PakAlumni Worldwide: The Global Social Network

The Global Social Network

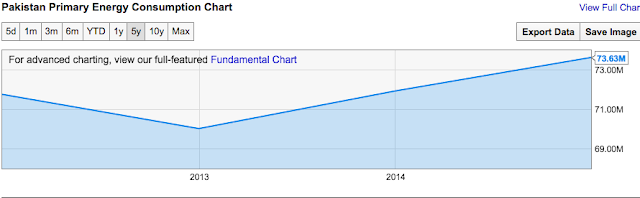

Pakistan Experiencing Strong Growth in Energy Consumption

Pakistan's energy consumption grew by 5.7% in 2015, faster than the 5.2% increase in neighboring India that claims significantly faster GDP growth. Primary energy consumption growth in a country is often seen as a strong indicator of its GDP growth. Ever since the advent of the industrial age, energy has become increasingly important as a driver of farms, factories, communication, transportation, construction, retail and other sectors of the economy. In addition to energy, other important economic indicators include cement and steel consumption, auto sales and air travel which are also growing significantly faster in Pakistan than in India.

Pakistan Primary Energy Consumption Trend (Source: British Petroleum) |

Primary Energy Consumption:

According to British Petroleum Statistical Review of World Energy released in June 2016, the primary energy consumption in Pakistan rose to 78.2 million ton oil equivalent (MTOE) in 2015, compared with 73.2 MTOE in 2014 confirming greater economic activity. It was the third fastest growth in energy consumption in Asia. Only the Philippines (9.7%), Vietnam (9.6%) and Bangladesh (8.7%) saw faster growth than Pakistan's.

Domestic Cement Demand:

All-Pakistan Cement Manufacturers’ Association reported cement industry sold 33 million tons in domestic market in fiscal year 2015-16, posting a robust growth of 17.01 per cent compared to the 28.2 million tons sales during the same period in 2015.

Local Auto Production:

Domestic auto production in Pakistan jumped by 21.57 percent (vs 2.58% growth in India) in fiscal 2016 compared to fiscal 2015, according to data from Pakistan Automobile Manufacturers Association. The data collected by Pakistan Bureau of Statistics (PBS) noted that as many as 168,363 jeeps and cars were manufactured during July-May (2015-16) while 138,490 units were produced last year(July-May 2014-15).

Rising Steel Demand:

Pakistan is experiencing 30% growth in steel imports, according to the State Bank of Pakistan. Local steel production is about 6 million tons. In addition, Pakistani imports of steel this year could surpass $2 billion as China-Pakistan Economic Corridor CPEC-related projects ramp up.

Air Travel Growth:

Pakistan air travel market is among the fastest growing in the world. IATA (International Air Transport Association) forecasts Pakistan domestic air travel will grow at least 9.5% per year, more than 2X faster than the world average annual growth rate of 4.1% over the next 20 years. The Indian and Brazilian domestic markets will grow at 6.9% and 5.4% respectively.

Pakistan saw 23% growth in airline passengers in 2015, according to Anna Aero publication. Several new airports began operations or expanded and each saw double digit growth in passengers. However, Gwadar Airport growth of 73% was the fastest of all airports in Pakistan.

The top 12 airports all saw large double digit increases. Multan grew 64%, Quetta 62% and Faisalabad +61% all climbing one place as a result of all of them seeing a growth of over 60%. Turbat Airport in Balochistan is the newest airport to reach the top 12 in terms of traffic.

Mobile Broadband Uptake:

Mobile broadband subscriptions have rocketed from zero to over 30 million in just two years since 3G/4G service rollout in Pakistan. Rapid growth is continuing with over 1 million new subscribers are signing up for 3G and 4G services every month. An equal or larger number of smartphones are are being sold.

