PakAlumni Worldwide: The Global Social Network

The Global Social Network

Indian Economy Shrank in USD Terms in 2012-13 as Global Economy Slowed

Sharp fall in Indian currency against the US dollar and slower economic growth have caused India's GDP for Fiscal Year 2012-13 to shrink in US $ terms to $1.84 trillion from $1.87 trillion a year earlier. The Indian rupee has plummeted from 47.80 in 2012 to 54.30 to a US dollar in 2013, according to Business Standard. Since this report was published in Business Standard newspaper, Indian rupee has declined further against the US dollar to Rs. 59.52 today. At this exchange rate, India's GDP is down to $1.68 trillion, about $200 billion less than it was in Fiscal 2011-12.

|

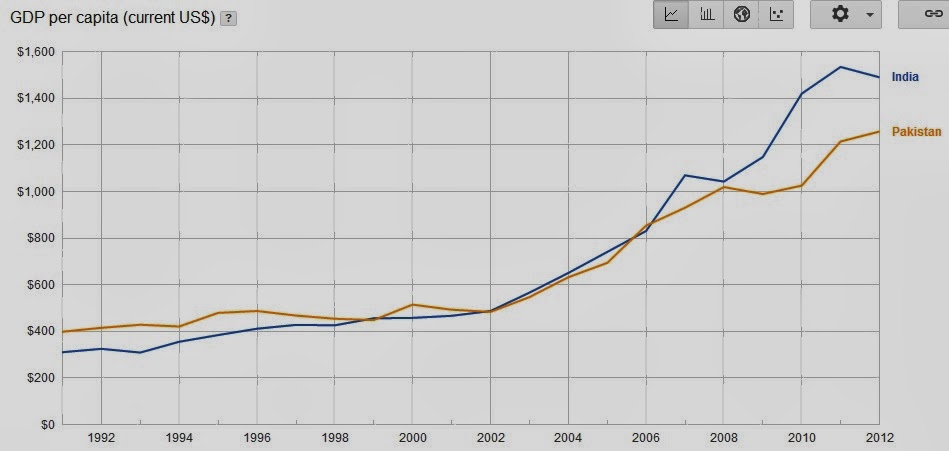

| Pakistan GDP Per Capita 1990-2012 Source: World Bank |

|

| Indian GDP Growth Rates 2004-2013 |

India's economy grew by 5.0% in 2012-13, its slowest annual rate in a decade, down from 6.2% last fiscal year. In the fourth quarter ending in March, gross domestic product grew by 4.8% year-over-year, slightly higher than the previous quarter when it expanded by 4.5%, according to Indian government data.

In the January-March quarter, the manufacturing sector increased output by just 2.6%, while production in the country's mines shrank by 3.1%.

Global ratings agency Standard and Poor's warned in May that India faces at least "a one-in-three" chance of losing its prized sovereign grade rating amid new threats to economic growth and reforms.

India's BBB-minus investment rating is already the lowest among BRICS and cutting it to "junk status" would raise the country's hefty borrowing costs.

The Organisation for Economic Cooperation and Development (OECD) this week lowered its projection of India's GDP growth this year to 5.3%, from 5.9% earlier.

Meanwhile, Pakistan's economy continues to struggle with its annual GDP rising just 3.6% to $252 billion ($242 billion at Rs. 100 to a USD exchange rate) in fiscal 2012-13, according to Economic Survey of Pakistan 2012-13 estimates based on 9 months data. The country is facing militancy and energy shortages impacting its economy.

Other world economies have also slowed down. US is slowly recovering but Europe is still struggling. BRIC growth rates are also slowing. China is slowing with its workforce aging and shrinking. In India, the slow pace of reform is hurting its growth, and Brazil and Russia are struggling with slowing demand for their export commodities.

Africa has replaced Asia as the continent with most of the world's fastest growing economies, according to The Economist magazine. The top 10 fastest growing economies in the world are: Macau, Mongolia, Libya, Gambia, Angola, Bhutan, China, Timor-Leste, Iraq and Mozambique.

