PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Growing Middle Class Drives Motorcycle Sales Boom

Pakistan's fiscal year 2015-16 saw production of motorcycles soar to a new high of over 2 million units. This represents a 16.5% surge from last year. At the same time, passenger cars and light trucks sales rose to over 200,000 in fiscal 2016, a 20% jump over the same period last year.

Motorcycle Sales:

Rising motorcycle sales in Asia's developing nations like Pakistan are seen as a barometer of expanding middle class. It is, in part, attributed to rising incomes and availability of bank financing at historic low interest rates in the country.

As many as 2,071,123 motorcycles were manufactured during July-June (2015-16) compared to 1,777,251 units during July-June (2014-15), according to the latest data released by Pakistan Bureau of Statistics (PBS) and reported by Pakistani media.

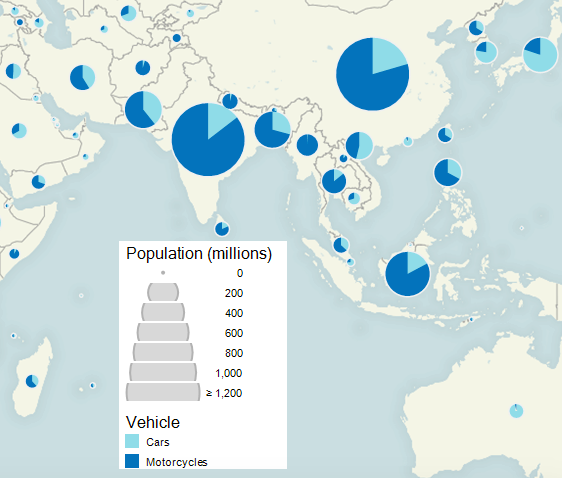

Pakistan is the World's Sixth Largest Motorcycle Market |

Car Sales:

In addition to the double digit increase in motorcycle sales, Pakistan also experienced 20% jump in sales of passengers cars, light commercial vehicles (LCVs), vans and jeeps. The total sales of local vehicles increased by 21% to 216,568 as compared to 179,953 units sold in FY15, according to industry data.

Auto Parts Industry:

Rising auto and motorcycle sales are helping boost Pakistan's auto parts industry as well. “We are getting orders and the pace is increasing,” said Sultan and Kamil International CEO Faisal Mahmood speaking to Pakistani media on the sidelines of the 12th Pakistan Auto Show 2016 held at the Lahore International Expo Centre. Mahmood’s company makes more than 350 automotive parts and exports to all major automobile markets in the world.

Other Growth Industries:

Among other industries seeing significant growth are pharmaceuticals (6.54%), cement (17.01%), chemicals (8.13%), non metallic mineral products (10.02%), fertilizers (13.81%), leather products (7.76%) and rubber products (7.16%), according to media reports.

Summary:

Pakistan's economic recovery is in full swing with double digit growth in multiple industries, including auto, pharma, chemicals, cement, fertilizers, minerals, etc. It is expected to pick up steam over the next several years with new investments on the back of China-Pakistan Economic Corridor related projects.

Related Links:

Growing Middle Class in Pakistan

China-Pakistan Economic Corridor

-

Comment by Riaz Haq on September 15, 2016 at 7:59pm

-

Pakistan wants to promote domestic production to create jobs for its growing labor force.

Excerpt of Wall Street Journal interview with President of Yamaha Motors in Japan:

WSJ: What about in South Asia?

Mr. Yanagi: We want to expand business in Pakistan and Bangladesh as soon as possible. We had a production venture in Pakistan but we dissolved it five years ago. We are now planning to begin local production again, on our own this time.

In Bangladesh, we import motorcycles from our plant in India on a small scale, but we are studying now the best way of running operations because of rising tariff barrier there.

http://www.wsj.com/articles/SB1000142405270230452070457912873316262...

Since this interview was conducted in Oct 2013, Yamaha has set up a motorcycle plant that began production last year in Pakistan.

