PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Fiscal Year 2022 GDP Reaches $1.62 Trillion in Purchasing Power Parity (PPP) Terms

Economic Survey of Pakistan 2021-22 confirms that the nation's GDP grew nearly 6% in the current fiscal year, reaching $1.62 Trillion in terms of purchasing power parity (PPP). It first crossed the trillion dollar mark in 2017. In nominal US$ terms, the size of Pakistan's economy is now $383 billion. In terms of the impact of economic growth on average Pakistanis, the per capita average daily calorie intake jumped to 2,735 calories in FY 2021-22 from 2,457 calories in 2019-20. Pakistan experienced broad-based economic growth across all key sectors in FY 21-22; manufacturing posted 9.8% growth, services 6.2% and agriculture 4.4%. The 4.4% growth in agriculture is particularly welcome; it helps reduce rural poverty. The country's per capita income is $1,798 in nominal terms and $7,551 in PPP dollars. These figures do not yet show up in Google searches. Under former Prime Minister Imran Khan's leadership, Pakistan succeeded in achieving outstanding economic growth and nutritional improvements in spite of surging global food prices amid the Covid19 pandemic. Increasing energy consumption and soaring global energy prices have rapidly depleted Pakistan's forex reserves, forcing the country to seek yet another IMF bailout. History tells us that these bailouts have been forced whenever Pakistan's GDP growth has exceeded 5%. The best way for Pakistan to accelerate its growth beyond 5% in a sustainable manner is to boost its exports by investing in export-oriented industries, and by incentivizing higher savings and investments.

|

| Pakistan Economic Data. Source: IMF April 2022 |

The IMF (International Monetary Fund) has updated its website in April, 2022 with data reported for FY 2020-21. It's not unusual for the IMF data reporting to lag by a year or more. Pakistan's Economic Survey 2021-22 was published in June, 2022.

|

| Sector-wise Economic Growth. Source: Economic Survey of Pakistan 20... |

Pakistan experienced broad-based economic growth across all key sectors in FY 21-22; manufacturing posted 9.8% growth, services 6.2% and agriculture 4.4%. The 4.4% growth in agriculture is particularly welcome; it helps reduce rural poverty.

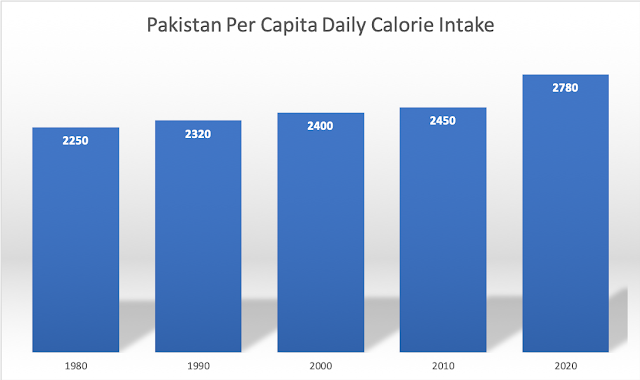

In terms of the impact of economic growth on average Pakistanis, the per capita average daily calorie intake jumped to 2,735 calories in FY 2021-22 from 2,457 calories in 2019-20. The biggest contributor to it is the per capita consumption of fresh fruits and vegetables which soared from 53.6 Kg to 68.3 Kg, less than half of the 144 Kg (400 grams/day) recommended by the World Health Organization. Healthy food helps cut disease burdens and reduces demand on the healthcare system. Under former Prime Minister Imran Khan's leadership, Pakistan succeeded in achieving these nutritional improvements in spite of surging global food prices amid the Covid19 pandemic.

|

| Pakistan Per Capita Daily Calorie Consumption. Source: Economic Surveys of Pakistan |

The trend of higher per capita daily calorie consumption has continued since the 1950s. It has risen from about 2,078 in 1949-50 to 2,400 in 2001-02 and 2735 in 2021-22. The per capita per day protein intake in grams increased from 63 to 67 to about 75 during these years. Health experts recommend that women consume at least 1,200 calories a day, and men consume at least 1,500 calories a day, says Harvard Health Publishing. The global average has increased from 2360 kcal/person/day in the mid-1960s to 2900 kcal/person/day currently, according to the Food and Agricultural Organization (FAO). The USDA (United States Department of Agriculture) estimates that most women need 1,600 to 2,400 calories, while the majority of men need 2,000 to 3,000 calories each day to maintain a healthy weight. Global Hunger Index defines food deprivation, or undernourishment, as consumption of fewer than 1,800 calories per day.

