PakAlumni Worldwide: The Global Social Network

The Global Social Network

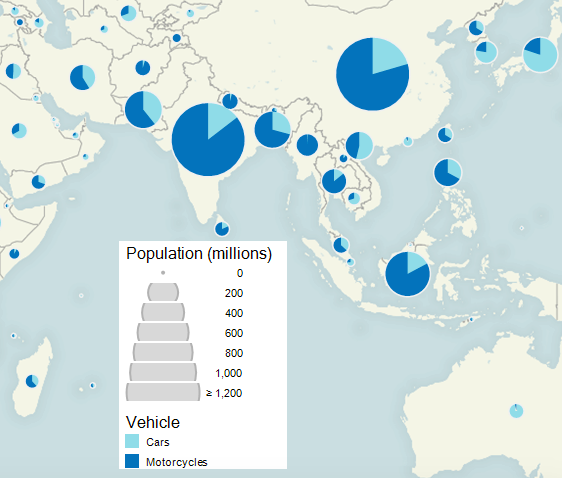

Pakistan's Growing Middle Class Drives Motorcycle Sales Boom

Pakistan's fiscal year 2015-16 saw production of motorcycles soar to a new high of over 2 million units. This represents a 16.5% surge from last year. At the same time, passenger cars and light trucks sales rose to over 200,000 in fiscal 2016, a 20% jump over the same period last year.

Motorcycle Sales:

Rising motorcycle sales in Asia's developing nations like Pakistan are seen as a barometer of expanding middle class. It is, in part, attributed to rising incomes and availability of bank financing at historic low interest rates in the country.

As many as 2,071,123 motorcycles were manufactured during July-June (2015-16) compared to 1,777,251 units during July-June (2014-15), according to the latest data released by Pakistan Bureau of Statistics (PBS) and reported by Pakistani media.

Pakistan is the World's Sixth Largest Motorcycle Market |

Car Sales:

In addition to the double digit increase in motorcycle sales, Pakistan also experienced 20% jump in sales of passengers cars, light commercial vehicles (LCVs), vans and jeeps. The total sales of local vehicles increased by 21% to 216,568 as compared to 179,953 units sold in FY15, according to industry data.

Auto Parts Industry:

Rising auto and motorcycle sales are helping boost Pakistan's auto parts industry as well. “We are getting orders and the pace is increasing,” said Sultan and Kamil International CEO Faisal Mahmood speaking to Pakistani media on the sidelines of the 12th Pakistan Auto Show 2016 held at the Lahore International Expo Centre. Mahmood’s company makes more than 350 automotive parts and exports to all major automobile markets in the world.

Other Growth Industries:

Among other industries seeing significant growth are pharmaceuticals (6.54%), cement (17.01%), chemicals (8.13%), non metallic mineral products (10.02%), fertilizers (13.81%), leather products (7.76%) and rubber products (7.16%), according to media reports.

Summary:

Pakistan's economic recovery is in full swing with double digit growth in multiple industries, including auto, pharma, chemicals, cement, fertilizers, minerals, etc. It is expected to pick up steam over the next several years with new investments on the back of China-Pakistan Economic Corridor related projects.

Related Links:

Growing Middle Class in Pakistan

China-Pakistan Economic Corridor

-

Comment by Riaz Haq on February 28, 2017 at 9:03am

-

#Automobile companies eye production in #Pakistan as local market accelerates. #manufacturing #economy https://www.ft.com/content/328ca8ae-f34a-11e6-8758-6876151821a6

When Naeem Khan went into his local automobile dealer in Karachi to replace his five-year-old taxi with a rickshaw, he was not expecting to leave with a brand new air-conditioned car instead.

But after getting a financing package that was cheaper than he expected, Mr Khan became one of an increasing number of Pakistanis who have recently bought vehicles they previously only dreamt of owning.

The national surge in sales has prompted three global carmakers to commit in the past few months to starting production in Pakistan, potentially doubling the number of foreign carmakers in the country.

“The dealer told me it was the right time to get a loan to buy a car,” says Mr Khan. “Five years ago he said he would have told me to buy a second-hand car or a rickshaw, but today I could afford to buy a new car.”

Pakistan’s car market is still small, and dominated by the three Japanese brands that have local manufacturing plants: Toyota, Honda and Suzuki. The trio made all but seven of the country’s domestically manufactured cars in 2015-16, according to the Pakistan Automotive Manufacturers’ Association, though the figures are just a fraction of their total global car sales.

