PakAlumni Worldwide: The Global Social Network

The Global Social Network

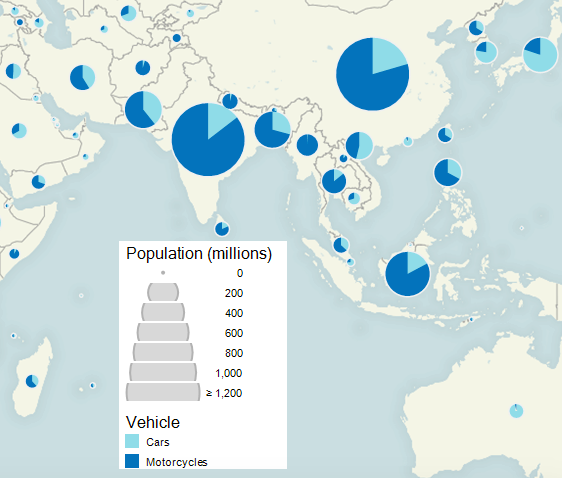

Pakistan is the World's 5th Largest Motorcycles Market

Pakistan is the 5th largest motorcycle market in the world after China, India, Indonesia and Vietnam. With 7,500 new motorcycles being sold everyday, Pakistan is also the among the world's fastest growing two-wheeler markets. Passenger car and motorcycle sales in Pakistan are both soaring at rates of over 20% a year.

Auto Demand Soaring:

Nearly 2.3 million motorcycles have rolled off the factories in Pakistan in the last 10 months. The production of motorcycles jumped 22.34 percent in the first four months of fiscal year 2017-18 (FY18), over the corresponding period of in FY17, according to the latest data from Pakistan Bureau of Statistics (PBS) as reported by the media.

Pakistan automobile market is also expanding along with the motorcycle market. Sales of passenger cars soared 20.4% to 103,432 units in the first half of the current fiscal year of 2017/18, recently released official data shows. Car sales were 85,901 in the same period of last fiscal year, according to Pakistan Automotive Manufacturers Association (PAMA).

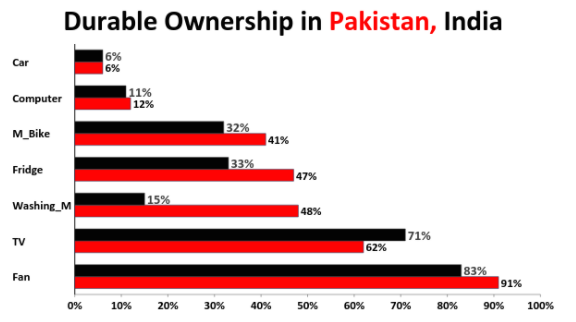

Durable Goods Ownership:

Ownership of consumer durables like computers, home appliances and vehicles is often seen as an important indicator of the size and health of the middle classes in emerging economies. Examples of periodic household surveys used by researchers to measure such data include NSS (National Sampling Survey) in India and PSLM (Pakistan Social and Living Standards Measurement) in Pakistan.

Pakistan's Trillion Dollar Economy:

Pakistan is now the world's third fastest growing economy among the world's top 25 economies with PPP GDP of over one trillion US dollars, according to the International Monetary Fund (IMF). IMF has recently raised the country's 2018 growth forecast to 5.6%.

Pakistan 3rd Fastest Among Top 25:

Spectator Index has ranked India first with 7.3% growth, followed by China (6.5%), Pakistan (5.6%), Indonesia (5.3%) and Turkey (3.7%) among the world's 25 largest economies in terms of PPP GDP.

Earlier in October 2017, the International Monetary Fund (IMF) forecast Pakistan's economy to grow at 6.3% CAGR over 2017-2022.

India-Pakistan Comparison:

Dr. Jawaid Abdul Ghani, a professor at Karachi School of Business Leadership, has recently analyzed household surveys in India and Pakistan to discover the following:

1. As of 2015, car ownership in both India and Pakistan is about the same at 6% of households owning a car. However, 41% of Pakistani household own motorcycles, several points higher than India's 32%.

