PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan ETF PAK Launched in New York

A new country Exchange Traded Fund (symbol PAK) started trading on New York Stock Exchange (NYSE) this week. The ETF will track the price and yield performance of the MSCI (Morgan Stanley Composite Index) All Pakistan Select 25/50 Index.

Pakistan ETF:

The new Pakistan ETF launch coincided with Chinese President Xi Jinping's visit to Pakistan where he announced massive $46 billion investment in Pakistan's energy and infrastructure. The sectors expected to benefit most initially from the Chinese investment are: energy, cement and financial services.

Pakistan Outperforms Emerging, Frontier Markets Source: Economist |

Although the ETF launch timing was fortuitous, it was actually planned well before the Chinese leader's visit. It caters to individual investors seeking outsize returns in Karachi where KSE-100 index has been outperforming both emerging and frontier markets for several years.

|

| Pakistan GDP, CAD Source: Economist |

In 2014, the KSE-100 Index gained 6,870 points thereby generating a handsome return of 27% (31% return in US$ terms), making Pakistan's KSE world's third best performing market. Total offerings in the year 2014 reached 9 as compared to 3 in the year 2013. After a gap of seven years, Rs 73 billion were raised through offerings in 2014 as compared to a meager Rs 4 billion raised in 2013. Foreign investors, that hold US$ 6.1 billion worth of Pakistani shares -which is 33% of the free-float (9% of market capitalization)-remained net buyers in 2014.

The ETF fact sheet shows that the index has 31 holdings in it. Also, the industry weightings are concentrated in financials (32.7%), energy (24.2%), materials (23%) and utilities (10.8%) — roughly 90% in four sectors alone.

The top equity holdings with weightings in the ETF are as follows: MCB Bank, 11.5% Oil and Gas Development (OGDC), 9.8% United Bank, 6.1% Fauji Fertilizer, 5.9% Lucky Cement, 5.7% Hub-Power, 4.9% Pakistan State Oil, 4.8% Engro, 4.7% Bank Al-Habib, 4.1% National Bank Pakistan, 3.7%

Pakistani Shares Valuation:

Even after outperforming both emerging and frontier market indices, Pakistani shares can be bought at deep discounts which make them very attractive, according to Renaissance Capital’s chief economist Charles Robertson. MSCI (Morgan Stanley Composite Index) Pakistan trades at only 8.4 times forward earnings, a 17% discount to MSCI Frontier Markets. For comparison purposes, fellow frontier south Asia markets Sri Lanka and Bangladesh trade at 13.4x and 21.4x respectively. India, included in the emerging market index, trades at 16.8 times.

Key Sectors:

Chinese investment in energy and infrastructure will help stimulate all sectors of Pakistani economy. But the sectors benefiting most from the $46 billion investment will likely include banks, energy and building materials, the sectors which are the favorites of Pakistani billionaire investor Mian Mohammad Mansha.

Being close to the ruling Sharif family makes Mansha the ultimate insider. Beyond his investments in banking, cement, energy and textiles, Mansha is also starting to invest in consumer products sector benefiting from rising incomes, growing middle class and increasing jobs created in Pakistan by the massive Chinese investment. Mansha owns a big chunk of Muslim Commercial Bank (MCB) shares. He has recently been pumping more money into energy, cement and dairy businesses. Mansha's DG Khan Cements has announced plans to build a $300 million cement plant near Karachi. In additions, his Nishat Dairies has imported thousands of dairy cows for a dairy farm in Lahore.

Summary:

The $46 billion Chinese investment in energy and infrastructure has brought attention to tremendous investment opportunities in Pakistan, a nation of nearly 200 million people with rising middle class and growing consumption. Pakistani military's recent successes against the terrorists and China's massive investment commitments are expected to boost investor confidence in the country. Higher confidence will help draw other significant investors to invest in Pakistan over the next several years.

Full Disclosure: I have personally invested in PAK ETF.

Related Links:

China Deal to Set New FDI Records in Pakistan

Post Cold War Realignment in South Asia

Haier Pakistan to Expand Production From Home Appliances to Cellpho...

Pakistan Bolsters 2nd Strike Capability With AIP Subs

Pakistan Starts Manufacturing Tablets and Notebooks

-

Comment by Riaz Haq on April 24, 2015 at 8:08pm

-

In his first state visit to Pakistan last week, China’s President Xi Jinping pledged $46 billion to build a 3,000-kilometer (1,860-mile) economic corridor linking China’s restive west to Pakistan’s southwest port on the Arabian Sea. It is by far Beijing’s biggest bet on another developing country.

Earlier this month, Pakistan raised $1 billion from the sale of a big stake in its largest commercial bank, Habib Bank (ticker: HBL.Pakistan). Demand was overwhelming, and three-quarters of the shares went to foreigners, mostly long-term institutional investors.

We associate Pakistan with terrorism and sectarian violence. But China’s leaders are practical and business-minded: Are we missing something?