|

| Share of Overweight or Obese Adults. Source: Our World in Data |

The share of overweight or obese adults in Pakistan's population is estimated by the World Health Organization at 28.4%. It is 20% in Bangladesh, 19.7% in India, 32.3% in China, 61.6% in Iran and 68% in the United States.

|

| Major Food Items Consumed in Pakistan. Source: Economic Survey of P... |

The latest edition of the Economic Survey of Pakistan estimates that per capita calories come from the annual per capita consumption of 164.7 Kg of cereals, 7.3 Kg of pulses (daal), 28.3 Kg of sugar, 168.8 liters of milk, 22.5 Kg of meat, 2.9 Kg of fish, 8.1 dozen eggs, 14.5 Kg of ghee (cooking oil) and 68.3 Kg of fruits and vegetables. Pakistan's economy grew 5.97% and agriculture outputs increased a record 4.4% in FY 2021-22, according to the Economic Survey. The 4.4% growth in agriculture has boosted consumption and supported Pakistan's rural economy.

The minimum recommended food basket in Pakistan is made up of basic food items (cereals, pulses, fruits, vegetables, meat, milk, edible oils and sugar) to provide 2150 kcal and 60gram protein/day per capita.

The state of Pakistan's social sector is not as dire as the headlines suggest. There are good reasons for optimism. Key indicators show that nutrition and health in Pakistan are improving but such improvements need to be accelerated.

South Asia Investor Review

Pakistan's Expected Demographic Dividend

Pakistan's Social Sector

World Bank: Pakistan Reduced Poverty, Grew Economy During Covid19 P...

Surging Global Food Prices Amid Covid Pandemic

Pakistan's Balance of Payments Crisis

Panama Leaks in Pakistan

Olive Revolution in Pakistan"

Nay Pakistan Sehat Card: A Giant Step Toward Universal Healthcare

Prime Minister Imran Khan's Effectiveness as Crisis Leader

India in Crisis: Unemployment and Hunger Persists After Waves of Covid

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on July 25, 2022 at 10:06am

-

Global Markets: Rice – Pakistan Export Forecast Rises to Record While Importing More Wheat

https://agfax.com/2022/07/16/global-markets-rice-pakistan-export-fo...

2021/22 Pakistan rice exports are forecast up 450,000 tons to 4.8 million, almost 30 percent higher than the previous year. Favorable export conditions are expected to continue as large stocks, competitive export prices, and strong demand from key markets are expected to spur exports further to 4.9 million tons in 2022/23.

Pakistan retains ample supplies following two consecutive record crops, despite hot and dry conditions delaying the 2022 May/June planting season. The Pakistan Meteorological Department forecasts ample monsoon rains which are expected to be beneficial for this season’s harvest.

In addition to favorable weather and market conditions, abundant supplies, and the devaluation of the Pakistani rupee have kept its prices globally competitive. Over the past year, Pakistani rice prices have closely mirrored Indian prices, which have been extremely low for almost 2 years; however, strong export demand has caused Pakistani quotes to spike in recent weeks.

Pakistan’s top export markets include a diverse group of countries to which it exports different rice varieties, including fragrant long-grain basmati, regular milled, and broken rice. In recent years, Pakistan has emerged as a major supplier to China, the world’s largest rice importing and consuming country.

In fact, in the first few months of 2022, Pakistan exported more rice to China than Vietnam, the historic top supplier. Pakistan exports both milled rice and broken rice to China, the latter primarily used in feed. Pakistan also exports competitively priced milled rice to East Africa – particularly Kenya, Mozambique, and Tanzania – and neighboring countries in Central Asia, mainly Afghanistan.

Pakistan is also a producer and exporter of basmati rice, a premium product known for its aromatic qualities. Demand for basmati rice has grown in recent years, especially in the European Union and the Middle East. While still facing stiff competition from India, the top global basmati exporter, Pakistan is a significant basmati supplier to the European Union, the United Arab Emirates, Saudi Arabia, and the United Kingdom.

Rice is an important food in Pakistan; however, wheat is the principal grain consumed domestically. Unfortunately, the same hot and dry planting conditions that delayed planting of the 2022 rice crop in Punjab and Sindh provinces have adversely affected Pakistan’s wheat production.