2. 12% of Pakistani households own a computer, slightly higher than 11% in India.

3. Higher percentage of Pakistani households own appliances such as refrigerators (Pakistan 47%, India 33%), washing machines (Pakistan 48%, India 15%) and fans (Pakistan 91%, India 83%).

4. 71% of Indian households own televisions versus 62% in Pakistan.

Growth over Time:

Dr. Abdul Ghani has also analyzed household data to show that the percentage of Pakistani households owning washing machines has doubled while car and refrigerator ownership has tripled and motorcycle ownership jumped 6-fold from 2001 to 2014.

Income/Consumption Growth in Pakistan. Source: KSBL |

Rapid Income Growth:

Rising ownership of durables in Pakistan has been driven by significant reduction in poverty and growth of household incomes, according to Dr. Abdul Ghani's research. Percentage of households with per capita income of under $2 per day per person has plummeted from 57% in 2001 to 7% in 2014. At the same time, the percentage of households earning $2 to $10 per day per person has soared from 42% of households in 2001 to 87% of households in 2014. The percentage of those earning over $10 per day per person has jumped 7-fold from 1% of households in 2001 to 7% of households in 2014.

Pakistani Middle Class:

Only 5% of Pakistanis in $2-$4 per day per person income group have college degrees. But 20% of those in $4-$10 have college degrees, according to the survey results.

Credit Suisse Income and Wealth Data:

Average Pakistani adult is 20% richer than an average Indian adult and the median wealth of a Pakistani adult is 120% higher than that of his or her Indian counterpart, according to Credit Suisse Wealth Report 2016. Average household wealth in Pakistan has grown 2.1% while it has declined 0.8% in India since the end of last year.

Median wealth data indicates that 50% of Pakistanis own more than $1,180 per adult which is 120% more than the $608 per adult owned by 50% of Indians.

GDP Estimates Using Household Survey Data:

Pakistan's GDP calculated from consumption data in PSLM is significantly higher than the government estimates based on production data. The reverse is true of Indian GDP.

M. Ali Kemal and Ahmed Waqar Qasim, economists at Pakistan Institute of Development Economics (PIDE), explored several published different approaches for sizing Pakistan's underground economy and settled on a combination of PSLM (Pakistan Social and Living Standards Measurement) consumption data and mis-invoicing of exports and imports to conclude that the country's "informal economy was 91% of the formal economy in 2007-08".

Prominent Indian economists Abhijit V Banerjee, Pranab Bardhan, Rohini Somanathan and TN Srinivasan teaching at MIT, UC Berkeley, Yale University and Delhi School of Economics believe that India's GDP estimate based on household survey (National Sampling Service or NSS) data is about half of what the Indian government officially reports as India's GDP.

Here's a quote from French economist Thomas Piketty's book "Capital in the Twenty-First Century" explaining his skepticism of production-based official GDP figures of India and China:

"Note, too, that the very high official growth figures for developing countries (especially India and China) over the past few decades are based almost exclusively on production statistics. If one tries to measure income growth by using household survey data, it is often quite difficult to identify the reported rates of macroeconomic growth: Indian and Chinese incomes are certainly increasing rapidly, but not as rapidly as one would infer from official growth statistics. This paradox-sometimes referred to as the "black hole" of growth-is obviously problematic. It may be due to the overestimation of the growth of output (there are many bureaucratic incentives for doing so), or perhaps the underestimation of income growth (household have their own flaws)), or most likely both. In particular, the missing income may be explained by the possibility that a disproportionate share of the growth in output has gone to the most highly remunerated individuals, whose incomes are not always captured in the tax data."

Who is Dr. Jawaid Abdul Ghani?