China and the US , the two largest economies, still continue to be the bright spots and the main locomotives of the world economy, offering hope of global economic recovery.

Related Links:

Haq's Musings

India's Hyphenation: India-Pakistan or India-China?

India's Share of World's Poor Jumps as World Poverty Declines

Forget Chindia--Chimerica Will Rescue the World

World Bank on Poverty Across India

Superpoor India's Superpower Delusions

Are India and Pakistan Failed States?

India Home to World's Largest Number of Poor, Hungry and Illiterate

India Leads the World in Open Defecation

India Tops in Illiteracy and Defense Spending

Indians Poorer than sub-Saharan Africans

-

Comment by Riaz Haq on August 10, 2013 at 4:42pm

-

Here's Forbes on the appointment of Raghu Rajan, former IMF Chief Economist, as India's central bank governor:

The world might look kindly on any boost Rajan & Co. can give to the incumbents if that dims the electoral prospects for a BJP opposition party led by Hindu firebrands. For India’s neighborhood, we were reminded this week, remains a dangerous one, with new deadly clashing on the Kashmir frontier and a bloody nightmare still brewing inside parts of bordering Islamic Pakistan. At least the current Indian government (and what passes for a Pakistani administration) have kept a decent lid on things.

One part of Rajan’s job will be to stand tall in the realm of international central banking, cutting what slack he can in those quarters for his nation’s task ahead. The status he now enjoys will be helpful, even as everyone remembers the famous brushback by Larry Summers when Rajan was more of an pesky outsider. Many would enjoy the irony of them working as colleagues in the future.

Ultimately, however, the authority in this latest move, this latest acknowledgment that India is broken and needs fixing, will come from the core Indian will. Does such a great, ancient people wish to continue to be the butt of so many comparisons to China, the most aching laggard of the BRICs (potential compared to result), the place that sends so many enterprising talents abroad? Rajan is just one man with a new job, but an optimist could imagine he represents something bigger.

http://www.forbes.com/sites/timferguson/2013/08/09/asias-week-rajan...

-

Comment by Riaz Haq on August 16, 2013 at 11:15pm

-

Here's an excerpt of a Reuters' story on India rupee hitting a new record low:

The central bank's capital outflow restrictions came a day before the dollar spiked after U.S. jobless claims data on Thursday suggested an early end to the Fed's asset purchases.

That prospect looms over India at a time when it is suffering from a current account deficit that hit a record high of 4.8 percent of gross domestic product and an economy growing at a decade low of 5 percent.

Foreign investors have already sold a net $11.6 billion of Indian debt and equities since late May, sparking fears of continued weakness.

India's main NSE index .NSEI fell 4 percent at one point on Friday, while benchmark 10-year bond yields surged to their highest since May 2012 as prices headed for their worst week in four-and-a-half years.

UBS strategist Manik Narain said that as emerging central banks tightened policy to defend their currencies, stocks would be affected, something that is already happening in India.

"India is losing control over the currency and you are starting to see the weakness transmitting to stock markets. There could be a self-perpetuating cycle where currency weakness flushes out equity investors and that takes the rupee weaker still."

CAPITAL CONTROLS?

The RBI's new measures also included further capping the amount that companies can invest abroad.

But overseas investments from India had already been on the wane, averaging a monthly $400 million in the first half of the year from $710 million in 2012, according to DBS data.

The biggest fear is that the RBI's action could be the start of a far stronger move to restrain capital.

"The steps taken so far only target residents, but if this raises expectations that they could potentially resort to capital controls targeted at non-residents, that could have adverse near-term implications for capital flows," HSBC's Chief economist for India and ASEAN Leif Eskesen said.

"It will, therefore, be critical to tread very carefully when it comes to capital controls, to anchor expectations, and also not use it as a substitute for more appropriate and effective measures," Eskesen said in a note to clients.

RUPEE FALLS

As policy makers struggling to find a solution for the rupee's falls, investors expect more weakness ahead. Overseas investors betting via one-month offshore non-deliverable forwards quoted the rupee trading at 62.46, while onshore bets see the rupee at 62.35 within the month.

