PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Prime Minister Imran Khan Demonstrated Effectiveness as Crisis Leader

Prime Minister Imran Khan has effectively led Pakistan through multiple crises in the last 4 years. Khan inherited dangerously low forex reserves in 2018 which are now at $23 billion, near the highest level in the nation's history. The COVID pandemic that hampered Pakistan's recovery has been handled well with the fully vaccinated rate for the eligible population at more than 75%. Not only has Khan deftly navigated his nation through these crises but his government has also revived the country's economy and grown exports by 26%. Domestic savings rate recovered to nearly 17% after plunging to a low of 12% in 2018. The year 2021 was a banner year for Pakistan's technology startups that raised over $350 million in funding, more than the amount raised in the previous 5 years. Manufacturing and construction industries are enjoying a boom last seen during the Musharraf years in 2000-2007.

|

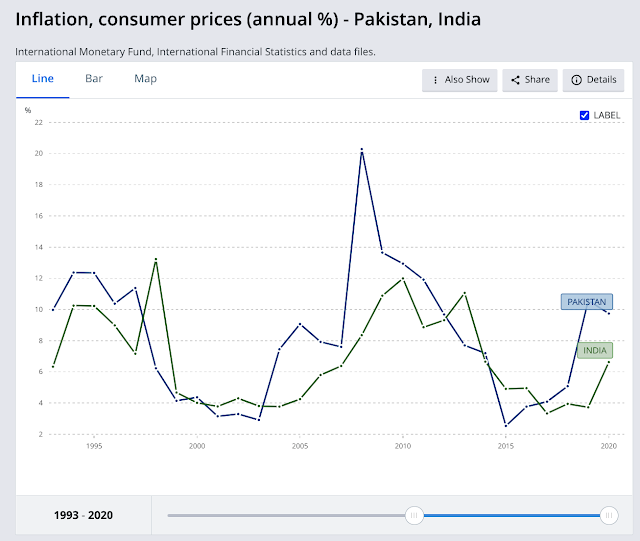

| Historic Inflation Rates in India & Pakistan. Source: World Bank |

|

| Pakistan Exports in First 8 Months (July 21-Feb 22) in FY 22. Sourc... |

|

| Pakistan Employment By Sectors. Source: Pakistan Bureau of Statistics |

For the first time in recorded history, the labor force participation rate in Pakistan is now higher than in India, according to the ILO/World Bank estimates.

|

| Labor Participation Rates in India and Pakistan. Source: World Bank... |

|

| Unemployment Rate in India and Pakistan. Source: ILO/World Bank |

|

| Pakistan Savings Rate. Source: Global Economy |

|

| QIM Index 2019-22. Source: APP |

|

| Pakistan Large Scale Manufacturing Index. Source: Mettis Global |

|

| Cement shipments in Pakistan. Source: All Pakistan Cement Manufactu... |

|

| Pakistan Startup Investments. Source: Aljazeera |

-

Comment by Riaz Haq on April 6, 2022 at 10:27am

-

Snap National Poll – National ASSEMBLY DISSOLUTION and Views of Pakistani Public

https://gallup.com.pk/post/33081

Key findings:

1) Widespread support for dissolution of National Assembly in Pakistan

Respondents were asked ‘ PM has dissolved the national assembly and called for fresh elections. Do you Support or are you against this’ To this question a wide majority 68% say they support and 32% say they oppose PM Imran Khan’s move.

2) Majority don’t believe in US Conspiracy to remove Imran Khan, although split exists along party lines.Significant majority 64% responded to this question and say that Imran Khan was being ousted because of inflation and not because of a foreign conspiracy.

3) Public Opinion split over performance of Imran Khan

Respondents were asked ‘ Imran Khan ruled for 3.5 years. Are you satisfied with the performance of their government or not satisfied?

To this question ‘ 54% said they are dissatisfied and 46% said they are satisfied’4) Anti Americanism: Only 1 in 3 consider US to be a friend

Respondents were asked Some people think that America is a friend of Pakistan, and some people think it is an enemy. what is your opinion?

