PakAlumni Worldwide: The Global Social Network

The Global Social Network

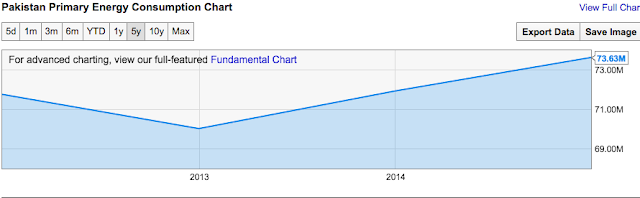

Pakistan Experiencing Strong Growth in Energy Consumption

Pakistan's energy consumption grew by 5.7% in 2015, faster than the 5.2% increase in neighboring India that claims significantly faster GDP growth. Primary energy consumption growth in a country is often seen as a strong indicator of its GDP growth. Ever since the advent of the industrial age, energy has become increasingly important as a driver of farms, factories, communication, transportation, construction, retail and other sectors of the economy. In addition to energy, other important economic indicators include cement and steel consumption, auto sales and air travel which are also growing significantly faster in Pakistan than in India.

Pakistan Primary Energy Consumption Trend (Source: British Petroleum) |

Primary Energy Consumption:

According to British Petroleum Statistical Review of World Energy released in June 2016, the primary energy consumption in Pakistan rose to 78.2 million ton oil equivalent (MTOE) in 2015, compared with 73.2 MTOE in 2014 confirming greater economic activity. It was the third fastest growth in energy consumption in Asia. Only the Philippines (9.7%), Vietnam (9.6%) and Bangladesh (8.7%) saw faster growth than Pakistan's.

Domestic Cement Demand:

All-Pakistan Cement Manufacturers’ Association reported cement industry sold 33 million tons in domestic market in fiscal year 2015-16, posting a robust growth of 17.01 per cent compared to the 28.2 million tons sales during the same period in 2015.

Local Auto Production:

Domestic auto production in Pakistan jumped by 21.57 percent (vs 2.58% growth in India) in fiscal 2016 compared to fiscal 2015, according to data from Pakistan Automobile Manufacturers Association. The data collected by Pakistan Bureau of Statistics (PBS) noted that as many as 168,363 jeeps and cars were manufactured during July-May (2015-16) while 138,490 units were produced last year(July-May 2014-15).

Rising Steel Demand:

Pakistan is experiencing 30% growth in steel imports, according to the State Bank of Pakistan. Local steel production is about 6 million tons. In addition, Pakistani imports of steel this year could surpass $2 billion as China-Pakistan Economic Corridor CPEC-related projects ramp up.

Air Travel Growth:

Pakistan air travel market is among the fastest growing in the world. IATA (International Air Transport Association) forecasts Pakistan domestic air travel will grow at least 9.5% per year, more than 2X faster than the world average annual growth rate of 4.1% over the next 20 years. The Indian and Brazilian domestic markets will grow at 6.9% and 5.4% respectively.

Pakistan saw 23% growth in airline passengers in 2015, according to Anna Aero publication. Several new airports began operations or expanded and each saw double digit growth in passengers. However, Gwadar Airport growth of 73% was the fastest of all airports in Pakistan.

The top 12 airports all saw large double digit increases. Multan grew 64%, Quetta 62% and Faisalabad +61% all climbing one place as a result of all of them seeing a growth of over 60%. Turbat Airport in Balochistan is the newest airport to reach the top 12 in terms of traffic.

Mobile Broadband Uptake:

Mobile broadband subscriptions have rocketed from zero to over 30 million in just two years since 3G/4G service rollout in Pakistan. Rapid growth is continuing with over 1 million new subscribers are signing up for 3G and 4G services every month. An equal or larger number of smartphones are are being sold.

Summary:

A whole series of indicators from auto and steel to manufacturing and construction and telecom services are confirming that economic growth is accelerating in Pakistan. Among the reasons for this growth are significantly improved security situation, political stability and soaring Chinese foreign direct investment (FDI) in CPEC related energy and infrastructure projects. These indicators are attracting investors who have already made Pakistan Stock Exchange the hottest shares market in Asia. KSE-100, Pakistan's main shares index, is up 18% year-to-date compared to 6% increase in India's BSE-30 index. The challenge for Pakistan is to continue to improve security and political stability to reassure investors of superior returns from their investments in the country.

