PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Prime Minister Imran Khan Demonstrated Effectiveness as Crisis Leader

Prime Minister Imran Khan has effectively led Pakistan through multiple crises in the last 4 years. Khan inherited dangerously low forex reserves in 2018 which are now at $23 billion, near the highest level in the nation's history. The COVID pandemic that hampered Pakistan's recovery has been handled well with the fully vaccinated rate for the eligible population at more than 75%. Not only has Khan deftly navigated his nation through these crises but his government has also revived the country's economy and grown exports by 26%. Domestic savings rate recovered to nearly 17% after plunging to a low of 12% in 2018. The year 2021 was a banner year for Pakistan's technology startups that raised over $350 million in funding, more than the amount raised in the previous 5 years. Manufacturing and construction industries are enjoying a boom last seen during the Musharraf years in 2000-2007.

|

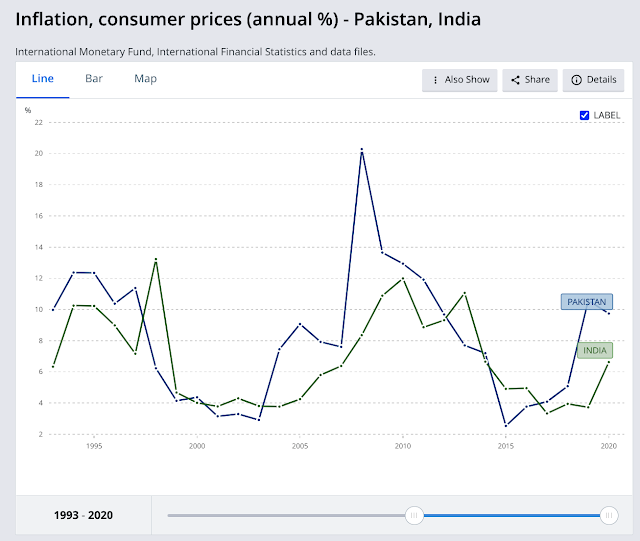

| Historic Inflation Rates in India & Pakistan. Source: World Bank |

|

| Pakistan Exports in First 8 Months (July 21-Feb 22) in FY 22. Sourc... |

|

| Pakistan Employment By Sectors. Source: Pakistan Bureau of Statistics |

For the first time in recorded history, the labor force participation rate in Pakistan is now higher than in India, according to the ILO/World Bank estimates.

|

| Labor Participation Rates in India and Pakistan. Source: World Bank... |

|

| Unemployment Rate in India and Pakistan. Source: ILO/World Bank |

|

| Pakistan Savings Rate. Source: Global Economy |

|

| QIM Index 2019-22. Source: APP |

|

| Pakistan Large Scale Manufacturing Index. Source: Mettis Global |

|

| Cement shipments in Pakistan. Source: All Pakistan Cement Manufactu... |

|

| Pakistan Startup Investments. Source: Aljazeera |

-

Comment by Riaz Haq on April 17, 2022 at 4:42pm

-

Pakistan’s Political Crisis Has Been an Energy Crisis, Too

Successive governments have failed to back renewables, cutting the country off from the cheapest source of indigenous energy. The new prime minister could change all that.

https://www.bloomberg.com/opinion/articles/2022-04-17/pakistan-s-po...

The political crisis that pitched Pakistan’s prime minister Imran Khan from office wasn’t just about the failure of his anti-corruption agenda and mismanagement of an economy where inflation running at nearly 13% has driven months of opposition protests. It’s also, as with so many of Pakistan’s political crises, about energy and exchange rates.

For decades, heavy dependence on imported energy has constrained growth. To break out of its chronic pattern of stagnation, Pakistan needs more power for its industrial, household and transport sectors. Whenever that has happened in the past, however, a rising bill for imported fossil fuels has prompted one of its periodic balance-of-payments crises. The International Monetary Fund bailout that’s widely expected within months would be Pakistan’s 19th since the early 1970s.

