PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Vast Oil Reserves

Pakistan has more shale oil than Canada, according to the US Energy Information Administration (EIA) report released on June 13, 2013.

The US EIA report estimates Pakistan's total shale oil reserves at 227 billion barrels of which 9.1 billion barrels are technically recoverable with today's technology. In addition, the latest report says Pakistan has 586 trillion cubic feet of shale gas of which 105 trillion cubic feet (up from 51 trillion cubic feet reported in 2011) is technically recoverable with current technology.

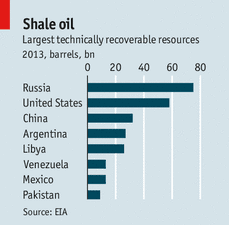

The top ten countries by shale oil reserves include Russia (75 billion barrels), United States (58 billion barrels), China (32 billion barrels), Argentina (27 billion barrels), Libya (26 billion barrels), Venezuela (13 billion barrels), Mexico (13 billion barrels), Pakistan (9.1 billion barrels), Canada (8.8 billion barrels) and Indonesia (7.9 billion barrels).

Pakistan's current annual consumption of oil is only 150 million barrels. Even if it more than triples in the next few years, the 9.1 billion barrels currently technically recoverable would be enough for over 18 years. Similarly, even if Pakistan current gas demand of 1.6 trillion cubic feet triples in the next few years, it can be met with 105 trillion cubic feet of technically recoverable shale gas for more than 20 years. And with newer technologies on the horizon, the level of technically recoverable shale oil and gas resources could increase substantially in the future.

|

| Source: US EIA Report 2013 |

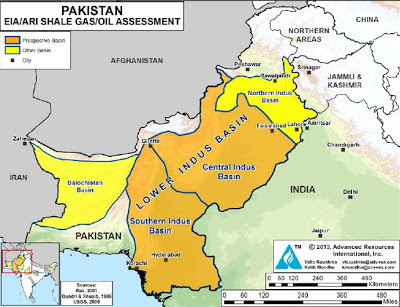

As can be seen in the shale resource map, most of Pakistan's shale oil and gas resources are located in the lower Indus basin region, particularly in Ranikot and Sembar shale formations.

|

| Source: US EIA Report 2013 |

Since the middle of the 18th century, the Industrial Revolution has transformed the world. Energy has become the life-blood of modern economies. Energy-hungry machines are now doing more and more of the work at much higher levels of productivity than humans and animals who did it in pre-industrial era. Every modern, industrial society in history has gone through a 20-year period where there was extremely large investment in the power sector, and availability of ample electricity made the transition from a privilege of an urban elite to something every family would have. If Pakistan wishes to join the industrialized world, it will have to do the same by having a comprehensive energy policy and large investments in the power sector. Failure to do so would condemn Pakistanis to a life of poverty and backwardness.

The availability of large domestic shale oil and gas expands the opportunity to reduce Pakistan's dependence on imports to overcome the current energy crisis and to fuel the industrial economy. But it'll only be possible with high priority given to investments in developing the energy sector of the country.

Related Links:

Haq's Musings

US EIA International Data on Per Capita Energy Consumption

Pakistani Guar in Demand For American Shale Fracking

Affordable Fuel for Pakistan's Electricity

Pakistan Needs Shale Gas Revolution

US Census Bureau's International Stats

Pakistan's Vast Shale Gas Reserves

US AID Overview of Pakistan's Power Sector

US Can Help Pakistan Overcome Energy Crisis

Abundant and Cheap Coal Electricity

US Dept of Energy Report on Shale Gas

Pakistan's Twin Energy Crises

Pakistan's Electricity Crisis

Pakistan's Gas Pipeline and Distribution Network

Pakistan's Energy Statistics

US Department of Energy Data

Electrification Rates By Country

CO2 Emissions, Birth, Death Rates By Country

China Signs Power Plant Deals in Pakistan

Pakistan Pursues Hydroelectric Projects

Pakistan Energy Industry Overview

Energy from Thorium

Comparing US and Pakistani Tax Evasion

Pakistan's Oil and Gas Report 2010

Circular Electricity Debt Problem

International CNG Vehicles Association

Rare Earths at Reko Diq?

Lessons From IPP Experience in Pakistan

Correlation Between Human Development and Energy Consumption

-

Comment by Riaz Haq on June 20, 2013 at 9:38pm

-

Here's a summary of a market research report on developing oil and gas resources in Asia Pacific, including Pakistan:

The new Asia Pacific shale gas report from OGANALYSIS noted that soaring demand, rapidly escalating LNG prices are forcing countries to look for possibility of shale gas production. In particular, China and India are witnessing rapid rise in demand and accordingly are planning to realize shale production earlier than planned. Australia is also planning to exploit its shale reserves to supply feed gas for its planned liquefaction terminals.

