PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Middle Class Jumps to 55% of Population

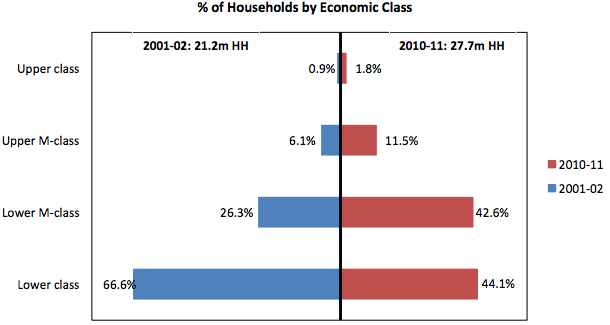

Majority of the households in Pakistan now belong to the middle class, a first in Pakistan's history, according to research by Dr. Jawaid Abdul Ghani of Karachi School of Business and Leadership (KSBL).

It's an important tipping point that puts Pakistan among the top 5 countries with fastest growing middle class population in Asia-Pacific region, according to an Asian Development Bank report titled Asia's Emerging Middle Class: Past, Present, And Future. The ADB report put Pakistan's middle class growth from 1990 to 2008 at 36.5%, much faster than India's 12.5% growth in the same period.

From 2002 to 2011, the country's middle class, defined as households with daily per capita expenditures of $2-$10 in 2005 purchasing power parity dollars, grew from 32% to 55% of the population, according to a paper presented by Dr. Abdul Ghani at Karachi's Institute Business Administration's International Conference on Marketing. Dr. Ghani has cited Pakistan Standards of Living Measurement (PSLM) Surveys as source of his data.

|

| Source: Dr. Abdul Ghani, Karachi School of Business |

Growing middle class is a major driver of economic growth, as the income elasticity for durable goods and services for middle class consumers is greater than one, according to a Brookings Institution study titled The Emerging Middle Class in Developing Countries.

Among some of the manifestations of the rising middle class, Dr. Abdul Ghani reports dramatic increase in the ownership of television sets, refrigerators and motorcycles in households in all income deciles in Pakistan. At the same the total household assets have nearly doubled from $387 billion in 2001-02 to $772.6 billion in 2010-11 in terms of 2005 purchasing power parity dollars.

Consumer spending in Pakistan has increased at a 26 percent average pace the past three years, compared with 7.7 percent for Asia, according to data compiled by Euromonitor International, a consumer research firm. Pakistan's rising middle class consumers in major cities like Karachi, Lahore and Islamabad are driving sales of international brand name products and services. Real estate developers and retailers are responding to it by opening new mega shopping malls such as Dolmen in Karachi and Centaurus in Islamabad.

Pakistan's transition to middle-class middle-income country over the last decade mainly during Musharraf years represents a major tipping point for the country's economy. It is likely to accelerate economic growth driven by consumption and draw greater investments in production of products and services demanded by middle class consumers. Some of it is already in evidence in booming sales of durable goods (TV sets, refrigerators, motorcycles) AND non-durables (cosmetics, shampoo, toothpaste, processed foods, etc) in Pakistan's booming FMCG sector.

Related Links:

Pakistan's Official GDP Figures Ignore Booming FMCG Sector

Musharraf Accelerated Human and Economic Development in Pakistan

Pakistan's Growing Middle Class

Pakistan's GDP Grossly Under-estimated; Shares Highly Undervalued

Fast Moving Consumer Goods Sector in Pakistan

-

Comment by Mumtaz A. Memon on March 20, 2015 at 11:05pm

-

Haza Min Fazal Rabbee has increased leading to no progress in any field and making official pocket almost all the budget for developmental works in last 20 years from Musharraf to ZARDARI and now SHREEFs of Model Town.

-

Comment by Riaz Haq on March 20, 2015 at 11:12pm

-

But where is fazle rabbi coming from? It couldn't be aid or loans that together make up only a couple of percent of GDP. Someone is producing it in the country.

-

Comment by Riaz Haq on March 21, 2015 at 8:56am

-

A reader has cited India's higher per capita income and HDI to challenge my contention that average Pakistanis are better off than their Indian counterparts.

