PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Actual GDP Estimated at $401 Billion in 2012

Even with the run-up (in KSE-100), Andrew Brudenell, manager of the HSBC Frontier

Markets fund (HSFAX) in London, says Pakistan is one of the cheapest

markets he follows, at about seven times earnings. He notes that

earnings growth has kept pace with the market. The firms, he adds, are

typically cash-rich, boast strong return on equity levels in the 20%

range, and pay good dividends. In Pakistan, the informal, cash-based economy for goods and services is larger than the formal economy. Barron's, November 17, 2012

Growing gap between dismal official economic statistics and consumption boom coupled with strong corporate profits in Pakistan is a challenge for many analysts around the world. Most believe that Pakistan's GDP is, in fact, much larger and growing faster than the government data indicates.

Informal Economy Estimates:

M. Ali Kemal and Ahmed Waqar Qasim, economists at Pakistan Institute of Development Economics (PIDE), have published their research on estimates of the size of Pakistan's informal or underground economy.

Kemal and Qasim explore several published different approaches for sizing Pakistan's underground economy and settle on a combination of PSLM (Pakistan Social and Living Standards Measurement) consumption data and mis-invoicing of exports and imports to conclude that the country's "informal economy was 91% of the formal economy in 2007-08". Here are the figures offered by the authors for 2007-8:

1) Formal Economy: Rs. 10,242 billion= $170 billion (using Rs.60 to a US dollar)

2) Informal Economy: Rs. 9,365 billion = $156 billion

3) Total Economy (Sum of 1 & 2): Rs. 19,608 billion = $326 billion

Assuming that the ratio of formal and informal economy remained the same in 2011-12, here are the figures for Pakistan's total economy as of the end of last fiscal year which ended in June, 2012 :

1) Formal Economy: $210 billion

2) Informal Economy: $191 billion

3) Total Economy: $401 billion

|

| Hypermart Lahore |

Naween Mangi of Businessweek in her piece titled "The Secret Strength of Pakistan's Economy" described how Pakistan's informal cash-based economy evades government's radar, illustrating it with the story

of a tire repair shop owner Muhammad Nasir. Nasir steals water and

electricity from utility companies, receives cash from his customers in

return for his services and issues no receipts, pays cash for his cable

TV connection, and pays off corrupt police and utility officials and

local politicians instead of paying utility bills and taxes.

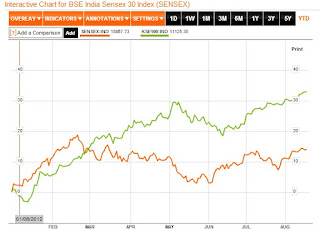

Karachi Stock Market:

|

| Comparing Karachi and Mumbai Share Indexes |

A string of strong earnings announcements by Karachi Stock Exchange

listed companies and the Central Bank's 1.5% rate cut have helped the KSE-100 index exceed 16,000 level, a gain of 42.1% (33.2% in US dollar terms) year to date. In spite of this run-up in KSE-100, Andrew Brudenell, manager of the HSBC Frontier

Markets fund (HSFAX) in London, remains bullish on Pakistani equities, according to Barron's. Pakistan is one of the cheapest

markets he follows, at about seven times earnings. He notes that

earnings growth has kept pace with the market. The firms, he adds, are

typically cash-rich, boast strong return on equity levels in the 20%

range, and pay good dividends.

Conclusion:

While Pakistan's public finances remain shaky, it appears that the country's economy is in fact healthier than what the official figures show. It also seems that the national debt is much less of a problem given the debt-to-GDP ratio of just 30% when informal economy is fully comprehended. Even a small but serious effort to collect more taxes can make a big dent in budget deficits. My hope is that increasing share of the informal economy will become documented with the rising use

of technology. Bringing a small slice of it in the tax net will make a

significant positive difference for public finances in the coming years.

