PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Fiscal Year 2022 GDP Reaches $1.62 Trillion in Purchasing Power Parity (PPP) Terms

Economic Survey of Pakistan 2021-22 confirms that the nation's GDP grew nearly 6% in the current fiscal year, reaching $1.62 Trillion in terms of purchasing power parity (PPP). It first crossed the trillion dollar mark in 2017. In nominal US$ terms, the size of Pakistan's economy is now $383 billion. In terms of the impact of economic growth on average Pakistanis, the per capita average daily calorie intake jumped to 2,735 calories in FY 2021-22 from 2,457 calories in 2019-20. Pakistan experienced broad-based economic growth across all key sectors in FY 21-22; manufacturing posted 9.8% growth, services 6.2% and agriculture 4.4%. The 4.4% growth in agriculture is particularly welcome; it helps reduce rural poverty. The country's per capita income is $1,798 in nominal terms and $7,551 in PPP dollars. These figures do not yet show up in Google searches. Under former Prime Minister Imran Khan's leadership, Pakistan succeeded in achieving outstanding economic growth and nutritional improvements in spite of surging global food prices amid the Covid19 pandemic. Increasing energy consumption and soaring global energy prices have rapidly depleted Pakistan's forex reserves, forcing the country to seek yet another IMF bailout. History tells us that these bailouts have been forced whenever Pakistan's GDP growth has exceeded 5%. The best way for Pakistan to accelerate its growth beyond 5% in a sustainable manner is to boost its exports by investing in export-oriented industries, and by incentivizing higher savings and investments.

|

| Pakistan Economic Data. Source: IMF April 2022 |

The IMF (International Monetary Fund) has updated its website in April, 2022 with data reported for FY 2020-21. It's not unusual for the IMF data reporting to lag by a year or more. Pakistan's Economic Survey 2021-22 was published in June, 2022.

|

| Sector-wise Economic Growth. Source: Economic Survey of Pakistan 20... |

Pakistan experienced broad-based economic growth across all key sectors in FY 21-22; manufacturing posted 9.8% growth, services 6.2% and agriculture 4.4%. The 4.4% growth in agriculture is particularly welcome; it helps reduce rural poverty.

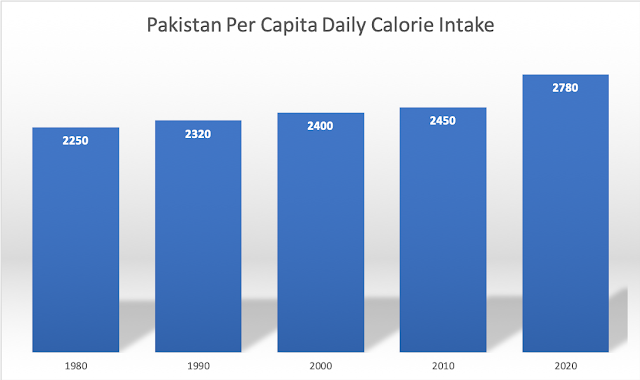

In terms of the impact of economic growth on average Pakistanis, the per capita average daily calorie intake jumped to 2,735 calories in FY 2021-22 from 2,457 calories in 2019-20. The biggest contributor to it is the per capita consumption of fresh fruits and vegetables which soared from 53.6 Kg to 68.3 Kg, less than half of the 144 Kg (400 grams/day) recommended by the World Health Organization. Healthy food helps cut disease burdens and reduces demand on the healthcare system. Under former Prime Minister Imran Khan's leadership, Pakistan succeeded in achieving these nutritional improvements in spite of surging global food prices amid the Covid19 pandemic.

|

| Pakistan Per Capita Daily Calorie Consumption. Source: Economic Surveys of Pakistan |

