PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Prime Minister Imran Khan Demonstrated Effectiveness as Crisis Leader

Prime Minister Imran Khan has effectively led Pakistan through multiple crises in the last 4 years. Khan inherited dangerously low forex reserves in 2018 which are now at $23 billion, near the highest level in the nation's history. The COVID pandemic that hampered Pakistan's recovery has been handled well with the fully vaccinated rate for the eligible population at more than 75%. Not only has Khan deftly navigated his nation through these crises but his government has also revived the country's economy and grown exports by 26%. Domestic savings rate recovered to nearly 17% after plunging to a low of 12% in 2018. The year 2021 was a banner year for Pakistan's technology startups that raised over $350 million in funding, more than the amount raised in the previous 5 years. Manufacturing and construction industries are enjoying a boom last seen during the Musharraf years in 2000-2007.

|

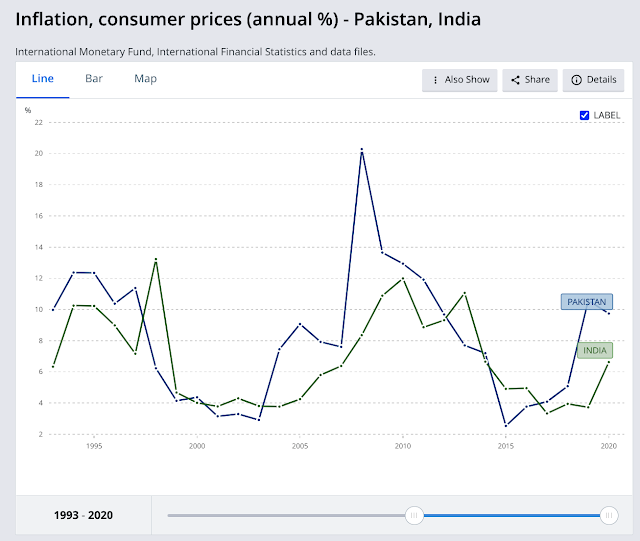

| Historic Inflation Rates in India & Pakistan. Source: World Bank |

|

| Pakistan Exports in First 8 Months (July 21-Feb 22) in FY 22. Sourc... |

|

| Pakistan Employment By Sectors. Source: Pakistan Bureau of Statistics |

For the first time in recorded history, the labor force participation rate in Pakistan is now higher than in India, according to the ILO/World Bank estimates.

|

| Labor Participation Rates in India and Pakistan. Source: World Bank... |

|

| Unemployment Rate in India and Pakistan. Source: ILO/World Bank |

|

| Pakistan Savings Rate. Source: Global Economy |

|

| QIM Index 2019-22. Source: APP |

|

| Pakistan Large Scale Manufacturing Index. Source: Mettis Global |

|

| Cement shipments in Pakistan. Source: All Pakistan Cement Manufactu... |

|

| Pakistan Startup Investments. Source: Aljazeera |

-

Comment by Riaz Haq on June 9, 2022 at 9:03am

-

It seems the economy fared better during the fiscal year 2021-2022, i.e. the PTI government’s final year. PML-N took over in April after the controversial vote of no confidence. While PML-N claims that Imran Khan’s government ruined the economy, broad-based growth was witnessed in all the sectors of the economy.

https://www.globalvillagespace.com/pakistans-economy-showed-robust-...

The incumbent government will today launch the pre-budget document, Economic Survey of Pakistan 2021-22, showing a robust GDP growth rate of 5.97 percent. The survey would cover the development of all the important sectors of the economy, including growth.

According to details reported by the media, most of the targets set for the outgoing fiscal year 2021-22 seemed to be achieved or even surpassed the previous years’ targets, as the macro economic indicators have shown good performance during the year.As per the Planning Commission’s estimations made in the 105th meeting of the National Accounts Committee (NAC), the provisional GDP growth rate for the years 2021-22 is estimated at 5.97%.

The growth of agricultural, industrial, and services sectors is 4.40%, 7.19%, and 6.19% respectively. The growth of important crops during this year is 7.24%. The growth in production of important crops namely Cotton, Rice, Sugarcane, and Maize are estimated at 17.9%, 10.7%, 9.4%, and 19.0% respectively.

