PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Economic History 1947-2010

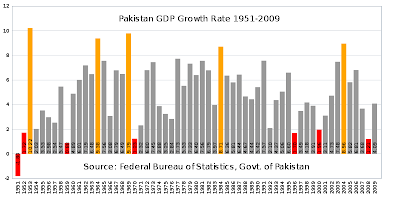

Pakistani economy grew at a fairly impressive rate of 6 percent per year through the first four decades of the nation's existence. In spite of rapid population growth during this period, per capita incomes doubled, inflation remained low and poverty declined from 46% down to 18% by late 1980s, according to eminent Pakistani economist Dr. Ishrat Husain. This healthy economic performance was maintained through several wars and successive civilian and military governments in 1950s, 60s, 70s and 80s until the decade of 1990s, now appropriately remembered as the lost decade.

In the 1990s, economic growth plummeted to between 3% and 4%, poverty rose to 33%, inflation was in double digits and the foreign debt mounted to nearly the entire GDP of Pakistan as the governments of Benazir Bhutto (PPP) and Nawaz Sharif (PML) played musical chairs. Before Sharif was ousted in 1999, the two parties had presided over a decade of corruption and mismanagement. In 1999 Pakistan’s total public debt as percentage of GDP was the highest in South Asia – 99.3 percent of its GDP and 629 percent of its revenue receipts, compared to Sri Lanka (91.1% & 528.3% respectively in 1998) and India (47.2% & 384.9% respectively in 1998). Internal Debt of Pakistan in 1999 was 45.6 per cent of GDP and 289.1 per cent of its revenue receipts, as compared to Sri Lanka (45.7% & 264.8% respectively in 1998) and India (44.0% & 358.4% respectively in 1998).

After a relatively peaceful but economically stagnant decade of the 1990s, the year 1999 brought a bloodless coup led by General Pervez Musharraf, ushering in an era of accelerated economic growth that led to more than doubling of the national GDP, and dramatic expansion in Pakistan's urban middle class.

Per Capita PPP GDP

Pakistan became one of the four fastest growing economies in the Asian region during 2000-07 with its growth averaging 7.0 per cent per year for most of this period. As a result of strong economic growth, Pakistan succeeded in reducing poverty by one-half, creating almost 13 million jobs, halving the country's debt burden, raising foreign exchange reserves to a comfortable position and propping the country's exchange rate, restoring investors' confidence and most importantly, taking Pakistan out of the IMF Program.

The above facts were acknowledged by the current PPP government in a Memorandum of Economic and Financial Policies (MEFP) for 2008/09-2009/10, while signing agreement with the IMF on November 20, 2008. The document clearly (but grudgingly) acknowledged that "Pakistan's economy witnessed a major economic transformation in the last decade. The country's real GDP increased from $60 billion to $170 billion, with per capita income rising from under $500 to over $1000 during 2000-07". It further acknowledged that "the volume of international trade increased from $20 billion to nearly $60 billion. The improved macroeconomic performance enabled Pakistan to re-enter the international capital markets in the mid-2000s. Large capital inflows financed the current account deficit and contributed to an increase in gross official reserves to $14.3 billion at end-June 2007. Buoyant output growth, low inflation, and the government's social policies contributed to a reduction in poverty and improvement in many social indicators". (see MEFP, November 20, 2008, Para 1)

The decade also cast a huge shadow of the US "war on terror" on Pakistan, eventually turning the nation into a frontline state in the increasingly deadly conflict that shows no signs of abating. Along with the blood and gore and chaos on the streets, there are hopeful signs that rule of law and accountability is beginning to prevail in the country with the restoration of representative democracy and independent judiciary, largely in response to an increasingly assertive urban middle class, vibrant mass media and growing civil society.

The Zardari-Gilani government inherited a relatively sound economy on March 31, 2008. It inherited foreign exchange reserves of $13.3 billion, exchange rate at Rs62.76 per US dollar, the KSE index at 15,125 with market capitalization at $74 billion, inflation at 20.6 per cent and the country's debt burden on a declining path. The government itself acknowledged in the same document that "the macroeconomic situation deteriorated significantly in 2007/08 and the first four months of 2008/09 owing to adverse security developments, large exogenous price shocks (oil and food), global financial turmoil, and policy inaction during the political transition to the new government". (Para 3 of the MEFP, November 20, 2008.