The PSLM household data cited in this blog post is taken from a recent presentation made by Dr. Jawaid Abdul Ghani at the Karachi School of Business and Leadership (KSBL) where he teaches. KSBL has been established in collaboration with Cambridge University's Judge Business School. Prior to his current faculty position, Dr. Abdul Ghani taught at MIT's Sloane School of Management and Lahore University of Management Sciences (LUMS). He has a computer science degree from MIT and an MBA from Wharton Business School.

Summary:

Pakistan is the 5th largest motorcycle market in the world after China, India, Indonesia and Vietnam. With 7,500 new motorcycles being sold everyday, Pakistan is also the among the world's fastest growing two-wheeler markets. Passenger car and motorcycles sales in Pakistan are both soaring at rates of over 20% a year. Pakistan has managed to significantly reduce poverty and rapidly grow its middle class since 2001. The country now boasts the world's third fastest growing economy among the world's top 25 economies with PPP GDP of over one trillion US dollars, according to the International Monetary Fund (IMF). IMF has recently raised the country's 2018 growth forecast to 5.6%. spite of major political, security and economic challenges. The foundation for the rise of the middle class was laid on President Musharraf's watch by his government's decisions to invest in education and infrastructure projects that led to the expansion of both human and financial capital. My hope is that the continued improvement in security situation and implementation of China-Pakistan Economic Corridor (CPEC) related projects will bring in higher long-term investments and accelerate Pakistan's progress toward prosperity for all of its citizens.

Related Links:

Credit Suisse Wealth Report 2016

Pakistan's Trillion Dollar Economy Among World's Fastest Growing

Pakistan: A Majority Middle Class Country

Karachi School of Business and Leadership

State Bank: Pakistan's Actual GDP Higher Than Officially Reported

College Enrollment in Pakistan

Musharraf Accelerated Development of Pakistan's Human and Financial...

-

Comment by Riaz Haq on January 19, 2018 at 10:23pm

-

SBP: #Pakistan #economy maintaining growth momentum despite external headwinds. Large Scale #Manufacturing (#LSM) soars 10% in Q1 FY18

https://dailytimes.com.pk/184644/economy-maintaining-growth-momentu...

KARACHI: The State Bank of Pakistan (SBP) Friday said the preliminary data on key macroeconomic indicators suggest that growth momentum remained in the first quarter of the current fiscal year.

The Central Bank mentioned in its first quarterly report for FY18 that several coincident indicators point to a further strengthening of aggregate supply and demand in the economy.

According to the report, with the exception of cotton, other major kharif crops achieved or surpassed the FY18 targets. This improvement is supported by sufficient water availability, healthy fertilizer off take and an encouraging increase in agricultural credit disbursements. The large-scale manufacturing also experienced a 10 percent high growth during Q1-FY18 – the highest quarterly growth since FY09.

The performance was encouraging as all sectors, barring fertilizer, contributed positively. This broad based\ growth can be attributed to better energy availability, improved security situation, and rising consumer demand on the back of higher purchasing power and access to affordable credit facilities. The healthy performance of commodity producing sectors had a positive impact on the services sector as well, it added.

The Report highlighted that timely policy support, favorable cyclical movements, low and stable inflation along with growing confidence triggered an uptick in the private sector credit. In particular, the fixed investment loans expanded for the twelfth consecutive quarter in Q1-FY18.

The Report also observed the noteworthy rebound in FBR revenues on the back of increased economic activity. New infrastructure projects, surge in imports, higher consumption of consumer durables, and increased prices and consumption of POL products significantly contributed to both direct and indirect taxes. Notwithstanding this performance, the Report emphasized on the need for more concerted efforts aimed at expanding the tax base.

It also highlighted that the recent significant gains in export growth and foreign direct investment are welcome developments. However, these gains were not enough to contain the overall balance of payments deficit. On the back of an expanding economy, import payments far exceeded the aforementioned positives and the external sector remained under pressure. The widening of current account deficit along with an increase in economic activity is a recurring phenomenon for Pakistan, and one that has the tendency of disrupting growth cycles. There is, hence, an urgent need to find innovative policy mixes, avenues for raising foreign exchange earnings, and realigning policies favoring export growth.