“The new investment from Yamaha will create jobs and bring new technologies,” said Yamaha Motor Company President Hiroyuki Yanagi, adding that, “Pakistan is all set to become one of the top global markets of motorcycles.

http://tribune.com.pk/story/876873/investment-yamaha-resumes-assemb...

-

Comment by Riaz Haq on September 15, 2016 at 9:28pm

-

Honda Pakistan has announced plans to double its production capacity in three years, to cater to the estimated growth of the motorcycle market in the country.

Atlas Honda Ltd. (AHL), the joint venture company that takes care of production and sales of Honda motorcycles in Pakistan, has two manufacturing plants – one in Karachi (in Southern Pakistan) and the other in Sheikhupura (in Northeastern Pakistan). The former produces 1.5 lakh units and the latter rolls out 6 lakh units per annum.

The capacity expansion will be carried out in the Sheikhupura plant, to equip the facility to produce 12 lakh units per year. The plan will be executed phase-wise, with the first part of the operation involving the installation of a new production line which will commence functioning in October 2016. Further stages over a three year period is planned to achieve the target of producing 1.2 million motorcycles a year.

The investment AHL will be making for this plant expansion process is approximately USD 50 million (INR 327.32 crores). About 1,800 jobs are estimated to be created.

http://indianautosblog.com/2015/11/honda-pakistan-double-motorcycle...

-

Comment by Riaz Haq on September 16, 2016 at 8:16am

-

#Pakistan flight in force at #Africa Aerospace & Defense Show 2016 | IHS Jane's 360 #AAD2016 http://www.janes.com/article/63857/pakistan-flight-in-force-aad16d3... …

Visitors to AAD are being treated to the aerial prowess of the Pakistan Aeronautical Complex Mushshak, a light, robust primary flight trainer and utility aircraft, whose display includes deliberate spinning.

PAC (Hangar 7, Stand CE12) entered the field of maintenance, repair and overhaul (MRO) of aircraft in the early 1970s, as well as components of Chinese origin for the Pakistan Air Force. PAC subsequently moved towards MRO of Mirage III and V aircraft.

In the field of aviation manufacturing, PAC progressed from the manufacture of the Mushshak and Super Mushshak aircraft for primary training to the Karakorum-8 (K-8) advanced jet trainer. The Super Mushshak is a powerful two-/three-seat trainer with a more advanced avionics package. The K-8 has a multi-role mission capability including air-to-air and air-to-ground weapon delivery.

Today, PAC has advanced technology to design and manufacture the multi-role JF-17 fighter aircraft and upgrade the avionics of fighter aircraft. The JF-17 Thunder is a new-generation single-seat multi-role light fighter with high manoeuvrability and beyond visual range capability. It has a long-range operational radius and advanced aerodynamic configurations.

The PAC contingent at AAD is headed by chairman Air Marshal Arshad Malik.

-

Comment by Riaz Haq on September 17, 2016 at 10:31am

-

Byco oil refining capacity goes up to 155,000 barrels per day

http://www.brecorder.com/fuel-a-energy/193:pakistan/1181388:byco-oi...

Byco is now ahead of all refineries in Pakistan following the completion of its second unit, as its crude oil refining capacity has gone up to 155,000 barrels per day from 35,000 barrels per day.

Asad Siddiqui, Byco Chief Financial Officer (CFO) of the complex, talking to a select group of journalists here on Monday said the second unit of the refinery has completed, enhancing its refining capacity by 120,000 barrels per day, making it the country's largest refinery. He said that Byco has crossed Pak Arab Refining Company (PARCO) which has the refining capacity of 90,000 barrels per day, followed by 68,000 barrels of National Refinery, 48,000 barrels of Pakistan Refinery Limited and 45,000 barrels of Attock Refinery.

Replying to a question regarding expected removal of international sanctions against Iran, he said that if the sanctions are lifted Byco Refinery is all set to take the advantage of expected crude oil imports from Iran at discounted rates.

Byco CFO said that his company was well placed to benefit from removal of international sanctions against Tehran unlike the country's other refineries which had long term crude supply contracts.

"It is comparatively difficult for other refineries to switch over because of their long term agreements" but Byco has the potential to quickly take advantage of the emerging opportunity.