This month, Pakistan’s 2022/23 wheat import forecast has been raised 500,000 tons to 2.5 million as the government has aggressively procured international and domestic wheat. Historically, the government intervenes heavily in wheat production, marketing, and trade to ensure sufficient supplies of a commodity critical to food security.

-

Comment by Riaz Haq on July 25, 2022 at 11:17am

-

The ongoing global energy crisis has left countries scrambling for fuel. As wealthy buyers of liquefied natural gas (LNG) offer top dollar for every available cargo, Pakistan faces dire fuel and power shortages with little end in sight.

https://ieefa.org/resources/ieefa-finding-right-way-forward-pakista...

There will be no easy way forward. Reversing Pakistan’s dependence on imported fossil fuels by accelerating the shift to low-cost domestic renewable energy sources will be crucial for energy security and economic growth. In the meantime, Pakistan needs a coherent LNG procurement strategy that avoids locking in high prices for upcoming decades.

Ripple effects of low LNG supply

In the aftermath of Russia’s invasion of Ukraine, Europe is buying significantly more volumes of LNG to cut its dependence on Russian gas. But with almost no spare global LNG supply capacity, European buyers have pulled existing cargoes away from developing nations by offering higher prices.

Pakistan is suffering the consequences. In July, state-owned Pakistan LNG Limited (PLL) issued a tender to buy ten cargoes of LNG through September but did not receive a single bid.

This is the fourth straight tender that went unawarded. In a previous tender, PLL received only one bid from Qatar Energy at a price of US$39.80 per million British thermal unit (MMBtu). At this price, a single cargo would cost over US$131 million, but the government rejected the offer to conserve its dwindling foreign exchange reserves.

The effects have been disastrous. Power cuts are crippling household and commercial activities, while gas rationing to the textile sector has resulted in a loss of US$1 billion in export orders. Despite energy conservation efforts, many areas continue to experience load shedding of up to 14 hours, as the generation shortfall reached 8 gigawatts (GW).

LNG procurement: spot purchases vs. long-term contracts?

Some countries are shielded from extreme LNG price spikes by long-term purchase contracts. But Pakistan sources roughly half of its LNG from spot markets, increasing the country’s exposure to global price volatility.

To mitigate the situation , Pakistan has expressed openness to signing new long-term contracts, with one official claiming the country would go for an unusually long 30-year contract. The contracts will most likely be signed with Qatar and United Arab Emirates.

However, Pakistan’s experience with long-term contracts has been problematic. Term suppliers had defaulted at least 12 times over the past 11 months, most recently in July when Pakistan desperately needed fuel.

Long-term contracts—which are typically tied to a ‘slope’ or a percentage of the Brent crude oil price—are reportedly 75% more expensive than one year ago. If Pakistan signed a deal now with a 16-18% slope, and assuming current Brent crude prices of US$100, a single cargo would cost roughly US$55-61 million. At the 11-13% slope of Pakistan’s current contracts, meanwhile, a cargo would cost US$37.5-44.3 million. Although Brent crude prices will vary, it is clear that Pakistan would risk locking in higher prices by signing new long-term contracts in the current LNG environment.

Moreover, with limited global LNG supply, long-term contracts would likely not start until 2026, when significant new global supply capacity is expected online. Pakistan’s LNG needs are more immediate.

Rather than lock in high prices for the long-term, buyers in Pakistan can consider signing shorter five-year contracts with portfolio players. Industry representatives have suggested there is space in the market for shorter contracts. Although shorter terms typically come at a price premium, they may temporarily help alleviate Pakistan’s exposure to extreme spot market volatility.

-

Comment by Riaz Haq on July 25, 2022 at 11:18am

-

The ongoing global energy crisis has left countries scrambling for fuel. As wealthy buyers of liquefied natural gas (LNG) offer top dollar for every available cargo, Pakistan faces dire fuel and power shortages with little end in sight.

https://ieefa.org/resources/ieefa-finding-right-way-forward-pakista...

Short-term contracts have to carry higher penalties in instances of non-delivery to avoid repeated supplier defaults. Coupled with the existing long-term contracts and spot purchases, short-term contracts would diversify the country’s supply portfolio, potentially allowing better price management, supply security, and flexibility.