Related Links:

Politcal Stability Returns to Pakistan

Auto and Cement Demand Growth in Pakistan

Pakistan's Red Hot Air Travel Market

China-Pakistan Economic Corridor FDI

-

Comment by Riaz Haq on October 30, 2017 at 10:48am

-

Banks’ growing romance with car industry

https://www.dawn.com/news/1365688/banks-growing-romance-with-car-in...

Car financing in particular and consumer loans in general saw signs of resurging after a gap of several years for the first time in 2013-14 on the back of economic growth.

In July-September this year, banks’ auto loans almost doubled to Rs11.1 billion from Rs5.7bn in July-September last year.

This is just a continuation of the huge 60 per cent rise recorded in auto loans last fiscal year ending June, according to the latest data of the State Bank of Pakistan (SBP). In 2016-17, banks’ auto financing totalled Rs70.5bn against that of Rs44bn in the preceding fiscal year.

According to the Pakistan Automotive Manufacturers Association, auto sales also recorded a matching growth of 60pc, as 44,372 vehicles were sold during July-September 2017 against 27,630 in the same period of 2016.

Senior bankers say an increase in auto loans (and also in overall consumer finance) in the first quarter of the fiscal year is always good as during this period net credit to private sector businesses remains negative due to usual heavy credit retirement.

‘The acceleration in car loans is demand-driven and bulk of the demand is coming from people employing vehicles in Uber and Careem e-hailing services,’ says the head of consumer banking

During the first quarter of this year, “it’s the volume of incremental auto loans (Rs11.1bn) that is noteworthy”, says the head of a local bank.

Between July and September this year, net stock of loans to private sector businesses saw a decline of Rs2bn, latest SBP stats show.

“The acceleration in car loans is demand-driven and bulk of the demand is coming from people employing vehicles in Uber and Careem e-hailing services,” says the head of consumer banking at a local bank.

Increasing car deliveries to people associated with Uber and Careem are helping the creation of full-time jobs for some and part-time opportunities for others. That is good for the economy.

What is bad, though, is that in their quest for meeting a demand rush, car assemblers are delaying deliveries.

Or this is what bankers tell their customers after sanctioning auto loans at lightning speed and then failing in ensuring vehicle delivery from designated dealers for weeks, and in some cases for months. Failure in timely delivery, regardless of who is responsible, reflects poorly on the auto industry’s reputation.

As auto financing fever runs high, banks, in competitive frenzy, are over-committing to car loan seekers. After approving auto loans, many bank branches debit down-payments from customers’ accounts and also make these accounts operational, thus requiring borrowers to start paying loan instalments. But they leave the customers at the mercy of car dealers instead of ensuring car deliveries within the promised timeline.

-

Comment by Riaz Haq on November 8, 2017 at 5:22pm

-

PM Abbasi welcomes #Volkswagen’s entry into #Pakistan. #Auto #Manufacturing

https://tribune.com.pk/story/1553317/2-pm-abbasi-welcomes-volkswage...

Prime Minister Shahid Khaqan Abbasi has welcomed on Wednesday Volkswagen’s decision to invest and undertake business ventures in Pakistan, assuring the world’s largest automaker of complete facilitation and support from the government.

Talking to Volkswagen Board of Management member Joseph Baumert, who met him at the PM Office, Abbasi highlighted strengths of Pakistan’s economy and credited investor-friendly policies for an “economic turnaround” in the last four years.

Abbasi said that both local and foreign investors had huge incentives to invest and reap benefits from a fast-growing economy as a result of the improved security situation.

The auto sector development also comes as a huge relief for a hungry Pakistani market long dominated by three Japanese players who face continuous capacity constraints. With the government recently imposing further regulatory duty on the import of new and used vehicles, the stage seems set for new entrants.