Meanwhile, a Reuters poll on Thursday showed short positions in the Indian rupee have hit the highest in two months.

At heart of India's failed defense of the rupee so far is that none of the measures unveiled so far have given markets assurance that the country can attract foreign flows in an increasingly difficult global environment.

India last month unveiled plans to further ease restrictions on foreign direct investment (FDI) but previous measures have had mixed results. FDI fell to $36.9 billion in the fiscal year ending in March from $46.6 billion the previous year.

This week it announced measures to attract near-term capital inflows, including by spurring state-run companies to sell debt abroad and raising funds from Indians abroad.

http://www.reuters.com/article/2013/08/16/us-india-markets-rupee-id...

-

Comment by Riaz Haq on August 18, 2013 at 6:01pm

-

Here's NY Times on India's growing troubles:

...a summer of difficulties has dented India’s confidence, and a growing chorus of critics is starting to ask whether India’s rise may take years, and perhaps decades, longer than many had hoped.

“There is a growing sense of desperation out there, particularly among the young,” said Ramachandra Guha, one of India’s leading historians.

Three events last week crystallized those new worries. On Wednesday, one of India’s most advanced submarines, the Sindhurakshak, exploded and sank at its berth in Mumbai, almost certainly killing 18 of the 21 sailors on its night watch.

On Friday, a top Indian general announced that India had killed 28 people in recent weeks in and around the Line of Control in Kashmir as part of the worst fighting between India and Pakistan since a 2003 cease-fire.

Also Friday, the Sensex, the Indian stock index, plunged nearly 4 percent, while the value of the rupee continued to fall, reaching just under 62 rupees per dollar, a record low.

Each event was unrelated to the others, but together they paint a picture of a country that is rapidly losing its swagger. India’s growing economic worries are perhaps its most challenging.

“India is now the sick man of Asia,” said Rajiv Biswas, Asia-Pacific chief economist at the financial information provider IHS Global Insight. “They are in a crisis.”

---.

The Indian government recently loosened restrictions on direct foreign investment, expecting a number of major retailers like Walmart and other companies to come rushing in. The companies have instead stayed away, worried not only by the government’s constant policy changes but also by the widespread and endemic corruption in Indian society.

The government has followed with a series of increasingly desperate policy announcements in recent weeks in hopes of turning things around, including an increase in import duties on gold and silver and attempts to defend the currency without raising interest rates too high.

Then Wednesday night, the government announced measures to restrict the amounts that individuals and local companies could invest overseas without seeking approval. It was an astonishing move in a country where a growing number of companies have global operations and ambitions.

---------

The submarine explosion revealed once again the vast strategic challenges that the Indian military faces and how far behind China it has fallen. India still relies on Russia for more than 60 percent of its defense equipment needs, and its army, air force and navy have vital Russian equipment that is often decades old and of increasingly poor quality.The Sindhurakshak is one of 10 Russian-made Kilo-class submarines that India has as part of its front-line maritime defenses, but only six of India’s submarines are operational at any given time — far fewer than are needed to protect the nation’s vast coastline.

Indeed, India has fewer than 100 ships, compared with China’s 260. India is the world’s largest weapons importer, but with its economy under stress and foreign currency reserves increasingly precious, that level of purchases will be increasingly hard to sustain.

The country’s efforts to build its own weapons have largely been disastrous, and a growing number of corruption scandals have tainted its foreign purchases, including a recent deal to buy helicopters from Italy.

Unable to build or buy, India is becoming dangerously short of vital defense equipment, analysts say.

Meanwhile, the country’s bitter rivalry with Pakistan continues. Many analysts say that India is unlikely to achieve prominence on the world stage until it reaches some sort of resolution with Pakistan of disputes that have lasted for decades over Kashmir and other issues.

http://www.nytimes.com/2013/08/19/business/global/a-summer-of-troub...