The services sector shows a growth of 6.19%. The wholesale and Retail Trade industry grew by 10.04%. It is dependent on the output of agriculture, manufacturing, and imports.

https://www.finance.gov.pk/survey/chapter_22/Highlights.pdf

-

Comment by Riaz Haq on June 9, 2022 at 6:41pm

-

Pakistan Economic Survey: Education 2021-22

https://www.finance.gov.pk/survey/chapter_22/PES10-EDUCATION.pdf

Pakistan is committed to transform its education system into a high-quality global

market demand driven system in accordance with the Goal 4 of Sustainable

Development Goals (SDGs) which pertains to quality of education. The progress

achieved by Pakistan so far on Goal 4 of SDGs is as under:

Primary, Lower and Upper Secondary Education Completion Rate stood at 67

percent, 47 percent and 23 percent, respectively, depicting higher Primary

attendance than Lower and Upper Secondary levels.

Parity Indices at Literacy, Youth Literacy, Primary and Secondary are 0.71, 0.82, 0.88

and 0.89, respectively.

Participation rate in organized learning (one year before the official primary entry

age), by sex is 19 percent showing a low level of consideration of Pre-Primary

Education.

Percentage of population in a given age group achieving at least affixed level of

proficiency in functional; (a) literacy and (b) numeracy skills is 60 percent.

--------

Literacy, Gross Enrolment Rate (GER) and Net Enrolment Rate (NER)

Literacy

During 2021-22, PSLM Survey was not conducted due to upcoming Population and

Housing Census 2022. Therefore, the figures for the latest available survey regarding

GER and NER may be considered for the analysis. However, according to Labour Force

Survey 2020-21, literacy rate trends shows 62.8 percent in 2020-21 (as compared to

62.4 percent in 2018-19), more in males (from 73.0 percent to 73.4 percent) than

females (from 51.5 percent to 51.9 percent). Area-wise analysis suggest literacy increase

in both rural (53.7 percent to 54.0 percent) and urban (76.1 percent to 77.3 percent).

Male-female disparity seems to be narrowing down with time span. Literacy rate gone

up in all provinces, Punjab (66.1 percent to 66.3 percent), Sindh (61.6 percent to 61.8

percent), Khyber Pakhtunkhwa (52.4 percent to 55.1 percent) and Balochistan (53.9

percent to 54.5 percent). [Table10.2].

Table 10.2: Literacy Rate (10 Years and Above) (Percent)

Province/Area 2018-19 2020-21

Male Female Total Male Female Total

Pakistan 73.0 51.5 62.4 73.4 51.9 62.8

Rural 67.1 40.4 53.7 67.2 40.8 54.0

Urban 82.2 69.7 76.1 83.5 70.8 77.3

--------

During 2021-22, PSLM Survey was not conducted due to upcoming Population and

Housing Census 2022. Therefore, the figures for the latest available survey are reported

here.

Table 10.3: National and Provincial GER (Age 6 -10 years) at Primary Level (Classes1-5)(Percent)

Province/Area 2014-15 2019-20

Male Female Total Male Female Total

Pakistan 98 82 91 89 78 84

Punjab 103 92 98 93 90 92

Sindh 88 69 79 78 62 71

Khyber Pakhtunkhwa

(Including Merged Areas)

- - - 96 73 85

Khyber Pakhtunkhwa

(Excluding Merged Areas)

103 80 92 98 79 89

Balochistan 89 54 73 84 56 72

Source: Pakistan Social and Living Standards Measurement (PSLM) District Level Survey, 2019-20,

Pakistan Bureau of Statistics.

-------------

Annual Status of Education Report (ASER)

Annual Status of Education Report (ASER-Rural) 2021, is the largest citizen-led

household-based learning survey across all provinces/areas: Sindh, Balochistan, Punjab,

Khyber Pakhtunkhwa (KP), Gilgit Baltistan (GB), Islamabad Capital Territory (ICT) and

Azad Jammu Kashmir (AJK). According to the ASER 2021, 10,000 trained

volunteer/enumerators surveyed 87,415 households in 4,420 villages across 152 rural

districts of Pakistan. Detailed information of 247,978 children aged 3-16 has been

collected (57 percent male and 43 percent female), and of these, 212,105 children aged

