PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Plans to Convert Coal-Fired Power Plants to Burn Domestic Thar Lignite

With a new 330 MW mine-mouth coal-fired power plant in Tharparkar, Pakistan has now reached 990 MW of power fueled by the local lignite. Thar coal production is being expanded and plans are in place to convert three more imported anthracite coal fired plants to burn domestic lignite as soon as its production is expanded and a rail link is completed to transport the fuel to the rest of the country. Plans call for using Thar coal in three coal-fired plants currently burning imported coal: Sahiwal Coal Power, China Hub Coal Power and Port Qasim Coal, each of 1,320MW installed capacity. These power plants may require some limited equipment changes to burn domestic lignite. It is worth noting that Pakistan contributes less than 1% of the global greenhouse-gas emissions. Using the higher polluting domestic Thar lignite is crucial to Pakistan's desperate need for cheap energy to spur industrialization for economic growth without running into recurring balance of payments crises.

|

| Pakistan Electric Power Generation Fuel MiX. Source: Arif Habib |

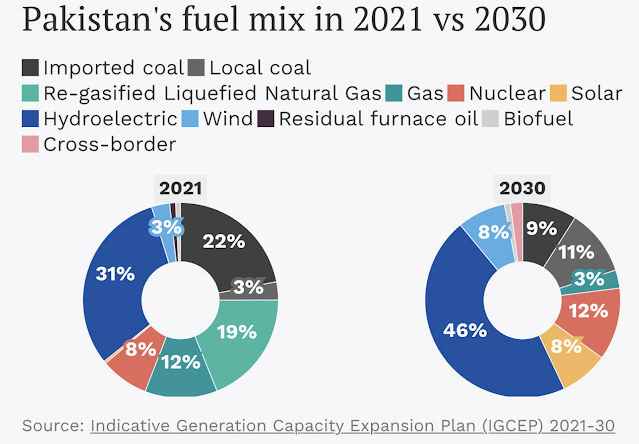

Last year, hydroelectric dams contributed 37,689 GWH of electricity or 27.6% of the total power generated, making hydropower the biggest contributor to power generated in the country. It was followed by coal (20%), LNG (19%) and nuclear (11.4%). Nuclear power plants generated 15,540 GWH of electricity in 2021, a jump of 66% over 2020. Overall, Pakistan's power plants produced 136,572 GWH of power in 2021, an increase of 10.6% over 2020, indicating robust economic recovery amid the COVID19 pandemic.

Lucky power plant in Karachi has been designed to use Thar Lignite Coal when it is available in sufficient quantity. Until that time, it will operate on imported lignite coal. Domestic lignite production is being expanded in a bid to replace costly fossil fuel imports that are depleting Pakistan's foreign exchange reserves and exacerbating circular debt in the power sector, according to Nikkei Asia.

SECMC (Sindh Engro Coal Mining Company) has commissioned a study for converting the China-Pakistan Economic Corridor coal plants in Hub, Jamshoro and Sahiwal to indigenous lignite. A 105km long Thar Rail project is being planned to connect Thar coal fields with Main Line (ML-1) at the New Chhor Halt Station to transport lignite to the power plants in the rest of the country. The transportation of lignite by trucks to Karachi and Kallar Kahar shows its movement by road and rail is feasible and safe despite higher moisture.

|

| Pakistan Electric Power Generation. Source: Arif Habib |

|

| Cost Per Unit of Electricity in Pakistan. Source: Arif Habib |

Construction of 1,100 MW nuclear power reactor K2 unit in Karachi was completed by China National Nuclear Corporation in 2019, according to media reports. Another similar reactor unit K3 is now in operation. It will add another 1,100 MW of nuclear power to the grid in 2022. Chinese Hualong One reactors being installed in Pakistan are based on improved Westinghouse AP1000 design which is far safer than Chernobyl and Fukushima plants.