Summary:

A whole series of indicators from auto and steel to manufacturing and construction and telecom services are confirming that economic growth is accelerating in Pakistan. Among the reasons for this growth are significantly improved security situation, political stability and soaring Chinese foreign direct investment (FDI) in CPEC related energy and infrastructure projects. These indicators are attracting investors who have already made Pakistan Stock Exchange the hottest shares market in Asia. KSE-100, Pakistan's main shares index, is up 18% year-to-date compared to 6% increase in India's BSE-30 index. The challenge for Pakistan is to continue to improve security and political stability to reassure investors of superior returns from their investments in the country.

Related Links:

Politcal Stability Returns to Pakistan

Auto and Cement Demand Growth in Pakistan

Pakistan's Red Hot Air Travel Market

China-Pakistan Economic Corridor FDI

-

Comment by Riaz Haq on August 7, 2016 at 4:27pm

-

#Pakistan’s #3G #4G users doubled to 29.53 million in FY16. #mobile #Smartphones

http://tribune.com.pk/story/1156572/3g4g-users-doubled-29-53m-fy16/

The number of users on mobile-phone internet networks – 3G/4G – has doubled to 29.53 million in the fiscal year ended June 30 as the country moves ahead on adopting broadband technology after the spectrum auction.

The Pakistan Telecommunication Authority (PTA) reported Friday that the number of 3G/4G subscribers has reached 29.53 million in June 2016, up from 14.6 million in July 2015.

3G/4G users up 3.74%, but growth slowing

“The availability of low-cost smartphones and aggressive roll-out of apps has made this possible,” said Parvez Iftikhar, an expert on information and communication technology.

The availability of social networking apps like Whatsapp and Facebook has played a significant role in attracting huge traffic on mobile internet.

Iftikhar added that introduction of 3G/4G internet services in Pakistan in 2014 has apparently helped boost the economy at length. “But to measure the real impact of 3G/4G on the economy, we need to conduct independent studies,” he said.

He said that the establishment of a number of technology incubators in the country was one example of boost to the economy through such cellular networks. Incubators have produced a number of startups, while many of them kept growing their businesses to larger scale.

Beware Pakistani mobile internet users

According to Iftikhar, the launch of online shopping portals, internet banking and roll-out of mobile money transfer by almost all cellular companies have also helped attract higher traffic on 3G/4G networks.

Besides, federal and provincial governments were also utilising mobile broadband for uplift of health, education and agriculture sectors.

PTA said that total broadband subscribers grew 92% to 32.41 million in fiscal year 2016 from 16.88 million in the previous fiscal year 2015.

The authority added that total teledensity recovered to 70.94% in FY16 from 62.9% in FY15. It peaked at 78.89% in FY14. The suspension of millions of mobile phone SIMs in the aftermath of biometric verification had reversed the growth in FY15.

Teledensity alone for cellular mobile regained to 69.12% in FY16 from 60.7% in FY15, PTA added.

The number of total mobile phone users, including non 3G/4G users, grew by 16% to 133.24 million in FY16 from 114.65 million in FY15, it added.

Sagheer Wattoo, a spokesperson at the federal ministry of information technology, credited the rapid growth in 3G/4G subscribers to the introduction of Telecommunications Policy 2015 last year.

High-speed internet: Broadband subscriptions near 30 million mark

“The policy note has made possible the sharing {cross use of} infrastructure and spectrum by telcos,” he said, adding this has resulted into attracting more subscribers.

“The growth in 3G/4G subscriber base was less than 3% before the current government in the centre came in power in 2013. This rate has accelerated to over 19% now,” he said.

-

Comment by Riaz Haq on August 11, 2016 at 8:42pm

-

Via @NPR: #India's Lagging #Manufacturing Sector Slows Job Creation. #Modi #Achhedin #BJP

http://www.npr.org/2016/08/11/489584349/india-s-lagging-manufacturi...

India needs an uptick in manufacturing to employ millions who enter the labor force every year. The slow expansion is imperiling India's ability to create jobs and lift millions out of poverty.

And you often hear about India having the world's fastest-growing economy. And it is growing at 7.6 percent. But beneath that headline is another reality. Manufacturing in the country is lagging, and that's hurting India's ability to create jobs and lift millions of people out of poverty. Let's go to New Delhi and NPR's Julie McCarthy.