5-16 years were assessed for language and arithmetic competencies. Moreover, 585

transgenders were also a part of the surveyed sample. Major findings of ASER 2021 and

its comparison with 2019 is given in Box-II

-

Comment by Riaz Haq on June 9, 2022 at 6:42pm

-

Pakistan Economic Survey: Health & Nutrition 2021-22

https://www.finance.gov.pk/survey/chapter_22/PES11-HEALTH.pdf

Infant Mortality Rate (IMR) in Pakistan has declined to 54.2 deaths per 1,000 live births

in 2020 from 55.7 in 2019, while Neonatal Mortality Rate declined to 40.4 deaths per

1,000 live births in 2020 from 41.2 in 2019. Percentage of birth attended by skilled

health personnel increased to 69.3 percent in 2020 from 68 percent in 2019 (DHS & UNICEF). Maternal Mortality Ratio fell to 186 maternal deaths per 100,000 births in

2020, from 189 in 2019 (Table 11.1).

With a population growing at 2 percent per annum, Pakistan’s contraceptive prevalence

rate in 2020 decreased to 33 percent from 34 percent in 2019 (Trading Economics).

Pakistan’s tuberculosis incidence is 259 per 100,000 population and HIV prevalence rate

is 0.12 per 1,000 population in 2020.

Table 11.1: Health Indicators of Pakistan

2019 2020

Maternal Mortality Ratio (Per 100,000 Births)* 189 186

Neonatal Mortality Rate (Per 1,000 Live Births) 41.2 40.4

Mortality Rate, Infant (Per 1,000 Live Births) 55.7 54.2

Under-5 Mortality Rate (Per 1,000) 67.3 65.2

Incidence of Tuberculosis (Per 100,000 People) 263 259

Incidence of HIV (Per 1,000 Uninfected Population) 0.12 0.12

Life Expectancy at Birth, (Years) 67.3 67.4

Births Attended By Skilled Health Staff (% of Total)** 68.0 (2015) 69.3 (2018)

Contraceptive Prevalence, Any Methods (% of Women Ages 15-49) 34.0 33

Source: WDI, UNICEF, Trading Economics & Our World in data

-----------

Food and nutrition

Calories/day 2019-20 2457 2020-21 2786 2021-22 2735

-------

Table 11.9: Availability of Major Food Items per annum (Kg per capita)

Food Items 2019-20 2020-21 2021-22 (P)**

Cereals 139.9 170.8 164.7

Pulses 7.8 7.6 7.3

Sugar 23.3 28.5 28.3

Milk (Liter) 168.7 171.8 168.8

Meat (Beef, Mutton, Chicken) 22.0 22.9 22.5

Fish 2.9 2.9 2.9

Eggs (Dozen) 7.9 8.2 8.1

Edible Oil/ Ghee 14.8 15.1 14.5

Fruits & Vegetables 53.6 52.4 68.3

Calories/day 2457 2786 2735

Source: M/o PD&SI (Nutrition Section)

-

Comment by Riaz Haq on June 13, 2022 at 1:42pm

-

Economic Survey of Pakistan 2021-22 (Manufacturing & Mining Chapter)

https://www.finance.gov.pk/survey/chapter_22/PES03-MANUFACTURING.pdf

During July-March FY2022, LSM staged

the growth of 10.4 percent against 4.24

percent growth in the corresponding

period last year. Production of 11 items

under the Oil Companies Advisory

Committee increased by 2.0 percent, 36

items under the Ministry of Industries and

Production surged by 10.3 percent, while 76 items reported by the Provincial Bureaus

of Statistics increased by 12.1 percent. The expansion of LSM is also appeared to be

broad based, with 17 out of 22 sectors of LSM witnessed a positive growth. Furniture,

Wood Products, Automobile, Footballs, Tobacco, Iron & Steel Products, Machinery and

Equipment, and Chemical Products remained the top performing sectors of LSM.

----------

Automobile sector marked a vigorous growth of 54.1 percent during July-March FY2022

against 21.6 percent growth last year. New Auto Policy, to promote new technologies

including Electric Vehicles (EVs) and Hybrid, and accommodative monetary policy to

promote auto financing paved the way to grew automobiles production. Besides, tax

incentives to promote locally manufactured cars also pent-up the demand as well as the

production of the given sector such as locally manufactured hybrid sales tax reduced

from 12.5 percent to 8 percent and FED reduced by 2.5 percent upto 1300cc for locally

manufactured cars. Moreover, during July-March FY2022 car production and sale

increased by 56.7 and 53.8 percent, respectively. Trucks & Buses production and sale

increased by 66.0 and 54.0 percent and tractor production and sale increased by 13.5

and 12.1 percent, respectively. Though the relief measures in form of waiving of taxes

pushed up the sector, in the meanwhile reduced the revenues of national exchequer and

built the pressure on imports besides creating uncertainty in market sentiments.