In the past, analysts say, manufacturers have been put off by the country’s relative poverty, as well as political instability and concerns about security.

But in the past few months, France’s Renault and both Hyundai of South Korea and its affiliate Kia have announced they will soon start assemblies in Pakistan, in partnership with local companies. It marks a return for Kia and Hyundai, which left in the previous decade when their local partner suffered financial problems.

The new and returning entrants are being drawn in by several factors.

The first is both the scale of the potential market in a country of 200m people, as well as the rate at which it is already growing. In 2012-13, carmakers sold 118,830 cars in Pakistan. By 2015-16, that had risen 52 per cent to 181,145.

Analysts say the surge has left Toyota, Honda and Suzuki struggling to meet demand with their customers sometimes forced to wait as long as five months before their cars are delivered.

Yong Sohn, general manager at the Hyundai group, says: “Population and growth-wise, Pakistan is very promising.”

Renault declined to talk about its plans while it is in negotiation with local partners.

Part of the reason for the rise in car sales is that Pakistanis are getting richer. Between 2010 and 2015, the amount each person earned per year rose from $4,370 to $5,320 as measured in gross national income per capita at purchasing power parity.

------

That trend is expected to continue, partly helped by China’s plans to invest more than $52bn in Pakistan’s infrastructure under the “One Belt, One Road” project. Hyundai forecasts that, consequently, car sales in Pakistan will hit 300,000 a year by 2020.

Just as importantly, say analysts, has been the corresponding fall in interest rates. Since September 2000, the rate at which banks can borrow from the Pakistan central bank has fallen from 13 per cent to 6.25 per cent.

Saleem Memon, who sells finance packages for carsin central Karachi, says: “A few years ago, customers sometimes paid 16 or 17 per cent in annual interest rates. Now, if they are lucky, they can get a good deal for around 11 per cent.”

Another factor drawing carmakers to Pakistan is that security has begun to improve thanks to a two-year campaign by the army. Mr Khan remembers days when he and other taxi driverswere routinely stopped at gunpoint by armed extortionists. “The streets are now safe and people feel comfortable driving till late at night,” he says.

Third, the government has drawn up policies aimed at attracting carmakers, such as cutting the duties applicable to parts shipped from abroad and making it easier to find a site to build a plant.

-

Comment by Riaz Haq on March 2, 2017 at 8:49am

-

#Pakistan #Auto Show 2017: Auto part manufacturers gear up for biggest ever exhibition in #Karachi

https://tribune.com.pk/story/1343197/pakistan-auto-show-2017-auto-p...

Pakistan’s auto part manufacturers are bullish on future growth of the industry due to growing sales of locally-assembled vehicles and planned investments of new companies.

“A record number of foreign exhibitors are going to participate in the Pakistan Auto Show (PAPS) 2017,” Pakistan Association of Automotive Parts and Accessories Manufacturers (Paapam) Chairman Mashood Ali Khan told reporters at a local hotel on Wednesday.

Pakistan, Thailand: PAAPAM expresses concern over inclusion of auto sector in FTA

Paapam officials expect over 65 international exhibitors in PAPS 2017, being held from March 3-5 at the Expo Centre, Karachi. Relative improvement in security, macroeconomic stability and the announcement of the new auto policy in 2016 has created an ideal condition for global car manufacturers to invest in Pakistan.

Current conditions are particularly beneficial for the local auto part making industry, which is expected to provide auto parts to new automobile entrants that need their partnership to produce economical cars in Pakistan.

“New auto players like Kia and Hyundai are setting up their plants in Pakistan and this is a huge opportunity for us,” former Paapam Chairman Aamir Allawala commented.

“Last year, only six international exhibitors participated in the event, but this time the response is overwhelming. We are pleased to entertain a large complement of dignitaries from across the globe,” added Khan.

This time a total of 85 local exhibitors, 17 sponsors, six universities and 17 support organisations are going to take part in the show. This comes to a total of 192 exhibitors this year, as against 104 last year. In PAPS 2013, a total 15,000 visitors and 100 exhibitors were part of the show while in 2014 the number of visitors was 25,000 and there were 150 exhibitors. In 2015, the visitors increased to 30,000 and exhibitors were 200.

Government officials, local and international buyers and manufacturers, machinery manufacturers, raw material providers and service providers are expected to visit the show.

International visitors from Afghanistan, Bangladesh, China, Japan, the Netherlands, Sri Lanka, the UAE, the UK and African countries have attended the past events, but this year visitors from other countries as well are expected in this show, Paapam Senior Vice Chairman Saeed Iqbal Ahmed Khan said.