In brief, the first quarter developments show that Pakistan’s economy is well poised to continue on its growth momentum for FY18. However, in order to maintain this virtuous equilibrium of high growth and low inflation in the medium- and long-term, the Report underlines the need to address long-standing structural reforms in the fiscal and external sectors.

-

Comment by Riaz Haq on January 26, 2018 at 10:25am

-

Imports of used cars in Pakistan jump 70pc

https://www.dawn.com/news/1385303/imports-of-used-cars-in-pakistan-...

KARACHI: Imports of used cars and minivans surged to 65,723 units in 2017, up almost 70 per cent from 38,676 units a year ago, latest data released by the auto industry shows.

The arrival of sport utility vehicles (SUVs) also increased 59pc to 7,758 units. Imports of pickups and vans registered a 9pc rise to 3,154 units.

The local industry maintains a record of each imported vehicle, whether new or old, through the Import General Manifest (IGM). Every imported car is logged in the customs’ IGM.

Toyota Vitz was most popular foreign vehicle in 2017

Toyota Vitz remained the most popular imported car in 2017. As many as 8,680 units arrived in 2017, up almost 40pc from a year ago. The volume of Daihatsu Mira swelled 73.1pc to 6,091 units.

Toyota Aqua imports climbed 96pc to 7,123 units from 3,622 units in 2016.

As many as 5,088 units of Suzuki Every were brought into Pakistan in 2017, up 14.6pc year-on-year. Imports of Daihatsu Hijet rose 34.5pc to 3,367 units.

The arrival of Suzuki Alto doubled to 4,158 units from 2,013 units a year ago. Suzuki WagonR imports surged 115pc to 3,574 units.

Imports of Honda Vezel and Toyota Land Cruiser stood 2,431 units and 3,301 units in 2017, up 57.5pc and 55.7pc, respectively, on an annual basis.

The overall volume of imported used vehicles grew 65pc to 76,635 units in 2017 from 46,500 units a year ago, data showed.

Low interest rates, increase in auto financing by banks and lifting of vehicles by investors for cab services like Careem and Uber boosted the imports of used cars as well as sales of locally assembled vehicles.

The government imposed regulatory duties on the purchase of foreign used vehicles in October, which largely failed to dent the overall annual import figures.

Sales of locally produced cars rose 20.4pc on a year-on-year basis to 103,432 units in July-December.

According to the Pakistan Bureau of Statistics, overall imports of cars increased 64pc to $276 million in July-December.

Pakistan Association of Automotive Parts and Accessories Manufacturers’ former chairman Aamir Allawala said the local vending industry lost estimated revenue of Rs23 billion last year.

The estimate is based on taking the average local content per vehicle of Rs300,000 on imports of 76,645 units in 2017. This is in contrast to a loss of Rs14bn in 2016 with imports of 46,500 vehicles.

He said imports of used cars were the biggest impediment to investment by existing assemblers, new entrants and part makers.

He said the government has modified the procedure for the payment of duties and taxes to curb imports of used vehicles.

“Time has come for the existing players to make prompt investment in capacity expansion, improve localisation, introduce new models and reduce delivery time to eliminate the menace of premium,” he said, adding that an increase in production will boost tax revenue and create jobs.

In the near future, Hyundai, Kia and Renault will set up plants in the country.

-

Comment by Riaz Haq on February 14, 2018 at 9:12pm

-

Pakistan's auto sales surge 23 pct in January 2018

http://www.xinhuanet.com/english/2018-02/12/c_136970661.htm

The Pakistan Automotive Manufacturers Association announced on Monday that Pakistan's locally assembled cars and Light Commercial Vehicles (LCVs) sales volume jumped by 23 percent to 23,562 units in January on the yearly comparison and by 22 percent on the monthly comparison.