-------------

In case of passenger cars, the production and sales are up by 57 percent and 54 percent

with 166,768 and 172,612 units, respectively. In this regard, higher growth has been

observed in up to 800cc and up to 1000cc segments registering 77 percent and 65

percent growth, respectively. Growth in exceeding 1000cc segment was 35 percent. For

similar reasons, the production and the sales of light commercial vehicles (LCV) and

SUVs registered increase by 44 percent and 46 percent, respectively. In the SUV and SUV

crossover segment two new products appear from Beijing Automotive Industry, BAIC

BJ40L and BAIC X25 with modest numbers which are expected to grow in time.

Farm tractor sector has shown growth with production and the sales up by 13.5 percent

and 12 percent respectively. This pleasant upward surge was due to overall growth in

agriculture sector ensuing better crop prices and consequent more buying power of the

farmers. However, these numbers are not even close to the highest numbers this

industry had achieved in the past.

The two/three wheelers sector showed modest fall in production and the sales by 3.5

percent and 4.1 percent respectively. This fall is due intra-industry production losses by

some units, while other units have shown their natural growth. Two/three wheelers

offers most economical public transport alternate for the lower income group, however,

at same time, it is extremely price sensitive. Massive exchange rate losses kicked off

inflationary conditions resulting inevitable price increase. Still, this sector offers most

preferred means of transport and best alternative in the absence of Public Transport in

the cities and thus holds a dependable and continued potential for growth in the coming

years.

-

Comment by Riaz Haq on July 18, 2022 at 10:09am

-

Barrick Gold Corporation - Reko Diq Alliance Between Pakistan and Barrick Set to Create Long-Term Value

https://www.barrick.com/English/news/news-details/2022/reko-diq-all...

Subject to the updated feasibility study, Reko Diq is envisaged as a conventional open pit and milling operation, producing a high-quality copper-gold concentrate. It will be constructed in two phases, starting with a plant that will be able to process approximately 40 million tonnes of ore per annum which could be doubled in five years. With its unique combination of large scale, low strip and good grade, Reko Diq will be a multi-generational mine with a life of at least 40 years. During peak construction the project is expected to employ 7,500 people and once in production it will create 4,000 long-term jobs. Barrick’s policy of prioritizing local employment and suppliers will have a positive impact on the downstream economy.

-----------------

ISLAMABAD, PAKISTAN – Finance Minister Miftah Ismail and Barrick president and chief executive Mark Bristow said after their meeting here today that they shared a clear vision of the national strategic importance of the Reko Diq copper-gold project and were committed to developing it as a world-class mine that would create value for the country and its people through multiple generations.

Reko Diq is one of the world’s largest undeveloped copper-gold deposits. An agreement in principle reached between the government of Pakistan, the provincial government of Balochistan and Barrick earlier this year provides for the reconstitution and restart of the project, which has been on hold since 2011. It will be operated by Barrick and owned 50% by Barrick, 25% by the Balochistan Provincial Government and 25% by Pakistani state-owned enterprises.

The definitive agreements underlying the framework agreement are currently being finalized by teams from Barrick and Pakistan. Once this has been completed and the necessary legalization steps have been taken, Barrick will update the original feasibility study, a process expected to take two years. Construction of the first phase will follow that with first production of copper and gold expected in 2027/2028.

“During the negotiations the federal government and Barrick confirmed that Balochistan and its people should receive their fair share of the benefits as part of the Pakistan ownership group,” Bristow said.

“At Barrick we know that our long-term success depends on sharing the benefits we create equitably with our host governments and communities. At Reko Diq, Balochistan’s shareholding will be fully funded by the project and the Federal Government, allowing the province to reap the dividends, royalties and other benefits of its 25% ownership without having to contribute financially to the project’s construction or operation. It’s equally important that Balochistan and its people should see these benefits from day one. Even before construction starts, when the legalization process has been completed we will implement a range of social development programs, supported by an upfront commitment to the improvement of healthcare, education, food security and the provision of potable water in a region where the groundwater has a high saline content.”