The fact is that India has much bigger problems in terms of multi-dimensional poverty which includes income poverty, inequality, disease burdens and basic hygiene. India also has a huge problem of inequality relative to Pakistan. All these affect quality of life more than just average composite indicators you quote.

http://www.riazhaq.com/2014/10/multi-dimensional-poverty-index.html

One data point to note here is that median per capita income in India ($60 per month) is significantly lower than that in Pakistan ($73 per month) in 2005 PPP $. Income poverty rate (those below $1.25 per capita per day) in India is 33% vs 13% in Pakistan

http://iresearch.worldbank.org/PovcalNet/index.htm?2

Another point to note is that agriculture value added per capita in Pakistan is about twice that in India. Agriculture employs the largest number of people in India and Pakistan.

http://www.riazhaq.com/2013/11/pakistan-leads-south-asia-in.html

India leads the world in open defecation. Disease burdens in India are much higher than in Pakistan.

http://www.riazhaq.com/2013/04/world-health-day-in-pakistan-prematu...

-

Comment by Riaz Haq on March 22, 2015 at 8:20pm

-

Pakistan is a rapidly growing country despite a lot of political and economic challenges. However, its growth rate since 1947 has been better than the global average.

A wide range of economic reforms has resulted in a strong economic outlook.

There has been a great improvement in foreign exchange and currency reserves.

New businesses are opening up across Pakistan which is reshaping its landscape.

The GDP growth accelerated to 4.14 percent in 2013-14 and the momentum of growth is broad based, as all sectors namely agriculture, industry and services are supporting economic growth.

The per capita income in dollar terms has reached to $1,386 in 2013-14.

The agriculture sector accounts for 21.0 percent of GDP and 43.7 percent of employment. It has strong backward and forward linkages. It has four sub-sectors including: crops, livestock, fisheries and forestry.

The industrial sector contributes 20.8 percent in GDP; it is also a major source of tax

revenues for the government and also contributes significantly in the provision of job opportunities to the labor force.

The government has planned and implemented comprehensive policy measures on fast track to revive the economy.

As a result, Pakistan’s industrial sector recorded remarkable growth at 5.8 percent as compared to 1.4 percent in the previous year.

The services sector contains six sub-sectors including: transport, storage and communication; wholesale and retail trade; finance and insurance; housing services (ownership of dwellings); general government Services (public administration and defense); and other private services (social services).

The services sector has witnessed a growth rate of 4.3 percent.

The growth performance in the services sector is broad based, all components contributed positively in growth, Finance and insurance at 5.2 percent, general government services at 2.2 percent, housing services at 4.0 percent, other private services at 5.8 percent, transport, storage and communication at 3.0 percent and wholesale and retail Trade at 5.2 percent.

The three main drivers of economic growth are consumption, investment and export.

Pakistan has a consumption-oriented society, like other developing countries.

The private consumption expenditure in nominal terms reached to 80.49 percent of the GDP, whereas public consumption expenditures are 12.00 percent of GDP.

The government has launched a number of initiatives to create enabling environment in the country including steps to improve the energy situation, law and order, auction of 3G and 4G licenses, and other investment incentives for the investors.

Moody’s recent ratings in favor of Pakistan coupled with jacking up from negative to positive rating of five of its banks — Habib Bank Limited (HBL), Muslim Commercial Bank (MCB), Allied Bank Limited (ABL), United Bank Limited (UBL) and National Bank of Pakistan (NBP) — would definitely boost investor confidence.

The current government has launched a comprehensive plan to create an investment-friendly environment and to attract foreign investors to the country. As is evident, the capital market has reached new heights and emitting positive signals for restoring investor confidence.

The European Union (EU) granted Generalized System of Preferences (GSP) Plus status to Pakistan with an impressive count of 406 votes, granting Pakistani products a duty free access to the European market.

The GSP Plus status will allow almost 20 percent of Pakistani exports to enter the EU market at zero tariff and 70 percent at preferential rates. Award of GSP Plus status depicts the confidence of international markets in the excellent quality of Pakistani products.

Pakistan emerged as one of the best performers in the wake of the global financial crisis, even with a backdrop of a country which waged a costly war against militants.

http://www.arabnews.com/saudi-arabia/news/721866

-

Comment by Riaz Haq on March 27, 2015 at 5:50pm

-

The fact that Pakistan's middle class has grown to 55% of the population from 2001 to 2010 while its GDP growth has been relatively low since 2008 is seen by some as a puzzle.

http://www.riazhaq.com/2015/03/major-tipping-point-pakistans-middle...

There's no puzzle here that basic understanding of income distribution can not solve. Headline stories of Economist and WSJ won't help you here.

It's not the overall GDP growth and average per capita income increases but the median per capita income growth that tells you how the GDP gains are shared among the population.

So to assess the size of the middle class, it's important to look at the median per capita income, an income level that divides the top 50% from the bottom 50% of income earners.