JULIE MCCARTHY, BYLINE: Manish Dhariwal, chief financial officer of PPAP Automotive Limited, steps onto the factory floor as a downsized second shift punches in.

MANISH DHARIWAL: Each part has a different design.

MCCARTHY: He sweeps his hand across a display case of strips that seal car doors and windows, components he sells to the largest Japanese car manufacturers. PPAP enjoys a 90 percent market share, but Dhariwal says sales are flat, and his operation is running at just 65 to 70 percent capacity.

DHARIWAL: There's a big problem because facilities are already there, and they are not, then, getting fully utilized. And the cost of manpower increases on an annual basis. So how do I find the money for that if there's no sales growth?

MCCARTHY: Dhariwal's company is hiring no new workers. That undercuts Prime Minister Narendra Modi's pet project, to make manufacturing the engine of employment. Ten million Indians enter the workforce every year. But according to the Labour Bureau, eight labor-intensive sectors, including automobiles, created only 135,000 jobs last year, the lowest in seven years...

RAJIV KUMAR: It's a ticking time bomb.

MCCARTHY: ...Meaning social instability. Rajiv Kumar adds, if you have no new jobs...

KUMAR: You don't, therefore, address poverty in any real sense. And you exaggerate inequalities in our country.

MCCARTHY: Kumar is former head of the Federation of Indian Chambers of Commerce. He says India's nearly 8 percent growth rate reflects a jump in the service sector but disguises sluggishness in manufacturing. Kumar urges the government to stop boasting about the GDP and focus on the number of jobs created.

KUMAR: Because that's what is the key. And if you have that as the key macroeconomic target, then growth will follow.

MCCARTHY: But Mihir Sharma, author of "Restart: The Last Chance For The Indian Economy," says India can unleash growth only if it becomes easier to do business. He says roads here are so bad, the bureaucracy so hidebound, it's often cheaper to fly raw materials in from overseas than to clear the hurdles within India. That includes, he says, India's labor laws, which make it hard to fire workers in shops with more than 100 employees.

MIHIR SHARMA: It might take months. It could take years. And that's to fire one person. We are not competitive because we just can't get the scale and get the flexibility that every other country in the world has.

MCCARTHY: Flexibility in the workforce is useful in the lean periods, says Vishal Lalani, whose factory churns out dashboards for commercial vehicles, a sector that tumbled. A recovery has kicked in. But Lalani says 6 to 8 percent inflation is eating at his bottom line. And Lalani echoes other entrepreneurs who say Prime Minister Modi's campaign, Make in India, is more slogan than substance.

VISHAL LALANI: That's the way I see it. And it's probably boosting India's image and giving people a feel-good factor. But there's not that much happening on the ground.

MCCARTHY: Demand in India's auto sector is picking up, but the number of new jobs created is negligible. Even in aspirational India, demand can only go so far without gainful employment. Julie McCarthy, NPR News, New Delhi.

-

Comment by Riaz Haq on August 17, 2016 at 5:10pm

-

From Wall Street Journal:

Up until a year ago, the shipping industry was ordering ships in droves. This year, orders of new vessels have fallen to a record low and companies can’t get rid of ships fast enough.

About 1,000 ships that have the combined capacity to haul 52 million metric tons of cargo will be dragged onto beaches, cut into pieces and sold for scrap metal this year. That is second only to the record amount of capacity of 61 million so-called dead weight tons that were scrapped and recycled in 2012.

The global economic slowdown is putting shipping through its most bruising period since the 2008 financial crisis. Companies including Maersk Line, a unit of Danish conglomerate A.P. Møller Maersk A/S, Germany’s Hapag-Lloyd AG and China Cosco Bulk Shipping Co. have 30% more capacity in the water than cargo. As the companies, mostly based in Europe and Asia, fight for bigger shares of the global market, freight rates have dropped so low they barely cover fuel costs.