Finance Minister Ismail said the development of Reko Diq represented the largest direct foreign investment in Balochistan and one of the largest in Pakistan.

“Like Barrick, we believe that the future of mining lies in mutually beneficial partnerships between host countries and world-class mining companies. The Reko Diq agreement exemplifies this philosophy and also signals to the international community that Pakistan is open for business,” he said.

-

Comment by Riaz Haq on January 2, 2023 at 8:06am

-

Barrick Gold strikes final deal with Pakistan for Reko Diq project

Published by Joe Toft, Editorial Assistant

Global Mining Review

https://www.globalminingreview.com/mining/30122022/barrick-gold-str...

Barrick Gold Corporationhas announced that it has completed the reconstitution of the Reko Diq project, having received a favourable opinion from the Supreme Court of Pakistan and the required legislation having been passed into law.

One of the largest undeveloped copper-gold projects in the world, Reko Diq is owned 50% by Barrick, 25% by three federal state-owned enterprises, 15% by the Province of Balochistan on a fully funded basis and 10% by the Province of Balochistan on a free carried basis.

Barrick president and chief executive Mark Bristow said the completion of the legal processes was a key step in progressing the development of Reko Diq into a world-class, long-life mine which would substantially expand the company’s strategically significant copper portfolio and benefit its Pakistani stakeholders for generations to come.

“We are currently updating the project’s 2010 feasibility and 2011 feasibility expansion studies. This should be completed by 2024, with 2028 targeted for first production,” Bristow said.

“With its unique combination of large scale, low strip and good grade, Reko Diq is expected to have a life of at least 40 years. We envisage a truck-and-shovel open cast operation with processing facilities producing a high-quality copper-gold concentrate. We expect it to be constructed in two phases with a combined process capacity of 80 million tpy.

Reko Diq will be a major contributor to Pakistan’s economy which is expected to have a transformative impact on the underdeveloped Balochistan province where, in addition to the economic benefits it will generate, the mine will also create jobs, promote the growth of a regional economy and invest in development programs. The province’s interest in the mine will be fully funded, which means that Balochistan will reap the dividends, royalties and other benefits of its 25% shareholding without having to contribute financially to its construction and operation.

“Reko Diq’s ownership structure is a further manifestation of Barrick’s commitment to partnership with its host countries and communities and to sharing the value our operations create fairly with all our stakeholders,” Bristow said.

“We’re making sure that Balochistan and its people will see these benefits quickly. Starting early next year, Barrick will implement a range of social development programs prioritising the improvement of healthcare, education, vocational training, food security and the provision of potable water. Our investment in these is expected to amount to around US$70 million over the feasibility and construction period. In addition, Reko Diq will advance royalties to the government of Balochistan of up to US$50 million until commercial production starts.”

During peak construction the project is expected to employ 7500 people and once in production it will create around 4000 long-term jobs. As elsewhere in the group, Barrick prioritises the employment of local people and host country nationals.

Bristow said Barrick already had the industry's best gold assets and the addition of Reko Diq would promote its copper portfolio into the world-class league, accelerating the company towards its goal of creating the world's most valued gold and copper mining business.

-

Comment by Riaz Haq on May 20, 2023 at 4:28pm

-

Pakistan is sitting on a gold mine

https://english.almayadeen.net/articles/analysis/pakistan-is-sittin...

The Reko Diq mine, renowned for its massive gold and copper deposits, is thought to contain the fifth-largest gold deposit in the world.

Reko Diq is a small desert village in the Balochistan district of Chagai, 70 kilometers northwest of Naukundi and close to Pakistan's border with Iran and Afghanistan. This region is situated within the Tethyan belt, which extends from Turkey and Iran to Pakistan. Reko Diq, which in Balochi means "sandy mountain," is also the name of an extinct volcano.

The Reko Diq mine, renowned for its massive gold and copper deposits, is thought to contain the fifth-largest gold deposit in the world. The mine is in a small desert area in the northeast of Balochistan, near the border with Iran and Afghanistan.

600,000 tons of concentrate produce an estimated 200,000 tons of copper and 250,000 ounces of gold on a yearly basis. The annual profit from the mines is estimated by the TCC to be approximately $1.14 billion for copper and $2.50 billion for gold, totaling $3.64 billion annually. Independent estimates suggest the number is as high as $500 billion, which is significantly higher than the TCC's estimation of $200 billion.