-

Comment by Riaz Haq on August 19, 2013 at 1:35pm

-

Here's FT on emerging market currencies tumbling:

The 20 biggest emerging market currencies tumbled against the US dollar on Monday with India’s rupee particularly badly hit amid mounting market turmoil in the developing world.

The rupee slumped to a fresh all-time low against the backdrop of deepening concerns over the government’s economic management. The 2.4 per cent fall to a record 63.2 to the dollar took the currency’s slump against the US dollar this year to 12 per cent.Monday’s moves in India came alongside grim news from emerging economies and further evidence of how the US Federal Reserve’s plan to end its monetary stimulus has continued to hit stocks, bonds and currencies across the developing world.

Over the past six months, China’s heavily managed renminbi is the only significant emerging market currency to have managed to hold its ground against a resurgent dollar.

Fears over the impact of the Fed’s plans to scale down its bond purchases have been compounded by slowing economic growth and deteriorating fiscal fundamentals in many countries. Investors are particularly concerned by states with current account deficits that have been plugged by inflows of more flighty investor capital, rather than stickier foreign direct investment.

“It’s the current account deficit countries that are in the most trouble,” said Angus Halkett, a bond fund manager at Stone Harbor Investment Partners. “The market is becoming a lot choosier where it puts its money, and some countries are going to find it tough.”

Indonesia provided evidence of that on Monday as its main equities index fell by 5.6 per cent after the country’s central bank reported on Friday that its current account deficit had widened sharply in the second quarter of this year.

New numbers on Monday also showed how the growth equation is changing for emerging economies with Thailand’s economy slipping into a technical recession thanks to weak exports and sluggish domestic demand.

But India remains the biggest concern for many investors with the pessimism there driven by questions about the government’s economic management following its introduction of a number of failed measures to support the currency, some of which appear to have exacerbated the country’s problems.

Only the Brazilian real and the South African rand have recorded bigger declines than the rupee in 2013. India’s benchmark Sensex share index also fell by nearly 2 per cent while 10-year bond yields pushed above 9 per cent, their highest level since the 2008 financial crisis.

The burgeoning crisis in India has also become increasingly political with senior figures from the opposition Hindu nationalist Bharatiya Janata party declaring on Monday that the only way out was for the government to call early elections, now due to be held by May 2014....http://www.ft.com/intl/cms/s/0/e10484c4-08c5-11e3-ad07-00144feabdc0...

-

Comment by Riaz Haq on August 19, 2013 at 8:33pm

-

India on verge of financial crisis, says The Guardian:

The Reserve Bank of India (RBI) in Mumbai. The country is facing its own financial crisis. Photograph: Vivek Prakash/REUTERS

India's financial woes are rapidly approaching the critical stage. The rupee has depreciated by 44% in the past two years and hit a record low against the US dollar on Monday. The stock market is plunging, bond yields are nudging 10% and capital is flooding out of the country.In a sense, this is a classic case of deja vu, a revisiting of the Asian crisis of 1997-98 that acted as an unheeded warning sign of what was in store for the global economy a decade later. An emerging economy exhibiting strong growth attracts the attention of foreign investors. Inward investment comes in together with hot money flows that circumvent capital controls. Capital inflows push up the exchange rate, making imports cheaper and exports dearer. The trade deficit balloons, growth slows, deep-seated structural flaws become more prominent and the hot money leaves.

The trigger for the run on the rupee has been the news from Washington that the Federal Reserve is considering scaling back - "tapering" - its bond-buying stimulus programme from next month. This has consequences for all emerging market economies: firstly, there is the fear that a reduced stimulus will mean weaker growth in the US, with a knock-on impact on exports from the developing world. Secondly, high-yielding currencies such as the rupee have benefited from a search for yield on the part of global investors. If policy is going to be tightened in the US, then the dollar becomes more attractive and the rupee less so.