In many ways, Pakistan’s prospects look brighter today than they have in a long time; in fact they’re similar to those of its bitter rival, India. Growth has ticked up, from 3.7% in 2013 to 4.1% last year. Like India, Pakistan recently got nods of approval from the International Monetary Fund and Moody’s, with the former lifting its GDP forecast to 4.3% this year and 4.7% next, and the latter raising Pakistan’s credit outlook to positive from stable. Pakistan almost halved its budget deficit to 4.7% of GDP last year, and is now targeting 4%.

Lower oil prices also help Pakistan. Inflation hit a new low of 2.5% in March, down from 8.5% a year earlier. In March, Pakistan’s central bank cut its key interest rate to 8%, with another reduction possible.

The major concern is, of course, security. While falling, the number of civilian fatalities from terrorist attacks still totaled 1,781 last year. That was a seven-year low. So far this year, there are 352 fatalities.

INVESTORS WILL USUALLY PAY a premium for structural reform. On this count, “Pakistan ticks many of the boxes” but is not getting the love, says Renaissance Capital’s chief economist, Charles Robertson. It trades at only 8.4 times forward earnings, whereas investors’ darling India fetches 16.8 times.

Much of the shortfall is Pakistan’s fault. During the financial crisis in 2008, Pakistan suspended stock trading, only to see a sharp selloff upon re-opening. The episode prompted indexer MSCI to downgrade the country from emerging to frontier market. If operating normally, the Karachi Stock Exchange, with a market valuation above $70 billion, and $140 million in daily trading volume, would qualify as an emerging market. Over 25 stocks generate more than $1 million in daily trades.

Stocks have done very well since the shutdown. They’ve risen an annualized 26% over five years. Last week, Global X launched the first U.S.-listed Pakistani exchange-traded fund, Global X MSCI Pakistan, under the ticker PAK.

Pakistani cement makers, beneficiaries of infrastructure spending, are a good bet, says Asha Mehta, frontier markets portfolio manager at Acadian Asset Management. Pioneer Cement (PIOC.Pakistan), for example, expanded its operating margin from 27% in 2012 to 34% in 2014 and trades at only 7.7 times earnings.

Pakistan isn’t for the faint-hearted. In March, its market fell 10% in five days because of one investor: Miami-based Everest Capital unloaded around $70 million to cover a bad bet on the Swiss franc, and local sell orders ballooned from resulting margin calls and panic. Though Pakistan’s stock market recovered, it’s unlikely that such an event could occur in India’s bigger, more mature market.

http://online.barrons.com/articles/global-investors-rediscover-paki...

-

Comment by Riaz Haq on May 5, 2015 at 5:01pm

-

Standard & Poor’s raised Pakistan’s credit rating outlook to positive from stable, as lower energy costs and an IMF loan boost growth and improve finances.

“The positive outlook reflects our expectations of Pakistan’s improved economic growth prospects, fiscal and external performance, and the supportive relationship of external donors over the next 12 months,” the company said in a statement on Tuesday.

It affirmed its B- rating, which is among the so-called junk grades, and raised the 2015-2017 average growth projection to 4.6 percent from 3.8 percent. Risks include higher oil prices, weakness in key trading partners and violence, S&P said.

The move follows a similar step by Moody’s Investors Service in March as Prime Minister Nawaz Sharif looks to resolve Pakistan’s crippling power shortages and boost investment. The nation’s foreign exchange reserves have almost doubled to $12.6 billion with the help of an International Monetary Fund loan and its stocks are among Asia’s best performers this quarter.

“Foreign inflows can be expected in the country and more dollars would mean more economic stability,” Saad Khan, an economist at Arif Habib Ltd. said by phone from Karachi after the upgrade.

The benchmark KSE100 index has risen 10.7 percent this quarter, trailing only Chinese and Hong Kong equities, according to data compiled by Bloomberg. The gauge fell 0.8 percent as of 12:24 p.m. in Karachi on Tuesday and Pakistan’s rupee was little changed.

China Pledge

China pledged $45 billion for roads, ports and power plants when President Xi Jinping visited Pakistan last month. The planned investment, 28 times more than the foreign direct investment Pakistan received in year ended June, will spur investment activity and help ease the country’s growing energy shortage, Moody’s said in a report on Monday.

Pakistan took a $6.6 billion loan from the IMF in 2013 to avert a balance-of-payments crisis and has cleared six program reviews. Oil prices have fallen 38 percent over the past year, lowering Pakistan’s import bill, easing price pressures and giving the central bank room to cut interest rates.

S&P forecasts Pakistan will report an average budget deficit of 3.5 percent of gross domestic product during 2016-2019 with interest costs falling to about 25.5 percent of revenues from an estimated 30.6 percent in 2015. Inflation is expected to average 4.8 percent over 2015-2019.http://www.bloomberg.com/news/articles/2015-05-05/pakistan-outlook-...

