PakAlumni Worldwide: The Global Social Network

The Global Social Network

Lower Import Duties Rattle Pakistan's Mobile Handset Makers

Pakistan Federal Board of Revenue has recently announced that “Sales Tax and Income Tax at import stage has been drastically reduced in case of smartphones of Rs15,000 or below". This action was apparently taken after Digital Pakistan Initiative led by Tania Aidrus asked for it. It has come under fire from the country's nascent mobile phone and smartphone manufacturing industry which is producing low-cost mobile phones. Pakistan's mobile handset market is the 8th largest in the world. Current annual demand is for about 40 million units of which 13 million are assembled in Pakistan while the rest are imported, according to a report by Dunya News. The import bill for Fiscal Year 2020 is expected to be about $1.2 billion. Boosting it will save billions of dollars of precious foreign exchange. It will create tens of thousands of jobs and spawn new auxiliary manufacturing industries for chargers, headphones, USB cables, cases, etc. In future, Pakistan could become a significant exporter of mobile handsets.

Mobile Phone Demand:

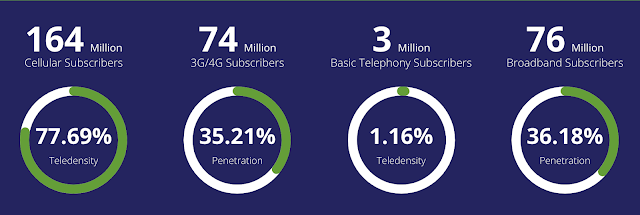

There are currently 164 million mobile phone users in Pakistan, the 8th largest in the world. The current annual demand for mobile phones in the country is estimated at about 40 million units, according to Pakistan Telecommunication Authority (PTA). The fastest growing demand is for 4G smartphones.

According to Pakistan Bureau of Statistics, mobile-phone imports (HS Code: 8517.1219) reached $498 million in 5 months period from July to November 2019, 64% jump over the prior year. Fiscal 2019-20 imports are expected to reach $1.2 billion.

Earlier, the growth rate for 4G handsets jumped from 16% in 2018 to 29% in 2019. Imports of mobile handsets soared 69% from $ 364 million in 2018 to $ 615.7 million in 2019. Pakistan is world's seventh largest handset importer and the 8th largest mobile phone market.

Domestic Manufacturing:

Pakistan Telecommunication Authority (PTA) has granted permission to 26 local companies for manufacturing out of which 15 are currently in production. Among those currently producing mobile handsets in Pakistan are: E-Tachi, GFive, Haier, Infinix and Tecno. They are producing 13 million mobile phones.

Domestic manufacturers claim that they can meet 80% of demand for mobile handsets over the next 2 to 3 years if they are sufficiently protected by higher tariffs on imports.

Domestic mobile phone manufacturing industry will save billions of dollars of precious foreign exchange. It will create tens of thousands of jobs and spawn new auxiliary manufacturing industries for parts, chargers, headphones, USB cables, cases, etc. In future, Pakistan could become a significant exporter of mobile handsets.

Summary:

Pakistan's mobile handset market is the 8th largest in the world. Current annual demand is for 40 million units. Domestic plants produce 13 million units while the rest are imported. The import bill for Fiscal Year 2020 is expected to be about $1.2 billion. The country's nascent mobile handset manufacturing industry fears a serious early setback if the FBR decision to lower duties on imports of foreign made mobile phones is not reversed. It is being blamed on Tania Aidrus, Prime Minister Imran Khan's advisor on Digital Pakistan Initiative, who would like to increase availability of mobile handsets. Domestic mobile phone manufacturing industry will save billions of dollars of precious foreign exchange. It will create tens of thousands of jobs and spawn new auxiliary manufacturing industries for chargers, headphones, USB cables, cases, etc. In future, Pakistan could become a significant exporter of mobile handsets.