But while the Indonesian rupee and the South African rand are also feeling the heat, it is India – with its large trade and budget deficits – that looks like the accident most likely to happen. On past form, emerging market crises go through three stages: in stage one, policymakers do nothing in the hope that the problem goes away. In stage two, they cobble together some panic measures, normally involving half-baked capital controls and selling of dollars in an attempt to underpin their currencies. In stage three, they either come up with a workable plan themselves or call in the IMF. India is on the cusp of stage three.

http://www.theguardian.com/business/economics-blog/2013/aug/19/indi...

-

Comment by Riaz Haq on August 22, 2013 at 11:14pm

-

Here's The Economist on India's reckoning:

.... They were there to launch an official economic history of 1981-97, a period which included the balance-of-payments crisis of 1991. The mood was tense. India, said Manmohan Singh, the prime minister, faced “very difficult circumstances”. “Does history repeat itself?” asked Duvvuri Subbarao, the outgoing head of the Reserve Bank of India (RBI). “As if we learn nothing from one crisis to another?”

The day before Indian financial markets had had their rockiest session for many years. The rupee sank and stockmarkets tumbled. Money-market rates rose. The shares of banks thought to be either full of bad debts or short of deposit funding fell sharply. The sell-off had been made worse by new capital controls introduced on August 14th in response to incipient signs of capital flight. They reduce the amount Indian residents and firms can take out of the country. Foreign investors took fright, fearful that India might freeze their funds too, much as Malaysia did during its crisis in 1998.

India’s authorities have since ruled that out. But markets keep sliding. On August 20th the RBI said it would intervene to try to calm bond yields. The rupee has dropped to over 64 to the dollar, an all-time low and 13% below its level three months ago. It is widely agreed the country is in its worst economic bind since 1991.

India is not being singled out. Since May, when the Federal Reserve first said it might slow the pace of its asset purchases, investors have begun adjusting to a world without ultra-cheap money. There has been a great withdrawal of funds from emerging markets, where most currencies have fallen by 5-15% against the dollar in the past three months. Bond yields have risen from Brazil to Thailand. Some governments have intervened. On July 11th Indonesia raised its benchmark interest rate to bolster its currency. On August 21st its president said he would soon announce further measures to ensure stability.

India, Asia’s third-biggest economy, is more vulnerable than most, however. Economic news has disappointed for two years, with growth falling to 4-5%, half the rate seen during the 2003-08 boom. It may fall further. Consumer-price inflation remains stubborn at 10%. A drive by Palaniappan Chidambaram, the finance minister, to push through a package of reforms and free big industrial projects from red tape has not worked. An election is due by May 2014, adding to uncertainty.

India’s dependence on foreign capital is also high and has risen sharply. The current-account deficit soared to almost 7% of GDP at the end of 2012, although it is expected to be 4-5% this year. External borrowing has not risen by much relative to GDP—the ratio stands at 21% today—but debt has become more short-term, and therefore riskier. Total financing needs (defined as the current-account deficit plus debt that needs rolling over) are $250 billion over the next year. India’s reserves are $279 billion, giving a coverage ratio of 1.1 times. That has fallen sharply from over three times in 2007-08 (see chart 1) and leaves India looking weaker than many of its peers (see chart 2)...

---------

India’s position could still get worse. But assuming things stabilise, when the official histories come to be written about 2013, what might they say? Most likely that the rupee’s slump caused a severe shock to the economy that made a recovery in growth rates even harder. But perhaps, also, that it prompted a more serious debate about the policies that India needs to become less vulnerable to the whims of an unforgiving world.

http://www.economist.com/news/finance-and-economics/21584010-why-in...

-

Comment by Riaz Haq on August 23, 2013 at 5:07pm

-

Indian rupee continued its downward spiral...down 4.4 percent to a record this week in its worst performance since 1993 on signs the U.S. is getting closer to reducing stimulus that fueled demand for emerging-market assets.

At INR 65 to a US $, India's 2012-13 GDP is down to $1.54 trillion....Rs. 100.2 trillion/65.

