PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

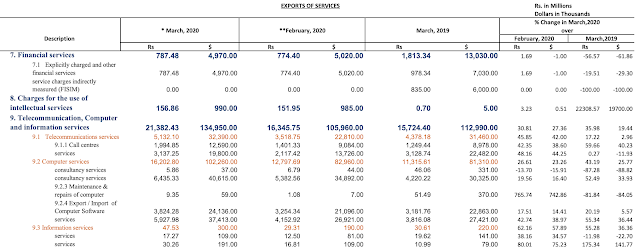

Pakistan's computer services exports soared 26% in March, 2020 over the same month last year. This growth occurred in spite of the coronavirus lockdown that began on March 23, 2020. The nation's total services exports fell 17% in the same month.

The ICT services exports bucked the overall down trend in Pakistan's exports. The country exported computer service worth $102.26 million in March, 2020, up 25.77% from $81.31 million in March, 2019. Overall telecommunications, computer and information services increased 19.44% to $134.95 million in March 2020, up from $112.99 million in March 2019. Prior to the current coronavirus lockdown, PBS reported that Pakistan's technology exports increased 26.24% in the first 8 months (July-February) of the current financial year.

|

| Double Digit CAGR in Pakistan IT-ITeS Exports in 2010-2018 |

The data released by the PBS showed that Pakistan earned a total amount of $887.47 million during the first eight months (July-February) of the fiscal year 2020, up from $702.99 million during the corresponding period of the fiscal year 2018-19. Computer services exports grew 31.57% to $677.23 million from July 2019 to February 2020 as compared to $514.74 million.

It is generally believed that Pakistan's PBS and central bank underestimate the country's technology exports. Some have argued that the actual IT exports were closer to $5 billion in fiscal 2018. Some of the differences can be attributed to the fact that the State Bank IT exports data does not include various non-IT sectors such as financial services, automobiles, and health care.

Pakistan has a thriving community of freelancers. Its digital gig economy growth is the fastest in Asia and fourth fastest in the world, according to digital payments platform Payoneer.

United States leads gig economy growth of 78% followed by the United Kingdom 59%, Brazil 48%, Pakistan 47% and Ukraine 36%. Asia growth was led by Pakistan followed by Philippines (35%) , India (29%) and Bangladesh (27%).

The rapid gig economy expansion of 47% in Pakistan was fueled by several factors including the country's very young population 70% of which is under 30 years of age coupled with improvements in science and technical education and expansion of high-speed broadband access. Pakistani freelancers under the age of 35 generated 77% of the revenue in second quarter of 2019.

Mohsin Muzaffar, head of business development at Payoneer in Pakistan, has said as follows: "Government investment in enhancing digital skills has helped create a skilled freelancer workforce while blanket 4G coverage across Pakistan has given freelancers unprecedented access to

international jobs".

In Q2/2019, Asia cemented its status as a freelancer hub. Pakistan, Bangladesh and India, Philippines made it to the top 10 list, collectively recording 238% increase from Q2/2018.

As of 2017, Pakistan freelancers ranked fourth in the world and accounted for 8.5% of the global online workforce, according to Online Labor Index compiled by Oxford Internet Institute. India led with 24% share followed by Bangladesh 16%, US 12%, Pakistan 8.5% and Philippines 6.5%.

Related Links:

Digital BRI and 5G in Pakistan

Pakistan Tech Exports Exceed Billion Dollars

Pakistan's Demographic Dividend

Pakistan EdTech and FinTech Startups

State Bank Targets Fully Digital Economy in Pakistan

Fintech Revolution in Pakistan

The Other 99% of the Pakistan Story

-

Comment by Akhtar Hussain on May 18, 2020 at 12:33pm

-

Mashallah. We need to stay at it. People had written us off. How wrong are they?

-

Comment by Riaz Haq on May 18, 2020 at 6:49pm

-

#Covid #Lockdown: #Pakistan’s #FDI soars 32% in April 2020 to $133.2 million, up from $100.8 million last year. #Oilandgas exploration sector led with $39.1m followed by #financialservices $30.8m, #telecom $20 million, #power $18.4 & #chemicals $14.9m. https://tribune.com.pk/story/2224412/1-despite-pandemic-pakistans-f...

Multinational companies have continued to inject fresh investment into ongoing projects in different sectors of Pakistan’s economy like telecommunication, power, and chemical despite the global economic crisis sparked by the coronavirus pandemic.

Foreign direct investment (FDI) rose 32% to $133.2 million in April 2020 compared to $100.8 million in the same month of the previous year, the State Bank of Pakistan (SBP) reported on Monday.