Median income in India ($60 per month) is significantly lower than that in Pakistan ($73 per month) in 2005 PPP $ based on 2009-10 surveys.

$60 per month per capita or $2 per day per capita in India means half the population in India does not meet the ADB and WB definition of middle class in India.

http://iresearch.worldbank.org/PovcalNet/index.htm?2

On the other hand, media income of $73 per month per capita in Pakistan means more than half of Pakistanis meet the ADB and WB definition of middle class.

Income poverty rate (those below $1.25 per capita per day) in India is 33% vs 13% in Pakistan, according to WB data on povcalNet.

Also Gini Index for India is 33 and for Pakistan 29, indicating that Pakistan has lower inequality.

-

Comment by Riaz Haq on April 1, 2015 at 9:29am

-

A New #Language for #Pakistan’s Deaf. Pakistan Sign Language adds to #Urdu national and 300 regional languages http://nyti.ms/1yzwe4a

A common Indo-Pakistan sign language was in use across the subcontinent long before the 1980s, but many words and concepts in Urdu and other regional languages had no place in it. Pakistan Sign Language grew out of this need, but by the late 1990s the books and guides developed by Absa were deemed outdated and went out of print. So the family education foundation worked with deaf instructors in Punjab and Sindh, and with Rubina Tayyab, the head teacher at the Absa School, to develop a new online lexicon that now contains 5,000 words and phrases. On its website, a new video each day shows men, women, girls and boys signing a phrase with its meaning repeated in English and Urdu. Aaron Awasen, the foundation officer in daily charge of the P.S.L. project, describes this lexicon not as a definitive dictionary, but as “a portal through which Pakistan Sign Language can continue to develop.”

Making technology central is typical of the Deaf Reach system. The online tools are accompanied by a book, a CD and a phone app. Computers and televisions are prominent in classrooms, and teachers are encouraged to explore the Internet for supplementary materials.

The P.S.L. tools imprint three languages — Urdu, English and P.S.L. — on the children’s brains at the same time. They also enable relatives and others to learn P.S.L. even if they can’t attend regular training sessions. Meanwhile, a publicity campaign called “Don’t Say It, Sign It” shows Pakistani celebrities like the filmmaker Sharmeen Obaid-Chinoy and the cricket star Shahid Afridi signing simple phrases in short online video clips, in an effort to remove the stigma of “otherness” and incapacity from the common perception of the deaf.

Ten thousand copies of the organization’s dictionary and DVDs have been distributed across Pakistan, and a second edition is in print. Next, the foundation will send “deaf leaders” to 25 cities to meet with their deaf communities and provide materials for smaller villages. By distributing 18,000 P.S.L. books and 7,000 DVD sets, the organization hopes this first phase of its project will affect 150,000 people.

In a country like Pakistan, where so many other languages and communities jostle for space, and a walk down any street reveals a modern-day Tower of Babel, what does it mean to give an entire community its own language? If “a loss of language is a loss of culture,” as Mr. Awasen says, then the gain of a language is a gain in culture. So empowering the deaf can only strengthen Pakistan’s social fabric; the deaf community will be proud to take its rightful position within the constellation of diversity that is one of Pakistan’s greatest assets.

-

Comment by Riaz Haq on April 27, 2015 at 7:49pm

-

Excerpt of Wall Street Journal interview with President of Yamaha Motors in Japan:

WSJ: What about in South Asia?

Mr. Yanagi: We want to expand business in Pakistan and Bangladesh as soon as possible. We had a production venture in Pakistan but we dissolved it five years ago. We are now planning to begin local production again, on our own this time.In Bangladesh, we import motorcycles from our plant in India on a small scale, but we are studying now the best way of running operations because of rising tariff barrier there.

http://www.wsj.com/articles/SB1000142405270230452070457912873316262...

-

Comment by Riaz Haq on October 16, 2015 at 8:39am

-

Pakistan’s middle class consists of over 6.27 million people, according to Credit Suisse, a global financial services company.

In its Global Wealth Report 2015 released on Oct 13, Credit Suisse said Pakistan has the 18th largest middle class worldwide.

The study revealed that 14% of world adults constituted the middle class in 2015 and held 32% of world wealth. The share of middle-class adults in Pakistan’s total adult population of 111 million was 5.7% in 2015 as opposed to India’s 3% and Australia’s 66% in 2015.

Middle-class Pakistani adults constituted 0.9% of the worldwide middle-class population. The highest concentration of middle-class population in 2015 was in China (108.7 million), followed by the United States (91.8 million) and Japan (62 million).