Related Links:

Haq's Musings

Investment Analysts Bullish on Pakistan

Precise Estimates of Pakistan's Informal Economy

Pak Consumer Boom Fuels Underground Economy

Rural Consumption Boom in Pakistan

Pakistan's Tax Evasion Fosters Aid Dependence

Poll Finds Pakistanis Happier Than Neighbors

Pakistan's Rural Economy Booming

Pakistan Car Sales Up 61%

Resilient Pakistan Defies Doomsayers

Land For Landless Women in Pakistan

Pakistan's Circular Debt and Load-shedding

Hypermart Pakistan

-

Comment by Riaz Haq on January 27, 2015 at 10:01pm

-

KARACHI: Subjective factors are holding back Pakistan, a nation that fares better than most its equals in the emerging world. “Pakistan has good cards. Here, it is more a question of playing them well.”

David Martin Darst, an investment strategist, writer and an incorrigible optimist, visiting Pakistan on the invitation of Aga Khan University Hospital, said while talking exclusively to Dawn.

Currently he serves as a senior adviser and a member of Morgan Stanley Wealth Management Global Investment Committee, the company he joined in 1996 from Goldman Sachs.

Counting Pakistan’s blessings, he mentioned demographic bonus, its geography, vibrant media, entrepreneurial bent, assertive judiciary, history and rich cultural diversity, pool of overseas Pakistanis remitting sizeable monies, deep-rooted faith, existence of family and community.

He considered future outlook good for Pakistan and bracketed it with nine emerging economies that have collective potential to outperform giants, like China and Japan, in the next four decades.

He reposed confidence in the country’s capital market which he thought can attract big inflow of portfolio investment on the strength of its comparative performance.

“People tend to see the world too simplistically. Sometimes greatest investment opportunity is in countries that are perceived to be most risky.”

David, who was in the office of Morgan Stanley at the World Trade Centre when it was attacked on Sept 11, 2001 and was amongst fortunate people who left the building before it collapsed, did not sound bitter.

He first came to Pakistan about 20 years back and likes to return to the country at every chance that comes his way.

“This is my 10th visit. I have seen a few cities and been to up north. I think Swat and other hill-stations are amongst most beautiful places I have ever been to. The more I know the country, the more I like it,” he mused.

He said Pakistan is the middle child of Asia, neither big, nor small and would play a decisive role in setting the direction for the region.

“The family goes the way of the middle child,” he quipped lamenting the negative world image of Pakistan that has failed to acknowledge its contributions, including the size of its participation in UN peace-keeping forces in difficult environments.

http://www.dawn.com/news/1159854/subjective-factors-holding-back-pa...

-

Comment by Riaz Haq on October 23, 2016 at 7:09pm

-

Shadow Economies All over the World

New Estimates for 162 Countries from 1999 to 2007

Friedrich Schneider

Andreas Buehn

Claudio E. Montenegro

Pakistan's shadow economy estimated at 36%

Activities associated with shadow economies are facts of life around the world. Most societies

attempt to control these activities through various measures such as punishment, prosecution,

economic growth or education. To more effectively and efficiently allocate resources, it is

crucial for a country to gather information about the extent of the shadow economy, its

magnitude, who is engaged in underground activities, and the frequency of these activities.

Unfortunately, it is very difficult to get accurate information about shadow economy

activities, including the goods and labor involved, because individuals engaged in these

activities do not wish to be identified. Hence, doing research in this area can be considered a

scientific passion for “knowing the unknown.”

Although substantial literature5

exists on single aspects of the hidden or shadow economy and

comprehensive surveys have been written by Schneider and Enste (2000), and Feld and

Schneider (2009), the subject is still quite controversial as there are disagreements about the

definition of shadow economy activities, estimation procedures utilized, and the use of their

estimates in economic and policy analysis.6

Nevertheless, there are some indications that the

shadow economy has grown around the world, but little is known about the development and

the size of the shadow economies in developing Eastern European and Central Asian (mostly

former transition) countries, and high income OECD countries over the period 1999 to

2006/2007. The period was chosen as it has the most comprehensive data availability. This

study is an attempt to fill this gap by using the same estimation technique and almost the same

data sample used in Schneider and Buehn (2009) and Schneider and Enste (2000).