Related Links:

Public Sector IT Projects in Pakistan

Pakistan's Gig Economy 4th Largest in the World

Afiniti and Careem: Tech Unicorns Made in Pakistan

Pakistani American Heads Silicon Valley's Top Incubator

Silicon Valley Pakistani-Americans

Digital BRI and 5G in Pakistan

Pakistan's Demographic Dividend

Pakistan EdTech and FinTech Startups

State Bank Targets Fully Digital Economy in Pakistan

Fintech Revolution in Pakistan

The Other 99% of the Pakistan Story

-

Comment by Riaz Haq on January 25, 2020 at 9:16pm

-

Mobile set manufacturing policy being finalised: chief of EDB’s board

https://www.brecorder.com/2020/01/16/562126/mobile-set-manufacturin...

Chairman EDB's Board, Almas Hyder on Wednesday said that final touches are being given to Pakistan's mobile set manufacturing policy which will be ready within the month.

While talking to Business Recorder, Hyder stated that the working on mobile set manufacturing policy began eight months ago and so far three-four meetings have been held to prepare the draft policy for the government.

In reply to a question, he said the main reason for the delay in finalization of draft policy was due to gathering of data and the formulation of procedure to acquire technology.

“Policy document is being finalised. I think one more meeting will be required to give it the final touches. We want to make it a driver of export," he added.

Almas Hyder maintained that the main purpose of the policy was to make engineering sector one of largest export-oriented sectors of Pakistan. This implies if the export of textile sector earns $ 12 billion per annum, then engineering sector would cross $ 12 billion benchmark within the next 8 to 10 years. He said that cell phone industry can contribute $500 million to $1 billion in exports of engineering goods.

“We will attract local as well as global players of mobile set manufacturers," he continued.

Mobile phone manufacturing is one of the biggest industries worldwide. This industry is now moving out of China and into countries such as India, Bangladesh, Indonesia and Vietnam.

A couple of days ago, Adviser to the Prime Minister on Commerce and Industries and Production and Investment, Abdul Razak Dawood said that the government will give incentives to local mobile phone manufacturers.

Ministry of Industries and Production announced last year that the mobile set manufacturing policy will be unveiled in November 2019. However, despite several consultations with stakeholders over a period of 10 months EDB has yet to present a draft to the Ministry of Industries for submission to ECC for approval.

Currently, there are more than 10 domestic assemblers of mobile phones. Most of them are producing 2G feature phones & waiting for Government policy to upgrade themselves to manufacturers of 4G smart phones. A Pak-China joint venture to locally assemble smart phones has already been set up in Karachi with an initial investment of Rs 160 million.

Prime Minister Imran Khan has been directing his economic ministries to create an environment conducive for investment, domestic & foreign, in the sub-sector which would lead to creation of job opportunities.

Industry sources state that mobile phone assembly is a labor intensive activity which if duly incentivised, can create over 120,000 jobs within a period of three years. Most of these jobs will be for skilled workers & young electronics engineers graduating from local universities.

Industry is demanding a clear roadmap from the Government – from assembling mobile phones and progressively encouraging localization of components & mother board assembly – over a period of 3-4 years.

Representatives of local manufacturers believe that after successfully introducing IMEI registration by the PTA in March 2019 all chances of smuggling and grey imports of mobile phones have been eliminated. This industry can now be used as a game changer for creating a base of Electronics sector in Pakistan which has a requirement of around 40 Million handsets on an annual basis.

-

Comment by Riaz Haq on January 26, 2020 at 5:52pm

-

GVCs – a fillip for exports

https://www.brecorder.com/2020/01/08/560023/gvcs-a-fillip-for-exports/

Sync with Global Value Chains (GVCs) is imperative for Pakistan to grow its struggling exports. In 1990, the ratio of GVCs to traditional share in exports was 40:60. Today it's almost at 50:50. Pakistan has lagged behind. Emphasizing on catching up, SBP has published a special section on GVCs in its recent quarterly economic update.