Why is it that Pakistani economy has done well under military governments and performed poorly when led by politicians? To put it all in perspective, let's recall how late Dr. Mahbub ul-Haq, the renowned Pakistani economist who is credited with the idea of UNDP's human development index (HDI), explained the corrosive impact of political patronage on economic policy in Pakistan.

In a 10/12/1988 interview with Professor Anatol Lieven of King's College and quoted in a recent book "Pakistan-A Hard Country", here is what Dr. Haq said:

"..every time a new political government comes in they have to distribute huge amounts of state money and jobs as rewards to politicians who have supported them, and short term populist measures to try to convince the people that their election promises meant something, which leaves nothing for long-term development. As far as development is concerned, our system has all the worst features of oligarchy and democracy put together.

That is why only technocratic, non-political governments in Pakistan have ever been able to increase revenues. But they can not stay in power for long because they have no political support...For the same reason we have not been able to deregulate the economy as much as I wanted, despite seven years of trying, because the politicians and officials both like the system Bhutto (Late Prime Minister Zulfikar Ali Bhutto) put in place. It suits them both very well, because it gave them lots of lucrative state-sponsored jobs in industry and banking to take for themselves or distribute to their relatives and supporters."

Here is how Pakistani economist and NUST Professor Ashfaque Husain Khan explains the current situation:

What went wrong? Why one of the fastest growing economies in the Asian region until two years ago has been totally forgotten in the region? Firstly, the speed and dimension of exogenous price shocks (oil and food) were of extraordinary proportions. Secondly, the present government found itself totally ill-prepared and clueless in addressing the challenges arising out of the shocks. While rest of the world was taking corrective measures and adjusting to higher food and fuel prices, Pakistan lurched from one crisis to another.

Despite peaceful election and a smooth transition to a new government, political instability persisted. For a protracted period there were no finance, commerce, petroleum and natural resources and health ministers in the country. The government lost six precious months in finding its feet. It gave the impression of having little sense of direction and purpose. A crisis of confidence intensified as investors and development partners started to walk away. The stock market nosedived, capital flight set in, foreign exchange reserves plummeted and the Pakistani rupee lost one-third of its value. In short, Pakistan's macroeconomic vulnerability had grown unbearable. It had no option but to return to the IMF for a bailout package. There were no Plan A, B and C. There was only one plan, that is, to return to the IMF.

While the country was moving rapidly towards the IMF, the ministry of finance had prepared the plan to bring $4 billion by June 30, 2008 through four transactions. A kick-off meeting was scheduled on April 23, 2008 at the ministry to give a final touch to the various roadshows. These transactions were canceled on April 20, 2008. Who ordered the cancellation of $4 billion transaction? This cancellation prompted balance of payment crisis and the rest became history.

The economy continues to remain in intensive care unit and is barely breathing thanks to the injection of funds from the IMF, World Bank and Asian Development Bank. The economy is not on the radar screen of the government and as such the economic managers have no relevance in the current political set up. The exit of Shaukat Tarin is a classic example. At least he tried his best to inject financial discipline but paid the price of teaching prudent financial management.

Since Tarin's departure, Abdul Hafeez Shaikh has assumed the position of finance minister. It is still early to judge him, as the economy has suffered yet another major jolt from the widespread devastation caused by recent floods. This has added to the already extreme challenge Pakistan's leadership faces in bringing political and economic stability to the nation.

Here's a video titled "I Am Pakistan":

Related Links:

Haq's Musings

Ishrat Husain: Structural Reforms in Pakistan's Economy

Role of Politics in Pakistan Economy

Pakistan's Economic Performance 2008-2010

Incompetence Worse Than Corruption in Pakistan

Pakistan's Circular Debt and Load Shedding

US Fears Aid Will Feed Graft in Pakistan

Pakistan Swallows IMF's Bitter Medicine

Shaukat Aziz's Economic Legacy

Pakistan's Energy Crisis

Karachi Tops Mumbai in Stock Performance

India Pakistan Contrasted 2010

Pakistan's Foreign Visitors Pleasantly Surprised

After Partition: India, Pakistan and Bangladesh

The "Poor" Neighbor by William Dalrymple

Pakistan's Modern Infrastructure

Video: Who Says Pakistan Is a Failed State?