The growth was largely attributed to Pak-Suzuki Motor Company's (PSMC) impressive sales numbers of the Wagon-R (an increase of 1,101 units) and Cultus (an increase of 680 units) and a strong response to Honda Atlas Cars' BR-V (an increase of 500 units).

Moreover, recent changes in import procedures have also resulted in a higher offtake for the less than 1,000cc segment, as consumers continue to shift to Pak-Suzuki Motor Company.

According to the Pakistani auto industry's official numbers, volumes for PSMC and Honda Atlas Car (HCAR) increased by 24 percent and 10 percent on yearly comparison while Indus Motor's volumes decreased by 7 percent.

Furthermore, growth was also recorded in LCVs sales, as they increased by 38 percent to 3,638 units in January this year when compared with the sales of 2,629 units in January last year.

Similarly, tractor sales continued to perform well, thereby registering 5,863 units for January, up by 9 percent as against 5,390 units in the same month of last year.

Moreover, motorcycles and three-wheelers also witnessed a fair bit of increase of 20 percent on the yearly comparison and 13 percent on the monthly comparison.

-------

Imports of used cars in Pakistan jump 70pc

https://www.dawn.com/news/1385303

Imports of used cars and minivans surged to 65,723 units in 2017, up almost 70 per cent from 38,676 units a year ago, latest data released by the auto industry shows.

The arrival of sport utility vehicles (SUVs) also increased 59pc to 7,758 units. Imports of pickups and vans registered a 9pc rise to 3,154 units.

The local industry maintains a record of each imported vehicle, whether new or old, through the Import General Manifest (IGM). Every imported car is logged in the customs’ IGM.

Toyota Vitz remained the most popular imported car in 2017. As many as 8,680 units arrived in 2017, up almost 40pc from a year ago. The volume of Daihatsu Mira swelled 73.1pc to 6,091 units.

-

Comment by Riaz Haq on August 5, 2018 at 10:16am

-

#Motorcycle production in #Pakistan up 15.44% in FY 2017-18. 2,650,233 motorcycles produced in July-May (2017-18) , up 15.44% from 2,295,846 during July-May (2016-17). #Manufacturing #economy

https://nation.com.pk/04-Aug-2018/motorcycle-production-up-15-44pc-...

The production of motorcycles during the first eleven months of fiscal year (2017-18) increased by 15.44 per cent as against the corresponding period of last year, Pakistan Bureau of Statistics (PBS) reported.

As many as 2,650,233 motorcycles were manufactured during July-May (2017-18) against the output of 2,295,846 during July-May (2016-17), showing growth of 15.44 per cent, the latest PBS production data revealed.

The production of cars and jeeps witnessed 20.10 per cent increase during the period under review as 214,904 jeeps and cars were manufactured during July-May (2017-18) against the production of 178,944 units during July-May (2016-17).

The production of light commercial vehicles (LCVs) witnessed an increase of 18.54 per cent in production during the period under review by growing from 22,927 units last year to 27,178 million during 2017-18.

The production of tractors also increased from 50,049 units last year to 67,371 units, showing growth of 34.61 per cent while the production of trucks increased by 20.27 per cent, from 7,104 units to 8,544 units.

However, the production of buses during the period under review witnessed the negative growth of 31.54 per cent by going down from the output of 1,043 units to 714 units.

Meanwhile, on the year-on-year basis, the production of motorcycles increased by 14.57 per cent by growing from the output of 231,295 units in May 2017 to 264,984 units in May 2018.

The production of tractors also witnessed an upward growth of 19.56 per cent by growing from 5,746 units in May 2017 to 6,870 units in May 2018.

The production of jeeps and cars increased by 0.74 per cent as the country manufactured 18,227 jeeps and cars during May 2018 against the production of 18,094 units in May 2017, the PBS data revealed.

The production of tractors also witnessed an upward growth of 19.56 per cent by growing from 5,746 units in May 2017 to 6,870 units in May 2018.

The production of LCVs witnessed decrease of 12.96 per cent in production by going down from the output of 2,368 units in May 2017 to 2,061 units in May 2018.