In the five years through 2015, owners ordered an average of 1,450 ships annually. This year orders through July fell to 293 vessels, or 11.6 million tons, according to U.K. marine data provider Vessels Value.

“Given the tremendous overcapacity, it will take much more recycling and at least two to three years of no growth in capacity to see some balance between supply and demand,” said Basil Karatzas, chief executive of New York-based Karatzas Marine Advisors Co.

------

Two years ago, in India, Pakistan and Bangladesh were paying about $460 a ton of steel. Last year it was $300 and it is now roughly $250, shipowners say. Officials at the Alang scrapyard—one of the world’s biggest, on India’s West Coast—said prices were likely to stay low through the rest of the year, as China is flooding the market with recycled steel.

Braemar ACM expects about 550 dry-bulk ships to be recycled this year, 29% more than last year and 48% more than in 2014. About 170 container ships are likely to be scrapped this year, compared with 85 last year and 164 in 2014. The scrapping of other ship types, such tankers, car carriers, general cargo ships and fishing boats, bring the year’s total to about 1,000 vessels.

South Asian scrapyards recycle about three-quarters of all ships every year. The remainder goes to yards in China and Turkey.

http://www.wsj.com/articles/economic-slump-sends-big-ships-to-scrap...

-

Comment by Riaz Haq on August 17, 2016 at 5:18pm

-

Does China see CPEC absorbing excess industrial capacity?

The CPEC provides an additional incentive for Chinese companies to extend further afield and expand their business models. Then there is the utilisation of its excess industrial capacity, which China stands to gain from considerably; “Putting idle machinery to use in another country helps to alleviate the domestic burden of idle productive capacity”, Polk explains, “which is currently one of the major constraints on China’s growth, so removing that excess capacity by building infrastructure in other countries may help to accelerate a stabilisation in China’s industrial sector”. Given such advantages for China, it would seem that the benefactor is gaining from the project as much as the recipient, and some may argue, even more so.http://www.worldfinance.com/infrastructure-investment/pakistan-and-...

-

Comment by Riaz Haq on August 18, 2016 at 9:54am

-

Over 60% of #Pakistan’s #mobile users have access to #3G #4G services. #broadband

http://tribune.com.pk/story/1165169/60-pakistans-mobile-users-3g4g-...Despite making a late entry into the 3G and 4G markets, 2014 to be exact, more than half of all mobile phone users in the country are now using these services.

OpenSignal, a company that specialises in wireless coverage mapping released a report that calculates Pakistan’s 3G networks at 63.47 per cent, that is almost two-thirds of all connections.

PHOTO: OPENSIGNAL

The site calculates the availability metric by measuring how often users can see a 3G or 4G signal on their device.

South Korea topped the chart with 98.54 per cent of users having 3G or better connection. Meanwhile, India only had a 56.10 per cent availability score which is surprising given the county launched 3G in 2008.

The report by OpenSingnal also included the overall speeds for each country with Pakistan averaging at 3.33 Mbps which is lower than India’s 5.30 Mbps. South Korea topped this category as well clocking in at 41.34 Mbps.

PHOTO: OPENSIGNAL

Overall speeds also take into account the availability of the services offered in each country which is why a country with fast LTE speeds but low 4G availability might have a much lower overall speed than a country with moderate LTE speeds but a very high level of 4G availability.

Another category included in the report is Time on WiFi. The metric shows the percentage of time that users in each country were connected to WiFi networks rather than cellular networks.

PHOTO: OPENSIGNAL

Pakistan’s score here came in a 34.12 percent suggesting that one third of the time users were connected to the internet using their WiFi in favour of mobile internet. Netherlands topped this list with a score on 70%.

OpenSignal gathers its data for the study using millions of devices that have downloaded their app as opposed to test-drive data that use same devices in a small number of locations which are not representative of the whole population. This results in data that is not biased and reports that are a lot more accurate and reliable.