GVC in modern world can be explained by the iPhone example. Designed in US; assembled in China and Vietnam; components to assemble are supplied by South Korea and Japan; and sold across the globe. The GVCs have made the economies think beyond domestically available resource based value added exports. For example, Bangladesh has become the second biggest world supplier of garments without any cotton production. Vietnam has created its niche in outer structure and final assembling of mobile phones by importing high tech components; it's the world third biggest mobile phone manufacturer including 40 percent of Samsung mobiles.

Meanwhile, Pakistan has continued concentrate on traditional exports within its low base in developed markets. The share in global demand of developed world shrunk from 81 percent in 1995 to 62 percent. The share of emerging economies is expected to increase further to 51 percent by 2030. Pakistan should look for new markets in a non-traditional way.

In 1995, foreign value added components of Pakistan's exports was 4.8 percent. In 2015, the ratio inched up to 5.6 percent. Consistently, 95 percent of country's exports are on value addition on domestic components such as cotton, rice, animal hides etc. Our foreign value addition in textile products is in the form of chemicals and dyes, high quality cotton, manmade fiber etc. Such process is termed as backward participation.

Pakistan's share in GVCs is mostly in forward participation i.e. some other country adds value in Pakistan's exports to re-export. For example, yarn and fabric are exported to China, Bangladesh and Turkey, which produce and export value added products to stores like Zara, Marks & Spencer and H&M.

Pakistan needs to create linkages with original brand manufacturers, and original brand designers. The textile sector lacks diversification in higher unit value manmade fibers. A good example within the country is of denim trousers (jeans) where exporters are contributing in the supply chain of brands like Target, Gap, Levi's etc.

There are two other sectors where we have footprints in GVCs – Medical Devices and ICT services. In the former, the skill set is clustered in Sialkot and 98 percent participation is in precision metal instruments. The low value addition does not lure multifetal enterprises (MNEs) to invest in Pakistan. These have production facilities in Malaysia, Mexico and Dominican Republican. Upcoming SEZs and EPZs should focus on bringing MNEs to become part of GVCs.

The way forward is to enhance Pakistan's share in GVCs within sections of existing exports – positioning for brands by improving quality standards in forward participation. Find new avenues to develop backward participation. World top five exporting sectors are electrical and machinery, petro chemical and non-metal minerals, transport equipment, metal products, and financial intermediaries and business activities. Pakistan's share ranges from 0.00 to 0,03 percent in global exports of these sectors.

The foremost important factor for enhancing footprint in GVCs is to liberalize trade (tariff) policy. For details read “National Tariff Policy – the long haul". SBP noticed that the tariff liberalization started in 2000s is non-uniform, “Some industries such as automobile and steel, have continued to enjoy higher protection, which fueled an anti-export bias". Government should end the protection to redirect the flow of productive capital in export oriented sectors.

-

Comment by Riaz Haq on January 27, 2020 at 5:33pm

-

The Standard Chartered SDG Investment Map reveals an almost USD10 trillion (USD9.668 trillion) opportunity for private-sector investors across all emerging markets to help achieve the UN’s Sustainable Development Goals (SDGs), with Pakistan representing USD96.2 billion of that totals. The study identifies opportunities for the private sector to contribute to three infrastructure-focused goals between now and 2030: SDG 6: Clean Water and Sanitation, SDG 7: Affordable and Clean Energy and SDG 9: Industry, Innovation and Infrastructure across emerging markets. Need for private investment intensifying.

https://nation.com.pk/28-Jan-2020/pakistan-presents-dollar-96b-oppo...

The greatest investment opportunity in Pakistan is found in achieving and maintaining universal access to electricity (a key SDG 7 indicator), representing a USD44.7 private-sector opportunity. This considers the proportion of the population currently without electricity access (29 per cent), projected population growth, and the growing demand for power as the economy develops.