The output of trucks witnessed the negative growth of 7.02 per cent by going down from the output of 869 units in May 2017 to 808 units in May 2018 while the output of buses declined by 19.51 per cent by declining from 82 units to 66 units.

It is pertinent to mention here that the overall 'Large Scale Manufacturing Industries' (LSMI) of the country witnessed the growth of 6 per cent during the first eleven months of the current fiscal year compared to the corresponding period of last year.

The country’s LSMI Quantum Index Numbers (QIM) was recorded at 149.19 points during July-May (2017-18) against 140.75 points during July-May (2016-17), showing growth of 6 per cent.

The highest growth of 3.62 per cent was witnessed in the indices monitored by Ministry of Industries, followed by 1.58 per cent growth in the products monitored by Provincial Bureaus of Statistics (PBOS) and 0.80 growth in the indices of Oil Companies Advisory Committee (OCAC).

On yearly basis, the industrial growth increased by 2.76 per cent during May 2018 as compared to same month of last year, however, on month-to-month basis, the industrial growth decreased by 11.63 per cent in May 2018 when compared to growth of April 2018, the PBS data revealed.

-

Comment by Riaz Haq on August 9, 2018 at 7:33am

-

Despite local production in millions, motorcycle imports up by 15.52 percent

https://en.dailypakistan.com.pk/business/despite-local-production-i...

Despite the massive local production, the motorcycle imports into the country witnessed 15.52 percent increase during the fiscal year 2017-18 against the corresponding year, according to Pakistan Bureau of Statistics (PBS).

Pakistan imported motorcycles worth $106.382 million in July-June (2017-18) against the imports of $92.089 million in July-June 2016-17, showing growth of 15.52 percent.

Meanwhile, on a year-on-year basis, the motorcycle imports surged by 22.83 percent during the month of June as compared to the same month of last year. The motorcycle imports in June 2018 were recorded at $9.562 million against the imports of $7.785 million in June 2017, the PBS data revealed.

On a month-on-month basis, the imports of motorcycles witnessed a nominal increase of 0.81 percent during the month of June 2017 when compared to the imports of $9.485 million in May 2018, according to the data.

Meanwhile, the local production of motorcycles during the first eleven months of fiscal year (2017-18) increased by 15.44 percent as against the corresponding period of last year.

As many as 2,650,233 motorcycles were manufactured during July-May (2017-18) against the output of 2,295,846 during July-May (2016-17), showing growth of 15.44 percent, the latest PBS production data revealed.

On the year-on-year basis, the production of motorcycles increased by 14.57 percent by growing from the output of 231,295 units in May 2017 to 264,984 units in May 2018.

-

Comment by Riaz Haq on June 16, 2019 at 7:48pm

-

Registered #vehicles in #Pakistan up 9.6% to 23,588,268 in 2018. #Motorcycles saw biggest increase of 11.5% reaching 17,465,880. #Cars, jeeps and station wagons rose 5.3% reaching 3,043,593. #Trucks surged to 277,416 and #buses 236,461 https://profit.pakistantoday.com.pk/2019/06/16/registered-vehicles-... via @Profitpk

The registered vehicles in the country increased by 9.6 per cent in 2018 as the number of vehicles have reached 23,588,268 in the last year compared to 21,506,641 vehicles in 2017, according to the data of Pakistan Bureau of Statistics (PBS).

The data revealed that two-wheel registered motor bikes witnessed highest increase during the said period showing a surge in their registration of 11.5 percent. Their number has jumped to 17,465,880 from 15,664,098 in the previous year.

Similarly, motor cars, jeeps and station wagons have grown by 5.3 percent reaching to 3,043,593 from 2,889,500 during the period of one year. However, the growth in the registration of three-wheel motor cycles, trucks, buses, taxis and others vehicles showed normal increase.

The number of trucks has surged to 277,416 from 272,934 in one year time period. The number of buses has also risen to 236,461 from 233,884, the data showed.

