PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Among Top 10 Countries With Fastest Growing Ultra-Rich Population

Pakistan is among the countries with top 10 fastest growing population of ultra-high net-worth (UHNW) individuals over the last 5 years. Bangladesh with 17.3% UHNW growth tops the list followed by China (13.4%), Vietnam (12.7%), Kenya (11.7%), India (10.7%), Hong Kong (9.3%), Ireland (9.1%), Israel (8.6%), Pakistan (8.4%) and United States (8.1%), according to World Ultra Wealth Report 2018.

Ultra-Rich Definition:

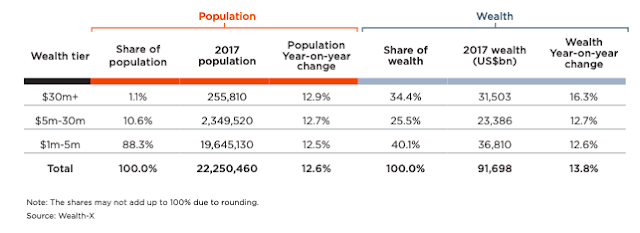

The report compiled by Wealth-X defines ultra-high net-worth (UHNW) as an exclusive group of wealthy individuals located across the globe, each with a net worth of $30m or more. Only the top 1.1% of the world's 22.25 million millionaires qualify for inclusion in UHNW group.

Here's an excerpt of the Wealth-X report:

"According to Wealth-X estimates of global private wealth, the number of individuals with net assets of more than $1million totaled 22.3 million in 2017, with a combined net worth of $91.7 trillion. A breakdown by tier shows not only the considerable share of wealth held by the small cohort of UHNW individuals, but also that the ultra wealthy experienced faster growth in net worth than each of the three lower tiers. Almost 90% of all millionaires had a net worth of between $1m and $5m, with this group of 19.6 million individuals holding a 40% share of global millionaire wealth. Exclusivity rises significantly above the $5m threshold, as does average net worth. For example, those individuals with net assets of between $10m and $30m – the closest to attaining UHNW status – held 14% of global millionaire wealth, while accounting for a 3.6% share of the population. Rising higher still, the global ultra wealthy population accounted for just 1.2% of the world’s millionaires but held 34% of the collective wealth. Whereas population growth rates across the different wealth tiers were very similar in 2017, an increase of 16.3% in total UHNW wealth significantly outpaced the average rise of around 12.7% in each of the other three tiers."

Credit Suisse Wealth Report:

Wealth-X report ranks Pakistan 9th in terms of ultra-rich individuals' growth while Bangladesh is ranked first and India ranked 5th. The relatively slower growth of ultra-rich in Pakistan is supported by other wealth reports as well. For example, data released by Credit Suisse with its Global Wealth Report 2017 shows that Pakistan is the most egalitarian nation in South Asia. It also confirms that the median wealth of Pakistani households is three times higher than that of households in India.

Wealth Inequality:

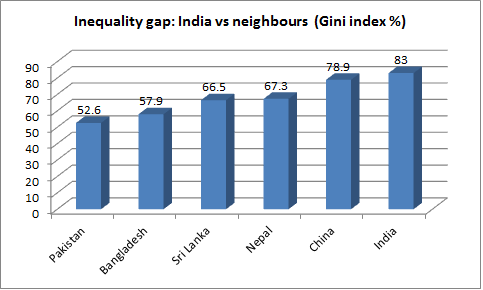

Inequality is measured in terms of Gini index. It ranges from 0% for perfect equality (when everyone has the same wealth) to 100% for total inequality (when all of the wealth is owned by one person). On this scale, Pakistan’s Gini index is 52.6%, Bangladesh’s 57.9%, Sri Lanka’s 66.5%, Nepal’s 67.3%, China’s 78.9% and India's 83%.

Household Wealth:

Here is per capita wealth data for India and Pakistan as of mid-2017, according to Credit Suisse Wealth Report 2017 released recently.