There is also significant opportunity for investment in digital infrastructure, with a potential private-sector contribution of around USD34 billion needed to achieve full digital adoption (measured by a combination of mobile phone subscription rates and internet connectivity). Digital access is a key indicator for SDG 9, which encourages improvement in industry, innovation and infrastructure. The other SDG 9 indicator in Opportunity2030 is transport infrastructure. To significantly improve Pakistan’s transport infrastructure by 2030 indicates a USD13.5 billion investment opportunity for the private sector.

The opportunity in the water and sanitation sector is smaller but could make a significant impact. Almost a quarter (24 per cent) of Pakistan’s population still do not have access to clean water and sanitation, a key SDG 6 indicator. Closing this gap by 2030 will require significant investment, with an opportunity for the private sector to provide around USD4 billion of the funding.

Shazad Dada, Chief Executive Officer at Standard Chartered, said: “Pakistan has demonstrated strong commitment to the UN Sustainable Development Goals by becoming the first country to adopt the SDGs as part of its national development agenda through a parliamentary resolution. The private sector will play a crucial role in enabling Pakistan to hit these targets and there is substantial opportunity for investment that supports infrastructure development, including digital, energy provisioning as well as clean water and sanitation.

“Opportunity2030 provides an important map of the SDG opportunities for private sector investors looking to invest with impact and improve the lives of millions of Pakistanis over the next decade.”

---------------------------------

Market Water and sanitation (SDG 6) Access to power* (SDG 7) Transport infrastructure (SDG 9) Digital access (SDG 9) Total

China USD26.1bn N/A USD2.310tn USD492.8bn USD2.829tn

India USD19.2bn USD701.5bn USD176.9bn USD226.5bn USD1.124tn

Indonesia USD4.0bn USD147.5bn USD75.5bn USD53.7bn USD280.7bn

Bangladesh USD3.2bn USD73.9bn USD21.6bn USD33.3bn USD132.0bn

The Philippines USD1.9bn USD61.3bn USD26.1bn USD28.2bn USD117.5bn

Nigeria USD5.7bn USD32.3bn USD28.8bn USD47.4bn USD114.2bn

Pakistan USD4.0bn USD44.7bn USD13.5bn USD34.0bn USD96.2bn

Thailand USD0.7bn N/A USD40.6bn USD17.0bn USD58.3bn

Vietnam USD1.3bn N/A USD20.1bn USD24.4bn USD45.8bn

Kenya USD2.3bn USD15.6bn USD9.1bn USD13.0bn USD40.0bn

Malaysia USD0.4bn N/A USD25.8bn USD8.8bn USD35.0bn

Ghana USD0.8bn USD7.8bn USD4.1bn USD6.9bn USD19.6bn

Sri Lanka USD0.2bn USD7.3bn USD4.6bn USD4.1bn USD16.2bn

Uganda USD0.8bn USD6.1bn USD2.8bn USD4.0bn USD13.7bn

Zambia USD0.7bn USD4.0bn USD1.6bn USD3.2bn USD9.5bn

https://www.sc.com/en/media/press-release/weve-launched-our-opportu...

https://av.sc.com/corp-en/content/docs/Standard-Chartered-Opportuni...

-

Comment by Riaz Haq on January 28, 2020 at 1:39pm

-

Incentives in the works to diversify exports

https://www.dawn.com/news/1530210

The Imran Khan government plans to introduce significant time-bound, structured fiscal incentives and protection for 20 industries other than the five zero-rated sectors besides ensuring their easier access to cheap short- and long-term finance for diversifying and boosting the country’s stagnating exports.

The incentives will be part of the new Strategic Trade Policy Framework (STPF) expected to be finalised in the next couple of months, Commerce Secretary Ahmed Nawaz Sukhera told Dawn on Thursday.

"The government is looking beyond the five zero-rated export sectors including the textile. It is time we also focused and facilitated industries like light engineering, chemicals, IT, etc with substantial potential to diversify and increase our exports," he said.

"Textile industry does have the potential to enhance its foreign sales but it can push our overall exports only so much. We need to encourage other industries with untapped potential."