Success of the US shale and ongoing activities in Europe are encouraging Asian players to develop policy and frameworks for shale gas development. While China is allowing foreign companies to participate in shale exploration, India is planning to launch first bids in 2013. Over 10 companies are actively perusing shale operations in Australia and Pakistan and Bangladesh are in plans of identifying their reserve potential.

The report analyzes the current status, potential and feasibility of shale development, ongoing activities, government stance and companies operating in each of the key Asian shale markets including Australia, china, India, Pakistan and Bangladesh. The research work also identifies the top trends of Asia Pacific shale market. Key drivers and challenges faced by countries along with feasibility of first commercial production are also discussed in detail. Further, the Asia Pacific shale gas report from OGANALYSIS discusses physical characteristics of major basins in each country along with their reservoir properties and resource characteristics. Further, shale formations and key plays in each basin are discussed in detail. Basin wise company information along with the current status of activities in permits awarded is analyzed. In addition, company wise shale activities are provided for leading ten companies.

Read more here: http://www.sacbee.com/2013/06/18/5505941/asia-pacific-shale-gas-mar...

-

Comment by Riaz Haq on June 26, 2013 at 8:42pm

-

Here's an ET report on a partnership for off-shore drilling for oil in Pakistan:

State-run Pakistan Petroleum Limited (PPL) and Singapore-based oil and gas company Orion Energy are likely to form a joint venture for offshore drilling in Pakistan.

Orion Energy, an independent oil and gas company headquartered in Singapore and with offices in London, is currently exploring scores of opportunities in Latin America.

According to sources, Orion had expressed interest in investing in Pakistan at the Pakistan Exploration Bidding Round 2012, held in London in December 2012 by the Pakistan Peoples Party-led coalition government.On the sidelines of the event, Orion Energy Director David M Thomas, and his lawyer Nadim Khan, met the PPL managing director. The interaction was followed by another meeting between representatives of PPL and Orion, chaired by the director general of petroleum concessions.

In the Petroleum Policy 2012, the government had increased the gas price for Offshore Shallow Zone to $7 per million British thermal units (mmbtu), for Offshore Deep Zone to $8 per mmbtu and for Offshore Ultra Deep Zone to $9 per mmbtu. A bonanza of $1 per mmbtu will be given to exploration companies for the first three offshore discoveries under the policy.

Orion Energy had expressed interest in exploring offshore areas in Pakistan in partnership with PPL because of the latter’s good reputation and extensive experience in exploration and production of gas.

Following extensive technical discussions and encouraging feedback from PPL, the two companies agreed to initially undertake a joint study to evaluate prospects of offshore drilling and identify prospective areas for comprehensive exploration work.

Orion Energy had also expressed a desire to come to Pakistan for technical discussions with PPL on offshore exploration and on matters pertaining to forming a joint venture to carry out the joint study. Both sides had also finalised a joint study agreement, which had been ready to be signed by officials.

However, the visit was delayed due to general elections in Pakistan. It was only later, in the first week of June, that an Orion team reached here.

Technical staff from Orion and PPL will undertake the study, based on the geological data available with the two companies and the directorate general of petroleum concessions. The study will be completed in about four months, and its main objective will be to identify potential offshore areas for detailed evaluation through an exploration work programme and the financial obligations that will entail.http://tribune.com.pk/story/565694/exploration-and-production-ppl-o...

-

Comment by Riaz Haq on June 26, 2013 at 8:50pm

-

Here's an OilPrice editorial on oil and gas potential in FATA:

Pakistan’s Tribal Areas (FATA) and Frontier Regions (FR) are believed to have massive reserves of oil and natural gas—which Pakistani officials have suddenly become very keen to demonstrate. But this is a highly restive, war-torn area where one right move could make all the difference, and one wrong move could ignite a conflict with irreversible consequences.

For now, the area remains unexplored and it was only in 2008 when Pakistani geologists began to study the area in earnest, with the support of the local authorities in the Federally Administered Tribal Areas (Fata) and the Frontier Region (FR). The results of this research were collected, processed and digitized in June 2012. The geologists discovered seven new oil and gas seepages during the mapping. The geologists also claim that 11 oil and gas exploration companies have already reserved 16 blocks in Fata.