Pakistan average wealth per adult: $5,174 vs India $5,976

Pakistan median wealth per adult: $3,338 vs India $1,295

Average household wealth in Pakistan is $15,522 (3 adults) vs India $14,940 (2.5 adults)

Median household wealth in Pakistan is $10,014 (3 adults) vs India $3,237 (2.5 adults)

Pakistan Gini Index 52.6% vs India 83%

Ownership of Appliances and Vehicles:

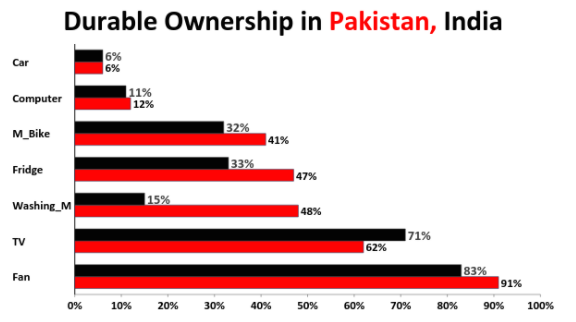

Growing household wealth in developing nations like India and Pakistan is reflected in ownership of consumer durables like computers, home appliances and vehicles. This data is sourced from periodic household surveys like NSS (National Sampling Survey) in India and PSLM (Pakistan Social and Living Standards Measurement) in Pakistan.

India-Pakistan Comparison:

Dr. Jawaid Abdul Ghani, a professor at Karachi School of Business Leadership, has recently analyzed household surveys in India and Pakistan to discover the following:

1. As of 2015, car ownership in both India and Pakistan is about the same at 6% of households owning a car. However, 41% of Pakistani household own motorcycles, several points higher than India's 32%.

2. 12% of Pakistani households own a computer, slightly higher than 11% in India.

3. Higher percentage of Pakistani households own appliances such as refrigerators (Pakistan 47%, India 33%), washing machines (Pakistan 48%, India 15%) and fans (Pakistan 91%, India 83%).

4. 71% of Indian households own televisions versus 62% in Pakistan.

Growth over Time:

Dr. Abdul Ghani has also analyzed household data to show that the percentage of Pakistani households owning washing machines has doubled while car and refrigerator ownership has tripled and motorcycle ownership jumped 6-fold from 2001 to 2014.

Income/Consumption Growth in Pakistan. Source: KSBL |

Rapid Income Growth:

Rising ownership of durables in Pakistan has been driven by significant reduction in poverty and growth of household incomes, according to Dr. Abdul Ghani's research. Percentage of households with per capita income of under $2 per day per person has plummeted from 57% in 2001 to 7% in 2014. At the same time, the percentage of households earning $2 to $10 per day per person has soared from 42% of households in 2001 to 87% of households in 2014. The percentage of those earning over $10 per day per person has jumped 7-fold from 1% of households in 2001 to 7% of households in 2014.

Summary:

Pakistan is among the countries with top 10 fastest growing population of ultra-high net-worth (UHNW) individuals over the last 5 years. Bangladesh with 17.3% UHNW growth tops the list followed by China (13.4%), Vietnam (12.7%), Kenya (11.7%), India (10.7%), Hong Kong (9.3%), Ireland (9.1%), Israel (8.6%), Pakistan (8.4%) and United States (8.1%), according to World Ultra Wealth Report 2018. Credit Suisse wealth data for 2017 shows that Pakistan has the lowest wealth inequality in its region as measured by Gini index. Lower inequality can be seen in terms of rising percentage of households that can afford to buy durables like appliances and vehicles as reported by Dr. Abdul Ghani of Karachi School of Business and Leadership (KSBL).

Related Links:

Pakistan Wealth Inequality Lowest in South Asia

2018 Year-end Review of Science and Technology in Pakistan

Remittances From Pakistan Diaspora Jumped 21X Since Year 2000

Pakistan's Middle Class Larger and Richer Than India's

Pakistan Translates GDP Growth to Citizens' Well-being

-

Comment by Riaz Haq on June 19, 2019 at 10:15am

-

Where is the gold stock coming from?

Afshan SubohiUpdated December 24, 2018

https://www.dawn.com/news/1453328

According to a document forwarded by Iqbal Tabish, CEO, Pakistan Gems and Jewellery Development Company, the annual value of the national jewellery market is worth $10 billion or Rs1.4 trillion at the current exchange rate.