-

Comment by Riaz Haq on May 6, 2015 at 10:21am

-

“We are now seeing growing stability in the economy,” he (State Bank of Pakistan Governor Wathra) says in an interview with the Financial Times.The IMF has acknowledged that Pakistan averted a balance of payments crisis in 2013 and managed to stabilise its foreign reserves. This week Standard & Poor’s, the credit rating agency, raised the outlook for its B minus rating from stable to positive, while Moody’s last month raised its outlook to stable from negative — albeit for a Caa1 rating, which puts it one notch above Greece.

With liquid foreign reserves having grown almost fourfold in the past year to $12.5bn, a figure equivalent to about three months of imports, Mr Wathra has less cause for concern about the stability of the rupee than some of his predecessors.

The recent plunge in the price of crude has seen the cost of oil imports fall to $9.7bn in the nine months to March, down from just over $11.2bn a year earlier, according to central bank figures.

Falling oil prices have also helped lower the fiscal deficit to an expected 5 per cent of gross domestic product in the year to June, down from above 8 per cent just over two years ago. And the country’s GDP is forecast to grow by about 4 per cent this year, following a similar rise last year.

But the government’s critics say the recent strong economic performance owes more to luck and a falling oil price than design.

Salman Shah, the former finance minister, is among those who say Islamabad cannot claim credit for this newfound economic stability. The stabilisation of foreign reserves “is a windfall that came because global oil prices fell and pressures on countries like Pakistan eased”, Mr Shah says. “It’s no credit to the government.”

Huge reform challenges remain. The government has failed to reform a notoriously corrupt and inefficient tax collection system, Mr Shah says. Western economists rate Pakistan’s tax collection as among the worst in the world. Only 1.5 per cent of the country’s 185m people pay any income tax.

“Progress has just not taken place,” Mr Shah says. “It’s the hard stuff where the government has simply failed to make a difference.”

Hafeez Pasha, a former finance minister, agrees. “There is an irony which is that while foreign reserves raise confidence, Pakistan’s economy remains very weak.”

Mr Wathra acknowledges that certain intractable issues remain, notably the country’s acute electricity shortages. “The most important issue [for the economy] is electricity generation and distribution,” he says.

It is not unusual for parts of Pakistan to see crippling power cuts for up to 18 hours a day, undermining key sectors of the economy like industry, agriculture and small businesses. The country’s reliance on expensive oil-powered plants helps explain the blackouts, as does the illegal tapping of electricity wires.

©Bloomberg

Security is high a the central bank in Karachi

One western economist says that up to 25 per cent of the electricity generated in Pakistan “is lost and unaccounted for in the transmission system. It’s the most visible theft of a valuable resource in Pakistan.”

Other risks remain. Pakistan’s economy is vulnerable to foreign policy — both its own and that of others. Tensions have mounted over the country’s reluctance to provide ground troops, naval assets and fighter jets to Saudi Arabia to join its offensive inYemen.

Some even fear that up to 2m Pakistani expatriate workers in Saudi Arabia could be repatriated — an unlikely but devastating outcome given the billions of dollars of remittances they send home every year.

Even as he welcomes the boost provided by the lower price of oil, Mr Wathra acknowledges the foolhardiness of relying on it to boost the Pakistani economy. “Why,” he asks, “should we rely on a factor which can be unpredictable and not in our control?”

http://www.ft.com/intl/cms/s/0/ed016c7c-e4df-11e4-bb4b-00144feab7de...

-

Comment by Riaz Haq on May 13, 2015 at 9:30pm

-

Confidence boost: MSCI includes two Pakistani companies in frontier index

MSCI added Hub Power Company and Indus Motor Company from Pakistan while removing Pakistan Tobacco from its MSCI FM Index in its latest Semi-Annual Index Review for MSCI Equity Indices.

However, the news failed to trigger a positive sentiment on the Karachi Stock Exchange (KSE), although the inclusion of two Pakistani companies should ideally bring more foreign portfolio investment and increased volumes to the country’s equity market.

In 2014, the Semi-Annual Index Review for MSCI Equity Indices had resulted in the addition of four Pakistani companies (and deletion of one) into the MSCI FM Index. Pakistan gained notably by the last year’s review, which reclassified Qatar and UAE from FM to Emerging Markets (EM). As a result, Pakistan’s weight in MSCI FM Index increased to 8.8% as of April 30, 2015 compared to 4.1% in May 2014.

According to Topline Securities, Pakistan’s weight in MSCI FM Index is expected to increase after these additions/deletion and a successful secondary offering in Habib Bank. It added that Pakistan will have as many as 16 companies – namely Engro Corporation, Fatima Fertilizers, Fauji Fertilizers, Habib Bank, Hubco, Indus Motor, K-Electric, Lucky Cement, MCB Bank, National Bank, OGDC, Pakistan Oilfields, Pakistan Petroleum, PSO, PTCL and United Bank – in the MSCI FM Index following the review.