Almost 2 in 3 Pakistanis(72%) think US to be an enemy. Anti Americanism was highest among PTI Supporters (80% thought America was an enemy) and lowest among PML-N voters (65%)

-

Comment by Riaz Haq on April 6, 2022 at 10:38am

-

Riaz Haq

@haqsmusingsGallup #Pakistan Poll: 68% of respondents support #imrankhanPTI's decision to dissolve the National Assembly & call early elections. https://gallup.com.pk/wp/wp-content/uploads/2022/04/Snap-National-P...

https://twitter.com/haqsmusings/status/1511759488147107846?s=20&...

-

Comment by Riaz Haq on April 6, 2022 at 10:43am

-

Pansota

@Pansota1

Old video of

@JoeBiden

@POTUS

from December 2020 which speaks volumes about his mindset. It reinforces the case of conspiracy against the

@ImranKhanPTI

. This can be exhibited as supporting evidence in the Supreme Court if the court wants to dilate upon the issue of conspiracy.https://twitter.com/Pansota1/status/1510862324667715587?s=20&t=...

-

Comment by Riaz Haq on April 6, 2022 at 1:35pm

-

Riaz Haq

@haqsmusings

Gallup #Pakistan Poll: #PTI enjoys overwhelming support (95%) across the country. Only 5% oppose it. #ImranKhan https://gallup.com.pk/wp/wp-content/uploads/2022/04/Snap-National-P...https://twitter.com/haqsmusings/status/1511803735336361985?s=20&...

-

Comment by Riaz Haq on April 10, 2022 at 8:21am

-

World Bank warns of debt crisis for developing nations

Developing economies were hit hardest by the global economic recession brought by the pandemic. A looming debt crisis could make things much worse, according to a new report.

https://www.dw.com/en/world-bank-warns-of-debt-crisis-for-developin....

Some of the world's poorest nations face a serious debt crisis which will greatly complicate efforts to recover from the recession caused by the COVID-19 pandemic.

More than 70 low-income nations are facing extra debt repayments of almost $11 billion (€9.7 billion) this year, an increase of 45% from 2020 after a sharp rise in borrowing last year.

However, a new report from the World Bank says that is only one strand of the debt problem faced by developing economies. It says that the issue of "hidden" or nontransparent debt — for example, slow or faulty detection of financial risks such as nonperforming loans — is hitting access to financing for low-income households and small businesses.

An equitable recovery?

In its annual World Development Report, the World Bank typically focuses on one specific aspect of global economic development in middle- and low-income countries.

Its 2022 report, titled "Finance For An Equitable Recovery," focuses on the issue of debt. It argues that, in addition to the challenge of mounting sovereign debt, unstable financing systems in developing economies make them more vulnerable to other issues, such as rising inflation and interest rates.

"The economic crisis of inflation and higher interest rates will spread due to financial fragility," says World Bank President David Malpass in the report. "Tighter global financial conditions and shallow domestic debt markets in many developing countries are crowding out private investment and dampening the recovery."

Of particular concern to the World Bank, which specializes in providing loans and grants to low-income countries, is the issue of hidden debt risks.

The pandemic exposed challenges such as lack of transparency in reporting nonperforming loans and delayed management of distressed assets, the report says.

It highlights the fact that, despite the major fall in incomes and business revenues caused by the pandemic, the overall share of nonperforming loans did not increase in many countries. "This may be due to forbearance policies and relaxed accounting standards that are masking significant hidden risks that will become apparent only as support policies are withdrawn," the report warns.

-

Comment by Riaz Haq on April 10, 2022 at 8:36am

-

World Bank Report: "FINANCE FOR AN EQUITABLE RECOVERY"

https://openknowledge.worldbank.org/bitstream/handle/10986/36883/97...