In the past year, Lucky has announced a joint venture with Kia Motors, while Hyundai Motor Company also plans to set up a car assembly plant with textile group Nishat Mills.

Meanwhile, Abbasi said that due to improved and enhanced road networks as a result of the China-Pakistan Economic Corridor (CPEC) project and greater spending on communication infrastructure, Pakistan offers great opportunities to international automobile companies to fill in the existing demand-supply gap through local production.

The premier also highlighted various features of the Auto Policy 2016-2021 which offers tax and other incentives to new entrants to enable introduction of new brands, develop market share, create distribution and after-sales service networks besides a parts-manufacturing base.

Abbasi expressed hope that Volkswagen would provide quality vehicles of international standards.

Baumert also expressed hope for a successful business venture in Pakistan. Other officials including Volkswagen’s head of overseas production Andreas Sprindler, head of Asia Pacific, Oliver Glaser, International Policy Foreign and Governmental Relations Klaus – Bo Steindorff and head of CKD Yuri Konushin, Premier Systems CEO Syed Arshad and Board of Investment secretary were present.

-

Comment by Riaz Haq on March 3, 2018 at 8:02pm

-

THE EXPRESS TRIBUNE > BUSINESS

Memon inaugurates Aisha Steel Mills’ expansion project

By Our CorrespondentPublished: December 31, 2017

https://tribune.com.pk/story/1597176/2-memon-inaugurates-aisha-stee...

Sindh Board of Investment (SBI) Chairperson Naheed Memon presided over a ribbon-cutting ceremony on Saturday to mark the beginning of construction on Aisha Steel Mills’ (ASM) expansion plans.

ASM, an Arif Habib Group company, has laid out plans to expand its capacity to a total of 700,000 tons per annum from its current capacity of 220,000 tons.

Addressing the ceremony, Memon said, “Initiation of expansion of Aisha Steel Mills reflects the confidence investors have in Sindh and Pakistan, strengthening our resolve to continue on this path of progress. “We are seeing expansion and new projects in almost all areas of manufacturing in Sindh,” the chairperson added, in a statement released by Arif Habib Corp.

She said that the board is committed to facilitate industrial investment in Sindh, which has the best infrastructure for setting up industries.

Also speaking on the occasion, ASM CEO Dr Munir said, “Our product mix, subsequent to the completion of expansion, will include 450,000 tons of Cold Rolled Coils (CRC) and 250,000 tons galvanised coils.”

He said, “The project is progressing on schedule and we are targeting phase-wise production to commence from the second quarter of the next financial year.”

On completion of expansion, ASM is expected to contribute over Rs10 billion to the revenues of the government.

-

Comment by Riaz Haq on March 3, 2018 at 8:05pm

-

Steel melters oppose duty, tax exemptions to Chinese company

https://www.thenews.com.pk/print/278225-steel-melters-oppose-duty-t...

KARACHI: Pakistan Steel Melters Association (PSMA) has rejected duty and tax concession / exemption granted by the government to China State Construction Engineering Corporation Limited, a statement said on Wednesday.

This taxes and duty exemption to Chinese company will cost national exchequer approximately Rs11 billion, it added.

The association said through SRO 47(I) 2018, China State Construction Engineering Corporation Limited, which is working on Motorway Sukkur to Multan section, has been allowed duty-free import of construction materials and machinery in Pakistan.

To record it reservations at the highest level, Pakistan Steel Melters Association has drawn attention of Prime Minister Shahid Khaqan Abbasi towards the issue through a letter, requesting him to withdraw the disputed exemptions allowed to a foreign company on the expenses of local steel sector, the statement said.

In 2017, Pakistan Steel Melting Industry was coined as the fastest growing steel industry in the world, as per LSM (Large-Scale-Manufacturing) data published by the SBP (State Bank of Pakistan), noting that billet/ingot production has grown 62 percent 4MFY18 year-on-year.

Hussain Agha, senior vice chairman of Pakistan Steel Melters Association, said: “The steel industry of Pakistan is gearing up for a massive $300 million capacity expansion within the next 24 months, which would yield multifold growth in the revenue collection to the national exchequer.”