-

Comment by Riaz Haq on August 18, 2016 at 4:29pm

-

China.org.cn: China's steel industry faces increasing trade frictions

China exported a total of 112.4 million tons of steel in 2015, the first time it reached 100 million tons, but it came with an increasing number of trade frictions. Forty-six trade remedy investigations were targeted at China's steel industry last year, an increase of 19 from the year earlier and accounting for 46.9% of all the trade remedy probes in China in 2015. Worse still, China's steel industry has been accused by some of being responsible for the steel overcapacity that has gripped the world.

Chinese industry insiders, however, have cited rapidly rising exports and the surge of trade protectionism as the real cause of the simmering trade frictions.

In late May, the United States issued hefty anti-dumping and anti-subsidy duties on corrosion-resistant steel not only from China, but also from India, Italy and South Korea. Moreover, Japan is also the target of a number of anti-dumping cases, demonstrating worldwide surging frictions in the steel industry.

"The international steel market has become a buyer's market with the steel glut worldwide. International buyers choose to buy China's steel, thus contributing to the growth of China' steel exports," said Li Xinchuang, the head of the China Metallurgical Industry Planning Association, recently. The surge in China's steel export is a result of the increasing competitiveness of China's steel products, he added.

--------------

Experts have proposed several ways of tackling the steel overcapacity and trade frictions. Lu Feng, a professor with the National School of Development of Peking University, said that expanding China's steel exports can move forward with the cooperation with developing countries.

He took the example of China and Pakistan. China's steel exports to Pakistan increased from 370,000 tons in 2011 to 2.56 million tons last year, a nearly six-fold increase in 4 years.

"The steel trade between China and Pakistan in recent years is mainly carried out in new projects under the Belt and Road initiative, thus it will not jeopardize the existing interest of other countries, but will help Pakistan better develop its economy," he said.

As a matter of fact, China's steel exports in recent years have increased significantly in countries involved in the Belt and Road initiative and developing countries. Data shows that the value of China's steel exports to Belt and Road countries has jumped from US$10 billion in 2009 to more than US$30 billion last year.

Lu Feng also said that digging deeper into China's domestic market and encouraging mergers of steel companies will also help the country's steel industry.

http://www.china.org.cn/business/2016-08/16/content_39099647.htm

-

Comment by Riaz Haq on August 23, 2016 at 5:01pm

-

#China's #Shanghai untility bids for $1.5 billion stake in #Karachi's #KElectric, #Pakistan. #CPEC http://reut.rs/2bMahLE via @Reuters

Chinese state-backed firms are frontrunners to buy a $1.5 billion controlling stake in Pakistani utility K-Electric, sources said, as they bet the benefits of a Beijing-led economic corridor will trump the risks of investing in Pakistan.

State-backed Shanghai Electric Power (600021.SS) and China Southern Power Grid are among Chinese firms leading the pack of about half a dozen bidders in K-Electric KELA.KA, one person familiar with the matter said.

Shanghai-headquartered Golden Concord Holdings is also among the bidders, as are some local Pakistani and other companies, according to people who know about the process.

Chinese companies' interest comes after China last year announced energy and infrastructure projects worth $46 billion in the South Asian nation, with a view to opening a trade corridor linking western China with the Arabian Sea.

"The China-Pakistan Economic Corridor (CPEC) is the main driver, with a lot of Chinese funding flowing into Pakistan," said one person aware of the K-Electric deal.

That demand underpins President Xi Jinping's ambitious "One Belt, One Road" initiative, under which Beijing is seeking to open new trade routes and markets as the domestic economy slows.

Under the program, Chinese companies invested nearly $15 billion in participating countries last year, up one fifth from 2014.

If successful, the K-Electric deal would be the biggest M&A agreement in Pakistan in a decade. Large tracts of Pakistan's economy remain nationalized or held by private businessmen with little interest in selling to new investors.

Chinese firms are eyeing new Pakistan power projects, roads and some engineering contracts but investing in a large private company that deals directly with consumers would be a first, a senior Karachi-based financial adviser said.