Although the volume of investment stood at an eight-month low in April, “what is encouraging is that investors have continued to pour fresh capital into ongoing projects in Pakistan despite the global economic recession under Covid-19,” Overseas Investors Chamber of Commerce and Industry (OICCI) Secretary-General M Abdul Aleem remarked while talking to The Express Tribune.

Moreover, the nature of investment stands diversified. Companies from multiple countries have poured new investment, unlike Chinese firms which have been the only major investors in Pakistan in recent times.

FDI should improve in the months to come as countries are slowly lifting lockdowns in a bid to revive economic activities around the globe. Accelerating the activities, however, may remain a challenge in the absence of a coronavirus vaccine and medicines.

Cumulatively, in the first 10 months (July-April) of the current fiscal year, foreign firms injected FDI worth $2.28 billion, which was more than double the investment of around $1 billion in the same period of the previous year, according to the central bank.

Before the outbreak of Covid-19 late in February in Pakistan, foreign investors seemed poised to initiate new projects in the country. They, however, have put the projects on hold in response to the virus.

“In the recent past, some foreign companies made a new investment in food, energy, and telecom sectors in Pakistan,” Aleem said.

Country-wise FDI

Hong Kong emerged as the largest investor with net FDI of $28.4 million in April 2020, followed by the Netherlands that injected $24.5 million, the US $22.5 million, Malta $18.5 million, and the UK $10.5 million.

Cumulatively, in the first 10 months of FY20, China was the biggest investor, with FDI worth $877.8 million compared to $45.5 million in the same period of last year.

Norway stood second with $288.6 million, followed by Malta that injected $185.2 million in July-April FY20.

However, in the same period of the previous year, the UAE was the largest investor with a net investment of $159.7 million, followed by Hong Kong at $147 million, while Japan invested $95.8 million.

Sector-wise FDI

The oil and gas exploration sector attracted the largest foreign investment of $39.1 million in April 2020, followed by the financial sector that got an investment of $30.8 million, the communication sector $20 million, power sector $18.4 million, and chemical sector $14.9 million.

Cumulatively, in 10 months, power, communication, and oil and gas exploration sectors were the top three sectors that attracted significant investment.

Investment in stock market

Although foreign investors continued to remain net sellers at the Pakistan Stock Exchange (PSX) in the first 10 months of FY20, they slowed down selling compared to the same period of last year.

They offloaded stocks worth $182.7 million in July-April FY20 compared to $408.1 million in the same period of last year, according to the central bank.

-

Comment by Akhtar Hussain on May 19, 2020 at 12:50am

-

Mr. Haq, I am very interested in going to Pakistan to invest in Hardware (ASIC + FPGA) design industry. I am also interested in the development of Software as it is relatively easier to do without actually having clients beforehand or necessary software tools etc. I know Cadence does not have an office in Pakistan. Our Silicon industry needs more help to mature. How can I, as an overseas Pakistani-American living in Europe make this possible? I mean should I approach the Pakistan consulate in Holland first or should I look for contacts in Pakistan, who are interested?

What is the right approach to invest and help develop the Hi-Tech industry?

Thank you.

Kind regards,

~Akhtar.

-

Comment by Riaz Haq on May 19, 2020 at 7:16am

-

Akhtar sahab,

There was a summit here in Silicon Valley last year on the subject of investing in high-tech in Pakistan. I wrote about it at the time. Here's an excerpt:

China will need 500,000 engineers trained in chip development over the next 5 years to meet its goal of producing 70% of semiconductors within the country, according to Pakistani-American entrepreneur Dr. Naveed Sherwani who presented at the Invest in Pakistan Summit in Silicon Valley.

Naveed and his wife Sabahat Rafiq see this as an opportunity to train a significant number Pakistani engineers in semiconductor chip development to meet China's needs. This will help develop Pakistan's tech-oriented human capital and open up the possibility for Pakistan to build its own chip design and development industry.

Sabahat said she is already training some engineers at an institute in Lahore for this purpose. She is hoping to expand it to accommodate more trainees in near future.

Naveed currently heads SiFive, a Silicon Valley startup specializing in RISC V microprocessor cores for customized systems on chip (SoC) development. RISC V is an open source chip architecture developed at UC Berkeley. It is the hardware equivalent of open source Linux OS software. Naveed is promoting SiFive in both China and Pakistan for "low-power embedded microcontrollers (as small as 13.5k gates) to multi-core applications processors".Please read more here: https://www.riazhaq.com/2019/10/invest-in-pakistan-summit-can-pakis...