He said perhaps Iran would also offer discount on crude oil to open up its market and it would be a good omen for Pakistan.

He said Byco had completed one of the two new projects for isomerization and desulphurization and it had relatively short term crude supply agreements that provide flexibility for Iranian crude.

He said the Byco also had past experience of refining Iranian crude before its supply had suspended due to international sanctions.

He said because of consolidated business model, the company would be declaring profit for the first time for the quarter ending June 30, 2015 that would set the direction for its improved financial position in future.

He said the Byco management had decided to consolidate its refining business before going into expansion of retail outlets, adding that so far Byco was operating 250 petrol pumps across the country.

"The focus of our marketing has been on furnace oil sales and we have been able to secure furnace oil business from Nishat Chunia, K-Electric, Tapal, Liberty and Hub Power Company", he maintained.

He said Byco was facing problems because of the issue of turn over tax, but the authorities had not only understood the tax anomaly but was committed to issue an enabling clarification. He explained that refinery was set up under tax-holiday for seven years when there was no turn over tax which was imposed subsequently and the government had agreed to do away with it. He said about 95 per cent of the oil pricing was based on crude price which meant that turn over tax could simply eat away the entire profit.

He said that due to the completion of isomerization and desulphurization of within plants into a couple of months it would convert its entire Naphtha production into motor spirit that would almost double its production from 12,500 barrels per day to cut costs.

He said the government had appreciated the co-operation extended by the Byco in controlling petrol crisis early this year and now looked forward to take benefit of its location and infrastructure.

He said the company could directly provide furnace oil to Hubco next door while Pakistan State Oil was also taking full advantage of Byco's strength of its own port facility in the shape of single point mooring.

Siddiqui said all major oil marketing companies including PSO, Hescol, Caltex and Shell in that order and other smaller companies were lifting products from Byco refinery.

-

Comment by Riaz Haq on September 18, 2016 at 5:10pm

-

Morgan Stanley's Ruchir Sharma: Prospects of #Pakistan’s #economy "VERY GOOD" & #India's "GOOD" http://tns.thenews.com.pk/pakistans-economy-ready-takeoff/ … via @TheNewsonSunday

Closer to home, he has clubbed four nations of South Asia — Pakistan, Bangladesh, India and Sri Lanka. In general the future outlook for South Asia holds ‘Good’ and for Pakistan it looks ‘Very Good’. I started jumping on the couch after reading the outlook for Pakistan and for the rest of the time I was reading the book I was only interested as to what the future outlook holds for Pakistan in the eyes of most influential investor and thinker. But then the author has added a caution and it’s damn important that we read and comprehend this fine print in detail.

Pakistan’s economy is taking off and the future outlook till 2020 has been termed ‘Very Good’. The rationale used in building this argument is that our working age population is growing and that’s a very good sign for the economy. Inflation is under control which is increasing in the vicinity of 3 per cent but on the other hand GDP is growing at 4.5 per cent. Contrary to the populist demagogy, our debt level is pretty low in relation to comparative economies whereby debt to GDP is at 65 per cent. We have a decent manufacturing base with export economy and we are also investing in factories by opening industrial parks as elucidated in the China-Pakistan Economic Corridor (CPEC).

Our trade deficit is on the decline as our import bill is on the wane, thanks to lower oil prices in the international market. We are also not exporting commodities whose prices are plummeting in the international market. We would be getting a shot in the arm once the CPEC starts rolling out as China has committed to invest US$ 46 billion in infrastructure and power related projects in Pakistan over the next 20 years.

Sharma says that even if 50 per cent of this commitment materializes, it would be enough to provide us with the necessary infrastructure that will take us from a low-income to a middle-income country during the next five years.

Though hard to digest, the most influential writer and investor says that we don’t have stale leadership like Vladimir Putin of Russia and Recep Tayyip Erdogan of Turkey who have clung to power for more than a decade and are in their fourth terms. But then Nawaz Sharif is in his third term too.

A very important point the author highlights is that for a coup-prone country like ours, the military finally seems to have decided to concentrate on ensuring the internal as well as external security while staying clear of politics.