Permanent shift away from LNG

In the longer term, cutting Pakistan’s dependence on imported fossil fuels altogether is the most affordable solution. Low-cost, domestic renewables like wind and solar can prove to be a crucial hedging mechanism against high, US dollar-denominated fossil fuel prices.

The government is beginning to recognize the unreliability and unaffordability of LNG compared to domestic renewables. Policymakers recently indicated that they would announce a new solar policy geared towards reducing LNG dependence, reducing high energy costs, and improving energy security.

Under the policy, due out August 1, 7-10 GW of residential solar systems would be deployed by the summer of 2023. In addition, the policy would allow the installation of seven utility-scale solar plants at the sites of existing thermal power plants.

This is a major step in the right direction, one that will help reduce gas and LNG demand in the power sector. We also identified other measures in a recent IEEFA report to limit LNG demand, such as reforming gas distribution company revenue regulations to reduce gas leakage, along with energy efficiency incentives.

Ultimately, there will be no one-size-fits-all solution to the current energy crisis, but a portfolio of short to long-term plans is necessary to mitigate Pakistan’s unsustainable reliance on LNG imports.

-

Comment by Riaz Haq on July 26, 2022 at 4:20pm

-

Pakistan’s financing worries are ‘overblown’ insists central bank governor

Murtaza Syed rejects comparisons with Sri Lanka and anticipates IMF funding tranche in August

https://www.ft.com/content/ba25a90c-e319-470b-9b74-27eda1c4f291

Pakistan’s central bank governor has rejected market concerns about Islamabad’s worsening liquidity crunch as “overblown” and said he expected the IMF to sign off on $1.3bn of new funding for the cash-strapped Asian country in August.

Murtaza Syed also told the Financial Times that Pakistan was engaged in talks with Middle Eastern countries, such as Saudi Arabia, as well as China “to get a little bit of the extra money that we need” as it contends with rising commodity prices, falling foreign exchange reserves and a depreciating currency.

“On the external debt servicing side, the next 12 months — while they look challenging — are not as dire as I think some people make them out to be,” Syed said. “Especially as we have the cover of the IMF programme during what is going to be a very difficult 12 months globally.”

Sri Lanka’s default on its foreign debt in May has stoked fears over the risk of defaults in other emerging economies.

The Pakistani rupee lost more than 7 per cent of its value against the US dollar last week, the steepest weekly drop since 1998, after a regional poll victory for Imran Khan, who was ousted as prime minister just a few months ago.

Pakistan’s widening current account deficit has drained its foreign exchange reserves, which have fallen by $7bn since February to just over $9bn in July, Syed said, equivalent to a month and a half of imports.

Fitch Ratings revised its outlook for the country to negative from stable last week because of what it called “significant deterioration in Pakistan’s external liquidity position and financing conditions since early 2022”.

However, Syed, who worked for the IMF for 16 years, said Pakistan’s debt vulnerability could not be compared with Sri Lanka’s problems. “Those fears are overblown and in fact, Pakistan is not in that very bad category of countries,” he said.

Unlike Sri Lanka’s tourism-reliant economy, he said, Pakistan “had a pretty good Covid”, with a milder economic contraction and stronger recovery than its smaller neighbour.

While Sri Lanka owes about 40 per cent of its debt to commercial lenders, most of Pakistan’s debt is owed to multilateral institutions and bilateral lenders, he added.

“We have external financing needs of about $34bn in the next 12 months and we have financing already identified because of the IMF programme of over $35bn,” he said. “So we are over-financed, actually.”

Syed said that he expected the next $1.3bn IMF disbursement from its $7bn facility to be approved in August, though this might be complicated by summer holidays. “We are trying to push for it sooner rather than later,” he said.

Khan’s upset victory last week in Punjab, the country’s largest province, has raised the likelihood of an early election that could unseat Shehbaz Sharif’s government.

However, Syed said that his “strong baseline” was that the Sharif government would remain in power. Even in the “hypothetical” event of an early election, he added, the IMF had a history of proceeding with programmes with caretaker governments.

“I think there is wide recognition across the political spectrum that the next 12 months are going to be hard for emerging markets and are going to be hard for Pakistan, too,” he said.