Another investment decision support tool, MSCI FM Small Cap Index, added four Pakistani companies – Kohat Cement, Maple Leaf Cement, Pak Elektron and Pak Suzuki – in the latest Semi-Annual Index Review for MSCI Equity Indices.

Five Pakistani companies, namely Hubco, Indus Motor, DG Khan Cement, Murree Brewery and National Foods, have been deleted from the MSCI FM Small Cap Index. With the latest round of additions and deletions, Pakistan will have 22 companies in the MSCI Small Cap Index.

According to Topline Securities, MSCI is expected to announce the result of its 2015 Annual Market Classification Review on June 9. The beginning of any consultation process to upgrade Pakistan from the MSCI Frontier Markets to the MSCI Emerging Markets may be initiated in the classification review, it said.

“The consultation process, however, takes a minimum of six to 12 months before the actual decision is taken to upgrade any country,” it stated.

http://tribune.com.pk/story/885943/confidence-boost-msci-includes-t...

-

Comment by Riaz Haq on May 13, 2015 at 9:38pm

-

Contrary to the negative headlines we often see in the press, you get an entirely different perspective on Pakistan when visiting the country.

----

Over the last few years, there has been a dramatic change in the political landscape. We have had for the first time a government completing a full term, the first time since independence 67 years ago, while the transfer of power to the opposition was also handed peacefully. Importantly, stability within the political landscape has led to a stability of economics and commitment to adhere to an International Monetary Fund programme.

This means we are dealing with a country that is lowering its budget deficit, privatising state-owned assets and starting to tackle energy shortages; all meaningful milestones for international investors.

As part of the IMF program, it has committed to a very aggressive, almost unprecedented privatisation program. In June 2014, Pakistan experienced its first privatisation in seven years, with the sale of 19.8% of United Bank. There are also other major plans for 2015.

Meanwhile, the country is also embarking and prioritising on a massive restructuring and privatisation of its power sector, which is much needed to unleash Pakistan’s economic growth. After slumping to less than 3% from 2007 to 2011, economic growth is steadily rebounding and is estimated at 5.5% this year, but this could be much higher if structural changes continue.

The fall in oil and other commodities is also providing a further tailwind to the economy. This has had a knock-on effect to inflation, with the rate dropping quite sharply in recent months, and is now at an 11-year low.

On the back of lower inflationary pressures, Pakistan's central bank cut its key discount rate to 8.5% in January and a further 50 basis points reduction in March to 8%. Encouragingly, we are expecting more to come if inflation remains anchored at these lower levels.

Positive Demographics and Most Liquid Market

Pakistan’s 186 million population is the largest among frontier markets, and the sixth largest globally – after China, India, US, Indonesia and Brazil. A 9% weight in the MSCI Frontier Markets Index ranks Pakistan third by weight, after Kuwait and Nigeria, making it the largest oil-importing country in the index.

With 560 companies listed, the $77 billion market cap Karachi Stock Exchange trades $150 million daily, giving Pakistan the most liquid equity market among countries in the MSCI Frontier Markets index. The market’s free-float is approximately 33%, with around 35% of the free-float owned by foreigners.

---

However, along with Sri Lanka, Pakistan stands out among Asian frontier markets as much of the bad news is already embedded in valuations. Recent gains have moved that forward P/E onto 9-times, but this still remains very favourable versus other frontier, emerging and developed markets.

The opportunity set in Asia, as with other frontier markets, is majorly focused on the financials sector. There are many banks trading at high single-digit to low double-digit levels when considering forward looking price-to-earnings ratios.

Many frontier banks are also generating exciting, but also sustainable, return on equity levels. Twenty per cent per-annum growth is not uncommon, especially in Pakistan and Sri Lanka.

In Pakistan, banks had been in a de-leveraging cycle for almost five years up until the summer of 2014. This has reversed sharply and loan growth has now picked up, into double-digits in some cases, as corporates have started to re-leverage. This is now coming through strongly in profits growth.

Overall, Pakistan and other markets in the Asian frontier region are becoming more important to investors. Positive demographics and low credit penetration levels provide a robust backdrop for investing.

- See more at: http://www.morningstar.co.uk/uk/news/137596/should-investors-recons...

-

Comment by Riaz Haq on May 14, 2015 at 8:27am

-

Summary

- India is considered by some to be the best emerging market for several reasons and the one to buy.

- The favorable environment for India is passing and the new one contains a great deal of headwinds.

- India is not a buy in my assessment once you take everything into account.

Of all the emerging markets that are out there, India is one of the more prominent ones. It's one of the BRIC countries, together with Brazil, Russia and China. India easily ranks as one of the more popular investment destinations among emerging markets. In fact, there are a large number of people who consider India as their number one pick when it comes to deciding where to invest in emerging markets.

