PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Garment Industry Becoming More Cost Competitive With Bangladesh's?

Low wages and trade preferential deals with Western nations have helped Bangladesh, currently designated "Least Developed Country" (LDC), build a $30 billion ready-made garments (RMG) industry that accounts for 80% of country's exports. Bangladesh is the world's second largest RMG exporter after China. With its designation as LDC (Least Developed Country), garments made in Bangladesh get preferential duty-free access to Europe and America. Rising monthly wages of Bangladesh garment worker in terms of US dollars are now catching up with the minimum wage in Pakistan, especially after recent Pakistani rupee devaluation. Minimum monthly wage in Pakistan has declined from $136 last year to $107 now while Bangladesh has seen it increase from $64 last year to $95 today. Western garment buyers, known for their relentless pursuit of the lowest labor costs, will likely diversify their sources by directing new investments to Pakistan and other nations. Competing on low cost alone may prove to be a poor long term exports strategy for both countries. Greater value addition with diverse products and services will be necessary to remain competitive as wages rise in both countries.

|

| Minimum Monthly Wages in US$ Market Exchange Rate |

Wage Hike in Bangladesh:

The government in Dhaka announced in September that the minimum wage for garment workers would increase by up to 51% this year to 8,000 taka ($95) a month, up from $64 a year ago, according to Renaissance Capital. But garment workers union leaders say that increase will benefit only a small percentage of workers in the sector, which employs 4 million in the country of 165 million people, according to Reuters. Bangladesh government promised this week it would consider demands for an increase in the minimum wage, after clashes between police and protesters killed one worker and wounded dozens.

| Monthly Minimum Wages in US$. Source: Renaissance Capital |

Pakistan Wage Decline:

Pakistani currency has seen about 25% decline in value against the US dollar since January 2018. As a result of this devaluation, the minimum monthly wage in Pakistan has dropped from $136 last year to $107 now while Bangladesh has seen it increase from $64 last year to $95 today. Renaissance Capital projects a further 10% depreciation in Pakistani rupee this year.

Race to the Bottom?

Competing on cost alone is like engaging in the race to the bottom. Neither Pakistan nor Bangladesh can count on being lowest cost producers in the long run. What must they do to grow their exports in the future? The only viable option for both is to diversify their products and services and add greater value to justify higher prices.

Pakistan's Export Performance:

|

|

|

|

| Top 10 Textile Exporters. Source: WTO |

|

| Top 10 Garment Exporters. Source: WTO |

Pakistan's Role:

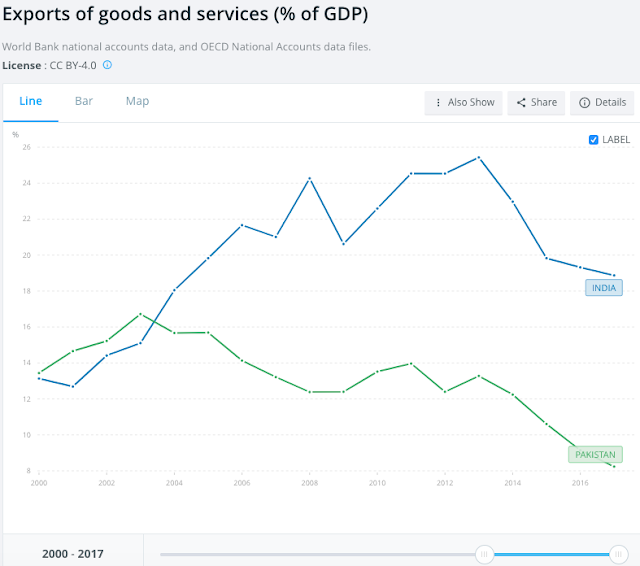

Pakistani currency has seen about 25% decline in value against the US dollar since January 2018. As a result of this devaluation, the minimum monthly wage in Pakistan has dropped from $136 last year to $107 now while in Bangladesh has seen it increased from $64 last year to $95 today. Renaissance Capital projects a further 10% depreciation this year. While this can help Pakistan's RMG exports in the short term, it is not good long term strategy. Competing on cost alone is a race to the bottom. Pakistan's manufactured exports per capita have declined in the last decade. Pakistan's exports have declined from about 15% of GDP to about 8% since 2003. The nation's trade deficits are growing at an alarming rate as the imports continue to far outstrip exports. This situation is not sustainable. Chinese Ambassador Yao Jing has offered a helping hand to increase Chinese investment and trade in Pakistan. Pakistan's new government led by Prime Minister Imran Khan should take the Chinese Ambassador's plan seriously. Finance Minister Asad Umar needs to form a high-powered team of top bureaucrats and leading businessmen on a comprehensive plan to attract investments in export-oriented industries and diversify and grow high-value exports to China and other countries.