“We would like to strengthen our international relationships, which have been developed after years of hard work. Export orientation will be the key to introducing new and upgraded technology,” he said.

Paapam Vice Chairman Syed Mansoor Abbas commented that an additional important objective is to strengthen relationships with OEMs and strive to increase localisation content.

-

Comment by Riaz Haq on April 1, 2017 at 6:22pm

-

#Pakistan Indus Motor Company unveils Rs4bln (US$400m) investment plan to expand production. #Automobiles #Toyota

https://www.thenews.com.pk/print/195925-Indus-Motor-Company-unveils...

Indus Motor Company Limited (IMC), a country’s leading automaker, on Saturday unveiled four billion rupees investment plan to expand its annual production capacity by 200,000 units in a bid to capitalise on the growing consumer demand.

Currently, IMC holds an annual production capacity of 54,800 units, which are sold under the brand name of Toyota. The planned capacity enhancement would bring the production to 75,000 vehicles a year.

“Pakistan’s auto industry future looks very promising,” IMC Chief Executive Officer Ali Asghar Jamali told media at its third auto workshop.

“I am hopeful that Pakistan will be producing 500,000 cars per year by 2022,” Jamali said.

The demand for local as well as used cars has exponentially been growing for the last three years due to overall improvement in the macroeconomic activities.

Despite being a world’s biggest densely-populated country, Pakistan has, however, not seen rapid motorisation. The country has only 16 cars per 1,000 people. By 2020 the ratio is likely to reach 20 cars per 1,000.

Industry experts are expecting a fast growth in car sales due to growing and young middle-class in the country.

The experts said the country is the third largest growing economy in emerging market and it could benefit from the ongoing $57 billion worth of China-Pak Economic Corridor (CPEC) projects.

IMC recorded five percent drop in sales during the July-February period of 2016/17, but in light commercial vehicle -- vans and jeeps – sales of Toyota Fortuner increased to 568 during the period from 368 units in the corresponding period.

Analyst Sohaib Subzwari at Taurus Securities Limited attributed the fall in sales to “strong demand for Honda Civic and operational issues restricting production.”

Subzwari, however, said the growing construction and road network development activities on account of CPEC would contribute to growth in volumes of heavy and light commercial vehicles.

In July-February, IMC emerged as the second leading player by number of sold vehicles. Pak Suzuki was the first, while Honda was the third.

The government recently announced auto policy 2016-21 containing a number of incentives for Greenfield and Brownfield projects in the country’s Japanese-dominated auto market.

IMC started its operation as a joint venture of House of Habib of Pakistan, Toyota Motor Corporation and Toyota Tsusho Corporation of Japan in 1989.

Analysts said auto industry generally feels comfortable about the new auto policy, which they say has provided a solid road map to the investors to plan investment for a long period.

On premium (own money) and black marketing, Jamali said the government should impose Rs100,000 as a levy per car if the first owner sells it within six months of the purchase. “This will eliminate the middleman and investors who create artificial shortage of cars in the market,” he added.

Car manufacturers said import of used cars poses the biggest threat to the local industry’s survival.

“We purchase local parts of Rs150 million on every working day, which becomes Rs40 billion per year,” said IMC executive.

Pakistan imports more than 46,500 used cars in a year, around 15 percent of the total car sales of 283,000 units in 2016.

Aamir Allawalla, ex-chairman of Pakistan Association of Automotive Parts and Accessories Manufacturers (Paapam) said import of five-year old used vehicles dented the industry as it led to shutdown of several plants.

“New variants to be introduced by local players in the next years would, however, give a tough competition to the imported cars,” Allawalla said.

He said local industry wants long-term auto policies to get return on their investment and in order to avert ‘sudden shocks’. A huge investment in the sector has been planned, he added.

-

Comment by Riaz Haq on April 2, 2017 at 10:38am

-

#Pakistan #automobile #motorcycle parts Industry looks for joint ventures with #Thailand

https://tribune.com.pk/story/1369096/auto-parts-industry-looks-join...

Pakistan auto part makers have met with their Thai counterparts in Bangkok to discuss the planned free trade agreement (FTA) and the possibility of joint ventures between the two countries.

The delegation from Pakistan was led by Pakistan Association of Automotive Parts and Accessories Manufacturers (Paapam) Chairman Mashood Ali Khan.

