PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Fintech Revolution to Promote Financial Inclusion

|

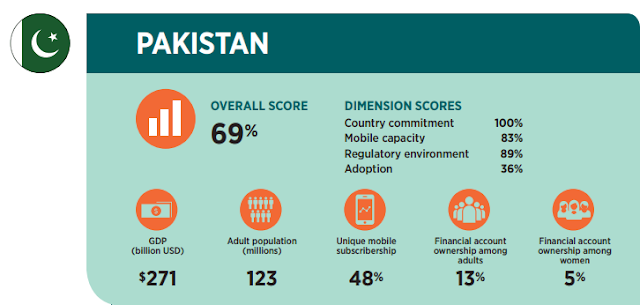

| Source: Brookings' Digital and Financial Inclusion Report 2017 |

Importance of Financial Inclusion:

Access to regulated financial services for all is essential in today's economy. It allows people to save, borrow and invest. Those who lack access to regulated banking services are often forced to resort to work with unscrupulous lenders who trap them in debt at unaffordable rates. Such loans in extreme cases leads to debt bondage in developing countries. Financial inclusion is good for the individuals as well as the national economies. It spurs economic growth and helps document more of the economy.

Easypaisa:

Fintech (financial technology) is bringing financial services to the unbanked population through non-bank institutions licensed by the State Bank of Pakistan, the top bank regulator in the country. One example of a non-bank is Telenor Pakistan, a leading mobile phone service operator, offering financial services via a large network of agents, currently over 70,000, far exceeding the total number of branches of all the banks in the country.

Easypaisa, a service operated by Telenor Pakistan, offers basic financial services like open a bank account, deposit or withdraw money, transfer funds, make mobile payments and pay utility bills.

Karandaaz:

Another important player promoting financial inclusion is Karandaaz Pakistan , a non-profit organization, set up by UK’s Department for International Development and Bill and Melinda Gates Foundation. It is providing grants to a number of local initiatives to develop and promote financial technology solutions in Pakistan.

Karandaaz Pakistan is promoting Fintech startups in 5 areas of focus:

1) Access to Financial services

Credit Scoring Models, Formalize savings through need based products, Digital lending services, and Insurance

2) Payments

Retail payments solutions through QR code, Supply / Value Chain Digitization, Ideas around digitization of online payments and merchant payments

3) E-Commerce

Smoothening of on-boarding process, Enabling Escrow Accounts

for a retail merchant, Alternate payment modes other than COD

4) Interoperability

Innovative ideas to address the lack of interoperability among m-wallets

5) Early stage ideas related to:

M-Wallet Use cases, Education of Financial Services through technology, Customer Engagement / Experience, Micro Credit, Digital Savings

Finja's SimSim Mobile Payment:

Finja is a Pakistani fintech startup that recently introduced SimSim app for mobile payments. It's the first such application that has received approval of the State Bank of Pakistan. Finja has raised $1.5 million in venture funds so far. SimSim uses NADRA, a biometric citizen identity card that the Pakistan government has issued to almost its entire adult population, comprising around 60 percent of the total population of 207 million.

Private Credit Bureaus:

Credit data and scoring are essential to facilitate risk assessment and lending by financial institutions.

Under the Credit Bureaus Act, 2015, privately-run credit bureaus can collect and disseminate the credit data from both financial and non-financial institutions including retailers, insurance companies, utility providers and landlords, as notified by the federal government, according to Muhammad Akmal, Director of Banking Conduct and Consumer Protection Department at the State Bank of Pakistan. The bureaus can do credit scoring, consolidate credit data for analysis and research purposes.

Progress To Date:

According to the latest State Bank statistics on branchless banking (BB) sector, m-wallets grew by 87% , reaching 27.3 million by the end of June 2017. It has a lot of room for growth in a county where about 100 million adults lack access to regulated financial services.

Pakistan is ranked 16th among 26 nations ranked by Brookings Institution with an overall score of 69% in "The State of Financial and Digital Inclusion Project Report" for 2017.