Therefore, the goal of this paper is twofold: (i) to undertake the challenging task of estimating

the shadow economy for 162 countries in various stages of development and located in

several regions throughout the world7

and (ii) to provide some insights about the main causes

of the shadow economy. To our knowledge, such an attempt has not been undertaken so far;

hence, we provide a unique database of the size and trends of the shadow economy in 162

countries over the period 1999 to 2006/2007. This is an improvement compared to previous

work – we used the MIMIC (Multiple Indicators Multiple Causes) estimation method for all

countries, thus creating a unique data set that allows us to compare shadow economy data.

http://www.gfintegrity.org/storage/gfip/documents/reports/world_ban...

-

Comment by Riaz Haq on April 30, 2017 at 7:27am

-

THE EXPRESS TRIBUNE > BUSINESS

Dissatisfied with size of Pakistan’s economy, Dar authorises World Bank study

https://tribune.com.pk/story/1397094/dissatisfied-size-pakistans-ec...

Pakistan has authorised the World Bank to undertake a study to come out of what an economist called the age of ‘statistical darkness’, after the country’s finance minister also started believing that the nation’s gross income is understated by as much as 25%.

“I have asked the World Bank to trigger a study and come out with the actual size of Pakistan’s Gross Domestic Product (GDP), which I believe is currently understated by 20% to 25%”, said Finance Minister Ishaq Dar on Saturday while addressing a gathering of chartered accountants from South Asian nations.

His statements came in the backdrop of a widely used figure for the size of the Pakistani economy, currently stated to be hovering around the $280-billion mark.

Dar said after noticing this undercounting of economic output, he decided to stick to 7% GDP growth rate target for 2019.

What is wrong with Pakistan’s economy?

He said that the input output coefficient of various industries has not been worked out for the last two decades. Dar said that the World Bank would require at least one year to complete the study.

He assigned the task to the World Bank last week during his visit to Washington. He is the second person and the first in the government who has now started believing that the country’s national output could be far more than what it is at the moment.

The idea was first floated by Shahid Javed Burki, former vice-president of the World Bank, during a meeting with Dar that took place two months ago.

Pakistani policymakers are taking decisions in statistical darkness and the World Bank can help to end this, wrote Shahid Javed Burki in an article published in The Express Tribune after his meeting with Dar.

He had written that China was also making a similar mistake and was underestimating its gross income by as much as 25%. He believed that Pakistan was under-counting its GDP by the same order of magnitude.

A 25% upward adjustment in the estimate of GDP will bring 2017 Pakistani income from $280 billion to $350 billion, improving its world ranking from 43rd to 31st. It is then likely to cross South Africa, Singapore, Malaysia and Egypt, according to Burki.

According to Burki, some of the methods that Pakistan was using and the surveys that collected required data were seriously outdated. Pakistan was also not correctly estimating the size of its modern services – in particular information, communications, entertainment, travel and advanced commerce. All these sectors contribute much more to the economy than suggested by official numbers, he wrote.

Tax target

Meanwhile, Dar on Saturday finally announced that this fiscal year’s tax target of Rs3.621 trillion has been revised downwards. “We are aiming for over Rs3.5 trillion tax collections for fiscal year 2016-17,” said Dar.

The Federal Board of Revenue (FBR) is now aiming to collect Rs3.521 trillion – a cut of Rs100 billion.

Pakistan’s economy quietly rises even as terror makes headlines

The government had to lower the target after it faced a shortfall of Rs168 billion during the first nine months (July-March) of the current year. The shortfall has further widened in April to Rs198 billion after the FBR also missed its April target by a margin of Rs30 billion. Against the monthly target of Rs290 billion, the FBR could pool Rs260 billion, according to provisional results. The monthly collection is expected to slightly go up to Rs263 billion.