“The Chinese are our brothers in progress and we warmly welcome China-Pakistan Economic Corridor (CPEC); however, we must ensure that it is done on a fair and mutually benefitting basis.”

Tremendous jobs are at stake, if the government gives anti-localisation incentives to special companies, Agha added.

Steel industry generates the largest revenue among the growing sectors of Pakistan and also aims at fulfilling the upcoming demand of CPEC through providing high grade manufactured steel.

Agha, who is also the executive director of Agha Steel Industries, said, “First phase of Agha Steels project is expected to come online in 2018, which will directly save the government at least $180 million/annum in direct import substitution and will further generate additional taxes for our government.”

New steel projects expected to come online within the next 12 months will save the national exchequer billions of dollars by import substitution, he said.

Pakistan Steel Melters Association strongly objects any policies that could hamper growth in Pakistan and SRO 47(I) 2018 will dampen future investments alongside with already gifting Rs11 billion loss to the government in revenue collection.

-

Comment by Riaz Haq on March 3, 2018 at 8:11pm

-

Amreli Steels finalises Rs2bln expansion plan

https://www.thenews.com.pk/print/283525-amreli-steels-finalises-rs2...Amreli Steels Limited, country’s leading steelmaker, on Tuesday announced its board had approved the second phase of expansion to increase its annual production capacity of reinforcement bars to 750,000 tons within the next two years.

The total cost of the expansion is estimated at Rs2.0 billion.

“The company will expand its plant located in SITE (Sindh Industrial Trading Estate) Karachi by 95,000 tons/annum, taking its annual capacity to 275,000 tons/annum, from the current 180,000 tons/annum,” the company said in a bourse filing said.

“The modernisation would result in savings on account of lower cost of utility, wastage, and maintenance.”

The re-bar roller also said it had earlier envisaged this expansion to add 145,000 tons/annum to its annual capacity, but did not give a reason for the change in the estimate.

The company decided to embark on the phase-II of capacity expansion in view of the growing construction activity around the country that is believed to sustain high levels of growth over the next decade.

The approved expansion, according to the company officials would further enhance the footprint of Amreli Steels Limited across the country by supplying quality rebars for infrastructure development and fulfilling needs of retail customers across Pakistan.

More than 100 steel makers are operating in the country, while steel is also imported to meet the demand of construction sector.

An analyst at Taurus Securities said “the notice in effect, trims down the envisaged annual SITE Karachi rolling capacity by 50,000 TPA”.

Amreli Steel also informed that it would be closing down the SITE Karachi plant for a minimum period of 10 months, starting June 2019 to March 2020, and that the plant was expected to resume production later by April 2020, to revamp and modernise the plant.

“This was expected as according to the management, the Dhabeji expansion is expected to come online by next month, after which, Amreli would be prioritising production from the much larger Dhabeji plant than the SITE facility in order to avail tax credits, and achieve lower fuel and power costs/ton,” the analyst added.

Currently, the steelmaker has an annual steel rebar manufacturing capacity of 180,000 metric tons. It produces high quality billets in melt shop. The World Steel Association projected steel demand in Pakistan at more than 12 million tons by 2019 from 7.1 million tons in 2015.

The steel manufacturer last year also announced a joint venture with a Chinese company to produce and sell electrical transmission equipment in the country seeing a raft of new power projects on their way to meet growing energy demand.

It has been looking for a joint venture with Chinese company Qingdao Huijintong Power Equipment Company Limited (HJT) and both the parties have agreed to consider establishing company in Pakistan which will be engaged in production and sale of electrical transmission towers and metal structural products.

-

Comment by Riaz Haq on March 3, 2018 at 9:22pm

-

Pakistan outpaces rest of world with steel production growth

https://www.recyclinginternational.com/recycling-news/11062/ferrous...

South Asia: Increasingly large-scale scrap importer Pakistan is the world’s fastest-growing steel producer, according to latest statistics from the World Steel Association. Having upped its crude steel output from 2.9 million tonnes in 2015 to 3.6 million tonnes in the ensuing year, production skyrocketed a further 39.3% last year to 5 million tonnes.