Summary:

Pakistan is ranked 16th among 26 nations ranked by Brookings Institution with an overall score of 69% in "The State of Financial and Digital Inclusion Project Report" for 2017. Access to regulated financial services for all is essential in today's economy. It allows people to save, borrow and invest. Those who lack access to regulated banking services are often forced to resort to work with unscrupulous lenders who trap them in debt at unaffordable rates. Such debt in extreme cases leads to bondage in developing countries. Financial inclusion is good for the individuals as well as the national economies. It spurs economic growth and helps document more of the economy. The rapid growth of mobile phones and Internet access in Pakistan offers a unique opportunity to increase financial inclusion in the country. A number of players are working on financial technology to make its application a reality in Pakistan. Among these players are non-bank banks like Telenor and non-profits like Karandaaz.

Related Links:

Haq's Musings

Financial Services Sector in Pakistan

Pakistan Ranked Among Top 5 For Financial Inclusion Efforts

Pakistani Banks Post Strong Growth

Branchless Banking in Pakistan

Pakistan Ranks High in Microfinance

World's Largest Democracy Tops Slavery Charts

NADRA's Biometric Database

-

Comment by Riaz Haq on March 14, 2018 at 8:58am

-

Pakistan's Community Savings

https://www.bloomberg.com/news/photo-essays/2013-01-17/pakistans-co...

Millions of Pakistanis save billions of rupees in informal, interest-free savings circles called ballot committees, run by housewives, students, office workers, shopkeepers, even high-society ladies. Each member of a group of trusted friends or relatives contributes the same sum daily or monthly to a pool for a predetermined length of time, usually one year. Through a ballot, each participant is allotted a number indicating his or her turn. Every month, one participant gets the pool total. Everyone on the committee keeps contributing until each member gets a pot of cash.

Pictured, Farzana Khatoon, 52, a mother of two sons and three daughters, with kitchen appliances, dishes, gold jewelry, and other items she bought for her daughter's wedding. She received 50,000 rupees ($512) in a ballot committee, which she used to buy the household goods that are traditionally parents’ gifts for a daughter's wedding.Ballot CommitteesMillions of Pakistanis save billions of rupees in informal, interest-free savings circles called ballot committees, run by housewives, students, office workers, shopkeepers, even high-society ladies. Each member of a group of trusted friends or relatives contributes the same sum daily or monthly to a pool for a predetermined length of time, usually one year. Through a ballot, each participant is allotted a number indicating his or her turn. Every month, one participant gets the pool total. Everyone on the committee keeps contributing until each member gets a pot of cash.

Pictured, Farzana Khatoon, 52, a mother of two sons and three daughters, with kitchen appliances, dishes, gold jewelry, and other items she bought for her daughter's wedding. She received 50,000 rupees ($512) in a ballot committee, which she used to buy the household goods that are traditionally parents’ gifts for a daughter's wedding.Phone FundsNasir Rao, 45, a driver, used his savings to buy a Nokia phone.

Household BudgetTahira Bibi, 34, a mother of three sons and two daughters, bought a washing machine and microwave oven with the 20,000 rupees she received through her savings circle. She also used some of the money for her children’s school fees.

Computer CashMuhammad Sajid, 28, who works at an advertising agency, bought a laptop with community savings.

Business CapitalRao Khayyam Shabbir, 32, owner of a fashion outlet, at his shop in Karachi. He received 5 million rupees in a ballot committee, and used 3.2 million rupees for investment in his business.

Car FinancingAli, 33, a shop owner, with the car he bought when he got his turn in a ballot committee.

-

Comment by Riaz Haq on March 15, 2018 at 11:33am

-

Alipay in Pakistan?

https://www.brecorder.com/2018/03/15/405127/alipay-in-pakistan/

Does Pakistan’s digital payments’ landscape finally have the breakthrough it was looking for? China’s Alipay, which has over 800 million users across multiple markets, is about to enter Pakistan. E-commerce watchers would now wish that Alipay’s founder, the Alibaba – which spun off Alipay from its e-commerce setup some years ago but still owns Alipay’s underlying technology – also follows suit soon.