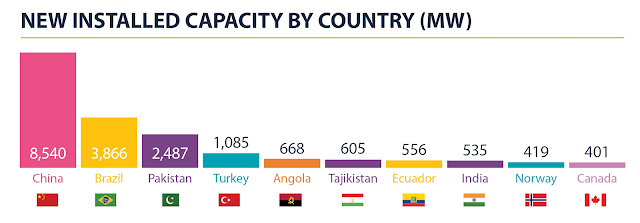

The biggest and most important source of low-carbon energy in Pakistan is its hydroelectric power plants, followed by nuclear power. Pakistan ranked third in the world by adding nearly 2,500 MW of hydropower in 2018, according to Hydropower Status Report 2019. China added the most capacity with the installation of 8,540 megawatts, followed by Brazil (3,866 MW), Pakistan (2,487 MW), Turkey (1,085 MW), Angola (668 MW), Tajikistan (605 MW), Ecuador (556 MW), India (535 MW), Norway (419 MW) and Canada (401 MW).

|

| New Installed Hydroelectric Power Capacity in 2018. Source: Hydrowo... |

Hydropower now makes up about 28% of the total installed capacity of 33,836 MW as of February, 2019. WAPDA reports contributing 25.63 billion units of hydroelectricity to the national grid during the year, “despite the fact that water flows in 2018 remained historically low.” This contribution “greatly helped the country in meeting electricity needs and lowering the electricity tariff for the consumers.”

|

| Pakistan's Current Account Balance vs International Oil Prices. Sou... |

Recent history shows that Pakistan's current account deficits vary with international oil prices. Pakistan's trade deficits balloon with rising imported energy prices. One of the keys to managing external account balances lies in reducing the country's dependence on foreign oil and gas.

|

| Pakistan Power Generation Fuel Mix. Source: Third Pole |

It is true that Pakistan has relied on imported fossil fuels to generate electricity. The cost of these expensive imported fuels like furnace oil mainly used by independent power producers (IPPs) has been and continues to be a major contributor to the "exaggerated external demand driven by its rentier economy" referred to by Atif Mian in a recent tweet. However, Pakistan has recently been adding hydro, nuclear and indigenous coal-fired power plants to gradually reduce dependence on imported fossil fuels.

Related Links:

Haq's Musings

South Asia Investor Review

Pakistan Among World's Largest Food Producers

Food in Pakistan 2nd Cheapest in the World

Indian Economy Grew Just 0.2% Annually in Last Two Years

Pakistan to Become World's 6th Largest Cement Producer by 2030

Has Bangladesh Surged Past India and Pakistan in Per Capita Income?

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid1...

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Incomes of Poorest Pakistanis Growing Faster Than Their Richest Cou...

Can Pakistan Effectively Respond to Coronavirus Outbreak?

How Grim is Pakistan's Social Sector Progress?

Double Digit Growth in Pakistan's Energy Consumption Confirms Econo...

Trump Picks Muslim-American to Lead Vaccine Effort

COVID Lockdown Decimates India's Middle Class

Pakistan to be World's 7th Largest Consumer Market by 2030

Pakistan's Balance of Payments Crisis

How Has India Built Large Forex Reserves Despite Perennial Trade De...

Conspiracy Theories About Pakistan Elections"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on April 18, 2023 at 6:22pm

-

#Coal #electricity returns to #China–#Pakistan Economic Corridor. “#Gwadar coal-fired plant is not a new project and has been in the #CPEC framework since 2016. We hope the Gwadar #power plant’s construction begins as early as possible" #energy #fossil https://chinadialogue.net/en/energy/coal-returns-to-the-china-pakis...

We have scrutinised the plant from every angle, including the environmental one, and tried to look at alternatives. Coal is the only feasible fuel.

Bao Zhong, Embassy of the PRC in Islamabad

News that the Pakistan government plans to secure financing and start construction on a long-stalled 300 megawatt coal-fired power plant in the port city of Gwadar has triggered a debate on the direction of the country’s energy sector. Set to be built and funded by Chinese state-owned entities, recent developments have also raised fresh questions about China’s pledge – made at the UN General Assembly in 2021 – not to build any new coal power plants overseas.

The Gwadar plant was first conceived in 2016, with an estimated cost of US$542.32 million. It is to be constructed by the Chinese company CIHC Pak Power, a subsidiary of the state-owned China Communications and Construction Group. The plant was recently reported to have secured financing from the Industrial and Commercial Bank of China (ICBC), China’s largest commercial bank. Once completed, it is intended to supply power, on a priority basis, to the industries being set up at the Gwadar Free Zone. This special economic zone at Gwadar port forms part of the China–Pakistan Economic Corridor (CPEC), the US$62 billion bilateral infrastructure and connectivity project between China and Pakistan.