-

Comment by Riaz Haq on August 23, 2013 at 10:23pm

-

Here's Wall Street Journal quoting BRIC coiner Jim O'Neill as saying “If I were to change it, I would just leave the ‘C’:

SAO PAULO–Former Goldman Sachs Asset Management Chairman Jim O’Neill, who coined the BRIC acronym describing four burgeoning emerging market countries, stands by the term he invented more than a decade ago, but admits that three of the countries have disappointed him in recent years.

The acronym created in 2001 groups Brazil, Russia, India and China, and has become a reference for a perceived shift in economic power toward developing economies.

“If I were to change it, I would just leave the ‘C,’” Mr. O’Neill said in an interview. “But then, I don’t think it would be much of an acronym.”

Economic growth in other BRIC countries has been disappointing, and the economic outlook for developing economies in general has changed in the last few years amid the end of a commodities boom and a slowdown in Chinese growth–which nevertheless remains high compared with that of its counterparts.

Meanwhile, signs of a recovery in the U.S and expectations the Federal Reserve will soon reduce its bond-buying program have helped strengthen the U.S. dollar, sucking money out of emerging markets and putting even more pressure on their less developed economies.

It has become “fashionable” to say the developed world is recovering while emerging markets are all slowing down, Mr. O’Neill said. “But what people don’t understand is the size of China,” he added.

The economist said that if China’s economy grows 7.5% this year, as he expects, that would create an additional $1 trillion in wealth, in U.S. dollar terms. “For the U.S. to contribute at the same level, it would have to grow around 3.75%,” Mr. O’Neill said.

Economists currently expect the U.S. economy to expand 1.5% in 2013, down from 2% projected in May, according to a recent survey by the Federal Reserve Bank of Philadelphia.

From 2011 to 2020, Mr. O’Neill said he has assumed average growth for the BRIC countries of 6.6% a year, less than the 8.5% average in the previous decade. Most of it up to now has come from China.

India has been the biggest disappointment among the BRIC countries, while Brazil has been the most volatile in terms of investor perceptions, the economist said.

“Between 2001 and 2004, many people told me I should never have included Brazil. Then, from 2008 to 2010, people told me I was a genius for including Brazil and now, again, people say Brazil doesn’t deserve to be there,” he said.

Brazil’s economic growth, which reached 7.5% in 2010, has been weak since then in spite of multiple government stimulus measures. The country seems doomed to growth of 2% or so in both 2013 and 2014, according to economists’ forecasts.

Brazil’s rapid growth in 2010 raised expectations, but many people forgot that the country is vulnerable to big moves in commodities prices, Mr. O’Neill said.

Another problem, he said, is that private investment remains a small share of the country’s gross domestic product. Brazil’s investment rate has been stuck at around 18% of GDP, the lowest level of any BRIC country, for a decade.

---

“They should only worry if there’s a pickup in inflation expectations; otherwise, they should relax,” he said, before the central bank late Thursday unveiled a massive intervention program to provide relief for the currency.

Brazilian inflation is currently 6.15%, close to the 6.5% ceiling of the central bank’s target range for 2013.

Even in the face of weak growth, Mr. O’Neill says he doesn’t plan to add or subtract letters from his famous acronym.

“If, by the end of 2015, there is persistent weak growth in Brazil, India or Russia, then I might,” he said, noting, however, that he expects Brazil to surprise positively in 2015, possibly even in 2014.

http://blogs.wsj.com/moneybeat/2013/08/23/china-only-bric-country-c...

-

Comment by Riaz Haq on December 25, 2013 at 9:59pm

-

Here's an excerpt of a PBS interview of India's central bank chief Rajan:

HARI SREENIVASAN: A few years ago, there was this notion that the developing countries were going to be this new engine. And now you see the BRIC countries, Brazil, Russia, India, China kind of slowing down a bit. India is growing at half the rate it was a couple of years ago. Are we waiting for larger economies to become the power, sort of the steam engine again, or can India rebound on its own?

RAGHURAM RAJAN: Well, I think everyone is looking for a new model of growth.

And I think India is going to discover that model over time. And -- and that model requires doing things a little differently, more investment, less consumption, more effective implementation of large products. I have no doubt that Indian growth will pick up from 5 percent, where it is now, is not bad. It's bad relative to the 10 percent it was growing at in some years in the past.