Ant Financial Services, the group that owns Alipay, has made a deal to buy 45 percent of Telenor Group’s stake in the Telenor Microfinance Bank, formerly Tameer Bank, at a value of $184.5 million. This is confirmed by Telenor Group’s public statement on this subject. After building critical mass of Easypaisa users, Telenor Pakistan will do well to further scale the business with a formidable strategic partner.

Mind you, Ant is the world’s largest Fintech co. It has been focused in the past couple of years on growing its scale overseas. Though its acquisition bid for US money-transfer giant MoneyGram failed earlier this year, Ant has struck local partnerships with digital and financial players in strategic markets like Indonesia, Malaysia, the Philippines, Thailand, Singapore and South Korea.

The Telenor-Ant deal, if it goes through the local regulatory checks, is significant for Pakistan, on multiple counts.

One, the deal would bring the local Fintech market into spotlight. The market potential of some 100 million unbanked individuals is a mouth-watering prospect for Fintech players. Alipay, with its robust technology payment platform, stands a better chance to build scale, which is essential to provide low-cost digital payment services in a low-income market.

Two, it may help the online economy’s ecosystem to grow further. The online economy – which includes e-commerce as well as the gig economy – needs acceptance of digital payment solutions at the grassroots level to be able to realize its billion-dollar potential in the near term. While the cash-on-delivery payment settlement is good to build user trust early on, in the long run, digital wallets will be more efficient.

Three, Alipay’s entry in the market might force the big banks as well as branchless banking (BB) providers to wake up and smell the coffee. Local banks seem content raising CASA deposits from a small user base – now they risk losing a big chunk of the potential market to digital. As for the BB operators, they are still stuck at a collective 15-16 million active accounts, drastically lower than the potential. It is time to make serious investments in Fintech and improve the service offering

And four, Alipay’s experience in Pakistan may provide impetus to some major e-commerce FDI coming into Pakistan later. While Alipay could help revolutionize the financial side of e-commerce here, local players like Daraz, TCS and others are slowly becoming efficient at merchandising and marketing. Should Alipay find traction in Pakistan, it may convince Alibaba to make its move and find a local partner, or target.

-

Comment by Riaz Haq on March 18, 2018 at 1:31pm

-

How Digital Payments Revolutionized Poor Women’s Lives in Pakistan

Pakistan’s women-focused social benefits payment system shows how the use of digital technologies not only increases financial access for women, but also gives them a voice at home and in the political landscape, writes researcher Atika Kemal.

https://www.newsdeeply.com/womensadvancement/community/2018/01/26/h...

Farzana*, 45, stands with her nine-year-old daughter in the scorching heat of the southern Pakistan town of Larkana. She is waiting in a long queue to hand her mobile phone and computerized national identity card to a banking agent. Farzana visits the agent every few months to collect her quarterly welfare payment of 4,500 Pakistani Rupees ($40).

Farzana doesn’t know how to retrieve the personal identification number sent by text message to her mobile phone to notify her of payment into her account, so she hands the phone over to the agent. The agent sees the PIN and uploads it into the system to verify her personal details. He then hands Farzana her grant, asks her for a thumbprint and gives her a record of the payment.

Charagh*, 78, is a widow suffering from advanced Parkinson’s disease. She travels by bus with her 20-year-old son to the nearest ATM – located on the fringes of her remote village in Bahawalpur, Southern Punjab. The journey takes three hours there and back.

Once she’s there, Charagh unwraps an embroidered handkerchief and gives the debit card inside it to her son. She wears her identity card – her most precious asset – as a necklace. Her son, who has only attended primary school, gets the money from the ATM and gives it to his frail mother.