India Worse Than Pakistan, Bangladesh on Nutrition

UNDP Reports Pakistan Poverty Declined to 17 Percent

Pakistan's Choice: Talibanization or Globalization

Pakistan's Financial Services Sector

Pakistan's Decade 1999-2009

South Asia Slipping in Human Development

Asia Gains in Top Asian Universities

BSE-Key Statistics

Pakistan's Multi-Billion Dollar IT Industry

India-Pakistan Military Comparison

Food, Clothing and Shelter in India and Pakistan

Pakistan Energy Crisis

IMF-Pakistan Memorandum of Economic and Financial Policies

-

Comment by Riaz Haq on November 17, 2021 at 11:13am

-

From Musharraf to the PTI

https://www.thenews.com.pk/print/384431-from-musharraf-to-the-pti

To separate fact from fiction, key economic indicators need to be analysed. Musharraf increased reserves from $1.9 to $11.4 billion. The PPP left $7.2 billion. The PML-N reached a record high of $19.4 billion but ended at $10 billion in FY18. Reserves were $8.3 billion on October 5, 2018. No government could avert the IMF. The PTI may borrow $15 billion.Musharraf increased the current account deficit from 0.7 percent of GDP to 4.2 percent. The PPP reduced it drastically from 8.2 percent to 1.1 percent. The PML-N ended at 5.8 percent ($18 billion) in FY18. In July 2018 it was 8.3 percent ($2.2 billion) and in August 2.3 percent ($0.6 billion) – a big drop. The dollar-rupee rate increased from 52 to 61, a 17 percent increase when Musharraf left. The PPP increased it by 61 percent to 98. The PML-N increased it by 24 percent to 121. In October 2018, it is 133.

Musharraf increased trade deficit from 2.1 percent of GDP to 8.9 percent. The PPP maintained it at 8.9 percent. The PML-N ended at 9.9 percent ($31 billion). In July 2018 it was 13.6 percent ($3.5 billion) and in Aug 9.2 percent ($2.4 billion). Exports reached a high of 13.5 percent of GDP during Musharraf’s period but ended at 11 percent. The PPP remained at 10.6 percent while the PML-N managed 7.9 percent ($25 billion). In August 2018 it was 8 percent ($2 billion).

Exports are limited to textiles (55 percent) and rice (8 percent). Dawood Razak’s target is $25 billion. Imports rose from 15 percent to 20 percent of GDP during Musharraf’s government. The PPP reduced them to 19.4 percent and the PML-N reduced it further to 18 percent ($56 billion). In August 2018 it was 17.3 percent ($4.5 billion).

Remittances were $5.5 billion in Musharraf’s term. They increased to $14 billion in the PPP’s time and $20 billion in the PML-N’s. Remittances growth dropped drastically to one percent in FY18 from double digits. Imran Khan’s target of $40 billion seems unrealistic. FDI increased from $120 million to $5 billion during Musharraf’s term. In the PPP’s time it dropped to $1.3 billion and in the PML-N’s to $2.8 billion. Pakistan’s Doing Business ranking dropped from 76th in 2007 to 147th in 2017. KSE100 Index has dropped 11.6 percent since August 20 this year. The PTI will need to address the prevailing economic and political uncertainty.

Musharraf increased GDP to 5.5 percent peaking at 9 percent. In FY09 it dropped it to 0.4 percent but the PPP ended with 3.7 percent. The PML-N managed 5.8 percent. The IMF has dampened the PTI’s grand plans with a growth rate of 3 percent, policy rate at 15 percent and inflation at 14 percent. Musharraf reduced the budget deficit from 4.9 percent to 4.1 percent of GDP. The PPP increased it from 7.3 percent to 8.2 percent. The PML-N ended at 6.6 percent (legal limit 4 percent) and borrowed Rs2,260 billion in FY18.