Pakistan imported 4.039 million tonnes of steel scrap in 2016 for a year-on-year increase of 24% over the 3.357 million tonnes of 2015.

When updated statistics become available, these are expected to reveal substantial additional import growth in 2017, especially as export data for the USA have already indicated that its own ferrous scrap shipments to Pakistan surged 59% year on year in January-November 2017 to 641 491 tonnes.

Pakistan ranked 28th in the league table of crude steel producers in 2017.

Taking 13th, 19th and 23rd places respectively on the same list, other countries to record massive growth in crude steel output last year were Iran (+21.4% to 21.7 million tonnes), Vietnam (+31.9% to 10.3 million tonnes) and Egypt (+35% to 6.8 million tonnes).

-

Comment by Riaz Haq on May 16, 2018 at 9:01pm

-

Pakistan’s largest refinery project contract awarded to TechnipFMC

https://profit.pakistantoday.com.pk/2018/05/16/pakistans-largest-re...

Pak-Arab Refinery Ltd (PARCO) has announced to award TechnipFMC the project management consultancy (PMC) services contract to carry out the management of pre-EPC activities for a grass root, fully integrated and deep conversion refinery to be constructed at Hub near Karachi, Pakistan.

The project will be managed and operated by a wholly-owned subsidiary, PARCO Coastal Refinery Limited (PCRL). When completed, the facilities will comprise a modern and deep conversion refinery with a capacity of 250,000 barrels per day, supported by associated marine loading facilities. It will be Pakistan’s largest refinery and serve the rapidly growing domestic markets for refined products.

The agreement was signed on May 16, 2018, by PCRL Chief Executive Officer Tariq Rizavi and TechnipFMC Senior Vice President – Project Management Consultancy Riccardo Moizo. Secretary Petroleum Division Sikandar Sultan Raja and PCRL chairman said, “Given the rapidly increasing energy and fuel demand of Pakistan, this project is of great importance to improve the fuel supply situation and will support the continued economic growth of the country.”

“This multi-billion dollar joint-venture project will further strengthen the relationship between our two brotherly countries. We believe, as the largest industrial project in Pakistan, it will deliver significant value for all stakeholders and provide many socio-economic benefits for the country,” said Mubadala Investment Company Executive Director Refining and Petrochemicals and PCRL Vice Chairman Khalifa Al Suwaidi.

“We understand the strategic importance of the long-term investment that PARCO is undertaking and are proud to be part of this project, which will help meet the fuel requirements of the country and contribute to the growth of PARCO and Pakistan”, said Riccardo Moizo.

-

Comment by Riaz Haq on July 3, 2018 at 10:59am

-

Cement sales likely to post 8-year high growth of 14 percent in FY2018

https://www.thenews.com.pk/print/336627-cement-sales-likely-to-post...

Local cement sales stood at 40.8 million tons in the last fiscal year, while its exports marginally rose 0.9 percent to 4.7 million tons, bringing the total cement dispatches 12.9 percent up to 45.5 million tons.

“Growth in local and export dispatches fared better… thanks to higher infrastructure demand from CPEC- (China-Pakistan Economic Corridor) related projects, real estate construction activities across Pakistan and increase in exports from Lucky Cement and Attock Cement new cement lines that came online in 2HFY18,” analyst Nabeel Khursheed at Topline Securities said in a report.

“Moreover, due to expected increase in competition in south region owing to upcoming capacities, players are tapping into new export markets that also supported export growth.”

Khursheed said construction sector reported nine percent growth in FY2018, which was in line with the last 5-year average growth rates.

“This was on the back of economic recovery and booming real estate sector. Credit to construction sector as of May 2018 stood at Rs156 billion, up 21 percent,” he added. “After being in the doldrums in 1HFY18 (witnessing average 16 percent year-on-year decline), exports recovered in the second half, recording stellar average growth of 37 percent thanks to higher exports from Lucky and Attock Cement’s new cement lines in the South region as well rupee devaluation.”