The cumulative tax collection during the first ten months (July-April) increased to Rs2.55 trillion. The FBR needs to generate Rs996 billion in the remaining two months of the fiscal year, which seems like an uphill task.

Special Assistant to Prime Minister on Revenue Haroon Akhtar said that the FBR sustained Rs121 billion shortfall due to change in polices by the government after the announcement of the last budget.

-

Comment by Riaz Haq on May 28, 2020 at 6:52pm

-

Investigators Find Rs 30 Million in Cash From Two Bags In Wreckage Of Crashed #Pakistan Aircraft. #PIAPlaneCrash #PlaneCrashKarachi https://www.ndtv.com/world-news/investigators-find-rs-30-million-in... via @ndtv

Investigators and rescue officials have found around Rs 30 million in cash in the wreckage of the Pakistan International Airlines' aircraft that crashed wth 99 people on board, killing 97 people, including nine children.

Flight PK-8303 from Lahore to Karachi crashed in a residential area near Karachi International Airport on Friday, with only two passengers miraculously surviving the crash.Investigators and rescue officials have found currencies of different countries and denominations worth around Rs 30 million from the aircraft's wreckage, an official said on Thursday.

"An investigation has been ordered into how such a huge amount of cash got through airport security and baggage scanners and found its way into the ill-fated flight," the official said.

He said that the amount was recovered from two bags in the wreckage.

"The process of identifying the bodies and their luggage which will be handed over to their families and relatives is going on," he said.

A total of 97 people including the aircraft crew died in the crash, one of the most catastrophic aviation disasters in Pakistan's history.

A government official said on Thursday that the identification of 47 bodies had been completed, while 43 bodies were handed over for burial.

Friday's accident was the first major aircraft crash in Pakistan after December 7, 2016 when a PIA ATR-42 aircraft from Chitral to Islamabad crashed midway. The crash claimed the lives of all 48 passengers and crew, including singer-cum-evangelist Junaid Jamshed.

-

Comment by Riaz Haq on November 4, 2021 at 6:25pm

-

A base year is a benchmark with reference to which national account figures such as GDP, gross domestic saving and gross capital formation are calculated.

According to the new base year, Bangladesh was an economy of Tk 34,840 billion in current prices in FY21, up 15.7 per cent from Tk 30,111 billion as per the previous base year.

https://www.thedailystar.net/business/economy/news/gdp-size-growth-...

"The size of our economy is huge, and the new base year will reflect it," he said, adding that a real scenario would allow the government to make more informed policy decisions.

Zahid Hussain, a former chief economist of the World Bank's Dhaka office, also welcomed the new base year.

He said timely revisions to data on GDP and its components determine the accuracy of national account estimates and their comparability across countries.

With the finalisation of the new series, Bangladesh will be ahead of all other Saarc countries in terms of the recency of the national account's base year.

Only the Maldives (2014) and India (2011-12) come close, while Pakistan (2005-06) and Sri Lanka (2010) are well behind.

"Improved data sources increase the coverage of economic activities as new weights for growing industries reflect their contributions to the economy more accurately," said Hussain.

The last revision was done in 2013.

The size of the agriculture, industry and services sectors has expanded as per the new base year.

The new base year uses data on about 144 crops while computing the contribution of the agriculture sector to the GDP, which was 124 crops in the previous base year.

The gross value addition by the agriculture sector rose to Tk 4,061 billion in current prices in the last fiscal year, up from Tk 3,846 billion in the old estimate, the BBS document showed.

The industrial sector saw the addition of the data on the outputs of Ashuganj Power Station Company, North-West Power Generation Company, Rural Power Company, cold storage for food preservation, Rajshahi Wasa, and the ship-breaking industry.

-

Comment by Riaz Haq on November 5, 2021 at 9:04pm

-

GDP rebasing: no more delays!