These are the stories of some of the 16 women I met during my research on Pakistan’s Benazir Income Support Programme (BISP) – the largest government-run social cash program run exclusively for women in southern Asia.

Every quarter, 5.4 million women from low-income households in Pakistan receive welfare payments using digital means. The use of digital tools, such as the Benazir Debit Card – which is embedded with a chip carrying the user’s information – and phone texts, is intended to make the system of receiving payments more convenient and safer for women to use.

My research shows it also has the unexpected effect of raising the status of women by granting them more decision-making powers, both within their households and in the political sphere.

When BISP was launched in 2008, welfare payments were disbursed in cash or money orders via local parliamentarians and postmen. In 2010, to improve transparency, visibility, security and efficiency in the delivery of social cash, the program shifted to electronic payments made directly into beneficiaries’ bank accounts.

Pakistan accounts for more than 100 million of the world’s 2.5 billion unbanked people. From a population of more than 190 million, only 13 percent of adults have a formal bank account, as reported by the 2014 Global Findex. Even more alarming, fewer than 5 percent of women in Pakistan are included in the formal financial sector, compared with south Asia’s average of 37 percent.

Digitizing BISP payments has had the benefit of ensuring that low-income women have access to bank accounts. For most of the women registered on the program, being enrolled was the first time they had ever had one.

To date, 94 percent of beneficiaries of BISP receive electronic payments. They provide flexibility and convenience to women, letting them cash their payments at various locations – banking agents, ATMs and point-of-sale machines – using a secure PIN. This eliminates the practice of some politicians or postmen demanding bribes for delivering cash payments to people’s homes.

-

Comment by Riaz Haq on September 4, 2018 at 9:39am

-

SBP to increase financial inclusion of SMEs to 17pc

https://pakobserver.net/sbp-to-increase-financial-inclusion-of-smes...

Assistant Chief Manager, SBP’s Banking Services Corporation, Ms. Rabia Yaqoob Khan gave a detailed presentation to the business community on financing schemes of SBP for SMEs.

Rabia Yaqoob Khan said that only six percent SMEs were currently availing loans from banks despite the fact that 40 percent of them have relationship with banks. She said that SBP has set target of increasing financial inclusion of SMEs from current 6 to 8 percent to 17 percent by 2020 so that these businesses could achieve better growth and development.

Assistant Chief Manager, SBP’s Banking Services Corporation said that SBP has launched 9 financing schemes for SMEs at 6 percent markup to facilitate them expansion and growth. She said that for this purpose, regulatory framework and taxation system would be simplified for SMEs.

She said that the incumbent government was taking keen interest in promoting SMEs and hoped that maximum SMEs should avail these schemes for fast growth and development.

In his welcome address, Senior Vice President ICCI, Muhammad Naveed Malik said that SMEs were the backbone of our economy as they constituted over 90 percent of total business enterprises in Pakistan. He said SMEs contributed 30 percent to GDP, 25 percent to exports and 78 percent to industrial employment that showed their important role in the economic development of the country.

The SVP ICCI said the tough collateral conditions of banks were the major hurdle for SMEs growth and urged that SBP should ask banks to offer soft term credit facility to SMEs that would help them to grow fast and play effective role in strengthening the economy.

Vice President ICCI Nisar Mirza said that strengthening SMEs would yield multiple benefits for the economy as it would promote trade and industrial activities, enhance exports, encourage investment, create more jobs and increase tax revenue of the government. He emphasized that government should pay special attention to promoting SMEs that would pave way for sustainable development of the economy.

Sardar Tahir, President, Islamabad Estate Agents Association, Zahid Rafiq General Secretary, Ch. Nadeem, Khalid Chaudhry, Dildar Abbasi, Muhammad Faheem Khan and others were present at the occasion.—INP

-

Comment by Riaz Haq on October 2, 2018 at 8:17am

-

With a significant growth of some 195 per cent, mobile phone #banking transactions in #Pakistan crossed the Rs410 billion mark in fiscal year (FY18). #mobilemoney #payments #financialinclusion https://profit.pakistantoday.com.pk/2018/09/30/mobile-banking-trans...