Pakistan’s trade gap has shrunk 31pc to $11.6 billion in the first half of this fiscal year to December, primarily on the back of 17 per cent compression in imports, which dropped to $23.2bn. Meanwhile, exports have risen by a mere 3.2pc to $11.5bn despite steep currency devaluation during last one and a half years and energy subsidies given to textiles, which fetch 55-60pc of the country’s total proceeds from foreign sales.

According to a World Bank report, the country’s share in the global exports has declined from a peak of 0.18pc to 0.13pc in 2018 with the bulk of them are resource-based or commodities.

"We are moving in the direction of export-led economic growth and away from import substitution policies. The global experience shows that you cannot pursue both export growth and import substitution policies simultaneously; so we have decided to increase competitiveness of our industries with export potential," Sukhera said.

The stabilisation on the external front in the recent months has created room for the State Bank to help exporting industries, and enhance the financing limit for exporters though its subsidised loan schemes — Export Finance Scheme (EFS) and Long Term Finance Facility (LTFF) — by Rs100bn for the full year.

Under EFS exporters are eligible to receive short-term loans at 3pc to meet their working capital requirements while LTFF caters to their needs for long-term funds to import machinery and plants. For the textile sector, LTFF is available at 5pc and for others at 6pc.

SBP Governor Reza Baqir, who has repeatedly underscored the importance of increasing exports to pull the country out of the frequent boom-and-bust cycles, says the scope of these schemes will be extended to more industries and sectors with export potential.

Experts say the current account stability based on massive import compression is hurting the industry and could backfire if exports are not increased substantially and swiftly. The current account deficit has squeezed by 73pc in the first six months of this fiscal year.

-

Comment by Riaz Haq on January 29, 2020 at 10:18pm

-

PTCL to build #Pakistan’s first high-perf #telecom 200G #network with #Nokia. PTCL CTO: “We have enhanced the existing capacity from 100G optical network to 200G to take care of the growing traffic in these cities (#Karachi, #Lahore, #Islamabad)” #fiber

https://www.developingtelecoms.com/telecom-technology/optical-fixed...

Pakistan Telecommunication Company Limited (PTCL) has deployed Nokia’s technology to expand the capacity of its recently installed 100G transport network to 200G optical network for both domestic and international traffic.

This capacity expansion has been carried out in the major cities of Islamabad, Lahore and Karachi to keep pace with the growing demands for capacity from both individuals as well as enterprises.

The deployment makes PTCL the first operator in Pakistan to deploy high-performance 200G 8 Quadrature Amplitude Modulation (QAM), an optical long-haul technology offering more capacity at lower cost. The upgrade of its optical network allows PTCL to address the growing demands of bandwidth, enabling its enterprise and individual users in Pakistan’s largest cities to use high-bandwidth services and applications such as HD and 4K video.

In addition, the network upgrade allows PTCL to enhance network capacity with the Software Defined Network (SDN) capabilities of Nokia’s optical solution. Further, the unique flexgrid technology will enable PTCL to upgrade to 300G or 400G in the future over the same installed base.

Saad Muzaffar Waraich, Chief Technology & Information Officer, PTCL, said: “We have enhanced the existing capacity from 100G optical network to 200G to take care of the growing traffic in these cities.”

Carlo Corti, Director of the Optics Business Development, MEA, Nokia, said: “Our field-proven technology enables PTCL to provide the best-in-class network experience to its subscribers. With our 200G technology, PTCL is now in a position to cost-efficiently address the ever-growing demand for capacity.”

-

Comment by Riaz Haq on February 1, 2020 at 9:53am

-

Pakistan urgently needs pathway for higher growth. Must be export-led by Sakib Sherani

https://www.dawn.com/news/1531587

AS large parts of the economy grind into recessionary conditions, the clamour for policy focus on growth is increasing. However, the government’s policy mix is constrained under an IMF-led stabilisation programme, with no space for a stimulus in either fiscal or monetary policy. Under the current programme, the government is bound to achieve fiscal consolidation over three years of almost 6.5 per cent of GDP — the highest reduction in the fiscal deficit in Pakistan’s history over a similar time span.