The trend of higher per capita daily calorie consumption has continued since the 1950s. It has risen from about 2,078 in 1949-50 to 2,400 in 2001-02 and 2735 in 2021-22. The per capita per day protein intake in grams increased from 63 to 67 to about 75 during these years. Health experts recommend that women consume at least 1,200 calories a day, and men consume at least 1,500 calories a day, says Harvard Health Publishing. The global average has increased from 2360 kcal/person/day in the mid-1960s to 2900 kcal/person/day currently, according to the Food and Agricultural Organization (FAO). The USDA (United States Department of Agriculture) estimates that most women need 1,600 to 2,400 calories, while the majority of men need 2,000 to 3,000 calories each day to maintain a healthy weight. Global Hunger Index defines food deprivation, or undernourishment, as consumption of fewer than 1,800 calories per day.

|

| Share of Overweight or Obese Adults. Source: Our World in Data |

The share of overweight or obese adults in Pakistan's population is estimated by the World Health Organization at 28.4%. It is 20% in Bangladesh, 19.7% in India, 32.3% in China, 61.6% in Iran and 68% in the United States.

|

| Major Food Items Consumed in Pakistan. Source: Economic Survey of P... |

The latest edition of the Economic Survey of Pakistan estimates that per capita calories come from the annual per capita consumption of 164.7 Kg of cereals, 7.3 Kg of pulses (daal), 28.3 Kg of sugar, 168.8 liters of milk, 22.5 Kg of meat, 2.9 Kg of fish, 8.1 dozen eggs, 14.5 Kg of ghee (cooking oil) and 68.3 Kg of fruits and vegetables. Pakistan's economy grew 5.97% and agriculture outputs increased a record 4.4% in FY 2021-22, according to the Economic Survey. The 4.4% growth in agriculture has boosted consumption and supported Pakistan's rural economy.

The minimum recommended food basket in Pakistan is made up of basic food items (cereals, pulses, fruits, vegetables, meat, milk, edible oils and sugar) to provide 2150 kcal and 60gram protein/day per capita.

The state of Pakistan's social sector is not as dire as the headlines suggest. There are good reasons for optimism. Key indicators show that nutrition and health in Pakistan are improving but such improvements need to be accelerated.

South Asia Investor Review

Pakistan's Expected Demographic Dividend

Pakistan's Social Sector

World Bank: Pakistan Reduced Poverty, Grew Economy During Covid19 P...

Surging Global Food Prices Amid Covid Pandemic

Pakistan's Balance of Payments Crisis

Panama Leaks in Pakistan

Olive Revolution in Pakistan"

Nay Pakistan Sehat Card: A Giant Step Toward Universal Healthcare

Prime Minister Imran Khan's Effectiveness as Crisis Leader

India in Crisis: Unemployment and Hunger Persists After Waves of Covid

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on June 30, 2022 at 1:47pm

-

Economic Survey of Pakistan 2021-22: Manufacturing

https://www.finance.gov.pk/survey/chapter_22/PES03-MANUFACTURING.pdf

Table 3.8: Production of Automobiles

Category Installed Capacity No. of Units 2020-21(July-March) 2021-22(July-March) %Change

CAR 341,000 106,439 166,768 56.7

LCV/JEEPS/SUV/Pickup 52,000 22,512 32,341 43.7

BUS 5,000 445 459 3.1

TRUCK 28,500 2,509 4,445 77.2

TRACTOR 100,000 36,900 41,872 13.5

2/3 WHEELERS 2,500,000 1,439,535 1,388,669 -3.5

Source: Pakistan Automotive Manufacturer Association (PAMA)