The potential:

• Pakistani geologists say Fata in particular is poised to become a “new oil state” whose production could rival Dubai’s in only five years

• The FR is bursting at the seams with gas, so they sayHere’s what the interest looks like so far:

• 17 companies have initiated operations in Fata/FR (in Khyber, Orakzai, North and South Waziristan, Peshawar, Kohat, Bannu, Tank and DI Khan)

• Tullow has been active in Pakistan since 1991,…http://oilprice.com/Energy/Crude-Oil/Tapping-into-Pakistans-Massive...

-

Comment by Riaz Haq on June 27, 2013 at 7:48am

-

Here's an Express Tribune piece on oil and gas prospects in FATA:

The Federally Administered Tribal Areas (Fata) and Frontier Regions (FR) have enormous reserves of minerals, oil and natural gas that can augment economic activity in the war-torn areas, a research project concluded.

Talking to The Express Tribune ‘Source Rock Mapping and Investigation of Hydrocarbon Potential (SRMIHP)’ Project Coordinator Dr Fazal Rabi Khan said that exploration and excavation of oil and gas will introduce a new era of development and prosperity in the tribal areas.

“There can be many job opportunities created for people in the tribal belt if mineral exploration and extraction is pursued properly,” said Khan, who is also the chairman of the Geology Department in Abdul Wali Khan University Mardan (Palosa Campus).

The project was launched in 2008 under an agreement between the Fata Development Authority and National Centre of Excellence in Geology University of Peshawar. The project, which was completed at an estimated cost Rs40 million, was completed in June 2012.

Khan said that their objectives include identifying hydrocarbon generating rocks and its distribution in the region, preparing a geo-database regarding hydrocarbon potential and generating a systematic data to attract oil and gas companies for exploration.The project has successfully collected, processed and digitised the data as a result of which, 80% of the project area has been mapped digitally. “This mapping has led to the discovery of seven new oil and gas seepages.”

He added that 11 oil and gas exploration companies have reserved 16 blocks in Fata, which go across from FR Peshawar and Kohat to Khyber, Orakzai, Bannu, Tank and up to North and South Waziristan.He said that recently 17 oil and gas exploration companies initiated their operations in Khyber, Orakzai, North and South Waziristan agencies as well as in FR Peshawar, Kohat, Bannu, Tank and DI Khan.

Khan said that Mari Gas Company, HYCARBEX Inc, Oil and Gas Development Company, Tullow, Saif Energy, MOL Pakistan Oil and Gas, Orient Petroleum International, Pakistan Petroleum, ZHEN, ZAVER and others are currently working in Fata.

Oil and Gas Development Company (OGDC) will start drilling in these areas for the exploration of oil and gas reservoirs. The chairman said that the foreign oil company, Tullow, has obtained a licence for the exploration of oil and gas in North Waziristan Agency and Bannu, while MOL has shown interest in Khyber Agency, Kohat and Peshawar.

“Although law and order problems can become a hindrance, the project can be managed considering its importance,” he added.....http://tribune.com.pk/story/484440/new-hope-springs-fata-fr-regions...

-

Comment by Riaz Haq on July 2, 2013 at 7:21pm

-

Here's a report on an on-shore discovery by Pakistan Petroleum (PPL) in Sindh province:

Karachi’s Pakistan Petroleum has reported flow test success from a deeper reservoir at its Adam X-1 gas and condensate find onshore Pakistan.

The state player said that it had evaluated the potential of lower basal sands at a depth of 3450 metres at the Block 2568-13 probe over the past two months.The Sanghar district, Sindh province well is to be put into production immediately after flowing 14.3 million cubic feet per day of gas and 125 barrels per day of condensate, the explorer said.

Pakistan Petroleum operates the licence on a 65% working interest with compatriot Mari Petroleum on 35%.

-

Comment by Riaz Haq on July 4, 2013 at 6:36pm

-

Here's a News report on rising oil production and declining gas production in Pakistan:

<i>KARACHI: Pakistan’s oil production in the fiscal year ended June 30, 2013 saw sharpest growth in 22 years of 14 percent. However, gas production decreased by almost three percent.

“The country’s FY13 oil production grew by 14 percent to average 76,000 barrels per day, which is well above historical 10-year oil production at cumulative average growth rate of one percent,” Atif Zafar at JS Global said. “But, the same was largely overshadowed by gas shortages in the country since gas production shrank by three percent to 4,100 million metric cubic feet per day (mmcfd).”

The decline is the rampant since 1987 mainly owing to natural depletion of existing fields.Pakistan’s proven recoverable oil and gas reserves stand enough only for 13 and 18 years, respectively, he said. However, analysts expect upgrade of reserves in the upcoming reserve appraisal.