NO GUARANTEE

Dubai-based private equity firm Abraaj Group, whose 66-percent stake in K-Electric has a market value of about $1.5 billion, is seeking final bids for its stake by the end of August.

Sources cautioned that although talks between the parties are advanced, there is no certainty of a deal being clinched.

The Pakistani government owns about 24 percent, but a spokesman for the water and power ministry said it was not in talks to sell.

CPEC envisages the construction of roads, pipelines and power plants across Pakistan that run south to Gwadar port and should mean more business for distribution companies like K-Electric that sell the electricity to users.

China and Pakistan call each other "all-weather friends" and their ties have been underpinned by long-standing wariness of their common neighbor, India, and a desire to hedge against U.S. influence in the region.

Islamabad wants Chinese funding to reinvigorate an economy hurt by militant violence and weak productivity, to provide new jobs and to ease chronic power shortages.

For China, markets like Pakistan and Malaysia are opening up new frontiers, just as it faces hurdles in countries including Australia.

"CHINESE ARE COMING"

"We are getting a lot more enquiries from Chinese investors about Pakistan in the last couple of years," said Muhammad Sohail, CEO at Karachi-based brokerage Topline Securities.

"Before it was always U.S. and Europe. The Chinese are coming," Sohail added.

Still, foreign investment in Pakistan remains relatively muted as it struggles to shake off a reputation for violence, corruption and instability, and despite the $250 billion economy growing at its fastest pace in eight years.

Inbound M&A into Pakistan has risen more than six times in the past five years, totaling $516 million so far this year, according to Thomson Reuters data.

-

Comment by Riaz Haq on August 26, 2016 at 11:12am

-

#Pakistan adds 2.2 million new #3G/4G users in July. #Mobile broadband subscribers up to 32m - The Express Tribune

http://tribune.com.pk/story/1170448/pakistans-3g4g-user-base-rises-...

In Pakistan, the number of users on mobile-phone internet networks – 3G/4G – has increased to almost 32 million.

According to the Pakistan Telecommunication Authority (PTA), in July, over 2.2 million new 3G/4G users were added by the telcos, taking the total number users in the country from 29,530,254 (2.9m) to 31,779,549 (almost 3.2m).

Pakistan’s 3G/4G users doubled to 29.53 million in FY16

The userbase increased by over seven per cent.

Leading the pack was Mobilink, which added over 1.2 million new 3G users to its network, whereas Zong attracted half a million new 3G users in addition to 109,000 4G users.

Mobilink is also leading in terms of total number of 3G/4G users with over 10.2 million 3G users – almost one-third of the total 3G/4G users in the country. It was followed by Ufone with around 8.6 million 3G users.

Beware Pakistani mobile internet users

According to the PTA, the total number of broadband subscribers have increased from over 32 million at the end of fiscal year 2016 to 34.5 million by the end of July.

Commenting on the growth of 3G/4G services in the country, Parvez Iftikhar, an expert on information and communication technology, said “The availability of low-cost smartphones and aggressive roll-out of apps has made this possible.”

The availability of social networking apps such as Whatsapp and Facebook, has played a significant role in attracting huge traffic on mobile internet, he added.

-

Comment by Riaz Haq on August 30, 2016 at 7:59am

-

#Pakistan’s #3G/4G penetration doubles to 24% in 12 months - #Mobile #Broadband http://bit.ly/2bz57WK

Pakistan’s mobile broadband (3G/4G) subscriber base more than doubled over the past year to 31.8 million at the end of July.

According to the Pakistan Telecoms Authority (PTA), 3G/4G penetration has jumped from 11 per cent to 23.8 per cent over the past 12 months. Operators added an average of 1.43 million 3G/4G subs a month, but the pace picked up in July with the five key mobile players adding 2.3 million in a single month.

Pakistan has just 1.17 million 4G users. China Mobile’s Zong has nearly 800,000, while Warid has about 370,000. A year ago they each had just over 100,000 4G subs.