-

Comment by Riaz Haq on July 31, 2019 at 8:10am

-

President Donald #Trump has indicated that #UnitedStates wants to increase its #trade with #Pakistan by at least four-fold following a meeting with #ImranKhan. Trump’s Pakistan Trade Aims May Need Levi, JC Penney Sourcing Strategy Help. #Garments #Textiles https://www.spglobal.com/marketintelligence/en/news-insights/resear...

President Donald Trump has indicated that the U.S. wants to increase its trade with Pakistan by at least four-fold following a meeting with Prime Minister Imran Khan, Inside Trade reports. No firm policies or trade deal process has been put in place yet, though the ongoing need to secure Pakistan as a regional trade partner may give some incentive to do so ahead of the 2020 elections.

While the Trump administration will doubtless focus on increasing U.S. exports, Pakistan needs a significant boost to its export economy before it is in a position to increase its purchases significantly. Panjiva analysis of S&P Global Market Intelligence data shows that its exports contracted by 0.2% year over year in the 12 months to May 31, following a 0.9% annual decline in the prior three years to reach $23.1 billion.

The U.S. accounted for 16.6% of the total, and managed to increase by 5.8% year over year in the past 12 months, Panjiva data shows. The need for a trade deal, and closer relations, with the U.S. has also become more important since India’s decision to increase tariffs on Pakistani exports as outlined in Panjiva’s research of February 18.

The major challenge in boosting imports from Pakistan will lie in either diversifying its exports to the U.S., or significantly eating into the market share of other countries supplying the U.S. In aggregate the apparel and textile industries accounted for 37.8% and 35.1% respectively of all U.S. imports from Pakistan in the 12 months to May 31.

Given Pakistan accounted for just 1.7% of U.S. apparel imports and 8.4% of textiles there may well be room for increased market share.

From a developmental perspective it’s worth noting that shipments aside from textiles and apparel have actually fallen as a proportion of the total to 27.1% in the past 12 months compared to 38.9% in 1998. Other major import lines include cotton at 3.3%, optical equipment at 2.8% and plastics which accounted for 2.6%.

The largest importer of apparel and textiles from Pakistan in the past 12 months, aside from trade finance houses, has been Levi Strauss with 1,682 TEUs shipped. That followed a 101.5% year over year surge in shipments in 2Q. Other importers have also already been expanding their shipments. That was followed by JC Penney with 991 TEUs shipped after a 13.3% rise in 2Q while Adidas shipped 641 TEUs and grew by 9.9%.

-

Comment by Riaz Haq on August 25, 2019 at 7:08am

-

#Pakistan #garment makers chase rivals in #India and #Bangladesh. Pakistan has been hailed as an "attractive sourcing base" by industry executives including Spencer Fung, CEO of Hong Kong-based supply chain giant Li & Fung https://asia.nikkei.com/Business/Business-trends/Pakistan-garment-m...

The global shift to online retailing is further intensifying cost competition, a trend that could benefit Pakistan.

Leading the shift is Amazon, which offers cheaper apparel that can be customized to individual shoppers' tastes and delivered quickly.

-----------

Pakistan garment companies are fighting hard to break into the supply chains of some of the world's biggest fashion brands as the country races to catch up with Bangladesh and other Asian apparel heavyweights.

The battle is fierce, however, as customers like Zara and H&M demand high quality and low costs from their suppliers, all on increasingly tight time tables.

Kay & Emms, a garment maker based in Faisalabad, says it is benefiting from clients' desire to diversify.

"We are getting more benefit because the customers are thinking that they are not 100% safe while putting all of their eggs in one basket that is either China or Bangladesh," Faisal Waheed, sales and marketing general manager at Kay & Emms.