----------------

Table-3.2: Production of selected industrial items of Large-Scale Manufacturing

S# Items Unit Weights July-March % Change % Point Contribution 2020-21 2021-22

1 Deepfreezers (Nos.) 0.167 68,947 84,205 22.13 0.04

2 Jeeps and Cars (Nos.) 2.715 114,617 177,757 55.09 1.41

3 Refrigerators (Nos.) 0.246 928,170 1,024,335 10.36 0.02

4 Upper leather (000 sq.m.) 0.398 13,324 10,966 -17.70 -0.06

5 Cement (000 tonnes) 4.650 37,619 36,543 -2.86 -0.21

6 Liquids/syrups (000 Litres) 1.617 86,212 144,638 67.77 1.30

7 Phos. fertilizers (N tonnes) 0.501 545,612 601,184 10.19 0.06

8 Tablets (000 Nos.) 2.725 20,380,940 14,695,108 -27.90 -0.85

9 Cooking oil (tonnes) 1.476 334,107 370,181 10.80 0.21

10 Nit. fertilizers (N tonnes) 3.429 2,450,066 2,505,757 2.27 0.09

11 Cotton cloth (000 sq.m.) 7.294 786,042 788,285 0.29 0.02

12 Vegetable ghee (tonnes) 1.375 1,087,827 1,060,111 -2.55 -0.05

13 Cotton yarn (tonnes) 8.882 2,577,675 2,594,690 0.66 0.07

14 Sugar (tonnes) 3.427 5,618,976 7,759,825 38.10 2.13

15 Tea blended (tonnes) 0.485 100,566 112,544 11.91 0.06

16 Petroleum Products* (000 Litres) 6.658 - - 2.10 0.01

17 Cigarettes (million No) 2.072 39,473 46,070

-

Comment by Riaz Haq on June 30, 2022 at 4:16pm

-

Shahbaz Rana

@81ShahbazRana

For the first time in recent history, FBR has surpassed its upward revised annual target. It has so far collected over Rs6110 billion. Collection is even better than what the FBR and Finance Ministry had hoped.https://twitter.com/81ShahbazRana/status/1542495557624659969?s=20&a...

-

Comment by Riaz Haq on July 1, 2022 at 10:02am

-

WB warns Pakistan of macroeconomic instability: Report

https://profit.pakistantoday.com.pk/2022/07/01/wb-warns-pakistan-of...

The report also stated that Pakistan’s real GDP per capita growth has been low at around 2 percent Since 2000 which is almost 2.7 percentage points lower than the South Asian average.On the other hand, the real GDP per capita growth of India and Bangladesh during the same time remained 5.2 percent and 4.8 percent respectively.

In addition the report also stated that exports and investment demand added on average 1.4 percentage points to aggregate demand growth from 1999 to 2009/10. This contribution fell to an average of 0.7 percentage points since 2010.

Low growth contributions of investment and exports are associated with productivity stagnation, the report further stated that an average worker in Pakistan in 2018 produced only 38.1 percent more output than in 1991, while one from Vietnam produced 257.6 percent more than in 1991.

The report states that evidence for publicly listed firms shows that firm’s average productivity between 2012 and 2017 has only increased slightly (and has been mildly falling since 2015).

Many firms are not investing enough even to replace their depreciation, “Though exporters invest more than domestic-oriented firms and foreign-owned firms invest more than domestic-owned firms”, the report added.

Pakistani exporters accounted for 0.15 percent of global exports in 2005, in 2019 they accounted for only 0.12 percent and this is suggestive of relative productivity stagnation, and of relatively low scope for future productivity growth.

The report stated that there is a need to focus on unlocking productivity-led growth through better allocation of talent and resources however technology could play a key role in reducing barriers that women face in accessing education and work opportunities.

----------

Pakistan - Country Economic Memorandum 2.0 (English)

Pakistan’s growth has been stunted by the inability to mobilize all of its talent and resources, and to allocate them to productive uses. The country’s growth prospects are directly associated with the ability of its firms to grow large and productive over time, so that they create good quality job opportunities for the increasing working age population.https://documents.worldbank.org/en/publication/documents-reports/do...(English)&text=to%20productive%20uses.-,The%20country's%20growth%20prospects%20are%20directly%20associated%20with%20the%20ability,the%20increasing%20working%20age%20population.