-

Comment by Riaz Haq on April 18, 2022 at 8:47pm

-

Pakistani financial platform Abhi Pvt. raised funds at a $90 million valuation within a year after introducing its business, the latest startup to benefit from investors’ increasing interest in the South Asian country.

The Karachi-based company’s $17 million Series A round was led by Speedinvest, marking the venture capital firm’s first bet in Pakistan, Abhi Chief Executive Officer Omair Ansari said in an interview. Global Ventures, VentureSouq, VEF, Sturgeon Capital, Rallycap, FJ Labs, Fatima Gobi, Sarmayacar and i2i Ventures also participated.

Pakistan is attracting investors eager to back startups in one of the last large untapped markets. Companies raised more than $350 million last year in the country, greater than the amount over the previous six years combined. Among the firms making their first-time investments in the country recently are Kleiner Perkins, Tiger Global Management and Dragoneer Investment Group.

Startup Fever Grips Pakistan, World’s Last Big Untapped Nation

The lending startup offers an alternative to people asking their employer, family or friends for cash to make ends meet until their next salary. It also gives small- and medium-sized companies financing for working capital requirements. The company has now become cash-flow positive.

“This is the first time you’re able to get this access in the country,” Ansari said in an interview. “As people and smaller companies get this access then it becomes something they want to keep using.”

The app takes less than 30 seconds and two clicks for a registered user to access the funds, with a flat 2% transaction fee. The funds are automatically deducted from the next paycheck.

Co-founder Ansari previously oversaw two funds at Morgan Stanley, and was looking at investment opportunities in consumer companies and fintech in emerging and frontier markets. He helped with early-stage investments in fintech companies from China to Brazil. He was also an adviser to VEF, which focuses on fintech in frontier and emerging markets.

The company has increased users to 650,000 from about 200,000 since a previous round in Novemberand also on-boarded over 150 companies. Individuals are accessing 15% to 20% of their monthly wage through the platform, Ansari said.

“Abhi has the potential to change millions of lives across MENA and South Asia,” said Stefan Klestil, general partner at Speedinvest. “It’s no wonder they have been able to establish themselves as one of the fastest-growing Pakistani startups.”

https://www.bloomberg.com/news/articles/2022-04-19/pakistan-startup...

-

Comment by Riaz Haq on April 19, 2022 at 7:00pm

-

Muzzammil Aslam

@MuzzammilAslam3

Finally, IMF has admitted that Pakistan posted 5.6% GDP in 2021, lowest CAD in last 11 years 0.6% of GDP & inflation at 8.9%. The IMF admission clearly indicates its flawed methodology of predicting economic variables. Also reminder to all news paper, IMF endorsed 5.6%.https://twitter.com/MuzzammilAslam3/status/1516535103027281921?s=20...

-

Comment by Riaz Haq on April 20, 2022 at 4:24pm

-

According to the World Bank’s Pakistan Development Update, released today, while economic activity maintained its momentum during July-December 2021, high demand pressures and rising global commodity prices led to double-digit inflation and a sharp rise in the import bill during this period. These developments have had an adverse impact on the rupee. Moreover, long-standing structural weaknesses of the economy including low investment, low exports, and low productivity growth pose risks to a sustained recovery.

https://www.worldbank.org/en/news/press-release/2022/04/19/long-sta....

The report highlights that with economic recovery and improved labor market conditions, poverty—measured at the lower middle-income class poverty line of $3.20 Purchasing Power Parity 2011 per day—declined from 37 percent in FY20 to 34 percent in FY21. However, rising food and energy prices are expected to decrease the real purchasing power of households, disproportionally affecting poor and vulnerable households that spend a larger share of their budget on these items.“Pakistan’s economic recovery after the COVID-19 crisis indicates that the country has enormous potential to overcome challenging economic situations,” said Najy Benhassine, World Bank Country Director for Pakistan. “However, sustaining the economic recovery requires addressing long-standing structural weaknesses of the economy and boosting private sector investment, exports and productivity.”