Compared to the traditional leaders in garment production -- China, Vietnam and Bangladesh -- Pakistan is still a minor player, and the pressure on companies to reduce costs is intense.

"There is always a war-footing situation," Waheed said. "Every customer is cost-conscious, because they know they have the buying power around the globe. They have a lot of suppliers in their basket -- Cambodia, India, Bangladesh, China and Pakistan. If you don't act on war footing, you will be losing business."

---------------------

Pakistan has been hailed as an "attractive sourcing base" by industry executives including Spencer Fung, CEO of Hong Kong-based supply chain giant Li & Fung, as garment production for Western brands continue to shift to lower cost countries.

Kay & Emms is still small by global standards, with an annual turnover of just $50 million and 2,300 employees, but it is growing at an annual rate of 60%. About a fifth of its sales comes from Zara, a brand belonging to Spain's Inditex. Kay & Emms has been supplying jogging pants, hoodies, crew neck shirts, pullovers and zipper jackets for Zara since 2014, but it was a hard-earned success, according to Waheed.

"After an effort of more than four, five months, we got the first order," Waheed said. "It was quite hard to get into their business."

Zara is a demanding customer, Waheed. "It is cost-conscious, quality-conscious and time-conscious." But his company was after the prestige of doing business with the world's biggest apparel company. Zara releases new items every three to four weeks, rather than on a four-season cycle. "It compels us to develop new fabrics and garments," Waheed said. "That's harder, but more exciting."

Pakistan's cost-competitive garment makers are drawing attention from multinational brands, even though the country's growth lags behind more dynamic markets such as India or Bangladesh. Pakistan is still recovering from the U.S. war on terror, which has stirred Islamic insurgency and has left tens of thousands dead near the border with Afghanistan.

-

Comment by Riaz Haq on September 14, 2019 at 7:03pm

-

Special Economic Zones (#SEZs) in #Faisalabad alone would help #Pakistan grow its #exports by $1billion to $1.5 billion per year in the short span of time by ensuring effective and comprehensive planning, Says (FIEDMC) Chief Mian Kashif #economy https://nation.com.pk/15-Sep-2019/sezs-to-boost-exports-to-1-5b-per...

Appreciating economic vision of Prime Minister Imran Khan, he said the premier has directed all the concerned departments to remove hurdles in the way of development of SEZs and establish them on priority basis.

Fortunately, he said almost hundred percent plots in M-3 Industrial Estate have already been sold out while hundreds of units have become operational and were playing their role in providing exportable surplus in addition to accommodating thousands of workers.

Mian Kashif said that the industrial city would house more than 400 textile, steel, pharmaceutical, engineering, chemical, food processing, plastic and agriculture appliances units in addition to providing jobs to 250 thousand workers.

He claimed that the city was also expected to attract Rs400 billion local and foreign direct investment which would help Pakistan to stabilise its economy. He further said that Faisalabad was strategically located in the heart of Pakistan with two motorways passing from its eastern and western sides.

He said that this city has a unique privilege to contribute 60 percent towards textile exports and 45 percent towards total exports of the country.

He further said that it was not only restricted to textile which was its iconic identification but hundreds of SMEs hailing from chemicals, steel, food processing and others were also playing their role in the overall economy of Pakistan.

FIEDMC Chairman further said investors from China, Turkey, Korea and Britain have pumped $ 1.10 billion and their confidence in Pakistan have been restored as they are also bringing more investors from their respective country to invest in SEZs.

He said these investors expressed their eagerness to explore the possibility of investment in diverse sectors of Pakistan especially in ceramics, chemicals, steel, food processing and automobiles.

He said Prime Minister Imran Khan clearly directed them to focus on developing such industry in SEZs which is based on export and import substitution to restrict the import bill.

He said the good thing is that a number of Chinese industries have started pumping investment in SEZs and apparently the reason behind this is the production cost in China has increased which is making Pakistan one of the beneficiaries of on-going US China trade war.

He emphasised that consistent policies were imperative to attract foreign investment into the country, which could lead the economy towards sustainable growth.

He said industries operating in the FIEDMC will have an immediate access to high-quality infrastructure, un-interrupted power supply, public facilities and support services along with simpler ease of doing business.