With a significant growth of some 195 per cent, mobile phone banking transactions in Pakistan had crossed the Rs410 billion mark in the last fiscal year (FY18).

According to the State Bank of Pakistan (SBP), mobile phone/app-based banking was being offered by 21 banks to 3.4 million registered users by the end of June 2018.

Intra-bank and Inter-bank fund transfer were the main contributors in total mobile phone banking transactions. Intra-bank fund transfers contributed 5.8 (26.6 per cent) million transactions by volume and Rs 186.2 (45.4 per cent) billion by value. Inter-bank fund transfers contributed 5 million (22.9 per cent) transactions by volume and Rs196.4 million (47.9 per cent) by value.

Utility bill payments had the share of 10.1 million (46.3 per cent) by volume and Rs10.5 billion (2.6 per cent) by value within the overall mobile banking volume and value transactions respectively.

Call centres/IVR banking channel processed 0.3 million transactions amounting to Rs8.7 million. This channel facilitates Intra and Inter-bank fund transfers, utility bill payments.

As on June 30, 2018, there were 26.5 million call centres/IVR banking channel registered users with banks. It also facilitates 16 million non-financial transactions during the year.

The e-banking channels, i-e real-time online branches (RTOB), ATMs, e-commerce, internet, mobile phone and call centres collectively processed 756.4 million transactions of value Rs 47.4 trillion during the last fiscal year. These transactions showed significant growth of 21 per cent and 28 per cent in both volume and value of transactions compared to previous year FY17.

During the year under review, RTOB processed 165.7 million transactions of Rs 39.9 trillion. These transactions depicted the YoY growth of 15 per cent and 28 per cent in volume and value of transactions respectively compared to the previous year.

-

Comment by Riaz Haq on October 3, 2018 at 10:21am

-

#Easypaisa launches QR #payment method in universities across #Pakistan inc #Lahore University of Management Sciences (LUMS), National University of Science & Technology (#NUST) in #Islamabad, FAST National University, #Karachi University. #mobilemoney https://en.dailypakistan.com.pk/technology/easypaisa-launches-qr-pa...

Easypaisa, Pakistan’s first digital payments platform launches “Easypaisa QR”, the first of its kind cashless payment system, in more than 137 educational institutes across Pakistan.

Some of the prominent universities where the Easypaisa QR payments systems have been successfully deployed are Lahore University of Management Sciences (LUMS), National University of Science & Technology (NUST), FAST National University, Karachi University & Punjab Group of Colleges.

With this, Easypaisa aims to be a part of the youth’s lifestyle by changing their conventional payment methods to digital and by giving the youth of Pakistan convenience in carrying out their everyday financial transactions.

Easypaisa QR not only permits students with convenience of their payments in this digital age but also rewards them with amazing discounts.

On this introduction of Easypaisa QR Payments, Shahid Mustafa, President & CEO of Telenor Microfinance Bank says,

“QR Payments are consistent with the Bank’s commitment to bring greater ease and access to our customers. We hope these payments enhance efficiency and productivity of individual users as well as businesses by simplifying the previously cumbersome payments processes.”

Easypaisa wants to take Pakistan into the future of financial technology and aims to keep the youth of this country at the center of this financial revolution.

Taking this vision forward, we at Easypaisa work tirelessly to raise the living standards of every Pakistani by bringing innovative services and products resulting in an empowered Pakistan.

-

Comment by Riaz Haq on October 4, 2018 at 4:14pm

-

#PayPal Could Soon Launch In #Pakistan: PayPal has now entered agreements with 5 #Pakistani banks in the country to accept payments through its Xoom money transfer service for #damsfund. #damsforpakistan https://www.valuewalk.com/2018/10/paypal-launch-pakistan-report/ via @valuewalk

The dam fund was set up to collect donations to support construction of the Diamer Bhasha and Mohmand dams. Since it was created, various lawmakers and public officials have been making contributions to it, and many Pakistanis living abroad are also wanting to help out.