On the back of high base affects and recent monetary tightening, real GDP growth is expected to moderate to 4.3 and 4.0 percent in FY22 and FY23, respectively. Thereafter, economic growth is projected to slightly recover to 4.2 percent in FY24, provided that structural reforms to support fiscal sustainability and macroeconomic stability are implemented rapidly, and that global inflationary pressures dissipate.

However, the macroeconomic risks remain very high. These include tighter global financing conditions, potential further increases in world energy prices, and the possible risk of a return of stringent COVID-19-related mobility restrictions. Domestically, political uncertainty and policy reform slippages can also lead to protracted macroeconomic imbalances.

“To mitigate immediate macroeconomic risks, the Government should focus on containing the fiscal deficit at a level which ensures debt sustainability, closely coordinate fiscal and monetary policy, and retain exchange rate flexibility,” said Zehra Aslam, the lead author of the report.

The special section of the report focuses on financial intermediation and how to increase financing to the real economy by addressing structural impediments impacting the demand and supply of finance, including in credit markets. These impediments include extensive government borrowing from the financial sector that crowds out supply of credit to the private sector and deepens the sovereign-bank nexus. Intermediation is further limited by low domestic savings, and underdeveloped capital markets. Overall financial inclusion remains low, but good progress has been made to enhance it through ongoing digital innovations. Resolving these constraints in the medium to long term requires concerted efforts by the government, regulators, and other stakeholders.

https://thedocs.worldbank.org/en/doc/410d0506bba8afc6fd9d9541148bfe...

-

Comment by Riaz Haq on April 20, 2022 at 4:37pm

-

P A K I S T A N

DEVELOPMENT UPDATE

April 2022

https://thedocs.worldbank.org/en/doc/410d0506bba8afc6fd9d9541148bfe...

Supported by higher growth and the recovery in the manufacturing and services sectors,

the poverty headcount, measured at the lower-middle-income class line of US$3.20 PPP

2011 per day, is estimated to have declined from 37.0 percent in FY20 to 34.0 percent in

FY21.

Rising inflation has disproportionally affected poor and vulnerable households that spend

a relatively larger share of their budget on food and energy. More specifically, the poor

spend around 50 percent of their total consumption on food items, whereas this share is

only 43 percent among the non-poor. In response, the Government inaugurated a

targeted commodity subsidy program, Ehsaas Rashan Riayat, in February 2022 to

compensate eligible households for higher prices.22

The Government undertook timely policy measures to mitigate the adverse

socioeconomic impacts of the COVID-19 pandemic. The State Bank of Pakistan (SBP)

lowered the policy rate and announced supportive measures for the financial sector to

help businesses and the Government expanded the national cash transfer program on an

emergency basis.2 These measures contributed to economic growth rebounding to 5.6

percent in FY21.3 However, long-standing structural weaknesses of the economy,

particularly consumption-led growth, low private investment rates, and weak exports have

constrained productivity growth and pose risks to a sustained recovery. Aggregate

demand pressures have built up, in part due to previously accommodative fiscal and

monetary policies, contributing to double-digit inflation and a sharp rise in the import bill

with record-high trade deficits in H1 FY22 (Jul–Dec 2021). These have diminished the

real purchasing power of households and weighed on the exchange rate and the country’s

limited external buffers.

b. Real Sector

Growth

Economic

momentum

continued, but

business confidence

has declined

During H1 FY22, y-o-y growth in car production and sales, petroleum sales, and foreign

remittance inflows indicate continued momentum in economic activity and private

consumption. Similarly, investment is also expected to have increased with a strong

growth in machinery imports and government development expenditure. Government

consumption is also expected to have expanded given the 16.0 percent increase in

consolidated current expenditure in H1 FY22. Activity in the external sector was also

vibrant, with import and export values growing by 54.4 percent and 27.3 percent,

respectively. While the flow of bank loans to private businesses grew in this period, it was

led by an increase in working capital or short-term financing, particularly as businesses

faced higher input costs, as opposed to long-term or fixed investment financing. The

business confidence survey index also declined from a pandemic high of 64.0 in June