-

Comment by Riaz Haq on July 27, 2022 at 8:32am

-

Arif Habib Limited

@ArifHabibLtd

Current Account Balance FY22

CAB: $ -17.4bn (+6.2x YoY)

Remittances: $31.2bn (+6% YoY)

Total imports: $84.2bn (+34% YoY)

Total exports: $39.4bn (+25% YoY)

https://twitter.com/ArifHabibLtd/status/1552313401535242246?s=20&am...

-----------------

SBP

@StateBank_Pak

1/2 As foreshadowed by earlier PBS data, a surge in oil imports saw CAD rise to $2.3bn in Jun despite higher exports & remittances. So far in Jul oil imports are much lower & deficit is expected to resume its moderating trajectory. Visit #EasyData https://bit.ly/3Ox6ZwI

https://twitter.com/StateBank_Pak/status/1552280965606768641?s=20&a...

--------------

SBP

@StateBank_Pak

2/2 3.3mn metric tons of oil was imported in Jun, 33% higher than in May. Together with higher global prices, this more than doubled the oil import bill from $1.4bn to $2.9bn. By contrast, non-oil imports ticked down. See report: https://sbp.org.pk/ecodata/Balancepayment_BPM6.pdf

https://twitter.com/StateBank_Pak/status/1552280968391712768?s=20&a...

-

Comment by Riaz Haq on July 27, 2022 at 10:11am

-

Arif Habib Limited

@ArifHabibLtd

CAD clocked in at 4.6% of GDP during FY22; last 10 years average 2.5%https://twitter.com/ArifHabibLtd/status/1552316041367375872?s=20&am...

-

Comment by Riaz Haq on July 28, 2022 at 8:00am

-

Pakistan may be able to avoid a full-blown economic crisis

But only if everything goes right

https://www.economist.com/asia/2022/07/28/pakistan-may-be-able-to-a...

On the list of unfortunate economies that markets think might soon follow Sri Lanka into debt default and economic crisis, Pakistan sits near the top. It relies heavily on imported food and energy. As commodity prices have soared, its current-account balance has widened and hard currency has drained away. In the past year, Pakistan’s foreign-exchange reserves have shrunk by more than half, to just over $9bn, about six weeks’ worth of imports. Its currency, the rupee, has lost 24% of its value against the dollar in 2022. Many reckon that a crisis is inevitable.

Not Murtaza Syed. A former employee of the International Monetary Fund (imf) now serving as acting head of Pakistan’s central bank, Mr Syed believes the country is well equipped to survive its current troubles. It is thanks only to lazy markets’ unwillingness to take a nuanced view of individual countries’ circumstances that Pakistan finds itself lumped in with other, more endangered economies.

Mr Syed has something of a point. At 74% of gdp, Pakistan’s public-debt load is high for a poor country, but below the level of many other vulnerable economies. Importantly, it owes much less to foreigners, and does not rely very heavily on bond markets. Pakistan’s funding problems mostly stem from bad timing; it owes a lot to external creditors over the next year, at a time when global financial conditions are deteriorating and the cost of imports is spiking. If it can survive this pinch point, Mr Syed reckons, things will look up.

Hopes for survival received a big boost on July 13th, when the government concluded an agreement with the imf to revive a pre-existing bail-out arrangement, clearing the way for about $1.2bn to flow in. With that money, Pakistan just about has the financing to meet an estimated $35bn in external obligations over the next year. Crucially, the imf’s renewed involvement should dissuade big creditors (including China) from demanding immediate repayment; rolling over those debts would meet nearly a third of Pakistan’s funding needs. The agreement might also convince markets that they have underestimated Pakistan’s financial health.

The problem with this plan is that it leaves little margin for error. Pakistan’s current-account deficit, which mostly reflects that more is being spent on imports than foreigners are spending on Pakistan’s exports, is responsible for a huge share (about a third) of its projected financing needs over the coming year. If in the coming months that deficit turns out to be larger than anticipated then the sums no longer add up. Weak inflows of capital, because of reduced investment or remittances, could also upset the delicate balance. Maintaining market confidence will be crucial. imf reports on the economy may well help in this regard, particularly if the new government shows that it is making progress towards its ambitious goals for trimming its budget deficit, which last year stood at 6% of gdp. But establishing that credibility will take time.