Defining ‘middle class’

Economists use a variety of methods, such as income and standard of living, to define what constitutes the middle class. Credit Suisse uses the measure of ‘personal wealth’ – or a ‘wealth band’ instead of an ‘income range’ – to determine the size and wealth of the middle class around the world.

Taking the United States as the benchmark country, Credit Suisse considers an adult to be part of the middle class if they have wealth between $50,000 and $500,000 valued at mid-2015 prices.

Credit Suisse came up with the minimum and maximum figures for the US middle-class wealth band based on its median earnings and the amount of capital a person close to retirement age needs to purchase an annuity paying the median wage for the remainder of their life.

Being a lower per-capita country, Pakistan has lower prices and consequently a reduced middle-class threshold. To be a member of the middle class in 2015, according to Credit Suisse, a Pakistani adult must have wealth of at least $14,413.

In terms of the local currency that buys one dollar for Rs104 these days, a Pakistani adult should be considered part of the middle class if they have wealth of between Rs1.5 million and Rs15 million.

With $14,413, Pakistan has the third lowest “middle-class lower bound wealth” for 2015, followed by India ($13,662) and Ukraine ($11,258). This suggests Pakistan has lower prices in general, which enables people to join the middle class by crossing a relatively lower threshold of wealth band.

Read: Minding middle class aspirations

Wealth in Pakistan

According to Credit Suisse, total wealth in Pakistan amounted to $495 billion in 2015. Given that the figure stood at $170 billion in 2000, total wealth in Pakistan has increased at an annualised rate of 7.4% for the last 15 years.

Total wealth of the world increased on average by 5.2% annually over the same 15-year period, the report shows.

A little more than 90% Pakistani adults had wealth less than $10,000 in 2015. The share of Pakistani adults with wealth between $10,000 and $100,000 in 2015 was 9.8% while only 0.1% adults owned wealth in the range of $100,000 and $1 million, the report revealed.

http://tribune.com.pk/story/973649/pakistan-has-18th-largest-middle...

http://publications.credit-suisse.com/tasks/render/file/index.cfm?f...

-

Comment by Riaz Haq on October 16, 2015 at 9:46am

-

#Pakistan middle class world's 18th largest: report. #Pakistan 5.7% vs #India 3% of population. #China 1st, #US 2nd http://tribune.com.pk/story/973649/pakistan-has-18th-largest-middle... …

Pakistan’s middle class consists of over 6.27 million people, according to Credit Suisse, a global financial services company.

In its Global Wealth Report 2015 released on Oct 13, Credit Suisse said Pakistan has the 18th largest middle class worldwide.

The study revealed that 14% of world adults constituted the middle class in 2015 and held 32% of world wealth. The share of middle-class adults in Pakistan’s total adult population of 111 million was 5.7% in 2015 as opposed to India’s 3% and Australia’s 66% in 2015.

Middle-class Pakistani adults constituted 0.9% of the worldwide middle-class population. The highest concentration of middle-class population in 2015 was in China (108.7 million), followed by the United States (91.8 million) and Japan (62 million).

Defining ‘middle class’

Economists use a variety of methods, such as income and standard of living, to define what constitutes the middle class. Credit Suisse uses the measure of ‘personal wealth’ – or a ‘wealth band’ instead of an ‘income range’ – to determine the size and wealth of the middle class around the world.

Taking the United States as the benchmark country, Credit Suisse considers an adult to be part of the middle class if they have wealth between $50,000 and $500,000 valued at mid-2015 prices.

Credit Suisse came up with the minimum and maximum figures for the US middle-class wealth band based on its median earnings and the amount of capital a person close to retirement age needs to purchase an annuity paying the median wage for the remainder of their life.

For the rest of the countries, Credit Suisse uses the IMF series of Purchasing Power Parity (PPP) values to derive equivalent middle-class wealth bounds in local terms.

Being a lower per-capita country, Pakistan has lower prices and consequently a reduced middle-class threshold. To be a member of the middle class in 2015, according to Credit Suisse, a Pakistani adult must have wealth of at least $14,413.

In terms of the local currency that buys one dollar for Rs104 these days, a Pakistani adult should be considered part of the middle class if they have wealth of between Rs1.5 million and Rs15 million.

With $14,413, Pakistan has the third lowest “middle-class lower bound wealth” for 2015, followed by India ($13,662) and Ukraine ($11,258). This suggests Pakistan has lower prices in general, which enables people to join the middle class by crossing a relatively lower threshold of wealth band.

Wealth in Pakistan

According to Credit Suisse, total wealth in Pakistan amounted to $495 billion in 2015. Given that the figure stood at $170 billion in 2000, total wealth in Pakistan has increased at an annualised rate of 7.4% for the last 15 years.