Chief Operating Officer Muhammad Aamer Saleemi also briefed the delegation and said FIEDMC in collaboration with Industrial Police Liaison Committee has established police post at M-3 Industrial City and the industrial community will work under safe environment.

“The whole industrial estate will be monitored by high resolution surveillance cameras and 24 hours police patrolling will be provided in the estate,” adding he said this would make FIEDMC the safest industrial estate in the country.

He said CPEC will attract $40 billion worth of investment which will directly raise investment-to-GDP ratio by 2.8 percentage points besides some indirect investment addition.

“The investment in hard currency will also support exchange rate stability in the country and stabilise balance of payments situation in the country,” he added.

-

Comment by Riaz Haq on September 30, 2019 at 7:10pm

-

14 #German #textile machinery companies covering the entire textile chain are participating in #Pakistan visit, which will showcase the benefits and #technological #innovations at seminars in both #Karachi and #Lahore. https://www.textileworld.com/textile-world/supplier-notes/2019/09/m... via @Textile World

A technical seminar in Karachi will be held at the Hotel Karachi Avari Towers on November 12 and a second in Lahore will be held on November 14 at the Hotel Avari Lahore Towers.

“The regions surrounding both of these cities have become major hubs for textile manufacturing, especially in areas such as home textiles and denim, where Monforts enjoys market-leading positions with its finishing systems,” said area sales manager Manfred Havenlith, who in addition to presenting at the seminars, will be holding meetings and networking with existing Monforts customers and potential new ones during the trip. “The Punjab region around Karachi, as Pakistan’s largest city, for example, is now dense with denim manufacturers, many of whom have already expressed keen interest in the new Monforts CYD continuous yarn dyeing system we introduced at ITMA 2019 in Barcelona in June.”

The CYD system integrates new functions and processes into the weaving preparation processes — spinning, direct beaming, warping and assembly beaming, followed by sizing and dyeing – in order to increase quality, flexibility, economic viability and productivity. The unique Eco Bleach process is the first bleaching system for yarn treatment available on the market and is combined with the washing units, after which the fabric is then dyed immediately, resulting in considerable savings in wastewater and chemicals.

It is possible to process short batches of yarn in order to produce minimum runs of finished fabrics in a single continuous process and by comparing the usual processing sequences within the denim industry with the new CYD system, the advantages become immediately clear.

Key customers

Existing Monforts denim manufacturing customers in Karachi include Artistic Milliners, Artistic Fabric & Garment Industries (AFGI), Denim Clothing Company, Denim International, Kasim, Rajby Industries and Soorty. Home textiles customers meanwhile include Afroze, Al Karam, Lucky Textile Mills, Mustaqim and Yunus.

The situation is similar in the region around Pakistan’s second largest city, Lahore, where major Monforts customers include Azgard-9, Crescent Bahuman, Crestex, Kohinoor Textile Mills, Naveena, Sapphire Textiles and US Denim Mills.

On Monday, November 11, the VDMA delegation will also be visiting Karachi-headquartered Gul Ahmed Textile Mills, a leader in the home textiles field, which operates both yarn dyeing and fabric finishing lines from Monforts, and in recent years has expanded into retail, with over 40 stores across Pakistan, offering a diverse range of products, from home accessories to fashion clothing.

Trading partner

The European Union is Pakistan’s most important trading partner and textiles and clothing accounted for over 80 percent of its total exports of 6.8 billion euros to the EU in 2018, according to the European Commission.

Starting from January 2014, Pakistan has benefited from generous tariff preferences — mostly zero duties — under the EU’s GSP+ arrangement, which aims to support the country’s sustainable development and good governance. In order to maintain GSP+, Pakistan has to effectively implement 27 core international conventions on human and labour rights, environmental protection and good governance.

The VDMA delegation is being organised by SBS systems for business solutions on behalf of the German Federal Ministry for Economic Affairs and Energy (BMWi), in collaboration with the German Pakistan Chamber of Commerce and Industry (GPCCI) and with the technical support of the VDMA Textile Machinery Association.