2021 to 53.4 in December 2021, indicating lower optimism in the business sector

regarding the economic outlook.4

Favorable weather

conditions are

expected to support

higher overall crop

production

In agriculture, estimates suggest that rice, sugarcane, and maize production will be higher

this year, reflecting better weather conditions.5 With regards to agriculture inputs,

agriculture credit disbursement grew 3.9 percent, and farm tractor sales increased by 21.2

percent in H1 FY22.6 Similarly, 97.7 percent of the sowing target for wheat has been met.7

----

Large-scale

industrial production

growth strengthened

The LSM index, a key indicator for industrial activity, increased by 7.5 percent y-o-y

during H1 FY22 compared to a muted growth of 1.5 percent in H1 FY21. Growth was

broad-based with 16 out of the 22 sectors recording higher production. Only

-

Comment by Riaz Haq on April 23, 2022 at 8:47pm

-

Arif Habib Limited

@ArifHabibLtd

Monthly Technology exports reached at all-time during Mar’22, up by 24% YoY and 29% MoM to $ 259mn.

During 9MFY22, technology recorded exports worth $ 1.9bn marking a 29% YoY jump.

https://twitter.com/ArifHabibLtd/status/1517809966501236737?s=20&am...

----------

Arif Habib Limited

@ArifHabibLtd

Highest ever total exports in the month of Mar'22, up by 18% YoY | 9% MoM to USD 3.74bn.

https://twitter.com/ArifHabibLtd/status/1517797547171094528?s=20&am...

----------

ICT exports surge to near $2 billion in 9M FY22

https://en.dailypakistan.com.pk/23-Apr-2022/ict-exports-surge-to-ne...

-

Comment by Riaz Haq on April 30, 2022 at 10:34am

-

there has been a robust growth of IT and IT-enabled (ITeS) remittances in the past five years. According to the Economic Survey of Pakistan (2020-2021), the compound annual growth rate for IT and related services reached 18.85 per cent, the highest growth rate of any industry in the region. In addition, micro enterprises, independent consultants and freelancers contributed around $500 million to IT and ITeS exports while the annual domestic revenue exceeded $1 billion.

https://www.dawn.com/news/1686067

According to the survey, from July to February of the outgoing fiscal year, IT export remittances in sectors including telecommunication and computer IT services surged to $1.29bn at a growth rate of 41.39pc, compared to $918m during the corresponding period in FY20. Enabling government policies have contributed to this remarkable growth. These include numerous sustainable development and accelerated digitisation projects, incentives to bolster growth, including 100pc equity ownership and specialised foreign currency (FCY) accounts for IT/ITeS firms and freelancers to fulfil operational demands, thus addressing a long-standing concern of IT companies regarding the easy inflow/outflow of foreign currency.

Now IT/ITeS companies and freelancers can keep 100pc of remittances received through proper banking channels in their FCY accounts without being forced to convert them to rupees. Moreover, outward transfers from FCY accounts are also unrestricted for Pakistan Software Export Board-registered IT companies and freelancers.

However, the revelation that the IT sector carries tremendous potential is not new, though the industry remains unexploited. Google recognised Pakistan as far back as 2018 for rapidly turning into a “digital-first country”. At present, Pakistan has the fourth-largest growing freelancers’ market globally. The country is known for software development, business process outsourcing (BPO) and freelancing of IT-related services.

-

Comment by Riaz Haq on May 14, 2022 at 8:25pm

-

Pakistan LSM (large scale manufacturing) sector grows 10.4% in Jul 2021-Mar 2022

https://tribune.com.pk/story/2356514/lsm-sector-grows-104-in-jul-mar

The economic advisory wing of the finance ministry (now under PMLN), which till March (under PTI) had been predicting around 5% overall growth rate, has suddenly cut the forecast to 4% in its latest publication.