-

Comment by Riaz Haq on September 19, 2016 at 8:05am

-

#India’s falling #exports killed 70,000 #jobs in just one quarter. #Modi #AchheDin http://qz.com/784625 via @qzindia

India’s dismal export growth is leading to massive job losses. And, after months of shrinking exports without any signs of improvement, the employment situation in Asia’s third-largest economy is set to worsen.

The jobs market is already in pain. In the July-September quarter of the 2015 fiscal year, India recorded the lowest job growth compared to the same period in 2009, 2011, and 2013.

Plummeting exports are adding to the problem. Some 70,000 jobs were lost in the second quarter of 2015 alone due to a fall in India’s exports, according to the Associated Chambers of Commerce & Industry in India (Assocham). Most of these were contractual in nature, the joint study by Assocham and Thought Arbitrage, a research institute, said.

“While contractual jobs were lost, not adequate regular jobs were added to compensate that loss. Textile has been most affected,” the industry body, which represents over 450,000 Indian business entities, said in a release on Sept. 18.

India’s export growth has been negative in the last couple of years. Lacklustre global demand is one reason. It also doesn’t help that India’s manufacturing sector is still weak. Private investment in manufacturing is yet to pick up, which means exporters are scrambling for funds. Their funding costs are high too. All this has had an impact on the jobs market because exports have been slacking in sectors that are labour-intensive, such as engineering goods, leather, textiles, and rubber, among others.

Eight of the 14 labour-intensive sectors saw exports shrink in the 2016 financial year. In the previous year, job growth in these sectors was the slowest in seven years.

-

Comment by Riaz Haq on September 28, 2016 at 9:24pm

-

Asian Development Bank increases #Pakistan's economic growth projection for 2017 from 4.8% to 5.2% #Economy #GDP

"As such-and assuming further improvement in energy supply and security, and likely recovery in cotton and other agriculture-the growth forecast for FY2017 is revised up to 5.2%", the report added.

--

The report added that a major impetus to growth in FY2017 and beyond would be the implementation of $46 billion program of infrastructure spending on roads, railways, pipelines and electric power in an economic corridor project linking Pakistan with the People's Republic of China (PRC), which was announced in April 2015.

Fast-tracking would enable several energy projects to come on stream in FY2018, the report added.

The government significantly strengthened macroeconomic fundamentals and advanced a comprehensive program of structural reform under a 3-year program with the IMF that ended in September 2016.

Inflation has been squashed to the low single digits, foreign reserves rebuilt, and the budget deficit markedly reduced.

---

The general government budget for FY2017 projects further reduction in the deficit to 3.8% of GDP achieved by adopting new revenue measures and streamlining current expenditure.

Tax revenues are projected to increase by half a percentage point, raising the ratio of tax to GDP to 12.8% by eliminating more tax concessions and exemptions, expanding the withholding system as part of administrative reform to widen the tax base, and raising some excise taxes and customs duties, the report added.

Inflation is now expected to average 4.7% in FY2017.

The upward revision takes into account expected oil price rises and stronger domestic demand in an increasingly supply constrained economy.

It is tempered by the prospect of a broad agricultural recovery and only modestly higher global food prices. The July 2016 Monetary Policy Statement covering the first 2 months of FY2017 kept policy rates unchanged as the central bank continues its cautious forward-looking approach, expecting to hold inflation within the range of 4.5%-5.5%.

The report observes that the current account deficit was expected to widen in FY2017 to about $5 billion, or 1.6 % of GDP, which is higher than forecast in March.

The revision reflects a somewhat greater increase in global oil prices than expected and continued expansion in other imports stemming from faster economic growth.

Exports are expected to perform better during the year, increasing by nearly 5% as a recovery in cotton production underpins an upturn in textile sales, and as global prices for non-oil commodities reverse from a sharp decline to a modest increase.

The report added that the mobilization of larger inflows into the capital and financial accounts had been central to the 3-year economic program with the IMF, and these flows are projected to increase to $6.5 billion in FY2017, mainly with more foreign direct investment and continuing sizeable official flows.