-

Comment by Riaz Haq on June 4, 2023 at 5:54pm

-

Barrick Gold Corporation - Reko Diq Mining Company Constitutes Community Development Committee for Locally Driven Development

https://www.barrick.com/English/news/news-details/2023/reko-diq-con...

NOKKUNDI, BALOCHISTAN – Reko Diq Mining Company (RDMC), a subsidiary of Barrick Gold Corporation, has constituted a 25-member Community Development Committee (CDC) at Nokkundi in the Chagai district. The CDC comprises local stakeholders and community leaders who will guide the company’s social investment plan in the area.

Speaking at the event, Ali Ehsan Rind, the country manager of RDMC said: “In all its operations worldwide, Barrick strives to be a good corporate citizen and a genuine partner of the host communities in locally led development. With the formation of this CDC, representing all the key local stakeholders, I am confident that our work will become a catalyst for the social development of the local communities.”

The meeting was also attended by the district commissioner of Chaghi, the deputy director of mines (Balochistan), tribal elders, local notables and a cross-section of representatives from the district.

The Nokkundi CDC was formulated after an extensive consultative process and engagement with 62 stakeholders. Its mandate includes consultation for consensus on the selection of social investment initiatives to be undertaken by the company.

Community Development Committees

CDCs are our community development partnership model, comprised of community members, elected locally and include a representative from the company to ensure projects chosen align with the five sustainable development focus areas and adhere to our policies including procurement and accountable governance.

The formation of this CDC is a concrete step taken by RDMC to ensure that the business delivers social investment projects of significant and lasting benefit to the local communities among whom it will operate. The management of RDMC values sustainable development and mutual advantage and seeks to build a harmonious partnership amongst the communities in and around the RD project area.

Reko Diq will be a multi-generational mine with a life of at least 40 years. During peak construction the project is expected to employ 7,500 people and once in production it will create 4,000 long-term jobs. Barrick’s policy of prioritizing local employment and suppliers will have a positive impact on the local economy. The company plans to finish the Reko Diq feasibility study update by the end of 2024, with 2028 targeted for first production from the giant copper-gold mine in the country’s Balochistan province. The new Reko Diq agreement ensures that benefits from the project start accruing to the people of Balochistan well before the mine goes

-

Comment by Riaz Haq on September 6, 2023 at 4:03pm

-

Reko Diq #Copper Mine in #Pakistan's #Balochistan has potential to be one of world’s biggest suppliers of metal needed for transition to clean #energy. #Canada's Barrick is investing in it. #SaudiArabia's #investment fund has also expressed interest. https://www.ft.com/content/7a1db3cf-a61b-4ef5-b90d-ea98fe530295

“Reko Diq is one of the bigger copper-gold undeveloped projects in the world,” said Mark Bristow, chief executive of Barrick, which aims to start mining in 2028 subject to an ongoing feasibility study. “It’s a very big deal. Any copper mine right now is a big deal.”

The project highlights how the copper shortfall is pushing miners into ever trickier markets in search of supply. Pakistan’s repeated political and economic crises have scared away all but the most determined foreign investors, and local authorities had blocked an earlier attempt involving Barrick to mine Reko Diq.

---

Bristow argues that the project, in which Barrick has a 50 per cent stake alongside the Pakistan and Balochistan governments, will bring much-needed development to the region.

“Mining, when it goes into emerging markets, is obsessed with getting its money back,” he said. “We’ve learned that you start paying benefits and dividends early on.”

As countries transition to clean energy sources, copper — whose conductive properties make it crucial to transporting electricity — is only expected to become more important to the global economy.

But with supply from incumbent mines in countries such as Chile and Peru stalling, an estimated $118bn of investment by 2030 is needed to plug a supply gap that will by next decade be equivalent to 35 Reko Diq-sized projects, according to analysts at CRU Group.

Th a record of operating in riskier markets such as Mali and the Democratic Republic of Congo.

While Reko Diq adds “a lot of uncertainty” for Barrick investors, “Barrick is no stranger to frontier jurisdictions”, said Canaccord Genuity analyst Carey MacRury.

Another factor that could help steer the Reko Diq project is the presence of a new investor. Saudi Arabia’s Public Investment Fund and state mining company Ma’aden have expressed interest in a stake. Analysts said the involvement of one of Pakistan’s most important allies would help shield the project from future political U-turns.