Contrary to that, the Planning Commission expects the growth rate in the range of 5% to 5.4%, which will be higher than the last PTI government’s target for the current fiscal year.

-----------------------

Big industries grew 10.4% during the first nine months of current fiscal year on the back of a low base effect and better output in sugar and apparel sectors, increasing prospects of achieving around 5% overall economic growth in this fiscal year.

Large-scale manufacturing (LSM) industries recorded 10.4% growth during July-March of the ongoing fiscal year over the same period a year ago, the Pakistan Bureau of Statistics (PBS) reported on Friday.

PBS data suggested that the increase largely came from the food sector, which has over one-tenth weight in the LSM index and apparel wear, which has 6.1% weight.

The other factor that contributed to the healthy momentum was the low base, as the index was at 126 in March last year, which jumped to nearly 154 this year.

The past year’s trend suggests that the LSM will post higher growth in April and May as well due to the low base effect.

The 10.4% growth during the first nine months of current fiscal year has strengthened the chances of achieving around 5% gross domestic product (GDP) growth in this fiscal year ending in June.

The increase in sugarcane and sugar production will offset the 1.5 million tons’ decline in wheat production.

The economic advisory wing of the finance ministry, which till March had been predicting around 5% overall growth rate, has suddenly cut the forecast to 4% in its latest publication.

Contrary to that, the Planning Commission expects the growth rate in the range of 5% to 5.4%, which will be higher than the last PTI government’s target for the current fiscal year.

The National Accounts Committee – the body that works out the growth estimates on the basis of input from the provincial and federal government departments – will meet by the mid of next week to approve the provisional growth rate for fiscal year 2021-22.

The new government has decided to revive the stalled International Monetary Fund (IMF) programme, which may also result in fiscal and monetary tightening to bring economic stability. This could hurt growth prospects for fiscal year 2022-23.

The previous government had targeted 4.8% economic growth for the current fiscal year. The IMF and other financial institutions have projected Pakistan’s economic growth in the range of 4% to 4.3%, which is a decent rate but nearly half of what is required to create jobs for all new entrants in the market.

The central bank has injected hundreds of billions of rupees into the economy, which provided a fresh impetus to the economic growth but fueled inflation in the country.

The LSM data is collected from three different sources. Data collected by the Oil Companies Advisory Council (OCAC) showed that the output of 36 items increased on an average by 2% in the first nine months of current fiscal year.

The Ministry of Industries, which monitors 11 products, reported a 10.3% increase in output during the July-March period. Provincial Bureaus of Statistics reported 12.1% growth in the output of 76 goods, stated the PBS.

On a yearly basis, the LSM sector showed 26.6% growth in March over the same month of last year. However, half of the increase in March output was because of increased production of sugar by the mills.

The industries that posted growth in the first nine months of current fiscal year included textile, which registered 3.2% growth.

The textile industry is the largest sector in the LSM index, having 18.2% weight. The production of apparel wear increased 34% during the first nine months of FY22.

-

Comment by Riaz Haq on May 21, 2022 at 5:00pm

-

PTI

@PTIofficial

Pakistan's economy showed robust growth across all sectors in FY2021-22; GDP grew by 6.0% while per capita income increased by 17.2% in PKR terms. Compiled by

@syed_maazuddin

, this shows how

@ImranKhanPTI

’s policies were beneficial for Pakistan.https://twitter.com/PTIofficial/status/1528042187337998347?s=20&...

-

Comment by Riaz Haq on May 21, 2022 at 5:22pm

-

GDP growth estimated at 5.97pc for FY 2021-22

By Ghulam Abbas

https://profit.pakistantoday.com.pk/2022/05/18/gdp-growth-estimated...

Pakistan has estimated the Gross Domestic Product (GDP) growth in the range of approximately 6 percent for the current fiscal year with the major contributions of industrial and services sectors.

Unlike the IMF projection of a 4 percent GDP growth rate for Pakistan, the Pakistan Muslim League Nawaz led government has estimated a 5.97 percent provisional GDP growth rate for the year 2021-22.