Why some people may want to invest in India

There are many reasons why India is currently a favored destination among some investors. India is an economy with relatively fast growth, at least in comparison to most countries out there. It also has a very large and a fairly young population. India has the potential to one day become a leading economy and a large consumer of all sorts of goods and services. Investing early on could pay off handsomely some day.

Unlike many other emerging markets, India does not depend on the export of commodities. On the contrary, India is a major importer of commodities such as crude oil and gold. The big drop in commodity prices starting in 2014 has therefore not hurt India, in contrast to other emerging markets that have experienced much turmoil due to the drop in prices of commodities.

The year 2014 also saw the election of the Modi government, which is considered by many to be friendly to businesses and open to reform. This factor along with others combined to generate a lot of optimism about the future and India became one of the best performing markets in 2014 as investment capital poured into the country.

The winds are changing direction

However, in a couple of days it will be exactly one year since the new government in India was elected. India will at some point have to turn some of its election promises into action. It cannot rely on being given the benefit of the doubt because its honeymoon period is now pretty much over. The government will be judged on what it's able to accomplish and not just what it says it's going to do.

Unfortunately, some of the early signs are not very promising. For instance, foreign companies and investors are still in the dark concerning potential tax payments that no one was informed of but will still be held liable for. The Indian government has not done enough to resolve this and other outstanding issues. Frankly, the Indian government has little if anything to show for with its one year anniversary coming up.

Furthermore, the price of crude oil has stopped declining. If it continues to rebound, other commodities could follow suit because the price of oil plays an important role when it comes to extracting commodities from the ground. This is a significant development for India because crude oil accounts for about one third of its import bill.

The declining price of crude oil was thought by many to be the reason for optimism because it would allow India to turn its current account deficit into a surplus. This has yet to happen and the rising price of crude oil makes that possibility more and more unlikely. The deficit could actually increase instead of decline as some had forecast.

It's important to remember that India has a number of weak fundamentals. India has a problem with chronic deficits, including a current account deficit, a trade deficit and a budget deficit. The deficits force India into borrowing, which is not a good situation to be in at this moment. Interest rates are looking to go up, which means that India will have to pay more for its borrowing. You do not want to pay more if you're already short on cash.

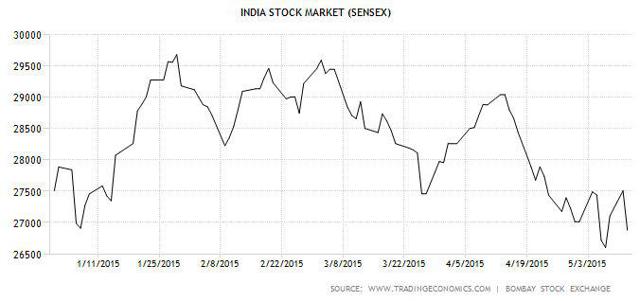

India is trading in a range and the outlook does not look bright

Since the start of 2015, the Indian market has essentially been stuck in a range. ETFs dedicated to India, including EPI (NYSEARCA:EPI) and INDA (BATS:INDA), are either flat or down for the year. Other emerging markets are doing much better in comparison. For instance, EEM (NYSEARCA:EEM), the largest ETF for emerging markets in terms of liquidity, is up by more than 7.5 percent.

More importantly, several factors look set to make the second half of 2015 a difficult one for India. For instance, the optimism generated in India after the election of the Modi government is starting to wane. The Federal Reserve could tighten monetary policy in the United States and begin raising interest rates as soon as June, although later in the year is probably more likely.

Commodity prices are also looking to rebound, which works in favor of competing emerging markets such as Brazil and Russia and against importers of commodities such as India. Investors and their capital could respond by switching to the former markets and away from the latter. This is not good news when you're as dependent on capital inflows as India is.

Conclusion

In a previous article that I wrote late last year, I argued that India was unlikely to repeat its previous performance in 2015. This forecast has so far proven to be accurate as the situation in India has more or less developed as I reasoned it would in 2015.

For starters, I thought that the drop in commodity prices would not be the windfall that some analysts had predicted. One reason being that a large chunk of what India imports is actually destined for re-export and not to satisfy internal demand. While India has seen some benefits such as lower inflation, it hasn't been enough to make the problem of deficits go away.

India at 19 times earnings late last year made it one of the most expensive emerging markets. Valuations have since eased somewhat, but India is still among the more expensive. At the same time, there are a number of emerging markets trading at lower valuations than India, which makes them more attractive in that regard.

I also expected India to have trouble living up to the lofty expectations that some people had of the country after the election of the Modi government. That's because politicians in general find it much easier to make promises during election campaigns than to actually turn those promises into reality once they're in power.

On top of all of this, not enough consideration has been given by many to the fact that India remains fundamentally vulnerable to global changes in interest rates and the flow of capital that can result because of this.