If successful, the mine could turn the company into one of the world’s largest copper producers. Diversifying its portfolio into copper is particularly important for gold miners such as Barrick to stay relevant with investors focused on environmental, social and governance issues, since the company’s core product plays no role in the energy transition.

Reko Diq sits along the largely untapped south Asian leg of a rock formation from Europe to south-east Asia that is believed to hold rich copper deposits. Analysts believe there is the potential for more mines.

Ahsan Iqbal, who recently stepped down as Pakistan’s planning minister and worked on the project, argued that Reko Diq would “put Balochistan on the mining map of the world”.

----------

Reko Diq “is 50 miles from Afghanistan and 40 miles from Iran”, one person involved with the project said. “So it will be a target.”

For support, Barrick has turned to Pakistan’s powerful army, which helps control the country’s politics and helped negotiate last year’s deal to revive the project, according to a person involved.

Pakistan’s army chief also this month attended a local mining conference alongside Bristow. “The military are a steadying hand,” Bristow said. “They are absolutely essential on the security side.”

Yet rights groups have repeatedly accused the army of abuses in Balochistan, including extrajudicial executions, allegations it denies.

Bristow has welcomed the potential Saudi interest in Reko Diq and dismissed hand-wringing over whether he can see through the project.

“When you look at the world, it is more complex than when I started,” he said. “Gone are the days that you can control a mining company from a multistorey, cushy building in the developed world.”

-

Comment by Riaz Haq on November 3, 2023 at 4:28pm

-

Saudis In Talks With Pakistan on Reko Diq, Barrick CEO Says

https://www.arabnews.com/node/2402616/press-review

Bloomberg reported Saudi Arabia is in ongoing talks with Pakistan to buy part of the government’s stake in a $7 billion copper project jointly owned with Barrick Gold Corp., according to the head of the mining company.

--------------

GOLDSaudi Arabia wants to buy major untapped copper-gold deposit in Pakistan, says Barrick Gold CEO

Barrick says the project will rank among the world’s top 10 copper producers when it reaches full production

https://mugglehead.com/saudi-arabia-wants-to-buy-major-untapped-cop...

The Kingdom of Saudi Arabia is in talks with Pakistan to buy one of the largest underdeveloped copper-gold projects in Pakistan which is partially owned by the gold giant Barrick Gold Corporation (NYSE: GOLD) (TSX: ABX).

“Saudi wants to buy some stake (in Reko Diq). We don’t know how much. So, those conversations are ongoing, and we are supportive of them, but we’re not there to get into the middle of it,” said Barrick’s CEO Mark Bristow in a Reuters interview following the release of Barrick’s Q3 2023 results.

As part of the proposed agreement, Saudi Arabia would purchase a stake in Reko Diq in collaboration with the Pakistani government. Barrick owns 50 per cent of the project, while the government and the province of Balochistan own the remainder.

“That’s something that is in the hands of the Pakistan government to come to a decision on,” Bristow told Reuters. “We would support any decision that’s made by the Pakistan government with the Saudis.”

The Reko Diq $7 billion project is located in the province of Balochistan, Pakistan and is set to be constructed in 2025 and targets production by 2028. Barrick says the project will rank among the world’s top 10 copper producers when it reaches full production.

Naguib Sawaris, an Egyptian gold billionaire, said in September he wanted to buy a piece of Reko Diq but Bristow dismissed his intention.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistan's Homegrown Link-17 Kill Chain Helped Shoot Down India's Rafale Fighter Jets

Using a homegrown datalink (Link-17) communication system, Pakistan has integrated its ground radars with a variety of fighter jets and airborne early warning aircraft (Swedish Erieye AWACS) to achieve high level of situational awareness in the battlefield, according to experts familiar with the technology developed and deployed by the Pakistan Air Force. This integration allows quick execution of a "…

ContinuePosted by Riaz Haq on May 31, 2025 at 9:00am — 10 Comments

American Prof John Mearsheimer on International Geopolitics in South Asia

Professor John Mearsheimer, a renowned international relations expert known for his theory of "offensive realism", has recently spoken to India's CNN-News18 about the impact of US-China competition on geopolitics in South Asia. Sharing his thoughts in interviews on India-Pakistan conflict after the Pahalgam attack, he said: "There is really no military solution to this (Kashmir)…

ContinuePosted by Riaz Haq on May 24, 2025 at 5:30pm — 23 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network