-

Comment by Riaz Haq on November 17, 2019 at 5:20pm

-

#Taiwanese #textile companies may relocate to #Pakistan. #Taiwan will transfer new #technologies & #manufacturing processes & Pakistan will not have to compete with #China or #Bangladesh or #Vietnam on price. Instead, it will add value to its products. https://tribune.com.pk/story/2100996/2-cpec-affect-taiwanese-textil...

Being a cheap labour market (after huge currency devaluation), Pakistan can transform into an excellent destination for Taiwanese textile companies, which are willing to relocate their units outside Vietnam, said Taiwan Textile Federation President Justin Huang.

“At present, Vietnam is crowded, which causes difficulties for Taiwanese textile firms there, such as labour shortages,” Justin said in an interview with The Express Tribune. “In Pakistan, however, labour issues will not emerge at least for the next 10 years and this is something attractive for us.”

He pointed out that China had invested massively in Pakistan’s infrastructure development projects under the China-Pakistan Economic Corridor (CPEC) and stressed that Taiwanese businessmen could take maximum advantage from such investment.

Pakistan had a duty-free export agreement with the European Union and in December, the second phase of a free trade agreement (FTA) with China would also become functional, which would prove to be helpful for the Taiwanese investors and trade and industrial development in Pakistan, he said.

“We are different from China and other countries because we focus more on technical and functional textiles,” he emphasised.

Justin added that he would forward all the information collected from Pakistan to other federation members in Taiwan including the fact that Pakistan was a huge market of 200 million with excess labour and the government was willing to support foreign investment.

The federation president expressed the resolve to devise a mechanism for enhancing trade and investment collaboration between Taiwan and Pakistan in the textile and garments sector. He was of the view that Pakistan’s textile industry produced excellent products for home use and had the capacity to produce quality apparel as well.

“If things follow the right direction, we will transfer new technologies and manufacturing processes to Pakistan, which will facilitate the country in upgrading its products,” Justin stressed.

“After that, Pakistan will not have to compete with China or Bangladesh on price issues and the country will be able to add value to its products.”

Textile companies based in Taiwan have already designed products for global brands like Nike and Adidas. Sixteen teams in the football World Cup 2018 used Taiwan-based fabric in their kits.

He voiced hope that the FTA with China would also assist Taiwanese companies, which had already invested in China and had set up their units in the country.

“Our officials can bring in their work experience to Pakistan along with the academia to train the local human resources,” he pointed out. “In future, Pakistan will need a lot of textile engineers, hence, there is a need to provide sufficient training to them so that the country can utilise its manpower.”

He also stressed the need for easing the visa approval process for the Taiwanese investors.

“Right now, it is difficult for us to visit Pakistan due to a long process of applying for the entrance visa,” he said. “It took me more than three weeks to get approval for Pakistani visa.”

-

Comment by Riaz Haq on December 25, 2019 at 1:32pm

-

#Pakistan exported $1,156 million worth of readymade #garments (#RMG) in five months, showing an increase of 36% in quantity and 13.19% in value. #exports

https://www.brecorder.com/2019/12/21/555315/pakistan-exports-increa...

Pakistan exports increase by 4.8pc in five months: Finance advisor

By Ali Ahmed on December 21, 2019

Sheikh said that from July-Nov 2019, exports increased by 4.8pc as compared to same period last year.

Value added exports like readymade garments, knitwear and other major exports are showing strong pick up in both quantity & value, he said.

Adviser to the Prime Minister of Pakistan on Finance and Revenue Abdul Hafeez Sheikh said that strong export growth is essential for the industrial expansion and job creation in an economy, as Pakistan posted 4.8pc export growth.

In a tweet, the advisor said that in five months (July-Nov 2019) exports increased by 4.8 percent as compared to same period last year. “Value added exports like readymade garments, knitwear & other major exports are showing strong pick up in both quantity & value," he said.

As per the data of Major Exports of Pakistan in 2019-20 (July-November) shared by Hafeez, knitwear items worth $1,320 million were exported in the five months, showing a quantity increase of 6 percent and value increase of 8.69pc.

Whereas, Pakistan exported $1,156mn worth of readymade garments in five months, showing an increase of 36pc in quantity and 13.19pc in value. Meanwhile bedwear was third on the list with $1.013bn worth of exports, an increase of 14.37pc in quantity and 4.69pc in value.