Mobilink is the 3G market leader with 10.2 million subs — up from just under four million a year ago. Telenor Pakistan was second with 8.6 million, a net gain of nearly four million, while Zong was third with 6.5 million (up from 3.1 million a year ago). Number four Ufone doubled its 3G subs during the period to 5.3 million.

The country has 133.3 million mobile subscribers, giving it a mobile teledensity of 69 per cent, which has been stable over the past year. Mobilink is the largest operator with 39.5 million total mobile subscribers, followed closely by Telenor (38.1 million). Zong again was third with 25.6 million, and Ufone fourth with 19.5 million.

-

Comment by Riaz Haq on September 7, 2016 at 8:05am

-

#Smartphones flourishing amid #mobile broadband expansion in #Pakistan. 40 million by yearend http://pakobserver.net/smartphone-flourishing-amid-mobile-broadband... … via @Pakistan Observer

The evolution of electronic media has been fast and swift with smartphones playing a major role as its growth is still alive, unlike in developed world. Millions of people are coming online for the first time in the South Asian region each month, it remains a lucrative market. According to a report, the number of smartphone users in Pakistan is increasing rapidly. With the introduction of the fastest 3G and 4G-LTE services in Pakistan, the use of mobile broadband is growing.

By the end of 2016, there will be more than 40 million smartphone users in the country. Currently, there are 31.77 million Internet users who are enjoying the third-generation (3G) and fourth-generation (4G) mobile communication services in Pakistan. This number is increasing. Moreover, the mobile subscribers are now 133 million, data issued by Pakistan Telecommunication Authority (PTA) revealed. Based on current trends in e-commerce sector and as per market estimates, more than two million users a month visit the online shopping stores to purchase a cell phone.

To gain the advantage from this ever-increasing demand, the major industry players from telecom operators to mobile phone manufacturers and an e-commerce platform have joined hands with the internet giant Google to promote online trade by giving exclusive discounts on phone purchases just ahead of the event of Eid. The publicly available data shows mobile phone imports regarding the value and not in units making it tough to figure out category wise imports.

According to the market experts, less than 20 per cent of the mobile phones imported in Pakistan are the smartphones. But, in the next couple of years, this figure is likely to change. In almost all the online shopping stores in Pakistan, the category of the smartphone is on the top. Grappetite, a mobile app development firm had released an infographics that details the usage patterns of smartphones in Pakistan. The infographics reveals that 35 per cent of the smartphone users in Pakistan carries a low cost phone on them for safety reasons while 68 per cent of the smartphone users in Pakistan are on Android.

Similarly, 77 per cent of smartphone users are just 21 to 30 years old and 60 per cent of the Pakistani’s use more than one cell phone. Around 16 per cent smartphone users regularly buy paid apps while remaining 84 % contents with free apps. Mobile is the primary access platform, and report foresees that over time more expensive devices will see sales grow as those new internet users seek to upgrade their smartphone.—APP

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

IMF Questions Modi's GDP Data: Is India's Economy Half the Size of the Official Claim?

The Indian government reported faster-than-expected GDP growth of 8.2% for the September quarter. It came as a surprise to many economists who were expecting a slowdown based on the recent high-frequency indicators such as consumer goods sales and durable goods production, as well as two-wheeler sales. At the same time, The International Monetary Fund expressed doubts about the Indian government's GDP data. …

ContinuePosted by Riaz Haq on November 30, 2025 at 11:30am — 1 Comment

Retail Investor Growth Driving Pakistan's Bull Market

Pakistan's benchmark index KSE-100 has soared nearly 40% so far in 2025, becoming Asia's best performing market, thanks largely to phenomenal growth of retail investors. About 36,000 new trading accounts in the South Asian country were opened in the September quarter, compared to 23,600 new registrations just three months ago, according to Topline Securities, a brokerage house in Pakistan. Broad and deep participation in capital markets is essential for economic growth and wealth…

ContinuePosted by Riaz Haq on November 24, 2025 at 2:05pm — 2 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network