The Oil and Gas Development Company (OGDC) recorded the highest production gains – based on barrels of oil equivalent – (up by three percent), whereas production of Pakistan Petroleum Limited (PPL) and Pakistan Oilfields Limited (POL) fell four percent and nine percent, respectively.

Based on provisional numbers for the last quarter of the fiscal year, the country’s oil production is up by only one percent, while gas production decreased by seven percent.

During the quarter, oil production of POL increased by 13 percent and gas by three percent, while OGDC’s oil production went up by two percent and gas by nine percent. Additionally, PPL’s oil production scaled up by four percent, while gas output was down by nine percent in the last quarter.

“We expect further improvement in oil production by an estimated 11 percent in the current fiscal year. However, additional gas production will largely be offset by natural depletion,” Zafar said.</i>http://www.thenews.com.pk/Todays-News-3-187125-Oil-production-at-22...

-

Comment by Riaz Haq on July 5, 2013 at 8:23am

-

US is where the shale gas extraction technology was developed. Almost all of the world's shale gas today is being produced in the US.

However, other companies elsewhere, particular Polish companies, are very active in starting to do shale and tight gas exploration. Here's one example in Pakistan:

KARACHI - Pakistan is expected to start producing 30 Million Cubic Feet per day (MMCFD) of tight gas in July-August this year from Sajawal gas field located in the district of Dadu. According to media reports quoting government officials this would be first time the country would be producing tight gas. Pakistan has estimate tight gas reserves of about 40 Trillion Cubic Feet (TCF). The first tight gas sales and purchase agreement was signed on November 13, 2012 in Islamabad for production from a tight gas reservoir in Pakistan from Kirthar Block in Dadu, Sindh. The Kirthar Block is jointly owned by Polish Oil and Gas Company (PGNiG), which has 70 percent stake and Pakistan Petroleum Limited owns 30 percent. For the implementation of this project, SSGC has been awarded a contract for the construction of 52-km pipeline from Kirthar Block’s Rehman Gas Field which will be integrated into SSGC’s system at Naing Valve Assembly through the Bhit gas pipeline.

http://www.pakistantoday.com.pk/2013/05/14/news/profit/pakistans-fi...

Here's an excerpt of a paper describing the difference between shale gas and tight gas:

All Shale Gas reservoirs are not the same. There are no typical Tight Gas reservoirs. These two statements can be found numerous times in the literature on shale gas and tight gas reservoirs. The one common aspect of developing these unconventional resources is that wells in both must be ‘hydraulically fractured’ in order to produce commercial amounts of gas. Operator challenges and objectives to be accomplished during each phase of the Asset Life Cycle (Exploration, Appraisal, Development, Production, and Rejuvenation) of both shale gas and tight gas are similar. Drilling, well design, completion methods and hydraulic fracturing are somewhat similar; but formation evaluation, reservoir analysis, and some of the production techniques are quite different.

Much of the experience in shale and tight gas has been developed in the US and in Canada, to a lesser extent; and most of the technologies that have been developed by operators and service companies are transferable to other parts of the world....

http://www.onepetro.org/mslib/app/Preview.do?paperNumber=SPE-160855-MS

-

Comment by Riaz Haq on July 6, 2013 at 10:32am

-

Pakistan's Sui Southern Gas Co (SSGC) signs first ever tight gas agreement with PPL and Polish Gas consortium for 20 million cubic feet of gas per day starting in 2013:

Pakistan joins the Tight Gas Club - A landmark achievement by SSGC

SSGC is now ready to receive its first gas delivery from Rehman Gas Field. The major scope of this project, Pakistan’s first ever Tight Gas Project, involved construction of 6”/8” dia x 52 Km pipelines that include flow lines and export pipeline. This project was conducted in one of the hardest terrains and under toughest climatic conditions where temperature soared to as high as 50oC. A maximum of 20 mmcfd will be injected in the SSGC’s system through the Field.

Other salient features of the project:

· Objective: This achievement is also in line with MD’s strategic objective of FY 2012-13

· Agreement: The project commenced after the agreement signed between SSGC and a consortium of Polish Oil and Gas Company and Pakistan Petroleum Ltd. (PPL) in November 2012.

· Main Departments involved in commissioning: Planning and Development, Projects and Construction, Legal, Finance, HSEQA and L&EM Departments.

· Tendering Process: SSGC participated in the competitive bidding process last year and won the pipeline project bid (Rs 235 million).

· Resources: The Company utilized in-house resources, engaging the manpower and equipments for a period of 6 months since SSGC had no major transmission project for construction during this time.