-

Comment by Riaz Haq on February 23, 2020 at 10:22am

-

#Pakistan #textile sector at full production capacity. “If all goes well, the developments in textile industry support…the government to achieve the set export target of $24-25 billion this fiscal year” #exports #trade The Express Tribune

https://tribune.com.pk/story/2162491/2-textile-sector-jumps-full-ca...

The textile manufacturing sector – the single largest export-oriented sector of Pakistan – has spiked to full-capacity production after the government withdrew duties and taxes on import of the raw cotton in January.

Besides, Islamabad is getting higher export orders for textiles since China, the single largest textile exporter at world across, is lying closed to fight against the deadly coronavirus for the past couple of months.

“Pakistan (textile sector) is working on full capacity,” All Pakistan Textile Mills Association (Aptma) former chairman Asif Inam told The Express Tribune on Saturday.

“If all goes well, the developments in textile industry support…the government to achieve the set export target of $24-25 billion this fiscal year (July-2019 to June 2020),” he said.

“We don’t have the capacity to take additional export orders these days. We have entered into the capacity constraint zone,” he said.

He said there is a 26% volumetric growth in textiles export. “This (26%) was the capacity in surplus till recent months. The government has fully utilised that,” Inam same.

State Bank of Pakistan Governor Reza Baqir said the other day there was up to 40% volumetric growth in textile exports. Besides, the export of finished goods is on the rise, while export of raw material, including cotton and yarn are on a downward trend, which are positive developments for Pakistan’s economy.

Pakistan has continued to receive good export orders, including in the downstream industry. “The world textile buyers have diverted their purchasing orders to Pakistan since China (70-80% production) is closed to fight against spread of the coronavirus,” Inam said.

The virus has disrupted the world. A significant number of countries have been affected by the virus, as over 2,300 people have died and over 75,000 people got infected.

The official claimed that the textile exports could be doubled over the next five year if the government overcomes the high energy pricing, gas connection and tax refund issues. The Aptma has demanded a long-term five-year textile policy from the government. “Once the government announces the policy, the textile exports will start growing at 10-15% per annum over the next five years,” he added.

Cotton import

He said Pakistan is estimated to import around 7.5-8 million bales (of 170 kilogram each) this fiscal year after local production came almost half of the required 15 million bales in FY20.

They will be record high import in Pakistan. Pakistan has produced around 7.5-8 million bales so far, which comes to around half of the domestic requirement.

“We have so far imported around one-third of the total required quantity of imported cotton at 7.5-8 million bales. We will import around 70% of that over the next two-three months and remaining in the rest of the period of FY20,” he said.

High energy, water costs may push Pakistan’s apparel industry towards crisis

The import of cotton paced up following the government withdrew 3% regulatory duty, 2% additional customs duty and 5% sales tax on import of cotton from January 15, 2020.

The imposition of the duty and taxes on cotton import by the previous government in the centre had put the textile industry in danger.

“The withdrawal of duty and taxes has fully mitigated the risk of decline in cotton consumption in Pakistan.

USAID has recently anticipated increase in consumption of cotton at textile industries in Pakistan. We will use at least 15 million bales this year (FY20),” Aptma former chairman said.

-

Comment by Riaz Haq on March 20, 2020 at 7:58am

-

#China #Pakistan FTA-2: #Pakistan textile #exports to rise to $25 billion in new regional hub. As #coronavirus outbreak puts the globalisation into reverse and challenges existing global value chains, new supply chains continue to form behind the scenes.

https://www.outlookindia.com/website/story/news-analysis-china-paki...

With the second phase of the CPFTA, there is a possibility of relocating the production of international brands, many of which have facilities in China that import cotton fabric from Pakistan as raw material—to Pakistan itself. The inflow of Chinese investment in machinery and technology in order to set up production bases in Pakistan will drive innovation and economies of scale, thereby making Pakistan regionally competitive in cotton-based garments. In addition, Pakistan will garner a favourable position for exporting to other markets that have so far been trading primarily with China as well as potentially to other Regional Comprehensive Economic Partnership (RCEP) members.