BR Research Updated 27 Aug 2021

https://www.brecorder.com/news/40115951

There is little doubt that the size of Pakistan’s economy is understated. Many economic indictors such as per capita income and debt levels depict bleaker picture than the situation on the ground reflects. When size of the economy is understated, it makes debt to GDP ratio appear unsustainable, in turn weakening government’s bargaining power with lenders such as IMF.

One strong indicator about economic activities in any economy is national electricity consumption. Most readers would be surprise to find out that per capita grid electricity sales are 25-30 percent higher in Pakistan than in Bangladesh. Many commentators point out that GDP per capita has become higher in Bangladesh over the last decade. But it is pertinent to note that while electricity consumption is based on actual data, GDP of any economy is based on many assumptions and estimates and is based on the level of documentation in any economy. Ergo, it would appear that the level of documentation in Bangladesh is significantly higher in Bangladesh than in Pakistan.

Yet, infrastructure and construction actives are significantly greater in Pakistan than in Bangladesh. Domestic annual cement sales in Pakistan are at 48 million tons against 33 million tons in Bangladesh; in per capita terms, the spending is 10 percent higher in Pakistan. Existing road infrastructure is also of better quality and much more extensive in Pakistan (although latter may also be an indicator of greater geographic area). Similarly, number of passenger vehicles in Pakistan – including much more pertinent, vehicle per 1000 persons – is also higher.

The purpose, of course, is not to undermine the economic performance of Bangladesh, and the significant gains made by that country in past two decades. However, it is equally important to engage in undercutting ourselves. Anecdotal evidence suggests that the widely held perceptions of smaller size of economy – exacerbated by lower growth rate in recent years – also contributes to brain drain; as skilled workers seek opportunities elsewhere due to bleak outlook.

Pakistan conducted its last GDP rebasing exercise in 2005-06. GDP rebasing becomes due every ten years, yet it has been much delayed since. Since the PTI government took office, work has been undertaken on the same for the last two years. Yet, the problem is that the post of chief statistician has been vacant for over three years. There are many sectors which have experienced mushroom growth since the last rebasing exercise was completed, and they are not fully recorded in GDP. For example, the value addition segment of textile industry is not recorded in official GDP. Similarly, packaging across many industries is not included. Economic activities is simply much greater than what the official estimation represents.

Then the undocumented cash economy is also growing fast. The velocity of money (computed as nominal GDP divided by broad money – M2) is down from the average of 2.6 during FY10-14 to 2.1 percent during FY17-21. The velocity in any country doesn’t change so abruptly. The catch lies in clamping down on cash economy. The currency in circulation kept on growing since 2015, and falling velocity implies that cash is not coming back into the system. It is turning into a mini-economy unto its own.

The excess average annual CIC (difference between the average CIC/M2 ratio in FY18-21 at 28% to FY10-15 ratio at 22%), of Rs1.2 trillion could have generated undocumented GDP of Rs3.1 trillion at the historic velocity of 2.6. In comparison to Bangladesh (CIC/M2 at 13%), Pakistan’s cash economy is double the size.

Planning ministry must bring life to the Bureaus of Statistics (PBS) and speed up GDP rebasing. Once its done, apples can be compared to apples, which can also help restore Pakistan’s negotiating position with global lenders.

-

Comment by Riaz Haq on November 12, 2021 at 5:22pm

-

THE size of Pakistan’s informal economy is estimated to be as much as 56 per cent of the country’s GDP (as of 2019). This means that it’s worth around $180 billion a year, and that is a massive amount by any yardstick. by LalaRukh Ejaz IBA Karachi Professor

https://www.dawn.com/news/1610606

The country’s large black economy is inextricably linked to the levels and quality of governance exercised by the state. In the course of fieldwork for my doctoral research for the University of Southampton, I found that many Pakistani women who were setting out starting their own businesses did so in the informal sector. The reasons they gave usually related to their experience of dealing with the bureaucracy and government machinery in Pakistan which they found to be dominated by red tape and tedious and complicated procedures.