Regards, Riaz

-

Comment by Riaz Haq on May 19, 2020 at 7:17pm

-

#Pakistan #domestic #savings rate up 1.1% of #GDP to 13.9% in outgoing fiscal year 2019-20. #Investment-to-GDP ratio dips to 15.4% and #economy contracts by 0.38% amid #coronavirus #lockdown, the first GDP contraction in 68 years. https://tribune.com.pk/story/2225282/2-pakistans-investment-ratio-d...

The savings-to-GDP ratio target of 12.8% was surpassed as the ratio stood at 13.9%. The ratio was better than the previous fiscal year due to the low current account deficit projected for the current fiscal year. The gap between total investments and savings is financed through foreign savings.

The results are based on estimates of the NAC that has approved a provisional economic growth rate of negative 0.38% for the fiscal year 2019-20, ending on June 30.

-----

Public investment showed slight improvement but it was because of using budgetary figures of the Public Sector Development Programme (PSDP) instead of actually spending that was expected to remain significantly lower than the budgeted sum.

Private investment went down further in the second year of the PTI government, suggesting that private investors were not showing their trust in the government.

Failure to achieve these crucial targets has limited the government’s ability to spend on deteriorating infrastructure and social sectors from its own resources.

This has increased the government’s reliance on external and domestic sources to meet its requirements, resulting in a mushroom growth in public debt in the past five years. The public debt-to-GDP ratio is projected to spike to 90% in the current fiscal year, according to the IMF.

The total size of the national economy is now estimated at $265 billion for this fiscal year, down from $279 billion a year ago. The size of the national economy in US dollar terms has shrunk 5%.

The investment-to-GDP ratio stood at 15.4% against the target of 15.8%, said sources. The ratio was worse than last year’s revised rate of 15.6%, they added.

The government’s inability to increase investment as a percentage of the total size of the national economy remains its biggest failure on the economic front, suggesting that the PTI government has not yet begun its journey towards addressing structural imbalances.

The private investment that had been recorded at 10.3% of GDP last year has also slipped to 10%, according to the official working. The government had set the target to increase private investment to 10.1%.

Public investment stood at 3.8% of GDP, up from 3.7%, due to using budgetary figures of development spending instead of actual expenses. Once actual numbers will be used, the public investment-to-GDP ratio is expected to fall to 3.3%.

Fixed investment remained at 13.8% of GDP in the fiscal year 2019-20 against the target of 14.2%. It was slightly down compared with last year’s level.

These figures of investment and savings would be officially published in the Economic Survey of Pakistan 2019-20, likely to be unveiled on June 11 by Finance Adviser Dr Abdul Hafeez Shaikh.

Pakistan has one of the lowest investment and saving rates in the region and the world, obstructing progress towards a path of sustainable and inclusive economic growth.

Provisional estimates suggest the per capita income shrank 6.2% to $1,366 in this fiscal year. It was lower by $89 when compared with the downward-revised per capita income of $1,455 for the last fiscal year.

The per capita income is worked out by dividing the total national income with the number of people. At the end of the PML-N tenure, the per capita income had been recorded at $1,652 and there was a reduction of 17.3% in two years due to currency devaluation.

In rupee terms, the per capita income stood at over Rs214,000. In dollar terms, the per capita income was the lowest in seven years.

-

Comment by Riaz Haq on May 19, 2020 at 7:20pm

-

Pakistan's economy contracts for first time in 68 years

https://tribune.com.pk/story/2224516/2-pakistans-economy-contracts-...

For the first time in 68 years, Pakistan’s economy has marginally contracted by 0.38% in the outgoing fiscal year due to adverse impacts of novel coronavirus coupled with economic stabilisation policies that had hit the industrial sector much before the deadly pandemic.

Except for the agriculture sector that grew 2.7%, the industrial and services sectors witnessed negative growth rates, pulling the overall growth rate down to negative 0.38% in the fiscal year 2019-20, ending on June 30. The per capita income in dollar terms has also dipped to 1,366 – a contraction of 6.1%, but it increased in rupee terms to Rs214,539.

The National Accounts Committee approved the provisional gross domestic product (GDP) growth rate for the outgoing fiscal year besides a downward revision of the economic growth rate for the first year of the PTI government. For fiscal 2018-19, the NAC cut the provisional growth rate of 3.3% to 1.9%, which is the lowest in 11 years.

The SBP’s quest for hot foreign money has adversely hit the industries even much before the Covid-19 started impacting the economy. In the end, neither the hot foreign money stayed in Pakistan nor the country achieved sustainable economic growth. There is a need to investigate the sources of hot foreign money inflows in Pakistan that created an artificial sense of economic stability.