The 105th meeting of the National Accounts Committee to review the final, revised and provisional estimates of GDP for the years 2019-20, 2020-21 and 2021-22 respectively was held on Wednesday under the chair of Secretary, MoPD&SI.

The provisional GDP growth rate for the year 2021-22 is estimated at 5.97% as broad-based growth was witnessed in all sectors of the economy.

Article continues after this advertisement

The growth of agricultural, industrial and services sectors is 4.40%, 7.19% and 6.19% respectively. Similarly, the growth of important crops during this year is 7.24%.

The growth in production of important crops namely Cotton, Rice, Sugarcane and Maize are estimated at 17.9%, 10.7%, 9.4% and 19.0% respectively.

The cotton crop increased from 7.1 million bales reported last year to 8.3 million bales; Rice production increased from 8.4 million tons to 9.3 million tons; Sugarcane production increased from 81.0 million tons to 88.7 million tons; Maize production increased from 8.4 million tons to 10.6 million tons respectively, whole Wheat production decreased from 27.5 million tons to 26.4 million tons. Other crops showed growth of 5.44% mainly because of an increase in the production of pulses, vegetables, fodder, oilseeds and fruits. The livestock sector is showing a growth of 3.26%. The growth of forestry is 3.13% and fishing is at 0.35%.

The overall industrial sector shows an increase of 7.19%. The mining and quarrying sector has decreased by 4.47% due to a decline in the production of other minerals as well as a decline in exploration costs. The Large Scale Manufacturing industry is driven primarily by QIM data (from July 2021 to March 2022) which shows an increase of 10.4%. Major contributors to this growth are Food (11.67%), Tobacco (16.7%), Textile (3.19%), Wearing Apparel (33.95%), Wood Products (157.5%), Chemicals (7.79%), Iron & Steel Products (16.55%), Automobiles (54.10%), Furniture (301.83%) and other manufacturing (37.83%). The electricity, gas and water industry shows a growth of 7.86% mainly due to an increase in subsidies in 2021-22. The value-added in the construction industry, mainly driven by construction-related expenditures by industries, has registered a modest growth of 3.14% mainly due to an increase in general government spending.

The services sector shows a growth of 6.19%. The wholesale and Retail Trade industry grew by 10.04%. It is dependent on the output of agriculture, manufacturing and imports. The growth in trade value-added relating to agriculture, manufacturing and imports stands at 3.99%, 9.82% and 19.93% respectively. Transportation & Storage industry has increased by 5.42% due to an increase in gross value addition of railways (41.85%), air transport (26.56%), road transport (4.99%) and storage. Accommodation and food services activities have increased by 4.07%. Similarly, Information and communication increased by 11.9% due to improvements in telecommunication, computer programming, consultancy and related activities.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

American Prof John Mearsheimer on International Geopolitics in South Asia

Professor John Mearsheimer, a renowned international relations expert known for his theory of "offensive realism", has recently spoken to India's CNN-News18 about the impact of US-China competition on geopolitics in South Asia. Sharing his thoughts in interviews on India-Pakistan conflict after the Pahalgam attack, he said: "There is really no military solution to this (Kashmir)…

ContinuePosted by Riaz Haq on May 24, 2025 at 5:30pm — 8 Comments

Has Pakistan Destroyed India's S-400 Air Defense System at Adampur?

Pakistan claims its air force (PAF) has destroyed India's high-value Russian-made S-400 air defense system (ADS) located at the Indian Air Force (IAF) Adampur air base. India has rejected this claim and posted pictures of Prime Minister Narendra Modi posing in front of its S-400 rocket launchers in Adampur. Meanwhile, there are reports that an Indian S-400 operator, named Rambabu Kumar Singh, was killed at about the time Pakistan claims to have hit it. Pakistan is believed to have targeted…

ContinuePosted by Riaz Haq on May 21, 2025 at 4:00pm — 5 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network