To support that effort, PayPal has now entered agreements with five banks in the country to accept payments through its Xoom money transfer service. According to Xoom’s own website, the five banks it is working with in Pakistan are Allied Bank, Bank Alfalah, MCB Bank, the National Bank of Pakistan and United Bank Limited.

The SBP is recommending PayPal’s money transfer service to Pakistani expatriates as a faster way for them to move their donations into the dam fund. According to ProPakistani, many expats have already been sending donations via debit or credit cards, but using that method takes a few days for the funds to reach the SBP account for the dams.

By using Xoom, Pakistanis living abroad can send donations faster and have them reach the account in the same day in some cases. So far, expats have donated more than Rs. 379 million toward the construction of the two dams.

We must emphasize that the State Bank of Pakistan is only temporarily allowing PayPal transfers via Xoom, and it’s only for donations made to the dam fund. At this time, no other PayPal payments are being allowed in the country.

It sounds like this could change very soon. ProPakistani said that if Xoom helps significantly grow the amount of money in the dam fund, it could “pave the way” for PayPal to launch its mainstream service in Pakistan. Additionally, Pakistan Finance Minister Asad Omer hinted in a TV interview recently that PayPal or a similar digital payment service could launch in the country some time in the next three or four months.

We should point out that we’ve been hearing that PayPal could launch in Pakistan since at least 2015, so the deal with Xoom is far from a guarantee that this will happen. On the other hand, just working with Xoom is the closest PayPal has come to actually launching in the country, so we will just have to wait and see what happens.

-

Comment by Riaz Haq on January 12, 2019 at 7:39am

-

#Pakistan’s First #Blockchain-Based #Remittance Service Launched Using #Alipay’s #Technology. Pak #Telenor and #Malaysia's #fintech firm Valyou offer the service. Service is expected to enhance the #efficiency and #speed of remittances

https://www.ccn.com/pakistans-first-blockchain-based-remittance-ser...

A Pakistani financial institution has rolled out a cross-border remittance service based on blockchain technology developed by Alibaba affiliate, Alipay.

Telenor Microfinance Bank and Malaysian fintech firm Valyou have partnered to offer the service to that will operate between Malaysia and Pakistan. The service is expected to enhance the efficiency and speed of remittances from the former to the latter.

Additionally, Pakistan’s first blockchain-based remittance service will eliminate intermediary costs making it cheaper to send money. Users will also be able to track the remittances at ‘every step of the way’, according to a statement.

Lucrative Remittance Market

At the moment, it is estimated that Pakistanis living and working in Malaysia send around $1 billion annually. This is about 5% of the estimated $20 billion in remittances that is sent by the combined Pakistani diaspora spread across the globe. The State Bank of Pakistan’s governor, Tariq Bajwa, noted during the launch of the service that remittances contribute significantly to the country’s economy.

At around USD 20 billion per year, international remittances are important from the perspective of overall macroeconomic stability and their positive spillover in improving lives of millions of families. Home remittances contributed to over 6% in GDP, equivalent to over 50% of our trade deficit, 85% of exports and over one-third of imports during FY 2017-18.

This is not the first time that Alipay is involved in a blockchain-based remittance solution in Asia. Mid last year, Hong Kong-based AlipayHK announced a blockchain-based money transfer service between Hong Kong and the Philippines.

https://twitter.com/CryptoCoinsNews/status/101157117132065177

During the launch of the service the founder of Alibaba, Jack Ma, indicated that he had long wanted to reduce remittance costs between China and Pakistan:

This comes from a promise I made a long time ago when Alipay was just launched. I have friends who are Filipino and they asked me when they could use Alipay to send money home because it was too expensive through banks, which charge too much.