-

Comment by Riaz Haq on July 3, 2021 at 6:56pm

-

The registered vehicles in the country increased by 9.6 per cent in 2018 as the number of vehicles have reached 23,588,268 in the last year compared to 21,506,641 vehicles in 2017, according to the data of Pakistan Bureau of Statistics (PBS).

https://profit.pakistantoday.com.pk/2019/06/16/registered-vehicles-...

The data revealed that two-wheel registered motor bikes witnessed highest increase during the said period showing a surge in their registration of 11.5 percent. Their number has jumped to 17,465,880 from 15,664,098 in the previous year.

Similarly, motor cars, jeeps and station wagons have grown by 5.3 percent reaching to 3,043,593 from 2,889,500 during the period of one year. However, the growth in the registration of three-wheel motor cycles, trucks, buses, taxis and others vehicles showed normal increase.

The number of trucks has surged to 277,416 from 272,934 in one year time period. The number of buses has also risen to 236,461 from 233,884, the data showed.

-

Comment by Riaz Haq on October 30, 2021 at 4:36pm

-

Pakistani Motorcycles Market burnt out. In the third quarter sales have been flat from the previous year. Consequently, Year to Date September sales were 1.4 million, up 37.5% vs the 2020 and 13.0% vs the 2019, running towards the second all-time level, just below the 2018 record.

https://www.motorcyclesdata.com/2021/10/25/pakistan-motorcycles/

Motorcycles Market 2021 Trend

Pakistani two wheeler market is accelerating and recovering fast, following the lost reported in the 2020, when prolonged shutdown and lockdowns blocked the production and the commercial activities for a while.

This year the demand is back very fast and we can expect the market to be back on the pre covid track, when it was one of the fastest growing worldwide.

Sales speed up in the first half of this calendar year, when two and three wheeler sales have been 951.093, up a huge 66.8% vs the 2020 and +9.0% vs the 2019, hitting the new record as highest semester ever.

In the third quarter sales have been flat from the previous year. Consequently, Year to Date September sales were 1.4 million, up 37.5% vs the 2020 and 13.0% vs the 2019, running towards the second all-time level, just below the 2018 record.

The competitive arena is dominated by Honda with sales up 52.2%. It is followed by United Auto (+10.7%) and Road Prince (+6.0%), the best local brands.

Pakistani Market Heritage

Before 2004, nobody could have ever thought that Pakistan motorcycle industry would flourish at such an exorbitant scale. In those years the market volume was below 0.1 million annual units and two companies only (Atlas Honda and Dawood Yamaha) were operating in the market. Suzuki and Qingqi held minor shares.

Thanks to government open policy, new manufacturers entered the market backed by Chinese technology and the sector become crucial in sustaining Pakistan economic development. In the last 15 years, it has become the preferred solution for individual mobility.

The following factors played a vital role in this development:

Cheap but reliable technology from China.

Independent sourcing of engines technology from China and body parts from local vendors.

Assemblers of Japanese brands had to pay a big amount as royalty to their principals, while new assemblers are sourcing everything independently. It has reduced bike cost.

Overhead expenses are small as most of the companies operate in limited areas.

Financing/leasing facility is available at local level. This facilitated lower-income people to buy a bike despite limited resources.

In recent years, Pakistani motorcycles industry has been among the fastest in the World. Indeed, the milestone of 1 million units has been hit for the first time only in 2015 and now the market is already running towards the 2 million annual sales. Following the over 1.4 million sales achieved in 2017, the market further boomed in 2018, with a record of 1.9 million sales. up 6.6%, and scoring the All Time Record.

However, rupee depreciation together with tax increase and less cash available for credit, penalized the market since the end of 2018. Motorcycles’ price further increase, discouraging the demand and the market has taken a negative path.

-

Comment by Riaz Haq on February 4, 2022 at 10:44am

-

Pakistan becomes the fourth largest bike manufacturer country in the world

https://www.edgedandtaken.com/pakistan-becomes-the-fourth-largest-b...