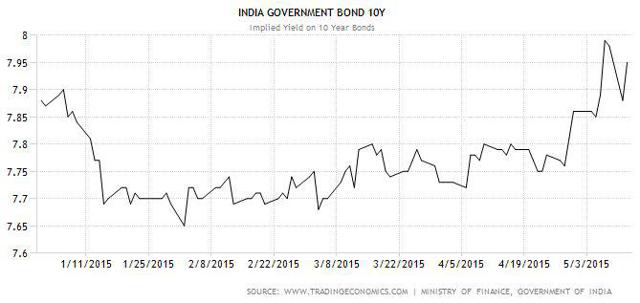

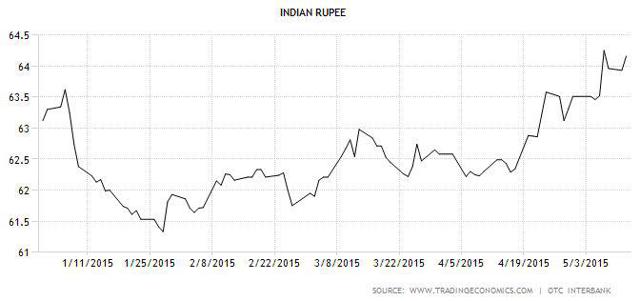

Even if interest rates do not go up in the coming months, the mere threat of them going up is enough to cause problems for a country like India which has to attract foreign capital to balance its books. That the Indian currency, the rupee, is depreciating and yields of government bonds are being pressured should come as no surprise once you look deeper into the overall state of India's economy.

While there are some who consider India to be the best emerging market and recommend it as such, my own assessment is different. Whether it's relatively high valuations, weak fundamentals with persistent deficits, government bonds under pressure, weakening currency, rebounding oil prices, declining confidence in the government and so on, India is facing a ton of headwinds going forward. Far too many to be a number one pick among emerging markets.

There are many reasons to stay away from India in such an environment and very few not to. India may be better off than some emerging markets, but there are also plenty of other countries that possess a better risk/reward profile. Therefore, I will reiterate my previous assessment that India is not a buy in my opinion.

http://seekingalpha.com/article/3182786-why-india-is-not-a-buy-in-t...

-

Comment by Riaz Haq on May 26, 2015 at 10:27am

-

Pakistan is an important part of the Silk Road strategy as it will be a conduit for Middle Eastern oil, via the Pakistani Port of Gwadar.

Pakistan is not the most stable country though, so massive investment in basic infrastructure like electricity generation is required as a first step to reduce risk. Increased trade and investment will create jobs, which is a crucial aspect of creating a more stable society.

But Pakistan is just the start. You can expect to see much more of these types of projects in the years to come. The main vehicle for financing this investment is the Asian Infrastructure Investment Bank (AIIB).

This is a multilateral bank set up by China. So far, there are about 60 member countries, including Australia, who joined the bank in March this year.

You may remember the furore it caused. The US didn’t want its allies, including Australia, to join. That’s because the AIIB threatens to undermine the influence of both the International Monetary Fund and the Asian Development Bank, institutions predominantly run and controlled by Washington.

But Australia, the UK and most of Europe didn’t listen. They all signed up to the AIIB, which is expected to launch officially by the end of this year. Only the US, Japan and Canada remain opposed to joining.

The member countries will contribute a total of US$100 billion to the bank, to be used as seed capital to finance infrastructure projects.

But that’s not all. In November 2014 China announced the establishment of a US$40 billion Silk Road Infrastructure Fund. It made its first investment in April this year, a US$1.65 billion hydropower project in Pakistan, part of the broader investment in Pakistan mentioned above.

The aim of the Silk Road Infrastructure Fund is to increase capacity and boost connectivity across the Eurasian and Australasian regions, via land and sea.

You’re probably starting to see now that the scope of this project is massive. This is going to reshape the global economy in the decades ahead, and shift the balance of power away from the US and towards China.

I go into more detail on this shifting dynamic in my special report on the topic, which you’ll get in your inbox tomorrow. Suffice to say, China is taking a very different approach to the US in its rise to global economic dominance.

China doesn’t want the same role as the US currently has. It doesn’t want to police the world and it doesn’t want the yuan to be the world’s reserve currency. It knows that by the US dollar fulfilling this role for decades, it has created huge distortions and imbalances in the global economy…and speculative and fragile financial markets.

I’ll expand on all this tomorrow. For now, understand that trade based infrastructure is the big emerging trend in the global economy right now.

I’ll be honest. I’m pretty bearish on a lot of things; central banks have turned stock markets into casinos, politicians around the world are myopic fools, savers are sacrificed to help the debtors…I could go on and on.

But I am bullish about China’s attempts to redraw the global economic map. Trade-based infrastructure investment is productive investment. Productivity is the driving force behind economic growth, jobs, and wealth creation.

