PakAlumni Worldwide: The Global Social Network

The Global Social Network

Massive Oil Discovery in Pakistan: Hype vs Reality

Prime Minister Imran Khan has recently raised Pakistanis' hopes of ExxonMobil and ENI being on the verge of a massive discovery of offshore oil and gas reserves in Pakistan. Is this real? Or mostly hype? What is the size of these reserves? Will it be more than sufficient to meet Pakistan's current needs of over 200 million barrels of oil per year? Will Pakistan become a net exporter of oil and gas like major OPEC nations?

Top 3 Offshore Drilling Sites in Asia-Pacific. Source: Bloomberg |

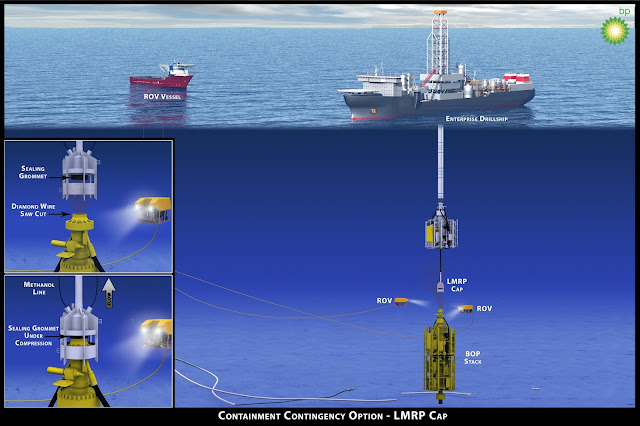

Why is it taking so long to get confirmation from the companies involved? What are the technical issues in getting confirmation of these huge reserves? Why is there such a big concern about blow-out? Is it because the 1.5 billion barrels pre-drill estimate of Kekra-1 well in block G of the Indus basin off the Karachi coast? Could such a large reserve cause a major blow-out accident like the one British Petroleum had in Gulf of Mexico near Louisiana in the United States? How long will it take to fix the blow-out preventer (BOP) and complete drilling of the remaining 600-800 meters of the total depth of over 5,500 meters deep in the Arabian Sea?

Offshore Blowout Preventer Stack. Courtesy: British Petroleum |

Azad Labon Kay Sath host Faraz Darvesh discusses these questions with Misbah Azam and Riaz Haq (www.riazhaq.com)

Related Links:

Pakistan's Insatiable Appetite For Energy

US EIA Estimates of Oil and Gas in Pakistan

Can Pakistan Avoid Recurring IMF Bailouts?

Pakistan is the 3rd Fastest Growing Trillion Dollar Economy

CPEC Financing: Is China Ripping Off Pakistan?

Information Tech Jobs Moving From India to Pakistan

Methane Hydrate Release After Balochistan Quake

-

Comment by Riaz Haq on September 17, 2024 at 9:36am

-

USGS: Pakistan Mining Industry 2019

https://pubs.usgs.gov/myb/vol3/2019/myb3-2019-pakistan.pdf

------

2018. In fiscal year 2019 (July 1, 2018, through

June 30, 2019), the mining and quarrying sector contributed

2.6% of the GDP and the growth rate of the mining and

quarrying sector was negative 1.96% compared with 7.72% in

fiscal year 2018 (International Monetary Fund, 2020; State Bank

of Pakistan, 2020a, p. 18–19; 2020b, p. 8; 2020d, p. 3).

The total import value in fiscal year 2019 was $54.8 billion

compared with $60.8 billion in fiscal year 2018. The import

value of mineral fuels, oils, and their distillation products was

$16.0 billion; iron and steel, $3.38 billion; articles of iron or

steel, $840 million; and aluminum and articles of aluminum,

$349 million. The total export value in fiscal year 2019 was

$23.0 billion compared with $23.2 billion in fiscal year 2018.

The export value of mineral fuels, oils, and their distillation

products was $477 million; salt, sulfur, lime, and stone,

$463 million; and copper and articles of copper, $269 million

(State Bank of Pakistan, 2020c, p. 123–124).