The (Pakistan) government’s Kamyab Pakistan Programme, rolled

out in September 2021 to provide subsidized

or interest-free loans to SMEs and agricultural

workers, could also have mixed impacts on the

stability and future growth potential of the

microfinance sector by distorting the price of

credit and increasing the moral hazard of strategic future default

------------

As the economic crisis arising from the COVID-19

pandemic unfolded in Pakistan, MFI operations

became severely restricted, and some MFIs were

forced to close temporarily. Many MFIs acted

quickly, however, to initiate business continuity

plans to ensure the health and safety of staff

and clients and work around lockdowns. Digital financial services and branchless banking

surged. In the first year of the pandemic, the

number of active branchless banking accounts

increased by 53.7 percent, from 27.7 million to

42.6 million.a

Meanwhile, from March 2020 to

March 2021 regulators enacted a debt moratorium to ease the financial crunch on borrowers

caused by lockdowns and the decline in economic activity. In addition, nonbank microfinance companies (NBMFCs) were shielded

by federal guidelines asking commercial banks

and other lenders to MFIs, such as the Pakistan

Microfinance Investment Company, to reschedule wholesale lending to the sector. Anecdotal

reports also suggest that handshake agreements

with other MFI lenders to extend repayment

terms, as well as the continued availability of

wholesale funding for creditworthy MFIs, helped

buoy the sector.

Overall, these measures appear to have

averted a liquidity crisis among Pakistan’s MFIs

in the short term, particularly those regulated,

deposit-taking, and digitally enabled.b

Indeed, during 2020 loans totaling approximately $635 million in the sector were deferred or rescheduled.

Some MFIs even experienced an increase in

business. Microfinance banks (MFBs) saw a net

increase in deposits in 2020 of 29 percent, and

gross loan portfolios increased from $1.97 billion

to $2.02 billion during 2020.c

However, results

were mixed across the sector. The largest MFBs

saw growth continue, while the smaller players,

including the vast majority of NBMFCs, saw

declines in their portfolios and asset quality. By

the end of 2020, many Pakistani MFIs had temporarily suspended their lending operations, and

the demand for credit declined slightly as people suffered income losses.d

-

Comment by Riaz Haq on April 14, 2022 at 7:45am

-

SBP

@StateBank_Pak

1/2 Latest SBP figures show strong growth in low-cost housing loans to individuals #MeraPakistanMeraGhar. Till 11Apr22, banks received applications of Rs409bn, of which Rs180bn has been approved & Rs66bn disbursed. A year ago total applications stood at Rs57bn &approvals at 16bn.https://twitter.com/StateBank_Pak/status/1514581716907794436?s=20&a...

2/2 Banks have almost doubled finance for builders and developers to Rs404bn as of 31Mar22 from Rs204bn a year earlier, supporting the construction sector and growth in the economy. See PR:

-

Comment by Riaz Haq on April 14, 2022 at 7:49am

-

SBP

@StateBank_Pak

Workers’ remittances rose to their highest level in history at $2.8 billion in March 22. Cumulatively, remittances have risen to $23 billion during the first 9 months of FY22, up 7.1% over the same period last year.https://twitter.com/StateBank_Pak/status/1514450543011409923?s=20&a...

-

Comment by Riaz Haq on April 14, 2022 at 10:22am

-

The bank borrowing of the private sector has surged by 170 percent to Rs. 1,198 billion from Rs. 443 billion during the first nine months (July-March) of the current fiscal year 2021-22.

https://propakistani.pk/2022/04/14/private-sector-borrowing-surges-...

According to the State Bank of Pakistan (SBP), the private sector has obtained loans worth Rs. 1,198 billion from the banking sector during the first nine months of the current fiscal year, which shows a positive trend in the private sector. The total debt stock of the private sector from local banks amounted to Rs. 8,827.38 billion up to 31 March 2022.

Some economic experts believe that this increase was possible after reducing government borrowing from the private banking sector for bridging the budget deficit.