Thus, even with the projected widening of the current account deficit, the overall balance should remain in surplus, augmenting official reserves.

The corridor project with the China is expected to attract more foreign direct investment, and already in 2015 investors announced 40 greenfield projects worth a remarkable $19 billion, or 4 times the norm in recent years.

Moreover, the decision by Morgan Stanley Capital International to put Pakistan in its MSCI emerging market index, effective from May 2017, will likely spur equity portfolio inflows.

http://www.brecorder.com/top-news/pakistan/320097-adb-revises-up-pa...

https://www.adb.org/sites/default/files/publication/197141/ado2016-...

-

Comment by Riaz Haq on October 22, 2016 at 8:34am

-

#Honda’s new plant inaugurated in #Pakistan to produce 1.35 million motorcycles a year in world's 6th largest market

http://www.dawn.com/news/1291204/atlas-hondas-new-facility-inaugurated

LAHORE: Takahiro Hachigo, President, CEO and Representative Director of Honda Motor Co Ltd Japan, on Thursday inaugurated new facility of Atlas Honda Ltd (AHL) in Sheikhupura to expand its motorbike production.

Speaking on the occasion, Mr Hachigo announced that Pakistan has now become the sixth largest motorcycle market in the world.

Saquib H. Shirazi, speaking on the occasion, said with the enhancement of the production capacity, Atlas Honda is now well poised to serve the expanding market.

AHL, Honda’s motorcycle production and sales joint venture in Pakistan, discussed its plans to carry out production enhancement in machining and other fields at the Sheikhupura plant during the next three years.

The annual assembly production capacity of AHL has now become 1.35 million units, with 150,000 units from the Karachi plant and 1.2 million units from the Sheikhupura plant.

-

Comment by Riaz Haq on January 29, 2017 at 4:38pm

-

#Pakistan #auto parts maker Loads Limited CEO more than bullish on nation's auto sector. #economy #manufacturing

http://tribune.com.pk/story/1310741/optimistic-loads-limited-ceo-ju...

Munir Bana advised many of his employees to buy the company’s shares as date of the book-building portion of the IPO neared. Many of them hesitated, but some of them opted to buy a personal stake in the auto part maker’s expansion plan.

Weeks later, many regretted their decision and those who bought the shares wished they had invested more.

After all, the share price of Loads Limited – the last listing on the Pakistan Stock Exchange in 2016 – jumped over 100% within a few weeks of trading. It is currently priced at Rs56.76 after starting on Rs34 and has also handed out 10% bonus shares and Rs1 as dividend to its shareholders.

“Our employees were hesitant to enter the stock market, but when I insisted many of them bought the company’s shares,” said Bana, the CEO of Loads Limited, one of the leading auto part makers in the country.

“Those who did not buy or purchase just a few shares now regret (their decision).”

Before offering 50 million shares through the IPO, the company first offered 2.5 million shares to its employees to engage them in the company’s future aggressive investment plans. The company eventually managed to raise Rs1.7 billion, an amount the company is now using for expansion of its production capacity.

Loads makes radiators, exhaust systems, mufflers, sheet metal components among other parts, and its clients include more than a dozen national and multinational companies engaged in the production of motorcycles, cars and heavy vehicles manufacturers.

Bullish on future growth

Bana, a Chartered Accountant, believes two developments have been positive triggers for the local auto industry — the China-Pakistan Economic Corridor (CPEC), a $55-billion investment and loan package that envisages changing the way China conducts trade, and the Automotive Development Policy (ADP) 2016-21 announced in March 2016.

Industry experts believe the auto sector would be a major beneficiary of CPEC, given the corridor’s vision of upgrading Pakistan’s road and highways network.

Officials say the country would need heavy vehicles not only during the construction phase, but also after the infrastructure projects are completed.

“New entrants and new models, as well as the increase in heavy vehicles, all speak for themselves,” he said.

-

Comment by Riaz Haq on February 1, 2017 at 10:43am

-

#Pakistan’s Middle Class Soars as Stability Returns - WSJ. #economy #middleclass

https://www.wsj.com/articles/pakistans-middle-class-soars-as-stabil...