Khan said he was optimistic that a Thai delegation would visit Pakistan soon to push forward bilateral talks. Paapam had earlier expressed reservations about the proposed FTA with Thailand, fearing it may hurt interests of the local industry in coming years.

The delegation informed Thai auto part manufacturers about the rapidly growing automotive market in Pakistan, according to a press release. Paapam asked them to provide a complete list of their components with HS code and other details and also discussed the possibility of joint ventures.

-

Comment by Riaz Haq on April 5, 2017 at 1:49pm

-

#Yamaha launches new 125cc #motorcycle in #Pakistan. CEO says Pakistan is the world's 5th largest motorcycle market

https://www.dawn.com/news/1324844

Yamaha Motor Pakistan announced the launch of their new 125cc bike vowing to cater the need of common motorcycle users in Pakistan, read a statement issued by the company.

The latest model YB125Z is equipped with features like longer and wider size seat, engine balancer to reduce vibration, powerful headlight halogen lamp, self-starter and gear indication on speedometer, it said.

Yamaha earlier introduced two sporty versions in the 125cc category as it introduced YBR125 & YBR125G models around two years back.

YB125Z is priced at Rs115,900 and this model will be available in the market from the middle of April 2017.

Speaking at the launch, Executive General Manager of Yamaha Motor Co., Ltd. (Japan) Hiroyuki Seto said that Pakistan was now the fifth largest motorcycle market in the world, and Yamaha was looking at Pakistan as a huge potential market.

“We want to establish our presence in the 125cc standard segment in Pakistan,” he said.

Also speaking on the occasion, Yamaha Motor Pakistan’s Managing Director Shigeru Ishikawa highlighted YB125Z as new weapon to cut into mass segment.

“We have big confidence in our new product and it’s a time for us entering the next stage so our valued customers can now experience the real,” he was quoted as saying.

-

Comment by Riaz Haq on April 5, 2017 at 5:01pm

-

The Pakistan motorcycle market is growing at the rate of 15 per cent annually. This is an appreciable static growth which anticipates the importance of presence of the local assemblers.

Atlas Honda is the market leader in the Pakistani motorcycle industry with over 65 per cent market share. Atlas Honda motorcycle industry showed a phenomenal jump from 1 million motorcycles a year in 2000-01 to currently 2 million a year .This is an evidence of dramatic change in consumer behavior in Pakistan.

In the past year over 1.5 million motorcycles were produced in the country out of which most were of 70cc engine capacity. A phenomenal growth has been observed in 100cc, 125cc and above segments with a growth trend of around 34 per cent and 20 per cent respectively. A decline in production of around 10 per cent is seen in the most popular 70cc motorcycles.

Due to Honda's 100 per cent motorcycle localisation and the prices of it being reasonable in the domestic market, the new international markets like South Africa and Iran are being explored. Already it has gained foreign markets like Bangladesh and Sri Lanka.

Local assembly of motorcycles started in 1964 when Atlas Group put up assembly facilities in Karachi to assemble Honda motorcycles before that the market was haunted by Japanese brands Honda, Yamaha and Suzuki.

The market experienced a major breakthrough in the late 1990's with the advent of assemblers. At present, there are around 100 assemblers in the country. Out of these around 81 are active assemblers. The popular 70cc brand still carries more than 80 per cent of the market share. The Honda Japan recently declared Pakistan as a hub for 70cc technology in the region.

From the years 2007 till 2011, the Honda motorcycle's price has gone up from Rs 58000 to Rs 68500. According to the Senior Managing Director of Honda Motor Company Japan, T Oyama, Pakistan will be amongst the top five countries in the world which will produce and export high quality motorcycles in the coming next few years.

Atlas Honda has achieved a lot of success in Pakistan and with its high sales and production; it will bring a boom to Pakistan's economy in an impressive way. Atlas Honda has invested $35 million this year alone in Pakistan and increased its motorcycle production capacity to 750,000 per year. Pakistan has one of the largest motorcycle consumer markets and it exports to regional buyers too.

The production capacity will be increased to one million units in the next few years with an estimated cost of an additional $50 million. This collaboration between Atlas Group Pakistan and Honda Japan is amongst the oldest in joint venture history of Honda Motor Company anywhere in the world, and together Atlas Honda Ltd. has brought about the drive for motorcycle industry in Pakistan.

Observing from recent growth in motorcycle sales in the 100cc and other categories, Pak Suzuki Motors Company has launched a new model of 110cc motorcycle. The company says it is keen to cater to the growing market of higher engine specification motorcycles. The launch price of the GD-110 has been set at Rs99, 999. The bike employs a 4-Stroke CDI engine which complies with Euro II emission standards.

