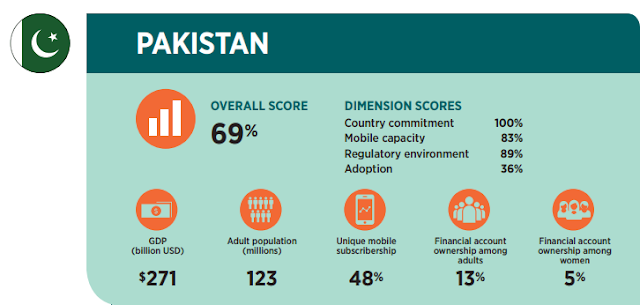

Pakistan is ranked 16th among 26 nations ranked by Brookings Institution with an overall score of 69% in "

The State of Financial and Digital Inclusion Project Report" for 2017. As the world observes the "

World Financial Inclusion Week" this week (October 30-November 3, 2017), the Internet revolution is enabling rapid growth of financial technology (fintech) for increasing

financial inclusion in Pakistan. The purpose of the observance of the week is to "hold conversations focused on how new products and partnerships are advancing financial inclusion, not just access", according to the

Center for Financial Inclusion. It is important for Pakistan where about 100 million adults lack access to formal and regulated financial services.

Importance of Financial Inclusion:

Access to regulated

financial services for all is essential in today's economy. It allows people to save, borrow and invest. Those who lack access to regulated banking services are often forced to resort to work with unscrupulous lenders who trap them in debt at unaffordable rates. Such loans in extreme cases leads to

debt bondage in developing countries. Financial inclusion is good for the individuals as well as the national economies. It spurs economic growth and helps document more of the economy.

Easypaisa:

Fintech (financial technology) is bringing financial services to the unbanked population through non-bank institutions licensed by the State Bank of Pakistan, the top bank regulator in the country. One example of a non-bank is Telenor Pakistan, a leading mobile phone service operator, offering financial services via a large network of agents, currently over 70,000, far exceeding the total number of branches of all the banks in the country.

Easypaisa, a service operated by Telenor Pakistan, offers basic financial services like open a bank account, deposit or withdraw money, transfer funds, make mobile payments and pay utility bills.

Karandaaz:

Another important player promoting financial inclusion is Karandaaz Pakistan , a non-profit organization, set up by UK’s Department for International Development and Bill and Melinda Gates Foundation. It is providing grants to a number of local initiatives to develop and promote financial technology solutions in Pakistan.

Karandaaz Pakistan is promoting Fintech startups in 5 areas of focus:

1) Access to Financial services

Credit Scoring Models, Formalize savings through need based products, Digital lending services, and Insurance

2) Payments

Retail payments solutions through QR code, Supply / Value Chain Digitization, Ideas around digitization of online payments and merchant payments

3) E-Commerce

Smoothening of on-boarding process, Enabling Escrow Accounts

for a retail merchant, Alternate payment modes other than COD

4) Interoperability

Innovative ideas to address the lack of interoperability among m-wallets

5) Early stage ideas related to:

M-Wallet Use cases, Education of Financial Services through technology, Customer Engagement / Experience, Micro Credit, Digital Savings

Finja's SimSim Mobile Payment:

Finja is a Pakistani fintech startup that recently introduced SimSim app for mobile payments. It's the first such application that has received approval of the State Bank of Pakistan. Finja has raised $1.5 million in venture funds so far. SimSim uses

NADRA, a biometric citizen identity card that the Pakistan government has issued to almost its entire adult population, comprising around 60 percent of the total population of 207 million.

Private Credit Bureaus:

Credit data and scoring are essential to facilitate risk assessment and lending by financial institutions.

Under the Credit Bureaus Act, 2015, privately-run credit bureaus can collect and disseminate the credit data from both financial and non-financial institutions including retailers, insurance companies, utility providers and landlords, as notified by the federal government, according to Muhammad Akmal, Director of Banking Conduct and Consumer Protection Department at the State Bank of Pakistan. The bureaus can do credit scoring, consolidate credit data for analysis and research purposes.

Progress To Date:

According to the latest

State Bank statistics on

branchless banking (BB) sector, m-wallets grew by 87% , reaching 27.3 million by the end of June 2017. It has a lot of room for growth in a county where about 100 million adults lack access to regulated financial services.

Pakistan is ranked 16th among 26 nations ranked by Brookings Institution with an overall score of 69% in "

The State of Financial and Digital Inclusion Project Report" for 2017.

Summary:

Pakistan is ranked 16th among 26 nations ranked by Brookings Institution with an overall score of 69% in "

The State of Financial and Digital Inclusion Project Report" for 2017. Access to regulated financial services for all is essential in today's economy. It allows people to save, borrow and invest. Those who lack access to regulated banking services are often forced to resort to work with unscrupulous lenders who trap them in debt at unaffordable rates. Such debt in extreme cases leads to

bondage in developing countries. Financial inclusion is good for the individuals as well as the national economies. It spurs economic growth and helps document more of the economy. The rapid growth of mobile phones and Internet access in Pakistan offers a unique opportunity to increase financial inclusion in the country. A number of players are working on financial technology to make its application a reality in Pakistan. Among these players are non-bank banks like Telenor and non-profits like Karandaaz.

Related Links:

Haq's Musings

Financial Services Sector in Pakistan

Pakistan Ranked Among Top 5 For Financial Inclusion Efforts

Pakistani Banks Post Strong Growth

Branchless Banking in Pakistan

Pakistan Ranks High in Microfinance

World's Largest Democracy Tops Slavery Charts

NADRA's Biometric Database

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network