PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Economy Ranks 23rd in the World

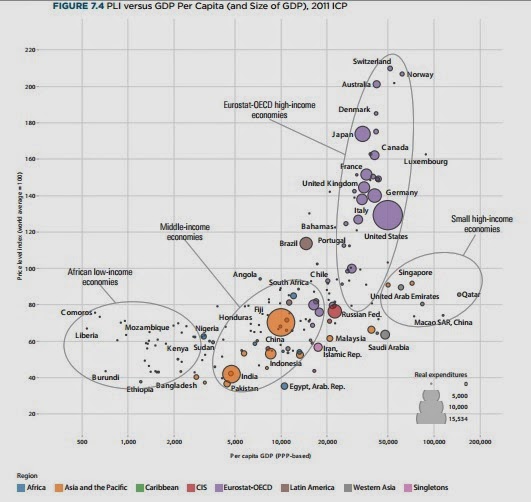

3. Pakistan is the second least expensive country in the world in terms of how much a US dollar can buy there. Egypt is the least expensive.

4. The six largest middle income economies – China, India, Russia, Brazil, Indonesia and Mexico – account for 32.3 percent of world GDP, whereas the 6 largest high income economies – United States, Japan, Germany, France, United Kingdom, and Italy – account for 32.9 percent.

4. Asia and the Pacific, including China and India, accounts for 30 percent of world GDP, Eurostat-OECD 54 percent, Latin America 5.5 percent (excluding Mexico, which participates in the OECD and Argentina, which did not participate in the ICP 2011), Africa and Western Asia about 4.5 percent each.

5. China and India make up two-thirds of the Asia and the Pacific economy, excluding Japan and South Korea, which are part of the OECD comparison.

6. Russia accounts for more than 70 percent of the CIS, and Brazil for 56 percent of Latin America.

7. South Africa, Egypt, and Nigeria account for about half of the African economy.

Here's the list of the top 25 economies in terms of PPP GDP as calculated by International Comparison Program (ICP) 2011:

1. United States $15,534 billion

2. China $13,495 billion

3. India $5,757 billion

4. Japan $4,380 billion

5. Germany $3,352 billion

6. Russia $3,216 billion

7. Brazil $2,816 billion

8. France $2,369 billion

9. United Kingdom $2,201 billion

10. Indonesia $2,058 billion

11. Italy $2,056 billion

12. Mexico $1,895 billion

13. Spain $1,483 billion

15. Canada $1,416 billion

16. Saudi Arabia $1,367 billion

17. Iran $1,315 billion

19. Taiwan $907 billion

20. Thailand $899 billion

21. Egypt $843 billion

22. Poland $838 billion

23. Pakistan $788 billion

24. Netherlands $720 billion

|

| ICP Based GDP Per Capita. Source: World Bank |

|

| Price Level Index Rankings. Source: World Bank |

-

Comment by Riaz Haq on May 15, 2014 at 3:08pm

-

There are 7 Muslim countries among the top 25 economies of the world:

1. Indonesia $2,058 billion #10

2. Saudi Arabia $1,367 billion #16

3. Iran $1,315 billion #17

3. Turkey $1,315 billion #17

4. Egypt $843 billion #21

5. Pakistan $788 billion #23

6. Malaysia $606 billion #25

Rounding up the top 10 Muslim nations are Nigeria ($511 billion), United Arab Emirates (($503 billion), Algeria ($475 billion) and Bangladesh (419 billion).

Top 10 Muslim economies have combined population of 1.1 billion people and their combined GDP is $10.2 trillion, just behind the United States's $15.5 trillion and China's $13.5 trillion GDP.

Source: http://siteresources.worldbank.org/ICPINT/Resources/270056-11833952...

-

Comment by Riaz Haq on May 27, 2014 at 8:23pm

-

Express Tribune: Pak per capita GDP projected at Rs. 160,443 for 2014-15:

The Annual Plan Coordination Committee has recommended setting next year’s economic growth target at 5.1% and of inflation at 8% but cautioned that energy shortages, security situation and additional taxes may pose downside risks to the growth target.

The APCC also recommended setting the investment target at 15.7% of Gross Domestic Product (GDP) against this year’s 14%. The per capita Gross National Product (GNP) is projected at Rs160,443 for the fiscal year 2014-15, commencing from July.

Headed by Minister for Planning, Development and Reforms Ahsan Iqbal, the APCC on Monday cleared the economic framework for the approval of the National Economic Council (NEC). Prime Minister Nawaz Sharif will chair the NEC on May 29 to approve the framework.“The growth targets are subject to risks like deterioration in energy availability, extreme weather fluctuations, non-implementation of envisaged reforms and fiscal profligacy,” noted the APCC. The APCC working paper, prepared by the Planning Commission, carries some quality advice for the Ministry of Finance to bring real improvement in the economic conditions.