-----------

Yes folks, we’re heading into a ‘Golden Age of Infrastructure’. The Asian region will see hundreds of billions of dollars in infrastructure investment in the years to come.

Yes, this is a positive for commodities. But resources aren’t the main game this time. There’s another sector set to dominate. The competition for work will be fierce, but there are a few Aussie companies ideally placed to benefit from this emerging new trend.

To find out more about how to play this trend, keep an eye out for my special report tomorrow.

Regards,

Greg Canavan+,

For The Daily Reckoning

http://www.dailyreckoning.com.au/how-you-can-profit-from-chinas-inv...

-

Comment by Riaz Haq on June 10, 2015 at 8:12am

-

#MSCI review: #Pakistan may rejoin emerging markets in 2016

http://tribune.com.pk/story/901134/msci-review-pakistan-may-rejoin-... …

MSCI, a leading provider of international investment decision support tools, said on Wednesday it may reclassify the MSCI Pakistan Index from ‘Frontier Markets’ to ‘Emerging Markets’ next year.

“We will add the MSCI Pakistan Index to the review list for its potential reclassification to Emerging Markets as part of the 2016 Annual Market Classification Review,” MSCI said.

Global institutional investors use different MSCI indices — such as frontier, emerging, China and US markets – to create balanced portfolios aimed at generating maximum returns while keeping in view their overall risk appetite.

The decision may appear to be a routine reclassification of economies by MSCI, but it has the potential to dramatically change dynamics of the Pakistan equity market: MSCI Emerging Market Index is tracked by global funds worth about $1.7 trillion, according to Bloomberg data.

“Not only the size of passive fund flows will increase, many large Emerging Markets funds may return to Pakistan,” says Topline Securities investment analyst Muhammad Tahir Saeed about the possibility of the elevation of the MSCI Pakistan Index to Emerging Markets next year.

In its brief commentary on the decision, MSCI said most accessibility criteria of the Pakistani equity market meet the MSCI Emerging Markets standards, except for some potential issues with the stability of the institutional framework.

“The Pakistani equity market has grown significantly and its liquidity has greatly improved. As a result, concerns about the potential for failing to meet size and liquidity criteria should there be a negative market event have receded,” MSCI noted.

Pakistan was part of the MSCI Emerging Markets between 1994 and 2008. However, the temporary closure of the Karachi Stock Exchange in 2008 led MSCI to remove it from the Emerging Markets and classify it as a “standalone country index”. MSCI made Pakistan a part of the Frontier Markets Index in May 2009 and it has remained as such since then.

The indexer says the MSCI Pakistan Index may potentially see its number of constituents decrease in the event of its reclassification to the Emerging Markets status. The reason for the reduction in the number of constituents is the application of more stringent ‘investability’ requirements for the MSCI Emerging Markets Index.

Pakistan currently has as many as 16 companies in the MSCI Frontier Markets Index, namely Engro Corporation, Fatima Fertilizers, Fauji Fertilizers, Habib Bank, Hubco, Indus Motor, K-Electric, Lucky Cement, MCB Bank, National Bank, OGDC, Pakistan Oilfields, Pakistan Petroleum, PSO, PTCL and United Bank.

Read: Weekly review: KSE-100 drops 703 points after insider trading probe

Based on a simulation using current data, MSCI believes the number of constituents will decrease from 16 to only six in the case of the possible reclassification. The removal of 10 companies from the index will result in a drop of 32% in its market capitalisation.

Notwithstanding the immediate drop in the index market capitalisation, the possible reclassification is expected to attract greater foreign inflows to the Pakistani equity market. “Although Pakistan’s weight in the Emerging Markets will be small, (the size of) funds tracking Emerging Markets is many times higher than (that of) funds tracking the Frontier Markets,” Tahir said.

-

Comment by Riaz Haq on June 13, 2015 at 9:49pm

-

- By

- QASIM NAUMAN

- The Dolmen City development in Karachi Pakistan.

- Dolmen Group

Investors piled into Pakistan’s first real-estate investment trust, which was launched this week with a public offer that was heavily over-subscribed, the REIT’s lead manager and analysts said on Thursday.

The Dolmen City REIT offered investors a 25% stake in a 22.24 billion rupee ($218.5 million) shopping mall and an office complex at Dolmen City, one of the most prominent real estate developments in Karachi, Pakistan’s largest city and its economic hub. The Arabian Sea-front project includes three other structures not included in the REIT.

Traders and the REIT’s main advisor said the initial offer for 75% of the trust to institutional investors and high net-worth individuals through bookbuilding on Monday and Tuesday drew demand of more than 7 billion rupees for an offering of shares worth 4.17 billion rupees at a floor price of 10 Pakistani rupees ($0.10). At the strike price, the initial offer raised 4.59 billion rupees, according to the REIT’s lead manager.