The environmental impacts of coal power – from local air and water pollution to carbon emissions – have made the project controversial.

“We are pushing the Chinese company to complete its financial closure by 31 December 2023, and start construction at the earliest so that it can be completed by 2025,” Shah Jahan Mirza, said managing director of the Pakistan-government-owned Private Power and Infrastructure Board. “Electricity shortage is the biggest impediment to developing Gwadar,” he said.

Pakistan’s energy sector is dominated by fossil fuels. According to the country’s Finance Division, as of April 2022, just under 60% of total installed generation capacity used fossil fuels, including gas, oil and coal. Just 3% of generated electricity in the 2022 fiscal year came from non-hydropower renewables. Pakistan’s climate pledge under the Paris Agreement – known as its Nationally Determined Contribution (NDC) – targets 60% renewable energy generation by 2030, including hydropower. The NDC also states: “From 2020, new coal power plants are subject to a moratorium.”

No new Chinese-backed coal power overseas?

In 2021, China’s president, Xi Jinping, announced that China would not build any new coal-fired power projects abroad. He also stated that the country would increase support for low-carbon energy in developing countries.

Bao Zhong, political counsellor at the Embassy of the People’s Republic of China in Islamabad, said the Chinese government stands by the pledge. “The Gwadar coal-fired plant is not a new project and has been in the CPEC framework since 2016,” she said. “We hope the Gwadar power plant’s construction begins as early as possible to ease the power shortage there.”

Ahsan Iqbal, Pakistan’s federal minister for planning, development and special initiatives, seconded Bao’s comments. “This project was approved in 2017, long before the Chinese president’s proclamation.”

-

Comment by Riaz Haq on April 18, 2023 at 6:24pm

-

#Coal #electricity returns to #China–#Pakistan Economic Corridor. “#Gwadar coal-fired plant is not a new project and has been in the #CPEC framework since 2016. We hope the Gwadar #power plant’s construction begins as early as possible" #energy #fossil https://chinadialogue.net/en/energy/coal-returns-to-the-china-pakis...

We have scrutinised the plant from every angle, including the environmental one, and tried to look at alternatives. Coal is the only feasible fuel.

Bao Zhong, Embassy of the PRC in Islamabad

News that the Pakistan government plans to secure financing and start construction on a long-stalled 300 megawatt coal-fired power plant in the port city of Gwadar has triggered a debate on the direction of the country’s energy sector. Set to be built and funded by Chinese state-owned entities, recent developments have also raised fresh questions about China’s pledge – made at the UN General Assembly in 2021 – not to build any new coal power plants overseas.

The Gwadar plant was first conceived in 2016, with an estimated cost of US$542.32 million. It is to be constructed by the Chinese company CIHC Pak Power, a subsidiary of the state-owned China Communications and Construction Group. The plant was recently reported to have secured financing from the Industrial and Commercial Bank of China (ICBC), China’s largest commercial bank. Once completed, it is intended to supply power, on a priority basis, to the industries being set up at the Gwadar Free Zone. This special economic zone at Gwadar port forms part of the China–Pakistan Economic Corridor (CPEC), the US$62 billion bilateral infrastructure and connectivity project between China and Pakistan.

The environmental impacts of coal power – from local air and water pollution to carbon emissions – have made the project controversial.

“We are pushing the Chinese company to complete its financial closure by 31 December 2023, and start construction at the earliest so that it can be completed by 2025,” Shah Jahan Mirza, said managing director of the Pakistan-government-owned Private Power and Infrastructure Board. “Electricity shortage is the biggest impediment to developing Gwadar,” he said.

Pakistan’s energy sector is dominated by fossil fuels. According to the country’s Finance Division, as of April 2022, just under 60% of total installed generation capacity used fossil fuels, including gas, oil and coal. Just 3% of generated electricity in the 2022 fiscal year came from non-hydropower renewables. Pakistan’s climate pledge under the Paris Agreement – known as its Nationally Determined Contribution (NDC) – targets 60% renewable energy generation by 2030, including hydropower. The NDC also states: “From 2020, new coal power plants are subject to a moratorium.”