This is precisely what drives many people who want to engage in economic activity towards the undocumented economy. The headache of having to deal with a large bureaucracy, of complying with complicated and long registration procedures, of getting approvals and licences from various government agencies and departments make it difficult for most people to operate within a documented framework.

A large black economy is an indication of misgovernance and indicates a failure of the government to ensure that all businesses and entrepreneurial ventures are included in the formal sector. This failure in turn leads to reduced tax revenue collection since all entities outside of the formal economy do not pay any tax to the government.

Pakistan’s black economy is linked to governance.

Given that the size of the black and informal economy is estimated at over half of the country’s GDP, bringing it under the documented net would bring hundreds of billions in tax revenue. Those funds would then be spent on social sector development projects and help the FBR meet its annual revenue collection targets.

The solution is to increase the size of the formal economy and this can be done by making transparent and efficient those institutions tasked with registering and regulating businesses. Instead of harassing businesses and entrepreneurs, agencies like the FBR should act as facilitators and make it easier for new ventures to be registered and come under the documentation net. This would in turn be good for the FBR because achieving the tax collection target would be easier than if they were in the black economy.

Government requirements for new businesses are linked to the general level of governance. A state whose primary aim is to improve the lives of its citizens will prioritise good governance over all other things and will formulate and implement policies that enable this. In fact, such a state will also be able to realise that having such priorities ends up helping it as well, not least because a happy populace is a more economically productive populace.

Unfortunately, in a country like Pakistan, so far, this has not been the case. A multitude of licences and permissions are required from a wide variety of federal, provincial and local government departments to operate a business or a store. Having to comply with all of these requires not only a lot of time on the part of the entrepreneur but also funds for greasing the cogs of the bureaucratic machinery that regulates businesses and commercial enterprises in Pakistan.

The result of this is that a significantly growing number of entrepreneurs, and especially those that happen to be female, are increasingly veering towards the informal sector. This is both good and bad — good because it enables economic activity to take place, and jobs to be created, away from the unwanted glare of government inspectors and officialdom, and bad because the incomes generated from such activity don’t end up getting counted in the national GDP and nor are taxes paid on it.

-

Comment by Riaz Haq on December 18, 2021 at 6:29pm

-

THE size of Pakistan’s informal economy is estimated to be as much as 56 per cent of the country’s GDP (as of 2019). This means that it’s worth around $180 billion a year, and that is a massive amount by any yardstick. by Dr. Lalarukh Ejaz, Assistant Professor, IBA Karachi

https://www.dawn.com/news/1610606

The country’s large black economy is inextricably linked to the levels and quality of governance exercised by the state. In the course of fieldwork for my doctoral research for the University of Southampton, I found that many Pakistani women who were setting out starting their own businesses did so in the informal sector. The reasons they gave usually related to their experience of dealing with the bureaucracy and government machinery in Pakistan which they found to be dominated by red tape and tedious and complicated procedures.

This is precisely what drives many people who want to engage in economic activity towards the undocumented economy. The headache of having to deal with a large bureaucracy, of complying with complicated and long registration procedures, of getting approvals and licences from various government agencies and departments make it difficult for most people to operate within a documented framework.

A large black economy is an indication of misgovernance and indicates a failure of the government to ensure that all businesses and entrepreneurial ventures are included in the formal sector. This failure in turn leads to reduced tax revenue collection since all entities outside of the formal economy do not pay any tax to the government.

Given that the size of the black and informal economy is estimated at over half of the country’s GDP, bringing it under the documented net would bring hundreds of billions in tax revenue. Those funds would then be spent on social sector development projects and help the FBR meet its annual revenue collection targets.

The solution is to increase the size of the formal economy and this can be done by making transparent and efficient those institutions tasked with registering and regulating businesses. Instead of harassing businesses and entrepreneurs, agencies like the FBR should act as facilitators and make it easier for new ventures to be registered and come under the documentation net. This would in turn be good for the FBR because achieving the tax collection target would be easier than if they were in the black economy.