Under the IMF stabilisation framework, short-run economic growth is not collateral damage — it is virtually ground zero, the epicentre of policy focus. Achieving a sharp correction in the external current account imbalance in the shortest possible time requires an equally sharp compression in imports. The contractionary policy mix adopted as a result leaves businesses struggling for survival — via the sucking out of purchasing power and the overall increase in cost of doing business (on borrowing, imported inputs and energy use).

In its latest monetary policy statement, the State Bank appears to indicate an abandoning of its unrealistic and overly optimistic assessment of growth prospects for the current fiscal year — something I have been pointing out for the last several months. With near-term growth prospects bleak, and unemployment and high inflation imposing a punishing burden on large swaths of the populace, there is a clear need for a policy framework that delivers less pain while achieving the broad aims of not just stabilisation but wider reform.

Pakistan needs a return to high rates of economic growth, but only one that is sustained, sustainable, export-led, jobs creating, and inclusive — rather than the four-year boom-bust cycle the country has been trapped in ie a better quality of growth. To achieve this requires serious structural as well as institutional reform — some of the very measures such as documentation and widening of the tax base that are contributing to challenging business conditions and pessimistic investor sentiment. So what can the government do differently, to ease the pain?

---------

In response to the Great Financial Crisis of 2007, countries ranging from the US to Singapore sought to insulate businesses from the effects of the recession by a host of heterodox policy measures. The US government pumped nearly $700 billion in fiscal stimulus measures alone in response to the recession, over and above the aggressive and unprecedented expansion of the US Federal Reserve’s balance sheet. Measures taken included recapitalisation of financial institutions, capital injections in the Big Three auto companies as well as insurance firm AIG, launching programmes such as ‘cash-for-clunkers’, cutting payroll taxes, and extending unemployment benefits. An expanded public works programme to create jobs was also launched.

Similarly, Singapore adopted maintaining citizen employment during the crisis as an explicit policy goal and launched a ‘jobs credit scheme’, effectively temporarily subsidising the wage cost of firms.

While Pakistan cannot match the scale of such measures given its fiscal constraints and public debt level, the foregoing presents examples of precisely the kind of bold thinking and heterodox policies that are required. Some possible measures that can be undertaken include:

— Extend energy tariff subsidy to indirect exporters/export sector supply chain.

— Underwrite fresh loans to SMEs.

— Provide interest rate subsidy on new loans/expand access to concessionary finance.

— Swap existing high-cost loans with subsidised credit schemes for certain high spillover sectors (with high linkages and employment intensity, for example)

— Ensure access to credit for credit-constrained SMEs.

— Ensure timely release of tax refunds due.

— Provide tax credits for new investment.

-

Comment by Riaz Haq on February 25, 2020 at 9:04pm

-

#Pakistan #MobilePhone #Imports Jump 79.46% in 7 Months of FY19/20. mobile #broadband (BB) penetration is up from 51.8 million subscribers in January, 2018 to 76.8 million in Nov 2019, an increase of 25 million in #smartphones sales. https://www.phoneworld.com.pk/import-of-mobile-phones-increase-by-7...

According to the data issued by Pakistan Bureau of Statistics (PBS), Pakistan imported mobile phones worth $760.582 million during July-January (2019-20) as compared to $423.818 million during July-January (2018-19), showing a growth of 79.46 percent,

As compared to last year, on a year-on-year basis, the import of mobile phones witnessed a growth of 141.65 percent in January 2019. The imports during January 2020 were $144.437 million against $59.77 million in January 2019.

On a month-on-month basis, the import of mobile phones witnessed an increase of 22.73 percent during January 2020, as compared to $117.682 million during December 2019.