No new Chinese-backed coal power overseas?

In 2021, China’s president, Xi Jinping, announced that China would not build any new coal-fired power projects abroad. He also stated that the country would increase support for low-carbon energy in developing countries.

Bao Zhong, political counsellor at the Embassy of the People’s Republic of China in Islamabad, said the Chinese government stands by the pledge. “The Gwadar coal-fired plant is not a new project and has been in the CPEC framework since 2016,” she said. “We hope the Gwadar power plant’s construction begins as early as possible to ease the power shortage there.”

Ahsan Iqbal, Pakistan’s federal minister for planning, development and special initiatives, seconded Bao’s comments. “This project was approved in 2017, long before the Chinese president’s proclamation.”

-

Comment by Riaz Haq on May 21, 2023 at 6:57pm

-

Top 10 countries with lowest energy consumption per capita

Outside Africa, Bangladesh, Pakistan and the Philippines stand out for low energy security

https://www.fdiintelligence.com/content/data-trends/top-10-countrie...

Outside Africa, fast-growing Asia economies such as Bangladesh, Pakistan and the Philippines use the least primary energy per capita, according to the latest BP Statistical Review of World Energy.

People in East Africa, Central Africa and Western Africa use 4.7, 5.7 and 7.2 gigajoules of primary energy per capita per year, respectively, the review notes. Primary energy is that classed as an energy source that has not been subject to any human-engineered conversion processes.

While energy use in these regions matches typically subdued levels of economic development, that is not the case in Bangladesh, Pakistan and the Philippines — countries with few indigenous energy commodities where energy infrastructure has struggled to keep up with the accelerating economic growth of the past years.

Per capita energy consumption in Bangladesh stands at 9.9 gigajoules, BP data shows — the lowest of any country outside Africa. Pakistan consumes 17.1 gigajoules and the Philippines consumes 17.6 gigajoules. By contrast, the average for countries in the OECD is 167.9 gigajoules, while stands at 56.2 gigajoules in non-OECD countries.

Bangladesh has resorted to Russian technology and financing to build the country’s first nuclear plant and thus limit the country’s recurrent power outages, while Pakistan, which already has six nuclear power plants in operation, has been developing liquified natural gas terminals to bump up imports of LNG.

After Sri Lanka, with 17.8 gigajoules, and the Southern Africa region (excluding South Africa) with 23.5 gigajoules, the top 10 is rounded out by two other emerging economic powerhouses — India and Morocco.

India, with 23.3 gigajoules per capita, continues to generate most of the primary energy it through coal and oil. The country is the world’s second-largest consumer of coal after China, although its first renewable energy generation has also come online in the past few years.

Morocco, with 25.6 gigajoules per capita, gets most of its primary energy from oil, although the country boasts the world’s biggest thermal solar power plant, and its renewable energy potential is now being assessed for major cross-border energy generation projects.

-

Comment by Riaz Haq on June 10, 2023 at 8:18am

-

Pakistan plans to push coal-fired power to 10 GW, shift away from gas

https://www.gastopowerjournal.com/markets/item/13377-pakistan-plans...

Soaring fuel prices have made Pakistan move away from importing LNG and use domestic lignite to generate electricity instead. “LNG is no longer part of the long-term plan,” Pakistan’s energy minister Khurram Dastgir Khan told Reuters, revealing targets to increase coal-fired capacity to 10 GW, up from currently 2.31 GW, and build no more gas-fired power plants.

-

Comment by Riaz Haq on June 17, 2023 at 6:23pm

-

The Evolution of Pakistan’s Energy Market: A Comprehensive Overview

https://www.energyportal.eu/news/the-evolution-of-pakistans-energy-...

Pakistan’s energy market has come a long way since the country’s inception in 1947. At that time, the energy sector was primarily dependent on imported oil and coal, with limited domestic production. Over the years, the government has made concerted efforts to develop indigenous resources, such as natural gas, hydropower, and more recently, renewable energy. Today, Pakistan’s energy mix comprises a diverse array of sources, including oil, natural gas, coal, hydropower, nuclear, and renewables.