During Musharraf’s period, government expenditure financed through borrowing was 22 percent, PPP 36 percent, PML-N 27 percent. The tax-to-GDP ratio declined from 9.5 percent during Musharraf’s period to 8.7 percent in the PPP’s time. The PML-N increased it to 11.2 percent (Rs3,842 billion). The IMF has proposed 15 percent, a daunting task. Agriculture – with 19 percent share in GDP – contributes only one percent to taxes.

Gross public debt during Musharraf’s time dropped from 79 percent of GDP (Rs3,018 billion) to 53 percent (Rs4,846 billion) in FY07. The PPP increased it from 58 percent (Rs6,128 billion) to 64 percent (Rs14,292 billion) in FY13. The PML-N reached 73 percent (Rs24,952 billion).

PSE debt was Rs220 billion in June 2007 (16 percent of total). The PPP added Rs276 billion (20 percent), while the PML-N increased it by Rs898 billion (64 percent) to end at Rs1,393 billion.

-

Comment by Riaz Haq on November 17, 2021 at 11:13am

-

From Musharraf to the PTI

https://www.thenews.com.pk/print/384431-from-musharraf-to-the-pti

The IMF recommends privatisation. PIA’s accumulated losses from 1998 to 2007 were Rs23 billion (6 percent). The PPP added Rs119 billion (33 percent) while the PML-N added Rs222 billion (61 percent) to end at about Rs364 billion. It is difficult to imagine PIA competing with Gulf airlines. Steel Mills profit were Rs9.5 billion during Musharraf’s time. The PPP recorded a loss of Rs119 billion; the PML-N increased it by Rs81 billion to Rs200 billion.

Oil prices increased from $25 in Dec 1999 per barrel to $90 by Dec 2007 (313 percent increase) during Musharraf’s period. The PPP faced over $90 in their term. The average in the PML-N’s time was $55. The PTI started at $73 but is now faced with $85. Gasoline’s average price increased from Rs26/litre to Rs56 (115 percent increase) during Musharraf’s period. The PPP increased it to Rs101 (80 percent) but the PML-N decreased it to Rs78 (-23 percent). In October this year, it increased to Rs93 (19 percent).

The total installed capacity increased to 29,573 MW by February 2017. In this, Musharraf’s contribution is 16 percent, PPP 28 percent and PML-N 56 percent. Considering the last four years of each government, Musharraf’s contribution was 30 percent, PPP 32 percent and PML-N 38 percent in electricity generation. In 2006, the circular debt was Rs87 billion. In August 2018, it was Rs1,200 billion. Musharraf added Rs145 billion (12.6 percent), PPP Rs727 billion (63.2 percent) and PML-N Rs279 billion (24.2 percent). No government has found a solution.

There is no doubt that the economy has been mismanaged. Past governments have been facing similar economic circumstances and governance realities as the PTI, whose main problem is tackling the expectations of its voters. International agencies are also culprits of the mess due to their propensity to provide loans for perpetuating poor governance and corruption. After signing the agreement with the IMF, the PTI’s 100-day agenda and election promises will be compromised. The new captain, the IMF, will carry out a heart transplant as it is not satisfied with Asad Umar’s bypass. ‘IMF ka Pakistan’ will replace ‘Naya Pakistan’.

The writer is a former member of the National Reconstruction Bureau.

Email: riazkhancrm@msn.com

-

Comment by Riaz Haq on November 23, 2021 at 4:08pm

-

Pakistanis are less miserable than Indians in the economic sphere, according to the Hanke Annual Misery Index (HAMI) published in early 2021 by Professor Steve Hanke. With India ranked 49th worst and Pakistan ranked 39th worst, both countries find themselves among the most miserable third of the 156 nations ranked. Hanke teaches Applied Economics at Johns Hopkins University in Baltimore, Maryland. Hanke explains it as follows: "In the economic sphere, misery tends to flow from high inflation, steep borrowing costs, and unemployment. The surefire way to mitigate that misery is through economic growth. All else being equal, happiness tends to blossom when growth is strong, inflation and interest rates are low, and jobs are plentiful". Several key global indices, including misery index, happiness index, hunger index, food affordability index, labor force participation rate, ILO’s minimum wage data, all show that people in Pakistan are better off than their counterparts in India.

http://www.riazhaq.com/2021/11/misery-index-whos-less-miserable-ind...