The remaining 25% of the stake was to be offered to the public on Friday at a strike price of 11 rupees ($0.11). Analysts and the REIT’s management expected the Friday offering to be fully subscribed as well, raising another 1.53 billion rupees.

“The interest rate is at a 42-year low, with the discount rate at 7%, so for people who invest in fixed-income instruments, REITs are attractive,” said Muhammad Tahir Saeed, deputy head of research at Topline Securities, a Karachi-based brokerage.

Pakistan’s economy has improved in recent years, despite political turmoil, major security challenges, and chronic electricity shortages that have hobbled industry. The country’s main stock market in Karachi has gained 72% since the 2013 election and the country’s improving prospects are increasingly being recognized internationally. Prime Minister Nawaz Sharif’s government has said boosting investment is one of its key economic objectives.

- Dolmen Mall Clifton, Pakistan’s largest shopping mall.

- Dolmen Group

With both buildings in the Dolmen City REIT fully occupied, it is expected to yield 9.5% in the first year, with a 10% increase every year based on escalation clauses in tenancy agreements. The development is located next to two of Karachi’s most affluent residential areas.

The Dolmen Mall Clifton, Pakistan’s largest shopping mall, currently has an occupancy rate of over 90%, according to a fact sheet provided by the REIT management. The mall has 130 stores, including foreign outlets such as Debenhams DEB.LN -1.13%, and a multi-level department store.

The neighboring Harbour Front office complex is currently fully occupied, with several high-profile tenants like Procter & Gamble and Engro, one of Pakistan’s largest corporations.

Pakistan’s commercial property sector was described in a first-quarter report this year by Lamudi Pakistan, an online real estate portal, as “almost at a standstill”. But analysts said investors in Pakistan are still keen on real estate as a long-term asset, particularly in properties such as Dolmen City’s Harbour Front with high-profile corporate tenants.

“In the long term there are significant opportunities as prices are low, meaning potential yields are high, and there is considerable room to expand and modernize Pakistan’s stock of commercial real estate,” BMI Research said in a report on the country’s real estate sector earlier this year.

Analysts said the success of the Dolmen City REIT could boost interest in the instrument.

“People were looking at Dolmen and expecting that, if it succeeds, many REITs will be launched in the coming years [in Pakistan],” said Saeed of Topline Securities. “I can foresee some groups [developing shopping malls] jumping into this asset class.”

http://blogs.wsj.com/frontiers/2015/06/12/investors-flock-to-pakist...

-

Comment by Riaz Haq on June 14, 2015 at 7:31am

-

#Pakistan gets a boost with #Moody's rating upgrade to B3, Big REIT launch, #MSCI upgrade review http://on.wsj.com/1GBtiLF via @frontiermarkets

Pakistan had a good week. Index provider MSCI surprised many observers by announcing that the South Asian nation will be included in MSCI’s 2016 review for potential upgrade to emerging markets status.

Later in the week, investors pounced on the opportunity to buy into Pakistan’s first real estate investment trust in a heavily oversubscribed IPO. And ratings agency Moody's MCO -0.04% upgraded the country’s foreign currency ratings to B3 from Caa1, citing “continued strengthening of the external payments position and sustained progress in structural reforms under the government’s program with the IMF.”http://blogs.wsj.com/frontiers/2015/06/13/this-week-on-the-frontier...

Pakistan had a good week. Index provider MSCI surprised many observers by announcing that the South Asian nation will be included in MSCI’s 2016 review for potential upgrade to emerging markets status.

Later in the week, investors pounced on the opportunity to buy into Pakistan’s first real estate investment trust in a heavily oversubscribed IPO. And ratings agency Moody's MCO -0.04% upgraded the country’s foreign currency ratings to B3 from Caa1, citing “continued strengthening of the external payments position and sustained progress in structural reforms under the government’s program with the IMF.”

http://blogs.wsj.com/frontiers/2015/06/13/this-week-on-the-frontier...

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Growing China-Pakistan Space Cooperation

A Pakistani astronaut is scheduled to be the first non-Chinese person to go to Tiangong, the Chinese Space Station, according to media reports. Last year, China put a Pakistani satellite ICUBE-Q aboard its historic Chiang’e 6 mission into the moon’s orbit, designed to retrieve samples from the little explored far side of the moon. Weeks later, Beijing put another Pakistani communication satellite into orbit. The two sides have also announced that China’s Chang’e 8 moon lander mission in 2028…

ContinuePosted by Riaz Haq on March 4, 2025 at 9:50am

Silicon Valley Helping Build Pakistan's Human Capital

Last week I attended a Silicon Valley fundraiser by iCodeGuru, a Pakistani-American group focusing on arranging training and guiding young men and women from underprivileged backgrounds to get full scholarships for advanced STEM (Science, Technology, Engineering and Mathematics) degrees at universities in America. The well-attended event held at Chandni restaurant raised over…

ContinuePosted by Riaz Haq on February 25, 2025 at 10:00am — 2 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network