And time may not be on Pakistan’s side. As the troubles of the emerging world grow, markets are showing signs of becoming less discriminating, not more. This pervading gloom may help explain why Mr Syed has gone on a public-relations offensive. Yet in these conditions, markets do not seem especially inclined to listen. ■

-

Comment by Riaz Haq on July 31, 2022 at 6:57pm

-

Pakistan July Imports Decline Amid Efforts to Bridge Trade Gap

ByRajesh Kumar Singh

https://www.bloomberg.com/news/articles/2022-07-31/pakistan-july-im...

The value of Pakistan’s imports in July declined to $5 billion from $7.7 billion last month, reflecting the government’s efforts to stem the country’s “large” current account gap, Finance Minister Miftah Ismail said.

The federal government is “determined to minimise the large current account deficit” left behind by its predecessor, the minister said in a Twitter post. Ismail didn’t provide an update on exports, although he had said earlier this week that July imports will be lower than the value of exports and remittances from other countries.

South Asian economies, including Pakistan -- heavily reliant on energy imports -- have been roiled by soaring prices of crude oil, natural gas and coal following Russia’s invasion of Ukraine. Pakistan is seeking help from the International Monetary Fund to avoid a default and stave off fears of a protracted economic crisis like the one being witnessed in Sri Lanka.

Pakistan’s Rupee Has Worst Month Ever Amid IMF Loan Concern

A delay in an IMF bailout tranche and a shortage of dollars has pushed the rupee to record lows. The currency fell more than 14% against the dollar in July, ending Friday’s trading at 239 per greenback, the biggest monthly slide since Bloomberg started compiling data in 1989. It’s among the worst currency decliners globally for the month.

The pressure on the currency is expected to drop in the next two weeks, Ismail said separately in a news conference in Islamabad.

-

Comment by Riaz Haq on August 1, 2022 at 8:07am

-

FRIM Ventures

@FRIMVentures

These tables show Pakistan’s debt profile portrays a very low likelihood of default. Maturity of external debt is mere $1.4bn for under one year (just 1.4% of total FX debt). (1/2)

https://twitter.com/FRIMVentures/status/1554009897443942401?s=20&am...

-----------------

FRIM Ventures

@FRIMVentures

Eurobonds contribute just 3% to public debt and total external financing requirements stand at just 9% of GDP and 36% of total debt (2/2)

https://twitter.com/FRIMVentures/status/1554009902753914881?s=20&am...

---------

FRIM Ventures

@FRIMVentures

*external financing requirement is 9% of GDP and external debt is 36% of total debt

https://twitter.com/FRIMVentures/status/1554027948193234944?s=20&am...

-

Comment by Riaz Haq on August 5, 2022 at 7:47am

-

#India, #SriLanka, #Pakistan #debt woes evoke memories of 1997 #Asian currency crisis. Back then, #Thailand’s devaluation led to a #global #market collapse. A sequel might be in the works. #PKR #INR #inflation #economy #rupee https://www.bloomberg.com/news/articles/2022-08-03/india-sri-lanka-...

Pakistan is scrambling for a bailout to avert a debt default as its currency plummets. Bangladesh has sought a preemptive loan from the International Monetary Fund. Sri Lanka has defaulted on its sovereign debt and its government has collapsed. Even India has seen the rupee plunge to all-time lows as its trade deficit balloons.

Economic and political turbulence is rattling South Asia this summer, drawing chilling comparisons to the turmoil that engulfed neighbors to the east a quarter century ago in what became known as the Asian Financial Crisis.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pak-Saudi Joint Defense: Is Pakistan A Major Power or Bit Player in the Middle East?

The recently signed “Strategic Mutual Defense Agreement” between Saudi Arabia and Pakistan states that “any aggression against either country will be considered an aggression against both”. It is being seen by some geopolitical analysts as the beginning of an "Islamic NATO". Others, such as Indian-American analyst Shadanand Dhume, have dismissed Pakistan as no more than a "bit player"…

ContinuePosted by Riaz Haq on September 27, 2025 at 5:30pm — 7 Comments

Silicon Valley Pakistani-Americans Among Top Donors to Mamdani Campaign

Omer Hasan and Mohammad Javed are the top donors to Zohran Mamdani’s mayoral campaign in New York City, according to media reports. Both are former executives of Silicon Valley technology firm AppLovin. Born and raised in Silicon Valley, Omer is the son of a Pakistani-American couple who are long-time residents of Silicon Valley, California. …

ContinuePosted by Riaz Haq on September 19, 2025 at 9:00am

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network