Pak Suzuki remains the dominant player in Pakistan's four-wheelers market with over 60 per cent of the market. However, its share in the motorcycles market is just less than 2 percent.

-

Comment by Riaz Haq on August 2, 2017 at 10:33am

-

#Pakistan #auto sales stay buoyant as volumes rise 14% in 10 months July 2016-April 2017

https://tribune.com.pk/story/1407581/local-auto-sales-stay-buoyant-...

Local automobile sales, including light commercial vehicles (LCVs) and jeeps, in the first 10 months (Jul-Apr) of the current fiscal year totalled 176,937 units, up 14% compared to 154,949 units (excluding Punjab taxi scheme sales of 29,150 units) in the same period of previous year, according to data released by the Pakistan Automotive Manufacturers Association (Pama).

Auto industry seeks tax relief at retail stage

“Car sales remained robust and are expected to touch 270,000 units (including 60,000 imported cars) by the end of fiscal year in June 2017,” Topline Securities commented on Thursday.

-

Comment by Riaz Haq on August 4, 2017 at 8:18pm

-

#Philippines (sales up 30%), #Pakistan (sales up 18.9%) help #motorcycle makers avoid the skids- Nikkei Asian Review https://asia.nikkei.com/Business/Trends/Philippines-Pakistan-help-m...

Philippines, Pakistan help motorcycle makers avoid the skids

Demand in two countries surges just as sales slow elsewhere in Asia

SADACHIKA WATANABE and JUN ENDO, Nikkei staff writers

https://asia.nikkei.com/Business/Trends/Philippines-Pakistan-help-m...

The Philippines and Pakistan have become bright spots in Asia's motorcycle market, helping to offset slowdowns in other key countries.

Like the Philippines, Pakistan is providing some much-needed vroom. Sales are rising by double digits in the South Asian country, which has a population of nearly 200 million but gross domestic product per capita of $1,500 -- half the Philippines' figure.

Improved security is giving consumers more confidence to buy motorbikes. Sales surged 18.9% last year, to 1.43 million units, according to industry figures. Auto researcher Fourin estimates the market was actually 1.8 million to 2 million, factoring in imports by Chinese manufacturers.

Honda plans to double its motorcycle production capacity in Pakistan in the 2015 to 2018 period. It is already capable of turning out 1 million motorbikes.

Yamaha Motor, which dissolved its local joint venture in 2008, built a new plant to re-enter Pakistan in 2015. Motorcycles with 70cc engines are selling well, and Yamaha aims to buff its brand with a 125cc model.

Despite a population of 100 million, the Philippines' motorbike market is less than half that of Vietnam, which is home to 90 million people. The wealthy tend to own cars, while low-income earners typically get around on Jeepneys and other public transportation in urban areas.

But a couple of Japanese bike manufacturers -- Honda Motor and Yamaha Motor -- have sought to change that with scooters featuring automatic transmissions. Their marketing drives, coupled with rising income levels, are giving sales more zip.

-

Comment by Riaz Haq on August 12, 2017 at 8:53pm

-

#Pakistan car sales in July 2017 jump 41% to 19,577 units in July 2017, from July 2016 #Tractor sales spike 125% YoY

https://tribune.com.pk/story/1478567/locally-assembled-car-sales-ac...

Sales of locally assembled vehicles, including jeeps and light commercial vehicles, jumped to 19,577 units in July 2017, up 41% compared to 13,932 units in the same month of 2016, according to latest data released by the Pakistan Automotive Manufacturers Association (PAMA).

A Topline Securities’ report said the numbers were in line with its estimates. The apparently large difference in monthly sales may be attributed to reduced working days in July 2016 because of Eid holidays, the report said.

Pakistan could soon see these electric cars on its roads

Sales of Pak Suzuki Motor Company increased 37% year-on-year (YoY) in July 2017 due to strong demand for Wagon-R, up 77%.

With the introduction of a new model, sales of Cultus rose 66% YoY while Ravi sales were up 41%, which also supported the company’s growth.

Honda outperformed its peers in vehicle sales, posting 113% growth due to successful introduction of a new Civic model and new sports utility vehicle (SUV) BR-V.

Indus Motor sold 4,618 units in July 2017, up 11% YoY. The company’s focus remained on production of higher-margin Fortuner, which recorded a stellar growth of 543%.