Prime Minister Imran Khan met yesterday with prominent industrialists and businessmen in Islamabad. During the meeting, the Prime Minister Imran Khan stated that Pakistan has become the fourth largest producer of bike in the world. Discussing the automotive sector, Imran Khan said tractor exports increased by 10% while the country produced 90% of its parts.

This is not the first time the Prime Minister has cited the bike industry and its apparent success. Last year, the Prime Minister stated that in the fiscal year 2020-2021, Pakistan recorded the largest number of motorcycle sales in the history of the country. He said record motorcycle sales show that the country’s low-income class is making progress. Given that motorcycles are known as the journey of an ordinary person, “aam admi ki sawari”, the Prime Minister Imran Khan says that the increase in motorcycle sales means the strengthening of “aam admi”.

Meanwhile, prices as well as bikes sales speak differently. During 2021, motorcycle companies gradually increased prices. According to our research, Honda has increased the rates by 7 times, Yamaha 5 times, while Suzuki has revised its rates 4 times.

The figures show that the price of the most famous Honda CD70 has risen by Rs. 14,800 last year, while the Honda CG 125 saw a total increase of Rs. 21 000. Meanwhile, Yamaha’s well-known YBR bikes have noticed a price increase of Rs. 30,500 during 2021.

And Suzuki motorcycle prices have risen to Rs. 25,000 last year. It shows how much prices have risen. Surprisingly, despite this repeated increase in prices, sales figures in 2021 continued to show upward trajectories, leading the country into a massive motorcycle manufacturer in the world.

According to the data, sales of Honda, Yamaha and Suzuki motorcycles increased in the period July-November 2021, as well as from month to month. The PAMA report showed that Atlas Honda Limited broke its sales record. In November, the company sold its highest number of bikes at 128,503 units, beating its October sales record when 125,031 bikes were sold.

Honda sales, meanwhile, rose to 563,575 units in July-November from 512,010 in the same period last year. Other Japanese motorcycle companies, Suzuki and Yamaha, also recorded high sales during this 5-month period.

The data showed that Suzuki sold 14,915 bikes in those five months compared to 8,719 in the same period last year. This means that its sales increased by 71%. Meanwhile, Yamaha sales rose to 9,962 units from 8,733 last year, a jump of 14%.

-

Comment by Riaz Haq on February 23, 2022 at 7:17am

-

Bilal I Gilani

@bilalgilani

From just 3 million motorcycles 15 year ago , we now have over 22 million motorcyclesPpl had disposable income to afford this

Much of these motorcycle are used for rural to urban mobility

Motorcycles r environmentally less harmful than cars ( ideal is public transport)

https://twitter.com/bilalgilani/status/1496406817794056194?s=20&...

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Has Pakistan Destroyed India's S-400 Air Defense System at Adampur?

Pakistan claims its air force (PAF) has destroyed India's high-value Russian-made S-400 air defense system (ADS) located at the Indian Air Force (IAF) Adampur air base. India has rejected this claim and posted pictures of Prime Minister Narendra Modi posing in front of its S-400 rocket launchers in Adampur. Meanwhile, there are reports that an Indian S-400 operator, named Rambabu Kumar Singh, was killed at about the time Pakistan claims to have hit it. Pakistan is believed to have targeted…

ContinuePakistan Downs India's French Rafale Fighter Jets in History's Largest Aerial Battle

Pakistan Air Force (PAF) pilots flying Chinese-made J10C fighter jets shot down at least two Indian Air Force's French-made Rafale jets in history's largest ever aerial battle involving over 100 combat aircraft on both sides, according to multiple media reports. India had 72 warplanes on the attack and Pakistan responded with 42 of its own, according to Pakistani military. The Indian government has not yet acknowledged its losses but senior French and US intelligence officials have …

ContinuePosted by Riaz Haq on May 9, 2025 at 11:00am — 32 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network