---------

In 2019, the production of lignite was estimated to have

increased by 180%; lead (mine, Pb content), by 68%; feldspar,

by 61%; chromium (mine, Cr2

O3

content), by 46%; zinc (mine,

Zn content), by 39%; talc, by 38%; lead (secondary, refinery),

by 33% (reported); soda ash, by 27%; bentonite, by 24%;

kaolin, by 17%; and sand and gravel (industrial, silica), by 12%.

In contrast, the production of fuller’s earth was estimated to

have decreased by 85%; dolomite, by 57%; bauxite, by 49%;

iron oxide pigment, by 47%; magnesite, by 39%; sulfur (native),

by 38%; pumice, by 33%; raw steel, by 30% (reported);

limestone, by 22%; iron (mine, Fe content) and phosphate rock

(gross weight), by 20% each; barite, by 15%; sand and gravel

(industrial, unspecified), by 13%; rock salt, by 12%; and quartz,

--------

Copper and Gold.—In 2019, Metallurgical Corporation

of China Ltd. (MCC) applied for an extension of its mining

license for the Saindak copper-gold mine, which was set to

expire in 2022. MCC operated the Saindak Mine through a

50%-owned subsidiary, Saindak Metals Ltd. The company

produced 13,049 metric tons (t) of copper (mine, Cu content)

in 2019, which was an increase of 4.1% from the 12,538 t

produced in 2018. MCC mined mainly the south and north ore

bodies using open pit mining; the deposits were expected to be

depleted of minable resources after 2021. The east ore body of

the mine was estimated to have 278 million metric tons (Mt)

of ore and an expected mine life of 19 years. The exports of

copper and articles thereof from Pakistan to China increased to

$550 million in 2019 from $106 million in 2016

----------

Natural Gas.—Pakistan was in the process of building five

liquefied natural gas (LNG) terminals that were expected to

start operation in 2021 or 2022. The new terminals would triple

Pakistan’s LNG imports and help lessen the gas shortage in

the country. Pakistan had been subject to shortages of natural

gas for power generation, fertilizer production, and household

usages owing to the country’s inability to supply enough gas

from domestic resources, its aged distribution network, and the

difficulty in sourcing LNG cargoes (Nickel, 2019; Abbasi, 2020;

Mohanty and others, 2021).

Petroleum.—Eni Pakistan Ltd. (owned by Eni S.p.A. of Italy,

as operator), Exploration and Production Pakistan BV, Oil and

Gas Development Co., and Pakistan Petroleum Ltd. each held a

25% interest in the Kekra-1 well of the Indus Block G. In 2019,

the consortium ended exploration at the Kekra-1 well after

no reserves of petroleum were found (Hassan, 2019; Rarrick,

2019).

Comment

- ‹ Previous

- 1

- 2

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

PFX to Advance Pakistan Air Force Modernization

Pakistan has unveiled its PFX (Pakistan Fighter Experimental) program as a significant upgrade to its JF-17 joint program with China. The new upgrade will have a number of stealth features ranging from the use of radar-absorbing composite materials and diverterless supersonic inlets (DSI) to internal weapons bay (IWB) which will significantly reduce the aircraft's radar signature. It is targeted for completion by the end of this decade. In addition, the PFX's twin-engine design will improve…

ContinuePosted by Riaz Haq on January 20, 2025 at 1:00pm

Pakistan to License Multiple LEO Satellite Internet Service Providers

The Pakistan government is preparing to license three low-earth-orbit (LEO) satellite operators for space communication services in the country, according to media reports. The companies whose applications are pending include London-based OneWeb, China's Shanghai Spacecom and US headquartered Starlink. They operate tens of thousands of small mass-produced satellites in low orbits that communicate with designated (mobile and stationary) ground stations. Each LEO satellite circles the earth…

ContinuePosted by Riaz Haq on January 15, 2025 at 1:30pm — 2 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network