Former finance minister Dr Hafiz Pasha had disputed the PTI government’s claim of a 3.3% growth rate and instead claimed a year ago that the growth in the first year of the PTI government was 1.9%. His assessment has become true and finally admitted by the government.

The Planning secretary chaired the National Accounts Committee meeting, which has representation of all the federal and provincial departments concerned, including the State Bank of Pakistan (SBP).

It is for the first time since 1951-52 that Pakistan’s economy contracted, although the pace of contraction was far lower than -1.5% growth rate predicted by the International Monetary Fund (IMF), the World Bank, the finance ministry and the SBP.

The GDP — the monetary value of all goods and services produced in a year — is projected to have a negative growth rate of 0.38% during the fiscal year 2019-20 ending on June 30, according to the NAC. These estimates are based on six to nine months provisional data projected for the whole year and adjusted for the impact of Covid-19 followed by the lockdown, it added.

The economic contraction coupled with currency devaluation has caused the size of the economy — in the US dollar terms — to slip to around $265.6 billion from $280 billion a year ago. At the end of the Pakistan Muslim League-Nawaz (PML-N) government’s term, the size of the GDP in dollar terms was $313 billion.

The GDP at the current market prices stands at Rs41.7 trillion for 2019-20. This shows a growth of 9.9% over Rs.37.9 trillion for 2018-19 due to double-digit inflation. The per capita income for 2019-20 has been calculated as Rs214,539 for 2019-20, showing a growth of 8.3% over Rs198,028 during 2018-19. However, in dollar terms, the per capita income has shrunk by 6.1% to $1,366.

The NAC also confirmed the 5.53% economic growth rate for the last year (2017-18) of the PML-N government. The growth came largely from the services sector, which was less job intensive.

Planning Secretary Zafar Hasan chaired the 102nd meeting of the NAC that endorsed the provisional economic growth rate figure on the basis of data received from the federal and provincial governments.

-

Comment by Akhtar Hussain on May 19, 2020 at 9:36pm

-

Dear Riaz sb.

Thank you for your prompt reply. I will read up.

We have to hit the iron while it is hot to make steel.

I will come back with my finding to keep you posted, Inshallah.

Thank you.

Kindly,

~Akhtar.

-

Comment by Akhtar Hussain on May 19, 2020 at 9:48pm

-

Riaz sb. looking at the graph you have posted, Pakistani freelancers need more sales and marketing jobs combined with writing services and translation. As for software development, I am sold on the idea of more Python programmers for Pakistan.

-

Comment by Riaz Haq on May 20, 2020 at 11:15am

-

#US urges #China to waive #Pakistan’s #debt. “At a time of crisis like Covid-19, it is really incumbent on China to take steps to alleviate the burden that this predatory, unsustainable and unfair lending is going to cause to Pakistan” #CPEC #PMLN #COVID https://tribune.com.pk/story/2225775/1-us-urges-china-waive-off-pak...

The United States on Wednesday urged China either to wave off or renegotiate what it called “unsustainable and unfair” debt of Pakistan as it once again raised serious questions about the lack of transparency in the multibillion-dollar China-Pakistan Economic Corridor (CPEC).

“At a time of crisis like Covid-19, it is really incumbent on China to take steps to alleviate the burden that this predatory, unsustainable and unfair lending is going to cause to Pakistan,” said Alice Wells, the outgoing US Assistant Secretary of State for South and Central Asia.

“We hope China will join in either waving off debt or renegotiating these loans and creating a fair and transparent deal for Pakistani people,” Ambassador Wells said while addressing a farewell news briefing through a video link attended by journalists from South and Central Asia.

This was not the first time the US and Wells in particular publically questioned the viability of CPEC. Wells in the past also expressed similar views, declaring CPEC detrimental to Pakistan’s economy.

China always dismissed the US claims and instead challenged Washington to match its economic assistance to Pakistan.

Ambassador Wells, who is retiring this week, said the US supports CPEC and other development projects as long as they meet international standards, uphold environmental and labour standards.

“I enumerated my concerns and the United States government’s concerns over CPEC, over the lack of transparency involved in the project, over the unfair rates of profits that are guaranteed to Chinese state organisations to the distortions it caused in the Pakistani economy including by the massive imbalance in the trade Pakistan now has with China,” she argued.

Pakistan has been seeking debt relief from G20 countries to offset the negative fallout of coronavirus on its economy.

----------------

The top US diplomat also spoke about President Trump’s South Asia strategy, which according to Wells, brought fundamental change in approach towards Pakistan.