Overall, telecom imports saw an increase of 31.36 percent during July-January 2019-20 as compared to last year. Total imports were recorded at $1.029 billion during this period compared to $783.453 million during the same of last year. Telecom imports stood at $184.474 million in January 2020 as compared to $161.895 million during December 2019 i.e. registered 13.95 percent growth.

Other telecom apparatus imports witnessed a decline of over 25.33 percent in July-January 2019-20 as it stood at $268.546 million against $359.635 million during the same period last year. When compared to December 2019, other telecom apparatus imports registered a decline of 9.45 percent and remained at $40.037 million in January 2020 compared to $44.213 million in December 2019.

Telecom experts are linking the phenomenal growth in mobile imports to the implementation of Device Identification Registration and Blocking System (DIRBS). According to Pakistan Telecommunication Authority (PTA) it has blocked a total of 50 million devices since implementation of DIRBS.

According to PTA these includes 32 million GSMA valid and 18 million non-standard i.e. non-compliant devices. Such devices were brought into Pakistan through grey channels causing security issues and revenue loss to the government of Pakistan.

Since implementation of DIRBS, mobile broadband (BB) penetration has increased from 51.8 million subscribers in January, 2018 to 76.8 million in November, 2019 showing an increase of 25 million due to increased usage of smart phones. The total cellular mobile subscribers reached 165.4 million by the end of November 2019.

As per DIRBS regulations, all devices operating on mobile networks within Pakistan as of 15th January, 2019 were registered. Devices with programmed IMEI which were not as per GSMA standard operating on mobile networks as of 15th January, 2019 were paired/ linked with the mobile number being used.

-

Comment by Riaz Haq on February 28, 2020 at 3:55pm

-

Infinix becomes first smartphone brand with manufacturing facility in Pakistan

https://dailytimes.com.pk/567038/infinix-becomes-first-smartphone-b...

Infinix, with its latest and high-quality premium products, is one of the leading smartphone brands in Pakistan. It has continued growing stronger, and one of the primary reasons is the company’s continuous investment and contribution to the economic and labor empowerment in the country. Now very proudly Infinix becomes the first smartphone brand manufacturing in Pakistan.

Fully aligning with the country’s initiative of “Made in Pakistan”, the company keeps growing its investment to contribute to turn the country into a regional tech hub, and it just got one step further towards its mission and local commitment to put Pakistan on road to progress and prosperity. This Chinese smartphone brand’s manufacturing facility being located in the country helps prevent unnecessary worry of Corona Virus and the inaccessibility of newest Infinix products, and also fulfills its aim of playing its role in empowering the local labor, and particularly women, as 60% of the workforce working in the Infinix Pakistan factory are women.

The manufacturing vicinity was also visited by the Consul General of the People’s Republic of China, Mr. Li Bijian, who applauded Infinix’s contribution in promoting local employment in the country.

Talking about their company mission, CEO of Infinix Pakistan Mr. Joe Hu said, “Infinix’s vision as a company is to enrich our customer’s experiences, whether it is through our products, or what goes in their manufacturing. To be able to play a small part in the empowerment of the labor force in Pakistan, and particularly the women of the country is an important step further towards our mission.”

-

Comment by Riaz Haq on February 28, 2020 at 3:56pm

-

EDB-BoM gives go-ahead on mobile device manufacturing policy

https://pakobserver.net/edb-bom-gives-go-ahead-on-mobile-device-man...

In a meeting of the Board of Management of Engineering Development Board (EDB), chaired by Mr. Almas Hyder, the mobile device manufacturing policy was approved for submission to Ministry of Industries & Production. The policy has been drafted, after extensive stakeholder consultation, with the objective to encourage local manufacturers in this sector through technology acquisition & localization.

The proposed policy is expected to promote local investments and FDI. Local device manufacturing activity is projected to create 200,000 direct and indirect jobs in the country alongside development of efficient manufacturing eco-system and linking Pakistan to the global supply chain. Needful to mention is that Pakistan is the 7th largest market for mobile sets with annual sales of 34 million sets in 2019. With an increasing demand and competitive advantage of labour cost, it can develop into a major industry capable to generate export surplus to sell its brand of “Make in Pakistan” in the international markets.