-

Comment by Riaz Haq on July 2, 2022 at 8:33am

-

Debt crisis looms for developing countries amid 'perfect storm'. #SriLanka has already defaulted on its debt, many others are on the brink. #Pakistan, #Argentina among developing nations facing high #debt #default risk. https://p.dw.com/p/4DB1y?maca=en-Twitter-sharing

https://twitter.com/haqsmusings/status/1543254966843760640?s=20&...

When Ghana lost access to international credit markets late last year, it was a foreboding of the debt troubles that awaited the developing world. The battle against COVID-19 has left governments vulnerable, saddling them with massive debts they took to soften the economic blow from the pandemic.

However now, with major central banks raising interest rates, those debts may become difficult to service.

Sri Lanka defaulted on its debt just weeks ago and Pakistan is struggling to avoid a similar predicament. In fact, more than half of low-income countries are currently at high risk of debt distress or already in debt distress, according to the World Bank.

On Sunday, Russia defaulted on its foreign-currency debt. But in this case, the reason was not a lack of reserves. Rather, Western sanctions imposed on Moscow over the Ukraine war simply don't not allow creditors in the West to accept Russia's payments.

What's fueling the debt crisis in developing countries?

After the Global Financial Crisis in 2008, central banks in industrialized countries cut interest rates and made funding cheap. For global investors in the United States and Europe, this meant lower returns on investments at home.

On the other side sat governments in the Global South. They wanted to profit from ultralow interest rates in the North by luring investors with their higher-rated debt denominated in US dollars, rather than local currency.

By the end of 2019, this pile of so-called external debt rose to $5.6 trillion (€5.28 trillion) in emerging economies, a study by the Financial Stability Board found. And as a result of the global pandemic, their sovereign debt in total saw the fastest annual increase in 2020 in the past three decades.

Experts have been warning for years that once interest rates start rising in the US, paying interests on all that dollar-denominated debt would become more expensive.

Now "we have several things coming together in a perfect storm," says Lars Jensen, alluding to high food and energy prices, global economic uncertainty due to Russia's war, and rising interest rates around the world as central banks try to rein in inflation.

Jensen published a report for the United Nations Development Program (UNDP) in 2021 identifying 72 debt-vulnerable countries. Among them was Ghana which saw surging food prices drive up inflation to nearly 30% in May. The Ghanaian currency cedi has dropped 22% against the US dollar this year.

Ghana's debt woes

With the COVID-19 pandemic, the amount of debt the Ghanaian government took to finance spending increased threefold. In 2020, the government of the West African country had to use 45% of its revenue for interest payments, IMF data shows. By comparison, Germany spent just 1%.

Ghana "has been earlier borrowing money in foreign currencies and then used that money to retire expensive domestic debt in the hopes of reducing their debt servicing costs," said economist Jensen. But now, with interest rates rising abroad and its currency weakening, Ghana could see the cost of foreign currency debt rise.

In Ghana, already infrastructure projects remain unfinished and spending on hospitals is scant. Furthermore, as global food prices rise "the debt burden is creating a problem for subsidies on fertilizers," explains John Gatsi.

The professor at the University of Cape Coast's school of business told DW the looming debt crisis is making government services to the population "becoming poorer and poorer."

-

Comment by Riaz Haq on July 2, 2022 at 8:33am

-

Debt crisis looms for developing countries amid 'perfect storm'. #SriLanka has already defaulted on its debt, many others are on the brink. #Pakistan, #Argentina among developing nations facing high #debt #default risk. https://p.dw.com/p/4DB1y?maca=en-Twitter-sharing

https://twitter.com/haqsmusings/status/1543254966843760640?s=20&...

But the problem is even worse.

Private lenders dominate the current debt crisis

Unlike previous debt crises in the developing world, like in Latin America in the 1980s, the current turmoil has private lenders at the center of the turmoil.