Pakistan, often in the headlines for terrorism, coups and poverty, has developed something else in recent years: a burgeoning middle class that is fueling economic growth and bolstering a fragile democracy.

The transformation is evident in Jamil Abbas, a tailor of women’s clothing whose 15 years of work has paid off with two children in private school and small luxuries like a refrigerator and a washing machine.

For companies like the Swiss food maker Nestlé SA, such hungry consumers signal a sea-change.

“Pakistan is entering the hot zone,” said Bruno Olierhoek, Nestlé’s CEO for Pakistan, saying the country appears to be at a tipping point of exploding demand. Nestlé’s sales in Pakistan have doubled in the past five years to $1 billion.

Although often overshadowed by giant neighbors India and China, Pakistan is the sixth most-populated country, with 200 million people. And now, major progress in the country’s security, economic and political environments have helped create the stability for a thriving middle class.

An unpublished study last year that measured living standards, from Pakistani market research firm Aftab Associates, found that 38% of the country is middle class, while a further 4% is upper class. That’s a combined 84 million people—roughly equivalent to the entire populations of Germany or Turkey.

Such households are likely to have a motorcycle, color TV, refrigerator, washing machine and at least one member who has completed school up to the age of 16, the study found. Official figures show that the proportion of households that own a motorcycle soared to 34% in 2014 from 4% in 1991, and a washing machine to 47% from 13% over that same period. These trends are also attracting international business.

In December, Royal FrieslandCampina NV, a Dutch dairy company, paid $461 million to buy control of Engro Foods, a Pakistani packaged milk producer in a country where most milk is sold unpasteurized from open milk containers.

“What we see is consumer spending is rising and a middle class coming up,” said Hans Laarakker, Engro’s new chief executive.

Late last year, China’s Shanghai Electric Power agreed to pay $1.8 billion for a majority of Karachi’s electric supply company; Turkish electrical appliance maker Arçelik paid $258 million for a Pakistani appliance maker, Dawlance, saying Pakistan has an “increasingly prosperous working and middle class”; and French car maker Renault SA said it was seeking to set up a plant in Pakistan.

Meanwhile, during the past three years, deaths from terrorist attacks have fallen by two-thirds, as the army battles jihadists. Economic growth reached an eight-year high of nearly 5% in the past financial year, and China has begun a multibillion-dollar infrastructure investment program. The Karachi stock market rose 46% last year and continues to soar.

------

In the developing world, the ability to purchase durable goods such as motorcycles—which itself can lead to new opportunities in employment, education and leisure—is generally viewed as an indicator of a middle class lifestyle. Motorcycle purchases soared in Pakistan to 2 million a year now from 95,000 in 2000, leading Honda Motor Co. to double its production capacity there. Buyers of Honda’s cheapest motorcycle typically earn between just $200 and $300 a month, which would put them well below the poverty line in the West, but here that gives them disposable income.

“All these big companies globally, if they’re not looking at Pakistan, need to look at Pakistan, because it’s a huge consumption economy emerging,” said Saquib Shirazi, chief executive of Honda’s Pakistan joint venture.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistan to Explore Legalization of Cryptocurrency

Islamabad is establishing the Pakistan Crypto Council (PCC) to look into regulating and legalizing the use of cryptocurrencies, according to media reports. Cryptocurrency refers to digital currencies that can be used to make purchases or investments using encryption algorithms. US President Donald Trump's endorsement of cryptocurrencies and creation of a "bitcoin reserve" has boosted investors’…

ContinuePosted by Riaz Haq on March 28, 2025 at 8:30pm — 2 Comments

World Happiness Report 2025: Poor Ranking Makes Indians Very Unhappy

Pakistan has outranked India yet again on the World Happiness Index, making Indians very very unhappy. Indian media commentators' strong negative emotional reaction to their nation's poor ranking betrays how unhappy they are even as they insist they are happier than their neighbors. Coming from the privileged upper castes, these commentators call the report "…

ContinuePosted by Riaz Haq on March 22, 2025 at 10:30am — 7 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network