· The Project enriched SSGC’s portfolio as an enterprising company.http://www.ssgc.com.pk/ssgc/media_center/pdf/2012_12_december.pdf

-

Comment by Riaz Haq on July 8, 2013 at 11:15pm

-

Here's an Upstream report on the start of tight gas production by Polish firm PGNiG in Pakistan:

Polish explorer PGNiG has commenced production in Pakistan for the first time, bringing two wells online at the Rehman field in southern Pakistan.

The Kirhtar licence area wells are producing on test at an expected rate of around 100 million cubic metres of gas per year.The gas is being fed directly to the Pakistani transmission system, with the field’s entire output being sold to Pakistani authorities, the Warsaw-headquartered explorer said.

Test output is due to last 22 months, with total gas resources at the licence area estimated at around 12 billion cubic metres.

Situated in the western part of Sindh province, the Kirthar licence is operated by PGNiG on a 70% stake, with Pakistan Petroleum on 30%.

Pakistan is the explorer’s second international location for operated production after Norway.

-

Comment by Riaz Haq on July 18, 2013 at 9:45am

-

Here's an ET story on pricing of domestic shale gas in Pakistan:

Pakistan Petroleum Limited (PPL) and Italy’s Eni have calculated that the price of shale gas should be $14 per million British thermal units (mmbtu), which has been rejected by the government as too much for the country’s existing tariff regime to absorb, an official told The Express Tribune.

The price was determined on the basis of expenditure required to drill for hard-to-reach shale gas reservoirs following a rise in interest in tapping this potential on the back of reports that Pakistan has massive reserves.

“There has to be a steady transition from conventional gas to tight and then finally to shale gas,” said Moin Raza Khan, Deputy Managing Director of PPL and head of its exploration operation. “This has to be a slow process because of the economics involved in the operations.”Almost all the 4,000 million cubic feet per day (mmcfd) of gas produced in Pakistan comes from conventional gas fields, which can be reached relatively easily. Tight gas is trapped in impermeable rocks whereas gas trapped in shale formation is called shale gas.

Average consumer gas price is around $4 per mmbtu, undermining the prospects for shale gas to be brought into the system at this stage, Khan said.

“One reason why the US produces shale gas in abundance is because of the economies of scale. We would have to do that to make it feasible and this can’t happen overnight,” he said.So for the time being exploration firms including PPL are focusing on tight gas, for which the government has increased the price by 40% through a separate petroleum policy.

First tight gas flows entered the transmission and distribution system in June this year as production of 15 mmcfd started from Kirthar block, which is a joint venture between a Polish firm and PPL.

Sui dilemma

For more than 57 years, Sui gas field fuelled the economy, so much that natural gas became synonymous with Sui gas. And now it has depleted.

“If you ask me I think the gas pressure will sustain for another 10 to 12 years,” Khan said. “The pressure used to be 1,300 psi (pounds per square inch), which has come down to only 300 psi.”

To tackle that problem, the company regularly installs compressor plants on the wells to maintain the pressure. “We are considering installing equipment for 100 psi and even 50 psi.”

Offshore expedition

PPL along with its local and foreign partners plans to drill a well in offshore Block-G in the Indus, the world’s second largest delta after the Bay of Bengal.

“Having a discovery offshore is very important,” he said, referring to the successive past failures. “So far, 13 wells have been drilled in Indus. Gas was found only in one and that wasn’t commercially feasible to take out.”

Pakistan has a coastline spread over 1,990 km and sub-divided into Indus and Makran deltas. Indus delta alone is spread over 1.1 million square kilometres. Pakistan’s area covers over 240,000 sq km of this....http://tribune.com.pk/story/577736/too-hot-to-handle-govt-rejects-s...

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

US Immigrant Visa Freeze For 75 Countries: Why Pakistan But Not India?

The US State Department has suspended processing of immigrant visas from 75 countries, including Pakistan but not India. This action followed President Donald Trump's social media post that listed, without context, the percentage of immigrant households from these countries that rely on the US government financial assistance. While Mr. Trump’s post singled out immigrants,…

ContinuePosted by Riaz Haq on January 17, 2026 at 5:30pm

Indian NSA Doval Urges Young Hindus to Take Revenge on Muslims

In a recent speech to young Hindus in New Delhi, the Indian National Security Advisor Ajit Doval urged his audience to "avenge history". He talked about the looting and destruction of Hindu temples and many centuries humiliation suffered by Indians. Though he did not…

ContinuePosted by Riaz Haq on January 14, 2026 at 2:00pm — 3 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network