Total wealth of the world increased on average by 5.2% annually over the same 15-year period, the report shows.

A little more than 90% Pakistani adults had wealth less than $10,000 in 2015. The share of Pakistani adults with wealth between $10,000 and $100,000 in 2015 was 9.8% while only 0.1% adults owned wealth in the range of $100,000 and $1 million, the report revealed.

http://publications.credit-suisse.com/tasks/render/file/index.cfm?f...

-

Comment by Riaz Haq on December 6, 2015 at 3:26pm

-

#Pakistan's Proper #Urbanization, Estimated at 55% Now, Can Yield Big Economic Benefits for its Rapid Urbanization http://www.worldbank.org/en/news/press-release/2015/12/05/proper-ur... …

Urbanization provides Pakistan with the potential to transform its economy to join the ranks of richer nations, but the country, like others in South Asia, has so far struggled to make the most of that opportunity, says a new World Bank report.

Leveraging Urbanization in South Asia: Managing Spatial Transformation for Prosperity and Livability was presented at the third Pakistan Urban Forum. Difficulty in dealing with the pressures that increased urban populations put on infrastructure, basic services, land, housing and the environment has fostered what the report calls “messy and hidden” urbanization in Pakistan and throughout the region. This, in turn, has helped to constrain Pakistan’s full realization of the prosperity and livability benefits of urbanization.

“Properly managed urbanization can enhance both the prosperity and livability of cities,” says, Peter Ellis, Lead Urban Economist at the World Bank. “This is certainly the case for Pakistan, which is the most urbanized large country in South Asia and derives so much of its economic growth from cities.”

Estimates indicate that cities generate up to 78 percent of Pakistan’s gross domestic product and the government’s Vision 2025 places a premium on urban job growth. Planning ahead for urban growth can help create vibrant and productive cities that fuel the country’s growth, but that will require dealing with the problems posed by the country’s messy and hidden urbanization to date.

Messy urbanization in Pakistan is reflected in the existence of low-density sprawl and the fact that cities are growing outward beyond administrative boundaries, creating challenges for planning, transportation and the provision of public services. It also reflected in the widespread existence of poverty and slums. In Pakistan in 2010, about one in eight urban dwellers lived below the national poverty line and an estimated 46.6 percent of the urban population lived in slums.

Hidden urbanization, the report said, stems from official national statistics understating the share of the population living in areas with urban traits. Officially, 36 percent of Pakistanis lived in urban settlements in 2010 but the World Bank estimates that the actual share of the population living in areas with urban characteristics may be as high as 55 percent. Acknowledging the true extent of urban areas can help to facilitate better planning and metropolitan management.

Failure to address these problems can make cities less livable. Pakistan faced an urban housing shortage of approximately 4.4 million units in 2010. The 2015 livability index of the Economist Intelligence Unit ranked Karachi 135th out of 140 cities; Dhaka was the only major city in South Asia with a lower ranking.

Since the turn of the century, Pakistan has seen a net decline in multi-city agglomerations – defined as continuously lit belts of urbanization containing two or more cities with a population each in excess of 100,000 – as the formation of new agglomerations was outpaced by the merging of existing ones. The Lahore agglomeration, for example, expanded to absorb those of Chiniot, Gujranwala, Gujrat, Lalamusa and Sialkot. In fact, the Lahore agglomeration meets its Delhi equivalent to form one continuously lit belt with an estimated population of 73.4 million, slightly less than the population of Turkey.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Trump's Tariffs on India: Can China or Russia Make Up For Lost Exports to US?

The United States is the biggest export market for India. Among its top 5 trading partners, the US is also the only country with which India runs a trade surplus. This surplus is now at risk with the 50% tariff recently imposed by President Donald Trump on imports from India. Can Prime Minister Narendra make up for it by cozying up to China and Russia? Recent trade data shows he…

ContinuePosted by Riaz Haq on September 8, 2025 at 7:00pm

US-India Ties: Does Trump Have a Grand Strategy?

Since the dawn of the 21st century, the US strategy has been to woo India and to build it up as a counterweight to rising China in the Indo-Pacific region. Most beltway analysts agree with this policy. However, the current Trump administration has taken significant actions, such as the imposition of 50% tariffs on India's exports to the US, that appear to defy this conventional wisdom widely shared in the West. Does President Trump have a grand strategy guiding these actions? George…

ContinuePosted by Riaz Haq on August 31, 2025 at 6:30pm — 18 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network