Government requirements for new businesses are linked to the general level of governance. A state whose primary aim is to improve the lives of its citizens will prioritise good governance over all other things and will formulate and implement policies that enable this. In fact, such a state will also be able to realise that having such priorities ends up helping it as well, not least because a happy populace is a more economically productive populace.

Unfortunately, in a country like Pakistan, so far, this has not been the case. A multitude of licences and permissions are required from a wide variety of federal, provincial and local government departments to operate a business or a store. Having to comply with all of these requires not only a lot of time on the part of the entrepreneur but also funds for greasing the cogs of the bureaucratic machinery that regulates businesses and commercial enterprises in Pakistan.

The result of this is that a significantly growing number of entrepreneurs, and especially those that happen to be female, are increasingly veering towards the informal sector. This is both good and bad — good because it enables economic activity to take place, and jobs to be created, away from the unwanted glare of government inspectors and officialdom, and bad because the incomes generated from such activity don’t end up getting counted in the national GDP and nor are taxes paid on it.

-

Comment by Riaz Haq on January 15, 2022 at 7:58pm

-

Deficient data

By Ishrat HusainDecember 24, 2021

https://www.thenews.com.pk/print/919381-deficient-data

In most countries, the national accounts are revised at intervals of five years or so. GDP at current and constant factor prices in Pakistan is still derived from the 2005-06 base, for which some of the surveys were carried out several years before the base year. The 2015-16 rebasing exercise has been completed for quite some time and is in danger of becoming redundant because of new capacity, new activities and new sectors that have emerged since these surveys were undertaken. Rebasing and extrapolation to the current year would show a substantial increase in the size of the economy, and per capita income providing a more realistic picture. Of course, the result of the rebasing is likely to lead to uproar by certain quarters as it would show decline in debt, fiscal and current account deficits/ GDP ratios and a lowering of tax, imports and exports ratios etc relative to GDP. The present ratios are misleading and do not guide policymakers in taking the right remedial actions.

----------------

Let me give one specific example of the unreliability and inaccuracy of the present data. The Quantum Index of Large Scale Manufacturing (QIM) with 2005-06 as base year gives a weight to textiles of 20.9 percent (Yarn 13.7 and cloth 7.2). If we examine the exports of textiles, the value added textiles (non-yarn and non-cloth) form almost 80 percent of the total textile exports. All the large exporting houses producing value added goods are not reflected in this weightage for LSM. So the critics rightly point out as to how exports are growing when the yarn and cloth output are declining.

The QIM is constructed in an ad-hoc manner by combining the data from the Oil Companies Advisory Committee (11 items), the Ministry of Industries and Production (36 items), and the Provincial Bureaus (65 items) reporting changes on a monthly basis in the components of the index. Not only is the methodology questionable, the coverage is also incomplete and inaccurate. The provincial bureaus – except Punjab – do not have the capacity to collect the primary information and therefore rely on the industry sources (which usually understate production to evade taxes) or secondary data.

Any correlations with the usage of inputs or electricity or gas consumption are not attempted to verify the authenticity and whatever raw data is reported goes into the index unvarnished. Decisions on export or imports of sugar were made on the basis of the production data provided by the sugar millers which subsequently was found to be erroneous. The same is the case with cement, fertilisers, automobiles etc output data that is included without validation or independent verification.

The last Census of Manufacturing Industries (CMI) which was used in the National Accounts and QMI was that of 2005-06. CMI 2015-16 was completed a few years ago and my information about Punjab shows there is quantum jump in the index compared to what we are using at present. The PBS and the Planning Commission should have made the switch but it hasn’t been done so far. This would affect our national accounts and the industry sector but also the services sector whose value added is dependent on the quantum of commodity producing sectors.

-

Comment by Riaz Haq on December 29, 2022 at 7:56pm

-

Informal Savings in Pakistan

https://www.dawn.com/news/1725956

According to research by Oraan, around 41pc Pakistanis saved via committees (or Rosca), whereas Karandaaz puts that figure at 34pc. Assuming the informal economy accounts for roughly 30pc, as suggested by research from the Pakistan Institute of Developing Economics, it translates into annual committees of Rs4 trillion at base prices, using conservative inputs.