There are 24 cement manufacturers operating in the country with Lucky Cement Limited having the biggest production capacity of nearly five million tons. Bestway Cement, Maple Leaf Cement, Attock Cement Pakistan, Kohat Cement Company are also the major producers with two to four million tons of operational capacity.

Industry utilisation stood at 95 percent in FY2018 as compared to 87 percent in FY2017, 85 percent in FY2016, 78 percent in FY2015 and 75 percent in FY2014.

“The utilisation this year will be a 2.5 decade high. The highest utilisation of 92.7 percent was recorded in FY1996,” Khursheed said.

The analyst said pricing remained a big concern for the industry despite outstanding domestic consumption during the year. Cement industry shed 42 percent during the last fiscal year due to rising input cost and increase in production capacities.

“Producers’ ability to pass on any hike in input cost (higher coal prices and rising transportation cost due to increase in international oil prices) going forward will depend on growth in local demand,” he added.

Cement prices in northern region averaged Rs529/bag in FY2018 versus Rs534/bag in FY2017. Cement prices in the northern region started to decline as low as Rs496/bag on an average after August last year. But, prices posted a recovery after March when cement makers passed higher coal cost and impact of federal excise duty on to consumers. Khursheed said free-on-board ‘Richards Bay’ coal prices increased 20 percent to $93.6/ton in FY2018. It is currently hovering at around $104.25/ton.

“If coal prices remained at this level, manufacturers may find it difficult to pass on the cost owing to upcoming cement capacities.”

In June, cement sales are likely to fall 30 percent month-on-month and rise three percent year-on-year to 2.5 million tons due mainly to Ramazan and Eid holidays. Cement exports, however, are expected to decrease 10 percent month-on-month and increase 10 percent year-on-year.

-

Comment by Riaz Haq on July 15, 2018 at 7:37am

-

#Pakistan domestic #cement consumption grows 13.8% in fiscal 2017-18, reaches 41 million tons. #CPEC #Housing #Infrastructure https://www.cemnet.com/News/story/164391/pakistan-cement-consumptio...

Pakistan cement industry ended fiscal 2017-18 on a jubilant note, by posting yearly growth of 13.84 per cent with domestic consumption increasing by 15.42 per cent and exports inching up by 1.77 per cent. This is the first time in nine years that cement exports have registered a growth.

According to data released by All Pakistan Cement Manufacturers' Association (APCMA), during the fiscal year 2017-18, domestic consumption stood at 41.147Mt, an increase of 15.42 per cent from 35.651Mt in 2016-17. However, exports grew by only 1.77 per cent from 4.664Mt in 2016-17 to 4.746Mt during 2017-18.

In the month of June 2018 alone, the total cement dispatches were 2.979Mt. Out of this, local dispatches in the north were 2.158Mt against 1.897Mt in June 2017 reflecting growth of 13.77 per cent. Cement dispatches in the south amounted to 0.423Mt against 0.485Mt in June 2017, reflecting negative growth of 12.79 per cent. The exports from grinding facilities located in the north amounted to 0.183Mt against 0.223Mt in June 2017 and from the south was 0.215Mt against 0.122Mt in June 2017.

The industry dispatched 45.893Mt of cement in 2017-18 against 40.315Mt dispatched in 2016-17. This is the highest ever growth posted by the industry in its history. In fact, the past five years have been positive for the cement industry of Pakistan as annual dispatches increased by 12.46Mt from 33.43Mt in 2012-13 to 45.89Mt in 2017-18. The year 2017-18 has witnessed particularly buoyant times as dispatches grew by 5.5Mt.

The industry increased its production capacity by 6.58 per cent during 2017-18 and its capacity utilisation stood at 92.82 per cent, the highest since 1992-93 when its total production capacity was only 8.89Mt compared with 49.44Mt in 2017-18.

A spokesman for the APCMA said that the reinvigorated export activity is a welcome sign for the industry and that the decline in rupee value against the dollar is finally restoring lost competitiveness of the cement sector in the global markets. However, the APCMA said that rising input costs, especially coal and fuel prices, are hurting the local industry.