For example, 57% of Ghana's external-debt payments go to private lenders rather than multilateral institutions such as World Bank or the International Monetary Fund (IMF), according to UK-based nonprofit, Debt Justice. Private lenders are international investment banks, hedge funds, and asset managers who look to maximize portfolios on behalf of their investors.

During the HIPC era, the 37 HIPC countries owed about 90% of their debt to official creditors. Many of the most debt-vulnerable countries today owe between 50-60% of their debt to private creditors.

The problem with this kind of debt, Jensen said, is threefold: Private debt is generally more costly than official debt that is often given on concessional terms. It is much more difficult to renegotiate in case of payment difficulties as there are numerous actors involved, and, most importantly, it is prone to price swings.

"When central banks in the North decide to raise interest rates, the interest rates on international financial markets rise broadly," said Jensen. "And this, of course, increases countries' debt servicing costs if they have to raise new debt or roll-over maturing debt."

Is there a way out of the debt spiral?

Solutions to the problem are still out of sight. After Zambia became the first country to default in November 2020 amid the spreading coronavirus pandemic, the country had entered into negotiations with the IMF. The Zambian government said at the time it was confident to end negotiations by September 2022. However, a large pile of the country's debt was held by private asset manager BlackRock which didn't show any interest in renegotiating the debt.

Also, the Debt Service Suspension Initiative, put in place by the World Bank in May 2020, had a very limited impact on the mounting debt problem in the developing world. The multilateral approach only allowed to defer payment on debt to a later date, rather than alleviating the burden. The initiative expired at the end of 2021.

Lars Jensen noted that a succeeding debt initiative called G20 Common Framework is also "pretty much dead" in its current form because of the procedural uncertainty involved and as countries using it fear being stigmatized and endangering their creditworthiness in global debt markets.

For Tim Jones, head of policy at Debt Justice, the multilateral programs offered by rich countries and global institutions are not going far enough. "Debt payments have to be stopped so money can stay in the respective countries," he said. He argued it's the private lenders who went searching for profits, pocketing large sums precisely because of the risks involved in poorer countries' debt. So, they, in turn, should take the biggest hit from a default.

-

Comment by Riaz Haq on July 4, 2022 at 10:00am

-

Pak Suzuki breaks sales record

Despite inflation and economic crisis, Pak Suzuki has posted record sales. While on the other hand, Toyota has stopped its booking.

https://www.globalvillagespace.com/pak-suzuki-breaks-sales-record/

Pak Suzuki Motor Company (PSMC) has recorded high sales this year despite economic crisis. According to a recent source, the company broke its previous record of over 15,500 automobiles sold in December 2021 by selling more than 16,000 cars in June 2022.

Reports indicate that the new Suzuki Swift has significantly impacted the total increase in sales, despite the fact that the split of sales is unknown.

Additionally, PSMC is a strong competitor in Pakistan’s small-car industry thanks to its extensive product selection of city automobiles. The firm dominates the automobile industry with a market share of more than 60%.

However, predictions state that by late 2022 or early 2023, sales of all automakers, including PSMC, will likely drop as a result of rising gasoline and vehicle prices. Due to the accumulation of backlogged orders, the sales will continue to be steady for the time being.

Suzuki New Motorcycle Costs

A 7% increase has been noticed in the Suzuki GD110S. Compared to the previous price of Rs. 212,000, the bike now costs Rs. 219,000.

The Suzuki GS150’s price has increased by Rs. 7,000, costing Rs. 239,000 as opposed to Rs. 232,000 previously.

The third motorcycle, the Suzuki GS150SE, now costs Rs. 256,000 as opposed to Rs. 249,000 at the previous price, an increase of Rs. 7,000.

Last but not least, the business raised the cost of the Suzuki GR150 by Rs. 10,000, bringing the new price up to Rs. 349,000 from Rs. 339,000 previously.

As usual, the firm has not provided any explanation for this price rise. These price increases are cruel and unreasonable, especially in light of growing inflation. The general population can no longer afford the “Awaami Sawari.”