While this back-of-the-envelope calculation is far from scientific, it helps contextualise how big the informal savings market really is. Everyone from a widow looking to save up for her children’s education to young adults trying to save up for their marriage, committees are what they turn to.

This phenomenon is not exclusive to Pakistan. According to a note by Middle East Venture Partners (one of the investors in Bykea), “the global market is largely untapped and ripe for disruption with 2.4 billion people using money circles through traditional channels.”

They recently participated in the Egyptian digital committees’ startup MoneyFellows’ $31m Series B.

Apart from the traditional financial institutions’ general apathy towards the customer, committees appeal to an average Pakistani for several reasons: they are a community-based instrument with some level of flexibility and there is no interest involved.

Most importantly, it helps them manage cash flow better due to habitual change. For women, the product enjoys particular popularity since the former financial services are largely inaccessible.

However, since committees are primarily cash-based with virtually no money trail involved, it poses massive risks, as we saw recently when a girl, Sidra Humaid, who ran a network of committees through social media, defaulted on Rs420m of payments.

----

Even beyond this, committees have flaws by design, only amplified by Pakistan’s macros. For instance, the person receiving the first lump sum amount will always be at an advantage since their instalments in the subsequent months would be worth less due to both inflation and rupee depreciation. The recipient of the last payment would see the amount’s purchasing power eroded substantially by the time they get it.

Moreover, due to the community-based nature of the product, the risk of network defaulting is higher as people of usually similar risk profiles would be pooling in their money.

For example, if employees from an organisation have running office committees, delayed salaries or layoffs within the organisation would lead to a bad equilibrium, creating losses for the rest of the group, often resulting in default.

However, there are ways to address some of those challenges. First of all, to (partially) protect your lump sum from depreciation or devaluation, you can enter a committee with a duration of up to 10 months. Given Pakistan’s macros of late, you’d still lose money in real terms but to be fair, that’d most likely be the case in any other instrument as well, including the risk-free government papers.

In fact, contrary to popular perception, there are certain ways to further alleviate the inflation problem. Digital committees have an option of gamifying the experience by rewarding good payment behaviour through loyalty programs and/or brand partnerships to provide discounts on utilities-based services and products.

Secondly, digital committees help create a trail of money which, coupled with a centralised authority (the platform itself), brings in accountability and recourse in the event of a default. The receipt and/or ledger helps with basic accounting in committees creating transparency for people within the group.

The third benefit of digital committees is the security factor. The participant has to go through a know-your-customer and credit check process to make sure there is no fraudulent behaviour that could negatively impact the group, along with the participant’s ability and willingness to pay to create an overall environment for responsible finance.

Comment

- ‹ Previous

- 1

- 2

- 3

- 4

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Silicon Valley Pakistani-Americans Among Top Donors to Mamdani Campaign

Omer Hasan and Mohammad Javed are the top donors to Zohran Mamdani’s mayoral campaign in New York City, according to media reports. Both are former executives of Silicon Valley technology firm AppLovin. Born and raised in Silicon Valley, Omer is the son of a Pakistani-American couple who are long-time residents of Silicon Valley, California. …

ContinuePosted by Riaz Haq on September 19, 2025 at 9:00am

Modi's Hindutva: Has BJP's Politics Hurt India's International Image?

The Indian cricket team's crass behavior after defeating the Pakistani team at the Asia Cup 2025 group encounter has raised eyebrows among sports fans around the world. Not only did Suryakumar Yadav, the Indian team captain, refuse to do the customary handshake before and after the match in Dubai but he also made controversial statements linking the match with the recent India-Pakistan conflict. “A few things in life are above sportsman’s spirit ......We stand with all the victims of the …

ContinuePosted by Riaz Haq on September 15, 2025 at 7:00pm — 1 Comment

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network