-

Comment by Riaz Haq on August 22, 2018 at 5:35pm

-

Pakistan’s energy-related imports increase 34% to $1.27b

https://tribune.com.pk/story/1786223/2-pakistans-energy-related-imp...

Pakistan’s import bill for energy products increased 34% to $1.27 billion, which amounts to one-fourth of the total import bill in July. The rise is due to uptick in demand, global surge in oil prices and rupee devaluation.

Cumulative import of petroleum products and gases stood at one-fourth, or $947 million, in the same month of the previous year, according to the Pakistan Bureau of Statistics (PBS).

“Imports have (partly) increased due to surge in demand emerging from power houses and rising number of cars on the roads,” Sherman Securities’ analyst Sadiq Samin said in a comment to The Express Tribune.

PBC urges Asad Umar to focus on ‘Make in Pakistan’

Power production increased 10% to 13,751 gigawatt-hour (GWh) in July 2018 compared to 12,497 GWh in the same month of the previous year, according to National Electric Power Regulatory Authority (Nepra).

Similarly, the sales of locally assembled cars surged 9% to 21,344 units in July on year-on-year basis, according to Pakistan Automotive Manufacturers Association (PAMA).

Additionally, the notable rebound of 36% in international oil (Brent crude) price to $77.85 per barrel and 19% devaluation of the rupee during the last 12 months have also contributed heavily to elevating the energy import bill in July, the analyst said.

Pakistan excessively relies on energy imports in absence of local oil and gas production. It meets over 70% of its energy demand through imports, according to an estimate.

LNG import

Import of liquefied natural gas (LNG) grew significantly by 144% to $332 million in the month compared to $136.2 million in July 2017 due to inception of several mega LNG-fired power houses in the last one year, according to the PBS.

Pakistan swiftly established LNG-based power plants following the formation of the import infrastructure in the last few years. At present, two LNG import terminals (Engro Elengy and Pakistan LNG) are operational with an installed capacity of 600mmcfd each.

The projects of a cumulative installed capacity of around 4,000 megawatt-hour have also replaced a number of oil-fired power plants.

The shift in power production to gas from furnace oil and diesel also reflected in the import data. The import of refined products dropped 27%. In value terms, it reduced 4% to $556.2 million in the month on a year-on-year basis.

Industry officials including Pakistan State Oil (PSO) CEO and MD Sheikh Imranul Haque have linked the drop in import of refined products to the closure or reduction in the use of oil-fired power plants in the country.

On the other hand, demand for other refined products like petrol and diesel remained on the higher side with improved performance of large-scale manufacturing industries like fertiliser, automobile, cement and steel and increase in number of cars on the roads.

Moreover, the trend of increase in crude oil import maintained its uptrend. The import of crude oil surged 4.5% to 0.71 million tons, or 70% to $332 million, in the month.

Samin said the increase in crude’s import may be seen due to expansion of Attock Refinery.

In addition, the increase may also be linked with restoration of operations at the country’s single largest oil refinery Byco Petroleum Limited in August 2017.

The 120,000-barrel-per-day refinery had to suspend its operation after catching fire years ago.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistan Minerals Investment Forum Draws Interest of Global Investors

Pakistan's mineral resources, estimated to be over $6 trillion, attracted global investor interest at the Pakistan Minerals Investors Forum 2025 (PMIF2025) held recently in Islamabad on April 8th and 9th. It was attended by major international companies and government officials from Australia, Canada, China, Saudi Arabia, Turkiye, the US and other nations. …

ContinuePosted by Riaz Haq on April 12, 2025 at 11:30am — 3 Comments

Pakistan to Explore Legalization of Cryptocurrency

Islamabad is establishing the Pakistan Crypto Council (PCC) to look into regulating and legalizing the use of cryptocurrencies, according to media reports. Cryptocurrency refers to digital currencies that can be used to make purchases or investments using encryption algorithms. US President Donald Trump's endorsement of cryptocurrencies and creation of a "bitcoin reserve" has boosted investors’…

ContinuePosted by Riaz Haq on March 28, 2025 at 8:30pm — 4 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network