What do you think of the recurring monthly price increases for bicycles? Do you think it’s appropriate? Has purchasing a bike altered your spending plan? Comment with your ideas in the space provided.

-

Comment by Riaz Haq on July 4, 2022 at 10:00am

-

Household Appliances - Pakistan | Statista Market Forecast

https://www.statista.com/outlook/dmo/ecommerce/electronics/househol...

Revenue in the Household Appliances segment is projected to reach US$1,765.00m in 2022.

Revenue is expected to show an annual growth rate (CAGR 2022-2025) of 10.07%, resulting in a projected market volume of US$2,354.00m by 2025.

With a projected market volume of US$102,300.00m in 2022, most revenue is generated in China.

In the Household Appliances segment, the number of users is expected to amount to 20.8m users by 2025.

User penetration will be 6.4% in 2022 and is expected to hit 8.6% by 2025.

The average revenue per user (ARPU) is expected to amount to US$120.10.

-

Comment by Riaz Haq on July 5, 2022 at 7:32am

-

Pakistan: how an economic crisis has sent prices rocketing

https://theconversation.com/pakistan-how-an-economic-crisis-has-sen...

Pakistan’s current economic struggles exemplify the little fires everywhere set alight across the global economy by a war during a pandemic. Like others in countries dependent on imported commodities — for example Ghana and Sri Lanka — Pakistanis are seeing food and fuel prices soar. Foreign exchange reserves – used to pay for imports such as food and fuel – have shrunk.

Pakistan is using up its foreign exchange reserves more quickly than previously anticipated because prices of foreign goods are going up. If the situation doesn’t change, the country faces bankruptcy.

In April, a litre of petrol cost about 150 rupees (£0.60), but by July 1 the price had risen to nearly 250 rupees. And the price of cooking oil increased by 40% just between May and June. At present the country has only enough foreign currency to pay for five weeks of imports. Pakistan is heavily dependent on imported fuel and cooking oil, but also on machinery and food grains from overseas.

All of this has made day-to-day activities more challenging. Power outages are not uncommon in the country, even when the economy is strong – they become frequent and long when the economy is under duress. This happens because energy companies struggle to operate when the costs of power generation are higher than the revenue they collect. Over the past few weeks, residents of major cities have had to go without electricity in their homes for as much as 10 hours a day – in rural areas for even more. The discomfort of the public is compounded by an intense heatwave in many parts of south Asia that has caused temperatures in some places to hit 51℃.

Foreign exchange reserves with the Pakistan central bank currently stand at US$10.3 billion, (£8.4 billion). This is a sharp drop from US$16.6 billion in January 2022. Though recently bolstered by Chinese bank lending, reserve levels have been volatile since late April 2022, when a political crisis resulted in the ousting of the prime minister, Imran Khan.

In Pakistan imports are far higher than exports. To preserve foreign currency, an early measure taken by the newly appointed government in May 2022 was to ban many types of imported goods deemed non-essential luxury items. The list included chocolate, nappies, pet food and tampons, but has been amended. Initially there were concerns that pets and livestock would be malnourished because of this ban, and that chocolate would be confiscated at international airports. And that menstruating women would not have access to sanitary pads. Because of public pressure, the list has been amended and clarified. Chocolate is no longer being seized, pet food taken off the list, and sanitary pads are being manufactured domestically.

-

Comment by Riaz Haq on July 5, 2022 at 7:33am

-

Pakistan: how an economic crisis has sent prices rocketing

https://theconversation.com/pakistan-how-an-economic-crisis-has-sen...

A more recent intervention, intended as a placid nudge but widely derided, is a cabinet minister’s suggestion that individuals should drink fewer cups of tea. The drink is ubiquitous in Pakistan, which is the largest global importer of tea by a considerable margin. It is considered one of life’s simple pleasures in a country troubled by power outages and expensive basic food items.