-----------------

In January 2020, Pakistan and China entered into the second phase of China-Pakistan Free Trade Agreement (CPFTA2), under which China has eliminated tariffs on 313 priority tariff lines of Pakistan’s export interest. In return, Pakistan has offered China market access to raw materials, intermediate goods, and machinery.

Of the 313 high-priority products that Pakistan can now export without duty payments to China, 130 are from textiles and clothing sector. Reduced tariffs, an expected surge in Chinese investment into Pakistan and the potential shift of production base from China to Pakistan, may change the regional dynamics of textiles trade. The numbers explain how.

Under the CPFTA2, many Pakistani textile products will now enjoy duty-free access to China, which has extended similar tariff reductions to other trading partners - Bangladesh, Thailand and Vietnam among others - under the ASEAN-China FTA. Tariffs on readymade cotton garments (HS codes 61, 62 and 63), have been massively reduced. For example, men’s ensembles of cotton (HS code – 62032200), Pakistan’s top world export, was traded with China at 17.5 per cent (MFN rate) which reduced to 12 per cent under Phase-I of FTA and has dropped to 0 per cent in the Phase-II of FTA. This places Pakistan at a more than equal footing with Bangladesh, and ahead of India which faces a tariff rate of 8 per cent on the export of this product to China.

---

Pakistan is likely to be preferred over Bangladesh given the former country’s comparative advantage in producing cotton fabric (nearly 25 per cent of Pakistan’s total cotton exports in 2018 were to China); ease of doing business (Pakistan ranks at 108 compared to Bangladesh at 168 and India at 63 under the World Bank’s Doing Business 2020 study); ease of trading across borders (Pakistan ranks at 111 compared to Bangladesh at 176 and India at 68) and ease of starting a new business (Pakistan ranks at 72 compared to Bangladesh at 131 and India at 136).

Pakistan’s government targets raising the country’s textile and clothing exports from USD 13.5 billion in 2018 to USD 25 billion by 2025. As China has the world’s largest textile industry—in terms of both production and export—it is an inevitable trading partner for Pakistan to meet this 2025 target.

For Pakistan, to fully reap the benefits of the CPFTA2, access to cheaper imported inputs will be crucial to its export competitiveness for cotton-based readymade garments.

While Pakistan grows cotton domestically, 37 percent of its cotton imports came from India. After the trade ban between India and Pakistan in 2019, Pakistan began sourcing cotton/yarn from the US and Vietnam, thereby witnessing a rise in cotton prices, amid low production and higher import tariffs (11% from the US and Vietnam, compared to 5 per cent from India for cotton yarn (HS Code 520524), one of Pakistan’s major imports from India).

-

Comment by Riaz Haq on March 27, 2020 at 4:32pm

-

#Pakistan #COVID19 #Lockdown Idles Factories. “It’s a pity as February 2020 garment exports increased by over 20%, an all-time record..... March to June it...could be slashed by at least 60-70%..” #textile #garments #exports #economy https://sourcingjournal.com/topics/sourcing/pakistan-coronavirus-lo... via @SourcingJournal

There’s a new kind of supply chain disruption in 2020—and it’s the kind that could leave destitution in its wake.

In the past week, key sourcing countries, including India and Bangladesh have put country-wide lockdowns or stay-at-home orders in place, and Pakistan has done the same.

Monday marked the beginning of a two-week lockdown that has all factories in the country, as well as other business producing or selling non-essentials, closed completely. Only medical, food and pharmaceutical facilities are still in operation, in addition to some gas stations and banks that remain open.

While the World Health Organization (WHO) has Pakistan’s confirmed cases at 991, with 104 new COVID-19 virus infections reported in the past 24 hours, local sources say the number of infected persons is closer to 1,100. And the country is trying to stanch the spread.

“All over Pakistan it’s a complete lockdown in all the provinces everywhere,” Hafiz Mustanser Ahmed, managing director of Lahore-based factory U.S. Apparel & Textiles, told Sourcing Journal Thursday. “The transportation when it comes to taking the employees to the factories or the public transportation, it’s all 100 percent closed. All the factories are closed.”

For now, moving goods back and forth between the ports and Lahore, Pakistan’s second-biggest textile manufacturing hub after Karachi, is still allowed, but there simply aren’t many goods to move, said Ahmed, whose factory produces denim bottoms for Levi’s, Target, H&M, J.Crew, Primark and Costco, to name a few.