The annual consumption of gold is stated to be 170 tonnes. The WGC document claims that the sector employs 0.53 million people in about 90,000 units countrywide. It reports $4.058bn export of jewellery over 10-year period (2006-07 to 2016-17) that comes to around $400m of export per annum.

Mr Tabish clarified that the company is vested with the task of promoting the sector by providing skills training facilities and working towards globally accepted standardisation of gold quality in the country, to build brand credibility in the international market.

Defending the company that was launched in 2006, he said it has since established five training centres, five gem identification labs, two assaying and hallmarking centres, two gem exchanges and organised various trade shows.

“We have made these facilities operational but do not have a mandate to force gold traders to register or trade locally and globally only in gold hallmarked by the competent agency,”

-

Comment by Riaz Haq on June 19, 2019 at 10:25am

-

Investment in prize bonds more than doubles to Rs814bln in last five years

https://www.thenews.com.pk/print/329778-investment-in-prize-bonds-m...

Investment in prize bonds more than doubled to Rs814 billion during the past five years of Pakistan Muslim League (Nawaz) government, the central bank's data showed, as tax-saving investors preferred the avenue alternative to banking deposits.

The State Bank of Pakistan’s (SBP) latest data showed that investment in prize bonds stood at Rs814 billion as of March compared with Rs388 billion in June 2013. Investment in prize bonds sharply rose to Rs518 billion in June 2015 after the government slapped taxes on all the banking transactions, especially on non-filers to increase documentation of the economy.

A senior financial analyst said investment in prize bonds sharply increased after the past government enhanced withholding tax scope to broaden tax base.

In June 2015, the withholding tax rate on cash withdrawal of Rs50,000/day by non-filers of tax returns increased to 0.6 percent, while it was kept unchanged at 0.3 percent for filers. The government brought down withholding tax to 0.4 percent from 0.6 percent on non-filers following strong protest by small business men, retailers and wholesalers.

The SBP’s statistical bulletin showed that investment in prize bonds were around Rs130 billion during the first two years (2013 to 2015) of the previous government, which appeared to be a normal trend.

“But since June 2015, parking of funds in bearer certificates increased sharply, which showed that dealers, traders, small business men and other retailers shifted their focus to trade in government securities and prize bonds,” an analyst said. Analysts said the act of the government to document the economy was a step in the right direction.

“It will take a long time; although it aroused interest in prize bonds, especially the big ticket prize bonds,” an analyst said. The central bank’s data showed that investment in prize bond of Rs40,000 increased to Rs229 billion from Rs99 billion during the last five years. Prize bond of Rs25,000 attracted Rs141 billion as compared to Rs40 billion. Prize bond with face value of Rs15,000 saw an increase in investment to Rs145 billion from Rs70 billion. Prize bond of Rs7,500 received inflows of Rs76 billion as compared to Rs48 billion and prize bond of Rs1,500 witnessed an increase in investment to Rs92 billion from Rs56 billion during the period under review.

Analysts said growth of investment in prize bonds was interplay of tightening measures of the government to increase documentation as well as rise in per capita income and economic growth.

An analyst said banking deposits would have surpassed Rs12 trillion if taxes were not introduced.

“Usually, middle class community buys prize bonds to get rich overnight, but now it has appeared to be safe haven for the people thanks to the policies of the previous government which introduced several measures to arrest ever-increasing black economy,” an analyst said.

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

International Schools: Pakistan Ranks Among Top 5 Countries in the World

Pakistan ranks among the top 5 nations in terms of international schools offering schooling based on International Baccalaureate (IB) and IGCSE (Cambridge) curricula. China leads with 1,000 international schools, followed by India (900), UAE (784), Pakistan (598) and Brazil (415). The medium of instruction in these schools is English. …

Posted by Riaz Haq on April 19, 2025 at 8:00am

Pakistan Minerals Investment Forum Draws Interest of Global Investors

Pakistan's mineral resources, estimated to be over $6 trillion, attracted global investor interest at the Pakistan Minerals Investors Forum 2025 (PMIF2025) held recently in Islamabad on April 8th and 9th. It was attended by major international companies and government officials from Australia, Canada, China, Saudi Arabia, Turkiye, the US and other nations. …

ContinuePosted by Riaz Haq on April 12, 2025 at 11:30am — 3 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network