Consternation over the petty politics of “austeri-tea” can deflect from larger, more compelling issues. These are recurrent and arise from the position of Pakistan, and other fragile, externally indebted economies in a global system of currency hierarchies.

Poor countries cannot borrow in their own currency, but need to use one of the major currencies being traded on the international exchanges. The US dollar is the most used currency, while other dominant currencies include the British pound and the euro. These “hard” currencies are those which indebted countries must regularly purchase to pay for imports and to repay and service the loans they owe to private bondholders, international financial institutions and lenders.

Before he was ousted, Khan tried to retain public support as prime minister by resisting demands from the International Monetary Fund (IMF) to increases taxes and remove subsidies. So, by not taking steps such as making fuel more expensive, the Khan government delayed inflows of external finance. This weakened Pakistan’s reserves and made it difficult to maintain the value of the rupee. As the chasm between the dollar and rupee grew, the popularity of the government fell.

Global sanctions on Russia and Iran complicate Pakistan’s economic situation. Khan was frustrated at not being able to use a supply of relatively cheap Russian oil because of international pressure over Ukraine. Given the need for drastic measures, Pakistan’s government may now follow in the footsteps of

-

Comment by Riaz Haq on July 5, 2022 at 7:33am

-

Pakistan: how an economic crisis has sent prices rocketing

https://theconversation.com/pakistan-how-an-economic-crisis-has-sen...

Pakistan has also refrained from importing oil from neighbouring Iran. Smuggled Iranian oil remains attractive to those living near the border. Fuel and energy cooperation between Pakistan and Iran is an especially prickly issue given opposition from the US and Saudi Arabia, another nation that has often financially assisted Pakistan.

To avert bankruptcy – and to continue buying food and fuel – Pakistan is now awaiting assistance from the International Monetary Fund (IMF). This Washington DC-based institution has rescued crisis-ridden economies on many occasions. In exchange, recipient governments must commit to policy reforms, that are often unpopular with the public.

Over the next few weeks, the IMF is likely to step in and commit to a bailout of approximately US$1.85 billion. If, and when, this happens, the exchange rate between the Pakistan rupee and US dollar will stabilise. Given that the dollar has risen more than 15% against the rupee since January 2022, policy makers will welcome a stronger Pakistani currency to calm surging prices.

But the heavy costs of a deal with the IMF have already driven a cost-of-living crisis as fuel subsidies have been sharply withdrawn and made food and transport unaffordable for many. Tax increases have also added to day-to-day pressures.

Currency issues and cost-of-living crises in Pakistan are inextricably linked. A more expensive dollar makes fuel more expensive, and these price increases are quickly reflected in daily essentials. Given that Pakistanis spend more than 40% of their income on food, inflation makes large segments of the population marginalised and vulnerable.

Unless exports drastically increase in coming years, Pakistan’s economy will remain precarious and high prices will remain a threat. Given this situation, financial assistance is the only way to overcome crises. Unfortunately this tends to come with financial or political strings attached.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pak-Saudi Joint Defense: Is Pakistan A Major Power or Bit Player in the Middle East?

The recently signed “Strategic Mutual Defense Agreement” between Saudi Arabia and Pakistan states that “any aggression against either country will be considered an aggression against both”. It is being seen by some geopolitical analysts as the beginning of an "Islamic NATO". Others, such as Indian-American analyst Shadanand Dhume, have dismissed Pakistan as no more than a "bit player"…

ContinuePosted by Riaz Haq on September 27, 2025 at 5:30pm — 7 Comments

Silicon Valley Pakistani-Americans Among Top Donors to Mamdani Campaign

Omer Hasan and Mohammad Javed are the top donors to Zohran Mamdani’s mayoral campaign in New York City, according to media reports. Both are former executives of Silicon Valley technology firm AppLovin. Born and raised in Silicon Valley, Omer is the son of a Pakistani-American couple who are long-time residents of Silicon Valley, California. …

ContinuePosted by Riaz Haq on September 19, 2025 at 9:00am

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network