It notes that the outlook for 2014-15 portends a significant recovery in growth momentum and trajectory amid wide ranging challenges including persistent energy shortages, supply-side constraints, inefficiencies of production, further reduction in fiscal deficit by mobilizing additional revenues and demand for structural reforms besides security challenges.

“Without bringing improvement in tax collection, investment and increasing exports, the country’s national development agenda remains incomplete,” said Iqbal after the APCC meeting.

The 5.1% growth rate is projected to be achieved with the aid of healthy growth in industry and services sector but a risk remains that growth in the agriculture sector will remain weak in the next fiscal year as well.

The agriculture sector is projected to grow by 3.3%, industry 6.8% and services 5.2%. The large scale manufacturing is projected to grow to 7% next year.

Regaining macroeconomic stability and adequate investment are critical for improved growth prospects, the APCC working paper observed.

The constraining factors such as lack of structural reforms, high fiscal deficit and accommodative monetary policies are no more desirable as they have serious consequences for inflation, balance of payments and foreign exchange reserves, the paper noted.

The government has also pinned down the reasons for below the expectations growth in the outgoing fiscal year.

The growth rate of 4.4% for the outgoing fiscal year was consistent with assumption of slight improvements in energy supplies, normal weather conditions, fiscal adjustments and better investment prospects. Some of these targets could not be achieved, resulting in the subsequent missing of the annual growth target.

“Fiscal situation for 2013-14 faced certain downside risks like shortfall in FBR tax collection and a sharp rise in federal current expenditures on account of more than budgeted expenditures on power subsidies and persistent increase in interest payments”.

It noted that in the outgoing fiscal year, the financing of the modest current account deficit remained challenging and the trade imbalance remained a cause of concern for a sustainable balance of payments.

For the upcoming fiscal, exports are projected to grow by 5.8% to $27 billion from $25.5 billion of this year. Imports during the next year are projected to grow by 6.2% to $44.2 billion, up from $41.6 billion of this year. The trade deficit is projected at $17.2 billion.

The current account deficit is projected at $2.8 billion or 1.1% of the GDP as against deficit of $2.6 billion or 1% of the GDP of this fiscal. The net capital inflows for the next fiscal year are estimated at $5.6 billion as against $4.9 billion of this year.http://tribune.com.pk/story/713508/apcc-recommends-5-1-growth-target/

-

Comment by Riaz Haq on May 31, 2014 at 10:48pm

-

Here's an excerpt of Wall Street Journal report on World Bank ICP 2011:

Like all data, though, there are reasons to treat PPP-based calculations with caution. For one, they are a statistical construction, based on complex surveys of baskets of goods in many countries. The IMF points out here the possible statistical errors. And the ICP notes in Wednesday’s release there’s a margin of error either way of 15% when using its data to compare economies of different sizes.

Some economists believe nominal GDP, by using market exchange rates, better measures what a nation’s people or its companies can buy in international markets.

Then, there’s the big issue of the relative populations of an economy. In many ways, it’s no surprise China, with 1.3 billion people, is catching up with the U.S., whose population is about a quarter the size.

“You’d expect countries with more people to have bigger output,” said Stephen Schwartz, a former International Monetary Fund official who now works as an economist for Moody’s Investors Service in Hong Kong. “In per capita terms, China is still very poor.”

Indeed. Ranking the ICP numbers on a per capita basis, China comes in 99th position. India is at No. 127. The U.S. places 12th, a reflection of its much higher productivity and relative wealth.

http://blogs.wsj.com/economics/2014/04/30/chinas-economy-surpassing...

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Trump Administration Seeks Pakistan's Help For Promoting “Durable Peace Between Israel and Iran”

US Secretary of State Marco Rubio called Pakistan Prime Minister Shehbaz Sharif to discuss promoting “a durable peace between Israel and Iran,” the State Department said in a statement, according to Reuters. Both leaders "agreed to continue working together to strengthen Pakistan-US relations, particularly to increase trade", said a statement released by the Pakistan government.…

ContinuePosted by Riaz Haq on June 27, 2025 at 8:30pm — 4 Comments

Clean Energy Revolution: Soaring Solar Energy Battery Storage in Pakistan

Pakistan imported an estimated 1.25 gigawatt-hours (GWh) of lithium-ion battery packs in 2024 and another 400 megawatt-hours (MWh) in the first two months of 2025, according to a research report by the Institute of Energy Economics and Financial Analysis (IEEFA). The report projects these imports to reach 8.75 gigawatt-hours (GWh) by 2030. Using …

ContinuePosted by Riaz Haq on June 14, 2025 at 10:30am — 3 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network