But going back to higher rates of growth, I think once it figures out how to do things more cleanly and better, I think it will resume that level of growth.

HARI SREENIVASAN: So, a few months ago, there was this meme in the Indian press about the price of onions and how they had doubled and in some places tripled. Now the price of vegetables in markets have come down for several reasons, but, really, the bigger question is about inflation.

Consumer inflation in India is 11 percent and almost 11.25 percent this month. How does the central bank address that, especially when the poor feel inflation on food and fuel prices disproportionately hard?

RAGHURAM RAJAN: Absolutely.

I think it's a important challenge. I think, as you said, vegetable prices have come down. There's a spike. They have come down substantially since then. So, we should see some of that inflation fall off. But whether it's 9 or whether it's 11, it's still too high. We need to bring it down.

Some of it has to be done by addressing the supply constraints in the economy. That will happen over time. But we have to also ensure that, from the central bank's perspective, we send a clear signal that higher rates of inflation will not be tolerated.

I think you have to bring both sides together to get inflation down to healthy levels.

HARI SREENIVASAN: Help us understand the balance between growth and inflation. Right? On the -- there are estimates that about a million new Indians will enter the work force -- or, I should say, be of working age every month for the next 10 years.

So how does the central bank create an environment where you can actually create jobs for all those people without contributing to inflation?

RAGHURAM RAJAN: Well, the first thing is, we don't directly have an effect on growth, other than through maintaining inflation relatively low.

Over the long term, these tradeoffs are -- basically disappear. And, essentially, the best way we can keep growth going is by maintaining a low level of inflation. However, as a developing country central bank, we have additional tools to the ones that developed countries have. We can develop the system. We can ensure, for example, payments reach every part of India.

Remittances can be sent by a migrant laborer to his village back at very lost cost. That helps the village flourish, helps more reallocation of labor to places where they can be employed. That can help growth.....

http://www.pbs.org/newshour/bb/world/july-dec13/rajan_12-25.html

-

Comment by Riaz Haq on January 29, 2014 at 5:10pm

-

US Fed decision to reduce bond purchases from $85 billion a month to $65 billion a month is playing havoc with emerging markets. The Indian rupee is down some 14% against the USD in the past year. India has a current account deficit of 4.37% of GDP...The Turkish lira is down 24% against the USD in the past year. Turkey has a current account deficit of 7.22% of GDP..The rupiah was the worst performing emerging market currency in 2013 and is down 21% against the USD in the past year. Indonesia has a current account deficit of 3.71% of GDP..The Brazil real is down over 15% against the USD in the past year. Brazil has a current account deficit of 3.59% of GDP..The South African rand is down over 19% against the USD in the past year. South Africa has a current account deficit of 6.8% of GDP.....

http://business.financialpost.com/2014/01/28/the-fragile-five-what-...

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Indian Military Begins to Accept Its Losses in "Operation Sindoor" Against Pakistan

The Indian military leadership is finally beginning to slowly accept its losses in its unprovoked attack on Pakistan that it called "Operation Sindoor". It began with the May 31 Bloomberg interview of the Indian Chief of Defense Staff General Anil Chauhan in Singapore where he admitted losing Indian fighter aircraft to Pakistan in an aerial battle on May 7, 2025. General Chauhan further revealed that the Indian Air Force was grounded for two days after this loss. …

ContinuePosted by Riaz Haq on July 5, 2025 at 10:30am

Trump Administration Seeks Pakistan's Help For Promoting “Durable Peace Between Israel and Iran”

US Secretary of State Marco Rubio called Pakistan Prime Minister Shehbaz Sharif to discuss promoting “a durable peace between Israel and Iran,” the State Department said in a statement, according to Reuters. Both leaders "agreed to continue working together to strengthen Pakistan-US relations, particularly to increase trade", said a statement released by the Pakistan government.…

ContinuePosted by Riaz Haq on June 27, 2025 at 8:30pm — 5 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network