The Board also deliberated on the Electric Vehicle Policy drafted by EDB in consultation with concerned stakeholders. It was proposed to have a comprehensive policy framework to not only cater for EV but that covers emerging technologies in this sector as well as ensuring that the supply chains of the existing players may not be disrupted. The Board emphasized on the need to have a favorable incentive regime to promote local investments and attract FDI.

A comprehensive plan for participation of engineering sector in international trade fairs/exhibitions were also presented in the meeting. The members appreciated efforts made by EDB’s management to promote engineering sector of Pakistan.

The Chairman advised to organize trade delegations to various Free Trade Zones of African to tap the huge export potential in this region. Members also advised to look for trade opportunities in European and American markets.

CEO-EDB also briefed the Members on the competitive/efficiency improvement and export enhancement exercise being undertaken by EDB. In this regard 350 companies, Associations, Chambers were approached to invite proposals in order to address the anomalies in tariff cascading, procedural delays in availing benefits like DTRE and technological constraints in meeting international bench marks.

-

Comment by Riaz Haq on March 16, 2020 at 6:56pm

-

#Pakistan #mobilephone #manufacturing co to export soon. Transsion Tecno is operating 3 production lines with a capacity to assemble 3 million #smartphones annually. The company has plans to localize production of 49% of handset parts in next 3 years. https://www.brecorder.com/2020/03/12/579377/china-pakistan-mobile-m...

Transsion Tecno mobile manufacturing firm, a joint venture between Pakistan and China is all set to manufacture 49 percent of its mobile phones in Pakistan in the coming years, informed Federal Minister for Economic Affairs Hammad Azhar.

“They will be focusing now on exports as their plant in Pakistan is most efficient of all owned by Transsion group globally (excluding China)," said Azhar, after his meeting with Transsion Tecno CEO, Aamir Allawala, at their phone assembly plant.

The minister said that in the next three years the company has targeted to localize production of 49pc of handset parts. “A huge export potential e.g. Vietnam is exporting USD37 billion of handsets annually," he said

Hammad said Transsion Tecno started producing three million handsets per annum and is increasing its production to up to 13 million handsets within a year.

He said that the introduction of DIRBS [Device Identification, Registration and Blocking System] has eliminated the menace of smuggled sets, and has been an instrumental factor in opening up the market.

Currently, Transsion Tecno is operating three production lines with a capacity to assemble 3 million smartphones every year. In terms of human resources, the company has on board 750 skilled workers, 70 engineers, and nine Chinese experts.

Aamir Allawala, the CEO of Transsion Tecno in his interview with BR Research had said that mobile phones can become Pakistan's biggest export item, surpassing textiles, if the country is able to tap into this market.

----------------

An interview with Aamir Allawala, CEO Transsion Tecno Electronics ‘Mobile phone exports can surpass textiles’

Amir Allahwala: "There are 164 million mobile subscribers. The handset market size is about 40 million units with 27 million units currently being imported and 13 million (which are mostly 2G) manufactured locally in the country. These are feature phones and we believe the future is smart. If we had to put a number to it, the potential handset market size should be over 60 million units annually. This would make us one of the top 10 handset markets in the world." https://www.brecorder.com/2020/03/11/578939/an-interview-with-aamir...

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

India-Israel Axis Threatens Peace in South Asia

The bonhomie between Israeli Prime Minister Netanyahu, an indicted war criminal, and Indian Prime Minister Narendra Modi, accused of killing thousands of Muslims, was on full display this week in Israel. Both leaders committed to supporting the Afghan Taliban regime which is accused of facilitating cross-border terrorist attacks by the TTP in Pakistan. Mr. Modi was warmly welcomed by…

ContinuePosted by Riaz Haq on February 27, 2026 at 10:45am — 1 Comment

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 13 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network