They believed that government heavily depends on external loans for bridging the fiscal deficit under the new policy. According to the Finance Ministry, the government has borrowed Rs. 1,025.6 billion external loans and Rs. 346 billion from domestic loans, including banking and non-banking side for bridging the budget deficit during the first half of the country’s fiscal year.

The government had obtained Rs. 454.4 billion external loans and Rs. 684 billion domestic loans, including banking and non-banking loans for bridging the budget deficit to Rs. 1,137 billion during the first half (July-Dec) of the last fiscal year 2020-21.

The data shows that the government has provided a cushion for the private sector for meeting the requirement of liquidity to run the business.

The SBP says that the bank borrowing of the private sector from conventional banking branches swelled by 261 percent to Rs. 791.56 billion from Rs. 219 billion during the first nine months of the current fiscal year compared to the same period of the last fiscal year. The debt stock of the private sector from the Conventional Banking Sector has reached Rs. 6,476.67 billion by March 2022.

The private sector has also borrowed Rs. 160.4 billion from Islamic Banks of the country during the first nine months of the current fiscal year. It had obtained loans worth Rs. 91 billion from the Islamic banks during the first nine months of the last fiscal year. The total loans of the private sector from different Islamic banks in the country amount to Rs. 1090.7 billion so far.

The loans from Islamic Banking Branches of Conventional Banks have also surged by 84.6 percent from Rs. 133.4 billion to Rs. 246.3 billion during the first nine months of the current fiscal year as compared to the same period of the last fiscal year.

According to the SBP report, the Credit to Public Sectors Enterprises (PSEs) has been also increased by Rs. 4 billion during the first nine months of the current fiscal year. The Public Sector Enterprises had retired Rs. 24.9 billion to the banking sector during the first nine months of the last fiscal year.

The credit to Non-Banking Financial Institutions (NBFIs) was also increased by Rs. 5.7 billion during the first nine months of the current fiscal year. The total debt stock from NBFIs has swelled to Rs. 78.5 billion so far.

-

Comment by Riaz Haq on April 17, 2022 at 2:07pm

-

Stephen Stapczynski

@SStapczynski

Pakistan bought a whole bunch of LNG at a record low price in July 2020But no one predicted prices would rise so sharply and so quickly in 18 months. The entire industry was caught flat footed by the global gas supply crunch

https://twitter.com/SStapczynski/status/1515592399124279305?s=20&am...

-------------

Stephen Stapczynski

@SStapczynski

Pakistan PM Shehbaz Sharif blamed the previous government for the fuel crunch. He said they should have bought more LNG when prices were $3/mmbtu(That’s not how it works. Prices were that low ~2 years ago. No one buys spot that far in advance)

https://twitter.com/SStapczynski/status/1515590037668126721?s=20&am...

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistan's Rising Arms Sales to Developing Nations

Pakistan is emerging as a major arms supplier to developing countries in Asia and Africa. Azerbaijan, Myanmar, Nigeria and Sudan have all made significant arms purchases from Pakistan in recent years. Azerbaijan expanded its order for JF-17 Thunder Block III multi-role fighter jets from Pakistan from 16 to 40 aircraft. The recent order extends a 2024 contract worth $1.6 billion to modernize Baku’s airborne combat fleet to $4.6 billion. This makes Azerbaijan the largest export customer of…

ContinuePosted by Riaz Haq on October 29, 2025 at 10:30am

Improved US-Pakistan Ties: F-1 Visas For Pakistani Students Soaring

The F-1 visas for Pakistani students are soaring amid a global decline, according to the US government data. The US visas granted to Pakistani students climbed 44.3% in the first half of Fiscal Year 2025 (October 2024 to March 2025) with warming relations between the governments of the two countries. The number of visas granted to Indian students declined 44.5%, compared to 20% fewer US visas given to students globally in this period. The number of US visas granted to Pakistani…

ContinuePosted by Riaz Haq on October 19, 2025 at 10:00am — 1 Comment

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network