-

Comment by Riaz Haq on September 20, 2022 at 10:54am

-

India’s economy has outpaced Pakistan’s handily since Partition in 1947 – politics explains why.

By Surupa Gupta

Professor of Political Science and International Affairs, University of Mary Washington

https://theconversation.com/indias-economy-has-outpaced-pakistans-h...

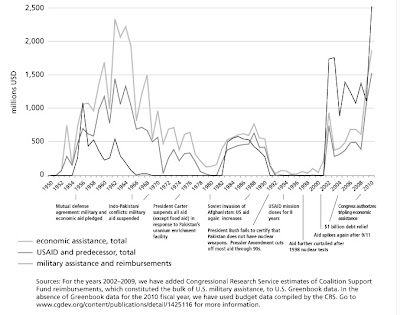

Pakistan's economy grew at a faster pace than India's from the 1960s through 1980s thanks in large part to generous outside aid and cheap loans, as well as more foreign trade...... The growth script flipped in the 1990s, with India growing at a 6% rate over the next 30 years, outpacing Pakistan’s 4%.

-------------

What explains the role reversal (starting in 1990s)? Economics and politics both played a part.

Pakistan has long relied on external sources of funding more than India has, receiving $73 billion in foreign aid from 1960 to 2002. And even today, it frequently relies on institutions such as the International Monetary Fund for crisis lending and on foreign governments like China for aid and infrastructure development.

The aid has allowed Pakistan to postpone much-needed but painful reforms, such as expanding the tax base and addressing energy and infrastructure problems, while the loans have saddled the country with a large debt. Such reforms, in my view, would have put Pakistan on a more sustainable growth path and encouraged more foreign investment.

While India also got a fair amount of support from international aid groups and a few countries such as the U.S. earlier in its existence, it never depended upon it – and has relied less on it in recent decades. In addition, in 1991, India liberalized trade, lowered tariffs, made it easier for domestic companies to operate and grow, and opened the door to more foreign investment.

These reforms paid off: By integrating India’s economy to the rest of the world, the reforms created market opportunities for Indian companies, made them more competitive, and that, in turn, led to higher growth rates for the overall economy.

Another way to measure the different paths is in gross domestic product per person. In 1990, India and Pakistan had almost identical per-capita GDPs, a little under $370 per person. But by 2021, India’s had surged to $2,277, about 50% higher than Pakistan’s.

The reasons for their different choices have a lot to do with politics.

Pakistan has suffered from near-constant political instability. From 1988 to 1998 alone, it had seven different governments as it alternated between civilian and military governments following coups. This discouraged foreign investment and made it much harder to make reforms and follow through on them. Through all these changes, Pakistan’s military spending as a share of its GDP remained higher than India’s during the entire post-independence period.

India, on the other hand, has managed to maintain a steady democracy. Though it’s far from perfect, it has kept leaders more accountable to the people and led to more inclusive growth and less reliance on foreign institutions or governments. In one decade alone, India lifted over 270 million people out of poverty.

At a time when democracy is under threat in so many parts of the world, this history, in my view, reminds us of the value of democratic institutions.

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Indian Military Begins to Accept Its Losses in "Operation Sindoor" Against Pakistan

The Indian military leadership is finally beginning to slowly accept its losses in its unprovoked attack on Pakistan that it called "Operation Sindoor". It began with the May 31 Bloomberg interview of the Indian Chief of Defense Staff General Anil Chauhan in Singapore where he admitted losing Indian fighter aircraft to Pakistan in an aerial battle on May 7, 2025. General Chauhan further revealed that the Indian Air Force was grounded for two days after this loss. …

ContinueTrump Administration Seeks Pakistan's Help For Promoting “Durable Peace Between Israel and Iran”

US Secretary of State Marco Rubio called Pakistan Prime Minister Shehbaz Sharif to discuss promoting “a durable peace between Israel and Iran,” the State Department said in a statement, according to Reuters. Both leaders "agreed to continue working together to strengthen Pakistan-US relations, particularly to increase trade", said a statement released by the Pakistan government.…

ContinuePosted by Riaz Haq on June 27, 2025 at 8:30pm — 5 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network