She said that Trump’s strategy had made it clear that Pakistan had to take decisive action against terrorist and militant groups that supported conflict in Afghanistan.

The suspension of security assistance by President Trump in January 2018 was a demonstration of that resolve to hold Pakistan accountable for the alleged presence of terrorist groups on its soil, she added.

According to Wells, since then Pakistan had taken “constructive steps” to advance Afghan peace process. She said Ambassador Zalmay Khalilzad had developed “solid cooperation” with Pakistan civil and military leadership.

The US senior diplomat also praised Pakistan’s steps to eradicate threat posed by terrorist groups to regional stability.

“Pakistan is also taking initial steps towards curtailing other terrorist groups that threatened the region such as arresting and prosecuting Laskhar-e-Tayaba leader Hafza Saeed and beginning to dismantle terrorist financing structures.

“And as Pakistan’s commitment to the regional peace grown, we see initial growth in our relationship with Pakistan as well particularly in trade,” she further said.

-

Comment by Riaz Haq on May 20, 2020 at 10:57pm

-

Overseas #remittances to #Pakistan increase 6% to $18.8 billion in 10 months (July-April), up by $980.6 million from $17.8 billion in the corresponding period a year earlier.

https://www.thenews.com.pk/print/657359-remittances-increase-6pc-to...

In April, remittances amounted to $1.79 billion, recording a decrease of $104.4 million, or 5.5 percent, over remittance received during the previous month of March. There was a 1.1 percent increase in April from $1.77 billion in the corresponding month a year earlier.

The World Bank expected remittances to Pakistan to fall in the current fiscal year compared with $22.5 billion in the preceding fiscal year due to global economic crisis caused by the COVID-19 pandemic and oil fall.

The COVID-19 might cause a significant drop in remittances since all the four major countries – Saudi Arabia, UAE, US and UK – from where 80 percent of the total remittances are received reeled from the coronavirus lockdown. Alone Saudi Arabia and UAE account for 60 to 70 percent of remittances inflows in Pakistan. Oil producing economies are facing decade-worst oil price crash.

In April, larger amounts of workers’ remittances ($451.4 million) were received from Saudi Arabia, followed by USA ($401.9 million), UAE ($353.8 million) and UK ($226.6 million), recording an increase of 14 percent for USA, whereas a decrease of 0.2 percent, 15.8 percent and 8.8 percent for Saudi Arabia, UAE and UK respectively as compared to March, the SBP said.

Pakistani workers living in Saudi Arabia sent home $4.3 billion in July-April FY2020, compared with $4.1 billion in the corresponding period of FY2019. Remittance from the USA rose 21.3 percent to $3.282 billion in July-April period. Pakistan attracted $2.7 billion from the UK, compared with $2.7 billion last year. Remittances from the European Union countries rose 6 percent to $515.2 million. Remittances from UAE stood at $3.9 billion, compared with $3.7 billion last year. From gulf cooperation council countries, the inflows amounted to $1.7 billion, up 3.6 percent year-over-year.

Workers’ remittances showed a 4 percent year-on-year increase in the monthly average till January.

Remittances grew at a compounded annual rate of nearly nine percent during five years (2012/19), with inflows mainly coming from gulf cooperation council countries – 54 percent of total remittances in 2019 –, followed by the US (16pc), the UK (16pc) and Malaysia (7pc). Remittances have grown even more, in terms of local currency, because the rupee depreciated more than 40 percent over this period.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Has Pakistan Destroyed India's S-400 Air Defense System at Adampur?

Pakistan claims its air force (PAF) has destroyed India's high-value Russian-made S-400 air defense system (ADS) located at the Indian Air Force (IAF) Adampur air base. India has rejected this claim and posted pictures of Prime Minister Narendra Modi posing in front of its S-400 rocket launchers in Adampur. Meanwhile, there are reports that an Indian S-400 operator, named Rambabu Kumar Singh, was killed at about the time Pakistan claims to have hit it. Pakistan is believed to have targeted…

ContinuePakistan Downs India's French Rafale Fighter Jets in History's Largest Aerial Battle

Pakistan Air Force (PAF) pilots flying Chinese-made J10C fighter jets shot down at least two Indian Air Force's French-made Rafale jets in history's largest ever aerial battle involving over 100 combat aircraft on both sides, according to multiple media reports. India had 72 warplanes on the attack and Pakistan responded with 42 of its own, according to Pakistani military. The Indian government has not yet acknowledged its losses but senior French and US intelligence officials have …

ContinuePosted by Riaz Haq on May 9, 2025 at 11:00am — 32 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network