--------------

“It will happen. Nobody can stop this,” Ahmed said. “In this part of the world, where Pakistan is operating, where Bangladesh is operating, the governments are not rich at all so they don’t have that much sufficient funds available with them. They won’t be able to pay for the salaries for them… For the workers who are on the piece rate, it’s going to happen because there are no pieces to produce, and the workers on the daily rate, it’s going to happen, and the workers who are on the salaries, it’s going to happen there as well.”

In the coming days, the government is expected to announce details of support package for workers, which could include food rations and subsidies for utilities. Factories, however, may not see funds to help facilitate their operations, though Schlossman said some duty refunds are being paid back to factories to partially ease the financial impact.

For now, retailers who are still willing to accept goods they had ordered, the government in Pakistan is making concessions to certain factories to deliver them.

“If you have a product that is almost ready for dispatch and if my customer is accepting the product, [the government] is allowing us to partially operate the factory to deliver those goods,” Ahmed said, noting, however, that the allowance is granted by application and under strict rules for the temporary operating period. Workers cannot stand too close to one another, buses shuttling them from home to work can only transport a limited number of passengers, the factory must have thermometers on hand to take workers’ temperatures, and immediately on dispatching the goods, the closure goes back into effect.

-

Comment by Riaz Haq on March 27, 2020 at 4:39pm

-

Coronavirus challenge and Pakistan’s exports

https://https://tribune.com.pk/story/2171994/2-coronavirus-challenge-pakist....com/topics/sourcing/pakistan-coronavirus-lo...

According to statistics released by Pakistan Bureau of Statistics, exports increased 13.82% year-on-year in February 2020. Amid a global slowdown in trade, exports from Pakistan have increased by 3.65% in the current fiscal year. Imports have continued to decline, registering a decrease in value of 14.06%.

The trade deficit in the first eight months of FY20 was 26.52% lower than the same period of FY19.

Interestingly, although exports increased sharply in February 2020 in terms of year-on-year and month-on-month growth, the decline in imports became much more subdued. Imports decreased 1.71% only over the same period of previous fiscal year.

Therefore, as the value of imports stabilises after reaching its apparent trough, the linkage between exports and imports must be maximised in order to ensure that Pakistan optimises its participation in international trade activities.

In essence, exports from Pakistan have shown a reversing trend as a general declining trend has now turned positive. Exports had declined from $25.1 billion in 2013 to $23.6 billion in 2018.

On the other hand, exports to the EU increased from $6.3 billion in 2013 to $8 billion in 2018.

This suggests that the unilateral trade incentives provided by the EU to Pakistan in the form of GSP Plus status did help boost export sales to the region and limit what otherwise could have been a complete decay of the export sector between 2013 and 2018. The trade linkages established between Pakistani exporters and their clients can help increase exports and tap newer markets as supply chains are threatened due to the spread of the coronavirus.

Pakistan must continue with its policies to boost total exports. Although the growth in global trade is likely to slow down this year, Pakistan must consider developing its export sector to take advantage of opportunities as a result of challenges reported by the large manufacturing powerhouses.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Russian Hackers Steal Indian Military Secrets From Pakistani Cyber Spies

Hackers linked to Russian intelligence have stolen Indian military data from cyber spies believed to be working on behalf of the Pakistani state, according to an assessment by Microsoft researchers. All those involved are part of what are known as "advanced persistent threat" (APT) organizations in their respective countries. TechTarget defines "Advanced Persistent Threat (APT)…

ContinuePosted by Riaz Haq on December 8, 2024 at 8:00am

IDEAS 2024: Pakistan Defense Industry's New Drones, Missiles and Loitering Munitions

The recently concluded IDEAS 2024, Pakistan's Biennial International Arms Expo in Karachi, featured the latest products offered by Pakistan's defense industry. These new products reflect new capabilities required by the Pakistani military for modern war-fighting to deter external enemies. The event hosted 550 exhibitors, including 340 international defense companies, as well as 350 civilian and military officials from 55 countries.

Pakistani defense manufacturers…

ContinuePosted by Riaz Haq on December 1, 2024 at 5:30pm — 3 Comments

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network