Moreover, buyers were postponing their purchase of Toyota Corolla, waiting for the face-lift model, which has arrived now.

Truck and bus sales of PAMA member companies in July 2017 remained strong, growing 13% YoY. The trend is expected to continue, fuelled by the China-Pakistan Economic Corridor (CPEC) led growth, higher road connectivity, lower financing rates and enforcement of the axle load limit per truck on highways by the National Highway Authority.

Two and three-wheel vehicle sales for July 2017 grew strongly by 42% YoY due to rising disposable income of the lower middle class, the report added.

Why Pakistan should switch to hybrid cars

Tractor sales continued to exhibit an upward trajectory with sales growing by 125% YoY in July 2017.

Lower general sales tax, improved crop yield due to Punjab government’s Kisan Package and continuation of fertiliser subsidy to improve farmers’ purchasing power contributed to the strong tractor sales.

Moreover, in the provincial budget for fiscal year 2018, the Sindh government has set aside Rs2 billion in subsidy on tractor purchases by farmers.

-

Comment by Riaz Haq on September 20, 2017 at 4:13pm

-

Pakistan Government asks auto investors to conclude committed investments

https://www.thenews.com.pk/print/216089-Government-asks-auto-invest...

The government on Wednesday asked four investors, which was given approval to invest around $3 billion in setting up auto assembling plants in the country, to furnish all the necessary documents in order to finalise the agreements by next week.

In June, ministry of industries and production allowed United Motors Private Limited, Kia-Lucky Motors Pakistan Limited, Regal Automobiles Industries Ltd, and Nishat Group to set up units for assembly and manufacturing of vehicles under the Greenfield investment category.

A senior official at BoI told The News that the four companies would likely to bring in investment of around three billion dollars, “which will help in breaking the existing cartel of three Japanese car assemblers and bringing down prices and create job opportunities.”

A statement said Khizar Hayat Gondal, secretary ministry of industries and production and Azhar Ali Chaudhry, secretary Board of Investment held a meeting on Wednesday with the four awardees of Greenfield status under the Auto Development Policy (ADP) 2016-21 as a follow-up of the meeting held on June 6.

The investors were urged to meet the necessary codal requirements under the policy as early as possible. They were asked to prepare their agreements to be effected pursuant to the award of ‘Greenfield status’ without any loss of time.

All concerned assured that these agreements would be finalised over the next week. Most of them expressed the resolve to present all necessary documentation by the 20th of this month, according to the statement.

Secretary ministry said companies awarded with Greenfield investment would be required to separately enter into agreements with the ministry of industries and production to ensure compliance with ADP 2016-21, relevant statutory regulatory orders and various timelines for completion of the projects for availing incentives under this policy.

The meeting asked the Engineering Development Board (EDB) to examine and put up these cases for approval as and when complete documentation is received.

Next monthly meeting with investors will be convened in the ministry of industries and production in the 2nd week of August 2017.

EDB will issue manufacturing certificate and list of importable components to new investors after verifying that their manufacturing facilities are adequate to produce roadworthy vehicles. The investors appreciated efforts of the ministry and the board for being pro-active in finalising investment proposals in record time.

Applicants for award of Greenfield status also participated during the meeting and showed their level of preparedness. The applicants are Habib Rafiq (Pvt.) Ltd., Khalid Mushtaq Motors (Pvt) Ltd., Pak-China Motors (Pvt) Limited, Foton JW Auto Park (Pvt) Ltd, Cavalier Automotive Corporation (Pvt) Ltd.

Comment

- ‹ Previous

- 1

- 2

- 3

- 4

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistan to Explore Legalization of Cryptocurrency

Islamabad is establishing the Pakistan Crypto Council (PCC) to look into regulating and legalizing the use of cryptocurrencies, according to media reports. Cryptocurrency refers to digital currencies that can be used to make purchases or investments using encryption algorithms. US President Donald Trump's endorsement of cryptocurrencies and creation of a "bitcoin reserve" has boosted investors’…

ContinuePosted by Riaz Haq on March 28, 2025 at 8:30pm — 3 Comments

World Happiness Report 2025: Poor Ranking Makes Indians Very Unhappy

Pakistan has outranked India yet again on the World Happiness Index, making Indians very very unhappy. Indian media commentators' strong negative emotional reaction to their nation's poor ranking betrays how unhappy they are even as they insist they are happier than their neighbors. Coming from the privileged upper castes, these commentators call the report "…

ContinuePosted by Riaz Haq on March 22, 2025 at 10:30am — 7 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network