Filipino Remittance Market

Currently, the Philippines is the world’s third-largest remittance market. In 2017, inflows into the Southeast Asian country amounted to approximately $3 billion. A significant proportion of the expatriate community in Hong Kong hails from the Philippines. In 2016, Filipinos in the city-state are estimated to have remitted $561 million to their home country.

Another Chinese firm that recently announced plans to launch a remittance service in the Philippines is Huaren Capital. Unlike Alipay, Huaren Capital will launch a stablecoin pegged to the Filipino Peso and partner with local banks.

-

Comment by Riaz Haq on January 22, 2020 at 7:31pm

-

Cut in import duty: FBR shatters MoI&P’s mobile handset-making policy dream

https://www.brecorder.com/2020/01/07/559644/cut-in-import-duty-fbr-...Currently one Chinese joint venture has been established to manufacture 3G/4G mobile phones in Karachi and few companies have set up their manufacturing facilities in collaboration with Chinese Principals; (vi) over the next 2-3 years local production can reach up to 80 percent of total Pakistan handset market if attractive tariff plan is given to the industry; (vii) creation of up to 100,000 hi-skill direct jobs in electronics & information technology industry & up to 400,000 in-direct jobs in ancillary sectors; (viii) a typical smart phone constitutes more than 60 parts and its assembly is a labor intensive. Pakistan can benefit from its low labor cost; (ix) China exports US $150 billion worth of smart phones every year and Chinese investors are looking for alternate manufacturing base in view of trade war with USA. Pakistan can become a hub for Chinese manufacturers in case an attractive policy and predictability is ensured to the industry for at-least five years and ;(x) local assembly will help create an echo system for development of local mobile software, applications and R&D centers in Pakistan.

“We are expecting 2,000 jobs if the local mobile sets policy is approved by the federal government," the sources added.

-

Comment by Riaz Haq on January 16, 2022 at 1:45pm

-

Meet the Investor Who Spots Opportunities for Jeffrey Katzenberg

Anthony Saleh oversees a growing venture-capital fund at the former Hollywood chief’s WndrCo, after its Quibi video app collapsed. He also works with the rapper Nas.

https://www.wsj.com/articles/meet-the-investor-who-spots-opportunit...

While working with Nas several years ago, Mr. Saleh cold-emailed Ben Horowitz, the co-founder of the venture-capital firm Andreessen Horowitz to discuss ideas, Mr. Horowitz said. The two men got to know one another, and in 2013, Mr. Saleh called Mr. Horowitz to say he and Nas were interested in bitcoin after seeing how many “unbanked” people in the world had no checking account but did have a cellphone—a dynamic he said could decentralize finance. When Mr. Horowitz later heard about Coinbase, the cryptocurrency exchange platform, he brought the duo into the investment.Last year, Coinbase Global Inc. was one of six investments in Mr. Saleh’s personal portfolio that ended in a public offering.

Comment

- ‹ Previous

- 1

- 2

- 3

- 4

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Major Hindu American Group Distances Itself From Modi's India

"We are not proxies for India in the US", wrote Suhag Shukla, co-founder and executive director of the Hindu American Foundation (HAF) in a recent article for The Print, an Indian media outlet. This was written in response to Indian diplomat-politician Shashi Tharoor's criticism that the Indian-American diaspora was largely silent on the Trump administration policies hurting India. …

ContinuePosted by Riaz Haq on October 11, 2025 at 2:00pm

Gaza Genocide: Is the Powerful Israel Lobby AIPAC Losing Influence?

Several Congressional Democrats have recently refused campaign contributions from AIPAC, the powerful Israel lobby, according to media reports. “Democrats who once counted AIPAC among their top donors have in recent weeks refused to take the group’s donations”, says a New York Times story titled "Democrats Pull Away From AIPAC, Reflecting a Broader Shift". “AIPAC is…

ContinuePosted by Riaz Haq on October 5, 2025 at 4:00pm — 8 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network