: “We do not see momentum slowing any time soon”, and added that he believed oil prices at their present levels were “not sustainable”.

However, he acknowledged that it was important for the company to “deliver the lowest cost per barrel to our customers, which in turn positions them and Halliburton to perform best in volatile markets.”

There could be a parallel for US oil in shale gas production. When prices fell to a 10-year low in 2012, it seemed that most US shale production would be uneconomic and output would collapse.

Interactive map

New extraction techniques and high oil prices boost US oil production

As it turned out, production did fall in higher-cost areas such as the Haynesville shale of Louisiana and Texas, but it continued to rise in the Marcellus Shale of Pennsylvania.

The best companies were able to produce at costs that were much lower than many people had expected. Cabot Oil and Gas, for example, says it has a cash cost in the Marcellus of just 75 cents per thousand cubic feet, compared with a benchmark US gas price of about $3.70.

If oil-focused- shale companies can follow that example, US output will be a lot more resilient than its competitors in other oil-producing countries would hope.

http://www.ft.com/intl/cms/s/0/0a25ecf4-5937-11e4-9546-00144feab7de...

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistan to Explore Legalization of Cryptocurrency

Islamabad is establishing the Pakistan Crypto Council (PCC) to look into regulating and legalizing the use of cryptocurrencies, according to media reports. Cryptocurrency refers to digital currencies that can be used to make purchases or investments using encryption algorithms. US President Donald Trump's endorsement of cryptocurrencies and creation of a "bitcoin reserve" has boosted investors’…

ContinuePosted by Riaz Haq on March 28, 2025 at 8:30pm — 3 Comments

World Happiness Report 2025: Poor Ranking Makes Indians Very Unhappy

Pakistan has outranked India yet again on the World Happiness Index, making Indians very very unhappy. Indian media commentators' strong negative emotional reaction to their nation's poor ranking betrays how unhappy they are even as they insist they are happier than their neighbors. Coming from the privileged upper castes, these commentators call the report "…

ContinuePosted by Riaz Haq on March 22, 2025 at 10:30am — 7 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network