One of the key drivers of Pakistan’s energy market evolution has been the growing demand for electricity. With a rapidly expanding population and increasing urbanization, the country’s electricity consumption has surged over the past few decades. To meet this burgeoning demand, the government has pursued an aggressive capacity expansion program, focusing on both conventional and renewable energy sources. Consequently, Pakistan’s installed power generation capacity has witnessed a significant increase, from a mere 60 MW in 1947 to over 37,000 MW in 2021.

The liberalization of Pakistan’s energy market has also played a crucial role in its development. In the early 1990s, the government embarked on a series of reforms aimed at deregulating the power sector and encouraging private sector participation. These reforms included the establishment of an independent regulatory authority, the unbundling of state-owned utilities, and the introduction of competitive bidding for power projects. As a result, the private sector now accounts for a substantial share of Pakistan’s power generation capacity, with several local and international companies operating in the market.

Foreign investment has been another critical factor in the evolution of Pakistan’s energy market. Over the years, the country has attracted significant investment in various energy projects, particularly in the power generation and oil and gas exploration sectors. Notably, the China-Pakistan Economic Corridor (CPEC), a flagship initiative under China’s Belt and Road Initiative, has emerged as a game-changer for Pakistan’s energy landscape. Under CPEC, several energy projects, including coal-fired power plants, hydropower projects, and transmission lines, have been completed or are under construction, significantly boosting Pakistan’s energy infrastructure.

Despite these achievements, Pakistan’s energy market continues to face several challenges. One of the most pressing issues is the affordability of electricity, as high tariffs and circular debt have put a strain on consumers and the national exchequer. Additionally, the country’s heavy reliance on imported fossil fuels has raised concerns about energy security and vulnerability to global price fluctuations.

Moreover, the environmental impact of Pakistan’s energy choices cannot be ignored. The country’s growing dependence on coal, particularly under CPEC, has raised alarm bells among environmentalists and climate change experts. With Pakistan being one of the most vulnerable countries to climate change, there is an urgent need to shift towards cleaner and more sustainable energy sources.

In recent years, the government has taken several steps to address these challenges. For instance, it has introduced policies to promote renewable energy, such as solar and wind, and set ambitious targets for their share in the energy mix. Furthermore, efforts are being made to improve energy efficiency and reduce transmission and distribution losses, which would help lower electricity costs and enhance system reliability.

In conclusion, the evolution of Pakistan’s energy market has been a fascinating tale of progress, diversification, and resilience. While the country has made significant strides in developing its energy resources and infrastructure, the journey is far from over.

-

Comment by Riaz Haq on September 28, 2023 at 5:46pm

-

Furthermore, this railway network will facilitate the supply of Thar coal to fertilizer and cement manufacturers, offering the potential for coal-to-gas conversion.

In a recent conversation with media, Abu Bakar Ahmed, secretary of the Sindh Energy Department, revealed that he had obtained federal government approval for the construction of a 105-kilometer railway line, spanning from Chorr to Islamkot, ultimately connecting to Port Qasim, a deep-sea port in Karachi.

This ambitious project is slated for completion by December 2024 and is estimated to cost Rs58 billion, with equal financial participation from both the federal and Sindh governments.

Comment

- ‹ Previous

- 1

- 2

- 3

- 4

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Barrick Gold CEO "Super-Excited" About Reko Diq Copper-Gold Mine Development in Pakistan

Barrick Gold CEO Mark Bristow says he’s “super excited” about the company’s Reko Diq copper-gold development in Pakistan. Speaking about the Pakistani mining project at a conference in the US State of Colorado, the South Africa-born Bristow said “This is like the early days in Chile, the Escondida discoveries and so on”, according to Mining.com, a leading industry publication. "It has enormous…

ContinuePosted by Riaz Haq on November 19, 2024 at 9:00am

What Can Pakistan Do to Cut Toxic Smog in Lahore?

Citizens of Lahore have been choking from dangerous levels of toxic smog for weeks now. Schools have been closed and outdoor activities, including travel and transport, severely curtailed to reduce the burden on the healthcare system. Although toxic levels of smog have been happening at this time of the year for more than a decade, this year appears to be particularly bad with hundreds of people hospitalized to treat breathing problems. Millions of Lahoris have seen their city's air quality…

ContinuePosted by Riaz Haq on November 14, 2024 at 10:30am — 2 Comments

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network